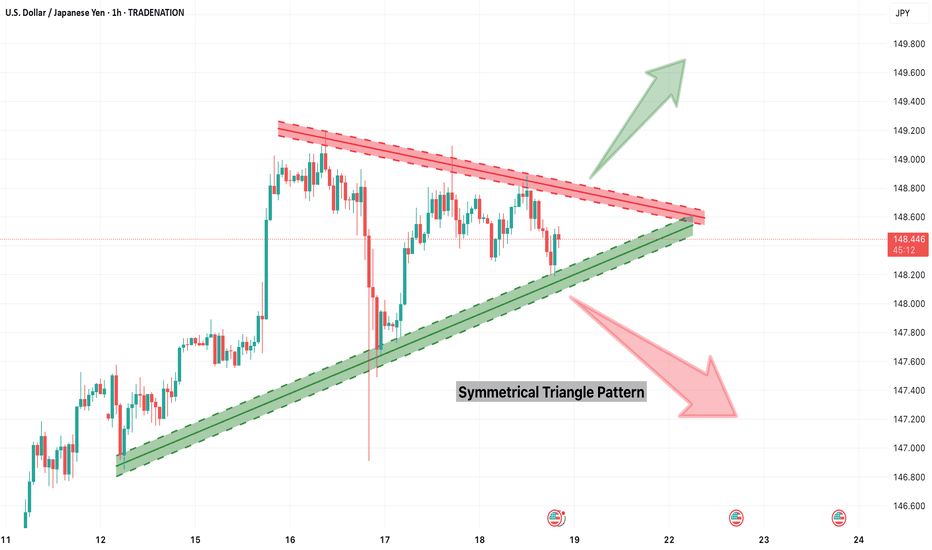

USDJPY Symmetrical Triangle – Be Ready for Breakout or BreakdownUSDJPY is currently squeezed inside a well-formed symmetrical triangle, indicating a breakout is imminent. This consolidation pattern is nearing its apex, and price action is getting tighter. A sharp move in either direction could unfold soon. Here's how to prepare:

🟢 Bullish Breakout Setup:

Entry Trigger: 1H candle close above 148.70

Stop Loss: Below last higher low or triangle support (~148.15)

Targets:

TG1: 149.20

TG2: 149.60

Final TG: 149.95–150.00

Bias: Favors trend continuation (previous uptrend)

🔍 Confirmation: Strong breakout candle with momentum and/or volume.

🔴 Bearish Breakdown Setup:

Entry Trigger: 1H candle close below 148.15

Stop Loss: Above triangle resistance (~148.70)

Targets:

TG1: 147.60

TG2: 147.20

Final TG: 146.80

Bias: Reversal or failed trend continuation

🔍 Confirmation: Clean breakdown with bearish candle close + possible re-test rejection.

⚠️ Avoid premature entries inside the triangle. Wait for a confirmed breakout or breakdown with candle close and rejection follow-up.

🎯 Tip: Triangle breakouts often result in fast directional moves. Plan your lot size based on volatility and stick to your risk parameters. This is a high-probability setup — trade with discipline.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

Symmetrywaves

Interesting Simetry in $AMZNStarting from the 5th of August 2024 every time NASDAQ:AMZN reaches an important Fibonacci level retraces around 7%, then moves higher.

Once it reached 0.618, the Fibonacci level corrected by 6.86% in 5 days and then moved higher.

We have another wave up followed by another correction this time 7.62% in 9 days.

And again another wave up followed by a correction of 7.51% in 10 days to Fibonacci level 1

Once it reached 1.618 Fib level retraced to 1.382 Fib level Correcting 7.24% in 18 days this time.

Where Does TSLA Land?

Trend

- Downtrend confirmed.

- Components of the channel chart:

The original downtrend channel plus a 100% extended channel.

Both channels divided in half by blue dotted lines.

The shaded zones furthest from the center represent "overbought/oversold forces," which counterbalance each other.

- Currently, the price is descending into the extended channel, suggesting a chance of reaching the lower band of the extended channel.

- Note that when the price enters the orange shaded zone, it could move rapidly in one direction, as there is minimal previous support and resistance.

- The trend lines serve as potential support and resistance levels.

100% Symmetrical Projection: Downtrend “N” Patterns

- A 100% Symmetrical Projection of the previous swing (from A to B) and then projected from C. As a result, D is the initial target price on the short side.

- The 0.5 level from C to D serves as a clear support, enhancing the value of this projection.

N Pattern’s Target Price & Fibonacci Price Cluster

- The target price of $116 at level D aligns with a major prior low on the weekly chart.

- Levels 1 & 2 are significant due to the price cluster effect, demonstrating the validity of the extension of the prior major swing.

- Consequently, Level 3 has a good chance of becoming a critical support and a potential target price.

Conclusion

- In comparison with symmetrical analysis, TSLA's trend channel chart provides higher reference value.

- The dynamic target price is the lower band of the extended channel.

- The fixed target price (strong support) could be $122, followed by $116.

Not Financial Advice

The information contained in this article is not intended as, and should not be understood as financial advice. You should take independent financial advice from a professional who is aware of the facts and circumstances of your individual situation.

TSM: After Downgrading The Outlook, What To Expect?

Trend

- On the weekly chart: Clearly showing an uptrend.

- The uptrend channel has extended 100% and is expected to return to the middle line at least, with a chance of reaching the lower band of the original channel.

100% Symmetrical Projection: Uptrend “N” Patterns

- A 100% Symmetrical Projection of the initial swing (from A to B) and then projected from C. As a result, D was our initial target price.

- Without a symmetrical retracement from D to E, there's a resistance-turn-support at level D, and the price continued to rise. The target price was adjusted another 100% higher to D' due to the very strong momentum.

- However, the price failed to reach D' and fell below level D at $135, indicating that the momentum has dissipated. Additionally, on the daily chart, there's a support-turn-resistance to reinforce the level's importance.

- What's next?

The price may retrace 100% of the "extra force" of the blue box; or

The price is likely to fulfill the original symmetrical retracement from D to E.

N Pattern’s Target Price & Fibonacci Price Cluster

- The 0.5 Fibonacci Retracement of the entire swing from A to HH perfectly aligns with level E, which can be seen as one of the current target prices on the short side.

- The 0.618 Fibonacci Retracement of the more recent swing from C to HH is close to the low of the returning blue box.

- Both levels and the previous key resistance level at B form a tight zone, likely to be a significant support area (the gray area).

Conclusion

- After breaking below the key level at $135, TSM is expected to retrace to the tight range between $109 and $112.7.

- In other words, if you’re considering to buy more and invest in TSM, this tight support area presents an opportune entry point.

Not Financial Advice

The information contained in this article is not intended as, and should not be understood as financial advice. You should take independent financial advice from a professional who is aware of the facts and circumstances of your individual situation.

Nasdaq for the coming week (7/10)

Channel

- There’s a clear uptrend channel.

Symmetrical projection: An uptrend N pattern

- By projecting a 100% symmetry projection of the initial swing from point A to B, and extending it from point C.

- As the expected symmetric pullback to E did not occur, I anticipate a further 100% extension from D to F ($16733). The target price level aligns with the historical high level, adding significance to the target price.

Resistance levels on the way

- The price range from $15340 to $15360 is a crucial resistance level zone, as it aligns with multiple key Fibonacci levels.

The 0.786 Fibonacci retracement level of the entire downtrend from point X to point A'.

The 1.5 Fibonacci extension level from point Y to point A'.

- $16216 could serve as another potential target if we apply a more conservative initial swing from Orange point A to point B.

Support/ Defence level for bulls

- The prior low at $14250 is a key support level that shouldn't be broken, otherwise, the bullish momentum will be difficult to sustain.

- In addition to being level D, the level aligns with two critical Fibonacci levels, further enhancing its significance.

The 0.618 Fibonacci retracement level of the entire downtrend from point X to point A’.

Assuming the current high marks the end of the uptrend, the 0.236 Fibonacci retracement level of the uptrend from point A’ to point Z perfectly aligns with the prior low level.

Key points on the chart.

**Not Financial Advice**

The information contained in this article is not intended as, and should not be understood as financial advice. You should take independent financial advice from a professional who is aware of the facts and circumstances of your individual situation.

APPL Price Target for Bulls

The price has taken out the prior high at $157.5.

→ The recent downtrend has officially ended.

Now we look for the uptrend rhyme.

→ Since there is a higher low formed and a clear resistance-turned-support at level B, we can project a 100% symmetry of the prior swing from A to B and project it from C.

→ The level of C happens to be the 0.618 Fibonacci retracement from A to B.

→ The level of D can be seen as the short-term goal, and it also happens to be the 1.618 Fibonacci extension from A to B.

What’s more? The level of D is also the level of the prior high on the weekly chart.

On the weekly chart, you may notice there’s a big downtrend channel. And the current price is just right under the downtrend pressure. However, the price didn’t fulfill the lower boundary of the downtrend channel this time and has challenged the pressure for the fourth time. Considering all the Fibonacci level coincidences mentioned above, it’s anticipated that the breakout of this downtrend channel will unfold.

