Twitter: Jack Dorsey's Second Gap Fill This MonthSquare rallied hard after filling a price gap a few weeks ago. Now Jack Dorsey's other company, Twitter , is doing the same thing.

Strong quarterly results on February 6 sent TWTR ripping on heavy volume. In a nutshell, better user monetization and engagement restored confidence in the social-media platform's business over the long term.

The stock has consolidated its gains as it chops along the 200-day simple moving average (SMA). It also probed the bullish gap but never filled it.

Next, the weekly chart just completed an inside candle: a higher low and lower high. It also closed a few pennies below the previous Friday. That can signal volatility is calming before movement returns.

Traders will now watch for TWTR to hold the 200-day SMA as it pushes against the $38-40 congestion area from October. Above that, the 2018 peak around $47-48 comes into play.

Technologystocks

Paychex: Steady Growth Stock Attempts Cup & Handle BreakoutPaychex isn't the most exciting stock on the planet. But it's forming a textbook cup and handle pattern, which may indicate a breakout is coming.

The payroll processing company surged about 40 percent between the end of 2018 and June 2019. It's consolidated those gains since, basing around $80 last August-September (cup), followed by a higher low around $82 in November (handle).

PAYX squeezed into a tighter range since then, finding support above its 200-day and 50-day simple moving averages (SMAs).

Next came its big candlestick from the December 18 earnings report. PAYX tried to gap higher on strong results and higher guidance, but sellers quickly swatted it back down to its range. The stock consolidated for a few more weeks before running to a new high pennies below $90. It then pulled back and held the 50-day SMA on January 31.

After that, it formed a tight channel between $87.25 and $88.90, which it's now on the verge of breaking.

Is Facebook Flying a Bearish Flag?Facebook gapped lower on a poor earnings report two weeks ago. It's staggered there since as the rest of the market rebounded, and now the technicals may be pointing lower.

The first big pattern is a potential bearish flag following the January 30 drop. The direction of movement was lower, so a continuation pattern like a bear flag could point toward another leg down.

Next, the bearish flag has taken shape along the 50-day simple moving average (SMA). The key line tried to give some support but now that could be fading after two weeks of consolidation.

Third, FB's recent move above $220 could be viewed as a false breakout compared to the July 2018 peak. That creates potential for distribution (otherwise known as "selling") if recent buyers near the highs lose confidence.

The news has already been shifting in that direction because FB's performing the opposite of many other big technology firms like Apple , Amazon.com and Microsoft . They're all delivering in key growth areas (services, AWS, Azure). Even companies like International Business Machines and Twitter are showing signs of a turnaround.

FB, on the other hand, is struggling to grow as regulatory pressures increase. A big downgrade from Pivotal Research yesterday also raised questions about ad revenue.

The current setup also has a potential level for risk management, with bears able to use the 50-day SMA as their pain threshold. To the downside, $200 could be the next line to watch.

Advanced Micro Bounces After First Decent PullbackSemiconductors have been one of the stronger corners of the market, and Advanced Micro Devices has been one of the strongest names in the space.

AMD might be extended in price but that's a sign of its leadership. It just pulled back to test its 10-week simple moving average (SMA) for the first time since it started running in October. The stock is also coming out of a bullish inside week, with a higher low, lower high and higher close. It's now on the verge of breaking the top of that range at $50.85.

Guess what else? The recent chopping around $48 represents a consolidation above AMD's old highs from May 2000 at the peak of the dotcom bubble.

Going forward, swing traders will probably stay bullish on AMD as long as the 10-week SMA holds.

Biogen: Sell opportunity.BIIB closed the week around +25% as news regarding a crucial patent ruling came out in the company's favor. With the company's earnings also higher than the forecast, investors seem upbeat with the stock's dynamics. Even though the 1D chart turned overbought (RSI = 75.219, MACD = 6.690), on the weekly chart there is still a clear Resistance Zone at 370.00 - 389.00 which has been holding since 2016.

The fact that the 1W candle pulled back making a big wick right after it entered the Resistance Zone, indicates that traders looked to book profits first. We see this as a strong sell opportunity towards at least the 267.00 Gap or even the 246.70 Symmetrical Support.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Veeva Systems: Another Software Stock Tries to MoveOne software stock after another has come to life and ripped higher in the last few months. Salesforce.com , Alteryx , ServiceNow , Trade Desk , Adobe : the list goes on.

