EUR/USD Technical Analysis📈 EUR/USD Technical Analysis

🔍 1. Market Structure

⚙ Trend Context

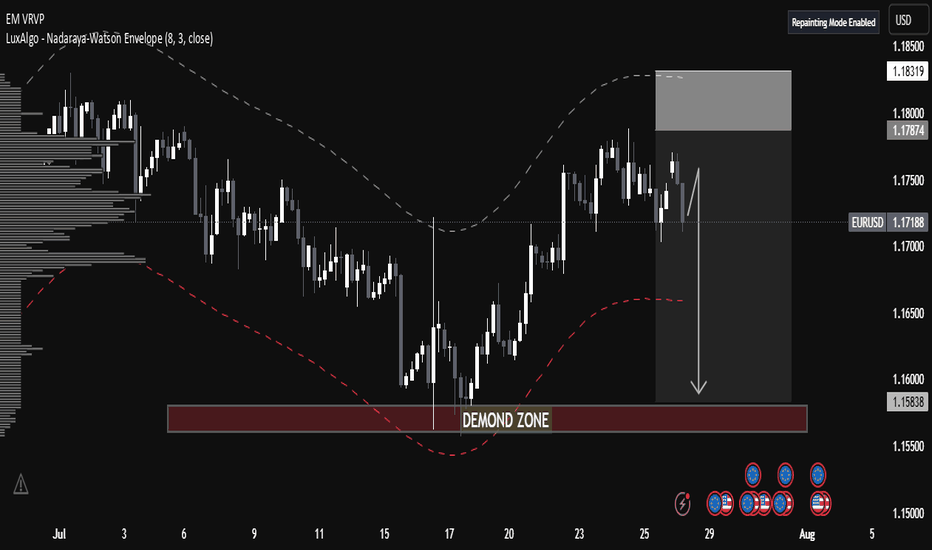

• The overall trend since mid-July has been bullish, with higher highs and higher lows forming after a bounce from a key demand zone (around 1.15380).

• However, recent candles show indecision and a potential reversal, suggesting weakening momentum.

⸻

🧱 2. Volume Profile Insight (VRVP)

• High Volume Nodes (HVNs):

• Significant trading activity occurred between 1.172–1.176, now acting as resistance.

• Low Volume Gaps:

• Thin liquidity zones exist between 1.165–1.158, which could result in swift price movement if selling pressure increases.

📘 Educational Insight: Thin volume areas on a profile typically allow for faster price transitions due to lack of order density.

⸻

📊 3. Envelope Indicator – Nadaraya-Watson (8,3)

• A mean-reversion tool estimating dynamic overbought and oversold areas.

• Price recently rejected the upper boundary, reinforcing the bearish outlook.

• The lower envelope, around 1.158–1.160, aligns with the projected bearish target.

⸻

🟫 4. Demand Zone Analysis

• Labeled “DEMAND ZONE” at 1.15380–1.15830

• Previously caused a strong bullish reversal, marking it as an area of institutional interest.

• A re-test of this zone may attract buyers once again, presenting a key support area.

📘 Educational Insight: Demand zones reflect

Suppport

gold simple level before big cpi newsgold price again flying on the news of china central bank gold buying since monday market open

while market totally ignored strong nfp, rising cpi number and overheating financial market

if white line and yellow horizontal level both at same place breakout at the same time

technically it will be big bullish signal and investors will buy more

if fail to breakout than sideway range correction can continue until fomc

EURUSD ,2H LONGHere EURUSD is LOOKING To REVERSE To The Upside Because of Few Reasons

1) The Market is making Lower Low and RSI is making Equal Lows which means Market is making Divergence

2) the market has braked the structure to the upside on lower time frames

3) there is also the liquidity pool on the upside where the market movers could grab all the SL of the traders ..

SO Overall it is Looking a Bullish Setup .

GoldViewFX - MARKET UPDATEHey Everyone,

Another awesome day of collecting pips. All our trading ideas posted this week HIT target and played out perfectly!!

We are still Bullish and continue to buy dips from Goldturn support levels and our intraday levels that we share daily.

We have now moved up the swing range to 1921 and identified a retracement range to 1931.

We have TARGETS above at 1944 again, 1952,1961. These TARGETS will be confirmed further with EMA5 cross or CANDLE BODY CLOSE above 1944.

We are now done for today and will come back Sunday with a full market review for the week ahead.

Please don't forget to like, comment and follow us to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

EURNZDthe market brekas the support line and the resistance line with a red candle that shows a significant volume compared to the others one of this day

- break of the moving average

and what confirm my idea is that the few candles before tested the vwap many times looking for a bearish trend

so I believe that we should sell EURNZD

GALAUSDT Daily Range| Price Action| Trend| Volume Evening Traders,

Today’s analysis – GALAUSDT – trading in a high timeframe range where a rotation to the range mid is probable,

Points to consider,

- Price Action Impulsive

- Bullish OB Support

(Range –Mid Confluence)

- Daily S/R Objective

- Low Volume

GALAUSDT immediate price action is impulsive where a correction to the range-mid will allow for a long entry.

The Bullish OB Support is in confluence with the Range-Mid S/R, a retest of this level is like to be respected.

The current volume profile is below average, an influx is highly imminent when testing a key trade location.

The overall objective is the Daily S/R, exceeding that level will lead to a trend continuation.

Overall, in my opinion, GALA is a valid long with defined risk, price action is to be used upon discretion/ management.

Hope this analysis helps

Thank you for following my work

And remember,

“Ultimately, consistent profitability comes down to choosing between the discomforts you feel when you follow your plan and the urge to let yourself be captures ( and ruled) by your emotions.”

― Yvan Byeajee

Possible Long CaseArea of 7.3 - 7.6 could act as a potential entry. We could enjoy 50 % profit during the next couple days provided that current support level holds

FISV SupportFISV is greatly declining from its resistance which allows for a great opportunity for a buy at support. Its Fibonacci is resting at 108. We will have to wait until it hits 108 for a indication of a resumption in its previous uptrend.

Fibonacci Support

-108

Fibonacci Resistance

-116

CADJPY Dynamic S/R| Swing High| Price Action| Trend Evening Traders,

Today’s analysis – CADJPY – trading with a bullish market structure, further upside probable,

Points to consider,

- Price Action Impulsive

- Dynamic S/R Support

- Swing High Objective

- Low Volume

CADJPY’s immediate price action is impulsive, trading above its dynamic s/r with further upside being imminent.

The swing high is the current objective, exceeding this level increases the probability of a trend continuation.

The current volume profile is below average, an influx is highly probable when testing key trade locations.

Overall, in my opinion, CADJPY is a valid long with defined risk, price action is to be used upon discretion/ management.

Hope this analysis helps

Thank you for following my work

And remember,

‘’No one strategy is correct all the time’’.- John Paulson

I put a long position in Waves!!!In Daily timeframe, WAVES closed up with a bullish hammer in this timeframe and I decide to buy some WAVES contract to long position until $40 USD, that will be my target that I believe that WAVES going to up to recover the trend.

UPWK - Gaining momentumUPWK has established a strong horizontal support zone @ 39-41 (which is about 50% fibonacci retracement of the major AB swing up). It bounced off a mini double bottom here and soon began consolidating between 44.50-47.50 in the past week.

Today it started to move out of this bull flag and with RSI now rippling above 50, the chance of a sustainable upside is good.

Long with initial stop loss just below 44. Trail stops up as trade goes our way. For swing traders, suggest to scale out on the way up @ 55 and then 64.

Disclaimer: This is just my own analysis and opinion for discussion and is not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance. Thank you. Feel free to give me your thoughts ! :)

I found a interesting support!When we are about 40 percent over this line I will sell. Then it will go under the line for about 15 to 18 days. There you can buy and you will have a nice profit. But the parabolic curve will come soon and this patterns will have a end. Then correctures arent very big about 5 to 10 percent and only 2 days or so.

bye.

Gold coming up to 3rd Fibonacci bounceSimple fractal moves down. Each Fibonacci reracement level since 2.06k we have seen a significant bounce to test bear movement down and continue retracement (12345)

I expect to see a similar move now we are sat at the 0.618 retracement level.

Check comments for updates, daily seeing a possible swing low forming right on the 0.618 line which could confirm move up, tuesdays close will be the candle to confirm swing low. expecting atleast a move to 1788 if confirmed to test a breakout at top of channel.

Just a Salmon

Ideas are not gospel

BTC takes support at 9150 | CCI in oversold regionAnalysis Summary

-Market in last 24hrs

-BTCUSD saw a downtrend

-Price volatility was high. Market moved ~2.5%, between $9.1k and $9.33k

Today’s Trend analysis

-Price sees support at 9150, CCI in oversold region

-Price at time of publishing: $9,180

-BTC’s market cap: $169 Billion

-Oscillator indicators are mostly neutral. RSI at 42

-Moving average indicators are biased towards downtrend. Ichimoku Cloud is neutral

-Volume indicators are indicating a downtrend with volumes seen on red candles

Price expected to take support from 9150 level and go up as it jumped from that level thrice . Most of the Oscillator indicators are neutral. MACD crosses down 0, downward histogram increasing in size, which is a bearish sign. RSI below midline around 40, which is a weak bearish sign. CCI crossed below -100 and is in oversold region, indicating a buying opportunity. Another interesting point to notice here is that if price drops below the support level then it can see a continued downward movement till 9k.

----------------------------------------------------------------------------------------

The analysis is based on signals from 28 technical indicators, out of which 17 are moving averages and remaining 11 are oscillators. These indicator values are calculated using 4 hr candles.

DM to get details of the above analysis and list of indicator & their values used to arrive at the above conclusion.

Note: Above analysis would hold true if we do not encounter sudden jump in trade volume .

----------------------------------------------------------------------------------------

If you find the analysis useful, please like and share our ideas with the community!

- Mudrex