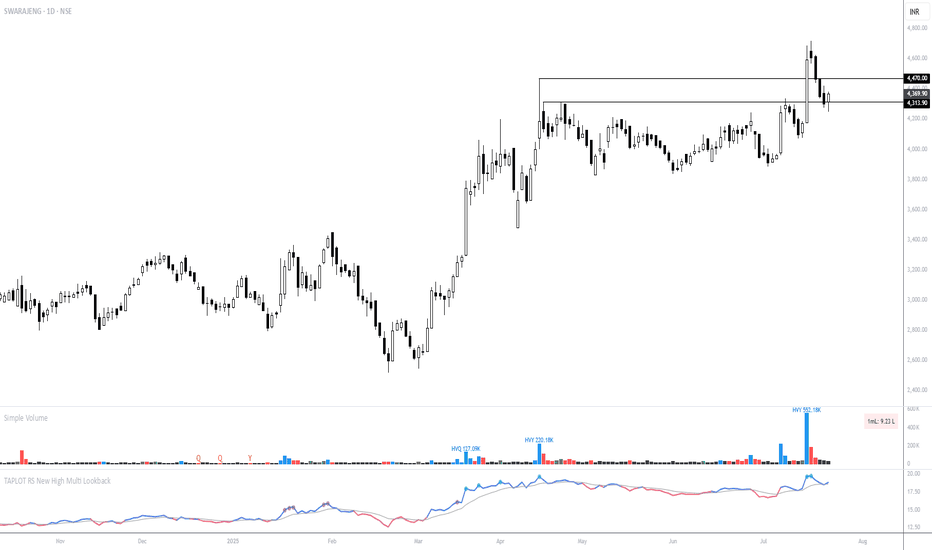

SWARAJENG - Earnings-Driven Breakout & RetestTechnical Overview

Trend: The chart shows a clear upward trend since early 2025. The price consolidated in a tight range for several months before breaking out convincingly.

Breakout: The breakout coincided with a notable spike in volume, indicating strong participation, likely due to robust earnings.

Current Price Action: After the breakout above the 4,313–4,350 resistance zone, the stock surged to fresh highs and is now pulling back, retesting the breakout zone as support.

Technical Setup

Support Levels:

4,350: Recent breakout level, now serving as immediate support.

4,313: Lower boundary of the support zone.

Resistance:

4,490 is the upper part of the breakout zone and the next resistance on upside moves.

Recent high (~4,700): Psychological and technical resistance.

Moving Averages: Price remains above the clustered short-term EMAs, supporting bullish sentiment.

Volume: Heavy buy volume on breakout; lighter volume during the pullback—suggesting selling pressure is mild so far.

Momentum (RSI/TA indicator): Still above the midline, positive but not overbought.

Action Plan

Bullish Scenario:

If price stabilizes and bounces off the 4,313–4,350 support zone—watch for bullish reversal candlesticks (e.g., hammer, bullish engulfing).

Entry: Consider long positions if the stock holds above 4,350 with a clear up-day and renewed volume.

Bearish Scenario:

If price breaks and closes below 4,313 on high volume, expect a deeper retracement (watch for next EMA or previous swing lows as possible supports).

Action: Consider tightening stops or reducing long exposure if the support fails.

Neutral/Wait-and-Watch:

If the price moves sideways or in a tight range near support, wait for clear resolution—either a decisive bounce or breakdown.

SWARAJENG

Swaraj Engines Boy , 🚜 and daddy - what next? NSE:SWARAJENG

~ Stock has stuck in a range for the last two years, line in a box

~ exactly playing from the last analysis horizontal line drawn

~ stock when below oblique support line and now trying to come back to its rails

~ check out below analysis from Sept 21 2022

~ Getting 120% in slightly over a year

~ Those not locked in profits will be stuck for the next rally.

~ A simple range analysis of the stock over the years tells the company's story.

~ With M&M now as the parent company - I don't know if there will be any wings for growth for this company.

~ Makes engines for tractor

disc: Have small tracking position, I should have existed as per my time stop but still holding :)

SWARAJENGNSE:SWARAJENG

[ b]One Can Enter Now ! Or Wait for Retest of the Trendline (BO) Or wait For better R:R ratio

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose