Tariffs

Sell in May and Go Away? You Might Want to Watch These LevelsThe S&P 500 is coming under pressure as we enter May. The old adage “sell in May and go away,” worked last year, but this month has mostly been positive since 2013.

There are obviously much bigger issues now than typical seasonality, especially after April’s huge bounce. The bulls have priced in significant recovery for the market, which creates the risk of selling the news as social distancing ends. It also opens the door to potentially new bearish narratives, like renewed trade tensions with China.

If you’re waiting and watching to see how things play out, three potential areas could be important on the S&P 500’s chart.

First is the current level around 2820, which is near the bottom from last August.

Next is roughly 2728. This low from 11 months ago briefly provided support March 9-11 and again on April 21.

It's also near the 50-day simple moving average (SMA), which has been knifing lower. Traders may want to test that line.

If 2728 fails, the next clear support area could be much lower: between 2467 and 2480. The first line we outlined here . The second was a weekly low March 9-13.

Beware a possible market topLast month, I posted an article here on TradingView in which I mentioned three indicators that 2020 might be a banner year for stocks. We had had a strong Santa Claus rally and a strong "first five days" of the year, I pointed out, and unless there was a major end-of-month correction, we were on course to have a strong January. All three of those indicators are highly predictive of full-year performance. Well, guess what? We got a strong end-of-month correction, and we ended January down 0.04% overall. That means we only got 2 out of the 3 bullish indicators, with overall January performance implying a bear year ahead.

Lately we've been rallying from that late January correction, but I'm not sure it can last. If China hadn't announced the removal of half its tariffs, the market would already have resumed a down trend due to growing coronavirus risk. The reality is that coronavirus impact is likely to be larger than the impact of a 50% tariff cut. Analysts are expecting 15% China production cuts in the auto industry, for instance, and oil prices already reflect a huge impact on travel and shipping. So far it's just international travel, shipping, and demand that are affected, but you can probably expect a larger impact on domestic markets within a month or two. My model suggests that the current global count of about 31,500 coronavirus cases is likely to grow to 190,000 by the end of February. (y = 126.23x2 - 1E+07x + 2E+11; R² = 0.999. See my Twitter page @WSPZoo for the graph.)

What might be the impact of coronavirus? Well, a quick review of a 2014 study on Spanish flu in Sweden-- where infection and mortality rates were similar to coronavirus-- suggests that capital returns fell by about 1%, and the poorhouse rate was about 11% higher in the hardest-hit areas than in the least-affected areas (due mostly to kids losing their parents). With the banking sector in the US currently very exposed to any increase in the poverty rate due to higher-than-2007-levels of subprime lending, I'd suggest coronavirus substantially increases the risk of another cascade of defaults like the one that triggered the 2008 Great Recession. The US also has a trillion-dollar deficit and low interest rates, leaving perhaps little room for fiscal stimulus if GDP growth should slow on the order of 1%. In short, this is very worrying.

The tariff news will buoy us a little, but I'm not sure how long it will last. If we end the day down today, then we will have made a bearish divergence on the RSI. And if we end the day down tomorrow, that'll probably give us a bear divergence peak on the MACD as well. I have already changed my allocation to about 75% cash, and it may be a while before I re-enter on anything but a few small option positions.

US Steel could pop on USMCA newsNews of the pending approval of the USMCA trade deal has been somewhat eclipsed by news of the signing of the Phase 1 China trade deal. However, the reality is that the USMCA deal has larger implications than the China deal, since we do a lot more trade with Canda and Mexico than with China. One sector affected by the deal is the U.S. steel industry, because the deal closes loopholes that foreign steelmakers have used to bypass steel tariffs when selling to U.S. manufacturers. That could give steelmaker stocks like X and AKS a nice bump when the media breaks the news of the deal passing in the Senate.

However, any bump in steel stocks may be short-term, because the loophole closure is scheduled to take 7 years to go into effect. So I suggest treating this as a quick scalp play, at least until the U.S. manufacturing sector starts to recover.

Deere Trying to Break Loose Before China DealTractor maker Deere might be setting up for a breakout as the U.S. and China move toward a trade deal.

DE has been consolidating in an extremely tight range for the last four weeks. It's pressed against near-term resistance around $177. Meanwhile the 50-day simple moving average (SMA) has squeezed up from below as support.

The company's backward-looking results haven't been terrific. Management guided lower on November 27, citing the trade war. But now the market is looking past that with Vice Premier Liu He scheduled to sign "phase one" at the White House on January 15.

Agricultural exports to the Asian country are a big part of that deal. DE is perhaps the most straightforward name for large institutional investors in the U.S. to position for the news.

Buyers may get more active if DE breaks the weekly high near $177. The 50-day SMA can be used for risk management if it goes the other way.

AUD/USD: Bulls Take Control in Short Term Technically bullish - currently overbought, AUD/USD should make a break above 0.70000 price level after some slight consolidation/ pullback.

US-China Trade developments will continue to take the spotlight for AUD pairs in 2020; With Phase 1 Deal to be signed sometime in January, (which includes Tariff reductions) AU bulls should temporarily take control..and then we move into Phase 2 of 3..

