XAU/USD: Potential Reaction at Supply Zone*On the 4H timeframe, XAU/USD has shown a clear CHoCH (Change of Character), with the previous Higher Low (HL) being broken, taking out Buy-Side Liquidity near the highs. Price is now trading within a supply zone, aligning with bearish order flow.

On the 30M timeframe (see chart):

• A CHoCH has been identified within the supply area, signaling a potential shift in direction.

• Price looking to clear the inducement (IDM) before tapping into the zone, strengthening the likelihood of a sell-off.

• I’m anticipating a reaction and continuation to the downside, targeting lower liquidity levels around $2,730.500.

Key Points:

• Bearish Bias from the 4H Supply Zone.

• Liquidity grab + CHoCH on the 30M confirms bearish intent.

• Targeting the lows near $2,730.500 for a high-probability trade setup.

Trade Idea:

Wait for confirmation within the 30M supply zone (e.g., a lower timeframe entry such as a CHoCH or breaker structure). Maintain discipline and proper risk management.

What do you think about this setup? Drop your thoughts below!

Bless Trading!

Technical-outlook

JOE / USDT Update 05/04/2024Honestly, no idea, even smallest...or it was a premature end of short order or it is going to "HIT" TP....

Personally me? I did "cash in" already...chasing the "crumbs" could lead to the loosing all pack of the bread...Simply I do not like pointless gambling... or... it is simply lack of the patience... not so sure...

G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS":

PS, general advice: ( 1 ) Remember: recommended re-enter area is between Stop Loss (ST) & Entry Point.

( 2 ) If price went half way between Entry Point & Take Profit (TP), be patient please & wait for price retracement to ( 1 )- EP-SL area or for the next new set up ;)

Congratulaions to all traders with profits again! ;)

Further downside on the cards for EUR/USD?On Wednesday, in addition to the usual market drivers, such as the uncertainty surrounding the US-China trade negotiations and the reduction of risk appetite, we had other interesting developments. As a result, the euro lagged.

For the first time since 2004 in a quiet move China sold euro-denominated bonds, that is highly significant and telling. The sale was only for 4 billion dollars of 7-, 12- and 20-year bonds but there was extremely high demand, around 20 billion euros worth. With that, the bonds priced about 20 basis points below China's initial target, according to a report.

Why this event is so important? For few reasons. The big one is that the euro is increasingly the preferred funding currency. It also signals the increasing cooperation between China and Europe. Finally, it signals China's efforts to diversify its FX and economic exposure away from the US.

With this demand and the near-certainty that eurozone rates will remain pinned to the floor, expect more countries and corporates to issue euro-denominated debt and promptly invest it elsewhere. That should keep the downside pressure on the euro, but could also give it further positive potential during risk-off phases.

In additional, take in mind that intraday strength in the US dollar index is a key factor behind weakness in the EUR/USD.

From technical analysis point of view, a clear break below 1.1062 support suggests completion of the corrective rebound from 1.0879. On the daily chart we have seen also clear break under the short-term support trendline. Now, intraday bias in EUR/USD is turned back to the downside for retesting 1.0879 bottom next.

But if the common currency manages to protect the abovementioned support, the technical picture would change. On the upside, a sustainable move above 1.1093 minor resistance will turn intraday bias neutral first. Further break of 1.1179 (October 21st high) will resume the rise to 1.1412 key resistance next.

Ultimately, I am a seller of this pair until we break out above the 200 day EMA on a daily close at the very least. Look for signs of exhaustion after short-term rallies, and then take advantage of any opportunities you get to pick up US dollars “on the cheap” going forward.

ETHUSD Ethereum Long and Short Term Outlook from HereETHUSD Long Term/Short Term Price Forecast

Per Adua ad Astra

Long Term

That low at 360 was as big and meaningful as Bitcoin's at

6000. Perfect Gann numbers too. Like, reeaally PERFECT.

Those lows are equivalent of the lows reached in the first

internet cycle when Nasdaq Composite fell from 5136 to 1118,

a decline of 78% in magnitude, playing out in 4 large waves

over 31 months.

For ETH the fall was from 1417 to 360, a decline of 74% - in 3

large waves over less than 3 months, so 10 times the speed of

the Nasdaq/Internet generation1 exactly.

Look what happened to Nasdaq Composite since: now at 7209

- up nearly 7 times over 16 years.

No real reason to figure that the Alt markets will perform any

differently in the longer term. Just 10 times quicker maybe!

And if that's the case it's effectively a buy dips market for the

next 1.6 years or 18 months or so - during which time ETH can

reach 360 x 7 = 2520. Stay long and keep tracking it as it rises.

Time will tell, as always.

Shorter Term

On and on towards the stars - a little local difficulty at 820 in

very near term but it should push higher with Bitcoin still

driving both Northwards but ETH still outperforming

beautifully.

This has already become the key larger market player in the

resurrection we see across the market in general. Could be

Google back in the day...

It should push on to 869 and 896 (900) and later to 978 where

it should spend time consolidating before breaking higher stiill

(add at this point) to 1400 and yes, one day to 2520 too.

Time will tell...never fails.

Here's to ETH. Let's hope it doesn't either.

Technical Analysis?I have a straight question to you, and would love to hear your answer in comment section.

What is technical analysis? Can you define it?

Most people think that I am technical trader, but I am not. I have nothing to do with technicals as I don't use them, so what is the definition?

I will write what I think about it, and it is only my subjective opinion.

You can write your's too.

There is no definition. Anyone can make up anything and call it technical analysis. The field now seem to encompass everything from drawing trend lines to astrology.

Technical analysis started out with quite simple concepts, which are not all that dumb. In the early days, it was about looking for directional trends in prices and divergences between related market indexes. Experience told traders that when prices start moving in one direction, they are more likely to continue than to reverse. Technical analysis was just a way to visualize this concept.

Divergences was mostly about comparing the Dow Jones Industrial with the Dow Jones Transport, the two most important indexes at the time, and draw conclusions from potential differences.

Adding things like simple oversold/overbought indicators is still in the realm of sanity. Again, experience had taught traders that extreme short term moves are often followed by a sudden pullback. Emotions run wild as the price takes off, propelling the price further until a short term correction sets in when the buyers are already in and there’s no one left to push the price higher. Common sense things where technical analysis was used as a tool to visualize abstract phenomena.

Then the problems set it. The visual nature of technical analysis lends itself to get-rich-quick stories. After all, there’s no need for all that hard work, right? Why waste time learning tough things and gaining real life experience when all you have to do is look at a chart and draw some lines? It was only a matter of time before this field was completely taken over by snake oil salesmen. To be fair, some of them are probably just delusional and not outright immoral.

There are no rules for what technical analysis is. So it became everything. In particular, everything that is easily sold. The more colorful naming and background story, the easier the sell.

At first we had the indicator explosion. An easy way to get famous in the field is to create an indicator. Especially if you manage to get that indicator included in standard technical analysis software packages. So everyone and his grandmother started making indicators in hopes of fame. It’s a comfortable illusion, that all you need is to find the right indicators and you’ll be rich in no time at all. Just get those parameters right.

Then we have the field of exotic names. Doji, three little soldiers, spinning dragons, crouching tigers, ichimoko, harami, spanking monkeys, and tons of more colorful names. Well, I might have made some of them up, but if others are allowed to make up random exotic names, why can’t I? Beware of anything that sounds ‘cool’. Most likely it has no other use than to sell products that won’t help you.

Do I say all Tech is crap? No, I wouldn’t go that far. There are actually plenty of professionals using concepts originating from technical analysis. Usually they don’t use the term though, for reasons made clear above. It has a very poor reputation. Trend following, the main strategy of the 300 billion dollar CTA industry, has its roots in technical analysis. A large part of quantitative, systematic trading is based on ideas from that came out of that field.

Peace.

TPP

AAOI hits LT resistance prior to earningsAfter hitting a 2015 long term high,aaoi appears to be entering a corrective wave: which is good if we hope price goes up afterwards. But if it consolidates or enters a second corrective phase, a downtrend could follow: and with a break below the fib fan resistance level, that could very well happen. Best, Matt

WTI US Oil Inverse H&S near termUSOil daily chart showing an inverse H&S pattern. Price is closed at neckline of $42. Breakout above $42 with meaningful conviction may bring the price to next major resistance of $45 to $46. Momentum indicators like CCI and RSI still have room to support potential upswing in prices. OBV yet to show improvement. Failure to break neckline signals continuation from the bearish downward trend to $38.

Zoom in 4hour chart to see clearly inverse H&S pattern.

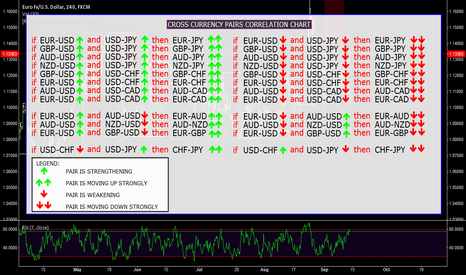

CROSS CURRENCY PAIRS CORRELATION - ADVANCED ANALYSIS Hi all, I wanted to share this chart with you - I am hoping it works when I publish it and the arrows stay inline with the text - something very interesting we all know about currencies moving in tandem with each other to some degree different economic events causing them to stop moving together but eventually they will again.

As a forex trader, if you check several different currency pairs to find the trade setups, you should be aware of the currency pairs correlation, because of two main reasons:

1- You avoid taking the same position with several correlated currency pairs at the same time and so you do not increase your risk. Additionally, you avoid taking opposite positions with the currency pairs that move against each other, at the same time.

2- If you know the currency pairs correlations, it may help you predict the direction and movement of a currency pair, through the signals that you see on the other correlated currency pairs.

If you would like more information describing the affects - reply with a short note and I will paste a URL