BITCOIN 2025 - THE LAST HOPECRYPTOCAP:BTC currently finds itself at the intersection of geopolitical tensions and broader macroeconomic uncertainty. Although traditionally viewed as a hedge against systemic risk, it is presently exhibiting characteristics more aligned with high-risk assets. The FED's forthcoming policy decisions will likely play a pivotal role in determining whether Bitcoin stabilizes or experiences further downward pressure.

The chart represents the most optimistic scenario for Bitcoin to date

Tarrifs

Tariffs. Turbulence. OpportunityMarkets Rattle as Global Currencies Slide: Central Banks Prepare to Act

Global financial markets plunged on Monday as U.S. tariffs under the Trump administration, alongside retaliatory measures from key trading partners, officially took effect. The result: a wave of uncertainty and volatility that sent the Australian, Canadian, and New Zealand dollars spiraling to steeply discounted levels.

As this new economic reality unfolds, institutional investors and households alike are scrambling to adjust. In response, central banks across the globe face mounting pressure to stabilize their economies. The most immediate solution? Accelerated interest rate cuts.

Beyond the headline noise of trade wars, the deeper concern lies in domestic economic resilience. Economists and central bankers are increasingly turning inward, looking to bolster aggregate demand through aggressive monetary easing. The U.S. Federal Reserve, nudged persistently by President Trump, has already signaled its willingness to comply. Other central banks are expected to follow suit as nations seek to shield local industries from the impact of trade disruption.

The era of lower global interest rates appears to be more than a passing phase—it is becoming the new norm. In volatile times, disciplined strategies and a long-term lens are more essential than ever. We remain focused on seizing value where others see only risk.

Don't trade Aussie this week!Dear traders,

Among the top 8 forex market currencies, tariffs war affects the Aussie most, because Australia is highly dependent on China.

Rank Trading Partner Exports (A$ million)

1 China 185,141

2 Japan 119,889

3 European Union 31,816

4 United States 30,690

Uncertainty about China's future means, fluctuations in Aussie. I don't trade AUDUSD this week,

only if everything goes well with negotiations between Trump and China, I might use confirmed break over zone of 0.64355 to take long trades.

Regards, Ali

NVDIA Don't Miss Out

Overview:

NASDAQ:NVDA is showing strong bullish momentum on the 2-hour chart, trading at $132.34 as of the latest candlestick. After a recovery from the March low of $88, the price is now testing a key resistance at $132.47. A breakout above this level could signal a continuation toward higher targets, supported by positive market sentiment and technical indicators.

Key Levels to Watch:

Resistance: $135.47

Next Target: $139.50 (psychological level and prior resistance)

Support: $116.24 (recent low, key support)

Trade Setup:

Direction: Buy on breakout

Entry: $133.50 (confirmation above resistance)

Profit Target: $139.50

Stop Loss: $125.00 (below recent pullback and 50-period MA)

Risk-Reward Ratio: 2:1 (Risk: $2.50, Reward: $5.00)

Follow for the Best Free AI Signals on the market

Ash.

AAPL Wait for Break Out Fibo LevelSignal for AAPL NASDAQ:AAPL

Direction: Buy 🟢

Entry Price: $214.41 (Wait For Fibonacci breakout level as shown in the chart) ✋

Profit Target: $236.90 (targeting the upper resistance level indicated in the chart) 🤑

Stop Loss: $198.75 (below the recent consolidation low for a 2:1 risk-reward ratio)

Risk-Reward Ratio: 2:1

Position Size: Risk 1-2% of your portfolio (e.g., for a $100,000 portfolio, risk $1,000-$2,000)

Entry Timing : Enter on breakout confirmation above $214.41 (Fibonacci level), ideally at the next 4H candle close after the break

Confidence Level: 70%

Why This Signal?

Price Action: AAPL is approaching a key Fibonacci level at $214.41 after consolidating between $203.75 and $214.41. A break above this level signals bullish momentum toward $236.90.

Technical Indicators:

Breakout above the 50-day and 200-day moving averages.

News Sentiment: Mixed with US-China trade tensions (per Forex Factory), but AAPL’s fundamentals remain strong with recent positive sentiment on X.

Follow for the best AI Generated Signals based on Latest Models.

Ash

Tesla Grabbing Liquidity Market Context 🚩

1-Month Move: +7.3% (from $261.30)

1-Year Move: +45.6% (from $192.50)

Technicals

RSI: ~68.4 (nearing overbought )

Moving Averages: Above 20-day, 50-day, and 200-day MAs (uptrend, but showing signs of exhaustion )

MACD: Bearish crossover forming (momentum fading, potential pullback )

Trade Setup

Instrument: TSLA ❌

Direction: PUT

Entry Price: $280.21

Take Profit 1 (TP1): $270.00 (~3.6% gain ) 🟢

Take Profit 2 (TP2): $260.00 (~7.2% gain ) 🟢

Expected Move: ~8–10% downward

Best AI Signals on the market.

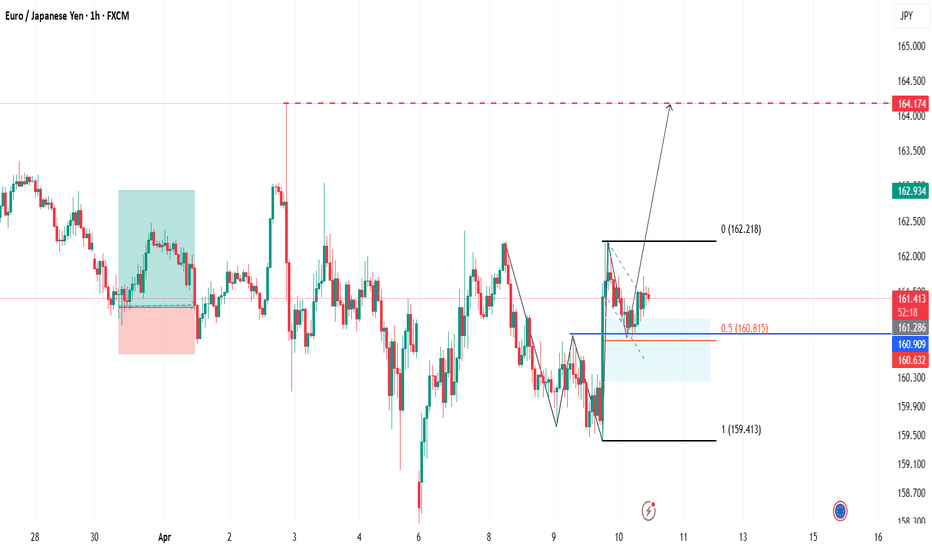

EUR/JPY Technical Outlook: Demand Zone Bounce Sets Up RallyGood Morning Traders,

Trust you are good.

Below is my analysis of the EURJPY pair.

Overview

Price is currently at 161.243, showing signs of a bullish rebound following a sharp drop. A clear bullish structure is forming, characterized by higher lows and a breakout from a recent consolidation zone. The demand zone between 160.900 and 161.100 has held strong, acting as a reliable support level.

Idea

A recent bullish impulse broke above minor resistance, followed by a healthy retracement into the demand zone—shaping a potential bullish flag or continuation pattern. This retracement aligns with the 50% Fibonacci level, providing added confluence for a continuation to the upside.

The projected target is 164.174, a level likely to contain buy-side liquidity and act as a magnet for price in the short term.

Conclusion

Despite macro uncertainty due to ongoing trade tensions, recent news of a 90-day tariff pause from Trump has eased some pressure, allowing the EUR to show resilience. As a result, EUR/JPY may continue its bullish push toward the 164.174 target. However, a break below 160.245 would invalidate this outlook.

Cheers and happy trading!

USDCAD 15-Min Setup: Buyers Defend Crucial ZoneGood morning traders,

Trust you are doing great.

Kindly go through my analysis of USDCAD currency pair.

Overview

The USDCAD M15 chart presents a bullish price setup around the 1.38350–1.38410 support zone, with current price action consolidating just above this area.

Idea

Price bounced off the key support zone (blue box), suggesting buyer interest. The BB Squeeze momentum indicator shows weakening selling pressure, which could signal an upcoming bullish move.

