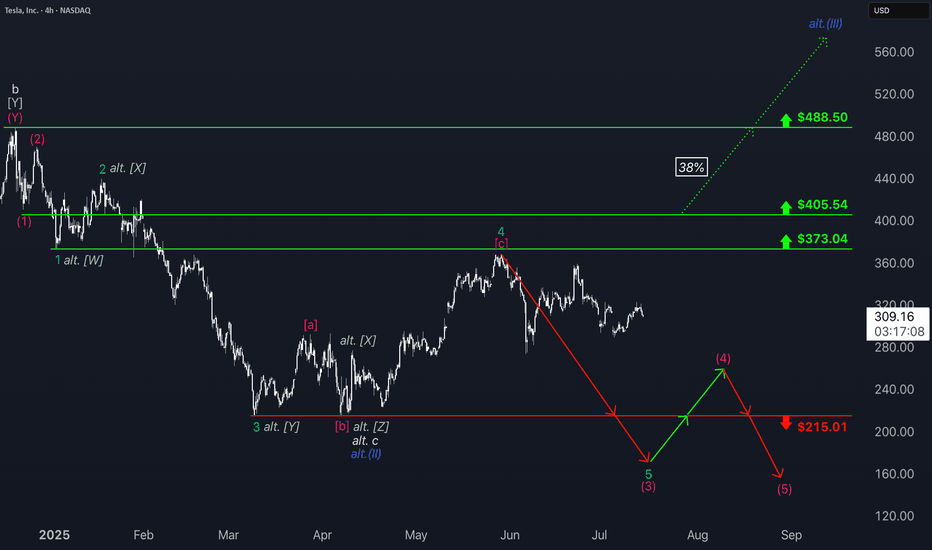

Tesla: Still Pointing LowerTesla shares have recently staged a notable rebound, gaining approximately 10%. However, under our primary scenario, the stock remains in a downward trend within the turquoise wave 5, which is expected to extend further below the support level at $215.01 to complete the magenta wave (3). This move is part of the broader beige wave c. However, if the stock continues to rally in the near term and breaks through resistance at $373.04 and $405.54, we would need to consider that wave alt.(II) in blue has already been completed (probability: 38%).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

Teslashort

Tesla, Below 200 Next - The Crash Can Reach 140, 150 & 160Tesla has been bearish since December 2024 and producing lower highs since. A strong lower high happened late May with a shooting start candlestick pattern. A month later another lower high and bullish rejection with an inverted hammer.

This looks like an ABC correction with the low in March/April being the A wave. The lower high in May the B wave and the next low the final C wave. This would complete the corrective pattern.

Conditions for bullish

An invalidation of the bearish bias and potential would happen with a rise and close, weekly, above 355. Any trading below this number and the bearish bias remains intact.

Indicators: RSI & MACD

» RSI:

The RSI looks pretty bad as it already curved down; trending down and moving lower since December 2024.

» MACD:

The weekly MACD is weak, starting to curve but still on the bullish zone. The daily MACD already turned bearish and moving lower.

Summary

Overall, market conditions are weak for this stock and everything points lower. The chart structure points to a lower low based on a broader bearish trend.

Thank you for reading.

Namaste.

MUSK on TRUMP's Bill | "outrageous, disgusting abomination"Elon Musk’s sided against the latest Trump-backed tax-and-spending package, in a plot twist between the recent partners turned enemies.

Musk called the legislation a “massive, outrageous, pork-filled Congressional spending bill” and a “disgusting abomination,” publicly shaming senators and representatives who backed it.

With such a strong opinion against it one may wonder, is this going to negatively affect Tesla?

Together with this strong reaction, the price has already been trading lower for the past few days.

The administration has defended it as the “One Big Beautiful Bill,” insisting it will stimulate growth, even though Elon Musk warned the bill would swell the U.S. budget deficit by roughly $2.3–2.5 trillion over the next decade, calling the added debt “crushingly unsustainable”.

