Review and plan for 15th April 2025Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Tariffs

NASDAQ Futures Long Setup: Pullback Entry After Tariff BoostMarket Outlook – April 13, 2025

Quick recap: In my last public analysis, I mentioned watching the 18,350–18,000 zone for signs of support — a level stacked with confluence (50–61.8% Fib, EMA, VWAP, pivot). Price broke down deeper than expected but responded beautifully:

✅ Tagged 18,000 almost to the tick

✅ Rejected hard at the 61.8 Fib

✅ Respected the 50 Fib on the way back up

All solid signs of strength.

Now with tariff exemptions announced today (bullish for tech/Nasdaq), I’m opening the door to more long setups this week.

Here’s What I’m Watching:

🔹 Scenario A: Pullback into the 18,575–18,500 zone (first dotted white line). If price reclaims structure or gives me something clean — EMA bounce, VWAP tag, candle pattern — I’ll look for longs.

🔹 Scenario B: If that level breaks or I miss the first shot, I’ll look for a second chance around 18,000–18,300. Same deal: not jumping in blindly, waiting for a setup to form.

To be clear — these are areas of interest, not automatic trades. I want clean structure and confirmation before entering.

Let’s see how it plays out. Will update if/when I take a position. Stay sharp. 📈

ECB decision shadowed by tariff risk Markets will be closely watching the European Central Bank’s (ECB) interest rate decision on April 17, with expectations for a seventh consecutive rate cut.

Despite this expectation, the euro surged to a three-year high against the US dollar last week, as traders continued to pull away from US assets.

The dollar index has dropped 4% since President Trump’s “Liberation Day” tariff announcements on April 2, falling below the key 100 level too.

At this stage, market participants will be looking for any signals on how the ECB might respond to the potential spillover effects of President Trump’s tariff measures. While some guidance may emerge around already-announced policies, the risk of further unpredictability remains high.

Trump being Trump, it is perhaps unlikely we have seen the last of his volatility-inducing tariff announcements. This can weigh further on the dollar, eroding confidence in the world’s reserve currency.

Another market manipulation. It is spiraling out of control!I’m not here to express political opinions, but let’s be real—the Trump family launching meme coins, rugging retail investors, and manipulating markets is spiraling out of control.

💥 $TRUMP and $MELANIA were just the beginning.

Today, we witnessed what could be the biggest market manipulation in history, and it was executed with textbook precision:

Step one: float a fake news headline to test the market reaction.

Step two: publish a deliberately confusing statement where Trump says everything and its opposite.

Many misunderstood it as a “90-day tariff pause.”

🕛 The timing?

The announcement dropped at 12:30 PM EST—midnight in Asia, and 7 PM in Europe, when banks and institutions were closed.

🎯 Only the U.S. was awake and able to buy the pump.

Everyone else? Left sidelined.

No politician in modern history has manipulated global markets to this extent.

It’s turning Wall Street into a Las Vegas casino for the elite.

To make matters worse, Trump even tweeted a sarcastic:

“It’s a great day to buy stocks.”

🧨 Reality check:

He lowered current tariffs by just 10%

Hit China with a massive 125% tariff

Recession risk? Still on the table

Economic uncertainty? Worse than ever

You think China will just let this slide? Retaliation is coming.

What we're seeing is a nation burning its credibility while recklessly using financial power to create chaos.

🚨 If you think your money is safe in markets run by these people, think again.

This isn't trading anymore—it's Russian Roulette. Markets needs stability.

DYOR

Bitcoin Nears $85K as Strategic Talks Grow. Where To Next?Bitcoin, the king crypto, is currently trading at $84,848.36. It has gained 3.10% in the last 24 hours, with a daily trading volume of $30.09 billion. Bitcoin’s market capitalization now stands at $1.68 trillion.

Globally, Bitcoin continues to gain attention at the policy level. In the U.S., there are growing discussions about recognizing Bitcoin as a national strategic asset. A U.S. Senator recently suggested the country acquire 1 million BTC, reinforcing the idea. Florida has introduced legislation allowing public funds to invest in Bitcoin.

North Carolina is considering recognizing Bitcoin as a legal payment method. Arizona’s Senate is evaluating the creation of a home-based Bitcoin activity policy and the possibility of a state reserve. Meanwhile, New Hampshire passed a bill allowing up to 10% of its state funds to be invested in Bitcoin. In Europe, Sweden is assessing the idea of adding Bitcoin to its national reserves for financial stability.

Technical Analysis

From a technical view, Bitcoin has been in a bearish phase since reaching its all-time high of $109,358 on January 19. Since then, the price has been forming an internal structure of lower highs and lower lows, a clear sign of a downtrend. It dropped to a low of $74K after Trump-era tariffs hit the market but has since rebounded to current levels.

The recent lower high stands at $88,996. The trend remains bearish until that level is broken with a strong candle close above it. If Bitcoin breaks and closes above this point, analysis show a potential move toward new highs. Without that breakout, bearish pressure may resume, possibly pushing the price back down to test support near $73K.

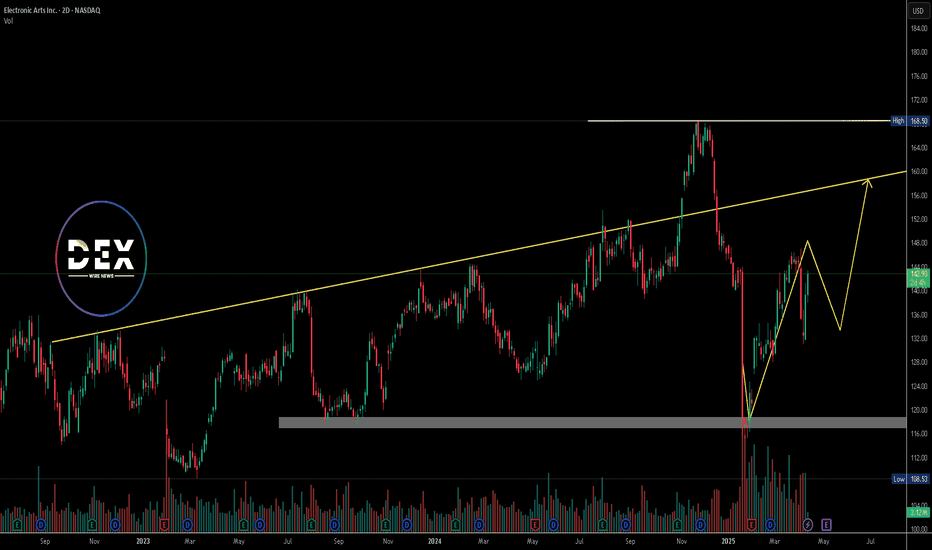

Electronic Arts Inc. Stock Sees Momentum Ahead of Earnings Electronic Arts Inc. (NASDAQ: NASDAQ:EA ) is gaining attention as the gaming industry shows signs of recovery. The stock closed at $142.93 on April 11, 2025, reflecting a gain of $3.54( 2.54%) for the day. Its next earnings report is scheduled for May 6, 2025.

The gaming industry grew rapidly during the COVID-19 pandemic but saw a decline as restrictions lifted. In 2024, inflation and lower spending led to layoffs and studio closures, though upcoming game releases may support a recovery.

EA is a major player in digital entertainment. It develops and distributes games across platforms, including consoles, mobile, and PCs. Popular titles in its lineup include EA SPORTS FC, Battlefield, Apex Legends, The Sims, Madden NFL, Need for Speed, Dragon Age, and Plants vs. Zombies. Billionaire investors continue to show confidence in EA, placing it among the top gaming stocks.

Technical Analysis

EA recently bounced sharply from the support zone around $115. This level aligns with a previous support zone. A strong bullish candle followed, with high volume pushing the price above key moving averages. Currently, EA trades near $143. The 50-day moving average is at $144.38, the 100-day at $141.01, and the 200-day at $133.68. These are levels that are likely to support the price in case of further declines.

The RSI stands at 52.41, showing neutral momentum. Next potential move suggests a short-term pullback before continuation. If the stock breaks above the immediate target and ascending trendline resistance, the next target lies near $168.50 previous high. EA is showing strength both fundamentally and technically as it approaches its next earnings release.

DoorDash (NASDAQ: $DASH) Gains Strength Ahead of May EarningsDoorDash, Inc. (NASDAQ: NASDAQ:DASH ) is showing strong momentum in a volatile market. As of April 11, DASH closed at $180.49, up 1.10% for the day. The stock has risen about 9% year-to-date, while the overall Computer and Technology sector has dropped around 11.8%. This places DoorDash ahead of many of its peers.

DoorDash belongs to the Computer and Technology group, which ranks #6 out of 16 sectors based on the Zacks Sector Rank. The company currently holds a Zacks Rank of #2 (Buy), signaling positive analyst sentiment. Over the last three months, analysts have revised DoorDash's full-year earnings estimate up by 14.7%. This indicates growing confidence in the company’s future performance.

Investors are now watching closely as DoorDash prepares to release its earnings report on May 7, 2025. The stock's upward trend and revised estimates may influence how it reacts to the upcoming results.

Technical Analysis

The daily chart shows that DASH recently bounced off a strong support zone around $162. This zone has acted as a demand area before, pushing the price higher in past sessions. Currently, DASH is approaching key resistance level at $200. A break above these could lead the stock toward the recent high at $215.25. The chart also suggests a possible retracement before a new leg up, reflecting a bullish continuation structure.

Volume increased during the bounce, indicating strong buying interest. RSI is at 48.16, which suggests neutral momentum with room for further upside. DoorDash remains one to watch heading into earnings season.

Netflix Earnings Growth Expected As It Prepares For Q125 ResultsNetflix (NASDAQ: NASDAQ:NFLX ) is set to report its earnings for the quarter ending March 2025 on April 17. Analysts expect year-over-year growth in both revenue and earnings. However, consensus earnings per share (EPS) estimates have been revised down slightly by 0.07% over the past 30 days. This suggests a cautious outlook among analysts.

At the close on April 11, Netflix stock traded at $918.29, down by 0.31%. In after-hours trading, the price edged slightly higher to $919.80. The stock traded with a volume of 4.07 million shares. RSI stands at 47.76, reflecting neutral momentum.

The final result could trigger a sharp price move. A positive earnings surprise might push the stock higher. On the other hand, a miss could lead to a decline. The outcome will also depend on management’s commentary during the earnings call.

Technical Analysis

On the daily chart, Netflix recently bounced off a key demand zone near the $820–$830 range. This zone had previously served as a strong support area. After touching this level, the price formed a reversal candle, signaling potential buying interest.

The stock is now hovering around $918.29, near the 50-day and 100-day moving averages at $961.61 and $931.24, respectively. If the price clears these levels, it may aim for the recent high of $1,064.50. A short-term retracement could occur before a possible continuation higher.

Volume analysis shows a spike during the bounce from support, indicating accumulation. The price pattern suggests a bullish structure is forming. Overall, eyes remain on the April 17 earnings report for the next major move, which might see Netflix surge to a new all-time high.

BlackRock Beats EPS Estimates Despite Revenue Miss in Q1 2025 BlackRock Inc. (NYSE: NYSE:BLK ) reported adjusted earnings per share (EPS) of $11.30 for Q1 2025. This beat the Zacks Consensus Estimate of $10.25, marking a 10.24% surprise. In the same quarter last year, EPS was $9.81.

Revenue came in at $5.28 billion, missing the estimate of $5.33 billion by 1%. However, it rose from $4.73 billion a year earlier. The company has surpassed EPS estimates in all four of the last quarters and has topped consensus estimates twice in that span. In the previous quarter, BlackRock posted EPS of $11.93, beating the $11.27 estimate. That represented a surprise of 5.86%.

BlackRock operates in the Financial - Investment Management industry. The market now awaits management’s outlook for future earnings. This will shape short-term price direction. So far in 2025, BlackRock shares have dropped 16.2%. In comparison, the S&P 500 has declined 10.4%.

Technical Analysis

BlackRock rebounded from a strong support zone near $780. This level aligns with the long-term horizontal support level that has held for over 3 years now. The RSI sits at 41, indicating it is nearly oversold. However, a bullish reversal momentum is forming around the support zone.

If the price continues to rise, resistance and target lie at the $1,084.22 recent high. A break above $950 may trigger a run toward the $1,000–$1,084 range. If the price is rejected, it could revisit the $780 support or possibly the ascending trendline sitting below the horizontal support.

Morgan Stanley (NYSE: MS) Reports Strong Q125 ResultsMorgan Stanley (NYSE: NYSE:MS ) Beats Q1 estimates with record Equity Trading Revenue. The bank posted earnings per share (EPS) of $2.60, beating analyst expectations of $2.18. Revenue reached a record $17.74 billion, topping forecasts of $16.44 billion.

The bank's equity trading revenue soared 45% year-over-year. It reached a new high of $4.13 billion as growth came across business lines and regions. Asia showed particularly strong performance. Prime brokerage and derivatives led gains, fueled by high client activity in volatile markets.

Morgan Stanley shares dropped 1% after the earnings release. However, the stock remains up over 20% in the past year. Volatility in global markets helped trading desks outperform.

Technical Analysis

Morgan Stanley bounced sharply from the $95 support zone. Buyers stepped in near the previous breakout level. Volume increased and confirmed renewed interest. This was seen as Trump paused tariffs for the next 90 days as well. Current price action suggests a recovery trend. The RSI stands at 39, hinting at oversold conditions. A potential path points to $142.03, which acts as the immediate resistance level.

If the price breaks $113 cleanly, momentum could carry it to $130 and beyond. If it fails, it is most likely to retest $95 support level. A strong break above recent highs would confirm bullish continuation. For now, Watch out the $113 and $142 levels closely.

Whirlpool of DividendsAm I crazy to be looking at a manufacturing play right now considering the tariff trade wars going on? The stock right now has a forward dividend yield of 8.65% at the current price with a technical setup. There are fundamentals around tariffs to consider but that could only be the "reason" the price has come to a great buy.

I set an alert almost a year ago in April 2024 based on a follower of mine liking the stock NYSE:WHR as a dividend play. I suggested that we set the buy alert for the Volume Profile level going back 20 years ago which also incorporated the 2020 COVID low:

That alert his this week and I did some fundamental research on the company. Back in 2018 Whirlpool took a big hit with the first round of China focused tariffs. However, the company responded by focusing on more U.S.-based manufacturing. Its competitors, LG and Samsung have more tariff exposure. Material costs could still present a challenge.

From a technical standpoint I see a major low with volume support that could hold up price.

Nvidia (NASDAQ: $NVDA) Shares Rally Amid AI Sector OptimismShares of Nvidia Corporation (NASDAQ: NASDAQ:NVDA ) have gained over 3% on Friday 11th April. The positive results come after U.S. markets rallied on tariff news. President Trump announced a 90-day pause on new tariffs. Reciprocal tariffs for most countries dropped to 10%, sparking investor optimism.

Major U.S. indices rose sharply following the announcement after being under pressure from rising trade tensions. The pause was seen as a welcome shift toward calmer negotiations.

However, Trump excluded China from this relief. Instead, he stated that tariffs on Chinese goods would increase to 125%. This came after China announced new retaliatory tariffs on U.S. imports. The tough stance toward China contrasted with the softened approach to other countries.

Despite the relief, market uncertainty remains. Investors are unsure whether the rally will last. Ongoing trade disputes, especially with China, could disrupt momentum.

Nvidia's price rose to $110.78, gaining $14.99 on Friday's session. The stock reached an intraday high of $111.53 and a low of $107.48. The current resistance sits at $153.13 high.

Technical Analysis

Nvidia bounced sharply off the $92 support zone, highlighted by strong buying pressure. The RSI sits at 49, indicating neutral momentum. A clear resistance lies near $153.13 high. If Nvidia breaks this level, a move toward $180 is likely. If it fails, price may revisit the $92 zone. Two scenarios are possible. The stock could either continue upward to $180 or face rejection and fall back. Watch the $153 level closely for confirmation.

DXY Drops to 3-Year Lows, EURUSD Soars to 1.14With the 3-Day RSI hovering near 2020 highs, the monthly chart shows potential for further upside as EURUSD breaks out of a long-term downtrend channel that began from the 2008 highs.

The pair has reached a high of 1.1470, aligning with the 0.272 Fibonacci retracement of the 2008–2022 downtrend.

A sustained hold above 1.15 opens the door for further gains toward resistance levels at 1.1730, 1.20, and 1.2350.

On the downside, if overbought conditions on lower time frames lead to a pullback below 1.1270, potential support levels to monitor include 1.1140, 1.1070,1.09, and 1.0850,

- Razan Hilal, CMT

British pound keeps rolling as UK GDP shinesThe British pound is up sharply on Friday, extending its rally for a fourth straight day. In the European session, GBP/USD is trading at 1.3088, up 0.94% on the day. The pound has surged 2.9% since Monday.

UK GDP higher than expected February with a gain of 0.5% m/m. This followed a revised 0% reading in January and beat the market estimate of 0.1%. This was the fastest pace of growth since March 2024. Services, manufacturing and construction all recorded gains. For the three months to January, GDP expanded 0.6%, above the revised 0.3% gain in January and higher than the market estimate of 0.4%.

The strong GDP data is welcome news amid all the uncertainty created by US President Trump's tariff policy. The UK's largest trading partner is the US and the 10% tariffs on UK products will hurt the UK export sector (Trump has suspended an additional 10% tariff for 90 days).

Bank of England expected to lower rates in May

The turmoil in the financial markets and escalating trade tensions has the Bank of England worried. The markets have priced in a rate cut in May, betting that the BoE will ease policy in order to support the weak economy, even with inflation above the 2% target. The BoE kept rates unchanged in March and meets next on May 8.

The US-China trade war rose up a notch on Friday, as China announced it would raise tariffs on US goods to 125% from 84%. This move was in response to the US lifting tariffs on China by 125% this week, for a total tariff rate at 145%. The trade war will dampen China's economy and Goldman Sachs has lowered its 2025 GDP forecast for China to 4.0% from 4.5%.

Gold ETF(GLD) - Gold is the Safe Haven?Is Gold the safe haven from all the market turmoil? Looking at the chart, it would appear that Gold is unfazed by current market conditions. Price is still making All-Time Highs as price continues to swing above the 25(green), 100,(yellow) and 200(blue) day EMAs. Further fears in the Bond market may increase interest in Gold as a stable asset. What are you thoughts? What are some other assets that are defying 'gravity'?

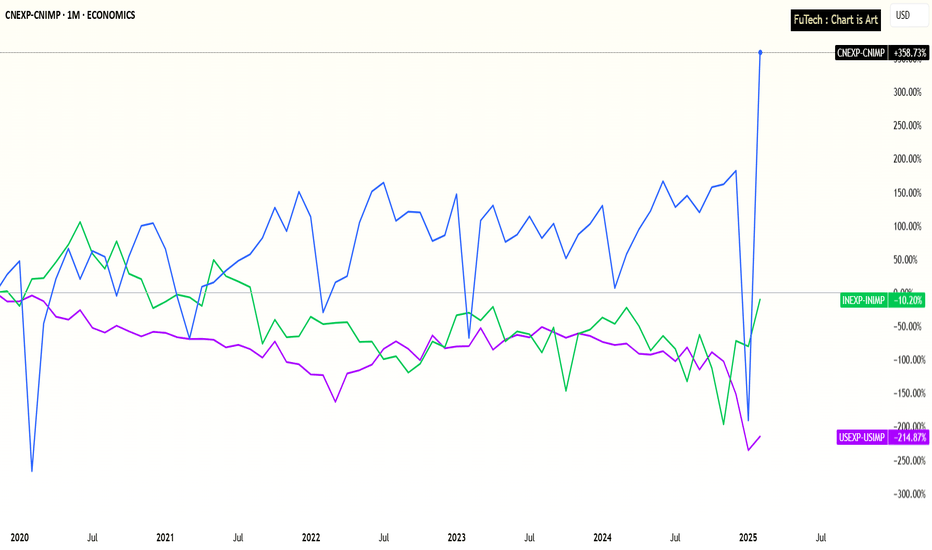

India, USA, China - Trade Deficit Performance after Covid PhaseIndia’s Trade Deficit Nearing a Turning Point – Strong Growth Amid Global Shifts

Trade Deficit Performance Over the Last 5 Years:

India: -10%

USA: -215%

China: +359%

Over the past five years, global trade dynamics have shifted significantly, with India showing promising signs of a turnaround in its trade performance.

India: A Rounding Bottom Pattern?

India’s trade deficit has improved by -10% over the last five years, hinting at a potential rounding bottom pattern that could transition into a trade surplus in the coming years.

This positive shift comes despite global economic headwinds, positioning India as a resilient and emerging export player.

USA: Longer Road to Recovery

In contrast, the United States has seen its trade deficit worsen by -215%, suggesting a deeper structural challenge in its trade balance.

While the U.S. economy remains strong in other metrics, its export-import imbalance will likely take more time and policy adjustments to stabilize.

China: The Export Powerhouse slowdown after Tariffs sanctions ?

China continues to dominate with a staggering +359% improvement in its trade surplus over the past five years, solidifying its position as the world’s top exporter.

However, rising global tariffs and geopolitical tensions could gradually redirect supply chains.

🌏 Macro Implications:

Tariff Realignment: As global companies look to diversify away from China amid escalating tariffs and political tensions, India is emerging as a key beneficiary.

This realignment could significantly bolster India’s export sector.

India’s Growth Story: With structural reforms, expanding manufacturing capabilities, and supportive government policies like PLI (Production-Linked Incentives), India is well-positioned to capture a larger share of global trade flows.

Global Slowdown, Local Resilience: Despite a global economic slowdown, India’s improving trade dynamics signal strong internal momentum and a maturing economy.

📈 Conclusion:

India is on the cusp of a major trade shift.

While China remains the global leader in exports and the USA faces growing imbalances, India’s improving trade performance, geopolitical advantage, and manufacturing push make it a compelling long-term trade and investment story.

Amid Tariffs war and global economy slowdown, India's growth story continues...

EURUSD Tests 17-Year Long-Term Trend!!!After Trump announced an additional 20% in tariffs, EURUSD made a relatively surprising move and surged sharply. This marks the second leg of the upward trend that began in early March. However, the sharp rise has now brought EURUSD to the doorstep of a very long-term resistance level.

Since testing 1.60 in 2008, EURUSD has been moving lower within a wide descending trend channel that has held for 17 years. Since 2015, the pattern has evolved into a wedge formation within this broader channel. The most recent test of this resistance came last year, but at the time, a weak Eurozone economy, crowded Euro long positions, and a hawkish Fed prevented a breakout.

This time, the landscape is different. The Eurozone is showing early signs of recovery, the ECB’s rate cuts appear to be nearing their end, and European countries have started to band together following a decline in confidence in their biggest ally and decide to increase technology, defence spending.

Despite these developments, the medium-term effects of the new tariffs and the strength of the long-term resistance level are likely to prevent a clear breakout for now. Still, the long-term outlook is beginning to shift in favor of the euro, and a breakout later this year carries a significant probability.

GBP/USD at a Crossroads: Imminent Breakout or Bull Trap?The weekly chart of GBP/USD shows a strong recovery following the late-April correction, which brought the price down to a key demand zone between 1.2550 and 1.2600. The bounce was sharp and decisive, but the pair is now facing resistance between 1.3000 and 1.3150 — a previously sold area marked by a visible supply block in red.

The current weekly candle reflects a bullish reaction, but the overall structure suggests a potential exhaustion zone for upward momentum. Price action reveals a series of lower highs in the short term, and while the RSI is bouncing, it remains far from overbought, hinting that this move may be just a technical rebound.

From a trading perspective, a confirmed weakness around the 1.3000–1.3150 zone could offer short opportunities with an initial target near 1.2700 and, if extended, down to 1.2550 — a key dynamic support area. On the flip side, a clean breakout above 1.3150 with strong volume and a weekly close would open the door for a new bullish leg toward 1.3300–1.3400.

Conclusion: GBP/USD is currently at a critical juncture. The next directional move will depend on how price reacts to this resistance zone: a confirmed rejection could trigger renewed selling pressure, while a confirmed breakout may reignite the bullish trend.

Revolving Credit Recession?YES! We are!

Revolving credit does not roll over like this unless people are scared! The question is are we already in a recession? We won't know until after the fact. But my guess would be YES!

My question is will we end up in a depression or not?

Click Boost, Follow, Subscribe, and let me help you navigate these crazy markets.

What on Earth Is a Circuit Breaker?!Every couple of days since April 2nd, everybody's been talking about a stock market halt all day. You're left there trying to Google it so you're not the only person in the group chat who doesn't know what's going on. But actually, nobody else in your group chat knows what's going on either. They're low-key Googling it under the desk. You don't have to know everything in the market to be a "seasoned" trader. What does get disappointing is when people guess instead of providing facts or a direct link to an article about market halts.

So, this is your quick-but-detailed-read article/ guide to market halts and circuit breakers. Send it to your friends in that group chat. Why today's dump happened in the first place? More on that later. It's a long story. 🥹

What is a circuit breaker?

