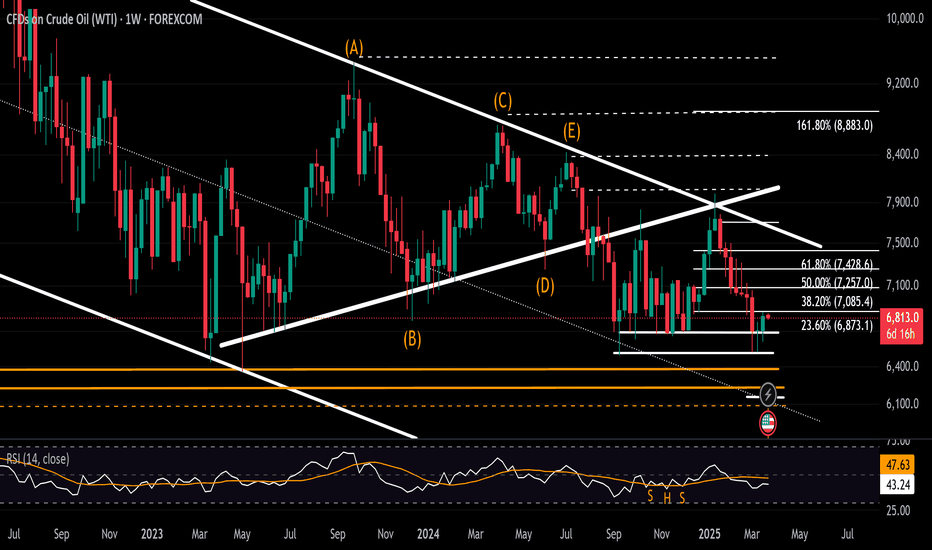

Crude Oil Week AheadFrom a weekly time frame perspective, oil prices have continued to respect the boundaries of a declining channel since the 2022 highs, reaching three-year lows in 2025, in alignment with the long-standing support zone between $64 and $66 that has held since 2021.

After recently rebounding from the $65 level, a decisive close below $63.80 would confirm further downside potential, opening the way toward key support levels at $60, $55, and, in more extreme scenarios, $49.

If the support zone holds, resistance levels within the declining channel may come into play at $70.80, $72.60, $74.30, and $76. A breakout above the channel’s upper boundary and a sustained hold above $78 could shift the outlook to bullish, with potential resistance at $80, $84, $89, and the $93–$95 range.

Despite a complex mix of OPEC quotas, U.S. policy shifts, Chinese economic dynamics, global growth uncertainty, renewable energy demand, and escalating geopolitical tensions, oil remains bearish and range-bound—awaiting a decisive breakout.

Written by Razan Hilal, CMT

Tariffs

Potenial inverse head and shoulders pattern for Bitcoin This is the scenario I’m believing in for the near term for BINANCE:BTCUSD .

One more leg down to confirm the neckline around 78,300 USD.

Quick reversal price action to retest the 92,300 USD (ish) level.

If the breakout takes place to the upside, then I think we will retest the previous highs, with a higher probability of going much higher. Although I believe the tariffs will have a big impact on the USD (DXY index), which I believe will have a strong effect on BTC for the near term, around the coming 6 months. So, I believe the new high will most likely come in Q4 this year, making this cycle different from the historic crypto cycles. Although, there is still a chance that other countries will start to adopt more crypto-friendly policies for crypto or Bitcoin, making this thesis more uncertain. If the policies come out as positive, then I think there are good chances of reaching new highs earlier than Q4, 2025.

2 more reasons to buy gold? Israel is sending a delegation to Washington for strategic talks on Iran, while Trump has reportedly given Tehran a two-month deadline for a nuclear deal—so far, Iran isn’t engaging.

So, the question is: Are we headed towards military conflict or a significant wave of sanctions?

Meanwhile, protests erupted after Erdoğan’s main rival was arrested, triggering a sharp selloff in Turkish markets. The lira hit record lows, forcing the central bank to intervene with nearly $10 billion in currency sales.

Turkey’s inflation remains elevated at 39%, with interest rates at 42.5%. Continued lira weakness could push inflation higher, forcing further rate hikes and adding to the country’s economic instability.

Ultimate summary of Powell’s comments today As expected, Powell reiterated that the Fed is in no rush to adjust rates, and the labour market is stable.

He also reaffirmed the Fed’s reliance on hard data over sentiment and the approach of slowing balance sheet reduction.

What’s different this time:

Inflation & tariffs: Powell acknowledged that recent inflation upticks may be tariff-driven, delaying progress toward price stability. The Fed’s base case assumes tariff inflation is temporary.

Economic sentiment: Consumer sentiment has weakened, partly due to Trump policy changes, and concerns over inflation are growing.

Recession risk: Forecasts now lean toward weaker growth and higher inflation, with recession risks slightly elevated but still not high.

Gold Devours Stocks and Outshines Crypto with 40% Gains. Why So?Gold OANDA:XAUUSD has returned 40% in the past twelve months — that’s more than four times the S&P 500’s SP:SPX 9% increase.

Besides leaving stock bros with a sour taste in their mouths, gold is also serving a cold dish of revenge to the crypto heads who had for years been slamming it for lack of appeal. It crushed the $3,000 mark last week, pumping to the rarefied air of $3,005 per ounce.

The market’s digital gold — Bitcoin BITSTAMP:BTCUSD — is up 26% in the past year. Gold is certainly having a moment here with just about every star aligning for its upside swing. War tremors, inflation jitters, consumer uncertainty and lower interest rates have come together to make gold great again.

Catch the drift? Yes, we mean US tariffs. Trump’s tariff drama is perhaps the biggest driver right now for the shiny stuff. Anxiety over gold getting slapped with a tariff has sent traders, dealers and investors scrambling to get more of it.

The US President has floated some comments on gold but not to the point where he even remotely hints at imposing a tariff. Around the end of February, Trump said he suspects someone might’ve actually been stealing gold from Fort Knox. His remarks came after Elon Musk, designated as a “special government employee,” raised some alarming questions.

“Who is confirming that gold wasn’t stolen from Fort Knox? Maybe it’s there, maybe it’s not,” Musk wrote on X . “That gold is owned by the American public! We want to know if it’s still there.”

Trump chimed in and said in an interview they’re planning to visit Fort Knox soon. “We’re going to go into Fort Knox, the fabled Fort Knox, to make sure the gold is there. He added that “if the gold isn’t there, we’re going to be very upset.”

Fort Knox is the equivalent of Scrooge McDuck’s impenetrable fortress full of gold collectibles. Only that Fort Knox staff doesn't backstroke through the piles of coins (or do they?). The vault holds a total of 147.3 million ounces worth roughly $430 billion today. To those who’re asking why not sell it and pay off some debt — America has a staggering $36 trillion debt burden . Selling gold to pay it off wouldn’t even return a blip on the chart.

According to Treasury Secretary Scott Bessent (who’s also a hedge fund manager) the gold at Fort Knox is audited “every year” and “all the gold is present and accounted for.”

All American gold is stored in a number of vaults, which collectively add up to a total of 261.5 million ounces (8,100 tons), according to Federal Reserve balances. That’s around a $770 billion piece of a market that’s worth nearly $20 trillion.

So is the gold rush exaggerated and maybe a little overrated?

In practice, gold is a pet rock with an added flair. It doesn’t generate yield, produce earnings or pay any form of interest to those who hold it. But gold has a solid history of being the ultimate store of value.

Gold’s supply is more or less fixed as miners are only able to dig out about 1% to 2% a year at best. All the gold ever unearthed in the world is a little over 216,000 tons , according to the World Gold Council. One way to picture that is 64,200 Tesla Cybertrucks. Or, if we were to melt it all, it would be enough to form a cube that’s 25 yards (23 meters) on each side.

You be the judge now — do you think gold is overpriced? Or are you a gold bug who believes that $3,000 could be the start of a new mega cycle for the precious metal? Share your comments below!

Soybeans: Deja Vu all over againCBOT: Micro Soybean Futures ( CBOT_MINI:MZS1! )

Let’s rewire the clock back for seven years. In 2018, trade tensions escalated between the US and China, resulting in a series of tariffs and retaliations.

On July 6, 2018, US imposed a 25% tariff on $34 billion of Chinese imports. On the same day, China immediately hit back with 25% tariff on equal value of US goods.

American soybeans were among the hardest hit by tariffs. The United States has been the largest soybean producer in the world. According to USDA data, American farmers produced 120 million metric tons of soybeans in 2017, contributing to 35.6% of the world production. About 48.2%, or 57.9 metric tons, were exported to the global market, making US the second largest soybean exporter after Brazil.

China is the largest soybean consumer and importer. In 2017, it imported 94 million metric tons of soybeans, accounting for 61.7% of the global imports. Brazil and the US were the largest sources of China’s imports, with 53% and 34% shares, respectively.

Tariffs on US soybeans punished American farmers. Total tariff level was raised from 5% to 30%. As a result, the FOB cost to Shenzhen harbor in southern China hiked up 700 yuan (=$110) per ton. This made US soybeans 300 yuan more expensive than imports from Brazil.

Tariffs priced American farmers out of the Chinese market. According to USDA Foreign Agricultural Service, China imported 1,164 million bushels of US soybeans in 2017. By 2018, China import dropped 74% to 303. While US exports recovered to 831 in 2019, it did not resume to the pre-tariff level until the signing of US-China trade agreement. CBOT soybean futures plummeted 15-20% in the months after the tariffs were imposed.

US farmers incurred huge losses from both reduced sales and lower prices. The following illustration is an exercise of our mind, not from actual export data.

• Without trade tensions, we assume exports of 1,164 million bushels each in 2018 and 2019, at an average price of $105 per bushel. This comes to a baseline export revenue of $244.4 billion for both years combined.

• Tariffs lowered export sales to 1,134 million bushels for the two-year total, at an average price of $87. Thus, the tariff-impacted revenue data comes to $98.6 billion.

• The total impact on soybean sales volume would be -51%, from 2,328 down to 1,134.

• The total impact on export revenue would be -60%, from $244.4 to $98.6 billion.

It is déjà vu all over again.

In February 2025, the Trump administration announced 10% additional tariffs on Chinese goods. This was raised by another 10% in March, setting the total to 20%.

To retaliate against US tariffs, China imposed import levies covering $21 billion worth of U.S. agricultural and food products, effective March 10th. These comprised a 15% tariff on U.S. chicken, wheat, corn and cotton and an extra levy of 10% on U.S. soybeans, sorghum, pork, beef, aquatic products, fruits and vegetables and dairy imports.

This is just the beginning. In the last trade conflict, average US tariff on Chinese imports was raised from 4% to 19%. Now we set the starting point at 39%. How high could it go? From history, we learnt that this could go for several rounds before it settles.

Trading with Micro Soybean Futures

On March 11th, USDA published its World Agricultural Supply and Demand Estimates (WASDE) report. Both the U.S. and global 2024/25 soybean supply and use projections are basically unchanged this month, meeting market expectations.

In the last week, soybean futures bounced back by about 2%, recovered most the lost ground since China first announced the retaliative measures.

The latest CFTC Commitments of Traders report shows that, as of March 11th, CBOT soybean futures have total open interest of 810,374 contracts.

• Managed Money has 101,927 in long, 109,849 in short, and 108,993 in spreading positions.

• It appears that the “Small Money” spreads their money evenly, not knowing which direction the soybean market would go.

In my opinion, the futures market so far has completely ignored the possibility of a pro-long trade conflict with China.

• Seriously, ten percent is just the start. What if the tariff goes to 30% like in 2018?

• How would soybean prices react to a 50% drop in US soybean exports?

Anyone with a bearish view on soybeans could express it by shorting the CBOT micro soybean futures (MZS). These are smaller-sized contracts at 1/10 of the benchmark CBOT soybean futures. At 500 bushels per contract, market opportunities are more accessible than ever with lower capital requirements, an initial margin of only $200.

Coincidently, Friday settlement price of $10.17 for May contract (MZSK5) is identical to the soybean futures price of $10.40 immediately prior to the 2018 tariff.

History may not repeat, but it echoes . At the last time, the tariff on soybeans saw futures prices plummeting 20% within a month. If we were to experience the same, soybeans could drop to $8.00. This is a likely scenario if tariffs were to rise higher.

Hypothetically, a decline of $2 per bushel would cause a short futures position to gain $1,000, given each micro contract has a notional of 500 bushels.

The risk of short futures is the continuous rise in soybean prices. The trader would be wise to set a stoploss at his sell order. For example, a stop loss at $10.50 would set the maximum loss to $165 (= (10.50-10.17) x 500), which is less than the $200 initial margin.

To learn more about all Micro Ag futures contracts traded on CME Group platform, you can check out the following site:

www.cmegroup.com

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Will ES go more deeper ?The E-mini S&P 500 futures contract ( CME_MINI:ES1! ) exhibited a liquidation profile (Profile A), characterized by two distinct distributions. The subsequent session (Profile B) formed a balanced profile and remained entirely below the lower distribution of Profile A, indicating continued bearish sentiment.

Profile C emerged as a short-covering profile, with its upper boundary testing the high of Profile B by a minimal margin. Both Profile B and C exhibited trading activity around the lower distribution of Profile A without breaching its low. Profiles A, B, and C established a base at the C Line, identified as a longer-term support or demand zone.

Yesterday's session (Profile D) also presented a liquidation profile, briefly trading below the C Line before recovering and maintaining balance around this level. The market demonstrates reluctance for further downside, with lower prices consistently triggering short-covering rallies rather than initiating new selling. Even though Profile D traded lower, it did not exhibit significant selling conviction.

Given the prevailing geopolitical risks, including the ongoing tariff disputes and the unresolved Ukraine-Russia conflict, further liquidation during today's Regular Trading Hours (RTH) remains a possibility.

However, sustained buying interest above the balance of Profile C, driven by short covering and new long positions, would indicate a potential shift in market sentiment towards accumulation on a higher timeframe. The market's behavior during today's RTH session will be crucial in determining the next directional move.

A Huge Technical Re-Test of This Important TL Has Just Occurred!Trading Family,

Tariff FUD is recking traders rn. After breaking important support which started in Nov. '24, I knew the SPY was in trouble. My first target down was 563. We hit that and broke it. My second target down was 550. We are there right now! Will it hold? I don't know. TBH, I don't think any analyst that is honest knows. Investors have never seen Tariffs levied like they have been recently by the Trump admin. Noone really knows how this is going to impact the current economy, which is now global (big diff from the last U.S. tariff econ in the late 1800's).

But I can say that this is a big support which is the neckline of our large long-term Cup and Handle pattern started all the way back in Jan. of 2022! We did have one retest already. Usually, this is all that is needed. But apparently, the market wants another. Though the support is strong, remember, every time it is tagged, it weakens. Thus, if it can't hold this current downturn, I suspect it will drop hard from here should it break, possibly dropping all the way to 460. Be prepared for this and watch your trendline closely!

On the other hand, if it holds, I see a huge bounce incoming! We'll probably then go all the way back up to test the underside of that support (red with two with lines) that we broke. Hold on to your hats! We are living in unprecedented times with unprecedented market volatility.

The last item to note is that, once again, this all seems to be occurring at the same time that U.S. congress and senate are voting on a continuing resolution. Correlation does not necessarily equal causation however, in this case, I would suggest that should a U.S. gov't shutdown occur, our support will break and down we'll go. Should a CR pass, big bounce incoming. Stay tuned and watch the news closely for this. It seems to be a news driven event.

✌️ Stew

Booze Wars... How DAX could react?Now it's time for US and EU to have their public tariff battle. Given that wine, champagne and beer are a huge part of EU export into the US, there might be some pain felt among the MARKETSCOM:DE30 bulls. Let's dig in.

XETR:DAX

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

EURUSD: Trump’s trade war crosses the Atlantic You may be sick of hearing about tariffs, but they are currently the catalyst for a huge amount of volatility in the market and a huge amount of trading opportunities.

And now Trump’s trade war has crossed the Atlantic

Today, the European Union announced retaliatory tariffs on approximately €26 billion worth of U.S. goods in response to President Donald Trump's recent increase in tariffs on steel and aluminum imports. Targeted products include Harley-Davidsons, bourbon, and jeans—key American exports that have been caught in previous trade disputes.

The EU has said it remains open to negotiation but has not ruled out further action.

In response, Trump vowed to retaliate, stating, “Of course I’m going to respond.” The daily chart for the EUR/USD shows the pair could fall into a larger corrective decline, given overbought RSI conditions.

International politics is now a high school dramaSo, Trump was all like, “Let’s slap an extra 25% tariff on Canadian steel and aluminum,” which meant total duties shot up to 50%.

Why? Because Ontario put a 25% tax on electricity exports to the U.S. And Doug Ford? He was not having it—saying he’d “respond appropriately” and “not back down.” But —he totally backed down and scrapped the tax on electricity exports to Michigan, New York, and Minnesota.

