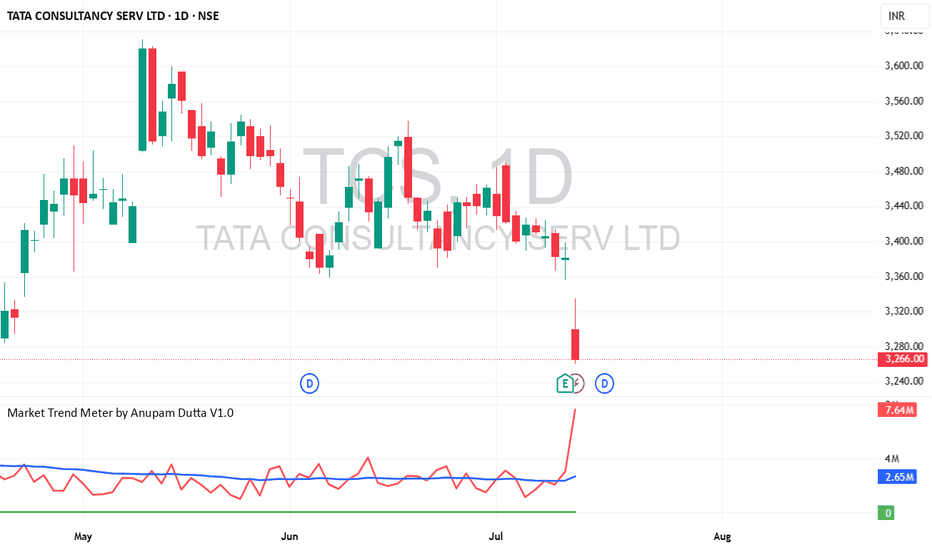

TCS Long Opportunity - Medium-Term Swing Trade📈 TCS Long Opportunity – Medium-Term Swing Trade

🔹 Entry : ₹3266 (Last Close)

🔹 Target : ₹3525

🔹 Qty : Up to 25 shares

🔹 Timeframe : ~6 months

🔹 Estimated ROI : ~16.49% annualized

A moderate-risk swing setup on Tata Consultancy Services . Technically and fundamentally aligned for gradual upside, assuming market conditions stay favorable. Entry near current levels with a well-defined target.

⚠️ Trade only if you're comfortable with the risk of capital loss. Position sizing is key.

Tcslong

TCS Analysis - Multi-Year Deal with Air France-KLMTrend: TCS is in a strong uptrend within an ascending channel since 2021, signaling steady growth potential.

Technical Signals:

EMA Support : Price bounced above key EMAs (20/50/100/200), showing strong support.

Volume Surge : High buying volume after the Air France-KLM deal indicates increased investor confidence.

RSI : Above 50, supporting bullish momentum.

Levels to Watch:

Support : ₹3,995.45 – Reliable base.

Immediate Resistance : ₹4,411.25

Final Target : ₹4,587.95 – Top of the channel.

Trade Setup:

Entry: On pullbacks or above ₹4,217.30.

Stop Loss : Below ₹3,995.45.

Target : ₹4,411.25 - ₹4,587.95.

TCS POSITIONAL LONG TRADE

Here is the valid Source and its Destination which has violated its opposite Supply;

This is the Demand & Supply Equilibrium Curve according to the Fresh Demand and Supply available.

We have further sub-divided the Curve into 5 areas; considering we as traders are supposed to buy low and sell high where is high and how low can it get; these areas give us an understanding about the Price position as per the Curve.

Price has come into the Demand making Lower Lows and then after reacting to the Weekly Demand Price has violated a previous High; which shows a possibility of Buyers upping their game vs the available sellers.

Finally we have a Demand formed in 45 mins which is the first Demand formed after Price has reacted to the Weekly Demand and we have a Buying momentum confirmation hence this is a Buy Trade favourable reward to risk ratio

TCS--@Breakout or Breakdown ??I am sharing the important levels of Support and Resistance. These levels plays a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

Take a look at these levels and trade accordingly. Recognizing and respecting these support and resistance levels can help traders make informed decisions and manage risk effectively. They serve as key reference points for technical analysis and are vital tools in successful trading strategies.

Trade safe...Thank you guys for your support

TCS Daily timeframe analysis for long term

NSE:TCS is strong bullish after it has taken splendid bounce from golden zone and has reached first target since buying level 3534.

Next Buy Level is 3679 - 3534. We can see long term move above 3680 if it give pullback buy more near 3679 to 3534 range.

Major targets levels are highlighted in blue lines.

TCS--3200 Or 3500I am sharing the important levels of Support and Resistance. These levels play a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

They serve as key reference points for technical analysis

Look for buy side from 3200 to 3500.

TCS trending upwardsTata Consultancy Services Ltd. is a leading global IT services, consulting and business solutions organization offering transformational as well as outsourcing services to global enterprises. The company has a global presence in multiple industry verticals and services consisting of consulting, integration, application services, digital transformation services, cloud services, engineering services and many more.

Tata Consultancy Services Ltd CMP is 3494.55. The Negative aspects of the company is high valuation (P.E. = 28.6). The Positive aspects of the company are no debt, FIIs are increasing stake, MFs are increasing stake, improving annual net profit, improving cash from operations annual.

Entry can be taken after closing above 3501. Targets in the stock will be 3582, 3682 and 3765. Long term target in the stock will be 3853+. Stop loss in the stock should be maintained at Closing below 3000.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

TCS --Near its Demand Zones??I am sharing the important levels of Support and Resistance. These levels play a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

If price breaks the resistance, we have a chance of filling the bearish gap, soo keep in buyside until it touches the zone of resistance and bearish gap.

Take a look at these levels and trade accordingly. Recognizing and respecting these support and resistance levels can help traders make informed decisions and manage risk effectively. They serve as key reference points for technical analysis and are vital tools in successful trading strategies.

Trade safe...Thank you guys for your support

TCS--@Resistance Zone?? This stock has encountered persistent resistance within the 3460 range on multiple occasions. On the flip side, the price has consistently found support along a trendline, leading to upward movements.

It's advisable to maintain a bullish perspective as long as the price remains above this trendline. However, exercise caution, as there's a possibility of a false breakdown below the trendline, which could mislead traders and necessitate a prudent approach before considering short positions.

TCS--Will break 3400 ??observations::

facing resistance multiple times from this zone...3400 range...

if this range is broken will see a strong momentum towards upside is possible...

we have a trendline support as well...now price is at important level...

if price takes the help of trendline will be on buyside...keep track this levels...

3200 and 3400.

TCS Low Risk High Reward IdeaAs per my analysis NSE:TCS is now ready to move upside for big levels. My buy level is 3189-3195 with stop loss of 3155 (-44 Points Risk). My expected upside target would be 3234 (+45), 3275 (+85) & 3435 (+246). This could be very low risk and high reward opportunity.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.

TCS--3400 or 3200??Observations::

Before going to rise again, price wants to test the demand at 3200 range.

Previously strong fall is observed from this zone @3400 range,

now its showing again bearishness...if this continue to fall happens up to 3225-3200 range..

look for buy in this zone...

we have a strong demand zone previously in this level, may again push the price above 3400 range.

#AMD3 Leveraged 3x Long with American Micro Devices StocksAll the World chipmakers are on the rush this night, due to Nvidia Q1'23 Earnings Report.

LSE:AMD3 is the Leverage Shares 3x AMD ETP Securities that seeks to track the iSTOXX Leveraged 3x AMD Index, which is designed to provide 3x the daily return of Advanced Micro Devices, Inc. stock, adjusted to reflect the fees and costs of maintaining a leveraged position in the stock.

It invests directly in the underlying Advanced Micro Devices, Inc. stock and uses margin (borrowing) to purchase additional shares of Advanced Micro Devices, Inc. stock.

For example, if Advanced Micro Devices, Inc. rises by 1% over a day, then the ETP will rise by 3%, excluding fees. However, if Advanced Micro Devices, Inc. falls by 1% over a day, then the ETP will fall by 3%, excluding fees.

Key Features

• Opportunity to magnify returns in one simple trade.

• Liquid. Trades like an equity on exchange, with multiple market makers (MMs).

• You cannot lose more than the amount invested, and an intraday rebalance mechanism is designed to cushion the largest intra-day falls.

• Simple to trade, no need for futures, no need to use margin accounts.

• Transparent structure with full ownership of the underlying assets, so credit risk effectively negated.

• Is independent and managed by industry experts.

Key Risks

• Investing in Short and Leveraged ETPs is only suitable for sophisticated traders who understand leverage, daily rebalancing and compounded daily returns.

• Investors can lose the full value of their initial investment (but not more).

• Losses are magnified due to the nature of leveraged returns. Therefore, Short and Leveraged ETPs are only suitable for investors willing to take a high level of risk.

• Daily compounding may result in returns which an investor may not expect if the investor has not fully understood how a Leverage Shares ETP works.

• Due to daily rebalancing and compounding, ETP returns measured over periods longer than one day may differ from the returns of the underlying stock multiplied by the leverage factor.

• Only use these ETPs if you can monitor your positions daily or during the day.

• Not an investment advise, so please see and read carefully the ‘Risks Factors’ section of the Prospectus for a more detailed discussion of the potential risks associated with an investment in this product.

Key TA Highlights

• LSE:AMD3 trades higher its weekly SMA(52), since middle of the May, 2023

• Technical picture indicates the possibility to further 100 per cent upside price action.