What if the price goes below the level of B?

→ Since the level of B has already been retested and held as a support level, it shouldn’t be broken. Otherwise, the bullish rhyme will also be gone. We should wait for another clear signal to enter/re-enter a trade.

**Not Financial Advice**

The information contained in this article is not intended as, and should not be understood as financial advice. You should take independent financial advice from a professional who is aware of the facts and circumstances of your individual situation.

NASDAQ 100 Futures update on 4/111. The price hasn't taken out the prior high (level X) at 13740 on a larger picture. So, technically, CME_MINI:NQ1! is still in a downtrend.

2. However, it's clear to see that the market is forming an up trend on the bottom now (higher high and higher low).

3. We can do a 100% symmetry projection of the prior swing from A to B, projected from C.

--> The short-term target price will be the level of D. And do notice the big prior high (level X) could be a possible strong resistance.

4. What makes this up-trend "N" swing constructive?

--> The level of 0.5 retracements from A to B is very close to the level of C, making a symmetry here.

--> There is a "resistance turned support" on the level of B.

5. What if the price comes below the level of B?

--> The price is likely to go sideway. It's better to wait for a more and clear signal to enter a trade.

**Not Financial Advice**

The information contained in this article is not intended as, and should not be understood as financial advice. You should take independent financial advice from a professional who is aware of the facts and circumstances of your individual situation.

Bitcoin at Symmetrical Pattern#Bitcoin 15 min. #TA at #Binance

As per #Symmetrical Pattern, and daily candlestick numerical analysis of 412111 last 10 days, today is now breaking point for Bitcoin within next 6-8 hrs.

Either it will be break towards $29k or it will be goes to $26k-27k.. Lets see, what happens today..

SOL 30% PUMP ON THE WAY?SOL is looking bulllish on daily timeframe and 4 hr timeframe , It formed a symmetrical triangle and breaked it on daily timeframe upside which means sol is ready for a take off to the next resistance of 60-69$ which also a region of daily 200 MA and also technically target of symmetrical triangle of around 30-39% . We just want a retest for confirmation, BUT BUT BUT...... still fundamentals will play a major rule for solana future for more and regular update follow our account.

S&P 500 WHERE WE REALY GOING ?In this chart again i use Fibonacci extension and retracements to have an idea of potential supports as-well as targets zones

price is trading bellow the 200 moving average and could be an indication of a further decline in SP500

a 100% projection would be a 100% symmetry from abc

are we really heading to 3602.8?

let me know whats your thoughts leave me a commend bellow

shibusdt/4hEveryone knows that wave analysis is very difficult and nothing is 100% in technical. This scenario is more stronger than before scenario that I published for SHIBA.

According to symmetrical movement for waves we have another rise for SHIBA up to 0.00006776 (0.00004528 was the end of BC) if our harmonic pattern going to be happen (AB=CD) and then a mega drop beside the 0.00003485 and finally a mega rise with 210% profit (0.00010652). You can see my targets on the chart (the black ones is the end of CD and our greens are for bullish mega wave)

17 Nov'21 and 23 Nov'21 are important dates (top and bottom)

HOW-TO: NZDCHF Full Trade Analysis & Strategy ApproachFor those of you trading NZDCHF, do you also get “confirmation” from higher time frames when deciding to go short or long?

Yes, that is one of the things I factor into my NZDCHF analysis - and so should you.

“Higher Time Frames” reveals how the price of a currency pair ( NZD CHF in this case ) fluctuates from within an hour or up to a day - providing you with additional data for your NZDCHF technical analysis - and time to plan your best course of action.

The result - you will never be trading NZDCHF today, tomorrow, next week blind - ever again!

By watching my trading NZDCHF video breakdown, I hope that it will not only help you create a more accurate NZD CHF market analysis - but learn to integrate time frames as part of your forex trading strategy: and analysis in general.

Watch my NZDCHF market analysis trading video right to the end, and leave a message if there’s anything you want to ask about the trade or my trading process.

Go watch how I did it, so you can replicate it!

EURCHF Correction Continues ?EUR/CHF started its last impulse at 1.07400 and correctly completed at 1.11516 on the 1 hour timeframe, using Fibonacci, then the correction began.

This formed a symmetric triangle which it's retest in turn formed a parallels channel to the base of the symmetrical triangle.

I think right now it has began it's journey to retest the level where the impulse broke out which is at 1.08938, but a fair value will be 1.09328

Note:

This is just my idea and trading strategy and not a financial advice .

Traders what do you think