JPMorgan at a Crossroads Bullish Surge or Bearish Retreat ? Hello, fellow traders!

Today, I’m diving into a detailed technical analysis of JPMorgan Chase & Co. (JPM) on the 2-hour chart, as shown in the screenshot. My goal is to break down the key elements of this chart in a professional yet accessible way, so whether you’re a seasoned trader or just starting out, you can follow along and understand the potential opportunities and risks in this setup. Let’s get started!

Price Action Overview

At the time of this analysis, JPM is trading at 243.62, down -1.64 (-0.67%) on the 2-hour timeframe. The chart spans from late March to early May, giving us a good look at the recent price behavior. The price has been in a strong uptrend, as evidenced by the higher highs and higher lows, but we’re now seeing signs of a potential pullback or consolidation.

The chart shows a breakout above a key resistance zone around the 234.50 level (highlighted in red on the Volume Profile), followed by a retest of this level as support. This is a classic bullish pattern: a breakout, a retest, and then a continuation higher. However, the recent price action suggests some hesitation, with a small bearish candle forming at the current price of 243.62. Let’s dig deeper into the tools and indicators to understand what’s happening.

Volume Profile Analysis

The Volume Profile on the right side of the chart is a powerful tool for identifying key price levels where significant trading activity has occurred. Here’s what it’s telling us:

Value Area High (VAH): 266.25

Point of Control (POC): 243.01

Value Area Low (VAL): 236.57

Profile Low: 224.25

The Point of Control (POC) at 243.01 is the price level with the highest traded volume in this range, acting as a magnet for price. Since the current price (243.62) is just above the POC, this level is likely providing some support. However, the fact that we’re so close to the POC suggests that the market is at a decision point—either we’ll see a bounce from this high-volume node, or a break below could lead to a deeper pullback toward the Value Area Low (VAL) at 236.57.

The Total Volume in VP Range is 62.798M shares, with an Average Volume per Bar of 174.44K. This indicates decent liquidity, but the Volume MA (21) at 165.709K is slightly below the average, suggesting that the recent price action hasn’t been accompanied by a significant spike in volume. This could mean that the current move lacks strong conviction, and we might see a consolidation phase before the next big move.

Trendlines and Key Levels

I’ve drawn two trendlines on the chart to highlight the structure of the price action:

Ascending Triangle Pattern: The chart shows an ascending triangle formation, with a flat resistance line around the 234.50 level (which was later broken) and an upward-sloping support trendline connecting the higher lows. Ascending triangles are typically bullish patterns, and the breakout above 234.50 confirmed this bias. After the breakout, the price retested the 234.50 level as support and continued higher, reaching a high of around 248.02.

Current Support Trendline: The upward-sloping trendline (drawn in white) is still intact, with the most recent low around 241.50 finding support on this line. This trendline is critical—if the price breaks below it, we could see a deeper correction toward the VAL at 236.57 or even the 234.50 support zone.

Key Price Levels to Watch

Based on the Volume Profile and price action, here are the key levels I’m watching:

Immediate Support: 243.01 (POC) and 241.50 (recent low on the trendline). A break below 241.50 could signal a short-term bearish move.

Next Support: 236.57 (VAL) and 234.50 (previous resistance turned support).

Resistance: 248.02 (recent high). A break above this level could target the Value Area High at 266.25, though that’s a longer-term target.

Deeper Support: If the price breaks below 234.50, the next significant level is 224.25 (Profile Low), which would indicate a major trend reversal.

Market Context and Timeframe

The chart covers 360 bars of data, starting from late March. This gives us a good sample size to analyze the trend. The 2-hour timeframe is ideal for swing traders or those looking to capture moves over a few days to a week. The broader trend remains bullish, but the recent price action suggests we might be entering a consolidation or pullback phase before the next leg higher.

Trading Strategy and Scenarios

Based on this analysis, here are the potential scenarios and how I’d approach trading JPM:

Bullish Scenario: If the price holds above the POC at 243.01 and the trendline support at 241.50, I’d look for a bounce toward the recent high of 248.02. A break above 248.02 could signal a continuation toward 266.25 (VAH). Entry could be on a strong bullish candle closing above 243.62, with a stop-loss below 241.50 to manage risk.

Bearish Scenario: If the price breaks below 241.50 and the POC at 243.01, I’d expect a pullback toward the VAL at 236.57 or the 234.50 support zone. A short position could be considered on a confirmed break below 241.50, with a stop-loss above 243.62 and a target at 236.57.