When I first read this, it made me think of Tesla's long generated “green credits”, which in 2024 alone, brought in roughly $2.76 billion. “green credits” (officially, zero-emission or regulatory credits) work by building more clean vehicles than required and selling the excess allowances to other automakers that need them to comply with emissions mandates.

Now I'm no expert on US policy, and so I roped in GPT to help me explain how this new bill implicates TESLA's profit:

Under the Senate’s “big, beautiful” tax-and-spending bill, Tesla’s regulatory-credit business faces two assaults:

❗ Repeal of CAFE- and ZEV-mandates

The bill would eliminate penalties for automakers missing Corporate Average Fuel Economy targets and roll back zero-emission vehicle mandates that currently force legacy manufacturers to buy credits if they fall short. Remove those penalties and mandates, and there’s no structural need for credits—undercutting the very market that funds Tesla’s $2–3 billion-a-year credit-sales business

❗ End of consumer EV tax incentives

By phasing out the $7,500 new-EV credit (and the $4,000 used-EV credit) within months of enactment, the bill dampens U.S. EV demand overall. A smaller EV market means fewer opportunities for Tesla to leverage fleet-wide ZEV regulations against higher-emitting rivals—further squeezing credit prices and volume

Bottom line: Without CAFE/ZEV obligations and with EV purchase subsidies gone, Tesla’s “green-credit” line—a major profit driver in recent quarters—would likely collapse, removing a key buffer against manufacturing and pricing pressures.

This could be the beginning of a bear market for Tesla lasting throughout the rest of the Trump administration.

________________________

NASDAQ:TSLA

Tesla's Perfect Storm: A $152 Billion MeltdownTesla's Perfect Storm: A $152 Billion Meltdown, Chinese Rivals on the Attack, and a Faltering Shanghai Fortress

A tempest has engulfed Tesla, the electric vehicle behemoth, wiping a staggering $152 billion from its market capitalization in a single day. This monumental loss, the largest in the company's history, was triggered by a dramatic and public feud between CEO Elon Musk and former U.S. President Donald Trump. The confrontation, however, is but the most visible squall in a much larger storm. Lurking just beneath the surface are the relentless waves of competition from Chinese automakers, who are rapidly eroding Tesla's dominance, and the ominous sign of eight consecutive months of declining shipments from its once-impenetrable Shanghai Gigafactory.

The confluence of these events has plunged Tesla into a precarious position, raising fundamental questions about its future trajectory and its ability to navigate the turbulent waters of a rapidly evolving automotive landscape. The narrative of Tesla as an unstoppable force is being rewritten in real-time, replaced by a more complex and challenging reality.

The Trump-Musk Spat: A Bromance Turned Billion-Dollar Blow-Up

The relationship between Elon Musk and Donald Trump, once a seemingly symbiotic alliance of power and influence, has spectacularly imploded, leaving a trail of financial and political wreckage in its wake. The public falling out, which played out in a series of scathing social media posts and public statements, sent shockwaves through Wall Street and Washington, culminating in a historic sell-off of Tesla stock.

The genesis of the feud lies in Musk's vocal criticism of a sweeping tax and spending bill, a cornerstone of the Trump administration's second-term agenda. Musk, who had previously been a vocal supporter and even an advisor to the President, lambasted the legislation as a "disgusting abomination" filled with "pork." This public rebuke from a figure of Musk's stature was a direct challenge to Trump's authority and legislative priorities.

The President's response was swift and sharp. In an Oval Office meeting, Trump expressed his "disappointment" in Musk, questioning the future of their "great relationship." The war of words then escalated dramatically on their respective social media platforms. Trump, on his social media platform, threatened to terminate Tesla's lucrative government subsidies and contracts, a move that would have significant financial implications for Musk's business empire. He also claimed to have asked Musk to leave his advisory role, a statement Musk labeled as an "obvious lie."

