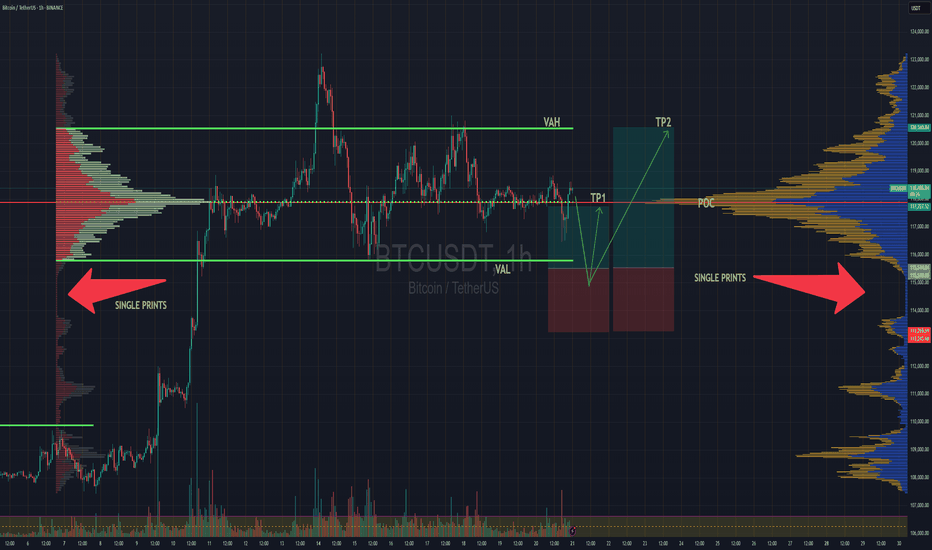

BTC Balanced Volume Profile BTC is now trading in a textbook D-Shape Volume Profile. In english - Buyers & Sellers are happy to transact here and will stay inside the value area & consolidating sideways until further notice.

Consolidation at POC is a signature of this profile, and one of the easiest and least stressful trade setups because now, your mission, should you chose to accept. Is to fade the Highs (VAH) and Lows (VAL) and avoid the middle unless you love donating money to the market.

I'll have buy limit orders waiting right below the VAL where we have the single prints. It doesn't get any easier than this.

Doesn't mean price cant rip through, but this is always the best entry with less risk, especially when the single prints have not been tested yet..

BINANCE:BTCUSD CME:MBT1!

Supplyandemandzones

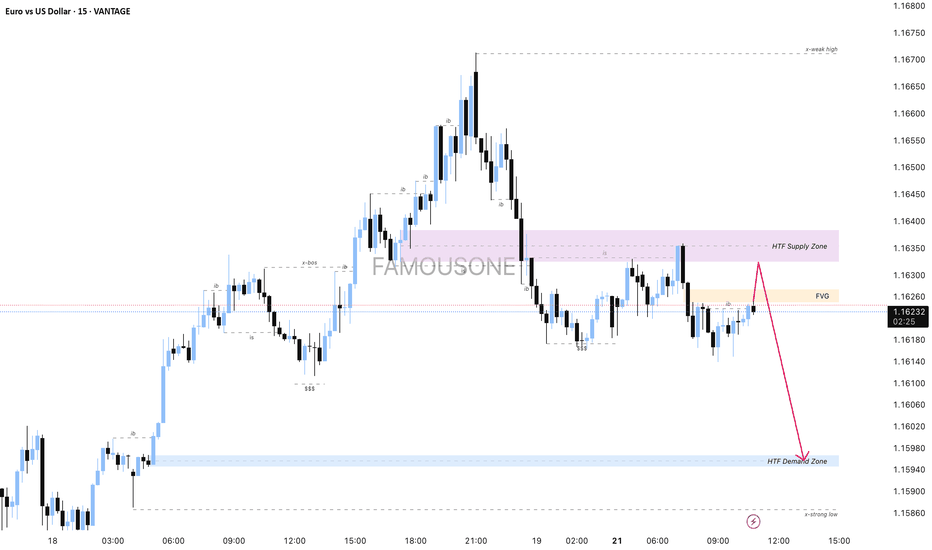

EURUSD - M15 Supply Zone RetestThe current price action shows that the market is expected to first fill the Fair Value Gap (FVG) area, which acts as a price inefficiency zone demanding liquidity clearance. After the FVG is filled, the price is anticipated to retest the Higher Time Frame (HTF) Supply Zone, which serves as a strong resistance area.

Following the retest of the supply zone, the prevailing downtrend is likely to resume, pushing the price downwards towards the HTF Demand Zone. This demand zone is identified as a key support level where buying interest is expected to emerge, potentially halting the decline temporarily or initiating a reversal.

This trading plan emphasizes waiting patiently for the FVG fill as a prerequisite step before looking for a supply zone retest confirmation to enter short positions targeting the demand zone below, aligning with the overall bearish trend continuation.

Bullish Bet , UnionBankBanknifty at support.

UnionBank on recent high making sideways moves, which means consolidation.

Once Banknifty Bounce back, UnionBank will break the resistance on weekly and monthly Basis and will start moving higher.

It has higher targets on a short and long term investment.

Good to hold for short term.

OIL fell sharply, opportunity for upside target of 70$OIL fell sharply and has now been in a contraction for a while, I am taking it into account for a potential breakout, as it shows tightening price action, which reflects market indecision.

Price action has now coiled into a symmetrical triangle, this is often a classic continuation or reversal pattern, and it’s building pressure for a potential breakout. So, if we do get a clean breakout above this pattern, with strong bullish candles, volume, or bullish divergence, that’s your confirmation cue.

This is totally achievable. It aligns beautifully with the 0.25 to 0.5 Fibonacci retracement zone from the recent swing high to low. It’s not just a psychological round number, it’s technically supported.

If the lower boundary of the triangle is broken with momentum, you’ve got to step back. No trade is better than a bad one. Watch how price interacts with the zone. If it loses it, you could be looking at a deeper leg down, potentially revisiting deeper support levels from prior bullish structure.

Gold Short To Medium Term OutlookGold bounced from the lower Support Zone after briefly breaching $3,270. Price is now attempting a recovery, currently trading near $3,290, but remains below both the 50 EMA and 200 EMA — confirming bearish pressure is still intact.

For bulls to gain momentum, we need to see a clean break and hold above $3,298–$3,327which would open the path toward $3,352 and possibly higher resistance levels like $3,364 and $3,383.

Until then, this move may simply be a short-term pullback within a broader downtrend. If price fails to reclaim $3,327, watch for a drop back toward $3,270, with a deeper correction targeting the $3,241–$3,211 zone.

📌 Key Levels to Watch:

Resistance:

$3,298 • $3,327 • $3,352 • $3,364 • $3,383

Support:

$3,270 • $3,241 • $3,211 • $3,179

🧠 Fundamental Focus:

This week is packed with high-impact events — including Non-Farm Payrolls on Thursday. These could trigger sharp moves in gold, so stay cautious and manage risk wisely.

XRPUSDT 4H | Untested Demand Zone RevisitIn this 4-hour chart analysis of XRPUSDT, I’m focusing on a clear and well-defined untested demand zone between 2.05–2.13 USDT . Unlike the first demand zone (already tested and played out), this second zone has not been retested since its formation, making it a fresh area of interest for a potential long setup.

Why this matters :

Untested demand zones often act as powerful magnets for price when revisited, as they represent areas where large buy orders might be waiting to be filled. Because this zone has not been revisited yet, there’s a higher probability for a bullish reaction when price returns to it.

Key Technical Factors :

✅ The 2.05–2.13 demand zone was formed following a significant bullish impulse that created a clear break of structure to the upside.

✅ Price is currently consolidating above this demand zone and also above a potential bearish CHoCH at 2.0784 . This suggests that the bullish structure is still valid unless price breaks below 2.0784.

✅ My bullish target is 2.65 USDT , where previous highs were formed and potential liquidity exists.

✅ My stop loss is set just below the demand zone, around 2.05 , to protect against a deeper retracement or a shift in market structure.

My Thought Process :

I expect that if price returns to the demand zone, there will be a strong chance for buyers to step in and push the market higher. However, I’m aware that if price breaks below 2.0784 , it would signal a bearish CHoCH and invalidate the long scenario. Therefore, patience is key — I’ll wait for price to either test the zone and react strongly or stay above 2.0784 to keep the bullish bias intact.

