AUDNZD Sellers In Panic! BUY!

My dear friends,

AUDNZD looks like it will make a good move, and here are the details:

The market is trading on 1.0957 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1005

Recommended Stop Loss - 1.0933

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

———————————

WISH YOU ALL LUCK

Techincalanalysis

XAUUSD Gold Analysis: Bounce from Support or Breakout Below?😉

🔹 Support & Resistance Zones:

▫️ Support Area: 📉 Around 3,022.26 — buyers might step in here!

▫️ Target Zone: 🎯 Near 3,070 — potential resistance or profit-taking spot!

🔹 Entry & Stop Loss:

📍 Entry Idea: Near the support area for a bounce!

❌ Stop Loss: Below 3,022.26 — minimizing risk if price dips!

🔹 Price Action & Projection:

🔹 Plan: 📈 Buy from support, aiming for the target zone!

🔄 Retracement: Small dip before pushing up — cautious entry!

🔥 Quick Take:

✅ If price respects the support, it could pop to the target!

❗ If it breaks below, stop loss saves the day!

Apple (AAPL): -50%. According to the planElliott Wave Analysis of Apple stock

.

● NASDAQ:AAPL |🔎TF: 1W

Fig. 1

The long-term wave markup has not been adjusted for the past three years. Except that the orthodox tops and bottoms and targets for third waves are slightly refined.

.

● NASDAQ:AAPL |🔎TF: 1W

Fig. 2

Earlier, at the end of 2023 , we have already suggested wave ((iv)) in 3 in the form of a running flat. As we can see, the attempt was unsuccessful, the formation of a sideways correction continues to this day. It can be a running flat or an expanded flat, the latter of which assumes a break of the 124.17 low.

Gold (XAU/USD) Trade Setup – Bullish Momentum Ahead?Gold Spot (XAU/USD) 1H Chart Analysis

🔹 Entry Point: 3,026.90 🔵

🔹 Stop Loss: 3,019.58 - 3,019.07 ❌ (Risk Zone)

🔹 Take Profit Levels:

TP1: 3,034.64 🎯

TP2: 3,041.72 🚀

Final Target: 3,053.04 🏆

📈 Trend Analysis:

🔸 The market has been in a strong uptrend 📈 before pulling back to the entry zone.

🔸 The trade setup suggests a buy (long) position, aiming for higher levels.

🔸 If momentum continues, price may reach TP1 → TP2 → Final Target.

⚠️ Risk-Reward Ratio:

✅ Potential Reward: ~27 points 🏅

❌ Risk: ~7-8 points 🚨

💰 Risk-to-Reward Ratio: 1:3 (Favorable setup)

🔻 Risk Factor:

If price drops below 3,019.58, the trade will hit stop loss and may indicate a trend reversal 🔄.

📢 Conclusion:

Bullish trade setup looking promising if price holds above the entry point and moves towards TP targets! 🚀🔥

USDJPY Massive Short! SELL!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 150.60

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 149.93

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

EURUSD Massive Short! SELL!

My dear subscribers,

My technical analysis for EURUSD is below:

The price is coiling around a solid key level - 1.0918

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.0894

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

CHF/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

Previous week’s green candle means that for us the CHF/JPY pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 166.301.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

AUD/JPY pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 2H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 93.209 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

DXY (U.S. Dollar Index) Bearish Outlook – Key Levels & PredictioDXY (U.S. Dollar Index) Analysis – Daily Chart

🔹 Recent Downtrend:

The DXY has been in a strong decline ⬇️ after breaking key support around 104.5 📉.

The price dropped sharply, showing bearish momentum 🚨.

🔹 Key Zones Identified:

Resistance Zone (104.0 – 105.0) ❌📊 (Previously support, now acting as resistance)

Support Zone (100.5 – 101.0) ✅📉 (Potential target for further downside)

🔹 Expected Price Movement:

A possible short-term bounce 🔄 back toward the 104.0 - 104.5 resistance ⚠️.

If rejected ❌, the downtrend may continue toward the 100.5 – 101.0 level 🎯📉.

🔎 Conclusion:

✅ Bearish Bias – Trend favors further downside unless the price reclaims 105.0.

📌 Watch for a retracement before another drop 📉.

