TCW

Trican, a compelling opportunity.Trican Well Service has come along way since they were last trading at lowly levels in 2016. The company has sold some overseas divisions and paid off mostly all their debt, acquired their largest Canadian competitor in 2017, Canyon Tech. For the past few years they have been re-purchasing their own shares thru an annual NCIB. Even during the most bearish times, the company has persevered and is positioned best for any uptick in activity in Canada. Trican's equipment is the best in Canada, able to facilitate high intensity plays which not all fracing equipment is up to task. Very shareholder friendly, tried, tested and true management under CEO Dale Dusterhoft.

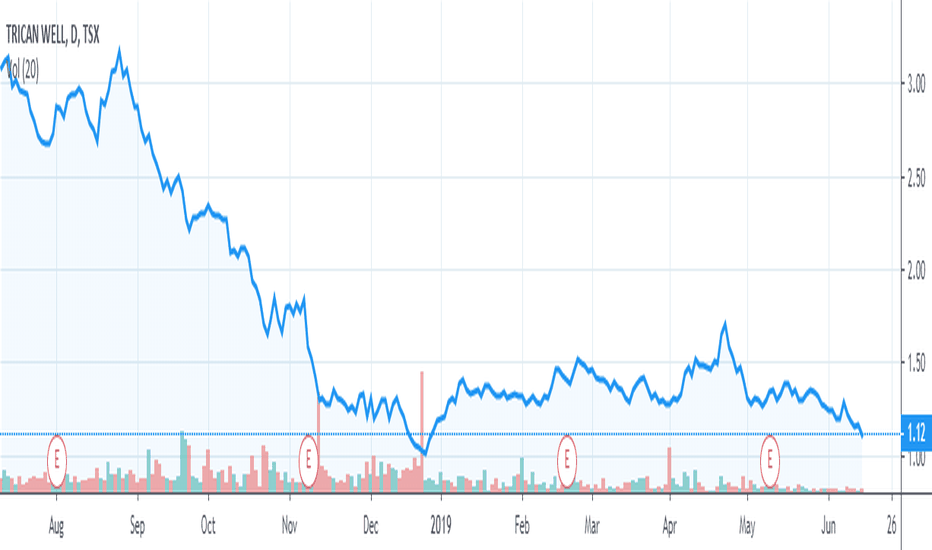

Overall this is perfect stop to buy and hold. It could very well be trading towards $5 in 12-24 months if things turnaround.

Purchasing this stock now is at a time of peak bearishness, in Canada and also in the global energy sector.