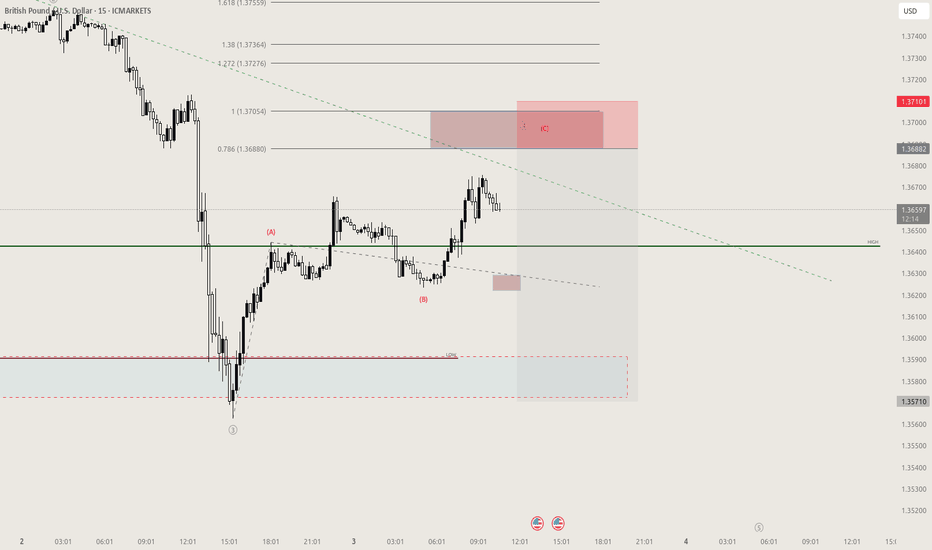

GBPUSD: Bullish Move After Liquidity Grab 🇬🇧🇺🇸

GBPUSD formed a bullish high range candle with a long lower wick going

below a key horizontal demand zone on a 4H.

A consequent recovery and a bullish London session opening suggest

a highly probable rise today.

Goal - 1.363

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Swingtrading

BTCUSD Breakout Confirmed – Targeting Next Reversal ZoneBitcoin (BTC/USD) is currently trading around $108,700, showing strong bullish momentum after breaking out of a consolidation structure. Price action has shifted significantly, with clear structural developments pointing toward continued upside — but not without caution around the next reversal zone.

🔍 Key Technical Insights:

🔹 1. Volume Contraction Triangle (Bullish Breakout)

The chart initially shows a volume contraction pattern forming a symmetrical triangle.

This pattern is often associated with market compression — a setup where smart money accumulates before a breakout.

BTC broke out of the triangle with strong bullish candles, confirming buyers have stepped in with conviction.

🔄 2. Structure Shift & Break of Structure (BOS)

A major BOS (Break of Structure) occurred as price broke previous swing highs, confirming a bullish market structure.

This BOS zone now acts as a potential support area if BTC pulls back.

A short-term SR interchange zone (Support becomes Resistance) was also respected and flipped again to support during the breakout — a clear sign of structural strength.

🧭 3. Next Reversal Zone – Supply in Sight

Price is approaching a major supply/reversal zone between $109,750 and $110,250.

This zone has previously shown strong selling interest.

Traders should watch for rejection or continuation patterns within this zone — such as bearish divergence, exhaustion candles, or confirmation of resistance.

🛡 4. Major Support Level

Below current price, a major support zone around $107,500–$107,800 remains intact.

This zone has provided a solid base during past consolidations and would be the first area of interest for buyers if a retracement occurs.

📌 Strategy Plan:

🔼 For Bullish Traders:

Those already in the breakout can hold with targets toward $110,000–$110,250.

If not in yet, wait for a retest of BOS/SR zone (~$109,000) for a safer re-entry.

Consider partial take-profits within the green reversal zone.

🔽 For Bearish Traders:

Watch for price exhaustion or a fake breakout in the reversal zone.

Potential short setups could form only if price fails to hold above the BOS zone and prints a lower high.

🔧 Technical Summary:

✅ Structure: Bullish Break of Structure confirmed

🔺 Momentum: Strong upside following volume contraction

📍 Next Key Resistance: $110,000–$110,250

📉 Major Support: $107,500–$107,800

⚠️ Caution Zone: Reversal area ahead – watch price action closely

Conclusion :

Bitcoin looks set to challenge the $110K psychological level as buyers remain in control. However, the reversal zone above is critical. A clean break and hold above it could open doors to further highs, while rejection here may trigger short-term pullbacks or range-bound conditions.

Gold (XAU/USD) Technical Analysis : Structural Analysis + TargetGold is currently trading near $3,292 on the 30-minute timeframe, showing classic signs of accumulation and compression within a well-respected descending channel. The current price action is approaching a critical decision zone, and the market is offering potential clues for both short-term and swing traders.

🔎 Detailed Breakdown of Chart Elements:

🔷 1. Descending Channel & Dynamic Support

Gold has been moving inside a falling channel, with price repeatedly reacting to both the upper and lower boundaries.

The lower boundary of the channel, currently acting as support, has been tested multiple times, suggesting a strong buying interest at this level.

This channel also aligns with the broader downtrend structure, giving sellers confidence while also creating interest for counter-trend buyers looking for reversal setups.

📐 2. Trendline Pressure and Compression

A downward sloping trendline, drawn from the recent swing highs, continues to apply bearish pressure.

Price is squeezing between the channel support and this descending trendline — a tight range compression, which often precedes a volatile breakout.

The analysis notes: “We have to wait for a trendline breakout” – this is a crucial technical signal that will determine the next move.

🚧 3. Break of Structure (BOS) Zones

Two potential bullish BOS (Break of Structure) levels have been identified:

Minor BOS (~$3,300):

A break above this level may signal short-term bullish intent and invalidate minor lower highs.

Early confirmation for buyers to enter with tight risk management.

Major BOS (~$3,310):

This is the key swing high which, if broken, would invalidate the current bearish structure and flip market sentiment bullish.

A strong bullish candle closing above this level could signal the start of a larger upward leg.

📍 4. Next Reversal Zone (Supply Area: $3,320 – $3,330)

This zone represents a strong supply area where previous price action saw heavy selling.

If bulls manage to clear the BOS zones, this area becomes the next target/resistance.

Price reaching this level could lead to a pullback, making it an ideal area for partial take-profits or reassessment of continuation trades.

📈 5. Scenario Planning & Strategy

✅ Bullish Bias (If Breakout Occurs):

Wait for a confirmed breakout above the trendline and Minor BOS with volume.

Ideal long entry would be on the retest of the trendline (now acting as support).

First target: Major BOS, then extend to the Reversal Zone.

Stop-loss can be placed below the channel support or latest swing low.

🚫 Bearish Continuation (If No Breakout):

If price fails to break above the trendline and continues to reject at resistance, sellers may look to short the retest of the trendline.

Targets can be set at the channel's lower boundary or previous lows.

Confirmation: Bearish engulfing patterns, rejection wicks, or divergence.

🧠 Technical Summary & Outlook

Gold is currently in a neutral to slightly bullish consolidation, showing early signs of demand at the bottom of the channel. The market is in "wait-and-watch" mode — traders should focus on the trendline breakout, which will serve as the trigger for directional bias.

The structure is clean, zones are well defined, and potential is high for both scalping and intraday setups. Traders are advised to stay patient and follow price action confirmation before entering trades.

📌 Key Levels to Watch:

Support Zone: $3,280 – $3,285 (Channel Base)

Trendline Resistance: ~$3,294–$3,296

Minor BOS: ~$3,300

Major BOS: ~$3,310

Reversal Zone (Supply): $3,320 – $3,330

NZDUSD: Important Breakout 🇳🇿🇺🇸

NZDUSD looks bearish after a false violation of a current daily structure high.

The price dropped with a high momentum bearish candle, violating

a significant support cluster and closing below that.

The pair may fall even more.

Next support - 0.5952

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

How Sell Side Institutions Move Price: BuybacksThere are Buy Side Institutions, aka Dark Pools, and there are Sell Side Institutions, the Money Center Banks and Giant Financial Services companies. These two groups dominate the market activity and move price in entirely different ways and for entirely different reasons.

Sell Side Institutions are short-term TRADERS. They are not allowed, nor do they wish, to hold stocks for the long term. The Sell Side trades stocks and has the most experienced, most talented, and most sophisticated floor traders in the world.

Buy Side Dark Pools have floor traders as well but they are strictly long-term investment companies managing the 401ks, pension funds, ETF long-term investments on behalf of the Middle Class of America and, in some instances, other nations.

Sell Side Institutions may buy a stock and hold for a few weeks or months but strictly for the short-term profits.

The Sell Side are also the Banks of Record who do the BUYBACKS on behalf of the Corporation which has made the decision by the Corporation's Board of Directors to do a buyback program, which tend to last many months or longer. Corporations do not have stock traders on staff. So the Bank of Record does the actual buying of the shares of stock.

The reasons for doing a Buyback:

To lower the outstanding shares which can create some momentum runs during high buying demand from retail groups and other investors.

Buybacks are intended to move price UPWARD in runs. The price range is established by the corporation. The runs are created by the Bank of Record.

Buybacks also increase dividend yields for long term investors, including pension fund investors.

NASDAQ:AAPL has a mega buyback that was approved in May but has just started now.

Buybacks can be a great strategy for trading stocks this year as many corporations will be doing buybacks due to the reduction of their taxes and more benefits to corporations.

Now is the time to start watching for buyback runs.

BTC — Weekend Pump Fades.. All Eyes on the Gartley Reversal ZoneBitcoin has been consolidating in a tight range between $110K and $105K over the past two weeks. This weekend’s attempted breakout stalled out quickly! BTC was rejected at the Point of Control (POC) of the previous range and came close to the 0.786 retracement of the recent drop.

🧠 Reminder: Weekend pumps are notorious for being unreliable, especially without strong volume.

Now, the charts point toward something much more structured — a potential Gartley harmonic pattern forming, with multiple levels of confluence suggesting the next key decision zone is just around the corner.

🧩 Gartley Completion Zone: $106,290–$106,400

This price zone is loaded with confluence:

✅ 0.786 Fib retracement of the XA leg sits at $106,290

✅ 1.0 trend-based Fib extension of the BC leg is at $106,370

✅ Anchored VWAP from all-time high aligns precisely at $106,370

✅ VAL (Value Area Low) sits at the same level

✅ Imbalance (Fair Value Gap) from earlier price inefficiency lies in this exact region

All of this stacks up into a high-probability reaction zone.

🎓 Educational Insight: How to Trade a Gartley Harmonic

The Gartley pattern is one of the most powerful harmonic setups — a structured form of retracement and extension that captures exhaustion before reversals. Here's how it works:

🔹 XA: Impulse leg

🔹 AB: Retracement of 61.8% of XA

🔹 BC: Retraces 38.2%–88.6% of AB

🔹 CD: Extends to 78.6% retracement of XA and aligns with a 1.0–1.272 Fib extension of BC

🟢 Point D is the entry zone — your reversal opportunity.

📉 Stop-loss sits just below invalidation (Point X).

💰 Targets usually lie at 0.382 and 0.618 of the CD leg.

🔎 Why It Works: It traps late traders and captures price exhaustion at natural Fibonacci ratios. Combined with other tools — like VWAP, liquidity zones, and order flow — it becomes a high-conviction strategy. These patterns are most effective on higher timeframes like 4H or daily.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

NVDA Support and Resistance Lines Valid from July 1 to 31st 2025Overview:

These purple lines act as Support and resistance lines when the price moves into these lines from the bottom or the top direction. Based on the direction of the price movement, one can take long or short entries.

Trading Timeframes

I usually use 30min candlesticks to swing trade options by holding 2-3 days max. Anyone can also use 3hr or 4hrs to do 2 weeks max swing trades for massive up or down movements.

I post these 1st week of every month and they are valid till the end of the month.

DXY 4Hour TF - July 6th, 2025DXY 7/6/2025

DXY 4hour Bearish Idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bearish

4hour - Bearish

All timeframes are suggesting we are sitll very much bearish. Going into this week we can spot two scenarios that will consider DXY either bullish or bearish.

Bearish Continuation - Ideally we can see price action stay below our 97.500 resistance zone which is also our 38.2% fib level. Look for price action to reject 97.500 with strong bearish conviction. This will most likely confirm a bearish dollar for the week ahead. Keep in mind, price action can push up to the 98.000 zone and still remain bearish.

Reversal - This is the less likely move for the week ahead but not impossible. For us to consider DXY bullish again on the 4hour timeframe we would need to see price action push above our 98.000 resistance area with a confirmed higher low above. Look for strong bullish rejection above & off of 98.000 acting as support. This is the first step for DXY in becoming bullish again.

Review and plan for 7th July 2025 Nifty future and banknifty future analysis and intraday plan.

Swing ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

BTC ANALYSIS🌸#BTC Analysis : Bullish Trend 🚀🚀

🚀As we can see that there is a formation of Flag & Pole Pattern in #BTC in daily time frame. Right now we can see that #BTC again retest from the resistance zone and we can see a bounce back from its support zone 💪

🔖 Current Price: $1,08,050

⏳ Target Price: $1,20,000

⁉️ What to do?

- We can trade according to the #BTC chart and make some profits. Keep your eyes on chart price action, observe trading volume. Always observe market sentiments and update yourself everyday.🔰🔰

#BTC #Cryptocurrency #Breakout #TechnicalAnalysis #DYOR

SWING IDEA - AJANTA PHARMAAjanta Pharma , a mid-cap pharma player with strong branded generics in ophthalmology, dermatology, and cardiology, is showing a compelling swing trade setup backed by a high-probability technical breakout.

Reasons are listed below :

Bullish engulfing candle on the weekly timeframe, indicating reversal strength

2,500 zone acting as a crucial support

Holding above 0.382 Fibonacci retracement level , suggesting healthy correction

Price trading above 50 & 200 EMA on the weekly chart – long-term strength intact

Breakout from narrow consolidation near the 50-week EMA

Target - 3080 // 3400

Stoploss - weekly close below 2415

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

Bitcoin Analysis: Risk under 108k, aiming 111k+ in continuation__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strong uptrend across all major timeframes (MTFTI “up”). Buyers remain in control; daily/4H/1H structure robust.

Key supports: 108,239.1 (720min Pivot, critical transversal support), 105,054.7 (240min Pivot), 99,581 (240min Pivot). Active defense seen on 108,239.1 at all timeframes.

Main resistances: 110,630.1 (1D), 110,483.1 (240min), 111,949 (W). The 110–111k area acts as the short-term ceiling.

Volume: Moderate activity, no spikes or climaxes, slight intensification noted on the 30min during key tests.

Risk On / Risk Off Indicator: “STRONG BUY” signal on all Tfs ≥30min, contributing to marked bullish momentum. Minor short-term divergence only on 15min.

Multi-TF behavior: ISPD DIV and Investor Satisfaction are neutral, no extreme behavioral stress; psychology is balanced, neither panic nor euphoria.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall bias: Bullish, synchronized multi-timeframes, dominant bullish liquidity.

Opportunities: Optimal long entries on validated pullback to 108,239.1, add on breakout of 110,630–111,949. Gradual partial take profit recommended in the 111k area.

Risk zones: Invalidation below 108,239.1 (confirmed H2 close), risk of further correction toward 105k then 99.5k; suggested swing stop under 108,000.

Macro catalysts: No major event, global markets stable. Geopolitical tensions monitored, low short-term impact.

Action plan: Prioritize “buy the dip” on pivots, active monitoring for any breakout/failure. Dynamic stop management, partial profit-taking on extension.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Very strong daily structure, high momentum, intermediate supports near 98k/100.5k. Watch for major resistances at 108–111k.

12H/6H/4H: Ranging below 110–111k resistance, no fragility. Supports 108,239.1 and 105,054.7 holding, no selling pressure detected. Watch for breakout/impulse.

2H/1H: Buy zone if maintained >108,239.1, risk of sell-off below this pivot toward 105k. Price is ranging, momentum remains positive.

30min/15min: Consolidation on supports. 15min: temporary divergence on the Risk On / Risk Off Indicator but bullish structure intact unless a clean break below 108,239.1.

