Is Samsung's Chip Bet Paying Off?Samsung Electronics is navigating a complex global landscape, marked by intense technological competition and shifting geopolitical alliances. A recent $16.5 billion deal to supply advanced chips to Tesla, confirmed by Elon Musk, signals a potential turning point. This contract, set to run until late 2033, underscores Samsung's strategic commitment to its foundry business. The agreement will dedicate Samsung's new Texas fabrication plant to producing Tesla's next-generation AI6 chips, a move Musk himself highlighted for its significant strategic importance. This partnership aims to bolster Samsung's position in the high-stakes semiconductor sector, particularly in advanced manufacturing and AI.

The deal's economic and technological implications are substantial. Samsung's foundry division has faced profitability challenges, experiencing estimated losses exceeding $3.6 billion in the first half of the year. This large-scale contract is expected to help mitigate those losses, providing a much-needed revenue stream. From a technological standpoint, Samsung aims to accelerate its 2-nanometer (2nm) mass production efforts. While its 3nm process faced yield hurdles, the Tesla collaboration, with Musk's direct involvement in optimizing efficiency, could be crucial for improving 2nm yields and attracting future clients like Qualcomm. This pushes Samsung to remain at the forefront of semiconductor innovation.

Beyond the immediate financial and technological gains, the Tesla deal holds significant geopolitical and geostrategic weight. The dedicated Texas fab enhances U.S. domestic chip production capabilities, aligning with American goals for supply chain resilience. This deepens the U.S.-South Korea semiconductor alliance. For South Korea, the deal strengthens its critical tech exports and may provide leverage in ongoing trade negotiations, particularly concerning potential U.S. tariffs. While Samsung still trails TSMC in foundry market share and faces fierce competition in High-Bandwidth Memory (HBM) from SK Hynix, this strategic alliance with Tesla positions Samsung to solidify its recovery and expand its influence in the global high-tech arena.

Supplychain

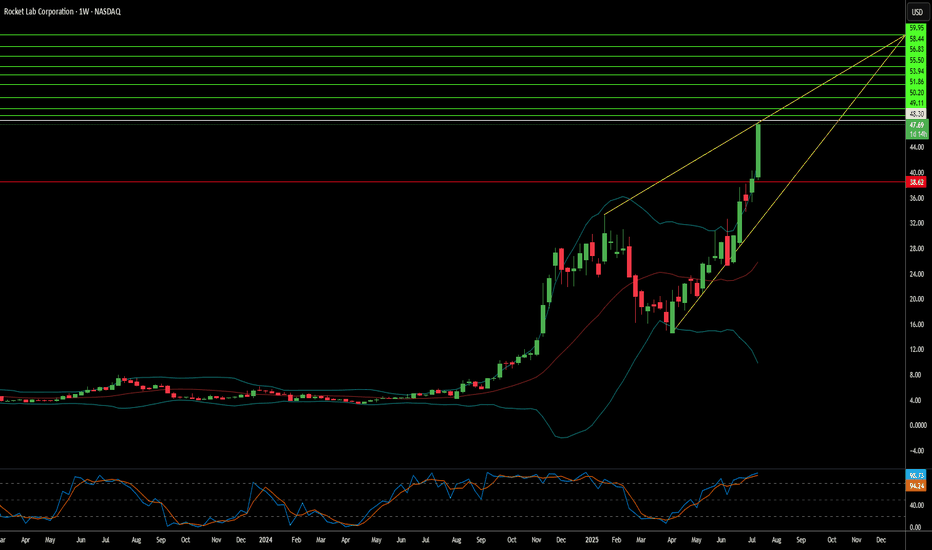

Is Rocket Lab the Future of Space Commerce?Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab leverages a strategic geographic presence, particularly its strong U.S. footprint. This dual-nation capability is crucial for securing sensitive U.S. government and national security contracts, aligning perfectly with the U.S. imperative for resilient, domestic space supply chains in an era of heightened geopolitical competition. This positions Rocket Lab as a trusted partner for Western allies, mitigating supply chain risks for critical missions and bolstering its competitive edge.

The company's growth is inextricably linked to significant global shifts. The space economy is projected to surge from $630 billion in 2023 to $1.8 trillion by 2035, driven by decreasing launch costs and increasing demand for satellite data. Space is now a critical domain for national security, compelling governments to rely on commercial entities for responsive and reliable access to orbit. Rocket Lab's Electron rocket, with over 40 launches and a 91% success rate, is ideally suited for the burgeoning small satellite market, vital for Earth observation and global communications. Its ongoing development of Neutron, a reusable medium-lift rocket, promises to further reduce costs and increase launch cadence, targeting the expansive market for mega-constellations and human spaceflight.