Clear Trade Setup :

📌 Entry Zone : 2.05–2.13

🛑 Stop Loss : Below 2.05

🎯 Take Profit : 2.65

🧩 Invalidation : Break below 2.0784

💬 Let me know if you have a similar zone marked out or if you see a different setup! Let’s share ideas and refine our strategies together.

Buy Fear, Not Euphoria: The Trader's EdgeWhen you look back at the greatest trading opportunities in history, they all seem to share a common element: fear. Yet, when you're in the moment, it feels almost impossible to pull the trigger. Why? Because fear paralyzes, while euphoria seduces. If you want to truly evolve as a trader, you need to master this fundamental shift: buy fear, not euphoria.

Let's break it down together.

________________________________________

What Fear and Euphoria Really Mean in Markets

In simple terms, fear shows up when prices are falling sharply, when bad news dominates the headlines, and when people around you are saying "it's all over."

Euphoria, on the other hand, is everywhere when prices are skyrocketing, when everyone on social media is celebrating, and when it feels like "this can only go higher."

In those moments:

• Fear tells you to run away.

• Euphoria tells you to throw caution to the wind.

Both emotions are signals. But they are inverted signals. When fear is extreme, value appears. When euphoria is extreme, danger hides.

________________________________________

Why Buying Fear Works

Markets are pricing machines. They constantly adjust prices based on emotions, news, and expectations. When fear hits, selling pressure often goes beyond what is rational. People dump assets for emotional reasons, not fundamental ones.

Here’s why buying fear works:

• Overreaction: Bad news usually causes exaggerated moves.

• Liquidity Vacuums: Everyone sells, no one buys, creating sharp discounts.

• Reversion to Mean: Extreme moves tend to revert once emotions stabilize.

Buying into fear is not about being reckless. It’s about recognizing that the best deals are available when others are too scared to see them.

________________________________________

Why Chasing Euphoria Fails

At the peak of euphoria, risks are often invisible to the crowd. Valuations are stretched. Expectations are unrealistic. Everyone "knows" it's going higher — which ironically means there's no one left to buy.

Chasing euphoria often leads to:

• Buying high, selling low.

• Getting trapped at tops.

• Emotional regret and revenge trading.

You’re not just buying an asset — you're buying into a mass illusion.

________________________________________

How to Train Yourself to Buy Fear

It's not enough to "know" this. In the heat of the moment, you will still feel the fear. Here's how you build the right habit:

1. Pre-plan your entries: Before panic strikes, have a plan. Know where you want to buy.

2. Focus on strong assets: Not everything that falls is worth buying. Choose assets with strong fundamentals or clear technical setups.

3. Scale in: Don’t try to catch the bottom perfectly. Build positions gradually as fear peaks.

4. Use alerts, not emotions: Set price alerts. When they trigger, act mechanically.

5. Remember past patterns: Study previous fear-driven crashes. See how they recovered over time.

Trading is a game of memory. The more you internalize past patterns, the easier it is to act when everyone else panics.

________________________________________

A Recent Example: April 2025 Tariff Panic

Very recently, at the start of April, Trump’s new tariff announcements sent shockwaves through the market. Panic took over. Headlines screamed. Social media was flooded with fear.

But if you looked beyond the noise, charts like SP500 and US30 told a different story: the drops took price right into strong support zones.

At the time, I even posted this : support zones were being tested under emotional pressure.

If you had price alerts set and reacted mechanically, not emotionally , you could have bought into that fear — and potentially benefited from the rebound that followed just days later.

This is the essence of buying fear.

________________________________________

Final Thoughts

In trading, you are paid for doing the hard things. Buying when it feels terrible. Selling when it feels amazing.

Remember:

Fear offers you discounts. Euphoria offers you traps.

The next time the market feels like it's crashing, ask yourself:

• Is this fear real, or exaggerated?

• Is this an opportunity hiding under an emotional fog?

If you can answer that with clarity, you're already ahead of 90% of traders.

Stay rational. Stay prepared. And above all: buy fear, not euphoria.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EURNZD strong daily demand level at 1.89. Long biasSupply and demand imbalances are the driving forces behind price movements in the Forex market. By identifying these key zones or imbalances, traders can anticipate high-probability reversal or continuation setups. Today, we’ll analyze the EURNZD cross pair, which has recently formed a strong demand imbalance at $1.89—the most significant impulse in months.

The Power of Supply & Demand Imbalances

Supply and demand trading revolves around identifying areas where price has made a strong, impulsive move (demand or supply zone) and then waiting for a retracement into that zone for a potential reversal or continuation.

Key Characteristics of a Strong Imbalance:

✅ Extended Range Candles (ERC): Strong, wide-bodied candles indicate institutional buying/selling.

✅ Strong Imbalance: A clear shift in market structure after a strong rally or drop.

✅ Fresh Zone: The imbalance has not been tested yet or has only been tested once.

XAUUSD ScenariosHi, market kept rallying up. Right now 2325 is a temporary level acting as a resistance. Below it market could drop to 3207 and 3197 levels.

In order to go long you need to wait for the market to reach to demand levels specified in the chart and act accordingly.

Make sure to add your intuition and knowledge into this and don't take everything blindly.

Be honorable

XAUUSD BUY OR SELLHello guys,

in Today's analysis , market is rallying up, the blue line is the resistance in which many would think of selling . And too many stops have been gathered there. So one scenario would be hunting the stops above blue line and hitting the resistance around 2413 and see sellers coming in.

3100 is the last resistance which now acts as a support. below that 3089 would be demand level.

stay gold

GBP/USD Market Analysis: Potential Short Setup at ResistanceThe GBP/USD pair is trading near the **1.3000** psychological level, showing signs of consolidation after a strong bullish move. The chart suggests a potential reversal as price approaches a key resistance zone, with an apparent liquidity grab at the recent high.

The highlighted area around **1.2946 - 1.2921** represents a significant **H4 demand zone**, where price could retrace before continuing its next move. A break below this zone would indicate a deeper correction, with potential downside targets towards **1.2870** (OA level).

**Key Considerations:**

- A sustained break above **1.3000** could invalidate the bearish setup, leading to further upside momentum.

- A rejection at this level, combined with bearish price action, could confirm a short opportunity with a target towards the demand zone and lower support areas.

**Conclusion:** Traders should monitor price action around the resistance level and confirmation of a bearish reversal before committing to short positions. If bullish momentum persists, a breakout could open the door for further gains.

GBPCAD Price ActionHello Traders,

As you can see, I've marked the Demand Zone, based on the 2-hour timeframe. Additionally, I've highlighted Liquidity Levels, clearly distinguishing between those already swept and the valid ones remaining.

On the 15M timeframe, you'll notice I've marked the Breakout Block, also identified as the Supply Zone. If the price breaks this Supply Zone, you should set a pending order. There are two effective ways to enter this market: either through an FVG (Fair Value Gap) or a Breaker Block entry.

Your trade can be held for up to one day, with the stop-loss positioned at the recent swing low. Remember, it's crucial to manage your risk responsibly and avoid greed. This structure repeats itself consistently.

Wishing you the best and happy trading!

Thank you.

NVDA $90 PRISONAs last time we were stuck within the $90 range I can see a previous order block that was created and retested making it invalid. I am considering regardless this area of $91/94 as a good demand area. Not only the sentiment of the fanatics is that it is a discounted price at $90. But speculations are already running online that once they reach this area, they need to load up to head to $130.

This is a good sentiment to capitalize both on the movement down and the bounce.

The good traders do not become "fans" of a company. We just capitalize on fanatic sentiments to get their money as any good record label would with their artist.

Ladies and gentlemen, NVDA is our artist for this week concert.

Let us capitalize on the fans and hope they request an encore.

USD/JPY – Precision Short Trade Breakdown🔥 Executed a precise short trade on USD/JPY this morning, aligning with institutional order flow and Prime Market Terminal insights. Here’s the full breakdown of how this setup played out!

🔍 Trade Setup & Analysis:

📌 Entry: 149.300 – Price rejected a key supply zone & Fibonacci retracement level.

📌 Stop Loss: 149.558 – Above key liquidity & invalidation area.

📌 Take Profit: 148.504 (first TP), 148.213 (final target).

📌 Risk-Reward Ratio: 1:3

📊 Prime Market Terminal Insights That Confirmed This Trade:

🔻 Institutional Positioning & Market Flow:

✔ Smart Money Report:

Large institutions were heavily net short USD/JPY, with leveraged funds reducing their long exposure.

Dealer intermediaries (banks and liquidity providers) also added more short positions, indicating further downside momentum.

