ridethepig | SEK Long-Term Macro Map📍 USDSEK Long Term Macro Map

After the " Moment of Truth for SEK " flow, which was so difficult with its own inherent positional issues, the next update here should appear all too straightforward again. Of course a well planned macro flow does not have to last forever; a dollar devaluation swing which only crops up occasionally, in fact can even threaten the 6.80x support.

Some 8 candles later, the flows are following the widely mapped positional forecast. This swing has the clear fundamental advantage from the soft inherent picture in Sweden. Things have not settled down on the virus front which has become quite forgotten by many. Then of course when a second wave occurs in the Northern Hemisphere during the Winter months, the almost forgotten complacency will return, bringing a zig-zag into the initial forecast into the initial 8.20x target.

Dollar seller's last move sees the impulsive swing being instated, for the threat is now the clear advance onto the main targets. It is therefore logically and casually relevant to all G10 crosses to include the DXY maps:

At the point when this was made, Fed was seen as a deer in the headlights via Covid capitulation / flip flop and, with what immense trouble they will have now in achieving credibility after funding the Whitehouse policies in broad daylight!! Watch for the lows next week, its not quite so easy for buyers to dispose of the momentum here: if this happens we may enter into waterfall mode.

Sweden

Striking similaritySweden had no lockdown, Europe did.

EURSEK going to zero like BTC.

Curious to see what happens. Let's check again in a few days.

Same idea as Bitcoin back then for me. If I see a double bottom I will buy.

All the brainlets should buy, if it goes up they will have "missed out" lmao.

There's very little retail interest in this, I won't get to see the "bull market is back" reactions :(

Hey maybe central bankers and investment banks are going to claim "bull market is back" 🐻😆

Short Modernity, Long Tradition.The only reason the time frame is so low is because I simply do not have enough data to work off otherwise, but I'm going to wager that the Swedish Kronor depreciates against the Mexican Peso, being that the Kronor is backed by a pro-immigration millennial gubment amidst a global pandemic while the Peso has both trumpbux repatriation efforts and a government that is actively shutting down borders as stimulus programs.

Should the value of Swedish fiat be more than 1.5x that of the small dollar? I mean peso?

Think of this as an investment in MXN against Sweden, the weakest pair I could figure, not the other way around.

Especially into the warmer months.

Who am I to counter-trade HA trend?

BillerudKorsnas (BILL) | Promising Buying Area!Hi,

BillerudKorsnäs AB (publ) provides fiber-based packaging materials and packaging solutions in Sweden and internationally. It operates through Packaging Paper, Consumer Board, and Corrugated Solutions segments. The Packaging Paper segment offers kraft and sack paper for industrial, medical equipment, and consumer sectors; and pulp.

BillerudKorsnäs have started to approach a pretty promising area. Fundamentally and in the numbers world, it looks pretty decent and technically, as said, starting to enter into the buying zone.

As we should already know, perfect trade and a perfect investment consist of good fundamentals and it also needs to fit with technical analysis.

Considering technical analysis, I can give you a green light to buy it from the marked buying-box but the second green light has to come after you have made your own research if you get it then you are ready to GO!

Buying-zone consists of:

1) 2004 and 2006 clean resistances becomes support level, plus nice breakout candle in 2013! It shows that the area is powerful and it increases the odds that this price zone may start to act as support level!

2) Fibonacci retracement 62%

3) Monthly EMA200

4) Channel projection - lower projected trendline should act as a support level.

5) AB=CD

6) 50% club!

7) Fibonacci Extensions acting as support levels.

Long-term investors can start to add their positions around 75.

Mid, short-term traders/investors should wait for 70, at least!

As said, do your own fundamental research and if this matching with my technical analysis viewpoints then you are ready to go! If it doesn't match then...SKIP IT!!

Regards,

Vaido

OMX SHORTThis is my thoughts.

We have reached an historic high and a recoil is natural. Now with the corona virus spreading worries OMX has landed at a in my opinion natural level.

What worries me is if we are to break the mid term trend. If that happens we will have a consolidation period that rapidly ends up in a "crash" down to former levels.

This can we take advantage of. I would enter a sell order if the consolidation confirms the down going trend.

-------

We are at a point where a positive recoil can occur as well so I wouldn't blindly count on a break down.

-------

This is not a recommendation, but rather my speculations and personal thoughts.

You should always make your own analysis before buying any stock.