Rocket Lab's strategic acquisitions, such as SolAero and Sinclair Interplanetary, enhance its in-house manufacturing capabilities, allowing greater control over the entire space value chain. This vertical integration not only streamlines operations and reduces lead times but also establishes a significant barrier to entry for competitors. While facing stiff competition from industry giants like SpaceX and emerging players, Rocket Lab's diversified approach into higher-margin space systems and its proven reliability position it strongly. Its strategic partnerships further validate its technological prowess and operational excellence, ensuring a robust position in an increasingly competitive landscape. As the company explores new frontiers like on-orbit servicing and in-space manufacturing, Rocket Lab continues to demonstrate the strategic foresight necessary to thrive in the dynamic new space race.

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture and proprietary platforms. This market leadership, coupled with formidable barriers to entry and significant switching costs in the aircraft engine industry, secures a robust competitive advantage. Furthermore, a highly profitable aftermarket business, driven by long-term maintenance contracts and an expanding installed engine base, provides a resilient, recurring revenue stream. This lucrative segment buffers the company against cyclicality and ensures consistent earnings visibility.

Macroeconomic tailwinds also play a crucial role in GE Aerospace's sustained growth. Global air travel is steadily increasing, driving higher aircraft utilization rates. This directly translates to greater demand for new engines and, more importantly, consistent aftermarket servicing, which is a core profit driver for GE Aerospace. Management, under CEO Larry Culp, has also strategically navigated external challenges. They localized supply chains, secured alternate component sources, and optimized logistics costs. These actions proved critical in mitigating the impact of new tariff regimes and broader trade war tensions.

Geopolitical developments have significantly shaped GE Aerospace's trajectory. Notably, the U.S. government's decision to lift restrictions on exporting aircraft engines, including LEAP-1C and GE CF34 engines, to China's Commercial Aircraft Corporation of China (COMAC) reopened a vital market channel. This move, occurring amidst a complex U.S.-China trade environment, underscores the strategic importance of GE Aerospace's technology on the global stage. The company's robust financial performance further solidifies its position, with strong earnings beats, a healthy return on equity, and positive outlooks from a majority of Wall Street analysts. Institutional investors are actively increasing their stakes, signaling strong market confidence in GE Aerospace's continued growth potential.

Can Strategic Minerals Transform National Security?MP Materials has experienced a significant market revaluation, with its stock surging over 50% following a pivotal public-private partnership with the U.S. Department of Defense (DoD). This multi-billion-dollar agreement, which includes a $400 million equity investment, substantial additional funding, and a $150 million loan, aims to rapidly establish a robust, end-to-end U.S. rare earth magnet supply chain. This strategic collaboration is designed to curtail the nation's reliance on foreign sources for these critical materials, which are indispensable for advanced technology systems across both defense and commercial applications, from F-35 fighter jets to electric vehicles.

The partnership underscores a profound geopolitical imperative: countering China's near-monopoly over the global rare earth supply chain. China dominates rare earth mining, refining, and magnet production, a leverage it has demonstrably used through export restrictions amidst escalating trade tensions with the U.S. These actions highlighted acute U.S. vulnerabilities and the imperative for domestic independence, propelling the DoD's "mine to magnet" strategy aimed at achieving self-sufficiency by 2027. The DoD's substantial investment and its new position as MP Materials' largest shareholder signal a decisive shift in U.S. industrial policy, directly challenging China's influence and asserting economic sovereignty in a vital sector.

Central to the deal's financial attractiveness and long-term stability is a 10-year price floor of $110 per kilogram for key rare earths, significantly higher than historical averages. This guarantee not only ensures MP Materials' profitability, even against potential market manipulation, but also de-risks its ambitious expansion plans, including new magnet manufacturing facilities expected to produce 10,000 metric tons annually. This comprehensive financial and demand certainty transforms MP Materials from a commodity producer vulnerable to market whims into a strategic national asset, attracting further private investment and setting a powerful precedent for securing other critical mineral supply chains in the Western Hemisphere.

Why Your Orange Juice Costs More?The price of orange juice is surging, impacting consumers and the broader economy. This increase stems from a complex interplay of geopolitical tensions, macroeconomic pressures, and severe environmental challenges. Understanding these multifaceted drivers reveals a volatile global commodity market. Investors and consumers must recognize the interconnected factors that now influence everyday staples, such as orange juice.

Geopolitical shifts significantly contribute to the rising prices of orange juice. The United States recently announced a 50% tariff on all Brazilian imports, effective August 1, 2025. This politically charged move targets Brazil's stance on former President Jair Bolsonaro's prosecution and its growing alignment with BRICS nations. Brazil dominates the global orange juice supply, providing over 80% of the world's trade share and 81% of U.S. orange juice imports between October 2023 and January 2024. The new tariff directly increases import costs, squeezing margins for U.S. importers and creating potential supply shortages.