It's simple: a circuit breaker is a 15 minute OR whole-day market-wide HALT when the market reaches 1 of 3 decline levels. It all depends on the level, how fast the decline is, and potentially other factors that we are not aware of. Keep in mind this is not something we have to deal with often.

When does it happen? And what stock does it track?

Good question. The halt is triggered following declines in the S&P 500 only . That is: AMEX:SPY SP:SPX $CME_MINI:ES1!.

If these level 1 & 2 are reached before 3:25 PM EDT , there is a 15 minute market-wide trading halt. Meaning you cannot enter or exit positions. If level 3 is reached at any time in the day, the entire day's trading will come to an end.

Level 1: -7.00% | 15 minute halt

Level 2: -13.00% | 15 minute halt

Level 3: -20.00% | Entire day halt

So when the S&P 500 index reaches -6.98%, be sure a halt is coming very soon at -7.00%. Sure, like today, "they" might pump it and use that as support and prevent a halt (we got very close to -6.35% on CME_MINI:ES1! if I'm not mistaken). But it's good to be vigilant and make sure you're not in any daytrades.

Does CME_MINI:NQ1! NASDAQ:QQQ CBOT_MINI:YM1! trigger the halt also?

No. The halt is only triggered by the S&P 500. The Nasdaq Composite famously moves much more than S&P 500, so a 7% drop in S&P is way more dramatic than a 7% drop in Nasdaq and it's highly likely at -7% in S&P that Nasdaq would be at -8% or -9%. Although, both are undoubtedly decimating for any long positions.

Why does this rule exist?

This was introduced after Black Monday of 1987 where the market was free falling ( DJ:DJI dropped 22.6%) with no safety stops in place to prevent a market-wide disaster. This prevents further panic selling and massive stop loss raids, and also gives institutional traders time to zoom out and see the bigger picture.

How close did we get recently?

Today we got within 0.7% of getting a 15 minute halt.

See for yourself:

And the intraday 15 minute chart:

FUN FACT: What if I shorted the top on CME_MINI:ES1! ?

Assuming your time machine goes back 24 hours (some time machines only go back 10 years minimum), you'd have booked 1500 ticks at $12.50 per tick. So around $19k per contract. You know that's not too bad. It's almost a Toyota Camry per contract. Do better! 😆

How do I trade this?

Do you really have to? Please do not FOMO & catch a falling knife. Trade light. The market is open for the rest of the year. Trade with a stop loss, and remember, if you FOMO'd and bought at -3% just because it's down 3%, you'd have gotten decimated. Use the charts not the % on your screen. 🔥

Hit the follow button for free educational content because knowledge is free. KD out.

WTI gets a boost, but is this really enough?We saw yesterday the positive reaction due to the pausing of tariffs. However, because of the economic uncertainties and OPEC+ production increases, the price of TVC:USOIL may see more downside.

Let's dig in.

MARKETSCOM:OIL

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

US-China Rift: India's Golden Hour?Heightened trade tensions between the United States and China, characterized by substantial US tariffs on Chinese goods, inadvertently create a favorable environment for India. The significant difference in tariff rates—considerably lower for Indian imports than Chinese ones—positions India as an attractive alternative manufacturing base for corporations seeking to mitigate costs and geopolitical risks when supplying the US market. This tariff advantage presents a unique strategic opening for the Indian economy.

Evidence of this shift is already apparent, with major players like Apple reportedly exploring increased iPhone imports from India and even accelerating shipments ahead of tariff deadlines. This trend extends beyond Apple, as other global electronics manufacturers, including Samsung and potentially even some Chinese firms, evaluate shifting production or export routes through India. Such moves stand to significantly bolster India's "Make in India" initiative and enhance its role within global electronics value chains.

The potential influx of manufacturing activity, investment, and exports translates into substantial tailwinds for India's benchmark Nifty 50 index. Increased economic growth, higher corporate earnings for constituent companies (especially in manufacturing and logistics), greater foreign investment, and positive market sentiment are all likely outcomes. However, realizing this potential requires India to address persistent challenges related to infrastructure, policy stability, and ease of doing business, while also navigating competition from other low-tariff nations and seeking favorable terms in ongoing trade negotiations with the US.