VEEV is another member of the group that's now trying to make its move. It's formed a broad basing pattern since last autumn. That followed a 100 percent move between early 2018 and mid-2018… which followed a 200 percent move in the two years before that.

VEEV is a "classic growth stock," going from small-cap to mid-cap to large-cap as its business expands. Growth stocks like this have been the cornerstone of the rally for years, and there's little sign of that changing.

VEEV is now trying to get back above its 200-day simple moving average (SMA). It resembles Amazon.com earlier this month and PayPal in December.

VEEV also just bounced at the same $148.50 zone that was previously resistance. Traders might expect a few more sessions of consolidation but also watch for continuation higher -- especially with earnings due in 3-4 weeks.

Speaking of earnings, VEEV has a history of surprising to the upside. Last quarter, it tried to rally before getting smacked lower. But now it's had time to consolidate and turn its 100-day SMA higher. Notice it's given useful signals in the past. (This chart below uses our Colored Moving Averages script to highlight direction of the 100-day SMA. In the dynamic chart above the 100-day SMA is gray.)

Coupa Software: Pullback to Old High and 50-day SMACoupa Software has had a monster run since early last year. Now it could be giving a potential entry.

COUP rallied about 150 percent between January 2019 and last October. It then had a big chopping period like two megaphones. It first got wider and then narrower, followed by a breakout in January.

Now COUP has come back to hold the old high around $160 and its 50-day simple moving average. This highlights a potential opportunity -- with a support zone and moving average in play. (You can thank Tesla for the pullback yesterday because it weighed on the Nasdaq.)

COUP is also a member of the fast-growing enterprise software space. It focuses on procurement systems. Enterprise software has become one of the biggest industries in the current bull market for growth stocks.

The next earnings report is due in a little more than a month.

Amazon: Ready for an expansion phase. Target: 2,800 - 3,200.AMZN marginally broke the formet All Time High (2,050 - 2,055) this week, which was a Resistance level that has been holding for 1.5 years. With the EPS smashing the forecast last month turning 1D extremely bullish (RSI = 72.875, MACD = 46.790 ADX = 23.292) we have turned very bullish on the stock as it is repeating the fractal (2014/2015) that preceded its last expansion phase.

The RSI on the 1W chart is also replicating this sequence on impressive symmetry. We therefore believe that Amazon is at the start of a new expansion phase and initially aim for the +145% extension. Our Target Zone is 2,800 - 3,200.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Micron: First Healthy Pullback Since Breaking OutChip stocks have been the strongest corner of the market for the last year. Now one of the most actively traded names in that group has had its first healthy pullback since breaking out to new 52-week highs: Micron Technology .

MU has been working its way through an 18-month consolidation pattern following a huge run between mid-2016 and mid-2018.

It broke out to a new 52-week high in mid-December as the market flew into new territory but remained below the previous peaks from 2018. The risk/reward wasn't great, even as MU kept chopping higher, but now it's pulled back to some key levels and may offer a cleaner opportunity.

Two important things stand out on MU's chart: The 50-day simple moving average (SMA) and the recent low around $52.50. Both provide a good risk-management zones for buyers seeking a move back toward $60.

Fundamentally, most indications have remained positive for semiconductors . MU CEO Sanjay Mehrotra called a bottom for memory chips in December, and Intel's (INTC) surprisingly bullish report on January 23 showed orders are still strong. There's also the forward catalyst of 5G networking.

EBay: Channel Breakdown UnderwayE-commerce stock eBay reported earnings last week. The backward-looking results were ok, but forward guidance wasn't so hot. The resulting drop is creating some bearish chart patterns.

First, EBAY formed a tight channel between $34.50 and $36.60 since October. It's now breaking the bottom of that channel.

Second, the channel began on October 24, when EBAY gapped lower on weak guidance. Its recent drop on January 29 wasn't technically a gap (because there was some price overlap with the previous session). However, you have a gap down, consolidation and further downward pressure. The direction and high-volume price moves have been negative.

Third, EBAY has formed something of a head and shoulders since last March and April. That pattern follows a failed breakout attempt in early 2018. Nothing bullish in that.

Finally, EBAY has gone almost two years without making a new 52-week high, unlike the broader S&P 500 and Nasdaq-100 indexes. A steady lack of relative strength like that is also a sign of underlying weakness.

A year ago, EBAY had a bullish gap between $31.02 and $32.73. It may now come into play as a downside target. Given the market's recent fears, traders looking to get bearish may want to start with weaker names already under pressure. EBAY could fit that bill.

New 52wk High in the Horizon Photon Controls setting up for nice move up, DEMA 11/22 crossed and rising. DEMA 22 sitting at support of $1.25 and DEMA 11 sitting at $1.35 or high for previous week with trading staying between $1.27 to $1.35. A/D is above its 22EMA sitting flat looking for it to start rising in the coming weeks. Photon Q3 showed cash and cash Equivalents of $34 Mil, used $.9 Mil to repurchase shares( always a good sign to see shares being bought back), posted $8.7 Mil in Revenue increase of 23% compared to Q2 , $1.5 Mil in Net Income with expectations of further increase to Rev in Q4. Looking back at insider buying we can see that they have been adding since Mid 2017 with little to no sale of shares. With the continued advancement/ increasing orders and New markets being opened (Look at Dec 16, 2019 news release) Photon has alot of bullish indicators signaling movement to new highs into the Q4 financials.

Current Target $1.74

Expected entry Point $1.28 - $1.30

Current Support $1.25

Current Resistance $1.40

Possible Low Zone $1.16 - 1.25

Facebook: There's Nothing Funny About a False BreakoutFacebook dropped sharply on Thursday after quarterly results raised questions about its longer-term growth story. Sure, the backward looking numbers weren't bad. But looking forward, newer offerings like Instagram don't seem to be catching fire. The "big blue app," with its slow-growing and ageing user base, isn't really thrilling investors.

This stands in contrast with other big tech names like Apple , Microsoft , Amazon.com and Tesla . Those are all evolving their businesses toward the "next big thing."

The technicals, as usual, show these fundamentals clearly: AAPL, MSFT, AMZN and TSLA have broken out to new highs. FB has not only failed to break out. It has a failed breakout.

This week's price action could have a long-term impact on the social-media giant because it represents a double-top spanning 18 months. Patterns like this are often followed by months, if not years, of consolidation and pain. Just look at Alphabet 's trading after its April 30, 2019, bearish gap.

That argues against rushing into FB here. Some chart watchers may like the 50-day simple moving average (SMA) and the $205.50 support area from July 2019. But this week's high-volume false breakout and double top could prove more powerful to the downside. It could be too early to buy the dip.

F5 Network (FFIV) | Strong Support, 50% Growth Potential!Hi,

F5 Networks provides multi-cloud application services for the availability, security, performance, and availability of network applications, servers, and storage systems.

Currently, it is pretty undervalued and the price of the stock has reached inside the strong support area. Technically, it is a pretty powerful support level and it consists of multiple criteria. Do your own research and if you think the company has potential then I let you know - technically it is ready to go upwards!

Technically, the buying area is $120-$130 and it consists of:

1. The price is currently inside a strong price level. It has been multi-year resistance and now it starts to act as a support level.

2. The trendline third touch act as a support level, super crossing area with the previous criterion.

3. Fibonacci 38% and 62% are inside the strong area acting as support levels.

4. Monthly EMA100 should act as a support level.

5. RSI Divergence

6. Two minor trendlines run through the crossing area to adding strength to the buying zone.

7. The fat blue trendline from the top is also called as a counter-trendline. The breakout has occurred a couple of months ago and now the price retests it and the retest should act as a supporter.

8. A bit subjective but still, AB=CD from the top and the D point is inside the strong support level.

As said, do your own fundamental research and if this matching with my technical analysis viewpoints then you are ready to go! If it doesn't match then...skip it!!

A bit cleaner chart :)

Good luck,

Vaido

Netflix: Update on our long term Buy.This is an update on our NFLX buy position since we posted the following trade in September 2019 when the price was trading on the $250-260 bottom:

We have called for a long term Target of $650 but in the mean-time told more medium term investors to start booking profits near the 385 - 415 Resistance. If you took that trade with us you should be almost +50% in profit. With 1D on a steady Channel Up (RSI = 62.074, MACD = 6.790, Highs/Lows = 8.4729), we think it is a good time to update this position and look at the more short term price action. That resembles the previous time Netflix reached 385. A Golden Cross comes as confirmation. If you are a short term investors book profits within 378.00 - 385.00.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Facebook: Higher High on 1W. Potential pull back.Facebook has been trading within a 1W Channel Up (RSI = 69.832, MACD = 8.020, ADX = 41.061, Highs/Lows = 15.2786) since early February 2019. Right now the price is only a fraction below the pattern's Higher High trend line which is typically an early bearish signal.

On top of that both the MACD and RSI indicators on the 1D chart have reached their respective multi month Resistance Zones. This is an additional sell signal. As FB has been trading within a narrower 1D Channel Up since the October Low, our short term Sell Target can't be below the Higher Low trend line (dashed line). Since the former July ATH at 208.50 matches perfectly on the trend line, we will take that as TP (target/ take profit). Notice how well the 1D MA50 comes for support near that level.

It can be argued that the 1W Channel Up has a gap to fill much lower for a Higher Low, but it is too early to discuss that. If the MA50 breaks, then the MA200 may come for support and accumulate buyers without reaching the Higher Low trend line. And since Facebook is on a long term uptrend it is best to buy such pull backs (when/ if they come) and not sell.

~~~ Our previous long term call on Facebook issued last September with the 220 target hit:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Beyond Meat: Lower buy opportunity exists.BYND topped yesterday following an impressive comeback from the November - December lows, which gave a strong bullish signal as the RSI was on a Bullish Divergence. This turned 1D extremely overbought (RSI = 85.585) and it was only natural to see investors booking profits first chance they got, and that was near the 137.00 Symmetrical Resistance.

With the rest of the technical indicators pointing towards a healthy uptrend (MACD = 6.860, ADX = 32.540, Highs/Lows = 29.3471) the trend seems sustainable. Investors however should first see a clear new low (higher low) before re-entering. By our projections this will most likely be 97.50 - 91.00 Symmetrical Support Zone. 108.00 is also a candidate (but a weaker one) so tight SL is needed there. Medium term TP Zone: 160.00 - 172.00.

~~~ Our last Buy Call on Beyond Meat:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

SWKS BUYBuy signal at 123.10 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

Take-Two Pulls Back After Breaking ChannelVideo-game maker Take-Two Interactive traded in a very tight range since October. But now it's broken above that channel and is potentially finding support at its old resistance around $125.

TTWO, owner of titles like NBA2K, is a classic growth stock -- the same kind of company that's come back into favor recently as the Federal Reserve keeps interest rates super low. It's had a decent earnings history, with the stock advancing after the last three reports. The next set of numbers is due in early February, which could boost interest in the stock going forward.

The entire videogame group also stands to benefit from the growth of Alphabet's Stadia cloud-based platform, and analysts have identified TTWO as a beneficiary of the new service.

TTWO also seems to be working its way out of a long-term cup-and-handle pattern following last year's dive toward $84. The recent high around $116 is potentially the higher low / handle part of that pattern.

Given the old resistance at $125, traders may want to use that level for risk management. Above it, buyers may look for a move back toward the hold highs near $140.

Breakeven Q1 2020 - Targets 8.4p/11.8p/15pA great business here, having invested previously & sold for 38% I have now started buying again for a longer run as business aims to break even by Q1 2020

Targets: 8.4p / 11.8p / 15p

Very bullish on chart, check MACD on daily where it's crossing

Headsets to breakeven: 400

Martin CEO has 8.41% of the company & whole BoD together about 15.6% so therefore aligned with shareholders.

Could this company do a Bidstack like rise? quite possibly but in this case it will be due to numbers as they aim for 1000 headsets by end of 2020.

Will be posting more notes very soon over on twitter.

Short position on NASTechnically it can be seen as long term downtrend starting. Until the resistance is doing the job, Nas would fall down eventually. It is a strong probability that Nas starting its long-overdue correction, but could be wrong too. Stop-loss is set from 30 points from the entry, potentially big win if right. If tunnel movement formed in the price we could see big 200 points down movement Fundementally, lots of going on: tensions between USA and Iran, trade war, oil price hike. Previous Gold trade thankfully capitalized me strong.

Salesforce.com Had a Cup and Handle. Is a Breakout Next?Salesforce.com is a classic growth stock, with high multiples but also steady expansion of its products over time. It's exactly the kind of company cited by William O'Neil in How to Make Money in Stocks .

That classic trading book teaches readers about the "cup and handle" pattern that often occurs in secular-growth stocks. It's a high basing formation following a big rally. O'Neil's technique is to watch for smaller pullbacks to produce a tighter range, looking for a potential breakout to new highs.

CRM may have that potential setup now -- especially when you look at the October low (above $140) versus the August low (around $138). That was followed by another higher low at the 200-day simple moving average (SMA) around $156. A "golden cross" pattern occurred around the same time in early December.

CRM's fundamentals have been solid, with strong results the last two quarters and the potential for synergies after acquiring Tableau Software. CRM is also on pace for a bullish outside week (higher high and lower low), plus its highest weekly close ever.

PayPal Finds Support at Old ResistanceOnline payments giant PayPal gapped higher on a strong earnings report in late October. It had plenty of downward momentum at the time, and some resistance points around $108 prevented much follow-through. PYPL also slammed into its 200-day simple moving average (SMA) and a declining 50-day SMA.

But that was then, and this is now. Has the stock paid its dues as MACD ramps higher? A bullish note from Wedbush drove the shares above their channel on Monday, and they've consolidated there since. Now it looks like the old $108 resistance level is turning into support.

This gives traders a potentially key price area for risk management. As long as it holds, buyers may trickle in and look to ride PYPL back toward the old peaks above $120.

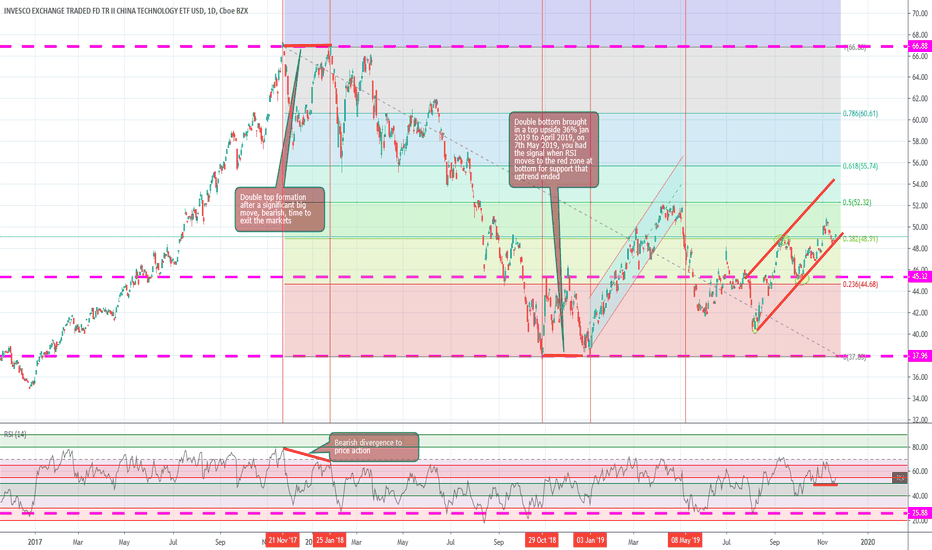

CQQQ, trying to etablish an uptrendAMEX:CQQQ on daily charts is trying to finds its wings to fly, awaiting clear direction

I have showed a few cases here, where after a significant up-move, we had a double top formation and also bearish divergence on the RSI, indicating high probability that the uptrend may end and fizzle out and then after a significant downside, price formed a double bottom, signifying that trend may reverse or at least bottom out.

Over the next few months, we saw a peak of 36% returns on investment since signal identified

As we speak, price is trying to break the $ 50 mark. At this stage, price is respecting the upward trending bottom channel but is failing to make higher highs, entering in somewhat a congestion zone.

Look out for this space closely as this may give us more confirmation on which way markets could break out

Happy to hear your views.

If you like what you see, please share a thumbs up and follow me for more ideas

Cheers