And now, Trump just ditched the extra 25% tariff, and boom— USDCAD broke below the recent low of 1.43986

Is Trump’s Golden Age a Recession in the Making? Let’s Find Out“This tariff low key slaps,” says no trader ever as markets get jerked and jolted day in and day out because no one can really figure out what’s happening. On some days, US President Donald Trump wakes up and chooses to slap a tariff or two on America’s closest and biggest allies. On other days, he goes for the pardon.

Turns out, investors don’t really like it. Stock markets left and right wiggled to the point they couldn’t take it anymore — the tech-heavy Nasdaq Composite NASDAQ:IXIC dived into correction territory last week. That is, the index plunged more than 10% from its most recent peak, which was a record high.

Even though Friday was a good day for stocks, the S&P 500 SP:SPX closed out its worst week since September, wiping off 3.1%. Zoom out and you get an S&P 500 that’s barely holding above the flatline since the election. In other words, more than $3 trillion has been washed out from the Wall Street darling since it hit a record high in late February.

Where Do We Stand on Tariffs Now?

So where has the dizzying labyrinth of tariffs landed? And is that final? (No, it’s not.) Trump last week declared that there’s simply “no room left” for Canada and Mexico to bargain over a deal or even a delay. That’s a 25% levy taking effect right there. A day later it was no more — a month-long reprieve for carmakers was introduced.

Then a day later, Trump suspended the 25% levy on almost all goods from its closest neighbors. To this, Trump said that the “big” wave of tariffs is coming in early April to a bunch of countries, including the European Union. Right now, only China’s 20% tariff remains in place.

The roller-coaster ride around who gets slapped with what has sent the dollar TVC:DXY in a freefall — so much so that the markets have started to chat about a “Trumpcession,” (not something you’d like to have your name on). That is, some traders and investors expect Trump’s policies to tip the American economy into a recession.

Swirling fears of a downturn came right as the Federal Reserve apparently managed to stick the soft landing — Jay Powell and his clique of central bankers lowered inflation through interest rate cuts while the economy continued to grow without nosediving into a downturn.

A side worry of the tariffs (with very real front-and-center consequences) is a pullback from the Federal Reserve on its rate-cutting campaign. Analysts are quick to say that the US central bank won’t be looking to trim borrowing costs any time soon. Not with all that White House noise threatening to derail consumer confidence and dent corporate profits and revenue.

Apparently, the huge wave of uncertainty around Trump’s tariff agenda, centered on isolation and protectionism, is making global investors nervous.

In this context, how are you navigating the sea change? What’s your portfolio showing and how do you feel about growth prospects ahead? Share you thoughts in the comment section and let’s chat!

EUR/USD keeps rolling after ECB rate cutThe euro has posted strong gains on Friday after taking a pause a day earlier. EUR/USD is trading at 1.0858 in the European session, up 0.69% on the day. It's been a remarkable week for the euro, which has soared 4.7% against the US dollar.

The ECB lowered rates by 25 basis points on Thursday in a widely-expected decision. This brings the deposit rate to 2.5%, its lowest level since Dec. 2022. The central bank has been aggressive in its easing cycle, slashing rates by 185 basis points in just nine months.

The rate reduction was no surprise and is being described as the "last easy cut". Inflation is running at a 2.4% clip, above the ECB's 2% target but low enough to deliver rate hikes in order to boost the flagging economy. What's next for the ECB is a tricky question, especially with economic and political developments moving at a dizzying pace.

First, the new Trump administration hasn't wasted any time in imposing (and in some cases, suspending) tariffs, which has chilled investor sentiment and sent equity markets tumbling. The US hasn't applied tariffs to the European Union although it has threatened to do so. The EU would surely retaliate and a trade war between the two giant economies will damage growth and raise inflation in the eurozone.

Second, Trump is showing growing impatience with Ukraine and has suspended military aid. Germany has responded by easing its fiscal spending rules and has proposed a massive spending scheme for defense and infrastructure. This has sent German bond yields and the euro soaring.

ECB President Lagarde said after the ECB meeting that the situation was changing "dramatically" by the day and the ECB would need to be "extremely vigilant" and "agile". She reiterated that future rate decisions would be based on the data.

The US wraps up the week with the February employment report. Nonfarm payrolls sank to 143 thousand in January from 256 thousand a month earlier. The market estimate for February stands at 160 thousand. A surprise in either direction from nonfarm payrolls would likely have a significant impact on the direction of the US dollar.

EUR/USD has pushed above resistance at 1.0801 and 1.0837 and is putting pressure on resistance at 1.0889. Above, there is resistance at 1.0925

1.0749 and 1.0713 are the next support lines

US Dollar Is Falling ImpulsivelyTrump tariffs and trade wars continue to dominate the market, and we have seen a strong sell-off in the US dollar recently. This reinforces the idea that the US may not win this battle easily, as some other countries have already responded and are trying to hit back. So it’s not a surprise that in this uncertainty stocks are also in a consolidation, but approaching a potential support.

Finally the USD is coming down, now breaking some key support at 106 which is an important indication for a resumption of a downtrend, especially if we consider that the current sell-off is sharp and can be third of a third wave.

So, a bearish trend can stay in play for much lower levels, mainly because Tariffs are delayed again, until April 2nd. Markets are stabilizing and recovering, while USDollar - DXY remains under bearish pressure with space for more weakness. Risk-On sentiment back?

USD/MXN: Mexico plans response to US tariffs The White House confirmed a one-month exemption for autos under the USMCA (United States-Mexico-Canada Agreement), following President Trump’s 25% tariffs on Mexican imports.

The exemption has significant consequences for Mexico’s economy, with tariffs expected to add billions in costs for automakers that rely on Mexican production.

Mexican President Claudia Sheinbaum plans to discuss tariffs with Trump on Thursday, before her government announces countermeasures on Sunday.

Meanwhile, the MACD indicator initially showed a potential bullish signal as moving averages crossed upward. However, momentum appears to be fading, and the pair has yet to retest its February 3rd highs.

USD/CAD holds up OK despite tariffsOK, so it's finally happened. On March 4, 2025, President Trump imposed a 25% tariff on imports from Canada and Mexico, with Canadian energy products facing a separate 10% tariff. Tariffs on Chinese imports were also doubled from 10% to 20%.

In response, Canada imposed immediate 25% tariffs on CA$30 billion worth of U.S. goods, with plans to extend them to another CA$125 billion in the coming weeks. While USD/CAD maintained a steady upward movement, it is difficult to characterize the move as a broad-based selloff. Maybe this is more of a trade scuffle than a trade war right now?

China announced additional tariffs of 10% to 15% on U.S. agricultural products, effective March 10. Mexico is set to announce its own retaliatory tariffs on March 9.

Now, the focus shifts to Trump’s next move. He has already suggested he will reciprocate the reciprocation. Where does this end? Full blown trade war? Meanwhile, reports suggest he is considering easing sanctions on Russia.

RBA minutes hawkish, Aussie edges higherThe Australian dollar has edged higher on Tuesday. AUD/USD is trading at 0.6243 in the European session, up 0.28% on the day.

The Reserve Bank of Australia's minutes from the February meeting reiterated the central bank's cautious stance. The meeting marked a milestone as the RBA pressed the rate-cut trigger for the first time in four years, after maintaining the cash rate at 4.35% for over a year. The decision was a "hawkish cut" with a message for the markets not to expect a series of rate cuts.

In the minutes, members said the rate cut did not "commit them to further rate cuts", a warning that the easing cycle could be short. The RBA remains concerned about inflation even though it has dropped to 2.4%, in the mid-range of the RBA's target band of 2%-3%. Governor Bullock has said that the RBA is keeping a close eye on the labor market, which has been resilient and not supportive of further rate cuts.

Another headache for the RBA is the threat of US tariffs, in particular the specter of another US-China trade war. Both countries have imposed new tariffs on the other, and a damaging trade war would hurt Australia's export industry, as China is Australia's largest trading partner.

Australia's retail sales posted a turnaround in January, with a gain of 0.3% m/m. This matched the market estimate and followed the 0.1% decline in December. The driver of the gain was food-related spending and most sub-categories showed an increase in spending. The outlook for consumer spending has improved, with the RBA rate cut, the drop in inflation and cuts to income tax.

AUD/USD is testing resistance at 0.6228. Above, there is resistance at 0.6251

0.6200 and 0.6177 are providing support

Oil Drops Below $68 Amid Trade Wars and Oversupply RisksCrude Oil drops on oversupply risks and weakening demand expectations

Key Events:

- Trade wars between the world’s largest economies heightens inflation and economic contraction risks

- OPEC plans to unwind supply cuts in April despite oversupply concerns.

- Trump - Ukraine dispute may disrupt oil's bearish trend if tensions escalate with the EU and Russia.

Key Levels:

Oil eyes a 4-year support zone ($63.80–$66), and the potential for the consolidation to extend above that zone persists.

- A close below $63.80 may extend declines to $61.50, $60, and $55 (aligning with the 0.618 Fibonacci retracement of the 2020-2022 uptrend.

- A hold above $68.80 could cap gains at $70.50, $73.50, and $75.

Upside potential on Oil is expected to remain short-lived given the bearish implications of trade wars in tandem with oil's 2022 - 2025 dominant downtrend. A clean close above 78-80 zone may reinforce longer term bullish expectations.

- Razan Hilal, CMT

So far, so good... WTI oil price continues to please the bears. So far, the our stance is unchanged, we remain somewhat bearish on the price of MARKETSCOM:OIL in the near-term. That said, certain criteria still need to be met for us to get comfortable with further declines, especially from the technical side. Let's dig in!

TVC:USOIL

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

GBP/CAD Analysis – Key Levels & Trade Scenarios📊 Timeframe: Weekly (1W) | Current Price: ~1.8391

📈 Bullish Context:

Resistance at 1.8391:

Price is testing a strong supply zone (dark red area).

A breakout above this level could open the door to further upside.

Support at 1.8233 & 1.7677:

1.8233: Short-term support where buyers have stepped in.

1.7677: Major support level, previously tested multiple times.

📉 Current Outlook:

Price has aggressively moved up, breaking through previous resistances.

Approaching a critical resistance area, where rejection is possible.

If a rejection occurs, a retracement toward 1.8233 or 1.7677 could be seen.

📈 Trade Setups:

🔼 Long (Breakout Play):

Entry: Above 1.8400 with confirmation.

Target 1: 1.8600

Target 2: 1.8800

Stop Loss: Below 1.8230 to avoid fakeouts.

🔻 Short (Rejection Scenario):

Entry: Bearish rejection from 1.8391 with confirmation.

Target 1: 1.8233

Target 2: 1.7677

Stop Loss: Above 1.8450.

📌 Final Thoughts:

GBP/CAD is at a critical resistance; a breakout could lead to new highs.

A rejection would confirm a pullback toward support levels.

Key macroeconomic data may impact momentum and direction.

DXY Holds Above 106, Currency Markets at Risk?The US Dollar Index (DXY) remains firm above the 106-mark, applying pressure on the latest currency market rebound amid escalating tariff and trade war concerns.

With the first wave of tariffs on Canada and Mexico set to take effect in early March, Trump's renewed tariff threats against the EU are further strengthening the Dollar's stance.

This has kept the EURUSD capped below 1.0530 and GBPUSD struggling at 1.27. Friday’s key inflation reports—including the German Prelim CPI and US Core PCE—are expected to introduce additional volatility risks.

🔻 Downside Scenario:

A break below 106, aligning with June 2024 highs, could expose the next support at 1.0520, coinciding with the upper boundary of the declining channel connecting lower highs from October 2023 to June 2024.

Further declines could see DXY testing 104 and 102.20, aligning with the 50% and 61.8% Fibonacci retracement levels.

🔺 Upside Scenario:

A solid close above 107.30 could reignite bullish momentum, pushing DXY towards the 2025 high of 110, potentially derailing the currency market’s 2025 rebound.

- Razan Hilal, CMT

Bitcoin Slips: Buy the Lows or Ride the Sell-Off? Following an extended expanding consolidation from Dec 2024 – Jan 2025, bearish pressure intensified after a downside breakout, increasing the probability of a double-top formation at 108,360 – 109,350. This raises concerns about a potential drop towards the previous major support-turned-resistance zone at 72,000 – 74,000.

🔹 Momentum Check: The RSI has hit oversold levels last seen in Aug 2024, when BTCUSD found a bottom before rallying past 100K.

🔸 Bullish Scenario: If BTCUSD holds above 82,000, upside targets include 86,500, 93,000, and potentially a retest of 109,000.

🔻 Bearish Scenario: A close below 82,000 could accelerate declines toward 79,500 & 72,000, aligning with the 50% & 61.8% Fibonacci retracement of the Aug 2024 – Jan 2025 uptrend.

- Razan Hilal, CMT