RBA expected to cut cash rate at their February meeting in order to further support growth for small businesses in particular.

FED expected to stay on hold.

Support levels: 0.6940 0.6900 0.6865

Resistance levels: 0.7000 0.7035 0.7070

*Trade at you own risk off of your own analysis ;)

-Krecioch

ORBEX: Risk Up on LOWER TARIFFS As China Announces Import Cuts!China announced they will be lowering tariffs on a number of items come January 1st, making markets looking more festive ahead of Christmas!

Aussie and Kiwi took the headlines with a positive tone, however, Cable kept entering lower territories on the back on post-election no-deal fears! Will the Santa rally continue?

Have a look at our Elliott Wave analysis for further clues!

Timestamp

AUDUSD 2H 01:15

NZDUSD 2H 04:10

GBPUSD 2H 06:20

15 December, the US will implement tariffs on $156B on ChinaTo offset the additional tariffs the CNY would have to depreciate - although the Chinese authorities have said that they won't pursue quantitative easing.

If there is a formal announcement to suspend or delay the tariffs, the market would expect a more positive risk reaction and that is currently being priced in. WIth the USDCNY trading around the 6.90 and below the 7.00 psychological level that was key back in the summer.

If Phase one of the deal does not pass and the tariffs go-ahead, we would expect the USDCNY to trade above the 7.100

Playing Mattel's momentum?Technical

MAT broke and sustained its 200sma resistance a couple of days ago.

Todays candle above the trend (pink trend line) are confirmation MAT longer downtrend might be over.

Fundamental / News

December 15th tariffs were removed, easing pressures for them. However, 25% tariffs will remain on $250 billion

Chinese imports and 7.5% will be put on much of the remainder.

Mattel (MAT) said Monday, December 9th, that it plans to offer $600 million aggregate principal amount of senior notes due 2027 to institutional buyers, subject to market conditions and other factors.

Why I reallocated most of my tech and retail to pharma and cashToday the market surged higher despite the worst jobless claims data since September 2017 and also despite reports that Trump has no intention of delaying the December 15 tariff deadline. Investors apparently are betting that an eleventh-hour deal will get made before Sunday, but personally I'm not willing to gamble on that.

If the US does impose $150 billion of new tariffs on consumer goods from China, retail companies and tech companies will be disproportionately affected. I shuffled some of my tech and retail shares into weed stock Aurora Cannabis and pharmaceutical companies Amyris and Lannett this morning after seeing some positive headlines about those companies. I also bought small positions in a gold miners fund and an inverse oil fund just for funsies. Those should both gain if no trade deal materializes.

Most of my money is now in cash, however, and I will choose a re-entry once I know what's going on with tariffs. I will definitely miss some profit if a deal gets made, but that's okay. I take safer bets; I don't play Trump roulette.

Potential Bull Flag in General Electric as Industrials ClimbIndustrial stocks have come to life since early October as investors look for the economy to recover from the U.S. – China trade war. Now one of the biggest and most liquid names in the entire sector is rebounding from a pullback, and a classic bull-flag continuation pattern may be taking shape.

General Electric reported a potentially transformative quarter on October 30. Strong free cash flow dispelled worries about its balance sheet -- similar to the story in Tesla . In both cases, big obstacles that once kept some investors on the sidelines could be going away.

GE gapped higher after that report and then pulled back. It found support at the same $10.70 - $10.80 area that was resistance in June and July. It's climbing again today following an upgrade by UBS, which raised it price target to $14.

It is a strong news-driven move with the potential for brief consolidation, so traders may find some opportunities closer to $11.20.

Energy is another potential catalyst because GE owns about one-third of oil-field servicing company Baker Hughes . This has also been one of the stronger niches in the market over the last week, and also stands to benefit from trade optimism potentially lifting crude.

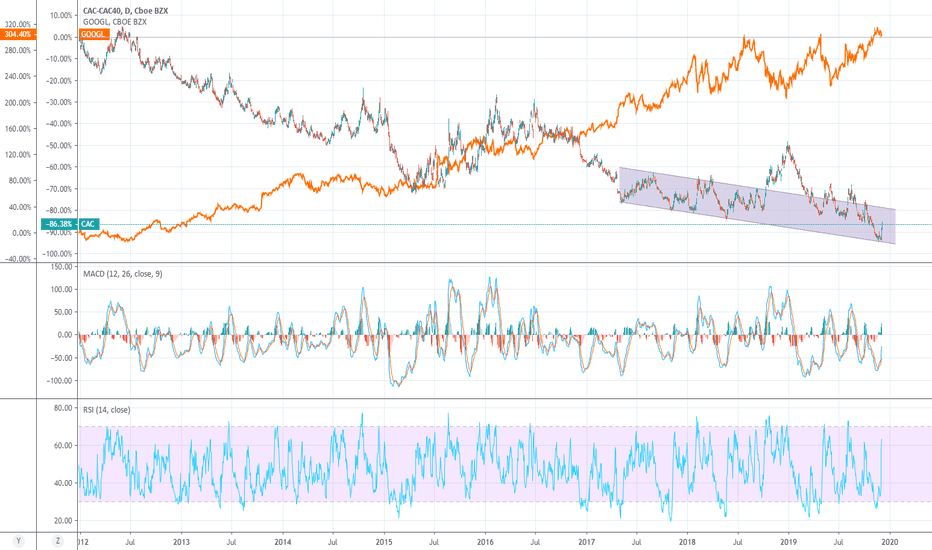

US could impose 100% tariffs on French goods after Google taxWhat was President Macron thinking about designing a tax for tech companies... A quick reminder, it will be separated in two categories — marketplace (Amazon’s marketplace, Uber, Airbnb…) and advertising (Facebook, Google, Criteo…). Despite the fact it wasnt planned specifically for American companies, the vast majority of big tech companies that operate in France are American. Thus, a company that generates more than €750 million in global revenue and €25 million in France, will have to pay 3% of the French revenue in taxes.

As expected, the U.S. Trade Representative claimed that“France’s Digital Services Tax (DST) discriminates against U.S. companies, is inconsistent with prevailing principles of international tax policy, and is unusually burdensome for affected U.S. companies.” And, as a result, now we might see tariffs that could be as high as 100% on French goods (wine, cheese, handbags…).

What is going to happen now? Frnce will say that the response will be equally damaging, but i personally doubt they manage to impose significant tariffs unless the whole European Union agrees to cooperate and istart acting. However, even in this case no one can guarantee that th EU will achieve something worthwhile... So, with a high probability we will see another decrease in the Cac-40.

ORBEX: Weekend Trade News Likely to Affect SPX, DXY!In today’s marketinsights video recording, I talk about SPX and DXY .

SPX takes a breather from all-time highs offering some pocket-relief to short-term bulls, however, with weekend trade headline news the rally could continue higher.

The US index looks bid too despite the medium-term bearishness as the economy performs incredibly well, supporting the dollar.

From a technical perspective, there's more room to the upside for both. The index, however, will most likely have a harder trip moving higher as its upside is limited. Unless if of course a sharp bullish move occurs, taking out breakeven stops and then reversing rapidly to everyone's surprise.

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

DXYThe heavily correlated DXY and EURUSD are trading in the complete opposite direction. This doesn't give enough reason to see why the trend would continue, but we do have a lot of bull-ish momentum as price continues to trade in a channel toward the upside. I'm looking to see The Dollar break resistance levels, and push higher.

ORBEX: GBPUSD, AUDUSD: Trade And Brexit Deals Fall Short!In today's #marketinsights video recording I analyse #GBPUSD and #AUDUSD

Pound Lower on:

- Highly complex proposal for a double customs system

- Nothing substantial or "workable" submitted to EU

Aussie Lower on:

- Tradewar shift, again, as tariffs part of the limited deal

- Phase one not documented, China needs confirmations

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice

XAUUSDGold, coming off a interesting key level here. Previous levels of resistance off the monthly chart. Federal Chairman speaks on lowering the alarms for a recessives period, this gives U.S markets strength and sends stocks for a rebound and the Dollar finds artificial strength. In correlation, precious metals become less appealing as a way to hedge inflation.

SPY Triple BottomPotential for a triple bottom on SPY. Depending on incoming news later tonight/tomorrow morning, I suspect a large move monday. Technicals would suggest that spy should be making a move upwards towards 293. If 293 rejects, then down we go again. If it breaks and retests as support, then we may make new highs. However, with the fear in the market, it is hard to say that's going to happen....except, "be greedy when others are fearful?"...

Currently in a long straddle.

Delayed tariffs "for Christmas" might help HASBRO

News/fundamental

The USTR says that the tariffs on some items, including “certain toys,” will be delayed until Dec. 15.

September is a key shipping month for those companies as they prepare for the holiday shopping season, when the majority of the industry’s business occurs.

Hasbro told CNBC earlier this month that it would have “no choice but to pass along the increased costs to our U.S. customers” if the tariffs were put into place.

--

Great risk reward ratio.

TRADERSAI - A.I. Powered Model Trades for Today, MON 08/12Bears Getting Emboldened?

The apparently mis-managed, mid-judged, and mis-publicized trade war appears to begin to take its toll on the confidence of businesses and investors - not only on the confidence, but could very well be on their bottomlines. And, this could be emboldening the bears to slowly emerge from their hiding.

Nevertheless, if you are itching to go short this market you need to tread carefully - there is still scope for stoking (baseless) hope and exuberance in the markets around the trade war agreement/developments (mass memory is said to be very short and politicians know this very well) - so, account for "short squeeze" spikes up when going short. Keep enough powder dry and do not jump all in.

Our medium term models have not formed any near term directional bias, yet, and are in an indeterminate state, waiting for further analyses of today's (Monday's) daily close. In the mean time, read below for our models' trading plans for the day.

tradersai.com

#ES #ESMINI #SP500 #SPX #SPY #Fed #China #Yuan #Yields #Rates #Tariffs #Tradewar