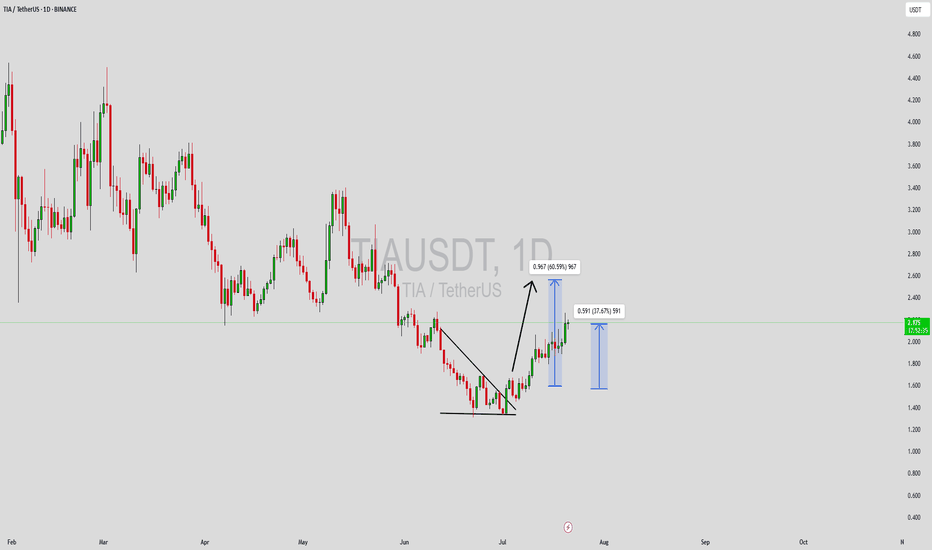

TIAUSDT Forming Falling WedgeTIAUSDT has recently shown a bullish breakout from a falling wedge structure on the daily timeframe—a pattern known for its strong reversal signals. This move is supported by rising trading volume, signaling fresh momentum entering the market. With current price action pushing higher, the short-term upside potential targets lie around the 50% to 60% gain zone, which aligns well with past resistance levels marked on the chart. This upward shift also breaks the series of lower highs that previously dominated the chart, suggesting a confirmed trend reversal.

From a broader perspective, TIA has built strong fundamentals as part of the Cosmos ecosystem, which gives it significant long-term value potential. The recent surge in price has been accompanied by increased community activity and mentions across social media platforms, which may indicate growing investor sentiment and renewed project interest. The consolidation phase appears to have ended, and TIA is now pushing for a sustained bullish leg.

Market participants should keep an eye on support retests and breakout validations as the rally progresses. The measured target after this wedge breakout puts TIA in a good position for a strong Q3 performance. With macro tailwinds favoring altcoins and mid-cap blockchain projects regaining traction, TIA could be setting up for an extended upward move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Tiausdtperp

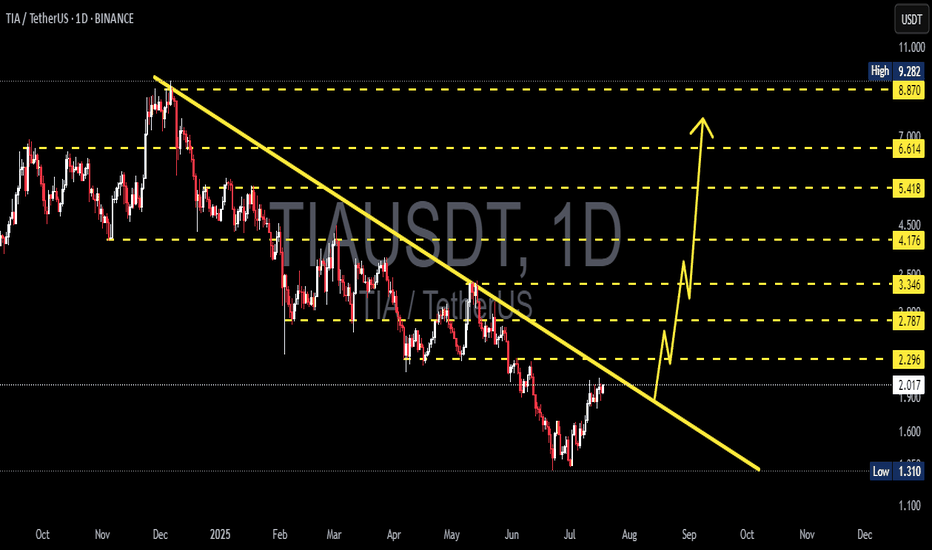

TIA/USDT – Major Breakout Incoming? Reversal in Sight!🔍 Full Technical Analysis (1D Timeframe):

TIA/USDT is approaching a critical turning point after experiencing a strong downtrend since December 2024. The chart clearly forms a Falling Wedge pattern — a classic bullish reversal signal known for explosive breakouts when confirmed.