Consolidation Scenario: Given the lack of strong volume and the proximity to the POC, we might see the price consolidate between 241.50 and 248.02 for a while. In this case, I’d wait for a breakout or breakdown with strong volume to confirm the next move.

Risk Management

As always, risk management is key. The 2-hour timeframe can be volatile, so I recommend using a risk-reward ratio of at least 1:2. For example, if you’re going long at 243.62 with a stop-loss at 241.50 (a risk of 2.12 points), your target should be at least 248.02 (a reward of 4.40 points), giving you a 1:2 risk-reward ratio. Adjust your position size to risk no more than 1-2% of your account on this trade.

Final Thoughts

JPMorgan Chase & Co. (JPM) is showing a strong bullish trend on the 2-hour chart, with a confirmed breakout above the 234.50 resistance and a retest of this level as support. However, the recent price action near the POC at 243.01 and the lack of strong volume suggest that we might see a pullback or consolidation before the next move higher. The key levels to watch are 241.50 (trendline support), 243.01 (POC), and 248.02 (recent high).

For now, I’m leaning slightly bullish as long as the price holds above 241.50, but I’ll be ready to adjust my bias if we see a break below this level. Stay disciplined, manage your risk, and let the market show its hand before taking a position.

What are your thoughts on this setup? Let me know in the comments below, and happy trading!

This analysis is for educational purposes only and not financial advice. Always do your own research before making any trading decisions.

Swingtrading

OptionsMastery: Sitting in a weekly demand on NKE!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Microsoft - A Little Lower And Much Higher!Microsoft ( NASDAQ:MSFT ) is about to retest strong support:

Click chart above to see the detailed analysis👆🏻

In mid 2024 Microsoft perfectly retested the previous channel resistance trendline and the recent weakness has not been unexpected at all. However the overall trend still remains rather bullish and if Microsoft retests the previous all time high, a significant move will most likely follow.

Levels to watch: $350

Keep your long term vision!

Philip (BasicTrading)

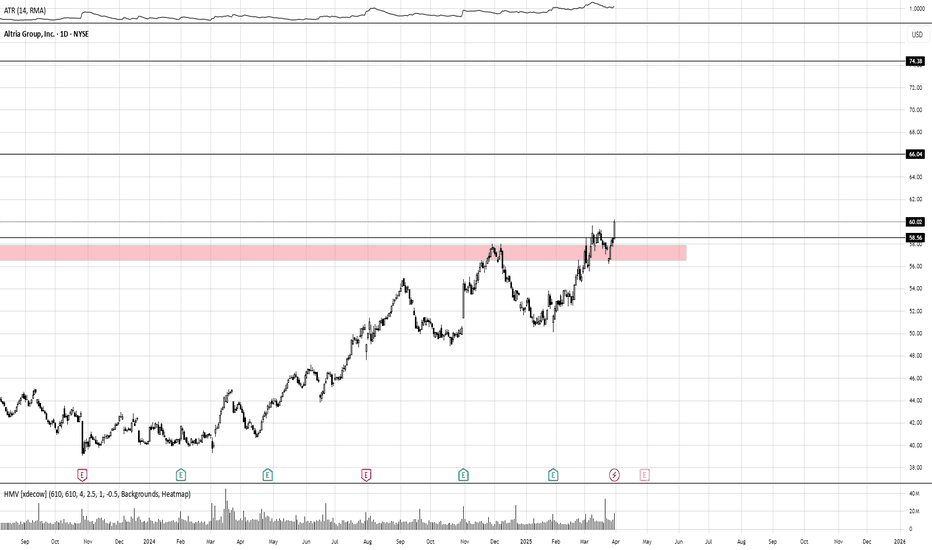

OptionsMastery: Immediate buy on MO!?🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

OptionsMastery: Breakout Setup on SBUX!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Gold - They All Call Me Crazy!Gold ( TVC:GOLD ) is just starting the next rally:

Click chart above to see the detailed analysis👆🏻

Just a couple of months ago, Gold perfectly broke out of the long term rising channel formation. After we then witnessed the bullish break and retest confirmation, it was quite clear that Gold will head much higher. This just seems to be the beginning of the next crazy major bullrun.

Levels to watch: $4.000

Keep your long term vision!

Philip (BasicTrading)

OptionsMastery: H&S on XLC!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Looking for a bearish swing on META! H&S!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

GBPUSD Dusting 350+ PIPS in Choppy Waters - Breakout is Brewing?Technical / Chart Analysis:

Double Top Formation: The chart clearly exhibits a potential double top pattern around the 1.30564 resistance level. This is a bearish reversal pattern that suggests a potential trend change from bullish to bearish.

Breakdown of Uptrend: The preceding price action shows an uptrend, which has now been halted by the double top.

Key Support Level: The most crucial level to watch is the support around 1.28642. A confirmed break below this level would validate the double top pattern and signal a potential strong move downwards.

Monthly Performance: January saw a +180 pip move, followed by February with a +230 pip gain. This demonstrates the potential for significant profits in GBPUSD through swing trading.

Swing Analysis: February's +230 pip move consisted of 3 upward swings and 2 downward swings, highlighting the importance of capturing both upward and downward momentum in this pair due to the Choppy Price Action.

Conclusion:

FX:GBPUSD is at a critical juncture. The potential double top formation suggests a bearish bias, but confirmation is needed. Traders should closely monitor the key support level at 1.28642 for a potential breakdown and look for LONG Trades on breaking key levels to the Upside

What are your thoughts on GBPUSD's potential for swing trading? Do you see a breakdown or a bounce? Share your analysis and comments below!

SHORT ON ES?This could be a short rade idea for swing trade.

Las week price invalidate long ideas and the structure remain bearish.

Depending on how we open on Sunday, and with NFP week ahead, I would see ha Monday price will dive quick again, or retrace a little and offer short second half of he week.

Tesla - There Is Hope For Bulls!Tesla ( NASDAQ:TSLA ) is just crashing recently:

Click chart above to see the detailed analysis👆🏻

After Tesla perfectly retested the previous all time high just a couple of weeks ago, we now witnessed a quite expected rejection of about -50%. However market structure remains still bullish and if we see some bullish confirmation, a substantial move higher will follow soon.

Levels to watch: $260, $400

Keep your long term vision!

Philip (BasicTrading)

SUI Swing: The Art of Patience in TradingSUI has been playing nice with the technicals lately, giving us some really neat swing trade opportunities. Remember that short trade we talked about—from $3 down to around $2? Well, here's why that setup was a winner.

After that initial short trade, SUI bounced off $2 and then traded in a tight range between $2.5 and $2.2 for about two weeks. Then it broke higher to test the monthly open at $2.83—and it hit that level right on the dot. That’s where all the magic happens.

Why This Short Trade Worked

Fibonacci Confluence: When you draw a Fibonacci from the high at $3 to the low at $1.9626, the 0.786 level comes in at about $2.778. This is right near the monthly open, and we know that price tends to reverse between the 0.618 and 0.786 zones.

Trading Range POC: The $2.8 area was our previous point of control, so it adds extra weight as a resistance level.

Anchored VWAP: The VWAP from the high at $3.8999 sits just above the monthly open at around $2.855, giving us another nod that this level is important.

Fib Speed Resistance Fan: Even the speed resistance fan at the 0.618 level lines up with the $2.8 zone.

All these factors lined up to form a solid resistance area. That’s why short entries between $2.778 and $2.855 made sense.

Trade Setup Recap

Short Trade:

Entry Zone: $2.778 to $2.855

Target: The bullish order block at about $2.4745, which also lines up with the 0.618 fib retracement from the low at $2.2358 and the high at $2.8309

Risk-to-Reward: This setup gave us a risk-to-reward of 4:1 or even better, depending on where you set your stop-loss.

There’s also a possible long trade at the bullish order block, but that one’s only for when you see the confirmation.

Wrapping It Up

The takeaway? Confluence is your best friend. Waiting for that high-probability setup can really pay off. Let the trade come to you, don’t force it, and stay calm and focused.

Thanks for reading this SUI analysis. If you liked it, please leave a like and drop a comment. Happy trading!

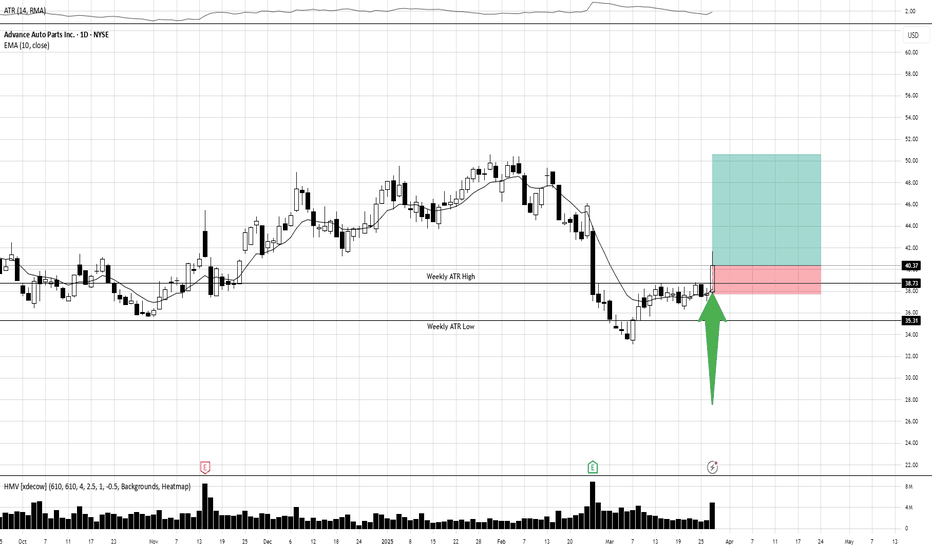

Looking for an immediate buy on AAP! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Bitcoin - Please Just Listen To The Charts!Bitcoin ( CRYPTO:BTCUSD ) remains in a bullish market:

Click chart above to see the detailed analysis👆🏻

Despite literally everybody freaking out about cryptos lately, big brother Bitcoin is still creating bullish market structure. During every past cycle we witnessed a correction of at least -20% before we then saw a parabolic rally. So far, Bitcoin is just doing its normal "volatility thing".

Levels to watch: 70.000, $300.000

Keep your long term vision,

Philip (BasicTrading)

Gold (XAU/USD) Double Top Pattern – High Probability Trade Setup📌 Overview of the Chart:

This 4-hour timeframe chart of Gold Spot (XAU/USD) highlights a Double Top pattern, one of the most reliable bearish reversal signals in technical analysis. The price has tested a strong resistance zone twice (Top 1 & Top 2) but failed to break above, suggesting that bullish momentum is weakening and a possible trend reversal is imminent.

This setup provides an excellent opportunity for a short (sell) trade, provided the price confirms the pattern by breaking below the neckline. The potential downside targets are marked as TP1 ($2,983) and TP2 ($2,938), with a stop loss placed above resistance ($3,056) to manage risk effectively.

📌 Key Chart Patterns & Market Dynamics

1️⃣ Double Top Pattern – The Bearish Reversal Signal

The Double Top pattern occurs when:

✅ The price reaches a resistance zone and gets rejected (Top 1).

✅ It then retraces downward to find support at the neckline.

✅ The price makes another attempt to push higher but fails at the same resistance level (Top 2).

✅ A break below the neckline confirms the bearish trend, as buyers lose strength and sellers take control.

🛑 Why is this pattern important?

The failure of buyers to push beyond resistance shows that sellers are dominating. This creates a psychological shift in the market, making traders and institutions more likely to sell aggressively once the neckline is broken.

2️⃣ Resistance Level – The Rejection Zone

🔵 Price Level: $3,050 – $3,056

🔵 Role: Key supply area where sellers are strong

🔵 Market Impact: Strong rejections at this level indicate that big players (institutions) are offloading positions, leading to bearish momentum.

Why Does This Matter?

📌 If the price breaks above this level, it would invalidate the bearish setup, leading to potential further upside.

📌 This is also why we place our Stop Loss above this level—to protect against unexpected bullish breakouts.

3️⃣ Neckline Support – The Breakout Zone

🔻 Price Level: Around $3,020

🔻 Role: The last line of defense for buyers before a bearish breakout

🔻 Market Impact: If this level is breached, it confirms the Double Top pattern, leading to a sharp decline.

📌 A confirmed break of the neckline is the ideal point for traders to enter a short (sell) position, targeting lower price levels.

4️⃣ Key Take Profit (TP) Targets – Where Price Might Drop

🎯 TP1 – $2,983:

This level is a minor support zone where price may temporarily pause before further decline.

Conservative traders may choose to secure profits here.

🎯 TP2 – $2,938:

A stronger historical support zone, making it a high-probability target for a full bearish move.

More aggressive traders may hold positions until this level.

📌 Why These Levels?

These targets align with Fibonacci retracement zones and previous market structure, increasing the likelihood of a reaction at these points.

5️⃣ Stop Loss – Managing Risk Like a Pro

Placement: Above the resistance zone at $3,056

Reason: If price breaks above resistance, it invalidates the bearish thesis, meaning we need to exit the trade.

Risk-Reward Ratio:

TP1: ~2:1

TP2: ~3.5:1

A good risk-reward setup, ensuring a profitable edge over multiple trades.

📌 Trading Strategy & Execution Plan

📉 Bearish (Sell) Setup:

1️⃣ Wait for confirmation – Price must break below the neckline ($3,020) before entering a short trade.

2️⃣ Sell Entry: On a confirmed break and retest of the neckline.

3️⃣ Stop Loss: Above the resistance zone ($3,056).

4️⃣ Take Profit Targets:

TP1 ($2,983) – First profit level.

TP2 ($2,938) – Secondary target for deeper decline.

📌 Optional Confirmation:

Look for bearish candlestick formations (e.g., Bearish Engulfing, Shooting Star, or Doji) near resistance or after a neckline breakout.

Monitor RSI/MACD for bearish divergence, confirming weakening momentum.

📌 Market Psychology Behind This Pattern

1️⃣ First Peak (Top 1): Buyers push the price up, but sellers step in at resistance and force a pullback.

2️⃣ Pullback to Neckline: Some buyers re-enter, believing the uptrend will continue.

3️⃣ Second Peak (Top 2): Price attempts another rally but fails at the same resistance, showing buyers' exhaustion.

4️⃣ Break of the Neckline: Sellers take full control, leading to a high-momentum sell-off.

📌 Key Takeaway:

💡 The Double Top is a trader’s favorite because it reflects a real psychological shift in market sentiment—from greed (buyers) to fear (sellers).

📌 Final Verdict – High Probability Trade Setup

✅ Double Top formation confirms a bearish trend reversal.

✅ Strong resistance & multiple rejections signal seller dominance.

✅ Clear risk management strategy (Stop Loss & TP Levels).

✅ Waiting for neckline break ensures a high-probability entry.

🚀 Watch this setup carefully! If the neckline breaks, GOLD could experience a sharp decline! 📉🔥

🔍 Pro Tips for Smart Traders

💡 Don’t rush into a trade! Wait for a solid break and retest of the neckline for confirmation.

💡 Monitor volume: A strong breakout should be accompanied by increasing volume for validation.

💡 Use confluence: Combine with other indicators (RSI, MACD, EMA) to increase accuracy.

🔥 What’s Your Take on This Setup? Will You Trade It? Let Me Know in the Comments! 🚀

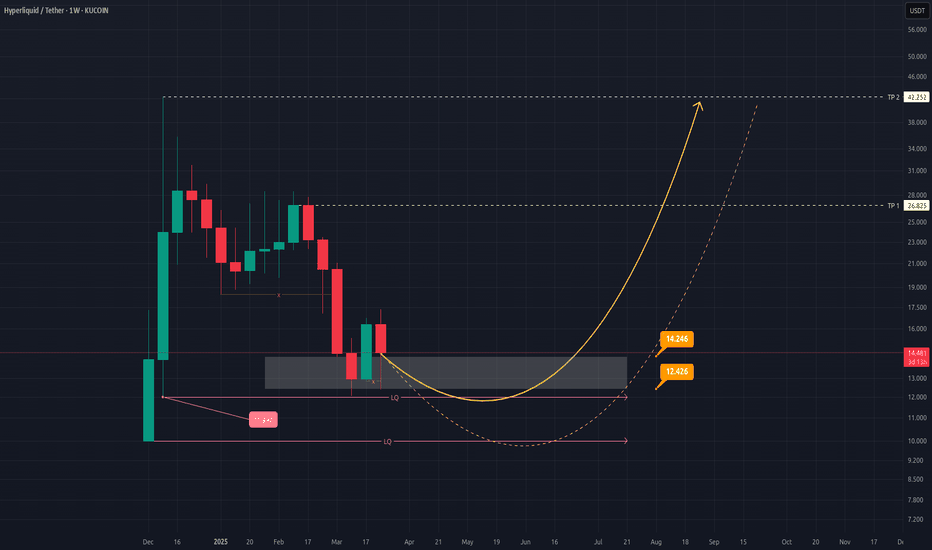

HYPEUSDT Weekly Outlook: Potential Reversal and Upside TargetsWeekly Chart Analysis of HYPEUSDT

The weekly chart of HYPEUSDT reflects a critical phase where the price is consolidating within a key demand zone, suggesting potential for a bullish reversal. Below is the detailed analysis:

Key Observations:

Demand Zone: The price is currently hovering around the highlighted gray box, which represents a strong liquidity zone ( LQ ) between $12.426 and $14.246 . This area has historically acted as support, and a bounce from here could signal a reversal.

Support Levels:

Immediate support lies at $12.426 .

A deeper correction could test the $11.997 and $10.000 levels, which are marked as liquidity levels below the current zone.

Bullish Scenario:

If the price holds above the current demand zone, it could initiate a rounded bottom pattern (illustrated by the yellow curved line).

The first target ( TP1 ) for this potential upside move is $26.825 .

The second target ( TP2 ), representing a more extended rally, is projected at $42.252 .

Candlestick Structure: Recent weekly candles show indecision, but if buyers step in strongly, it could confirm bullish momentum.

Risk Management:

Traders should monitor for any breakdown below the $12.426 level, as it may invalidate the bullish setup and lead to further downside toward $10.000 .

Conclusion:

HYPEUSDT shows promising signs of recovery from its demand zone, with upside targets at $26.825 and $42.252 in sight if bullish momentum builds. However, caution is advised until clear confirmation of reversal occurs.

This analysis provides a roadmap for both short-term and long-term traders to plan their entries and exits effectively.

ANKRUSDT: A Strong Demand Zone or Breakdown Risk?ANKRUSDT is currently sitting at a crucial demand zone, a level that has historically triggered massive price movements. This same area in February 2021 acted as a springboard for huge gains, leading to a double top formation at $0.21 before experiencing a major downtrend. Since August 2022, the price has been stuck in a sideways range, with no clear breakout in sight—until now.

Why This Demand Zone is Key

The weekly support level within the range has proven to be resilient, holding strong since 2021. Additionally, the Stochastic RSI is in oversold territory, signaling a potential loss of selling pressure. This setup suggests that buyers might step in soon, making this zone a prime accumulation area for long-term holders.

Best Buy Zone:

🔹 $0.015 - $0.022 → A historically strong support level, ideal for long-term positions.

Potential Targets:

📌 Short-Term Target: $0.057 - $0.066 (Top of the current range)

📌 Mid-Term Target: $0.097 (Potential supply zone)

📌 Long-Term Target: $0.21 (Previous all-time high)

Bearish Scenario: What If Support Breaks?

While the demand zone is strong, there's always a chance of a breakdown. If price fails to hold support, the next major demand zone lies at $0.008—a crucial level for long-term investors to watch.

Final Thoughts

✅ The setup is strong, with price at weekly support and indicators signaling a potential reversal.

⚠️ But always have a plan—if the demand zone breaks, be ready for lower levels.

💡 Risk management is key—stick to your strategy, and trade with confidence!

What’s your take on ANKR? Are you bullish or waiting for more confirmation? Let’s discuss in the comments! 🚀

Keep it shiny~!

KinaStar

Possible Swing trading(long) opportunity in HEG Possible Swing trading(long) opportunity seems to be emerging in HEG.

Prince has broke out of a trend line. Price has closed above R1 pivot point.

Please note this is not a trading recommendation. This is for educational purposes only. I may or may not have my position in this stock. I record my conviction about a stock to check in the future if it played out as per the anaysis or not?

GBP/AUD Bulls Eye 2020 HighFutures traders are net-long GBP/USD futures and net-short AUD/USD futures. So it is quite fitting to see GBP/AUD in a strong uptrend, with traders now eyeing the 2020 high.

However, the weekly chart suggests the current upswing may be nearing a cycle peak. A small bearish divergence has also formed on this timeframe. I am therefor seeking evidence of a swing high to form, somewhere around the 2020 high (or below).

For now, the daily chart is grinding higher and the 10-day EMA is supporting. There are also early signs of an ending diagonal / rising wedge, which could still allow for another leg or two higher before the anticipated mean reversion towards the 10 and 20-week EMAs kick in.

Matt Simpson, Market Analyst at City Index and Forex.com

Cardano - Focus On This One Altcoin!Cardano ( CRYPTO:ADAUSD ) will lead the bullish rally:

Click chart above to see the detailed analysis👆🏻

It really seems to be unbelievable but Cardano is 100% repeating the previous cycle which we saw back in 2018. A double bottom neckline breakout, followed by a significant rally and another break and retest and Cardano is now clearly heading towards the previous all time high.

Levels to watch: $0.6, $2.5

Keep your long term vision,

Philip (BasicTrading)