Beyond tariffs, a convergence of macroeconomic forces and adverse weather conditions amplify price pressures. Higher import costs fuel inflation, potentially compelling central banks to maintain tighter monetary policies. This broader inflationary environment impacts consumer purchasing power. Simultaneously, orange production faces severe threats. Citrus greening disease has devastated groves in both Florida and Brazil. Extreme weather events, including hurricanes and droughts, further reduce global orange yields. These environmental setbacks, coupled with geopolitical tariffs, create a robust bullish outlook for orange juice futures, suggesting continued price appreciation in the near term.

Howmet Aerospace: Navigating Geopolitics to New Heights?Howmet Aerospace (HWM) has emerged as a formidable player in the aerospace sector, demonstrating exceptional resilience and growth amidst global uncertainties. The company's robust performance, marked by record revenues and significant earnings per share increases, stems from dual tailwinds: surging demand in commercial aerospace and heightened global defense spending. Howmet's diversified portfolio, which includes advanced engine components, fasteners, and forged wheels, positions it uniquely to capitalize on these trends. Its strategic focus on lightweight, high-performance parts for fuel-efficient aircraft like the Boeing 787 and Airbus A320neo, alongside critical components for defense programs such as the F-35 fighter jet, underpins its premium market valuation and investor confidence.

The company's trajectory is deeply intertwined with the prevailing geopolitical landscape. Escalating international rivalries, particularly between the U.S. and China, coupled with regional conflicts, are driving an unprecedented surge in global military expenditures. European defense budgets are expanding significantly, fueled by the conflict in Ukraine and broader security concerns, leading to increased demand for advanced military hardware incorporating Howmet’s specialized components. Simultaneously, while commercial aviation navigates challenges like airspace restrictions and volatile fuel costs, the imperative for fuel-efficient aircraft, driven by both environmental regulations and economic realities, solidifies Howmet’s role in the industry’s strategic evolution.

Howmet's success also reflects its adept navigation of complex geostrategic challenges, including trade protectionism. The company has proactively addressed potential tariff impacts, demonstrating a capacity to mitigate risks through strategic clauses and renegotiation, thereby protecting its supply chain and operational efficiency. Despite its premium valuation, Howmet’s strong fundamentals, disciplined capital allocation, and commitment to shareholder returns highlight its financial health. The company's innovative solutions, crucial for enhancing the performance and cost-effectiveness of next-generation aircraft, solidify its integral position within the global aerospace and defense ecosystem, making it a compelling consideration for discerning investors.

Why the Sudden Surge in Soybean Oil Prices?Recent sharp increases in Chicago soybean oil prices reflect a confluence of dynamic global and domestic factors. Geopolitical tensions, particularly those impacting crude oil markets, have played a significant role, as evidenced by the recent surge in Brent crude futures following events in the Middle East. This volatility in the broader energy complex directly influences the cost and strategic value of alternative fuels, positioning soybean oil at the forefront of this market shift.

A primary driver of this ascent is the transformative policy initiatives from the U.S. Environmental Protection Agency (EPA). The EPA's proposed Renewable Fuel Standard (RFS) volume requirements for 2026 and 2027 represent an aggressive push towards increased domestic biofuel production. These mandates, significantly exceeding previous targets, aim to bolster U.S. energy security and provide substantial support for American agriculture by boosting demand for soybeans and their derivatives. Key changes, such as the transition to RIN equivalents and reduced RIN costs for imports, are designed to further incentivize domestic consumption and reshape market dynamics.

This policy-driven demand fundamentally reorients the U.S. soybean oil market, causing Chicago Board of Trade futures to increasingly reflect internal American forces rather than global trends. This necessitates a shift in focus for traders towards physical market prices in other regions for international insights. The market has reacted swiftly, with notable increases in futures prices, a surge in open interest, and record trading volumes, indicating strong investor confidence in soybean oil's role within this evolving landscape. Concurrently, the new mandates exert pressure on imported biofuel feedstocks, further solidifying the emphasis on domestic supply.

Ultimately, the rise of soybean oil prices signifies more than just market speculation; it marks a pivotal transformation. It positions soybean oil as an essential commodity within the U.S.'s energy independence strategy, where robust domestic demand, shaped by forward-looking policy, becomes the prevailing force. This transition underscores how intertwined agricultural markets now are with national energy objectives and global geopolitical stability.

Can P&G Weather the Economic Storm?Procter & Gamble, a global leader in consumer goods, currently faces significant economic turbulence, exemplified by recent job cuts and a decline in its stock value. The primary catalyst for these challenges stems from the Trump administration's tariff policies, which have directly impacted P&G's supply chain by increasing costs for raw materials and finished goods imported from China. This financial burden, estimated to be hundreds of millions of dollars, compels P&G to reassess sourcing strategies, enhance productivity, and potentially raise product prices, risking a reduction in consumer demand.

In response to these escalating pressures and a noticeable slowdown in category growth rates within the U.S., P&G has initiated a substantial restructuring program. This includes the elimination of up to 7,000 jobs, representing approximately 15% of its non-manufacturing workforce, over the next two years. The company also plans to discontinue sales of certain products in specific markets as part of its broader strategic adjustments. These decisive measures aim to safeguard P&G's long-term financial algorithm, although executives acknowledge they do not alleviate immediate operational hurdles.

Beyond the direct impact of tariffs, a pervasive sense of economic uncertainty and declining consumer confidence in the U.S. further complicates P&G's operating environment. Recent data indicates a sustained drop in consumer sentiment, directly influencing discretionary spending and prompting households to become more cautious with their purchases. This shift, combined with broader negative economic indicators such as rising jobless claims and increased layoffs across various sectors, creates a challenging landscape for companies reliant on robust consumer spending. P&G's immediate future hinges on its strategic agility in mitigating tariff impacts, managing pricing, and adapting to a volatile economic climate.

Will Middle East Tensions Ignite a Global Oil Crisis?The global oil market faces significant turbulence amidst reports of potential Israeli military action against Iran's nuclear facilities. This looming threat has triggered a notable surge in oil prices, reflecting deep market anxieties. The primary concern stems from the potential for severe disruption to Iran's oil output, a critical component of global supply. More critically, an escalation risks Iranian retaliation, including a possible blockade of the Strait of Hormuz, a vital maritime chokepoint through which a substantial portion of the world's oil transits. Such an event would precipitate an unprecedented supply shock, echoing historical price spikes seen during past Middle Eastern crises.

Iran currently produces around 3.2 million barrels per day and holds strategic importance beyond its direct volume. Its oil exports, primarily to China, serve as an economic lifeline, making any disruption profoundly impactful. A full-scale conflict would unleash a cascade of economic consequences: extreme oil price surges would fuel global inflation, potentially pushing economies into recession. While some spare capacity exists, a prolonged disruption or a Hormuz blockade would render it insufficient. Oil-importing nations, particularly vulnerable developing economies, would face severe economic strain, while major oil exporters, including Saudi Arabia, the US, and Russia, would see substantial financial gains.

Beyond economics, a conflict would fundamentally destabilize the geopolitical landscape of the Middle East, unraveling diplomatic efforts and exacerbating regional tensions. Geostrategically, the focus would intensify on safeguarding critical maritime routes, highlighting the inherent vulnerabilities of global energy supply chains. Macroeconomically, central banks would confront the difficult task of managing inflation without stifling growth, leading to a surge in safe-haven assets. The current climate underscores the profound fragility of global energy markets, where geopolitical developments in a volatile region can have immediate and far-reaching global repercussions.

Why Did 3M Stock Soar Despite Tariff Clouds?Shares of industrial giant 3M Co. experienced a significant rally following the release of its first-quarter 2025 financial results. The surge was primarily driven by the company reporting adjusted earnings and total net sales that exceeded Wall Street's expectations. This performance signaled a stronger operational footing than analysts had anticipated.

The positive results stemmed from several key factors highlighted in the report. 3M demonstrated solid organic sales growth and achieved notable adjusted operating margin expansion. This margin improvement reflects the effectiveness of management's ongoing cost-cutting initiatives and strategic focus on operational efficiency, contributing directly to double-digit growth in earnings per share during the quarter.

While the company did warn about potential future impacts on 2025 profit due to rising global trade tensions and tariffs, management also detailed proactive strategies to mitigate these risks. Plans include supply chain adjustments, pricing actions, and leveraging their global manufacturing network, potentially increasing U.S. production. The company maintained its full-year adjusted earnings guidance, notably stating that this outlook already incorporates the anticipated tariff effects. Investors likely responded positively to the combination of strong quarterly performance and clear actions to address identified headwinds.

Cocoa's Future: Sweet Commodity or Bitter Harvest?The global cocoa market faces significant turbulence, driven by a complex interplay of environmental, political, and economic factors threatening price stability and future supply. Climate change presents a major challenge, with unpredictable weather patterns in West Africa increasing disease risk and directly impacting yields, as evidenced by farmer reports and scientific studies showing significant yield reductions due to higher temperatures. Farmers warn of potential crop destruction within the decade without substantial support and adaptation measures.

Geopolitical pressures add another layer of complexity, particularly regarding farmgate pricing in Ghana and Côte d'Ivoire. Political debate in Ghana centres on demands to double farmer payments to align with campaign promises and counter the incentive for cross-border smuggling created by higher prices in neighbouring Côte d'Ivoire. This disparity highlights the precarious economic situation for many farmers and the national security implications of unprofitable cocoa cultivation.

Supply chain vulnerabilities, including aging trees, disease prevalence like Swollen Shoot Virus, and historical underinvestment by farmers due to low prices, contribute to a significant gap between potential and actual yields. While recent projections suggest a potential surplus for 2024/25 after a record deficit, pollination limitations remain a key constraint, with studies confirming yields are often capped by insufficient natural pollination. Concurrently, high prices are dampening consumer demand and forcing manufacturers to consider reformulating products, reflected in declining cocoa grinding figures globally.

Addressing these challenges necessitates a multi-pronged approach focused on sustainability and resilience. Initiatives promoting fairer farmer compensation, longer-term contracts, agroforestry practices, and improved soil management are crucial. Enhanced collaboration across the value chain, alongside government support for sustainable practices and compliance with new environmental regulations, is essential to navigate the current volatility and secure a stable future for cocoa production and the millions who depend on it.

Chips Down: What Shadows Loom Over Nvidia's Path?While Nvidia remains a dominant force in the AI revolution, its stellar trajectory faces mounting geopolitical and supply chain pressures. Recent US export restrictions targeting its advanced H20 AI chip sales to China have resulted in a significant $5.5 billion charge and curtailed access to a crucial market. This action, stemming from national security concerns within the escalating US-China tech rivalry, highlights the direct financial and strategic risks confronting the semiconductor giant.

In response to this volatile environment, Nvidia is initiating a strategic diversification of its manufacturing footprint. The company is spearheading a massive investment initiative, potentially reaching $500 billion, to build AI infrastructure and chip production capabilities within the United States. This involves critical collaborations with partners like TSMC in Arizona, Foxconn in Texas, and other key players, aiming to enhance supply chain resilience and navigate the complexities of trade tensions and potential tariffs.

Despite these proactive steps, Nvidia's core operations remain heavily dependent on Taiwan Semiconductor Manufacturing Co. (TSMC) for producing its most advanced chips, primarily in Taiwan. This concentration exposes Nvidia to significant risk, particularly given the island's geopolitical sensitivity. A potential conflict disrupting TSMC's Taiwanese fabs could trigger a catastrophic global semiconductor shortage, halting Nvidia's production and causing severe economic repercussions worldwide, estimated in the trillions of dollars. Successfully navigating these intertwined market, supply chain, and geopolitical risks is the critical challenge defining Nvidia's path forward.

Will Coffee Remain an Affordable Luxury?Global coffee prices are experiencing a significant upswing, driven primarily by severe supply constraints in the world's major coffee-producing regions. Adverse weather conditions, notably drought and inconsistent rainfall linked to climate change, have crippled production capacity in Brazil (the largest arabica producer) and Vietnam (the largest robusta producer). Consequently, crop yield forecasts are being revised downwards, export volumes are shrinking, and concerns over future harvests are mounting, putting direct upward pressure on both arabica and robusta bean prices worldwide.

Adding complexity to the situation are fluctuating market dynamics and conflicting future outlooks. While recent robusta inventories have tightened, arabica stocks saw a temporary rise, sending mixed signals. Export data is similarly inconsistent, and market forecasts diverge significantly – some analysts predict deepening deficits and historically low stocks, particularly for Arabica, while others project widening surpluses. Geopolitical factors, including trade tensions and tariffs, further cloud the picture, impacting costs and potentially dampening consumer demand.

These converging pressures translate directly into higher operational expenses for businesses across the coffee value chain. Roasters face doubled green bean costs, forcing cafes to increase consumer prices for beverages to maintain viability amidst already thin margins. This sustained cost increase is impacting consumer behaviour, potentially shifting preferences towards lower-quality coffee, and diminishing the price premiums previously enjoyed by specialty coffee growers. The industry faces significant uncertainty, grappling with the possibility that these elevated price levels may represent a new, challenging norm rather than a temporary spike.

Vietnam's Shadow Over Nike's Swoosh?Nike's recent stock dip illuminates the precarious balance of global supply chains in an era of trade tensions. The article reveals a direct correlation between the proposed US tariffs on Asian imports, particularly from Vietnam – Nike's primary manufacturing hub – and a significant drop in the company's stock value. This immediate market reaction underscores the financial risks associated with Nike's deep reliance on its extensive factory network in Vietnam, which produces a substantial portion of its footwear, apparel, and equipment.

Despite robust revenues, Nike operates with relatively thin profit margins, leaving limited capacity to absorb increased costs from tariffs. The competitive nature of the athletic wear industry further restricts Nike's ability to pass these costs onto consumers through significant price hikes without risking decreased demand. Analysts suggest that only a fraction of the tariff burden can likely be transferred, forcing Nike to explore alternative, potentially less appealing, mitigation strategies such as product downgrades or extended design cycles.

Ultimately, the article highlights Nike's significant challenges in navigating the current trade landscape. While historically cost-effective, the deep entrenchment of its manufacturing in Vietnam now presents a considerable vulnerability. Shifting production elsewhere, particularly back to the US, proves complex and expensive due to the specialized nature of footwear manufacturing and the lack of domestic infrastructure. The future financial health of the athleticwear giant hinges on its ability to adapt to these evolving geopolitical and economic pressures.

