Tesla Stock Gains After Musk Gets $30 Billion Award — What Now?Tesla board is hoping that the pile of shares would be enough to pin down the CEO and lock down his focus. But challenges are there. Here’s one — $30 billion might not be enough to keep Musk around.

💰 $30 Billion Retention Bonus

Tesla stock NASDAQ:TSLA is up about 4% since the start of the week after the board of directors handed Elon Musk a gift-wrapped, legally-contingent $30 billion stock package .

What’s inside? A cool 96 million shares — nearly enough to buy a small country or, at the very least, keep Musk’s wandering focus in the Tesla lane.

In a letter to shareholders, the board didn’t mince words: “We are confident that this award will incentivize Elon to remain at Tesla. Retaining Elon is more important than ever.” Translation: “Please don’t leave, here’s money.”

This isn’t just about stock awards or executive compensation. It’s about bringing back lost focus and whether the most famous CEO on the planet can be convinced to stop juggling a handful of companies and pay full attention (ok, more attention) to the one that’s public, highly volatile, and still kinda trying to figure out self-driving and robotaxis .

🎢 If the Stock Could Talk

The market’s response? Pretty bullish. Traders seem to like the idea of Musk staying inside the Tesla factory gates — or at least not moonlighting in so many side quests.

After all, Elon’s presence — erratic tweets, spontaneous product reveals, and all — is a core part of Tesla’s brand value. The stock has often behaved more like a crypto coin than a traditional automaker.

Musk already owns over 400 million shares, around 13% of Tesla, worth roughly $125 billion. But he’s gunning for more: his long-stated ambition is 25% voting control (equal to $250 billion in shares based on the current $1 trillion market valuation. This new package edges him closer to that goal. If he can’t own a country, a quarter of Tesla might do.

⚖️ A Legal Complication Worth $56 Billion

There’s one tiny footnote here: if Elon wins back his 2018 $56 billion pay package — the one struck down by a Delaware court — he might have to forfeit this new batch.

So yes, Tesla may have just given the richest man in the world a “Plan B” golden parachute. Or a “Plan A” depending on how Delaware judges are feeling when they decide on it.

🤖 AI, Robots, and Attention Deficits

Let’s not forget what lit the fire under this latest move. Back in January, Elon posted on X that he was “uncomfortable growing Tesla to be a leader in AI & robotics” without more control. It was a public shakedown — and apparently it worked.

Tesla’s ambitious AI goals — full self-driving software, Optimus the humanoid robot, and a suite of other sci-fi-sounding visions and promises — are largely tied to Musk’s personal involvement. Investors know that without him, these projects could end up shelved… or sold to xAI, his other pet project and owner of X (former Twitter).

🧮 The Math of Mega-Pay

Tesla says the accounting value of the package — after subtracting what Musk would have to pay to exercise the options and adjusting for restrictions — sits at about $23.7 billion. That's about the GDP of Malta and only slightly smaller than the SEC’s collective headache every time Musk tweets.

In return, Musk has to stick around for five years — or at least not officially leave. The board hopes that’s enough to keep him engaged. But the question is: How much is enough to counteract everything else going on?

The man’s worth $350 billion to $400 billion (depending on volatility) and if he wants to build Martian houses or dig tunnels under Paris, a few billion dollars aren’t going to make a difference.

🔀 A Shifting CEO, A Shaky Business?

It’s not just about Elon’s attention span. Tesla’s business hasn’t exactly been smooth sailing. The EV market is more crowded than ever. Sales are dropping in Europe. Tariff threats are buzzing in the background.

On top of that, it’s the earnings season and the Earnings calendar is hot to the touch. In recent quarters, Elon’s perceived absence from the factories have coincided with slumping revenue and nervous investors.

Add in the fact that Elon just exited the Trump administration after a brief stint and dramatic fallout — yes, that happened — and Tesla investors are understandably hoping for a little more focus in the months ahead. Not to mention his new Washington gig — his “America party” political party .

🚗 Is Tesla Still a Growth Story?

Tesla is still the largest EV maker in the US, but the shine has worn off a bit. The Cybertruck’s still not mainstream, Model 3s are getting old, and margins are being squeezed by global competition and pricing wars.

If Musk is serious about staying and building, this could be Tesla’s opportunity to pivot — from hype-driven volatility to sustained, AI-powered growth. But if not, well... there’s SpaceX. Or xAI. Or Neuralink. Or The Boring Company. Or the next startup he tweets into existence.

Off to you : Do you feel like Tesla is paying Elon to stay interested — or rewarding him for prior (and future?) performance. And is that the way to buy loyalty and dedication? Share your thoughts in the comments!

Teslastock

Tesla Shares (TSLA) Drop Following Earnings ReportTesla Shares (TSLA) Drop Following Earnings Report

Yesterday, after the close of the main trading session on the stock market, Tesla released its quarterly earnings report. While both earnings per share (EPS) and gross profit slightly exceeded analysts’ expectations, the results reflected a negative trend driven by declining sales. This decline is being influenced by intensifying competition from Chinese EV manufacturers as well as Elon Musk’s political activity.

According to Elon Musk:

→ The company is facing “a few tough quarters” due to the withdrawal of electric vehicle incentives in the US;

→ The more affordable Tesla model (mass production expected in the second half of 2025) will resemble the Model Y;

→ By the end of next year, Tesla's financials should become "highly compelling".

Tesla’s share price (TSLA) fell by approximately 4.5% in after-hours trading, clearly reflecting the market’s reaction to the report. Today, the stock is likely to open around the $317 level, down from over $330 just the day before.

Technical Analysis of TSLA Stock Chart

In our analysis of TSLA charts dated 2 July and 8 July, we outlined a scenario in which the stock price could form a broad contracting triangle, with its axis around the $317 level.

The new candlesticks that have appeared on the chart since then have reinforced the relevance of this triangle, as the price rebounded from the lower boundary (as indicated by the arrow) and headed towards the upper boundary. However, yesterday’s earnings report disrupted this upward move.