Risk On / Risk Off summaries: Dominant “strong buy” tone, synchronized momentum, only weak short-term divergence. No behavioral stress (ISPD DIV neutral everywhere).

__________________________________________________________________________________

Cross-analysis and recommendations

__________________________________________________________________________________

Momentum: Bullish environment sustained as long as >108,239.1. Continued upside bias if breakout above 110–111k is confirmed.

Risks: No major vulnerabilities detected. Very low probability of a local top, except in the case of exogenous macro shock.

Macro & On-chain: Stable newsflow, no distribution from HODLers or significant new inflows. Preferred strategy: swing trading in trend direction, tight stop under the main pivot.

__________________________________________________________________________________

Decision summary

__________________________________________________________________________________

Preferred scenario: Hold long >108,239.1, add on validated pullback, look for breakout with volume extension to 111k+.

Risk management: Stop under 108,000, partial profit-taking in the 110,630–111,949 area.

No immediate macro constraints: Use this calm window to ride the trend.

Monitoring: Resilience of the main support, any sudden geopolitical shocks.

BTC/USDT keeps a clear bullish bias, favoring swing or trend-following strategies as long as key pivots hold. Buy the dips remains optimal while technical structure holds; strict stop management is advised pending any “breakout fail”.

ABCL — Bullish Breakout with Upside PotentialAbCellera Biologics Inc. (ABCL) has recently confirmed a breakout above a long-term descending trendline, followed by a successful retest of both the trendline and previous local highs. This technical development increases the probability of a sustained upward move.

The first target stands around $5.70, with a potential medium-term extension toward $13.20, offering attractive risk-to-reward parameters.

The company operates in the biotechnology and healthcare innovation sector — one of the most promising and rapidly advancing industries. While such stocks often face increased volatility due to news-driven events, the potential for high returns makes them compelling for both swing traders and long-term investors.

SWING IDEA - JK LAKSHMI CEMENT JK Lakshmi Cement , a key player in India’s cement sector under the JK Group showing strong technical confluence making this a swing-worthy setup.

Reasons are listed below :

Formation of a bullish engulfing candle on the weekly chart, indicating a potential trend reversal

Strong support from the 50-week EMA , reinforcing medium-term trend strength

Breakout from a consolidation range that lasted over a year, suggesting renewed momentum

Inverse Head & Shoulders breakout , a classic bullish pattern

Target - 1000

Stoploss - weekly close below 795

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

Looking for a leap on LULU. OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

GBP/JPY Bears Eye Drop to 195GBP/JPY closed lower for a third day on Wednesday, with bearish momentum increasing thanks to political tensions in the UK and dovish comments from BOE voting members.

While the daily RSI (2) is oversold, there could still be room for a move to 195 over the near term. Its less than a day’s trading range away using recent volatility levels, and it also sits near the bullish trendline from the May low.

The 1-hour chart shows prices are drifting higher in an apparent corrective fashion, yet prices remain in the lower third of Wednesday’s range. I suspect bears will seek to fade into any pops higher in anticipation of another drop towards 195, near the daily S1 pivot, weekly S and rising trendline.

Should GBP/JPY drop to the lower target area, how prices react could provide clues over its potential to use the level as a springboard or break lower from that pivotal zone.

Market Analyst at City Index and Forex.com

Review and plan for 3rd July 2025 Nifty future and banknifty future analysis and intraday plan.

Swing ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

“Accumulation, Breakout, Repeat: SBSW’s Time Again?” SBSW | Weekly Chart Analysis

4-Year Cycle | Smart Money Levels | Precious Metals Macro Tailwind

This chart paints a clear picture — Sibanye-Stillwater (SBSW) has followed a reliable 4-year accumulation-to-expansion cycle:

🔹 2015–2016

🔹 2019–2021

🔹 Now shaping up for 2025–2026

Each rally kicked off after institutional accumulation around the $3 level, and once again, we’re seeing the same behavior. History doesn’t just rhyme — it repeats.

🧠 Smart Money Moves

Every major cycle began after price based out near the $3 level. That’s exactly what we’ve just seen — accumulation, basing, and now lift-off. We’ve entered a familiar pattern — the same smart money footprints showing up again.