Copper's Grip: Stronger Than Oil's?Is the U.S. economy poised for a red metal revolution? The escalating demand for copper, fueled by the global transition to clean energy, the proliferation of electric vehicles, and the modernization of critical infrastructure, suggests a shifting economic landscape where copper's significance may soon eclipse oil. This vital metal, essential for everything from renewable power systems to advanced electronics, is becoming increasingly central to U.S. economic prosperity. Its unique properties and expanding applications in high-growth sectors position it as a linchpin for future development, potentially rendering it more crucial than traditional energy sources in the years to come. This sentiment is echoed by recent market activity, with copper prices hitting a new record high, reaching $5.3740 per lb. on the COMEX. This surge has widened the price gap between New York and London to approximately $1,700 a tonne, signaling strong U.S. demand.

However, this burgeoning importance faces a looming threat: the potential imposition of U.S. tariffs on copper imports. Framed under the guise of national security concerns, these tariffs could trigger significant economic repercussions. By increasing the cost of imported copper, a vital component for numerous domestic industries, tariffs risk inflating production costs, raising consumer prices, and straining international trade relationships. The anticipation of these tariffs has already caused market volatility, with major traders at a Financial Times commodities summit in Switzerland predicting copper could reach $12,000 a tonne this year. Kostas Bintas from Mercuria noted the current "tightness" in the copper market due to substantial imports heading to the U.S. in anticipation of tariffs, which some analysts expect sooner than previously anticipated.

Ultimately, the future trajectory of the U.S. economy will be heavily influenced by the availability and affordability of copper. Current market trends reveal surging prices driven by robust global demand and constrained supply, a situation that could be further exacerbated by trade barriers. Traders are also anticipating increased industrial demand as major economies like the U.S. and EU upgrade their electricity grids, further supporting the bullish outlook. Aline Carnizelo of Frontier Commodities is among the experts forecasting a $12,000 price target. However, Graeme Train from Trafigura cautioned that the global economy remains "a little fragile," highlighting potential risks to sustained high demand. As the world continues its march towards electrification and technological advancement, copper's role will only intensify. Whether the U.S. navigates this new era with policies that ensure a smooth and cost-effective supply of this essential metal or whether protectionist measures inadvertently hinder progress remains a critical question for the nation's economic future.

Is Apple's Empire Built on Sand?Apple Inc., a tech titan valued at over $2 trillion, has built its empire on innovation and ruthless efficiency. Yet, beneath this dominance lies a startling vulnerability: an overreliance on Taiwan Semiconductor Manufacturing Company (TSMC) for its cutting-edge chips. This dependence on a single supplier in a geopolitically sensitive region exposes Apple to profound risks. While Apple’s strategy has fueled its meteoric rise, it has also concentrated its fate in one precarious basket—Taiwan. As the world watches, the question looms: what happens if that basket breaks?

Taiwan’s uncertain future under China’s shadow amplifies these risks. If China moves to annex Taiwan, TSMC’s operations could halt overnight, crippling Apple’s ability to produce its devices. Apple’s failure to diversify its supplier base left its trillion-dollar empire on a fragile foundation. Meanwhile, TSMC’s attempts to hedge by opening U.S. factories introduce new complications. If Taiwan falls, the U.S. could seize these assets, potentially handing them to competitors like Intel. This raises unsettling questions: Who truly controls the future of these factories? And what becomes of TSMC’s investments if they fuel a rival’s ascent?

Apple’s predicament is a microcosm of a global tech industry tethered to concentrated semiconductor production. Efforts to shift manufacturing to India or Vietnam pale against China’s scale, while U.S. regulatory scrutiny—like the Department of Justice’s probe into Apple’s market dominance—adds further pressure. The U.S. CHIPS Act seeks to revive domestic manufacturing, but Apple’s grip on TSMC muddies the path forward. The stakes are clear: resilience must now trump efficiency, or the entire ecosystem risks collapse.

As Apple stands at this crossroads, the question echoes: Can it forge a more adaptable future, or will its empire crumble under the weight of its design? The answer may not only redefine Apple but also reshape the global balance of tech and power. What would it mean for us all if the chips—both literal and figurative—stopped falling into place?

Can One Bean's Rally Reshape Global Markets?The extraordinary trajectory of cocoa in 2024 has rewritten the commodities playbook, outperforming traditional powerhouses like oil and metals with a staggering 175% price surge. This unprecedented rally, culminating in record prices of nearly $13,000 per metric ton, reveals more than just market volatility—it exposes the delicate balance between global supply chains and environmental factors.