Thus, while the broader stock market is trending higher (with the S&P 500 reaching a historic high yesterday), TSLA may remain "stuck" in a consolidation phase, fluctuating around the $317 level—at least until new fundamental drivers shift market sentiment.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

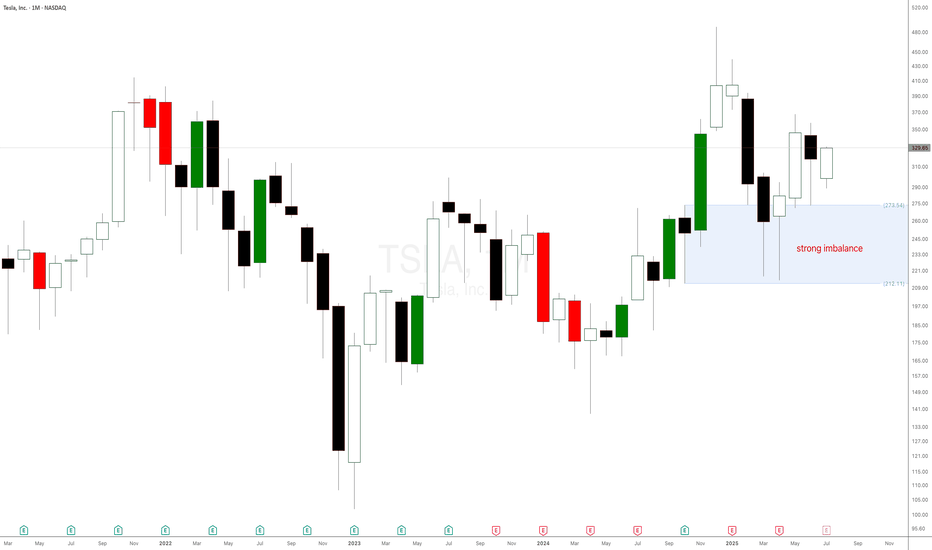

Don’t Listen to Elon Musk – Tesla Stock Chart Tells the REAL StoTesla Stock Set to Break Records: The Power of Monthly and Weekly Demand Imbalances at $273 and $298. Welcome back, traders! In today’s supply and demand breakdown, we’re diving deep into Tesla Inc. (NASDAQ: TSLA) — not from the noisy headlines or what Elon Musk just tweeted, but strictly from raw price action, demand imbalances, and the truth on the charts. Forget the fundamentals, forget the hype, because that’s already been priced in.

This is all about supply and demand, price action, and the power of patience.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

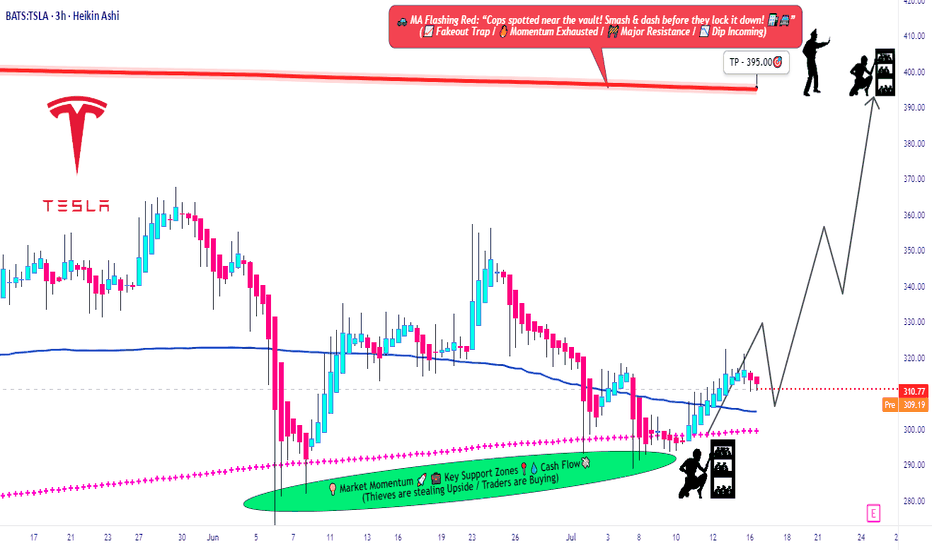

Tesla Bulls Assemble: It’s Time for a Clean Robbery🚨🔥TESLA STOCK ROBBERY BLUEPRINT: Thief Trading Heist Plan v2.0🔥🚨

(Swing & Day Traders, Scalpers — Welcome to the Ultimate Market Raid)

🌍 Greetings, Money Makers & Market Bandits!

Hola! Ola! Bonjour! Hallo! Marhaba! Salute from the global Thief Squad! 💰💸🕶️

Today, we’re unleashing a bold market raid on NASDAQ:TSLA (Tesla Inc.), using our signature Thief Trading Strategy™ — a fusion of technical precision, smart risk, and fundamental power. This is not your average trade idea — this is a robbery plan, tailor-made for those ready to outsmart the market with elite tactics.

🎯 The Mission: Steal the Bullish Breakout Before the Bears Wake Up!

Market Status:

Tesla is showing early signs of bullish strength — short-term consolidation with a potential breakout toward the upper red zone. However, that red zone is where the “Police” (resistance + short sellers) wait to ambush — so we enter with strategy, not emotion.

🟢 Entry Zone – "Vault is Open, Thieves Assemble!"

We’re looking for a long entry anywhere inside the most recent pullback zones (use 15m / 30m candles). Place layered buy-limit orders like a DCA thief stacking charges, targeting the swing low or support wick.

🔑 Pro Tip: Be patient. Let the pullback bless your orders. We rob smarter, not harder.

🛑 Stop Loss – "Escape Route Planned"

Stop Loss = Placed under swing low (3H TF). Current suggested SL: $280.00 (adjust for risk profile).

💬 Thief Note: Your SL depends on position size, number of entries, and account leverage. Never risk your life savings on one job. 😉

🎯 Target Zone – "The Big Loot"

Main Target 🎯: $395.00

Optional Exit: Trail your SL and escape early with bags full of gains. Exit before the trap if heat rises. 🔥

👀 Scalpers – "Fast Hands Get First Cash"

Stick to the long side only. Shorting this train is standing in front of a robbery truck. Use trailing SLs and grab those quick gains.

If you're a small account thief — no worries — ride with the swing crew. We share the loot.

📊 Why the Heist Now?

TSLA's move is supported by:

🔍 Fundamental strength & positive sentiment

🌐 Macro tailwinds & sector rotation favoring EV/Tech

🧠 Intermarket & index alignment

📰 Bullish outlook from recent positioning and COT data

🧨 Consolidation base forming an explosive setup

⚠️ Caution Tape – News Alert Zone

🚨Stay Clear of Major News Releases!

Avoid opening fresh entries during high-impact news. Use trailing SLs to protect your gains. Market heat can go nuclear — be alert, not emotional.

💖 Support the Heist – Smash That BOOST Button!

If you love this Thief Strategy, hit the BOOST 💥

Help us reach more robbers, dreamers, and money makers across TradingView. Let’s build the biggest, smartest, most strategic trading crew ever.

📌 Disclaimer (We're Thieves, Not Financial Advisors)

This is not financial advice — it’s a strategic idea shared for educational purposes. Adjust based on your own risk profile. Never enter a robbery without a plan. 🧠💼

🔥 Stay locked in. Another market heist blueprint is coming soon.

Until then — keep your charts clean, your entries smart, and your exits legendary.

💸Rob the Market — The Thief Way™

🐱👤🎯📈🚀

Tesla (TSLA) Leads Declines in the Equity MarketTesla (TSLA) Leads Declines in the Equity Market

Yesterday, President Trump announced that letters had been sent to the United States’ trading partners regarding the imposition of new tariffs — for instance, a 25% tariff on goods from Japan and South Korea. This marks a return to “trade diplomacy” under the America First strategy. The tariffs are scheduled to take effect on 1 August, though the date remains subject to revision.

As we highlighted yesterday, bearish signals had begun to emerge in the US equity market. In response to the fresh wave of tariff-related headlines, the major indices moved lower. Leading the decline — and posting the worst performance among S&P 500 constituents — were shares of Tesla (TSLA). The sell-off followed news of a new initiative by Elon Musk, who now appears serious about launching a political “America Party” to challenge both the Republicans and Democrats.

Trump criticised his former ally’s move on his Truth Social platform, and investors are increasingly concerned about the potential impact on Tesla’s business. Tesla shares (TSLA) fell by more than 6.5% yesterday, accompanied by a broad bearish gap.

Technical Analysis of Tesla (TSLA) Stock Chart

On 2 July, our technical outlook for TSLA anticipated the formation of a broad contracting triangle in the near term. Yesterday’s price action appears to confirm this scenario:

→ The sharp move highlighted the lower boundary of the triangle (marked in red);

→ The $317 level — where the previously rising channel (marked in blue) was broken — acted as resistance.

It is worth noting that during yesterday’s session, TSLA did not fall further following the gap down. In other words, the bears were unable to extend the sell-off, suggesting that the stock may attempt a recovery towards the $317 level. This area could potentially act as a central axis within the developing triangle pattern.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Musk-Trump Feud Sends Tesla (TSLA) Shares DownRenewed Feud Between Musk and Trump Drags Tesla (TSLA) Share Price Lower

The US Senate yesterday narrowly approved Trump’s so-called “big, beautiful budget bill.”

Elon Musk, who had previously criticised the bill for potentially adding $3.3 trillion to the national debt, warned that Republican lawmakers who supported it would face political consequences. In a post on X, Musk wrote:

“Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame! And they will lose their primary next year if it is the last thing I do on this Earth.”

He also reiterated his intention to establish a third political force under the name “America Party.”

In response, President Trump issued sharp threats:

→ to apply federal pressure on Musk’s companies by revisiting existing subsidies and government contracts (estimated by The Washington Post at $38 billion);

→ to deport Musk back to South Africa.

The market responded immediately to this renewed escalation in the Trump–Musk conflict. Tesla (TSLA) shares fell by over 5% yesterday, forming a significant bearish gap.

Technical Analysis of TSLA Stock Chart

Eight days ago, we analysed the TSLA price chart, continuing to observe price action within the context of an ascending channel (indicated in blue). At that point:

→ In mid-June, when the initial Musk–Trump tensions surfaced, TSLA managed to hold within the channel. However, as of yesterday, the price broke below the lower boundary, casting doubt on the sustainability of the uptrend that had been in place since March–April;

→ The price breached the lower channel limit near the $315 level — a zone that previously acted as support. This suggests that $315 may now serve as a resistance level.

As a result, optimism related to the late-June launch of Tesla’s robotaxi initiative has been eclipsed by concerns that the Musk–Trump confrontation may have broader implications.

If the former allies refrain from further escalation, TSLA may consolidate into a broadening contracting triangle (its upper boundary marked in red) in the near term, ahead of Tesla’s Q2 earnings release scheduled for 29 July.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tesla: Back on Track?Tesla has resumed downward momentum, aligning with our primary scenario and moving away from resistance at $373.04. As part of the ongoing turquoise wave 5, we expect continued selling pressure: it should break below the $215.01 support. This would complete magenta wave (3) of the current bearish impulse. A reversal back above $373.04 – and especially a breach of $405.54 – would force us to adopt the 38% likely alternative scenario. Under this count, the correction low of blue wave alt.(II) would be already in, and Tesla would now be rallying in wave alt.(III) .

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Launch of Robotaxi Service Boosts Tesla Share Price by Over 8%Launch of Robotaxi Service Boosts Tesla (TSLA) Share Price by Over 8%

As previously announced by Elon Musk, Tesla has launched its robotaxi service in Austin, Texas. The cost of a ride is $4.20.

The service is not yet fully operational. It is more of an extended testing phase, as access is currently by invitation only, and a Tesla employee may be present in the back seat.

Nevertheless, the market responded positively — Tesla (TSLA) shares rose by more than 8% (comparing the closing prices of daily candlesticks).

Technical Analysis of TSLA Share Price Chart

In our 11 June publication, we:

→ identified an ascending channel;

→ highlighted the May support level (marked with an arrow), suggesting it could act as resistance following a bearish breakout.

Since then:

→ the channel has remained relevant;

→ the aforementioned level acted as resistance but was broken by the bulls yesterday.

As a result, the TSLA share price has reached the median of the current ascending channel, where it may find equilibrium and form a consolidation zone once the initial positive reaction to the robotaxi launch subsides.

It is also worth noting the stock’s resilience following Elon Musk’s controversy with President Trump — the price has already risen more than 28% from the June low, indicating the potential for a scenario in which resistance at $365 is tested.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tesla Rolls Out Much-Awaited Robotaxis. Buy or Sell the Stock?They’re here. After years of tweets, teasers, and timelines that aged like unrefrigerated dairy, Tesla NASDAQ:TSLA officially launched its long-awaited robotaxi service in Austin, Texas.

The self-driving revolution, we were told, would arrive like a lightning bolt. Instead, it quietly rolled up to the curb with a safety monitor riding shotgun.

On Sunday, ( as promised ) a small, highly curated fleet of Teslas — fully driverless, but not entirely unsupervised — began picking up paying passengers in an isolated section of Austin. CEO Elon Musk, as usual, led the cheer squad, declaring victory on X.

“Super congratulations to the Tesla AI software and chip design teams on a successful robotaxi launch!! Both the AI chip and software teams were built from scratch within Tesla.”

Investors, naturally, perked up. Tesla shares edged higher by more than 5% Monday morning as Wall Street tried to figure out whether this was the long-awaited catalyst for another rally… or just another “sell-the-news” moment that fizzles as quickly as the hype fades.

🔔 The Soft Launch Heard Around The Internet

Let’s not get carried away. This wasn’t a citywide revolution. Tesla’s launch was extremely limited — more of a PR exercise than a true market rollout. Only a handful of Teslas were involved, operating in a tightly controlled, geofenced area.

The riders? Carefully selected influencers, many of whom were more excited to film TikToks than analyze technical driving capability. In other words, this wasn’t exactly New York City rush-hour stress testing.

The rides cost a flat fee of $4.20, because, of course they did. And while the cars drove themselves, safety monitors sat in the front passenger seats — a very human reminder that the project is still very much in beta mode.

The bigger question for investors: Does this prove Tesla’s technology is ready for prime time? Or is it simply an appetizer served years before the main course?

📈 The Market Reaction: Buy the Rumor, Sell the Launch?

Here’s where things get tricky for traders.

The stock market, as always, is forward-looking. Tesla stock didn’t just wake up bullish on Monday because of a few rides in Austin — it’s been rallying for months because of the promise of robotaxis.

Since Tesla’s big October 10 robotaxi event — where Musk laid out plans to launch a self-driving cab service in 2025 — shares have climbed roughly 35%. Much of that gain is already baked into expectations for Tesla finally delivering on what Musk has been promising since at least 2016.

Now that the product is technically “live,” even in tiny demo form, some traders are wondering: is this the start of an even bigger rally?

The answer probably depends on how fast Tesla can scale. And that’s where reality gets stickier.

🤔 The Scaling Problem: A Long Road Ahead

As exciting as Sunday’s launch may have been for influencers and Tesla superfans, it’s not exactly proof of scalability. Deploying 10 carefully monitored cars in a tiny slice of Austin is one thing; blanketing entire metro areas, or states, or countries is another beast entirely.

Tesla’s AI software may be improving, and its in-house chip design gives it some vertical integration advantages. But scaling fully autonomous fleets will require navigating a minefield of regulatory, safety, and logistical challenges — not to mention stiff competition.

Alphabet’s Waymo is already operating robotaxi services in Phoenix, San Francisco, and Los Angeles, with years of public road testing under its belt. Cruise (General Motors) ran its own driverless service before recently pausing operations after high-profile safety incidents. The technology arms race is fierce — and far from settled.

Industry experts continue to caution that mass-market robotaxis may take years — if not decades — to fully materialize. And while Tesla loves to move fast and break things, cities, regulators, and insurance companies tend to prefer a bit more caution when thousands of driverless vehicles are involved.

📝 What’s Actually Priced Into Tesla Stock?

Here’s where this gets existential for Tesla bulls.

A huge chunk of Tesla’s market valuation — some would argue most of it — now rests on the idea that it isn’t just a car company. It’s an AI company. A software company. A robotics company. A future robotaxi empire. If those narratives start to weaken, so does the multiple.

Tesla remains dominant in EV production and it still benefits from profit margins (about half of the profits coming from selling regulatory credits to other carmakers). But even Musk himself has made clear that Tesla’s long-term valuation depends heavily on successfully delivering robotaxis and humanoid robots.

If Sunday’s soft launch is the start of something truly scalable, then maybe the valuation holds up. If it stalls — either due to regulatory hurdles, technological ceilings, or public skepticism — the market may need to reevaluate just how much of Tesla’s price reflects reality versus dreams.

👀 Bottom Line: Revolutionary or Just Another Test Ride?

So, should you buy or sell Tesla after its long-awaited robotaxi debut?

That depends on how you frame this moment. The bulls see a trillion-dollar industry being born, with Tesla perfectly positioned. The bears see a carefully staged PR event masking how far away true autonomy still is.

For now, Tesla gets credit for being bold — even if it’s bold enough to roll out a very small, very managed test.

But markets eventually ask: “What’s next?” And unless Tesla can quickly scale from 10 cars in Austin to fully functioning fleets in major cities, a victory lap here could feel a little premature.

As always with Tesla: the story is thrilling, the stock is volatile, and the future is still very much under construction.

And with its earnings just around the corner — you’re following the earnings calendar , right? — things might just be getting exciting.

Off to you : Which side are on? The bullish traders looking to add to their long positions or the bearish sellers who’ve been calling “overvalued” for years? Share your thoughts in the comments!

Tesla (TSLA) Shares Rebound After Sharp DropTesla (TSLA) Shares Rebound After Sharp Drop

When analysing the Tesla (TSLA) stock price chart six days ago, on the morning of 5 June, we:

→ highlighted Elon Musk’s critical comments regarding the spending bill promoted by the US President;

→ noted that a potential rift between Musk and Trump could have long-term implications, including for TSLA shares;

→ outlined an ascending channel (marked in blue);

→ suggested that the price might correct from the upper to the lower boundary of the channel.

This scenario played out rather aggressively: later that same day, during the main trading session, Tesla’s share price dropped sharply to the lower boundary of the channel amid a scandal involving Musk and Trump.

However, the lower boundary of the channel predictably acted as support. Yesterday, TSLA shares were among the top five performers in the S&P 500 index (US SPX 500 mini on FXOpen), gaining around 5.6%.

As a result, TSLA stock price climbed back above the psychologically important $300 mark, recovering from the previous week’s sell-off.

Why Are Tesla (TSLA) Shares Rising?

Bullish drivers include:

→ The upcoming launch of Tesla’s robotaxi service, provisionally scheduled for 22 June. Elon Musk has stated he intends to use the service himself.

→ Easing of tensions with the US President. Donald Trump declared that he has no intention of "getting rid of Tesla or Starlink" should he return to the White House.

→ Continued support from Cathie Wood, the prominent asset manager, who once again reaffirmed her confidence in Tesla’s future success.

Technical Analysis of TSLA Chart

Today, TSLA’s share price is hovering near the median line of the previously identified ascending channel – a zone where supply and demand typically seek equilibrium.

Also worth noting is the $320 level: in May, it acted as support, which suggests it may now function as resistance.

Given these factors, it is reasonable to expect that the sharp recovery from the 5 June low may begin to lose momentum, with the price likely to stabilise and form a consolidation range following the recent spike in volatility.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tesla (TSLA) Shares Rebound on Musk’s CommentsTesla (TSLA) Shares Rebound on Musk’s Comments

According to media reports, speaking via video link at the Qatar Economic Forum, Elon Musk stated that he plans to:

→ remain Tesla’s CEO for another five years;

→ reduce his focus on politics, saying he feels he has already done enough;

→ increase his stake in the company from 12.5% to 25%.

These comments, which came alongside news that Tesla will begin testing robotaxis in Texas in June, sparked renewed interest in Tesla (TSLA) shares. TSLA stock outperformed other MAG7 members, climbing above the $353 mark at yesterday’s peak — its highest level since late February 2025.

Just ten days ago, when the price was still below the psychological $300 level, we highlighted TSLA’s strength following its rebound from the $220 support area and suggested a bullish outlook. But is the picture still as optimistic today?

Technical Analysis of TSLA Chart

The chart shows that TSLA is trading within an ascending channel (highlighted in blue), with the price currently near the upper boundary — an area that often acts as resistance. Price action supports this: note the two large candlesticks with closes near their lows (indicated by arrows), suggesting strong bearish pressure.

This gives reason to believe that sellers may take advantage of the roughly 22% rise in the TSLA stock price to lock in profits — a potentially bearish signal. Traders should therefore consider a correction scenario in which the local support at point Q could be tested for resilience.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tesla Stock Soars 60% in 4-Week Winning Streak. Should You Buy?With global trade tensions easing and the outlook clearing up a bit, especially with next month’s robotaxi launch, Tesla bulls are jumping right in to buy the dip and ride out a four-week rally. Is there more to that? Let’s find out.

Tesla NASDAQ:TSLA just pulled off a move most gym bros would call “bulking season.”

The stock is up 60% over the past month. That’s not a typo — it’s a full-on, pedal-to-the-metal rally that’s left shorts scrambling and bulls fist-pumping like it’s 2020 again.

In just four weeks, Elon Musk’s EV maker ripped higher with the kind of velocity typically reserved for SpaceX rockets or Dogecoin bonanzas.

But now that we’re at cruising altitude (and even dipped a little bit again first thing on Monday), the obvious question floats in: Should you still be buying this? Or is this just another one of the speculative dopamine-driven dead-cat bounces?

Let’s plug in, charge up, and break it down.

💡 From Earnings Letdown to Elon Euphoria

The move started innocently enough — with bad earnings. The first-quarter report disappointed Wall Street — revenue came in light. Margins shrank. Deliveries were meh. (Mandatory “keep an eye on the earnings calendar ” remark!) Most companies would’ve been punished after such a showing.

But Tesla is not like most companies.

Instead of spiraling, shares soared 18% the week after the report — because, surprise, Tesla said it will stick to its promises. The company reiterated plans for a lower-priced EV (a Tesla for the masses), and doubled down on its robotaxi rollout, the Cybercab, slated to launch in Austin, Texas, this June.

Cue the retail stampede.

Investors didn’t see a company in trouble. They saw a growth story still in motion, with enough Muskian magic to keep hope (and valuations) alive. Tesla didn’t need to crush numbers — it just had to convince traders it hadn’t stalled out.

Mission accomplished.

🤙 Macro Tailwinds and China’s “Chill Pill”

Tesla didn’t rally in a vacuum (though that sounds like an Elon side project). The broader market has been in risk-on mode lately , helped by:

Easing China–US trade tensions , which is great news for Tesla’s Shanghai Gigafactory and its global supply chain.

A less hawkish Fed narrative against the backdrop of cooling inflation , making growth stocks slightly less allergic to rising rates.

Renewed optimism around AI and automation, both of which Tesla has front-row seats to.

Tesla benefits from all of these themes. It’s not just a car company — it’s a tangled web of EVs, robotics, self-driving tech, and Elon’s very public moonshots. When macro winds are favorable, Tesla catches more than its fair share of breeze.

📊 Technically Speaking: Breakouts and Burnouts

From a chart perspective, the move has been textbook FOMO.

Tesla sliced through its 50-day, 100-day and 200-day moving averages like butter. Volume popped. Momentum soared. And it finally reclaimed the $300-350 zone that acted like a gravitational sinkhole for months. In other words, Tesla is back above the $1 trillion valuation handle.

Is there a flipside, though? The chart’s showing signs of overextension. RSI is flirting with overbought territory. Momentum is hot — but not sustainable forever.

That doesn’t mean you short it. It just means don’t chase it like it’s a Black Friday deal on dual monitor setup.

🔎 Valuation? Let’s (Not) Talk About That

Oh right, valuation. That inconvenient little thing.

Tesla is still trading at eye-watering multiples. Forward price-to-earnings (P/E) ratio? North of 170. Tesla’s profits peaked in 2022 and have since been tumbling. But who cares — compared to traditional automakers, Tesla is operating on a completely different planet.

Analysts are eyeballing earnings per share for 2025 to land at $3.30. Even if markets were to slap a 50x forward P/E ratio, it would give Tesla a valuation of $165 a share and still be at a premium.

And to be fair, bulls will say that’s exactly the point. Tesla isn’t a car company. It’s an AI platform with a vision for the future. An energy business. A robotaxi empire-in-waiting. Maybe even a sentient Mars colony someday.

So… the price doesn’t have to make sense — if you buy the vision.

But if you’re looking for fundamentals, well, they’re still catching up.

🚗 The Robotaxi Wildcard

Let’s talk robotaxis.

Tesla’s robotaxi launch next month could be a game-changer — or a meme. If it works, and the Cybercab is a success, even in a limited beta, it will validate one of Elon’s long-promised, never-quite-delivered moonshots . It opens the door to software revenue, recurring cash flows, and the holy grail of auto tech: mobility-as-a-service.

If it flops? Well, it won’t be the first time. But this time, the market has already priced in success.

That’s risky.

🧐 Should You Be Buying?

No one ever went broke taking profits. And if you rode this 60% move, pat yourself on the back and consider trimming. It doesn’t make you a bad long-term investor. It makes you a responsible one.

If you missed it? Don’t FOMO in at the top (but also — who’s to say that’s the top?). Tesla’s chart has looked like this before — only to collapse in a pile of overhyped press releases and supply chain “hiccups.” But if you see a pullback or at least some consolidation? Great trades are about patience, not hot takes.

❤️ Bottom Line

Tesla’s four-week tear is impressive. It’s got narrative fuel, technical follow-through, and macro support. But that doesn’t mean it’s an all-you-can-eat rally buffet.

Tesla is still a volatile beast with sky-high expectations and a CEO who can tank the stock with a tweet or an Oval Office speech. It’s also a company that might reinvent urban transport next quarter.

So what’s the play? Are you ramping up your long bets on the volatile EV stock or you're more of a waiting-for-the-pullback trader? Share your thoughts in the comments!

Tesla Shares (TSLA) Hit Two-Month HighTesla Shares (TSLA) Hit Two-Month High

During Friday’s trading session, Tesla shares briefly rose above the $300 mark — the first time in over two months. Although the daily candle closed below this key psychological level, TSLA still outperformed the broader stock market.

This move was supported by:

→ Investor approval of Elon Musk’s late-April pledge to spend less time on the Department of Government Efficiency (DOGE) and focus more on his role at the company.

→ A recent announcement from the Trump administration regarding a trade deal with the UK, alongside hints that more agreements may follow — potentially alluding to US-China negotiations.

Technical Analysis of TSLA Shares

In our previous analysis of TSLA’s stock price, we:

→ Highlighted the key support level around $220, which prevented deeper declines in early April even as broader indices saw more bearish trends;

→ Identified a descending channel (marked in red).

This channel remains relevant for now, but the price has already approached its upper boundary. It’s reasonable to assume that this level could act as resistance — similar to the midline of the channel (as indicated by arrows) — especially when reinforced by the psychological $300 level.

However, bulls may find strong support from any further details on a US-China trade deal (as discussed earlier today). A bullish breakout of the red channel in the coming days cannot be ruled out, potentially confirming the relative strength of TSLA stock and extending the trajectory marked by the blue lines.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tesla: More Room in Wave 4With the recent increases, TSLA approached the more significant local high from early April. Although we locate the price in a turquoise downtrend impulse, the internal corrective upward move of wave 4 still has some more room. With the following wave 5, the stock should then fall below the support at $215.01 to complete the magenta wave (3), which is also part of a downtrend impulse. Meanwhile, our alternative scenario suggests a much faster progression. We consider it 27% likely that with the low on April 7, the blue wave alt.(II) and thus the major corrective movement have already ended. In this case, the path would be clear for a new uptrend of the blue wave alt.(III), which would lead to increases above the resistance at $488.50. Primarily, however, we expect the corrective movement to conclude at a later time and at lower levels.

Tesla Suspends Guidance: Why Its Forecasts Were Often WrongTesla Pulls the Plug on Guidance: Why Its Forecasts Weren't Worth Much Anyway

Tesla, the electric vehicle behemoth that has captivated and often confounded investors for over a decade, has made another move guaranteed to stir debate: it's suspending its forward-looking guidance. For many companies, withdrawing financial forecasts signals significant uncertainty or a major strategic shift, often sending shares tumbling. While Tesla's stock undoubtedly reacts to such news, a deeper look reveals a compelling argument: Tesla's official guidance, particularly in recent years, had become such a moving target, so frequently untethered from eventual reality, that its predictive value was already deeply questionable. Suspending it might simply be acknowledging the obvious.

For years, Tesla's earnings calls and investor communications were punctuated by ambitious, often audacious, targets set by CEO Elon Musk and the company. These weren't just vague aspirations; they were often specific numbers for vehicle deliveries, production ramps, timelines for new technologies like Full Self-Driving (FSD), and launch dates for anticipated models like the Cybertruck or the Semi. The market, enthralled by Tesla's disruptive potential and Musk's charismatic pronouncements, frequently hung on these words, baking them into valuation models and trading strategies.

However, the history of Tesla meeting these self-imposed targets is, charitably speaking, inconsistent. The guidance often veered into the quixotic, reflecting a potent blend of extreme optimism, engineering ambition, and perhaps a dash of Musk's famed "reality distortion field."