Key Support: 1.38350

Upside Targets: 1.38650, 1.38880, and 1.39039

Invalidation: Setup fails if price breaks below 1.38280

From the fundamental context, we can see that the Canadian dollar (CAD) is moving more in sync with the U.S. dollar (USD) again, a return to its historical behavior. This happens because Canada was spared from certain tariffs, making its economy more closely tied to U.S. growth sentiment—a key bullish factor for CAD when the USD strengthens. But because CAD is now closely tied to U.S. sentiment, CAD won't weaken as sharply, which might explain why the price is consolidating instead of spiking aggressively. As such, we might see a slow but steady move on the pair as time progresses.

Conclusion

As long as the price holds above the 1.38350 support zone, a bullish continuation toward the mentioned targets is likely.

Cheers and happy trading.

XRP/USDT I Reverse Short Squeeze Alert! Resistance at 2 USDTHey Traders after the success of my Previous trade this month on NASDAQ:HOOD hitting Target 1 & 2 in 2 days more than 16%+

With a Similar Trade setup But Crypto I bring you today

BINANCE:XRPUSDT

Short opportunity

- Market structure

- Head and shoulder pattern

- Currently will be trading at supply zone which was a recent support and now an ideal place for a reversal which is taking place as we speak- 4 Hour TF.

- Breakdown and retest

- Risk Aversion Dynamics in Cryptocurrency Markets

PROTIP/-

Entry on Bearish candle stick pattern on Current Levels

Stop Loss : 2.2292

Target 1 : 1.4707

Target 2 : 1.0507

Technical View

The orange circle marks a double top within the supply zone, acting as the shoulders of a larger head and shoulders pattern, suggesting strong resistance.

Bearish Trendline

breakdown + Retest

Risk Aversion Dynamics in Cryptocurrency Markets

Fundamental View - How Current Affairs can effect this pair!

The proposed imposition of significant tariffs, such as the 60% levy on Chinese imports suggested by former U.S. President Donald Trump, could trigger a chain reaction across global markets. This scenario would likely amplify risk aversion among investors, potentially catalyzing a sell-off in risk-sensitive assets like XRP (Ripple) in favor of perceived safe havens such as the U.S. dollar (and by extension, Tether/USDT). Below, we analyze the mechanics of this relationship and its implications for the XRP/USDT trading pair.

1. Tariff Escalation and Its Macroeconomic Consequences

1.1 Direct Impact on China’s Economy

A 60% tariff on Chinese exports to the U.S. would directly reduce China’s export competitiveness, potentially lowering its GDP growth by 1.5–2.5 percentage points annually, according to UBS economists. This slowdown would exacerbate existing vulnerabilities in China’s economy, including a property market crisis, weak domestic demand, and deflationary pressures (June 2024 CPI: 0.2% YoY). Reduced economic activity in China—the world’s second-largest economy—could dampen global trade volumes and commodity prices, indirectly affecting risk sentiment in financial markets.

1.2 Global Spillover Effects

The UBS analysis highlights that retaliatory measures by China or other nations could amplify trade fragmentation, further destabilizing supply chains and corporate earnings. For example, the April 2025 announcement of 25% U.S. tariffs on automotive imports triggered a 2.9% drop in the S&P 500 and a 5–7% decline in major Asian equity indices. Such volatility often precedes broader risk aversion, as investors reassess exposure to growth-dependent assets.

2. Risk Aversion Dynamics in Cryptocurrency Markets

2.1 Flight to Safety and USD Appreciation

During periods of economic uncertainty, capital typically flows into safe-haven assets like U.S. Treasuries and the dollar. Tether (USDT), a stable coin pegged 1:1 to the USD, often benefits from this dynamic as crypto traders seek stability. For instance, Bitcoin’s role as a “weak safe haven” for the USD in acute crises suggests that stable coins like USDT could see increased demand during tariff-induced turmoil, while altcoins like XRP face selling pressure.

2.2 XRP’s Sensitivity to Risk Sentiment

XRP, unlike Bitcoin, lacks established safe-haven credentials. Its price action in Q2 2025 exemplifies this vulnerability: a 7.5% decline over 30 days (peaking at 2.57 USDT on March 19 and bottoming at 1.64 USDT on April 7). This volatility aligns with broader patterns where altcoins underperform during risk-off periods. A global slowdown would likely intensify this trend, as retail and institutional investors reduce exposure to speculative crypto assets.