Musk, in turn, did not hold back. On X (formerly Twitter), he claimed that without his substantial financial support in the 2024 election, Trump would have lost the presidency. This assertion of his political influence was a direct jab at the President's ego and a stark reminder of the financial power Musk wields. The spat took an even more personal and inflammatory turn when Musk alluded to Trump's name appearing in the unreleased records of the Jeffrey Epstein investigation.

The market's reaction to this public spectacle was brutal. Tesla's stock plummeted by over 14% in a single day, erasing more than $152 billion in market capitalization and pushing the company's valuation below the coveted $1 trillion mark. The sell-off was a clear indication of investor anxiety over the political instability and the potential for tangible financial repercussions from the feud. The incident underscored how intertwined Musk's personal and political activities have become with Tesla's financial performance, a vulnerability that has been a recurring theme for the company.

The Chinese Dragon Breathes Fire: Tesla's EV Dominance Under Siege

While the political drama in Washington captured headlines, a more fundamental and perhaps more enduring threat to Tesla's long-term prosperity is brewing in the East. The Chinese electric vehicle market, once a key engine of Tesla's growth, has become a fiercely competitive battleground where a host of domestic rivals are not just challenging Tesla, but in some aspects, surpassing it.

Companies like BYD, Nio, XPeng, and now even the tech giant Xiaomi, are relentlessly innovating and offering a diverse range of electric vehicles that are often more affordable and technologically advanced than Tesla's offerings. This intense competition has led to a significant erosion of Tesla's market share in China. From a dominant position just a few years ago, Tesla's share of the battery electric vehicle market has fallen significantly.

One of the key advantages for Chinese automakers is their control over the entire EV supply chain, particularly in battery production. This allows them to produce vehicles at a lower cost, a crucial factor in a price-sensitive market. The result is a growing disparity in pricing, with many Chinese EVs offering comparable or even superior features at a fraction of the cost of a Tesla.

Furthermore, Chinese consumers are increasingly viewing electric vehicles as "rolling smartphones," prioritizing advanced digital features, connectivity, and a sophisticated user experience. In this regard, many domestic brands are seen as more innovative and in tune with local preferences than Tesla. This shift in consumer sentiment has been a significant factor in the declining interest in the Tesla brand in China.

The numbers paint a stark picture of Tesla's predicament. While the overall new-energy vehicle market in China continues to grow at a remarkable pace, Tesla's sales have been on a downward trend. This is a worrying sign for a company that has invested heavily in its Chinese operations and has historically relied on the country for a substantial portion of its global sales.

The pressure on Tesla's sales in China is so intense that its sales staff are working grueling 13-hour shifts, seven days a week, in a desperate attempt to meet demanding sales targets. The high-pressure environment has reportedly led to high turnover rates among sales staff, a clear indication of the immense strain the company is under in this critical market.

The Shanghai Gigafactory: A Fortress with a Faltering Gate

The struggles in the Chinese market are reflected in the declining output from Tesla's Shanghai Gigafactory. For eight consecutive months, shipments from the factory, which serves both the domestic Chinese market and is a key export hub, have seen a year-on-year decline. In May 2025, the factory delivered 61,662 vehicles, a 15% drop compared to the same period the previous year.

This sustained decline in shipments is a significant red flag for several reasons. Firstly, the Shanghai factory is Tesla's largest and most efficient production facility, accounting for a substantial portion of its global output. A slowdown in production at this key facility has a direct impact on the company's overall delivery numbers and financial performance.

Secondly, the declining shipments are a direct consequence of the weakening demand for Tesla's vehicles in China. Despite being a production powerhouse, the factory's output is ultimately dictated by the number of cars it can sell. The falling shipment numbers are a clear indication that the company is struggling to maintain its sales momentum in the face of fierce competition.

The situation in China is a microcosm of the broader challenges facing Tesla. The company's product lineup, which has not seen a major new addition in the affordable segment for some time, is starting to look dated compared to the rapid product cycles of its Chinese competitors. The refreshed Model 3 and Model Y, while still popular, are no longer the novelties they once were, and are facing a growing number of compelling alternatives.

A Confluence of Crises: What Lies Ahead for Tesla?

The convergence of a high-profile political feud, intensifying competition, and production headwinds has created a perfect storm for Tesla. The company that once seemed invincible is now facing a multi-front battle for its future.

The spat with Trump, while seemingly a short-term crisis, has exposed the risks associated with a CEO whose public persona is so closely tied to the company's brand. The incident has also highlighted the potential for political winds to shift, and for government policies that have benefited Tesla in the past to be reversed.

The challenge from Chinese automakers is a more fundamental and long-term threat. The rise of these nimble and innovative competitors is not a fleeting trend, but a structural shift in the global automotive industry. Tesla can no longer rely on its brand cachet and technological lead to maintain its dominance. It must now compete on price, features, and innovation in a market that is becoming increasingly crowded and sophisticated.

The declining shipments from the Shanghai factory are a tangible manifestation of these challenges. The factory, once a symbol of Tesla's global manufacturing prowess, is now a barometer of its struggles in its most important market.

To navigate this storm, Tesla will need to demonstrate a level of agility and adaptability that it has not been required to show in the past. This will likely involve a renewed focus on product development, particularly in the affordable EV segment, to better compete with the value propositions offered by its Chinese rivals. It will also require a more nuanced and strategic approach to the Chinese market, one that acknowledges the unique preferences and demands of Chinese consumers.

The coming months will be a critical test for Tesla and its leadership. The company's ability to weather this storm and emerge stronger will depend on its capacity to innovate, to compete, and to navigate the complex and often unpredictable currents of the global automotive market. The era of unchallenged dominance is over. The battle for the future of electric mobility has truly begun.

TSLA Weekly Options Trade Plan 2025-04-17TSLA Weekly Analysis Summary (2025-04-17)

Below is an integrated analysis of the reports and market data:

──────────────────────────────

MODEL REPORTS – KEY POINTS

• Grok/xAI – Price and moving averages on both 5‑min and daily charts are below key EMAs; RSI and MACD point to current bearish momentum. – Notable technical support at about 239.75 with resistance above near 242. – The options chain shows heavy put activity at the $240 strike (premium about 0.67), and max pain is at 245, although that level is less relevant for a near‐term (0DTE) trade. – Recommendation: Trade the TSLA $240 PUT at an ask of 0.67 at the open, aiming for roughly a 100% gain and using about a 50% loss as a stop.

• Gemini/Google – Technicals on short‐term and daily timeframes are mixed: the daily chart is clearly bearish while some 5‑min indicators hint at stabilization. – Conflicting signals (including the max pain pull toward 245 and falling VIX) result in not having a high‑conviction directional bias. – Conclusion: “No trade” is recommended today because the conflicting indicators raise the risk of getting whipsawed.

• Claude/Anthropic – Technical analysis on both 5‑min and daily confirms a moderately bearish bias (price well below major EMAs, RSI below 50). – However, one suggested trade was a TSLA $237.50 PUT at an extremely low premium (0.13) which seems less attractive given the preferred premium range. – In essence, the model sees downside potential but selected a strike a bit further out from the current price.

• Llama/Meta – A moderately bearish setup is noted, with the technical picture similar to the others on very short‐term charts. – However, the model also flags the influence of max pain at 245 and concludes that a naked call (for example, at the $240 or $242.50 strike) could profit if the upward “max pain pull” works in play. – Ultimately, this view contrasts with the put trades favored by others.

• DeepSeek – Confirms the overall technical picture: price is below key averages, with bearish momentum evident on both 5‑min and daily charts. – Emphasizes the high open interest on $240 puts and the near-term support at 239.75. – Recommends buying the TSLA $240 PUT at its 0.67 ask price for this weekly (0DTE) option. ────────────────────────────── 2. AREAS OF AGREEMENT AND DISAGREEMENT

Agreements: – Most reports note that TSLA is trading in a moderately bearish state with price below the relevant moving averages and key support levels near 239.75. – There is broad recognition that options activity is concentrated around the $240 strike—especially on the put side, where volume and open interest are very high, underscoring bearish positioning. – Technical indicators (RSI, MACD, Bollinger Bands) on short‑term and daily charts lean toward bearishness despite some very short‑term signals of stabilization.