Do you have similar thoughts about OMX? Please comment or give the analysis a like.

Good luck!

Why I am shorting Sandvik [SAND] | Technical AnalysisFor you who would like to check the company out more in dept: www.home.sandvik

§1 Fundamental blah blah

§2 Position and forecast

§3 Technical summary

§1 Fundamental blah blah

Sandvik is a Swedish company which is well diversified troughout the mechanical industry.

They make things like:

Ceramic metal cutting tools and tool holders

Mining equipment

CNC machines (computer controlled metal working machines - Computer numerical controll)

Special alloys

Induction heating elements (for heating special tool holders which require heating to change tools, hard to explain)

I think sandvik is a great company, but at the price it's at today, I don't think big investors are going to look at buying more stocks,

not only because of market fear (which there is undoubtedly a lot of)...

But I also think most of the big investors are looking to exit their positions around this mark as

it was the last high, and a very significant one at that.

§2 Position and forecast

My current position is short from - price is currently so it hasn't really moved since i put my short on.

I think there is quite a big possibility that price will drop within the next week, if not it will likely consolidate until the market gains bullish momentum again.

§3 Technical summary

Bearish divergence on the RSI

Price is at significant resistance

Price met trend line resistance and resistance at and fell to previous support, until price breaks 182.50 level my stance will be bearish.

USD/SEK Outlook.Technical confirmation of macroeconomic information on the Swedish Krona. Multiple factors point toward a weakening dollar, and a strengthening Krona, namely an increase in interest rates by the Bank of Sweden after nearly 10 years of negative rates, and the probability of further quantitative easing by the US Federal Reserve.

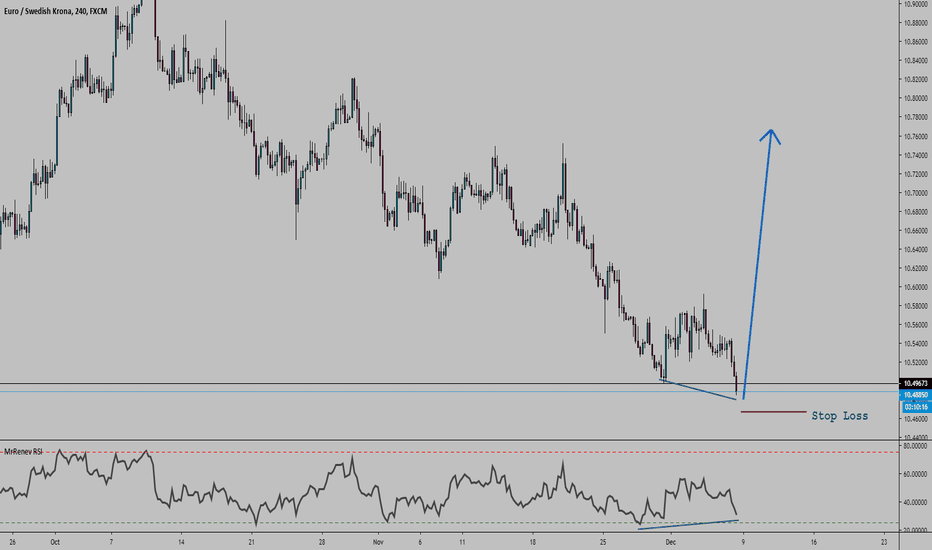

EURSEK SFP reaction. Still bearish on the SEK.More people in the country than there are houses. Sweden is not really socialist but they really on an inevitable course to self destruction.

Not going to go into too much details.

Good entry to short this failing currency.

I think this is my best currency this year. I have good hopes.

1/3 or more of my good trades I had to enter on friday afternoon -.-

So I don't even care anymore (also I have account protection and guarenteed stops).

USDSEK Reversal Pattern after All Time New Highs!USDSEK has been on my watchlist for quite sometime after we made new all time highs and then produced large red candles showing no momentum in the break.

You can see we tried to create another higher high, but price was rejected and reversed at 9.7280.

You can see the head and shoulders pattern which has occurred after making multiple higher lows and higher highs in an uptrend. This is ideal as we want to see an established trend before a reversal pattern.

We did break the neckline yesterday and have seemed to retest the breakout zone with todays daily candle, with the wick retesting the zone and indicating sellers stepping in.

I do not use trendlines very much, but also shows a break of the trend so adds some more confluence.