Consider the infamous "production hell" of the Model 3 ramp-up. Initial targets were wildly optimistic, projecting volumes that the company struggled immensely to achieve, facing bottlenecks in battery production and assembly line automation. While Tesla eventually overcame these hurdles, the timeline and cost deviated significantly from early guidance. Similarly, the promise of Full Self-Driving has been a perennial "next year" phenomenon. While the capabilities of Tesla's Autopilot and FSD Beta have advanced significantly, the arrival of true Level 4 or 5 autonomy, capable of operating without driver supervision under virtually all conditions – as often implied by the timelines suggested in guidance – remains elusive, years behind schedules hinted at in past forecasts.

The Cybertruck provides another stark example. Unveiled in 2019 with a projected start date that came and went multiple times, its eventual, limited launch in late 2023 was years behind schedule, and scaling its unique manufacturing process remains a challenge. Guidance around its ramp-up has been adjusted repeatedly.

This pattern isn't necessarily born from deliberate deception, but rather from a confluence of factors inherent to Tesla's DNA and the volatile industries it operates in:

1. Aggressive Goal Setting: Musk is known for setting incredibly ambitious "stretch goals" intended to motivate teams to achieve breakthroughs. While effective internally, translating these aspirational targets directly into public financial guidance is fraught with risk.

2. Underestimation of Complexity: Bringing revolutionary products to mass market – whether it's a new vehicle platform, a complex software suite like FSD, or novel battery technology – involves navigating unforeseen engineering, manufacturing, supply chain, and regulatory hurdles. Initial guidance often seemed to underestimate these complexities.

3. Market Volatility: The EV market itself is dynamic. Consumer demand shifts, government incentives change, raw material costs fluctuate, and competition intensifies – all factors that can derail even well-laid plans and render guidance obsolete.

4. The "Musk Factor": Elon Musk's public statements, sometimes made spontaneously on social media or during earnings calls, often became de facto guidance, even if not formally enshrined. His optimism could inflate expectations beyond what the operational side of the business could reliably deliver on a set schedule.

Given this history, why did the market continue to pay such close attention? Part of it was the sheer scale of Tesla's ambition and its undeniable success in revolutionizing the automotive industry. Investors betting on disruption were often willing to overlook missed targets, focusing instead on the long-term vision. Past stock performance also created a feedback loop; as the stock soared despite missed guidance, it reinforced the idea that the specific numbers mattered less than the overall trajectory and narrative. Guidance served as a signal of intent and ambition, even if the execution timeline slipped.

However, the context has shifted dramatically. Tesla is no longer the lone wolf in a nascent EV market. Competition is fierce, particularly from Chinese automakers like BYD, but also from legacy manufacturers finally hitting their stride with compelling EV offerings. Global EV demand growth, while still present, has slowed from its previously exponential pace. Tesla itself has engaged in significant price cuts globally to maintain volume, putting pressure on its once-stellar automotive margins.

In this more challenging environment, the luxury of consistently missing ambitious targets wears thin. The decision to suspend guidance now can be interpreted in several ways:

• Pragmatic Realism: Management may genuinely lack visibility into near-term demand, production capabilities (especially with new models or processes), or the impact of macroeconomic factors. Suspending guidance is arguably more responsible than issuing forecasts they have low confidence in.

• Strategic Pivot: Tesla is increasingly emphasizing its future potential in AI, robotics (Optimus), and autonomous ride-sharing (Robotaxi). These ventures have even longer and more uncertain development timelines than vehicle production. Focusing investor attention away from quarterly delivery numbers might be part of a strategy to reframe the company's narrative around these future bets.

• Avoiding Accountability: A more cynical take is that suspending guidance removes a key benchmark against which management's performance can be judged, particularly during a period of slowing growth and heightened competition.

Regardless of the primary motivation, the practical implication for investors is clear: the already thin reed of Tesla's official guidance is now gone entirely. This forces a greater reliance on analyzing tangible results – actual deliveries, reported margins, cash flow generation, progress on FSD adoption rates, and demonstrable advancements in new ventures – rather than promises of future performance.

The suspension underscores that investing in Tesla requires a strong belief in its long-term vision and its ability to execute on extremely complex technological and manufacturing challenges, often without a clear, company-provided roadmap for the immediate future. The focus must shift from parsing guidance to meticulously evaluating performance, competitive positioning, and the plausibility of its next-generation bets.

In conclusion, Tesla's decision to stop issuing formal guidance is less of a shockwave and more of a formal acknowledgment of a long-standing reality. Its forecasts were often more aspirational than operational, reflecting a culture of ambitious goal-setting within a highly volatile industry. While the absence of guidance introduces a new layer of uncertainty, savvy investors likely already applied a significant discount factor to Tesla's projections. The company's future success now hinges more transparently than ever not on what it promises for tomorrow, but on what it demonstrably delivers today. The quixotic forecasts may be gone, but the fundamental challenge of execution remains.

Breaking: Tesla Up 6% In Premarket Albeit Q1 Profit Drops 71%Shares of Tesla (NASDAQ: NASDAQ:TSLA ) stock surged 6% in early premarket trading on Wednesday amidst missing expectation, Q1 profit drops 71%.

Tesla investors breathed a sigh of relief after CEO Elon Musk said he would refocus his attention on the electric automaker, but that promise did not entirely dispel worries that his right-wing shift had irrevocably damaged the company's image.

The automaker's shares (NASDAQ: NASDAQ:TSLA ), rose about 6.5% in premarket trading on Wednesday after Musk said he would cut back, opens new tab his work for U.S. President Donald Trump to a day or two per week from sometime next month after the automaker posted a 71% slump in net income and a sharp drop in automotive revenue.

Since hitting a record high in December, Shares of Tesla (NASDAQ: NASDAQ:TSLA ) have lost about half its value reducing its market capitalization by more than $500 billion, largely on concerns that brand damage could hurt sales for a second straight year.

Tesla said it will a review of its full-year delivery forecast amid shifting global trade policies in the second quarter earnings update, which is expected in July.

While Tesla is less likely to be affected by global tariffs than legacy automakers, it still expects an outsized impact on the fast-growing energy storage business that uses battery cells from China.