Currently, the price is testing a key confluence zone around $2.00 – $2.30, where:

A major horizontal resistance meets

A long-term descending trendline (yellow), acting as dynamic resistance since the last local high.

🚀 Bullish Scenario (Confirmed Breakout):

If TIA successfully breaks and closes above the $2.30 – $2.78 range with strong volume, it could trigger a major mid-term rally. The potential upside targets are aligned with previous structural resistance levels:

Target Resistance Level

🎯 Target 1 $3.34

🎯 Target 2 $4.17

🎯 Target 3 $5.41

🎯 Target 4 $6.61

🎯 Target 5 (Extended) $8.87 – $9.28 (Major Weekly Supply Zone)

✅ Additional Bullish Confirmation: A volume breakout + RSI moving into the 50–70 zone would strengthen the bullish case.

🛑 Bearish Scenario (Fake Breakout Risk):

If the price gets rejected again from the descending trendline and fails to close above $2.00, the bearish pressure may push the price back toward key demand zones:

First support zone: $1.60

Last major defense: $1.31 (the current swing low)

This could lead to a double bottom structure before any meaningful trend reversal happens.

📐 Pattern Breakdown:

Pattern: Falling Wedge Breakout Pattern

Duration: Over 7 months of consolidation below trendline

Risk-to-Reward Potential: Highly favorable if breakout is confirmed

🧠 Market Sentiment:

Many altcoins are showing early signs of bottoming out and accumulation.

TIA could become a breakout leader in the next wave if it clears the current resistance cluster.

Expect momentum traders to join in once a solid bullish candle closes above the wedge.

✅ Conclusion:

TIA/USDT is at a technically golden level. A breakout from this falling wedge structure could ignite a multi-stage rally. However, caution is advised: wait for a confirmed breakout and manage risk in case of a failed breakout attempt.

#TIAUSDT #CryptoBreakout #FallingWedge #AltcoinRally #ReversalPattern #BreakoutTrade #CryptoTA #MomentumTrade #Altseason #TechnicalAnalysis #CryptoSignals

TIA/USDT – Potential Reversal After Channel BreakTIA has broken out of a long-standing descending channel on the 4H timeframe, signaling a possible trend reversal. The price is attempting to flip structure, and bullish momentum is building.

Structure:

Clear descending channel breakout

Retest of upper trendline underway

RSI back above 50, showing recovery

Setup:

Entry: On successful retest of the breakout zone near 1.50–1.55

Stop Loss: Below 1.43

Target Levels:

1.67, 1.83, 2.25 until 2.95

This setup looks promising if the price holds above the trendline. Watch closely for volume confirmation and follow-through.

DYOR. Not financial advice

#TIA #Altcoin

TIAUSDT Forming Descending TriangleTIAUSDT is gaining attention as traders and investors look for fresh opportunities in the altcoin market. With good volume backing recent moves, this crypto pair shows promising potential for a 40% to 50%+ gain in the near term. Although there’s no specific pattern visible right now, the price action suggests that TIA could be entering an accumulation phase before its next leg up. As the market sentiment for altcoins improves, TIAUSDT is likely to benefit from renewed buying interest.

Celestia (TIA) is a modular blockchain project designed to tackle scalability and customization in the crypto space. Its unique architecture allows developers to deploy their own blockchains with ease, making it a key player in the next generation of decentralized applications. This innovation, combined with growing community support, is a positive fundamental catalyst for the TIA token, which could translate into solid price action in the coming weeks.

Technical traders are closely watching support and resistance levels to catch the next breakout move. The increasing trading volume and investor interest are strong signals that a significant move could be on the horizon. Keeping an eye on upcoming project milestones, network upgrades, or partnership announcements could help you stay ahead of the curve and position yourself for the anticipated 40% to 50% gain.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Celestia TIA price analysis#TIA price currently looks “weak,” gradually sliding down and updating lows.

A “ray of hope” may be a repeat of the fractal behavior of the OKX:TIAUSDT price from last year, when, after the third slight update of the low, the price began to rebound upward.

If we take this fractal as a basis, then in the near future, the price of the #Celestia token should rebound to $4, followed by a correction and continued growth to $5.55.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

TIA/USDT – Trendline breakout watchTIA/USDT – Trendline breakout watch

TIA has broken above the descending trendline, indicating a potential shift in momentum. If the price manages to hold above the breakout zone with stability, we can expect a bullish move ahead.

A successful retest and hold above the trendline could trigger a pump of around 15–30% in the coming sessions.

Key levels to watch:

* Breakout support zone

* Confirmation with volume

* Immediate resistance ahead

Monitor closely — holding the breakout could open the door for a solid upside move.

$TIA pullback looks healthy for next leg up !!LSE:TIA is retesting the breakout zone perfectly

After a clean breakout from the falling wedge structure, the price is now pulling back into the key demand area.

I expect this zone to hold and if it does, we could see a strong move toward $5+ in the coming days.

Keep a close eye on this level, the next move could be explosive! 🚀

Like & Retweet if you're bullish!

#TIA #CRYPTOMOJO_TA

TIAUSDT — 2025 Technical RoadmapTIAUSDT — Daily Technical Roadmap

🕞 60-Second Read

Trend on the 1-D chart is still structurally bearish ; price (spot 2.865 USDT) just carved a higher-low off the 2.44 vector block and is knocking on the Yearly BC lid. Two large upside voids now beckon.

Hot-Zone #1 – 2.60 → 2.44 (1 D + 4 H vector demand): stacked fresh liquidity, 9-15 % under spot.

Hot-Zone #2 – 2.985 (Yearly BC): first breaker & range cap, only 4 % above; a daily close above here opens the air-pocket to 4.27.

Hot-Zone #3 – 4.932 → 6.947 (Yearly Pivot ↔ Yearly TC): macro supply shelf guarding a 72-142 % rally window.

💧 Liquidity & Imbalance

Daily vector 7.85 (77 % fill-rate inside 60 d).

Stacked 4 H vectors 9.86 / 9.83 = 2.5 % supply shelf.

Demand stack 2.69 – 2.44 only 18 d old.

⚡ Volatility & Momentum

GMMA Z-Score curling up from −2 σ; short ribbons still under long ribbons – suggests pause, not reversal.

🎲 Probability Dashboard

HTF Structure −3

Liquidity voids +1

Momentum −1

Vol-regime 0

Bear / Neutral / Bull ≈ 42 % / 33 % / 25 %

📈 Trade Playbook

Strategy 1

1. Layered Limit Grid – Aggressive Counter-Trend Long

Entry layers (size %):

2.60 – 40 % of your allocated TIAUSDT size

2.44 – 30 %

2.05 – 20 %

1.90 – 10 %

SL = 1.75 (≈ 1 ATR below extreme demand)

TP ladder:

2.985 – 25 % off-load

3.722 – 25 %

4.932 – 25 %

6.947 – 15 %

7.849 – 10 %

Weighted R:R ≈ 4.3

Strategy 2

2. Layered Limit Grid – Conservative Breakout Long

Trigger: daily close > 3.722 (Yearly Low reclaim), then place grid orders.

Entry layers (size %):

3.75 – 40 %

3.55 – 30 %

3.25 – 20 %

2.985 – 10 %

SL = 2.70

TP ladder:

4.932 – 30 %

6.947 – 30 %

7.849 – 20 %

9.860 – 15 %

12.432 – 5 %

Weighted R:R ≈ 3.8

⚠️ Risk Radar

Low-float token – slippage risk on size.

Macro event: FOMC 1 May → volatility spike possible.

BTC options IV rising – spill-over risk to alts.

Price must conquer 2.985 to open the upside magnet trail toward 4.27 → 4.93. Failure keeps 2.60 → 1.90 demand stack in play before any durable markup.

Not financial advice – do your own research & manage risk.

#TIA/USDT#TIA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.18.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 2.27

First target: 2.36

Second target: 2.42

Third target: 2.53

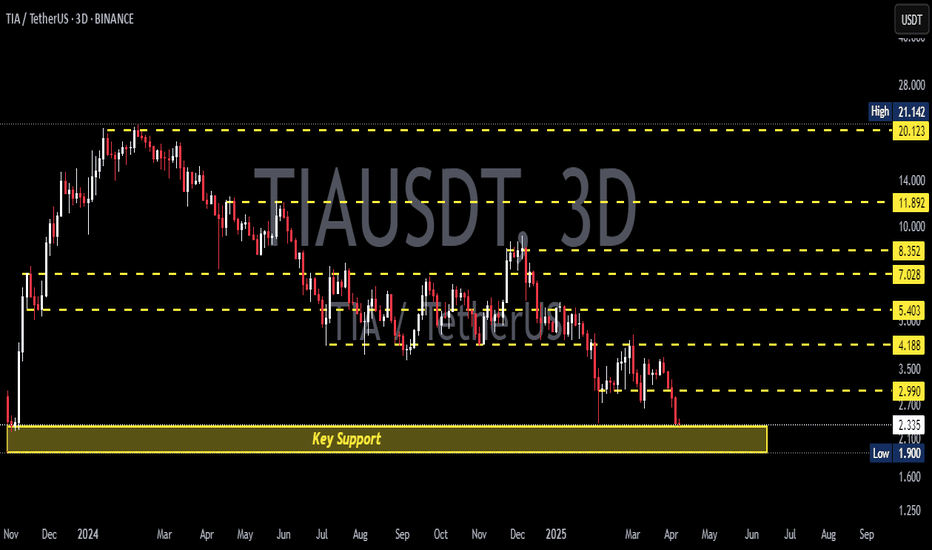

TIAUSDT Bottoming Out?TIAUSDT Technical analysis update

TIAUSDT has been trading within the longest descending channel. The price has once again touched the channel support and also retested the November 2023 support level or bottom. A strong bounce from this zone is likely, and we could potentially see a 100–150% move from the current level.

Is TIA About to Break Down Hard? Traders Beware Before It’s lateYello, Paradisers! Did you catch the recent bullish rally on #TIAUSDT? It’s been delivering solid gains over the past couple of days, giving traders reason to celebrate. But what if we told you that this rally might just be setting up a classic trap—one that smart money is already preparing to take advantage of? The technical structure forming right now suggests a high probability of a reversal, and if you’re not paying attention, you might end up on the wrong side of the move.

💎#TIAUSDT, at the core of setup is a developing a probable Bearish Gartley pattern. These harmonic structures are rare but extremely powerful when they align with multiple technical confirmations and that’s exactly what we’re seeing here. With the recent move upward, TIAUSDT appears to have completed its C leg, a critical part of the Gartley structure. This sets the stage for the D leg, which typically completes much lower. The price reacted strongly from the C leg area, which also happens to line up perfectly with a previous local high adding even more probability to the resistance at that zone.

💎This resistance isn't just horizontal there's a dynamic element at play as well. The 21-period EMA on multiple timeframes is currently acting as a ceiling for price action. When a key moving average starts rejecting price repeatedly, it often signals that the current trend is losing steam and this dynamic resistance only strengthens the case for a downside move from here.

💎Looking deeper, the bearish signs are confirmed by momentum indicators. The RSI on lower timeframes is not only overbought but also showing clear signs of bearish divergence. This divergence occurs when the price continues to make higher highs while RSI starts forming lower highs a classic sign that momentum is weakening. It’s one of the more reliable early warnings that a reversal may be near. In this case, RSI is flashing that warning now, suggesting that buyers may soon run out of fuel.

💎If this bearish probable scenario plays out as expected, the first key level to watch on the downside sits around the 3.278 zone. This minor support may offer a temporary bounce, but if the D leg of the Gartley is to be completed, we could see even deeper price action. This makes the current area extremely sensitive—any weakness from bulls could trigger a fast move downward.

💎However, no pattern is complete without an invalidation level, and for the Bearish Gartley, that comes in around the 3.805 resistance zone. A strong, sustained close above this level would invalidate the bearish setup and signal renewed bullish momentum. Until then, all technical signals are pointing toward caution, especially for those still riding long positions without a tight risk plan.

Stay alert, Paradisers. The market is about to decide. This is a textbook moment where emotions can take over, and late buyers get punished for chasing green candles. That’s why, we are playing it safe right now. If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest probability trading opportunities.

MyCryptoParadise

iFeel the success🌴

TIAUSDT – Weak at Key Weekly Level! More Downside Ahead?TIAUSDT – Weak at Key Weekly Level! More Downside Ahead?

“This chart looks weak—momentum favors the downside. But is there a bounce first?”

🔥 Key Insights:

✅ Sitting at a Critical Weekly Zone – A breakdown here could be brutal.

✅ Momentum Looks Bearish – No real strength from buyers.

✅ Only Considering Low-Risk Buys – Fibonacci Green Zone (0-0.5) is the ideal cheap area.

💡 The Smart Plan:

Looking for a Break & Retest Downward – If support cracks, shorts become clear.

Small Risk Buys from the Fibonacci Zone – Only for aggressive traders.

CDV & Volume Profile Must Confirm – No buyers? No trade.

“Weak price action, heavy risk. Only the right levels matter here—watch closely!” 📉🔥⚠️

A tiny part of my runners;

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

#TIA/USDT#TIA

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 3.67

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 3.74

First target 3.80

Second target 3.86

Third target 3.92

TIA target $5.64h time frame

-

Entry: $2.96

TP: $5.64

SL: $2.66

RR: 8.77

-

(1) TIA is still correcting and building the bottom structure after dump on 3rd Feb.

(2) Double bottom is one of the possible structure, the potential right leg is $2.9

(3) Fibonacci provides first target at $4.5 and final target at $5.6

(4) Stop loss once going below $2.66