USOIL 1HR // 03 April 2025 AnalysisWe can see a small uptrend forming on the 1 hour timeframe.

Let's see how the price reacts around the trendline and the marked are of support and resistance.

Potential buys if we get a rejection from both the trendline and marked area of support/resistance.

Alternatively, if the price breaks through the area of support and resistance and the trendline, we can wait for a break and retest for potential sells.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

Thebrowntrader

NZD/JPY 1D // 18 March 2025 AnalysisWe can see the price approaching the downtrend on NZD/JPY on the daily timeframe.

Looking to see how the price reacts to the marked area of resistance around the 86.500 area and the trendline.

Potential swing sell situation with a target around the 83.826 area.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

NAS100 1HR // 17 March AnalysisWe can see that the 1 hour downtrend on NAS100 has been broken.

Looking to see if the price can retest the drawn support/resistance zone around the 19500.00 area. Potential buys with 20000.00 being a nice target if we see a nice retest from the marked support/resistance zone.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

US30 1HR // 17 March AnalysisWe can see that BLACKBULL:US30 is in a downtrend on the 1HR timeframe.

The price is near the our trendline and has touched our area of resistance around the 41500.00 once. Looking for the price to approach the area of resistance as well as trendline and show a good rejection for potential sells.

A good target would be the 40750.00 area.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

S&P500 4HR // 17 March 2025 AnalysisWe can see the S&P500 going into a downtrend.

Waiting to see what the price does when it reached the trendline and the marked support/resistance zone around the 5750.00 area.

Potential sells if we can get a good rejection off the area as well as the trendline. A good target would be the 5500.00 area.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

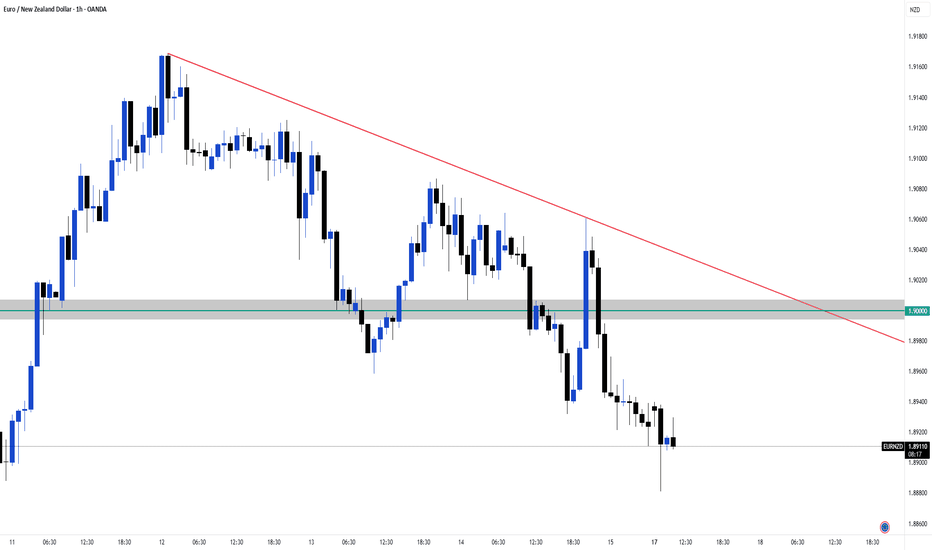

EUR/NZD 1HR // 17 March 2025 AnalysisEUR/NZD has been in an uptrend for quite a while now and we can see a small downtrend form on the 1HR timeframe.

Waiting to see how price reacts to the trendline and the support/resistance zone drawn around the 1.9000 psychological price area.

Looking for potential sells if we get a good rejection from the area as well as the trend line and could look for potential long term swing targets.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

BTC/USD 4HR // 17 March AnalysisBTC/USD is forming a downtrend on the 4HR timeframe.

We can wait and see if the price reached the trendline and how it reacts to it and the resistance zone marked.

We can look for potential sells if we get a good rejection from the area.

Long term target would be between the 72500 and 70000 area as previous strong level of support/resistance.

CAD/CHF 1HR // 17 March AnalysisWe can see the downtrend on CAD/CHF being broken on the 1 hour timeframe.

The price did respect the trendline and the marked resistance zone previously but ended up breaking it.

We can look for potential buys if the price breaks through the red support/resistance area. We may see price play between the two areas before giving us an indication the direction.

A good target for buys would be around the 0.62150 area.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

USOIL 1HR // 16 March AnalysisUSOIL has been in a downtrend.

With this trendline forming and the price nearing the trendline, we can look for potential sells.

The price has been resisting the 68.00 area, we can wait and see how it reacts to the trendline.

potential sells if we can see a good rejection from the trendline as well as the resistance zone. A good target would be near the 65.00 price area.

USD/CHF 1HR // 16 March Analysis We can see a potential downtrend on USD/CHF on the 1 hour timeframe.

2 resistance zones have been identified, depending on how the market moves in the coming week and around which area the price touches the trend line, we can look for potential sells around the resistance zones if we can get a good rejection.

A good target could be the 0.87500 zone marked.

AUD/JPY 1D // 27 July 2024 AnalysisWe can see that AUD/JPY has been on an uptrend on the daily timeframe.

If the price rejects from the trendline as well as the area of support/resistance marked, we can look for potential buys.

The 97.500 level has also been marked on the chart as it is an important level.

EUR/USD 4HR // 18 July 2024 AnalysisEUR/USD has a beautiful downtrend setting up on the 4HR timeframe.

We can see that the price is moving towards the trendline.

If the price touches the trendline and shows us a good rejection from the the trendline as well as the area of support/resistance marked, we can look for potential sells.

A good area to target in the long run would be the 1.07500 area.

EUR/CAD 1HR // 09 July 2024 AnalysisEUR/CAD has given us another opportunity, looking at the 1HR timeframe, we can see a downtrend with 2 previous touches and a third touch.

Price has also rejected from the marked area of support/resistance.

A good target would be around the 1.4700 area.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

EUR/NZD 4HR // 09 July 2024 AnalysisEUR/NZD currently has a downtrend setting up with 3 previous touches on the trendline and another one with a sweet rejection from both the marked area of support/resistance as well as the trendline.

Confirming a good rejection on a lower timeframe, we can look for potential sells, a good target would be around the 1.75000 area.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

US OIL 1D // 02 July 2024 AnalysisWe can see a beautiful downtrend for USOIL on the daily timeframe.

The price is currently at our area of support/resistance which is marked around the 84.00 area.

For possible sells would like to see a good rejection from the marked area. A good target would be the previous swing low around the 73.00 price area.

USD/CHF 4HR // 02 July 2024 AnalysisWe can see a beautiful downtrend for USD/CHF on the 4HR timeframe.

The price is currently at our area of support/resistance which is marked.

For possible sells would like to see a good rejection from the marked area. A good target would be the previous swing low around the 0.88400 price area.

CAD/CHF 1D // 04 July 2024 AnalysisCAD/CHF has been in a downtrend for quite a while now.

We can see that the price is approaching the trendline again, with an area of support/resistance marked.

If the price resects the trendline and shows us a good rejection from the trendline as well as the area, we can look for sells.

A good first target can be the area around 0.65510 price.

I will be sharing another idea for the same by zooming into the current price and support/resistance area as this map is quite zoomed out.

EUR/CAD 1D // 02 July 2024 AnalysisLooking at the daily chart on EUR/CAD, we can see that the previous uptrend had been broken.

Currently the price has come back tpo retest the trendline and we can see a good rejection from the trendline as well as the quarter price level of 1.47500.

Good selling opportunity here.

AUD/CAD 1HR // 08 July 2024 Analysis In the zoomed in picture we can see that the price approached the trendline and has started rejecting from it.

Let's see if it completely rejects our marked area of support and resistance too.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

AUD/CAD 1D // 08 July 2024 AnalysisWe can see a beautiful downtrend on AUD/CAD on the daily timeframe.

The price has just approached the trendline and is in our marked area of support/resistance.

A long term good sell opportunity can be seen if price respects and rejects from the trendline as well as the marked area.

A good target would be the 0.90600 area.

Another chart with the area zoomed in will be posted for reference.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.