Technical Outlook

As of the time of writing, NASDAQ:TSLA shares are up 6.5% in premarket trading. The asset is undergoing a bullish reversal pattern after bouncing off from the critical support point of $218.

TSLA shares are aiming for a 118% surge should the asset break the key Fibonacci levels highlighted on the chart. With the last trading session's RSI at 46, NASDAQ:TSLA is well primed for a bullish campaign since consolidating late December, 2024 losing almost 56% of value, TSLA shares are looking to capitalize on that.

Tesla LongTesla Long Analysis

Tesla (TSLA) currently presents potential long opportunities near key support zones at $194 and $186. These levels align with historical demand zones and provide a favorable risk-to-reward setup for bullish trades.

Key Analysis:

Support Levels:

$194: A critical zone where buying activity has previously increased, indicating strong institutional interest.

$186: A lower support level that historically acts as a buffer against further downside.

Technical Indicators:

A confluence of moving averages and trendline support near these zones bolsters their significance.

Catalysts:

Upcoming earnings or positive developments in Tesla’s production or delivery numbers could act as bullish triggers.

General market sentiment and Nasdaq trends will also play a role in TSLA's price action.

Strategy:

Entry: Long positions near $194 and $186 with stop-losses below respective levels.

Target: First target around $240 and extended target near $350, depending on momentum.

This setup provides an opportunity for scalpers and swing traders to capitalize on Tesla’s volatility with managed risk.

$TSLA Sales Slump but is Support Near?Is Tesla ( NASDAQ:TSLA ) facing a sales slump and an overpriced valuation? In this video, we dive into the latest Tesla stock analysis, starting with the declining sales numbers and why the current valuation might be raising red flags for investors. We then break down the weekly chart, spotlighting a potential breakdown retest as NASDAQ:TSLA price nears key support levels around the 243 weekly SMA. What was once resistance could now flip to support—find out how! Zooming into the daily chart, we explore the 280 price level where the 200 SMA is and outline a possible 5-wave pattern completing at 243, followed by a correction toward Goldman Sachs’ 320 target and Bank of America’s 380 forecast. But could a deeper drop to 200 be on the horizon? Get the full technical analysis, price targets, and insights to navigate NASDAQ:TSLA ’s next move in this must-watch stock market update!

Tesla Stock $TSLA monthly imbalance. Bullish price action to buyTesla Stock NASDAQ:TSLA monthly imbalance at $273 has taken control. Bullish price action to buy shares of Tesla stock. Expecting a decent reaction for this stock in the following days. You can use smaller timeframe stock strategies, bullish option strategies and intraday stock strategies to trade this imbalance.

TESLA SWING LONG IDEA - TSLA We had a great run on Tesla after Trump's election, which boosted the idea of Robotaxi and green earnings over time.

If you follow me on X, you would know that I have been buying Tesla since the $204 level (August 5th crash). We had a great run from there to $490.

Currently, we have seen a 33% retracement from the top.

The price hit the weekly demand zone and showed a strong rejection there (forming a weekly dragonfly doji).

I have started to build a swing position from this level to ride Tesla to new all-time highs.

The first challenge will be the bearish trendline that has been driving the bearish trend since December 18th. Breaking that trendline should lead to new highs, in my opinion.

If the price breaks and closes below $300 on the daily chart, it will invalidate my setup, and I will look to exit the position.

Analyzing Tesla (TSLA) Weekly Chart: Key Observations and TrendsFrom the weekly chart shared, Tesla (TSLA) has recently shown intriguing price action, with some potential bearish signals emerging. Here’s a breakdown of what the chart suggests and what it could mean for the stock’s direction moving forward.

Key Observations:

1. Strong Uptrend with a Pullback

Tesla has experienced a significant rally, moving well above its key moving averages. However, the recent price action suggests a pullback from the high near $488, which could signal consolidation or the beginning of a deeper correction.

2. Short-Term Bearish Indicators

▷ The latest weekly candle reflects selling pressure, hinting at potential downside in the short term.

▷ There’s visible resistance near $488, which could act as a potential short-term top unless the price breaks above this level.

3. Support Levels to Watch

Several key support zones are apparent on the chart:

▷ $375-$380: Aligns with the short-term moving average and could act as the first line of defense.

▷ $330-$350: A strong zone of support near the medium-term moving average.

▷ $300-$310: A major psychological level and close to the longer-term moving average, which is critical for the broader bullish trend.

Potential Descending Triangle Formation

On closer inspection, the chart hints at a potential descending triangle, which is a bearish pattern. This is characterized by:

▷ Flat Support at $400: The price seems to be testing this level repeatedly.

▷ Lower Highs: After reaching the $488 high, the stock is forming a series of lower highs, signaling weakening momentum.

If the pattern plays out, a breakdown below $400 could trigger further downside. Using the triangle’s height (approximately $88), the target could be around $312-$325, aligning with a strong support zone.

Risks if $300 Support Breaks

While $300 is a key support level, a breach below this level could lead to a spiral of selling pressure . This would put Tesla’s stock in a vulnerable position, potentially targeting much lower levels. The $300 mark represents a major psychological and technical zone, so a breakdown here could significantly damage market sentiment.

If this occurs, Tesla could spiral into a more pronounced downtrend, with no clear bottom in sight until it stabilizes at significantly lower levels, potentially revisiting areas around $250 or lower.

What to Watch For:

1. Confirmation of the Bearish Triangle

▷ A break below the $400 level with high volume would confirm the descending triangle and suggest further downside.

2.Invalidation

▷ A breakout above the descending trendline (lower highs) would invalidate the bearish scenario, signaling renewed bullish momentum.

Final Thoughts:

While Tesla remains in an overall uptrend, the short-term bearish signals and the potential descending triangle formation suggest caution. If the $400 support level holds, it could lead to consolidation or a bounce. However, a breakdown below this level could accelerate the decline toward key support zones around $312-$325.

If $300 fails to hold, the stock could spiral out of control, triggering panic selling and pushing prices toward much lower levels. Traders and investors should monitor these critical levels closely and plan their strategies accordingly.