EURSEK was a trade I covered and took a few weeks back, and it can still make another lower high. Perhaps there is still ways downward for the Swedish Krona.

I am looking to take profits at the flip zone of 9.30 in the long term, although I would expect to see some reaction at 9.45.

ridethepig | EURSEK 2020 Macro MapTime for another forward walk in 2020, this time the focus is EURSEK. I am tracking for a year of "two halves" with the first providing support for SEK and a lot of demand for the most undervalued G10 cross.

On the SEK side lets start with the Long-term chart:

On the EUR side lets start with the Long-term chart:

For the Swedish Macro details, Sweden is badly exposed to extreme levels of domestic credit with the SEK depreciation. Houses in Sweden have also not been attractive for a while and are finally showing signs of a bounce. The Riksbank is widely expected to hike in Dec, if the housing market plays ball then we can have more hikes from Riksbank next year.

We have traded EURSEK a few times previously here:

Risks to the thesis come from the Swedish housing market, if this breaks down we are going to see expectations shift in EURSEK. I will be releasing my 2020 FX outlook reports along with other strategy research in the coming weeks. 2020 is setting up for fireworks on the FX board with expectations and valuations starting to diverge and with late cycle concerns creeping back in through the back door to put the cherry on top. For those interested can send a PM on here or Tradingview.

SEB (SEB_A) | Money-Laundering Concerns! Keep an eye on ~60!Hi,

Shares of SEB' AB (Skandinaviska Enskilda Banken AB provides corporate, retail, investment, and private banking services in Sweden and internationally) fell by more than 14% (on Friday) as investors worried that another Nordic bank will be dragged into the scandal over money-laundering. It is hard to say, how the following weeks/months may affect the SEB price (investigations are ongoing) but anyway, I would like to point out a technically strong price level which should play an important role in further price action.

Currently, I can only recommend - stay away from it. The price can get more hits during the investigations, especially when these stories get firmer confirmations.

To talk about that price level - my eyes are pointed around 60. It needs to fall another ~25% to the mentioned level and definitely, it is doable. I don't want bad but as an investor and trader, I'm looking forward to this level because technically, it is a pretty strong and clean one.

Two other major Scandinavian banks, Swedbank and Danske, had already been subject to major investigations in large-scale money laundering activities and I would like to share a comparison with Swedbank, who has already gone through it (almost):

As you see, the historical similarities have been pretty amazing. Now, we can take this Swedbank price movement as an example (Swedbank price is the orange line) and it is pointed also to my mentioned "keep-an-eye" level 60. Let's count the other criteria which should act as support levels:

1) Okay, the comparison with Swedbank is pointed to the marked area.

2) 2000/01, 2011 clean resistance levels start to work as a support level.

3) The middle number 60 itself should work as a tiny support level.

4) Channel projection bottom trendline may push the price upwards from the green area.

5) Different Fibonacci Extensions are adding strength to the shown area.

6) Fibonacci retracement 50%. Pulled from 2009 low to 2015 high.

7) AB=CD

8) If the price reaches to the shown area, then it has fallen from the 2015 high at 111.50 to the ~55, which is 50% from the recent high and pretty often stocks make a bounce after they have fallen approximately 50%. So, it matching perfectly with our mentioned area.

9) Obviously, perfect would be a bullish Weekly or Monthly candlestick pattern formation around the green area!

Summary: As said, stories around the SEB' stock are serious which makes this stock extremely risky to invest/trade at the current price levels.

Be patient, wait for conclusions and if the conclusions are enough for you to be satisfied (after the price has reached ~60) then this could be a perfect spot and timing to invest or reinvest to SEB'.

What if it doesn't reach to the mentioned area? Nothing(!), the situation around Nordic banks is highly risky and I search only high-probability investment setups, not the mediocre ones. Mediocre setups can easily damage my success rate, especially under such conditions.

If it was helpful then take a second and support my effort by hitting the "LIKE" button, it is my only fee from You!

Regards,

Vaido

ICAGruppen downward momentumICAGruppen seems to be ready for a downmove.

- Blow off top in a long lasting uptrend.

- Divergence on the blow off top, it wants to play out.

- To be safer, I'm working with a stop sell order.

- Daily pinching OBV.

Sweden: Let's drop ancient history from school curriculumHello,

in Sweden, unsurprisingly, they are getting to the "book burning" step. They want to replace their history with their political agenda thing: in favor of gender roles & postmodernism.

I think this is not the first time it was proposed thought, but they are testing it each time, and getting closer to passing this law/act.

Source: www.rt.com

Pretty clear what is going on here. One would have to be blind to not see they are going full insane just like every other socialist dictatorships including the NAZIs they hate so much. Lmao what idiot would still argue "everything is fine". Literally burning books and rewritting history. What's next? Gulag death camps for "those evil white skinned blonde haired right wingers"? This IS the next step you know... Always has been always will be.

We'd have to look at other socialist countries.

Now the NAZI GNP went way up after 1932, but they were a mix of far right and far left.

The book burning did not stop the growth.

I think it is possible not likely but possible the swedes pump their stock market.

Make sure there can be no infinite loss.

All socialist/communist "book burning" places went way down.

Now going to get into it here, an idea is too small to make an in depth analysis, but it would be necessary.

Before shorting & holding OR simply to build your bias for short term trades (all short preferably & then run your winner as long as possible).

The global "economy", the world stock markets have a long way down to go. In 2000 & 2008 the FED kept cutting rates, but they weren't negative or close to that like now.

When the bond market bubble implodes the FED will be powerless. Yields are negative. It's literally a ponzi. Or call it a greater fool game. You lose money for holding bonds. Only hope is price go up as bigger idiots buy after you.

If they keep cutting like -5% people just get 5% a damn year for taking money. I don't see how this cannot end up like Zimbabwe or 1920s Germany.

All I see is a great reset, they HAVE to let it all crash, and hope it slowly recovers... Tensions especially in the US and UK will get worse... More gilets jaunes too, more terrorism, all that stuff.

Here is what is possible, this is much after the big fall of the soviet union, so it's not "that bad". It sure isn't the worse that can happen.

I'd like to show what happened to the soviet union:

East europe after 1990 got known as "the third world poor people place".

Absolute RUIN.

Mind you, the soviet union had oil, loads of it.

And its not like the price crashed in the early 90s, actually went up.

So they were still able to sell their oil at high prices and cushion the fall.

40 YEARS!

Venezuela has oil too. Cambodge did not. North Korea don't have Oil. And they returned to the middle ages.

Zimbabwe had no oil. Absolute ruin, nothing left.

Heard how poor east germany was? Keep in mind they had russia helping them out and when russia crashed, they had west germany.

Sweden has no oil... And no Oil country sending it money & goods.

It's going to be biblical.

SAAB is not getting any loveThe main focus is as the comment describes:

"Testing weak support for the fourth month in a short period of time,

if it breaks I expect a move down to around ~ 260."

The second most important thing to be looking at is that it never really recovered from december lows, while the rest of the market went mooning to new heights.

Entering half of my intended position on monday, rest if monthly closes below 50 day MMA.

Failed socialist country going to ZERONot going to enter into details about Sweden.

Sweden central bank "Uh we have no idea why our currency is falling and why our economy is falling behind" duuuuh!

Am already shorting it via EURSEK & added a bit with USDSEK, have a limit order at that green level.

If I am in the green on EURSEK & add on USDSEK as it goes does can I call this adding to my winner?

Stop loss is tight. If this EURSEK is THE double bottom before the rally (and USDSEK bottoms at the same time) this can fly up to the moon.

3:d day in a rowOMXs30 has been one of the biggest hit since the start of the year. Bullish for more than 3 months in a row. Until May when the shock came that the currency of Sweden got lower and had an impact on Swedish tourism outside Sweden. We couldn't such that they caught us telling that traveling outside Sweden would be a loss. Which then gave a comeback that OMXs30 now have been bullish since that bearish peak.

For now such that the swedish currency is low and that imports now i more expensive than before since May. Might look like the export is a better way and active money spending in investments have a turn around for what the budget for a nice weeked or more in Thailand "common for a swed to travel" no have their budget to expand and build a higher on for next comeback of the currency.

OR autumn as is has that the centralbank will come with THE report that has us all under for what the market as a whole will be in further notice. Since ECB didn't touch the rent.

What to wait for, OPEC and the Oil report in June. Anyway, there is a volatile summer that comes and there is more to make of.

GL with your trading and thanks for the view.

// F1SH

Swedbanknear time it could cover the dividend which is 8%. once the the buyers who caught the bottom have got there 10% and the dividen has been paid i expect theprice to double bottom on 150 (nice round number.

# If interst rates rise in Sweden this will be positive, at the momemnt this will be reveiwed again in may...