Disagreements: – Gemini/Google sees too many conflicting signals (including the upward pull implied by max pain) and hence recommends no trade, while the majority of the other analysts view the setup as tradeable. – Llama/Meta is open to trading a naked call (capitalizing on the max pain influence) whereas Grok/xAI, DeepSeek, and to a lesser degree Claude/Anthropic advocate for a bearish put trade instead. ────────────────────────────── 3. CONCLUSION & TRADE RECOMMENDATION

Overall Market Direction Consensus: Most opinions point to a moderately bearish bias for TSLA on a near-term, 0DTE weekly horizon. Even though conflicting signals (like max pain toward 245 and some stabilization on very short timeframes) introduce uncertainty, the weight of the technicals and put side open interest lean toward downside pressure.

Recommended Trade: Trade a single‑leg, naked PUT (weekly option) on TSLA.

Trade Parameters: – Instrument: TSLA – Strategy: Buy a TSLA $240 PUT – Expiration: 2025‑04‑17 (weekly, 0DTE) – Premium: Approximately $0.67 per contract (slightly above the preferred range, but justified by high liquidity and clear technical support) – Entry Timing: At the open – Profit Target: Around 100% gain from the entry premium (i.e. exit near a $1.34 premium) – Stop‑Loss: Roughly a 50% loss at about $0.33 per contract – Confidence Level: Approximately 65% – Key Risks & Considerations: • The mixed signals (especially Gemini’s caution and the max pain theory) mean price could quickly reverse if TSLA rebounds near 245. • Very short‑term trading (0DTE) carries risks related to rapid time decay and volatility spikes. • A failure to break important support (around 239.75) would warrant an early exit. ────────────────────────────── 4. TRADE_DETAILS (JSON Format)

{ "instrument": "TSLA", "direction": "put", "strike": 240.0, "expiry": "2025-04-17", "confidence": 0.65, "profit_target": 1.34, "stop_loss": 0.33, "size": 1, "entry_price": 0.67, "entry_timing": "open" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

TESLA | Monthly Analysis After NASDAQ:TSLA hitting its ATH target, 87% - 90% retracement is next target

start of 2027 = will be a buying signal for tesla unless there's some issues involving with Elon Musk, then tesla could experience under performance

Long term investors - prepare for down side inside buying channel

Tesla Stock Goes 'Interesting', Ahead of Earnings CallTesla is preparing to release its fourth-quarter earnings report on January 29, 2025, and analysts are closely watching the stock as it approaches this key event.

Here are some important points regarding Tesla's current stock situation and what to expect:

Current Stock Performance

Tesla shares have seen a 10% increase in 2025, but recently experienced a more than 5% decline, trading at Monday's pre-marker below $400, approximately $395.

The stock's valuation is considered high, with some analysts stating it is "priced for perfection," indicating that any earnings miss could lead to a significant pullback.

Earnings Expectations

Analysts forecast earnings per share (EPS) of 72 cents and revenue of $27.23 billion for the fourth quarter.

Gross profit margins are expected to widen slightly to 18.85%.

Key Factors Influencing Stock Valuation

👉 Delivery Performance. Tesla's deliveries were slightly below expectations in 2024, with 1.79 million units delivered, compared to 1.81 million in 20231. Investors will be keenly interested in guidance for 2025, especially with increasing competition from Chinese manufacturers like BYD and NIO.

👉 New Vehicle Launches/ The anticipated launch of the smaller SUV, referred to as the Model Q, is expected later this year, which could impact Tesla's growth trajectory.

👉 Technological Developments. Progress in autonomous driving software and energy generation will also be focal points during the earnings call.

👉 The company aims to launch its Level 3 Full Self-Driving software in specific U.S. states and expand its energy storage business.

Analyst Sentiment

There is a mix of opinions among analysts; while some maintain a cautious stance due to potential delivery shortfalls and market competition, others see Tesla as a strong buy-and-hold investment for the long term.

The average price target among analysts is around $345.11, suggesting a potential downside from current levels.

Technical Sentiment

Technical graph indicates on epic upside channel breakthrough, as a result of China DeepSeek AI model influence.

Ahead of Tesla Earnings Call our "super-duper" Team is Bearishly calling to $300 per Tesla share, that is correspond to major current support of 125-day SMA.

Conclusion

As Tesla approaches its earnings report, investors should remain vigilant about delivery numbers and guidance for the upcoming year. The stock's high valuation combined with competitive pressures makes it susceptible to volatility based on the forthcoming financial results.

Tesla's Unhealthy Rise Could Correct Tesla's Unhealthy Rise Could Correct 🚨

Tesla has experienced a significant and rapid price rally recently, creating a potential imbalance in the market. However, this chart highlights a few key areas that traders should watch for potential corrections:

1️⃣ Gap Formation: A noticeable gap formed during the rally (highlighted on the chart). Gaps often act as magnets, and markets tend to revisit them over time. This suggests the possibility of Tesla retracing to this level.

2️⃣ Resistance Zone (~$420): The price is currently testing a resistance zone after the recent pullback. If Tesla fails to break and sustain above this level, it could trigger further bearish momentum.

3️⃣ Potential Targets:

First Target (~$360): If the bearish move begins, this level, marked as a prior area of support, could act as the next stopping point.

Second Target (~$316): A deeper correction could bring Tesla back to a more balanced price range, aligning with longer-term support zones.

Tesla ShortHere is my trade for a Tesla short. We don't usually get into stocks but this one didn't want to miss.

We hope that everyone had a great Christmas and enjoys the profit from this trade.

Please feel free to message me if you need some help, my name is Sarah, and I have been a professional trader for nearly 10 years. The drama you are going through, I completely understand

TESLA option play planFirst of all thanks to papa E and orange toasty for becoming besties, we getting the mad pump.

Second of all it was a reasonably easy bet to take. Why take 2x on vanilla trump vs harris when you can slap on some out of the money option calls? its a full win/lose bet but the options get you 5-10x average for this one.

Risk - Reward ratio is everything. If your taking the risk make sure the reward pays for it.

Putting this one down so I can reference going forward. Yeh we might go flat for few months.. or dump because of tarrifs and xyz blah blah,, but This is just the strong bull option which is the scenario im aiming to hopefully play.

Euphoria/blow off phases tend to have two main features

1. its velocity/momentum is faster than you think (its over before you know it; just when your getting really excited)

2. it tends to go higher than you thought

PE ratios, valuations etc are hinting at top energy here.

lets ride it and hopefully jump ship in time.

Tesla Are we pushing down to 249 or 241 ??? Good morning Trading Fam

A quick update with Tesla , we did not a see a break up into our buy zone and now a correction or more is in place to 249 or 241. However beware this is either a correction or a bigger move down which currently we need more info to figure out before we make that thesis.

Enjoy the video

Kris/ Mindbloome Trading

Trade What You See

TESLA – Slippery Slope to 208 or a Drop All the Way to 191?Alright, traders, here’s the lowdown on Tesla (TSLA). Things are looking a bit dicey as the price slips through key zones. If the bulls don’t step in soon, we could see TSLA sliding down to the 208-207 range (black box). But if that level doesn't hold, we’re in for a deeper pull toward the 191-188 zone (orange box).

Key Levels to Watch:

Current Price: 218

First Support: 208-207 (black box) – Bulls need to show up here, or it’s more downside.

Deeper Target: 191-188 (orange box) – If sellers keep control, this could be the next landing zone.

The sellers seem to have the upper hand for now, but a bounce from 208 could shift things in the bulls' favor. Keep an eye on lower time frames to catch any early signs of a reversal.

If this analysis helped you, drop your thoughts in the comments—do we hold 208, or are we heading for 191? Follow, share, and spread the word if you found this valuable. Stay tuned for more updates.