📊 Key Levels:

Resistance: 104.0 – 105.0 🚧

Support: 100.5 – 101.0 🛑

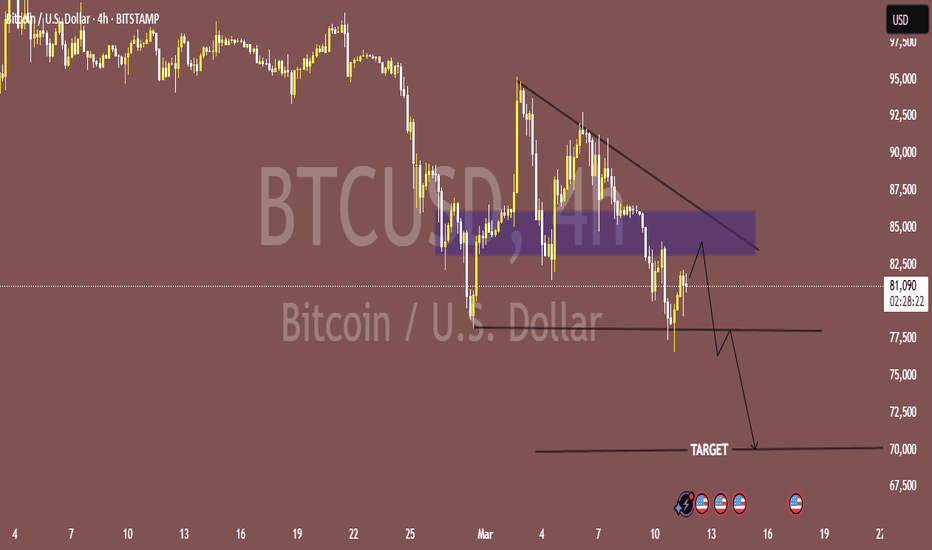

BTC/USD Breakdown? Bearish Target at $70K!🔥

📉 Bitcoin Downtrend Alert! 🚨

📊 BTC/USD (4H Chart) - BITSTAMP

🔻 Bearish Structure!

📉 Lower highs & lower lows – trend is down!

📏 Descending trendline keeping price under pressure.

📌 Resistance Zone (~ FWB:83K - $85K)

🛑 Price struggling to break past strong supply area (purple box).

📉 Support Levels:

🟡 $77,500 🏗️ – Weak support? Possible break!

🔴 Target: $70,000 🎯 – Major support level ahead!

🛠️ Possible Price Action:

1️⃣ Retest resistance 🚀?

2️⃣ Rejection & drop to $77,500 ❌

3️⃣ Break below = CRASH to $70K 💥

⚠️ Warning: Bulls need to reclaim trendline for reversal! Otherwise, bears in control! 🐻💪

📢 Conclusion:

Trend = BEARISH! Until a breakout happens, shorting may be the best play! 🎯

🔥 What do you think? Bullish or Bearish? 🤔👇 #BTC #Crypto

SILVER SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

SILVER uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 3,176.0 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the SILVER pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Gold (XAU/USD) Bullish Breakout – Targeting $2,960:

📊 Gold (XAU/USD) 4H Chart Analysis

🚀 Bullish Momentum: The price is currently at $2,912.80, showing signs of an upward breakout.

📈 EMA Support:

🔴 30 EMA (short-term) at $2,905.06 is acting as support.

🔵 200 EMA (long-term) at $2,862.78 suggests an overall uptrend.

🟣 Key Zones:

🛑 Resistance: Around $2,930 - $2,960 (Target Zone 🎯).

✅ Support: $2,900 (Previously tested and held).

⚡ Trade Setup:

📌 Possible pullback to the VG (Fair Value Gap) before pushing higher.

💡 If price holds above $2,905, it could rally to $2,950-$2,960.

🔥 Conclusion:

📢 Bulls are in control! Watch for confirmation above resistance before entering trades. 🚀💰

[INTRADAY] #BANKNIFTY PE & CE Levels(11/03/2025)Today will be slightly gap down opening expected in banknifty. After opening if it's sustain above 48050 and give reversal then possible some bullish rally in index. Upside 48450 level will act as a strong resistance for today's session. Any strong bullish side rally only expected above 48550 level. In case banknifty starts trading below 47950 level then there will be sharp downside rally possible in index upto 47550 level.