3. Mechanism: From Tariffs to XRP/USDT Price Decline

3.1 Investor Behavior in Risk-Off Environments

Tariff Announcements → Equity Market Sell-Off: The April 2025 auto tariffs caused a 6–7% drop in Asian equities, signaling growing risk aversion.

Liquidity Reallocation: Investors exit equities and crypto (including XRP) to hold cash or cash equivalents like USDT.

USD/USDT Demand Surge: Increased demand for USD lifts USDT’s relative value, pressuring XRP/USDT downward.

3.2 Technical and Fundamental Pressure on XRP

Supply-Demand Imbalance: As sellers dominate XRP markets, the token’s price in USDT terms declines. The 14.56% 90-day volatility in XRP/USDT suggests heightened sensitivity to macroeconomic shocks.

Liquidity Crunch: A broader crypto market downturn could reduce trading volumes, exacerbating price swings.

4. Historical Precedents and Limitations

4.1 Bitcoin’s Mixed Performance as a Hedge

While Bitcoin has shown limited safe-haven properties for the USD in short-term crises, its decoupling from altcoins like XRP during stress periods is well-documented. For example, Bitcoin’s 40% rebound post-COVID crash contrasted with XRP’s prolonged slump in 2020–2021.

4.2 Mitigating Factors

Stimulus Measures: If China implements aggressive fiscal stimulus, as UBS posits, a partial recovery in risk appetite could cushion XRP’s decline.

Crypto-Specific Catalysts: Regulatory clarity or Ripple-related developments (e.g., SEC case resolutions) could counteract macro-driven selling.

5. Conclusion: Bearish Outlook for XRP/USDT in Tariff Scenario

In a tariff-driven slowdown, the XRP/USDT pair faces downward pressure due to:

Risk Aversion: Capital rotation from crypto to stable coins.

USD Strength: USDT demand surges as a proxy for dollar safety.

Altcoin Underperformance: Historical precedent of XRP lagging during macro stress.

People interested should monitor China’s policy response and U.S. tariff implementation timelines, as these factors will determine the severity of XRP/USDT’s downside. A breach below the April 7 low of 1.64 USDT could signal prolonged bearish momentum.

This analysis synthesizes macroeconomic triggers, market psychology, and cryptocurrency-specific dynamics to outline a plausible pathway for XRP/USDT depreciation amid escalating trade tensions.

Not An Investment Advise

Gold Trade Review – Potential Pop, Drop, then ATH's SetupWe are currently watching a potential pop and drop and potential ATH scenario developing in gold. Price is holding above a key daily level at $3,021.4 , which will serve as the critical pivot area. A sustained move below this level will likely trigger continuation toward the next significant daily level at $2,968.5 for T1, and potentially further into the weekly/daily support zone at $2,953.2 , with an extended target at the daily level of $2,929.0.

I would expect that zone to provide support, though there is an untested area lower near the recent lows at $2,893.6. Ideally, I do not want to see price move much beyond our first weekly/daily support zone mentioned above but would lean on the lower level as a last ditch effort to hold the structure.

From the current price structure, based on Fridays close there's also potential for a move higher into (#1) $3,058 , which is an untested daily level (approached from below). If this level acts as firm resistance, it could trigger the anticipated drop into the zones outlined above. Keeping an eye on being above or below $3,021.4 will be critical for progression in either direction.

DXY at Make-or-Break Level Ahead of Trade Deal UncertaintyGood day Traders,

Take a moment to go through my outlook of DXY.

Currently, DXY is moving within a clearly defined ascending channel, showing a short-term bullish correction after the sharp drop seen last week. Price is respecting the channel's boundaries, making higher highs and higher lows, characteristic of a pullback phase in a broader bearish move.

However, attention is now drawn to the resistance zone around 103.80 – 104.19 zone. This area coincides with:

1. Top of the channel (confluence resistance)

2. A harmonic pattern completion zone or reversal block

3. A previous structural support-turned-resistance area

In my view, the recent price action suggests a potential reversal at or just above this zone, leading to a new bearish leg that could see DXY breaking below the current trend channel and targeting sub-102.56 and 102.00 levels.

From the fundamentals, it appears that optimism around a trade deal is helping the USD recover short-term. The market may be pricing in hope, not reality. If sentiment shifts, or deal details (between US and China) disappoint, a swift reversal is highly likely—aligning with the anticipated turn near 104.00 from the technicals.

I think this makes the current zone a high-alert area for dollar bulls and bears alike. A fake-out to the upside into this supply zone could trap late buyers before the larger macro and technical forces push the dollar back down. By implication, we then expect to see a slight drop then rally on EURUSD, GBPUSD etc.

Cheers and Happy trading!

XAU/USD BUY IDEA (R:R=5)Buying XAU/USD now. I placed a buy earlier at $3,015. Just got a stronger confirmation due to it breaking above PIVOTAL area. It also just took out the A on the down Fibonacci sequence on the 15 minute TF. With all the fear that's present in the market right now due to President Trump's tariffs. GOLD will continue to climb even higher.

Tariffs on China set to rise to at least 104% on Wednesday, White House says

Stop Loss is: $2,900

Please move to break even once price reaches $3,175

1st Target: $3,400

2nd Target: $3,800

Happy trading! :)

Markets in Flux: EUR/USD Chart Hints at BreakoutGood morning Traders,

Trust you are well.

Below is my analysis of the current price action on EURUSD amidst the trade war.

Overview

EUR/USD is trading within a descending channel, showing signs of a potential bullish breakout. Price recently rejected the 1.08115 support zone with a strong wick, suggesting buyer interest. Globally, trade tensions are escalating—President Trump reintroduced 34% tariffs on China, with China responding in kind. The EU is also planning a 25% tariff on U.S. goods, sparking further risk-off sentiment. US hinting at further extending tariff on China to 50%.

Idea

This analysis suggests a buy-the-dip opportunity near 1.08115, with a likely breakout toward 1.10127 and beyond. Safe havens like CHF and JPY are gaining, reflecting rising risk aversion. Despite the short-term USD strength, prolonged trade wars could eventually weigh on the dollar.

Conclusion

EUR/USD is gearing up for a move. I will watch for a dip to support before a bullish push around 1.08115 and 1.07689. With trade wars heating up and risk sentiment dipping, commodities and currencies are about to get spicy.

Do trade with caution.

Cheers and Happy trading!

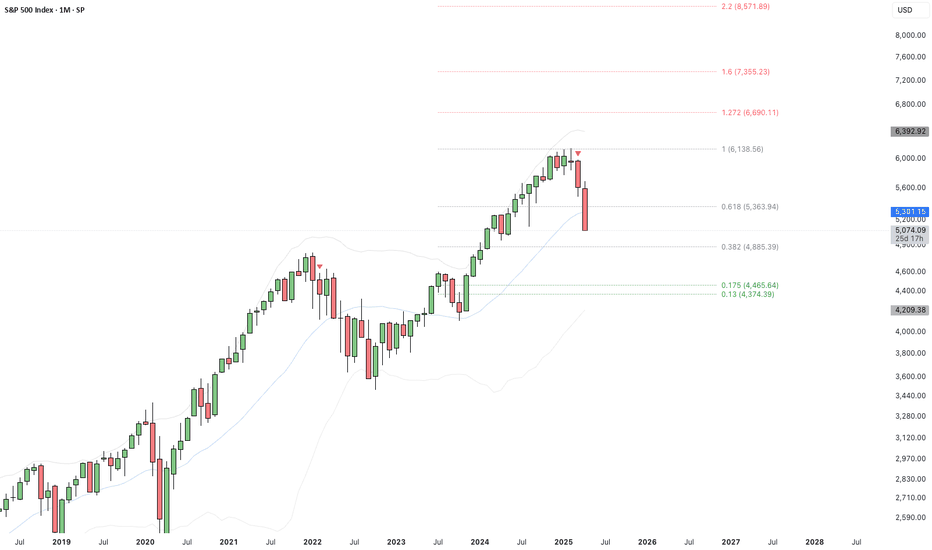

Bittensor at Make-or-Break Trendline — Bearish Targets Ahead?Bittensor is currently testing a key weekly trendline that’s held since mid-2023. A close below this level could confirm a break in market structure, opening the door to deeper downside targets.

