EURSEK 1W: triangle breakdown - bearish retest in playOn the weekly chart, EURSEK completed a symmetrical triangle pattern followed by a clean breakdown. The recent bullish move is now testing the 0.705–0.79 Fibo zone ($11.29–11.20), which aligns with the lower boundary of the former consolidation and 200 EMA resistance. So far, the price fails to break and hold above — suggesting a bearish continuation is likely.

Technical outlook:

Symmetrical triangle broke downward

Price is retesting Fibo zone 0.705–0.79

Strong resistance near 11.29

EMA200 adds overhead pressure

Next downside target: 1.618 Fibo at 10.38

From a macro perspective, the Swedish krona is holding better due to domestic rate expectations, while the euro may weaken further if the ECB pauses tightening. If the trend holds, EURSEK could break 11.00 and head toward 10.38 in the coming weeks.

When structure and fundamentals align - markets tend to follow.

Technialanalysis

XAUUSD Daily Update: Gold Enters "Strong Bearish MomentumXAUUSD Daily Update: Gold Enters "Strong Bearish Momentum" – Where Are the Opportunities?

Hello TradingView Community!

Hot news from the Gold (XAUUSD) market today! We've just closely analyzed the Daily Chart and spotted a crucial signal: Gold's downward momentum is extremely strong and clear! This indicates that the short-term trend may have shifted, or selling pressure is currently overwhelming other supporting factors.

🌍 Current Macroeconomic Context (A Multi-faceted View):

Previously, we discussed how a weaker USD might support Gold. Indeed, concerns about the Fed's independence (due to rumors of Powell's replacement) and expectations of Fed rate cuts have pushed the USD lower, typically a positive for Gold.

However, the market isn't driven by just one factor. The sustained ceasefire between Israel and Iran is reducing Gold's safe-haven demand. It appears that, at present, factors like decreased safe-haven demand and potentially strong technical breakdowns are prevailing, creating significant selling pressure on the daily timeframe. We also need to emphasize that the market remains very cautious about confirming a bottom for Gold, and we are still awaiting crucial US economic data (especially PCE on Friday) and FOMC speeches.

➡️ In summary: While a weaker USD theoretically supports Gold, the price action on the daily chart clearly shows bears are dominating. We must respect this signal and adjust our strategy accordingly.

📊 XAUUSD Technical Analysis (Focus on Daily Chart - Strong Bearish Momentum!):

Based on the strong bearish signal from the Daily timeframe and key price levels from the chart (image_e9d325.png):

Primary Trend on Daily: Clearly strong bearish momentum. Large, consecutive bearish candles breaking previous support zones indicate overwhelming selling pressure.

Resistance Zones (Potential SELL Opportunities - where price might retrace before falling further):

3313.737 - 3315: This is the nearest and most important resistance area. If the price retraces here, it could present an opportunity to sell.

3321.466 - 3330.483: A stronger resistance zone, if price retraces deeper.

3341.947: Extremely strong resistance, unlikely to be reached in this context unless there's a major trend-reversing news event.

Support Zones (BUY Opportunities - extremely cautious, only for Scalp or clear reversal signals):

3294.414: Immediate support, but could be easily broken if bearish momentum persists.

3276.122: The next support area if the price continues to fall.

3264.400: This is a very strong support and a potential downside target if bearish momentum holds. Consider BUYs here only if price hits this level and shows clear reversal patterns on smaller timeframes.

🎯 Updated XAUUSD Trading Plan (Prioritizing SELLs):

Given the strong bearish momentum on the Daily chart, we will prioritize active SELL entries and approach BUY scalps with extreme caution, only at very strong support levels or with clear reversal confirmations.

1. ACTIVE SELL TRADES (Priority):

SELL ZONE 1 (Selling at near resistance):

Entry: 3313 - 3315 (If price retraces to this area and shows bearish rejection candle patterns on H1/H4)

SL: 3320 (Just above the nearest resistance)

TP: 3310 - 3305 - 3300 - 3295 - 3290 - 3280 - 3276.122 (Next target according to the chart) - 3264.400 (Final target if strong bearish momentum continues)

SELL ZONE 2 (Selling at stronger resistance - if deeper retracement):

Entry: 3331 - 3333 (If price retraces deeper and shows reversal signals)

SL: 3337

TP: 3326 - 3320 - 3316 - 3310 - 3305 - 3300 - 3294.414

2. CAUTIOUS BUY TRADES (Only for Scalp/Clear Reversal Signals):

BUY ZONE (BUY SCALP AT STRONG SUPPORT):

Entry: 3266 - 3264 (Only buy if price hits this zone and shows clear reversal signals on M15/M30, such as reversal candle patterns, RSI divergence, etc.)

SL: 3260 (Very tight, acknowledging higher risk)

TP: 3270 - 3276.122 - 3280 - 3284 - 3290 (Aim for short TPs, no expectation of prolonged uptrend in strong bearish conditions)

INTERMEDIATE BUY SCALP:

Entry: 3284 - 3282 (If price has broken down through here and retraces, wait for confirmation)

SL: 3278

TP: 3288 - 3292 - 3296 - 3300 (Short-term targets only)

⚠️ Crucial Factors to Monitor Closely Today:

Price Action at Resistance/Support Levels: How price reacts at these key marks will dictate the next move.

US Macro Data (especially PCE on Friday): Any surprising news can rapidly reverse the current trend.

FOMC Speeches: Can induce significant volatility in USD and Gold.

Geopolitical Situation: Although currently optimistic, any unexpected developments could reignite safe-haven demand.

Nightly $SPY / $SPX Scenarios for May 15, 2025 🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 15, 2025 🔮

🌍 Market-Moving News 🌍

📊 Producer Price Index (PPI) Release Today

The Bureau of Labor Statistics will release the April PPI data at 8:30 AM ET. This report will provide insights into wholesale inflation trends, following the recent Consumer Price Index data that showed inflation easing to a four-year low.

🛍️ Walmart ( NYSE:WMT ) Earnings Report

Walmart is set to release its earnings today, offering a glimpse into consumer spending patterns amid ongoing economic uncertainties. Investors will be watching closely for any indications of how inflation and trade policies are impacting retail performance.

👟 Foot Locker Acquired by JD Sports ( NASDAQ:JD )

JD Sports has officially acquired Foot Locker ( NYSE:FL ) for $1.6 billion ($24 per share). The deal aims to consolidate market share in the sportswear and athletic retail sector, with JD expanding its U.S. footprint. Foot Locker shares surged 67% premarket following the news.

💻 Nvidia ( NASDAQ:NVDA ) Faces AI Export Rule Implementation

The U.S. government's AI Diffusion Rule comes into effect today, potentially restricting Nvidia's chip sales to certain foreign markets. This regulatory change could influence Nvidia's stock performance and has broader implications for the tech sector.

📊 Key Data Releases 📊

📅 Thursday, May 15:

8:30 AM ET: Producer Price Index (PPI) for April

10:00 AM ET: Manufacturing and Trade Inventories and Sales for March

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

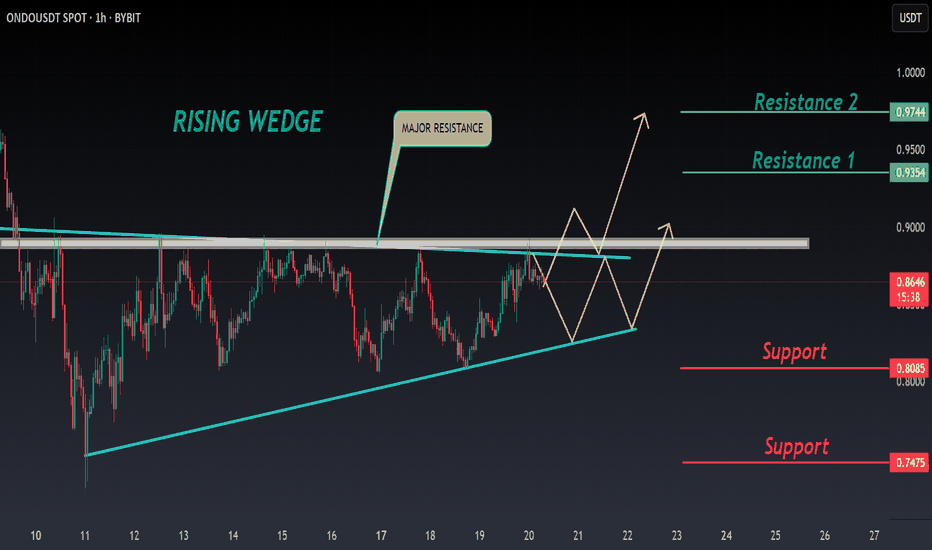

ONDO ANALYSIS 🔮 #ONDO Analysis 💰💰

🌟🚀In 1hr chart we can see a formation "Rising Wedge Pattern in #ONDO. There is a strong resistance zone near at $0.8840 and we could see a rejection from that level but if the price breaks the resistance zone then we would see a bullish move 💲💲

🔖 Current Price: $0.8640

⏳ Target Price: $0.9350

⁉️ What to do?

- We have marked some crucial levels in the chart. We can trade according to the chart and make some profits in #ONDO. 🚀💸

#ONDO #Cryptocurrency #DYOR #PotentialBreakout

GOLD 4H TECHNICAL ANALYSIS GOLD ATH / READ CAPTION CAREFULLY Dear Traders,

Please find our updated analysis of the 4H Chart (5th February):

Key Observations:

Orange Circles: Highlight previously achieved targets, showcasing the precision and effectiveness of our analysis.

Previous Chart Review:

TP1 (2788): Successfully hit.

TP2 (2815): Successfully hit.

TP3 (2841): Successfully hit.

Market Overview:

* TP1 (2850) Successfully Achieved

* GOLD is trading at an ATH of 2851, oscillating between the weighted level with a gap above 2850 and a gap below the 2823 Entry Level.

* EMA5 and FVG are offering strong support in this range.

* Price action will test these levels side-by-side until a decisive break and lock above/below the weighted levels confirm the next directional move.

Resistance Levels:

2850, 2876, 2903

Key Support: 2776

Support Levels (GOLDTURN Levels):

2828 (Critical Weighted Level)

2803 (Critical Weighted Level)

2776 (Major Support Level)

2747 (Lower Major Demand Zone)

EMA5 (Red Line):

* Currently below TP1 (2850), indicating sustained bullish momentum.

* EMA5’s behavior will be pivotal in determining the next price action trajectory.

Recommendations

* Focus on EMA5 Behavior:

Bearish Case:

* If EMA5 holds below TP1 (2850) and resistance levels remain intact, bearish momentum may drive prices to retest GOLDTURN weighted levels.

* Scenario 1: If EMA5 crosses and locks below Entry 2823, expect further bearish movement toward GOLDTURN 2803.

* Scenario 2: If EMA5 crosses and locks below GOLDTURN 2803, anticipate another decline toward the major support at GOLDTURN 2776.

Bullish Case:

Scenario 1: If EMA5 crosses and locks above TP1 (2850), the next bullish target is 2876.

Scenario 2: If EMA5 crosses and locks above TP2 (2876), the subsequent bullish target will be 2903.

Scenario 3: A crossover and lock above TP3 (2903) will set the stage for the next target at 2925.

Short-Term:

Utilize 1H and 4H timeframes to capture pullbacks at GOLDTURN levels.

Target 30–40 pips per trade, focusing on shorter positions in this range-bound market.

Each Level allows 30 -40 pips bounce, buy at dip level for proper risk management

Long-Term Outlook:

* Maintain a bullish bias, viewing pullbacks as buying opportunities.

* Buying dips from key levels ensures better risk management, avoiding the pitfalls of chasing tops.

Final Thoughts:

Trade with confidence and discipline. Our detailed and accurate analysis equips you to navigate market movements effectively. Stay tuned for daily updates and multi-timeframe insights to stay ahead in the game.

Please support us by likes, comments, boosts and following our channel

Best regards,

📉💰 The Quantum Trading Mastery

TradeCityPro | EURGBP : Testing Weekly Range Support👋 Welcome to TradeCity Pro!

In this analysis, I’ll review the EURGBP forex pair, focusing on the daily timeframe.

📅 Daily Timeframe: Downtrend Near Weekly Support

The pair has been in a downward trend accompanied by deep retracements. Currently, it is moving along a descending trendline and has reached the 0.82711 support level.

🔍 The 0.82711 level represents the bottom of a weekly range that has been in place since 2020. At present, the price is oscillating near this crucial support.

✨ If the 40.17 level in RSI is broken, bearish momentum will increase, raising the probability of breaking the 0.82711 support. In such a case, the next support would be at 0.80934.

📈 If the price holds at this zone, the first long trigger is at 0.83901. However, this is considered a risky trigger. Personally, I prefer waiting for a higher low above this level to confirm a trend reversal.

🔼 The next long trigger is a breakout above 0.85129, which is a more reliable signal. The subsequent resistances are at 0.86142 and 0.87442.

🔑In my opinion, the price is likely to move upward from here as it has reached the bottom of a 4-year range, and market momentum is declining. For now, I anticipate the price will find support at this level and may attempt to break the range in the future.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

XAUUSD H1 Analysis - BullishPair Name = Gold

Timeframe =H1

Analysis = technical + fundamentals

Trend = Bullish

Support Levels = 2514, 2508, 2500

Resistance Level =2523, 2529, 2445

Explanation : -

Gold Moving As predicted Yesterday. Still getting Good Volume and On the way To Our main Target 2550. But always Secret of the market is buy the dips and sell tops. So if you are sure market is bullish or bearish, the main and important thing in the life the trader is perfect entry with proper Risk Management. One more thing I wanna discuss before the details explanation about the GOLD today Move. Maximum traders fails because they don't use Risk Management formula in trading.

Here I wanna Explain the Gold Next Move. Gold Dips has hit The Price levels 2514, 2508, 2500 .All These were the key points for the bearish move as predicted yesterday. In bullish Move Key Levels are 2523, 2529, 2445

In bullish Move Gold Will Target These Points.

Gold can make small movement up, after which rebound downHello traders, I want share with you my opinion about Gold. By observing the chart, we can see that the price some time ago declined to support line of the pennant, thereby breaking the support level, which coincided with the buyer zone, but soon XAU rebounded from it and made impulse up to 2050 points, breaking 2005 level one more time. Next, the price made a little correction, after which continued to move up to the resistance line of the pennant, breaking the resistance level, which coincided with the seller zone. After this movement, Gold rebounded from this line and in a short time declined below the 2055 level, thereby breaking it again. After this, the price fell to 2015 points, where it turned around and made impulse up to the seller zone. Price made a fake breakout of the resistance level, after which it declined to the support level. Also recently, Gold bounced from this level and started to rise. So, just a moment, I think the price can make a movement up, after which the price starts to decline to support line of the pennant. For this case, I set my target at the 2010 points, which coincides with this line. Please share this idea with your friends and click Boost 🚀

LOCKHEED MARTIN CORP - LONG THEN BIG SHORTIn examining the technical analysis (TA) of Lockheed Martin Corp's stock chart, we observe discernible indications of a potential trend reversal. Notably, multiple Bearish daily Fair Value Gaps (FVGs) are present, accompanied by a Bearish Order Block (OB) situated just beneath the preceding major peak of $508.10, as delineated in the accompanying chart by blue boxes.

From a fundamental analysis perspective, information from reliable sources indicates imminent challenges within a specific segment of the company's operations. These challenges, poised to become public knowledge shortly, could substantially impact Lockheed Martin's growth trajectory if not adeptly managed.

The root of these challenges can be traced back to 'a program', which is on the brink of exposure due to impending government intervention. Should the company persist in a non-transparent approach to these issues, we anticipate a marked increase in bearish market sentiment favoring selling, potentially depressing the stock's value significantly below its support level at $393.77.

Conversely, if Lockheed Martin's management adeptly capitalizes on the significant commercial and public relations opportunities—particularly concerning the mass production of a groundbreaking, revolutionary product—we foresee a robust market sentiment driving the stock well beyond its all-time high of $508.10. One of the new opportunities could emerge from diversifying Lockheed Martin Corp's business model, potentially exploring manufacturing sectors beyond their traditional scope, or through strategic collaborations with a company (example: 'Tesla') known for their innovation and lateral thinking, thus broadening the range of their market engagement.

Currently, it is imperative for investors, including myself, to encourage Lockheed Martin to engage proactively with governmental entities and the broader community. Such engagement could pave the way for a brighter communal future, concurrently augmenting the intrinsic value of the company. Assuming the mass production of this innovative product materializes, it could potentially double the company's value in a relatively short timeframe. This projection might appear ambitious, but the potential is undeniable once fully comprehended.

However, failure to seize this opportunity could precipitate considerable selling pressure, potentially triggering a significant market correction over time, with the potential to reach a critical support level of $119.95.

USDJPYA Indecision pullback to resistanceUSDJPY is in an intraday uptrend again. The overall trend is bullish however I believe that this is a re-test of the former high and based on how price is approaching the resistance it doesn't signal much bullish strength anymore. Price is currently at a high of an untested zone, the all time high and a Daily evening star pattern.

Technical Analysis: EURUSD Buys into 1.08161I am expecting a strong reaction off the current price zone, we recently made a swing high and are now in a retracement and I expect price to retest those highs to continue higher. This trade is based on the 1H and 4H timeframe.

4H fib markup :

In order to take this trade I am waiting on a buy signal from the indicator or a buy signal and retest of the RSI stops indicator trail.

GBP struggles to maintain upward trend👑 GBP struggles to maintain upward trend 👑

👑 Last week, the British pound positively surprised all investors. Because the Bank of England announced the purchase of assets such as bonds

👑 Against the JPY, we could see a rebound of about 10%.

👑 This gave a clear signal confirming the continuation of the upward trend on the pair

👑 The high bounce we made may be cooled in the upcoming trading sessions

👑 But looking at the dynamics, I'm willing to risk saying that the upward trend on this pair is not over yet

👑 Do you like analytics? Watch the profile👑

💸 AUD/CAD Breakout time 💸💸 In today's analysis we look at an interesting opportunity on the aud/cad pair.

💸 Since the beginning of today's session, we can see the strength of the Austarlisian dollar against the Canadian dollar.

💸 Most of the technical analysis indicators signal the possibility of a breakout and divergence from the previous moment when we were at the same price level.

💸 I sense a breakout from the double bottom

💸Risk/Reward ratio: 4.52 (excellent)

💸 If you like the post? Follow the profile!

LOOM/BUSD PRICE ACTIONHi folks ,

There could be a entry opportunity for guys ,

1ST: If it come back to support area ( 0.063-0.065) and reject to break the support , then you can enter.

2nd : if it break the current resistance then you can enter when it come back to retest it .

TPs are in the figure

Please buy into parts and if you will get into some profit , you can close it or can move your stops to breakeven

Please like my idea and follow ,

In past 3 days I gave 2 signals

Vidt/usdt - 26% profit ( in hours )

Fida/Usdt - 30% profit ( 2 days )

CRV - Selling SignalBYBIT:CRVUSDT

4 Hours trend chart

-

CRV cannot be supported from the uptrend anymore, also forms a small double top here.

We can plan a strategy to short at the broken candle, which closed point is 0.992, and set target/stop as below.

-

Targets:

1) $0.962~$0.953

2) $0.932

3) $0.9

Stop:

1) $1.034

EUR/GBP - LongPrices are still hovering near the descending trend-line level at 0.8470/90.

A weekly close above here will accelerate the upward move that can drive prices higher toward 0.8620 and 0.8740 through 0.8530 and 0.8575.

We recommend building long positions at market with a stop loss level at 0.8327.

DOGE / USDTAs you can see in the chart in TIME FRAME 1H this is the pattern that we are in

since I do trading based on patterns and the break outs so just use my analysis for short term not for holding or long term

just take the advantage of market movement

Keep eye on the chart and wait for it to make it long or short the targets are in the chart

THIS IS NOT FINANCIAL ADVICE , IT'S JUST MY PERSONAL OPINION

DO NOT FORGET TO USE STOP LOSS

GOOD LUCK

The cup and handle pattern for ADA confirmed.After forming the cup and handle , the movement is expected to be ascending and equal to the amount of dip to ceiling of the cup. So after forming a small handle, we expect an increase of 28.7%. The existence of a 1,260 key point confirms our conjecture. After reaching the 1.260 target, we expect a correction to short-term bullish channel floor.

BTC Accurate Dump Fractal?Unfortunately it seems Bitcoin is following a similar pattern of price action as it did in 2018 during its near 50% correction during a long and drawn out bear market.

This consolidation before dropping below support has incredible similarities, and could come into fruition within the next few weeks if price action continues this way.

Especially considering the bearish BTC narrative, and how accurate retail and traditional analysts have been with their forecasts, I think this situation is more than likely to play out...

Just one thing to consider, if you hadn't already noticed this is in fact an inverted price chart. BTC doesn't look so bad right now, everyone being bearish isn't a bad sign, and a bear market isn't guaranteed.

This is not an indication to be bullish, it's just a thought that anything could happen!