📊 Technical Breakdown

This is the weekly chart, and we’re now testing the 0.236 Fibonacci retracement level (7.39) drawn from the 2020 high to the recent low.

✅ A weekly close above this level + structure building could confirm the beginning of a long-term leg higher.

📈 Volume Flow Indicator has crossed above the midline for the first time in years, suggesting that real buying pressure is back. That’s a shift in momentum worth noting.

🎯 Key Areas of Interest:

• $10.00 – Volume node + prior S/R

• $12.00 – Fib midpoint + prior pivot

• $14.90 – Confluence zone

These are zones where I’ll be watching for continuation, reaction, or reversal.

🌎 Macro Tailwind: Precious Metals Demand

Platinum and palladium are gaining renewed attention as demand increases in EVs, clean energy, and industrial sectors. SBSW — with its deep exposure to both metals — is positioned as a long-term beneficiary if this trend continues.

Add to that the recent global instability and de-dollarization chatter, and you’ve got a macro backdrop favoring real assets over paper. Precious metals are catching a bid — and SBSW could ride that wave.

🧠 My Position

Started buying $4.00 calls and recently rolled to $5.50s. I’m letting this one develop over time — watching for confirmation and continuation.

(Not financial advice — just sharing my perspective as always.)

🕰️ Cycles matter.

📚 History teaches.

💰 Smart money accumulates before the breakout.

This setup has all the hallmarks of a repeat cycle in progress. I’m locked in.

—

📍 Long-term chartwork, weekly timeframe. Zoom out to see the rhythm.

SBSW | Weekly Chart Analysis

4-Year Cycle | Smart Money Levels | Precious Metals Macro Tailwind

This chart paints a clear picture — Sibanye-Stillwater (SBSW) has followed a reliable 4-year accumulation-to-expansion cycle:

🔹 2015–2016

🔹 2019–2021

🔹 Now shaping up for 2025–2026

Each rally kicked off after institutional accumulation around the $3 level, and once again, we’re seeing the same behavior. History doesn’t just rhyme — it repeats.

🧠 Smart Money Moves

Every major cycle began after price based out near the $3 level. That’s exactly what we’ve just seen — accumulation, basing, and now lift-off. We’ve entered a familiar pattern — the same smart money footprints showing up again.

📊 Technical Breakdown

This is the weekly chart, and we’re now testing the 0.236 Fibonacci retracement level (7.39) drawn from the 2020 high to the recent low.

✅ A weekly close above this level + structure building could confirm the beginning of a long-term leg higher.

📈 Volume Flow Indicator has crossed above the midline for the first time in years, suggesting that real buying pressure is back. That’s a shift in momentum worth noting.

🎯 Key Areas of Interest:

• $10.00 – Volume node + prior S/R

• $12.00 – Fib midpoint + prior pivot

• $14.90 – Confluence zone

These are zones where I’ll be watching for continuation, reaction, or reversal.

🌎 Macro Tailwind: Precious Metals Demand

Platinum and palladium are gaining renewed attention as demand increases in EVs, clean energy, and industrial sectors. SBSW — with its deep exposure to both metals — is positioned as a long-term beneficiary if this trend continues.

Add to that the recent global instability and de-dollarization chatter, and you’ve got a macro backdrop favoring real assets over paper. Precious metals are catching a bid — and SBSW could ride that wave.

🧠 My Position

Started buying $4.00 calls and recently rolled to $5.50s. I’m letting this one develop over time — watching for confirmation and continuation.

(Not financial advice — just sharing my perspective as always.)

🕰️ Cycles matter.

📚 History teaches.

💰 Smart money accumulates before the breakout.

This setup has all the hallmarks of a repeat cycle in progress. I’m locked in.

📍 Long-term chartwork, weekly timeframe. Zoom out to see the rhythm.

🛑 Invalidation below $5.50 — no structure, no conviction, I’m out.

If SBSW breaks back below the $5.50 level with high volume and fails to reclaim it quickly, that would invalidate the current breakout structure and suggest this move was a false start. I'd reassess the cycle thesis if we revisit the $4 range with no buyer defense.

Please feel free to comment and let me your opinion