⚠️ Key Levels to Watch:

- Holding the current trendline may lead to a short-term bounce.

- A breakdown targets the $168 – $136 zone, aligned with previous demand and Fib confluence (0.175 & 0.13 levels).

How to survive The Tarrif Tsar's Idiocratic EconomyI'm not gonna go terribly in-depth into this. These are the tickers I am personally using to hedge my risk against the complete and total incompetency of this regime. They are not without risk, in fact, not only are they inverse but the high dividend makes them among the riskiest assets to hold over any significant duration.

Please honestly read the prospectus on these before considering any of them and talk to an advisor. That's genuinely not ass covering, but out of genuine concern.

The biggest risk of holding these in my personal opinion is that decay is very significant and the risk of US treasures default is not accounted for by any of the issuers. The liquidity on these is also fairly low which is a significant issue.

That said, the advantage of them is the incredible (mispricing of) low margin costs and high leverage when IV of the underlying options, spikes. Also if you can manage to hold on to and profit from the capture the dividend, it's entirely possible to reach double digit % returns within a week or month timeframe, dependent on the asset and how you manage your average cost basis with volatility based position sizing or other methods of risk management.

That's all I'm really willing to disclose and discuss at this moment.

I have to manage the fallout from this just like everyone else.

There's no free lunch.

Eat Well Bears.

EUR USD Weekly Timeframe Outlook EUR USD Trade Setup weekly timeframe

On the weekly timeframe EUR USD has tapped on a strong supply level.

this level has also acted as a strong resistance level in the past.

So we will be looking for selling opportunities from the lower timeframe.

Patterns to watch out for.

1. Double Top

2. Head and shoulders pattern

3. Bearish break and retest + it must align with the 0.50 - 0.618 Fib Retracement level for stronger confirmation.

4. Lower timeframe supply levels.

Check next post to see the pattern i found.

Stocks jittery as markets await tariffs Volatility was again the name of the game in equity markets as investors braced for President Donald Trump’s impending tariff announcement, which promises to reshape global trade dynamics. With uncertainty swirling around the scope and impact of his so-called reciprocal tariffs, there remains little consensus on how markets will react as the final deliberations unfold.

A few headlines that have come out:

Trump administration official has confirmed that Amazon has put in a bid to buy TikTok

Tesla Inc. jumped 5% on hopes Elon Musk will refocus on the carmaker as a news report suggested his time as a top adviser to Trump may end soon.

US tariffs will be in bands of 10%, 15% and 20% -- Sky News

The bands will differ by both country and industry depending on how the White House views barriers to trade.

CNBC: TRUMP ADMINISTRATION CONSIDERING REVOCATION OF TARIFF EXEMPTIONS FOR CHEAP SHIPMENTS FROM CHINA - SOURCE

Trump auto tariffs due to take effect at midnight - Reuters

The key resistance area to watch today is between 5670 to 5695 - as shaded in yellow on the chart. This zone was previously support and has now turned into a bit of resistance, capping today's gains. Will the selling pressure resume from here or do we go back above it?

It all depends on severity of tariffs.

In the event we go lower, then the area between 5500 to 5550 is the key support zone to watch.

In the event the market go higher, and break through 5670 to 5695 zone, then the 200-day average and prior resistance near 5770-5787 will come into focus next.

By Fawad Razaqzada, market analyst with FOREX.com

From $110K to $66K? The Political Game Behind BitcoinBitcoin's surge from $73,000 to $110,000 was purely driven by political factors and Trump's statements. However, after Trump took office, the market was waiting for a stimulus to continue its bullish rally. With Trump's silence and the start of a trade war, sellers took control, leading to a 30% correction from the all-time high.

🚨 Key question: What happens next? 🚨

📉 If Bitcoin doesn’t receive further political support from Trump, we could see a drop below $73,000, possibly even $66,000!

Is this a buying opportunity or a warning sign? Let me know your thoughts! 👇💬🚀