✔ COT (Commitment of Traders) Data:

Open interest showed a significant drop in long positions, suggesting weakness in USD/JPY.

Hedge funds and asset managers increasing short exposure aligned with my bearish bias.

✔ DMX Open Interest:

66% of institutional traders were short on USD/JPY, confirming my sell-side setup.

Short positioning had increased by 34% in the last session, reinforcing my downside expectation.

🔻 Volatility & Liquidity Insights:

✔ Average True Range (ATR) Analysis:

ATR showed a high probability of an extended move, suggesting the potential for price to hit my targets.

Recent daily ranges indicated USD/JPY had room to move another 100+ pips to the downside.

✔ Session Range & Market Structure:

Liquidity grab above 149.300 supply zone, followed by strong rejection and sell-off.

Previous session lows were swept, indicating smart money targeting deeper liquidity.

Institutional orders clustered around 148.200, suggesting a likely downside target.

🔻 High-Impact News That Influenced USD/JPY:

📢 Japanese Unemployment Rate (Actual: 2.5% | Forecast: 2.5%) → No surprise, minimal impact.

📉 Business Capex (MOF YY) (-0.2% vs. 8.1% previous) → Indicated economic slowdown, weakening JPY demand.

📰 U.S. Economic Data Later Today:

Redbook YY (USD) expected at 6.2% – could impact USD sentiment.

Fed’s Williams speech on monetary policy could affect USD volatility, reinforcing our bias.

🎯 Trade Execution & Outcome:

✅ TP HIT! Price dropped as expected, hitting both targets with precision.

🚀 Perfect confluence of:

✅ Smart money selling pressure

✅ Liquidity sweep & supply zone rejection

✅ High-probability move from ATR analysis

📸 Prime Market Terminal Screenshots Included:

📊 DMX Open Interest → Confirmed institutions were net short.

📊 COT Data → Showed decline in long positions.

📊 ATR & Volatility Charts → Supported extended downside movement.

📊 Session Ranges & Market Structure → Confirmed liquidity grab & supply zone rejection.

🔑 Key Takeaways from This Trade:

✔ Trade with institutional momentum – Always check positioning before entering!

✔ Multiple confirmations = High probability setups – Don’t rely on a single indicator.

✔ Liquidity is key – Smart money moves price to hunt liquidity, trade accordingly.

✔ Fundamentals matter – Weak JPY capex data helped push price lower.

💬 What’s your view on USD/JPY? Will we see further downside? Drop your thoughts below!

📊 Follow for more trade setups, market analysis & strategy breakdowns!

XRP Weekly-Monthly Analysis / Retracement Levels for BuyWeekly - Monthly trend: Bearish

Chart Pattern: Head & Shoulders (H&S) - Continuation Pattern

Retracement Fib Price Levels:

0.00% (3.4000)

23.60% (2.6879)

38.20% (2.2474)

50.00% (1.8914)

61.80% (1.5353)

78.60% (1.0284)

100.00% (0.3827)

Good prices for buy:

61.80% (1.5353) – Golden Zone / Golden Pocket

78.60% (1.0284) – Entry Zone

Between 78.60% (1.0284) and 100.00% (0.3827) is the Risk Zone, which we have the Neckline of the ‘’ Quadruple Bottom Pattern ‘’ at the price range ‘’ 0.6291 – 0.7850 ‘’

LEMONTREE HOTELS 240 MINS TIME FRAMEThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

We do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Please keep your comments useful & respectful.

Keep it simple, keep it Unique.

Thanks for your support

Tradelikemee Academy

Saanjayy KG

SPX500: Possible bounce from key support toward 5,980?FOREXCOM:SPX500 has reached a significant support zone, highlighted by previous price reactions and strong buying interest. This area has acted as a key demand zone, increasing the likelihood of a bullish bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a bullish reversal. A successful rebound could push the price toward 5,980 . However, if the price breaks below this zone, the bullish outlook may be invalidated, opening the possibility for further downside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

CADJPY - Potential buying opportunity in sightOANDA:CADJPY is trading near a clear support level that triggered bullish reversals in the past. The recent bearish move into this area creates a potential opportunity for buyers to regain control.

If bullish confirmation appears, such as increased buying volume or candlestick reversal patterns, I expect the price to move toward 105.550. On the other hand though, a break below this support would weaken the bullish scenario and suggest further downside.

Just my take on support and resistance zones—not financial advice.

Best of luck in the markets.

EUR/USD Daily Market Outlook – Here's Why We're Pushing HigherWelcome back, traders! My name is Steven, and this is your daily EUR/USD outlook. Make sure to leave a like, follow, and share your thoughts in the comments below. Now let’s dive straight into the charts.

The Bigger Picture: Weekly Insights

On the weekly timeframe, EUR/USD has made a strong bullish statement. After a series of lower lows and retracements, we’ve now broken above the weekly fractal high This move has solidified a bullish structure, setting the stage for further upside.

Where did this momentum come from?

The pair retraced into a fresh daily demand zone, formed around equal lows just above a key candlestick. Once those equal lows were swept, the demand zone held firm, leading to a V-shaped reversal. This is a textbook liquidity grab, and now the market is pushing back toward the highs.

Key Levels to Watch

Previous Weekly High – The next logical liquidity target sits above last week’s high, which remains untapped.

Monthly High – Just beyond the weekly high lies the previous month’s high, which also holds a cluster of liquidity.

Liquidity Bump in the Road – Zooming out, we can identify a minor “bump” in the impulse down, where significant stops and liquidity remain.

Lower Timeframe Strategy: Entries and Targets

If you’re trading the four-hour or lower timeframes, here’s what I’m watching:

Setup #1: The market is currently trading inside a four-hour demand zone, formed after yesterday’s inflation-driven dip. For confirmation, I’ll drop to the 1-hour or 15-minute timeframe and look for a trend shift. This means waiting for lower lows to turn into higher highs, creating fresh demand zones to trade from.

Setup #2: Alternatively, if we sweep the previous daily low, I’ll look for a reversal from that level to go long.

Both setups rely on lower timeframe order flow aligning with the higher timeframe bullish trend. Be patient—this confirmation is key.

What’s Driving EUR/USD Higher?

Yesterday’s inflation data sparked volatility, initially strengthening the dollar. However, the rally quickly reversed, with EUR/USD tapping a four-hour demand zone and bouncing higher.

Additionally, positive geopolitical developments—specifically talks of peace between Russia and Ukraine—have provided a boost to the euro, as a potential resolution would alleviate Europe’s energy inflation concerns.

Technical Takeaways

Bullish Trend Intact: Both weekly and daily structures remain bullish, supported by liquidity grabs and demand zone rejections.

Targets in Sight: I’m watching for a move toward the previous weekly high and potentially beyond, toward the monthly high.

Risk Management: As always, use tight stops and manage your risk, especially when trading lower timeframes.

Action Plan for Today

Monitor the four-hour demand zone for lower timeframe confirmations.

Watch the previous daily low for a potential liquidity sweep and reversal.

Stay tuned for any major news updates that could shift sentiment or momentum.

That’s it for today’s EUR/USD outlook! Let me know your thoughts in the comments below, and don’t forget to like and follow for more insights. Trade safe and good luck!

EUR/USD Technical Analysis: Consolidation, Demand Zones✅ Daily Timeframe Insights:

The EUR/USD has been consolidating between the 25% and 75% levels of its range. A potential upside continuation is expected if the demand zone at the bottom of the range holds. We’re eyeing a breakout of key levels for a bullish push.

✅ Weekly Timeframe Overview:

The EUR/USD is poised to target the previous week's high, supported by a weekly structural shift. This aligns with a broader retracement from liquidity lows, indicating strong momentum for further upside in the short term.

✅ Key Levels to Watch:

Resistance at 1.04670 (December high) is critical for further bullish confirmation.

Immediate downside risk arises if the current demand zone fails to hold.

✅ Economic Impact:

Today’s inflation data release will likely drive significant volatility. Traders should prepare for rapid price action and adjust strategies accordingly.

⚙️ Technical Tools & Key Concepts Used:

Liquidity zones

Supply & demand analysis

Fibonacci retracements (0.5 and 0.618 levels)

Weekly and daily fractal structure shifts

🚀 Forecast Summary:

While the bullish trend remains intact, news events like inflation figures could create temporary volatility or even reversals. For now, EUR/USD’s demand zones remain in control, favoring upside continuation. A break below key levels would signal short-term bearish opportunities.

Tags:

#EURUSD #ForexTrading #TechnicalAnalysis #SupplyAndDemand #PriceAction #TradingStrategy