West Africa's cocoa belt lies at the heart of this transformation, where Ivory Coast and Ghana face a complex web of challenges. The convergence of adverse weather conditions, particularly the harsh Harmattan winds from the Sahara and widespread bean disease, and the encroachment of illegal gold mining operations, has created a perfect storm that threatens global chocolate production. This situation presents a compelling case study of how localized agricultural challenges can cascade into global market disruptions.

The ripple effects extend beyond just chocolate manufacturers and commodities traders. This market upheaval coincides with similar pressures in other soft commodities, notably coffee, which saw prices reach forty-year highs. These parallel developments suggest a broader pattern of vulnerability in agricultural commodities that could reshape our understanding of market dynamics and risk assessment in commodity trading. As we look toward 2025, the cocoa market stands as a harbinger of how climate volatility and regional production challenges might increasingly influence global commodity markets, forcing investors and industry players to adapt to a new normal in agricultural commodity trading.

Are Global Coffee Markets Brewing a Crisis Beyond Price?In an unprecedented turn of events, the coffee industry faces its fifth consecutive season of demand surpassing production, driving prices to their highest levels in nearly half a century. This isn't merely a story of market dynamics – it's a complex narrative where climate change, shifting consumption patterns, and agricultural sustainability converge to reshape the future of the world's favorite beverage.

The situation has reached a critical juncture as major producing regions struggle with severe weather disruptions. Brazil's drought-stricken Arabica crops and Vietnam's weather-battered Robusta production have created a perfect storm in the market. Volcafe's dramatic reduction of its 2025/26 Brazilian production forecast by 11 million bags underscores the severity of these challenges. China's 60% surge in coffee consumption over five years adds pressure to an already strained supply chain.

Perhaps most concerning is the structural nature of these challenges. Traditional growing regions, from Kenya's prestigious AA bean farms to Brazil's vast coffee plantations, face existential threats from climate change. The delicate balance required for premium coffee production – specific humidity levels, temperature ranges, and rainfall patterns – is increasingly difficult to maintain. One industry expert notes that suitable growing areas continue to shrink, suggesting current market pressures may become the new normal rather than a temporary disruption.

This convergence of factors presents both challenges and opportunities for investors, industry stakeholders, and consumers alike. As major producers like Nestlé and J.M. Smucker announce price increases for 2025, the industry stands at a crossroads. The future of coffee will likely be defined not just by how we manage immediate supply challenges, but by how we adapt to an*56C3VFGBHd innovate within these new environmental and market realities.

Will China's Game Redefine The Global Copper Paradigm?In the dynamic landscape of global commodities, copper emerges as a fascinating case study of economic interconnectedness and strategic policymaking. Recent developments have seen prices climb to $8,971.50 per metric ton, driven by China's bold $411 billion treasury bond initiative – a move that could reshape the metal's trajectory in international markets. This price movement, however, tells only part of a more complex story that challenges conventional market wisdom.

The interplay between supply fundamentals and geopolitical forces creates an intriguing narrative. While physical demand remains robust and Chinese inventories run low, the market grapples with a 19% decline from its May peak, highlighting the delicate balance between immediate market dynamics and broader economic forces. This tension is further amplified by the looming influence of potential U.S. trade policies under President-elect Trump's administration, adding another layer of complexity to an already multifaceted market equation.

Perhaps most compelling is the transformation of copper's role in the global economy. As traditional demand drivers like property construction show weakness, the metal's crucial position in the green energy transition offers a new frontier of opportunity. With electric vehicle sales continuing to break records and renewable energy infrastructure expanding, copper stands at the crossroads of old and new economic paradigms. This evolution, coupled with China's strategic stimulus measures and the market's response to supply-side developments, suggests that copper's story in 2025 and beyond will be one of adaptation, resilience, and strategic importance in the global economic landscape.

Will America's Tech Sovereignty Rise or Fall on a Silicon Chip?In the high-stakes chess game of global technological supremacy, Intel emerges as America's potential knight—a critical piece poised to reshape the semiconductor landscape. The battleground is not just silicon and circuits, but national security, economic resilience, and the future of technological innovation. As geopolitical tensions simmer and supply chain vulnerabilities become increasingly apparent, Intel stands at the crossroads of a transformative strategy that could determine whether the United States maintains its technological edge or surrenders ground to international competitors.

The CHIPS and Science Act represents more than a financial investment; it is a bold declaration of technological independence. With billions of dollars earmarked to support domestic semiconductor production, the United States is making an unprecedented bet on Intel's ability to leapfrog current manufacturing limitations. The company's ambitious 18A process, slated for 2025, symbolizes more than a technological milestone—it represents a potential renaissance of American technological leadership, challenging the current dominance of Asian semiconductor manufacturers and positioning the United States as a critical player in the global tech ecosystem.

Behind this narrative lies a profound challenge: can Intel transform from a traditional chip manufacturer into a strategic national asset? The potential partnership discussions with tech giants like Apple and Nvidia, and the looming geopolitical risks of over-reliance on foreign chip production, underscore a moment of critical transformation. Intel is no longer just a technology company—it has become a potential linchpin in America's strategy to maintain technological sovereignty, with the power to redefine global semiconductor production and secure the nation's strategic technological infrastructure.

Can a Single Onion Slice Reshape the Future of Fast Food?In a dramatic turn of events that has sent ripples through the quick-service restaurant industry, McDonald's Corporation faces a watershed moment that transcends mere food safety concerns. The recent E. coli outbreak linked to Quarter Pounder burgers, resulting in 49 reported cases across 10 states, serves as a powerful reminder of how seemingly minor supply chain decisions can cascade into significant corporate challenges. With shares plummeting 7% in after-hours trading, this crisis presents a compelling case study in crisis management, operational resilience, and the delicate balance between efficiency and safety in modern food service operations.

The revelation that slivered onions from a single supplier could potentially trigger such widespread impact challenges conventional wisdom about supply chain diversification in the fast-food industry. McDonald's swift response - removing Quarter Pounders from menus across several Western states and implementing immediate supply chain modifications - demonstrates the complex interplay between brand protection and operational agility. This situation raises profound questions about the industry's approach to supplier relationships and the potential vulnerabilities created by centralized sourcing strategies in pursuit of consistency and cost efficiency.

Beyond the immediate health concerns and financial implications, this crisis illuminates a broader narrative about consumer trust and corporate responsibility in the modern food service landscape. As McDonald's navigates this challenge, their response may well set new standards for crisis management and transparency in the industry. The incident serves as a catalyst for reimagining food safety protocols and supply chain resilience, potentially ushering in a new era where consumer safety and operational efficiency are not just balanced but fundamentally integrated into the fabric of fast-food operations.

Will the World's Most Vital Artery Become Its Achilles' Heel?In the intricate dance of global energy markets, few factors wield as much influence as the Strait of Hormuz. This narrow waterway, often overlooked in daily discourse, stands as a silent titan, controlling the ebb and flow of 21% of the world's daily oil consumption. As geopolitical tensions simmer in the Middle East, the stability of this crucial chokepoint hangs in delicate balance, challenging us to confront a stark reality: how vulnerable is our global economy to disruptions in this single maritime passage?

The potential for conflict to spill over into the Strait of Hormuz presents a fascinating study in risk assessment and market psychology. Despite the looming threat of supply disruptions that could send oil prices soaring to unprecedented heights—some analysts project as high as $350 per barrel—the market remains surprisingly sanguine. This dichotomy between potential catastrophe and current calm invites us to explore the complex interplay of factors that shape oil prices, from geopolitical maneuvering to the subtle influence of alternative supply routes.

As we stand at this crossroads of energy security and global trade, we are challenged to think critically about the future of oil markets and international relations. The Strait of Hormuz serves not just as a geographical feature, but as a mirror reflecting our world's intricate dependencies and the delicate balance of power that underpins global stability. In contemplating its significance, we are invited to look beyond the immediate concerns of oil prices and consider broader questions of energy resilience, diplomatic strategy, and the evolving landscape of international trade in an increasingly uncertain world.

Can Rio Tinto Save the Day? The Looming Mining Supply CrisisAs the world races towards a greener future, a critical challenge looms on the horizon: a looming supply shortage for essential energy-transition metals, particularly copper. This shortage, if left unchecked, could jeopardize our ambitious plans for a sustainable future.

Rio Tinto, a global mining behemoth, has sounded the alarm, urging the industry to expand mining operations to meet the escalating demand. The company's chairman, Dominic Barton, has dismissed the notion that mergers and acquisitions alone can solve this crisis. He insists that organic growth, involving the discovery and development of new mines, is the only viable path forward.

The urgency of this situation cannot be overstated. The demand for copper, a vital component in electric vehicles and renewable energy infrastructure, is set to skyrocket in the coming decades. Failure to secure adequate supplies of this critical metal could hinder our progress towards a sustainable and electrified world.

Rio Tinto's leadership in the mining industry is undeniable. Their proactive stance on addressing the supply crisis is commendable, and their commitment to organic growth and exploration for critical minerals demonstrates their dedication to the cause. However, even with the efforts of industry giants like Rio Tinto, the road ahead is fraught with challenges.

The Chinese economy, a major player in the global mining landscape, is currently facing its own difficulties. While Barton remains optimistic about China's ability to overcome these challenges, their current economic state could further exacerbate the supply crisis.

As the world grapples with the pressing issue of climate change, the mining industry must rise to the occasion. The time for complacency is over. It is imperative that we invest in exploration, expand mining operations, and secure the critical resources needed to power a sustainable future. The stakes are high, and the world is watching. Can Rio Tinto and the mining industry save the day?