QQQ supported by 20smaWe have seen the test of the 20sma, being bought back with strong volume.

Volume has been decreasing daily for the past 10 days. Today's sell-off is on the lowest volume yet (we are a couple hours away from the close though).

Risk-reward-ratio makes sense placing a stop-loss below $252.

Technology

TSLA Short! Target: $1000 - $1200 NASDAQ:TSLA

It seems pretty clear based on valuation standards that many tech companies are significantly overbought. Over the past two weeks there has been significant capital outflow from the technology sector while there has simultaneously been large capital inflow into commodity markets, especially oil and natural gas.

Head and shoulders pattern forming on the 2hr and 4hr charts. Looks like a great short set up to return to the longer-term price trend.

I'm not a TSLA hater, I like Elon Musk, but I think this is a great short set up. Just an idea, do your own research!

IBM Mega TriangleIBM has been making this triangle chart pattern since 1997 and will forced to a decision point one way or the other by 2026. For some investment strategies, you have to perceive time like a tree. :)

IBM's earnings and sales have been shrinking for many years-- EPS at a rate around 2.5% per year, and SPS at a rate around 0.25% per year. That makes this essentially a depreciating asset in terms of earnings and sales. The dividend over 5% offsets that somewhat, but IBM would need a growth strategy to break out to the upside. Despite technology leadership, the company has struggled to turn its technology into growth.

IBM is still worth trading within the triangle, however. It's certainly worth a buy in the event it should drop to the bottom of the triangle range. I kind of like the idea of owning a piece of IBM's AI, because I think this technology eventually will drive a turnaround story for IBM and a return to earnings and sales growth. Among other things, IBM is partnering with Verizon to use its AI in Verizon's 5g.

IBM will be a sell at triangle top until and unless the slopes of the earnings and sales trendlines begin to turn positive long-term.

Swing Trade Idea: Long over 130 low resistance & tons of supporteasy play based on solid consistent rev growth on a hot sector

Maxlinear $MXL$MXL is a candidate for a new uptrend. there are good news coming for this company. watch for a breakout of $28.70

12 months Consensus Price Target: $26.5

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

XILINX $XLNX "worth to watch stock"The positive upbeat news coming for chip makers and $XLNX is one of the one worth to watch for a new uptrend. $113.36 is a buy point but if you want to take a risk you may get it above $103.74

12 months Consensus Price Target: $99.24

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

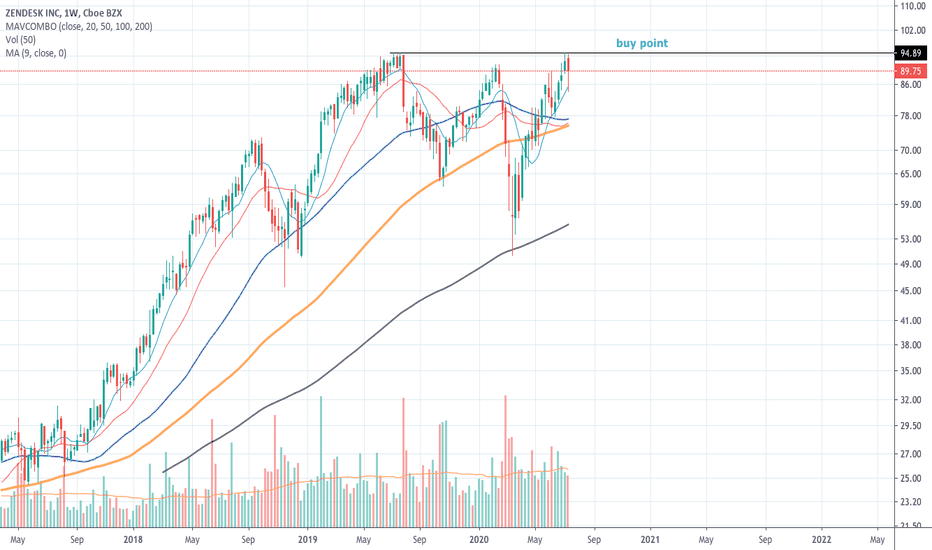

Zendesk $ZEN$ZEN is hitting the pivot to breakout. needs to hold above to get in. watch out for a breakout.

12 months Consensus Price Target: $94.10

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

How to Trade the Tech Cold War? BIG SHORT?

FA:

Global supply chain issues have made the logistics of semi-conductors even more complicated; thus we can expect rising costs and lower profits

The Tech cold war between USA and China if led to Chinese retaliation may lead to US semi-conductor companies being hit hard the most as China contributes to 60% of the market demand of semiconductors

Skyworks Solutions is predicted to release a decline in earnings for the period ending in June 2020

Decrease in Hedge fund interest when you analyze portfolios

TA:

Perfect Gann Set up, with the second pull up providing a perfect shorting area with the Stop loss being defined outside of the Gann area

You can book profits earlier, but when trading with Gann , you usually book profits at the point where there is a bullish crossover which is when it crosses above the 1/1 region.

-Megalodon Whales (Rahim)

Enjoyed doing this chart for you, PLEASE Share/Like and Comment

Taiwan Semiconductor guidance crushed Street estimatesI saw a couple articles this morning suggesting that maybe TSM sold off today because forward guidance disappointed Street expectations. That's nonsense. Revenue guidance came in about 7% above expectations, and earnings guidance came in about 15% above Street expectations. This company's guidance crushed it . The stock sold off for one reason only: it is overbought.

TSM does look a bit pricey, even with the strong guidance for Q3. Even after factoring in the strong forward guidance, I am calculating forward P/E at about 21 and forward P/S at a little below 8. That's about 20% more expensive in forward P/E terms and 34% more expensive in forward P/S terms than the stock's average valuation over the last three years. In this challenging macroeconomic environment, that seems like an unreasonable valuation. It's a reflection of how inflated tech valuations have gotten due to Fed liquidity and investors piling into tech as a safe haven.

Having said that, TSM has an extraordinarily strong growth narrative right now, as the company is set to take over chip production for Apple. Formerly Apple's chips were manufactured by Intel. TSM also makes chips for Qualcomm, among other large companies. Thus, I think TSM will continue to outperform the Nasdaq and is a buy on any significant pullback. Ideally, I'd like to see this stock pull back to the volume node near $53.50 before buying, but in truth I don't see that happening any time soon.

$CMCM can rise in the next daysContextual immersion trading strategy idea.

Cheetah Mobile Inc. operates as a mobile Internet company.

The demand for shares of the company still looks higher than the supply.

This and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $2,71;

stop-loss — $2,41.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Netflix: More upside potential. $700 realistic before profit-takNFLX is trading on a long term Channel Up on the 1W chart (log scale) since early 2013. Despite being overbought (RSI = 79.335, MACD = 45.450, ADX = 45.358, CCI = 303.3862) with the earning approaching, Netflix has still room to grow before the next selling wave within the Channel takes place.

Both the LMACD and RSI are on levels where the price previously posted one last run to the Channel's Higher High, before it hit the Resistance Zone (red ray) and pulled back. We have a Target Zone for NFLX within 700 - 800.00.

It is beneficial to add here that these long-term projections on NFLX have been particularly useful to our strategy. See our previous trading call on this stock in September 2019 when the price was trading at $260. The price is now more than double and approaching our (then) target of $650:

** If you like our free content follow our profile to get more daily ideas. **

Comments and likes are greatly appreciated.

IMPINJ $PI$PI is just below the buy point. It did a very good volume yesterday. RSI broke the trendline as well. Watch for a breakout of $29.95

12 months Consensus Price Target: $32.67

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

Palo Alto Networks $PANW "cup"$PANW is breaking out the cup formation with high volume.

12 months Consensus Price Target: $257.66

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

FireEye $FEYE "Bounce back"$FEYE found support as 50SMA with high volume. It is a descent sign for a bullish trend.

12 months Consensus Price Target: $16.17

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

Twitter: Emerging Golden and MACD cross. Bullish mix.TWTR was rejected yesterday on the 37.00 Resistance which was the June 8th High. The 1D chart remains bullish (RSI = 63.007, MACD = 0.470, ADX = 33.487), the MACD made a bullish cross and the MA50 is about to cross over the MA200 (Golden Cross). This is a very bullish mix for Twitter and we encourage investors to buy either if the Resistance breaks, or on the next pull back to the 1D MA200. Our Target is 42.00.

** If you like our free content follow our profile to get more daily ideas. **

Comments and likes are greatly appreciated.

Mastercard $MA Mastercard is close to buying point of $310.43. Forming a double bottom, to confirm needs to get above the buy point.

12 months Consensus Price Target: $326.85

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx