$JSEVOD Vodacom basing for a bigger move?$JSEVOD released a decent set of results this morning in the face of a tough economic environment which we have witnessed locally for the last little while. Perhaps now with elections out the way and a gradual uptick in economic activity, this local counter could benefit from inflows into the SA inc sector of our market. This year we have seen price action contained within a tight range of R110-R122. It has formed an inverted Head & Shoulders formation with multiple bottoms around the R111-R112 area. If we see the stock break above the recent highs of the neckline around R122, we could see this stock off to the races to test the upper end of the larger channel which comes in at roughly R132- R133.

Telecom

Sprint: Death Cross on 1D pointing lower.Sprint made a Death Cross on 1D last week (MA50 crossing under MA200) on bearish RSI = 38.934, MACD = -0.125, Highs/Lows = -0.1518. The same pattern has been spotted 3 times in the past, all of which resulted in massive loss in value (roughly -41.50%, -52.30% and -47.80% respectively). Assuming it follows a similar pattern, an equivalent of the last Death Cross (which was the "weakest") will pull the price down to $3.25. It is definitely not a good time for investors to enter Sprint. Traders may look to start adding shorts using the previous Lower High as stop loss.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

T did something exciting!So last night I said that AT&T was going to rally to 32.45. It was looking good with gains and natural consolidation, but it looks like it wigged out finally. it got near the 32.45 marker and then dropped to open at 31.78. We are inside my pitchfork again (unfortunately), but with the patterns we've been seeing we will most likely see a bounce back up sooner or later around 31.35. If this is correct, AT&T will most likely reach 32.45 within the month.

More to come later.

Xiaomi has Started to Climb

Xiaomi has fallen hard from the IPO, but has hit a bottom and will not start to climb back up built off new phones and increased phone services. Huawei will probably always be the top in China but Xiaomi will be a strong #2 in the market and a top 10 in the rest of the world.

CRNT - A Hidden JewelA little known stock called Ceragon Networks will play a role in the rollout of 5G networks in the United States. With the earnings call coming in less than a week, I see this bullish stock to test the resistance around $4.07. I have this in my mid term portfolio til 5G rolls out.

YY - Increasing volumeChinese cellphone platforms:

Y Inc. (YY) is a social platform that engages users in real-time online group activities through voice, video and text on personal computers and mobile devices. The Company's segments include YY IVAS and others, Huya broadcasting, and 100 Education. YY enables users to create and organize groups of varying sizes to discover and participate in a range of online activities, including music shows, online games, dating shows, live game broadcasting and e-learning. YY offers users an entertainment experience through its social community. It owns the domain names of YY.com, Duowan.com, 100.com, Huya.com, Edu24ol.com and Zhiniu8.com. The Company's YY platform, including YY.com, is jointly operated by personnel from Guangzhou Huaduo and Zhuhai Duowan. Its product, YY Client, enables users to engage in live interactions online. Its Web-based YY enables users to conduct real-time interactions through Web browsers without requiring any downloads or installations.

Full retracement, when will Cboe VIX drop below 15-16?

YY

AMEX:CBOE

I - Intellistat (Satellite Comms)Comparing Cboe VIX VIX to I I

Currently leaning toward lower fibretracement, but we're talking about low earth satellite comms for 5G, Gov, Mil, all things big data or stock wouldn't have crushed it last 18mo.

Just a note here in case reaching lower fibonacci retracement for entry.

Nokia 5G prowessNokia is 4.2% div. yield 5G stock. Awaiting if going back to 786fibretracement below or near 5 or stabilizing upward to 618fibretracement.

NOKIA (NOK) Still bordering marginally negative earnings, indicating it's emergence from post 2000's is emerging with new IT Software for 5G as earnings about to turn profitable.

Watch for further support for growth or retracement to .786 from .618 bounce it's currently on.

Consolidated Communications Holdings Cup&Handle about to brkout Watch for breakout: 9.26.18 2:30pm

CNSL is about to come out of a weekly cup and handle formation or minimally a double bottom, which both usually rise upward.

Small-cap telecommunications stock adding fiber optic lines and hurt by earnings after infrastructure investment.

* Compares to: CBB FTR CMCSA T

* Pays 12% Dividend yield currently, so little risk. Ex-divident is Oct. 12th. payable Nov. 1st and quarterly.

* Potential to double on Fibretracement to $24 into early 2019 and upward by end of 2019 into 5G massive MIMO communications and fiber optic cable lines for markets served.

* Will be positioned to grow into 2019 with dividends and then catch 5G services growth and target by year end 2019 likely $28-30, as Telecom stocks grow when profits made.

* EPS Growth was -386800%, just indicates it is making progress with profitability vs industry average 144%, but it is a small cap.

* Mkt Cap $914M, 2018 sales will be $1.4B, that's a bababa-billion. Enterprise value with recent upgrade is paultry 3.25B, or shows undervalue ratio 3.25/0.914 = 3.55 and poised to grow customers. Book value buy?

* Debt however is high and will reduce with growth as small-cap to mid-cap (expected for market and opportunity).

* Insider buying is small, but a positive 27,000 shares/yr. last 2 yrs.

* With telecom & cable industry at current prices not sure if it'd be an acquisition target?

About CNSL: Consolidated Communications Holdings, Inc., through its subsidiaries, provides various integrated communications services to business and residential customers in the United States. It offers a range of communication services and products that include local and long-distance, high-speed broadband Internet access, video, voice over Internet protocol, private line, custom calling features, security, cloud, data center, managed and IT, and directory publishing services, as well as engages in equipment sales activities. The company also sells and supports telecommunications equipment, such as key, private branch exchange, IP-based telephone systems, and other hardware solutions, as well as offers support services to medium and large business customers. As of December 31, 2017, it had approximately 972 thousand voice connections, 784 thousand data connections, and 103 thousand video connections. The company serves customers in consumer, commercial, and carrier channels.

Argentine Telecom deep discount breakout on falling wedgeTEO breaks out of deep falling wedge from half its value earlier in year.

* Paid a 17.45% dividend last year and known for double digit dividends

* Telecom 5G play for new subscribers in 2019, or watch until 2019 entry at higher price, likely near $30.

* Growing mid-cap telecom, cable, cellular provider

* Fell out of favor on negative earnings miss building infrastructure

* Revenue growth +35%, Revenue change +24%

* Currently only 20% large fund ownership, which will grow with 5G emergence

* Breaking out from bottom just above $15 and below $20 and going up.

Viewers come to own conclusions with charts and investing.

ORCL - Oracle stock dominated by mobile architecture JavascriptORCL

Oracle (large cap.) offers a 1.59% dividend with current stock prices.

Dividend has not been raised since end early 2017 and overdue.

Top Oracle Software Exec. taking leave of absence per WSJ 9.7.18

Oracle 5G CUPS is new control and user plan software architecture partially introduced in 4G & to be fully integrated in 5G and help support cloud data integration & support SaaS.

* Dividend $0.19/Q, or 0.78/yr, which at $47.81 is a 1.59% yield.

* 5G will generate profits in late 2019 and slightly earlier for SaaS services

* Key markets healthcare, transportation, blazing internet, smart cities, energy security, aka billions of devices coming on-line

* In Aug. a pension fund started lawsuite with Oracle, accusing them of farbricating cloud sales and creating unstable sales model. In reviewing their chart, they are just like the spikes of major telecomm stocks associated with 1G-2G-PDA-3G-4G-4G LTE and soon 5G in 2019-2020.

* The past year was anything but stable for ORCL, which is more like telecomm stocks than IT/Software stocks.

* #needstodiversify

This posting is for own reference. Come to own conclusions. Comments welcomed.

QCOM, AAPL, OLED - Coincidence on new iphone plans?TELECOM Sector

Qualcomm snapdragon chips tend to go into cell phones #QCOM

Apple introducing new iphone as release X a fake release to 5G #AAPL

OLED displays are the best in the market #OLED

STM chips for ASIC might be made by someone else #whoknows

AXTI 3D sensors might have competition ?? #whoknows (not PM)

Yes, I left out AMD, which might be making the GPU, who knows ?? #toolate-shipsailing

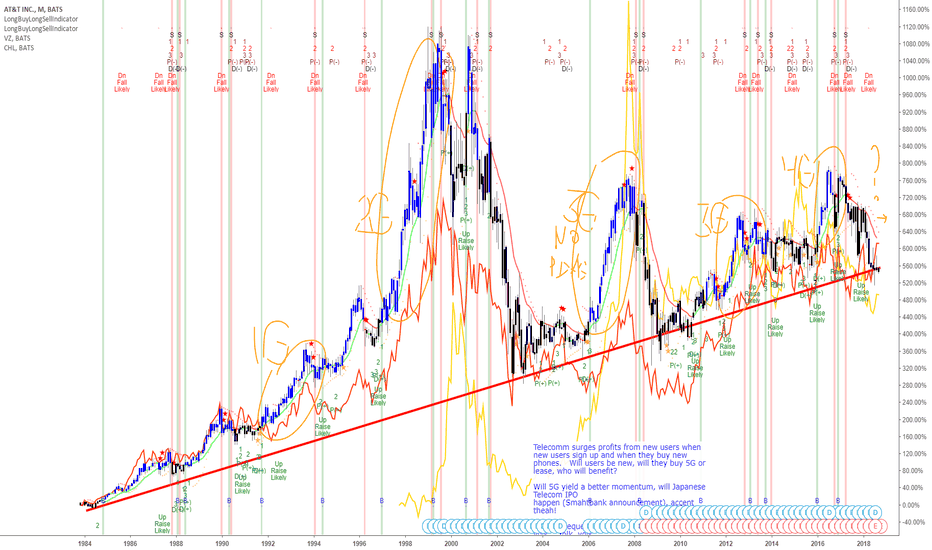

Am I more interested in Softbank comment on new Japanese Telecom Carrier IP and needing big investments from banks.

Bought OLED in August. QCOM in Sept. Sold AXTI for now...3D sensor users needed. STM well holding on for no good reason.

These are all prognostications and viewers come to own sense of reality, investing, and humor.

Samsung / 5G-Apple here's a new product idea: I'd love to see a whole house smart phone system. Every phone has WIFI, display, GPU, etc. for under $1K or abouts.

Unlimited by 200 Day MASprint is a decent looking buy a little lower, and it looks like it may be going towards $5 something (Or maybe higher). The company has a couple of warning signs on Gurufocus.com: I don't know what they are, (I don't subscribe to the full version yet) . The stock just hit it's 200 day moving average. Most whale investors like to see that as a qualifier for investment stocks (At least thats what I've heard). NYSE:S has invested well into it's networks and cellular users' experiences. It looks like the chart could be forming a bearish flag at this point. It does have a stock price below its Peter Lynch number, which famed investor Peter Lynch used to measure a stock's price compared to it's earnings...It basically means that the stock is possibly a good buy, if it's graphical price line is below it's graphical earnings line. CONS: Net sales are down a little in Q4 2017 from Q4 2016. Does NOT pay dividends. EBIT was down in Q4 2017 from Q4 2016. PROS: Increased cash, equity, and assets in Q4 2017. Decreased debt in 2017 Q4. High trading volume and well-known US company.

Cup of Tea, Anyone? PT: $57Market top value line has historically been around $45 for Roku since its first IPO quarterly report. The hype was real and the price collapsed, only to rebound once again before the next call, at which point everyone realized things took off too high, too fast.

I'm sure we can all remember the long, straight road down, back towards a normalized, long term, average trend line. Lockup period also expired and things just kept going. As it percolated in the low $30s, some good bits of news for the company bumped it here and there, but the volatility of the last 6 months also had its toll on the price.

After the latest call, Roku impressed with its numbers, its move towards revenue as an ad platform (via Roku Channel) and its plans for growth the rest of the year. It's a domestic company, social, entertainment and free of tariffs for now, so the road ahead looks clear. The same trend line upwards has repeated for a third time during this long term Cup And Handle pattern. The handle itself has formed very well and maintained above the desired levels. I would personally shoot for starting a position around $43. It could dip as low $40 before the march upwards begins, so prepare accordingly. Volume has been steadily increasing since May.

The traditional breakout upwards seems to lineup for sometime next week, or the week after. Once it starts, the channel upwards towards $55+ is clear and coincides perfectly with the estimated future earnings call on August 8th. On heavy volume, it could reach $60 close to the call date. Tariff drama should be behind us by the end of the month, which would help market sentiment and momentum and further rally ROKU towards some nice gains. If you're holding this since the $30s, stay LONG. This is a gem of a streaming service that has massive adoption because of its low price point and ease of use.

[CSCO] Strong Tech Name Looking to break Resistance at ATHCisco, it's got the story. It's got the upcoming earnings .

Besides the technical charts showing strength, it's attractive and I'm surprised I haven't heard a lot of news coverage given earnings coming up.

CSCO 0.72% has the cloud thing going on, it's got the telecoms aspect in a digital way that integrates with its cloud and enterprise solutions. Having that sort of niche-type aspect of cloud solutions seems solid since the competition isn't coming from broader Cloud players like AMZN 0.98% , GOOGL 2.87% , MSFT 1.18% , etc.

Intensive focus on a niche-(ish?) areas in the future of tech is always a buy for me. AAPL 0.70% has been doing the same thing since the 80's without giving a damn about all the people saying that the company is dead if they don't branch out.

“People think focus means saying yes to the thing you've got to focus on. But that's not what it means at all. It means saying no to the hundred other good ideas that there are... Innovation is saying no to 1,000 things." - Steve Jobs

TMUS good entry Buy, higher all the way to Memorial Day Weekend This finds which have formed Cup-with-Handle patterns which are at least 8 weeks long and at most 9 months long. The beginning, or left side, of the cup, has to start after a rally of at least 30%.

Then a 20% to 30% correction from the old high (left side cup edge) must occur. The stock then builds a rounded base which slowly climbs back toward the old high The right edge of the cup must be at most 15% below the left edge (the old high). Then a slight pullback occurs which forms the handle.

The handle can be a minimum of 1 week long & max of 6 weeks in duration. It must also form within the top half of the cup and be within 15% of the left side top of the cup.

The official / traditional buy point is when & if the stock rises above the RIGHT edge of the cup on higher than average vo lume

2H Growth & Acquisition Friendly (PT: $9.00)Second half of the year has already been projected by various telecom companies and suppliers to be strong and accelerated compared to the first half. Seasonally weak Q1 numbers came in almost across the board. However, NPTN managed to not do as badly as most had anticipated, hence the growth in March fueled by positive sentiment that momentum was returning.

NPTN has repeatedly shown that it will dip under its overall trend lines (red+yellow) and return fiercely for some gains. It will take a stable, forward looking market with growth and momentum to get it back to $9. However, in the short term, I can easily see it retracing back up towards $7.50 before some profits are taken and the price drops back around $6.50. NPTN guided for a solid Q2, though the ZTE news may have a bit of a negative effect on it. However, that news has probably been baked into the current price, which is in part why it's dropped to where it is now. Ignore the Huawei noise, as China talks are at least still neutral, but moving forward again with additional talks and likely more extensions for negotiations.

Q3 guidance should remain the same, specifically focused on getting margins up with flat revenue compared to Q2. Anything above that, and we've got a rocket that will easily coast to $8 I think. Sales and growth into its strongest areas of 400G and 600G continue, with Verizon and others quickly deploying and growing 5G capabilities that NPTN participates in. Additionally, now that LITE has chosen to buy OCLR, the speculation that NPTN could be acquired escalated, so owning a piece of NPTN has additional leverage.

AAOI: Fool Me Twice? Ignore The Hype, Wait For Trust (PT $24.50)The recent run up in AAOI stock price is a familiar story if you've been tracking or involved in the company since last year. What was once a glorious shining star from a parabolic blowout, quickly became a bubble of sorts and collapsed. The stock is tainted because of leadership's comments and weak guidance last quarter. The only reason to run the stock up is to profit and then watch it come back down, which I believe it most likely will. This is a volatile market full of excuses to bring any and all names down and AAOI is a very, very easy target.

I personally took a $70k loss last quarter on an investment I started back on 9/19/2017. I'd averaged down and waited for news and the tide to turn. A nice chunk of my portfolio ended up being allocated within the position, so it was dead money just sitting there for over 4 months. I think the company's technology, manufacturing capabilities and products (margins) are phenomenal. I think their execution to leverage their strengths and positions within the industry, plus their credibility, are found wanting though, and that's the real killer holding the stock back.

AAOI was dead money until the recent run-up. It's not going to grow back into the $40s without some serious and flawless momentum. You have an insanely high amount of short interest always playing against you. No matter what gains the price makes, they'll bring it back down. On top of that, ANY bad news will just send the stock down even further. It's already hit the mid $20s. People have been calling for prices into the teens without hesitation. I'm inclined to believe they'll push it down there if they want to on a bad, upcoming call.

The volatility in both the price and management's lack of transparency is not good for anyone seeking stability or trying to recoup money lost within the stock. Again, any good news will be processed and then cast aside because of the short interest. Any bad news will be magnified and blow the price down. Management made some really weird comments in their last call that make the specter of dishonesty rear its head. A lot of people already don't trust what they say, so you're playing against that as well. Leadership in ANYTHING has to be solid for any entity to move forward.When that starts getting questioned, it does not bode well for results or for participants.

Guidance for Q1 was terrible. Almost all the commentary and other positive catalysts for the company are taking place in the second half of 2018. June is about where the stock will finally start to test whether it can go back up, and that's assuming nothing crazy or weird hits the company again. My thoughts are that this quarter will meet expectations and guide for some growth, but it will only keep the stock back in the $30s. Anything less and it'll be back down to $24.50, maybe less if sh*t hits the fan. The short interest is just so brutal and easy for people to hold down that it's a struggle. If the stock starts to rebound, stabilize and hold, positive news starts rolling in (FB extends their contract into Year 2) and the short interest starts to decrease after June, I'll look at possibly buying again. That's a ton of 'ifs' and a great company shouldn't have to instill that kind of hesitation in investors.

It'll be another year before the stock even tries touching back to the $40s or $50s. Management has to rebuild trust, their execution has to blow the competition away and they have to chase out the massive short interest. Please be careful with this one. The risk is extremely high. Don't bother "hoping" for some quick cash. Find the stability and begin a position then if guidance is promising.

Alternate Telecom Play (Materials) w/ Cyclical Trade HistoryTelecom build out in 2nd half or 2018 has been confirmed by multiple companies to be primed and heavy. First report of year is seasonally week and reflected across sector. AXT is traditionally conservative with forward looking statements, so beats are regular and plausible. New factory is almost completed and 3D Sensing capability has already been confirmed for further exploration. Technical trade up to $9 PT coincides with resistance line after price has managed to sustain within fib levels during recent periods of volatility.

A Telecom Monopoly in RussiaMBT is quietly becoming a monopoly in the Russian mobile telecom space. I wrote a detailed analysis of the company, which you can find here: rockvuecapital.wordpress.com

In short, the company is a monopolistic giant with tremendous reach and power in Russia and Eastern Europe. Despite this tremendous power and monopolistic qualities, the company trades at roughly 13x FCF and sports a 10.6% FCF Yield.

Please be critical if and where you don't agree.

All the best,

Brandon