Mindbloome Trader

TESLA (TSLA) Plummets: Short Trade Hits Key TargetsTesla has shown a strong downward movement, breaking below key support levels. The entry point was established at 247.34, and since then, the price has declined rapidly, confirming the bearish momentum.

Key Levels

Entry: 247.34 – This level marked the beginning of the short trade as Tesla broke down below the Risological dotted trendline.

Stop-Loss (SL): 253.24 – Positioned slightly above the resistance formed by the recent highs, this level provides sufficient protection in case of a reversal.

Take Profit 1 (TP1): 240.03 – Already achieved, confirming the initial bearish move.

Take Profit 2 (TP2): 228.22 – The next level of profit where further downside pressure see sellers locking in profits.

Take Profit 3 (TP3): 216.40 – Tesla has reached this point, reflecting strong bearish momentum, possibly heading towards the final target.

Take Profit 4 (TP4): 209.10 – This is the final support level where the trade could conclude, given the sustained bearish sentiment.

Trend Analysis

Tesla has broken below both the Risological Dotted trendline (red line), indicating a solid downtrend.

The steep sell-off suggests the stock may continue its downward trajectory unless there is a strong reversal or news event that shifts market sentiment.

The bearish momentum is well in play for Tesla, and with TP3 already hit, the stock is moving towards the final profit target at 209.10

Tesla Weekly Analysis ? Bearish quite possibly Weekly: Tesla:

My thesis is if we continue bearish and break the pitchfork resistance at the 200 area we will then go down to 176 range which could possibly see some type of correction before continuing to head to our first goal which is 142.93 which then we could see a correction before heading further south.

The key here is with the bearish thesis is to make sure we break the 205 area , then 190 then go to 180 range first before this thesis becomes more true and evident to our lower targets.

Let me know what you think ?

MB Trader

Tesla is closing to resistance level, More Correction?Firstly, Tesla is closing to the downtrend line, which might be rejected to drop.

Secondly, the high volume candle shares the same level with this resistance area, double confirmed the importance of this resistance level.

So, in my opinion, it may go bullish after break above the resistance level.

$TSLA Powering down expected until we break the channel The chart is still showing a bearish trend with the price trading within a descending channel, indicating a consistent downtrend.

Key Levels:

- $200 Resistance:

The failure to reclaim and hold above $200 reinforces bearish sentiment.

- 0.618 Fibonacci Support at $165:

This level is the next major support within the current downtrend. A break below could lead to further declines.

- Target 1 ($165): Immediate support level, aligned with the 0.618 Fibonacci retracement.

- Target 2 ($100): A deeper support level and potential downside target if bearish momentum continues.

The price remains below the moving averages, further supporting the bearish outlook. NASDAQ:TSLA is likely to test the $165 level, with the potential for further decline towards $100 if the bearish trend persists. A bullish reversal would require a break above the descending channel and key resistance levels.

TSLA Bearish Trend with Key LevelsTechnical Overview:

- Support Levels:

Immediate support at $164 (61.8% Fibonacci retracement). Further support around $100.

- Resistance Levels:

Primary resistance near $260 (38.2% Fibonacci retracement).

- Moving Averages:

The daily 50MA is currently above the price, indicating a bearish sentiment.

- Volume Analysis:

Volume is relatively stable, but a decrease could indicate further bearish movement.

Outlook:

Tesla is currently within a descending channel, showing bearish tendencies. A breakdown below the $164 support could target $100.

Conclusion:

NASDAQ:TSLA current bearish trend suggests a potential move down to $100, with key support at $164. Watch for volume changes and price action at these levels.

Tesla bears be excited >> (-20%?) Tesla, come on, you just paid Elon musk so much money. What is exactly worth +50% in a month? In addition to what you see technically from what I outlined, I think the entire market is due for a correction. Given tesla's beta relative to the market, I anticipate at least 20% retracement from 260 towards 210 maybe 230. Ill be updating this as it changes.