CAD/CHF BEST PLACE TO BUY FROM|LONG

Hello, Friends!

The BB lower band is nearby so CAD-CHF is in the oversold territory. Thus, despite the downtrend on the 1W timeframe I think that we will see a bullish reaction from the support line below and a move up towards the target at around 0.626.

✅LIKE AND COMMENT MY IDEAS✅

MANA Accumulating – Ready for a Pump?$MANA/USDT weekly chart shows the price moving within a sideways accumulation zone, respecting a rising support line after a prolonged downtrend.

It is currently testing the 50 EMA, which acts as a key resistance level. A breakout above this could signal further upside, while failure to hold could lead to a retest of the support zone.

The Stoch RSI is in the oversold region, suggesting potential bullish momentum. If MANA breaks above 0.35 USDT, it could push towards 0.70 USDT+, while a drop below 0.20 USDT might extend the bearish trend.

DYOR, NFA

Do Likes and follow us

Gold Buy Setup – Smart Money Flow & Institutional Order PositionGold (XAU/USD) is showing bullish potential, aligning technical, fundamental, and liquidity factors for a high-probability setup. Let’s break down the market structure, trade execution, and institutional flows that support this move.

📊 Trade Execution & Technical Breakdown

🔹 Entry Zone: Price retraced into a key demand zone aligning with the 0.62 Fibonacci level (2902.190).

🔹 Confluences: ✅ Trendline support held, confirming bullish momentum.

✅ Fibonacci retracement (50%-79%) aligned with institutional order blocks.

✅ Liquidity sweeps confirmed smart money accumulation.

🔹 Target Zones:

📈 First target: 2,926.183 (previous high).

📈 Final target: 2,950.176 (-0.62 Fibonacci extension).

📌 Market Structure:

The 1H timeframe suggests a bullish continuation pattern.

Daily EMAs are trending upwards, reinforcing buying pressure.

Supertrend indicator on the 4H supports bullish sentiment.

🎯 Institutional Positioning & Market Depth

📌 Commitment of Traders (COT) Report Insights:

📈 Institutional traders increasing long positions, signaling confidence in an uptrend.

📉 Retail traders are majority short, fueling a potential short squeeze.

📌 Liquidity Data:

Volume profile shows high demand near 2902, confirming strong buy-side interest.

Market depth data from Prime Market Terminal indicates institutional buy orders stacking in this range.

⚡ Fundamental Drivers – Key News & Events

📊 Economic data influencing XAU/USD:

📈 ISM Manufacturing PMI (53.5) vs. forecast (52.8) – Initially strengthened USD.

📈 Durable Goods Orders +3.2% – Positive US data caused a pullback.

📉 Gold supported by weaker USD following liquidity rebalancing.

🛑 Impact on Trade:

✔️ Initial USD strength provided a discounted long entry on Gold.

✔️ Market reacted with bullish momentum as institutional flows aligned with demand zones.

📈 Volatility & Liquidity Insights

📌 Prime Market Terminal Liquidity Analysis:

ATR (Average True Range) increased, signaling upcoming volatility.

High-volume nodes align with the 2902 support area.

Institutional order flow confirms bullish positioning.

🔥 Conclusion – High-Probability Long Setup

✅ Smart money accumulation & institutional order flow confirm a bullish bias.

✅ Confluence of technical, fundamental, and liquidity factors supports upside movement.

✅ Potential targets: 2,926 → 2,936 → 2,950.

📌 Did you catch this move? Let me know your thoughts in the comments! 🚀💬

TON/USDTToncoin (TON) is the native cryptocurrency of The Open Network (TON), a decentralized layer-1 blockchain initially developed by Telegram's team. Designed to support scalable and secure decentralized applications, TON utilizes a proof-of-stake consensus mechanism. Toncoin serves various purposes within the network, including transaction fee payments, network security through staking, and governance participation.

Technical Analysis: Toncoin is exhibiting a bearish trend, with prices moving downward. Currently, the price is consolidating within a small wedge pattern. A breakdown from this wedge could signal further declines. Additionally, there's an untested Volume Weighted Average Price (VWAP) in the highlighted green area, which may serve as a potential support level.

NATGAS What Next? BUY!

My dear friends,

My technical analysis for NATGAS is below:

The market is trading on 3.819 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 4.073

Recommended Stop Loss - 3.667

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK