Next Robinhood? TIGR, a hidden gem.We all know the story about retail going crazy on $HOOD. But what about its SEA counterpart, TIGR? Will our SEA friends follow the same trend?

With more and more retail traders rushing to the stock market, TIGR is a safe grab to get on the retail frenzy.

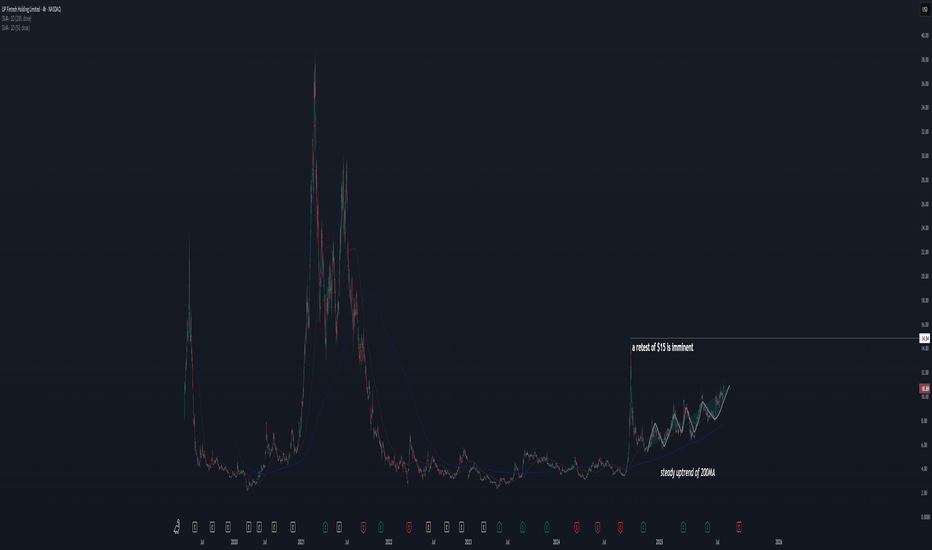

This is also supported from a technical side:

1) a zigzag pattern trending up,

2) a slow and steady uptrend of the 200MA,

3) 3 consecutive earning beats during the last 3 quarters.

All these is suggesting that a retest of the previous high at $15 will happen very soon, if not more (I think there will be more upside, but I have to wait and see how patterns develop when the previous high will be tested).

I am holding TIGR I purchased at 9.55 with a 2.3% portfolio size, with the expectation of reaching at least $15 before/around Oct.

TIGR

UP Fintech Holding Ltd. (TIGR) – Fintech Expansion in MotionCompany Snapshot:

NASDAQ:TIGR is a digital-first brokerage gaining global traction by combining smart technology, cost efficiency, and a user-friendly experience that appeals to both retail and institutional investors.

Key Catalysts:

User Growth Acceleration 🚀

In Q2 2025, TIGR added 60,900 new funded accounts—a 111.2% YoY surge, signaling successful customer acquisition strategies and platform stickiness.

Diversified Capital Flows 💼

Net inflows from both retail and institutional segments reflect a broad and balanced client base, enhancing revenue durability and cross-sell opportunities.

Operational Efficiency 💰

With a gross margin of 83.8%, TIGR exhibits strong pricing power and scalability, positioning it well for future international expansion and product diversification.

Investment Outlook:

Bullish Entry Zone: Above $8.25–$8.50

Upside Target: $14.50–$15.00, backed by its asset-light model, tech-first approach, and rising user momentum.

📱 As global fintech adoption rises, TIGR’s digital brokerage model is proving both resilient and scalable.

#TIGR #Fintech #OnlineBrokerage #DigitalFinance #UserGrowth #MarginExpansion #GlobalInvesting #ScalableTech #FinancialInclusion #StockMarket

TIGR UP Fintech Holding Limited Options Ahead of EarningsIf you haven`t bought TIGR before the previous earnings:

Now analyzing the options chain and the chart patterns of TIGR UP Fintech Holding Limited prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $0.76.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Long TIGR (Maybe Double Up)

NASDAQ:TIGR is a fintech company incorporated in Singapore and headquartered in Beijing. Think HOOD for asian markets, and having direct access to those equities. From the chart you can see they clearly align with the China trade and do get a huge boost if we see China's market pick up.

Current Position:

Average Share Price $5.87 and continuing to buy this up.

Options

$6 12/20/2024

$4 01/17/2024

$5.50 04/17/2025

$5.50 01/16/2026

$5.50 01/15/2027

Still adding. I think $10 is pretty likely even in the short term, but obviously taking some long plays as well, and just picking my spots to grab options when IV is reasonable and I can get some deals. If the China / Asia trade gets some legs, I don't think $20-$25 is out of the question.

My Reasoning

They just did a pretty sizeable offering Oct 23 at $6.25 of 15 million shares, with underwriters getting the opportunity to buy an additional 2.25 million in the 20 days after the offering. (Which they did). This caused approximately 10% dilution to existing share holders. Share price held up pretty well and already trading well above the offering, even while the rest of China continues to downtrend or chop.

2024 Q3

- Revenue: $101 million - record high (44.1% year-over-year increase).

- Net Revenue: $30.84 million - the highest in 3 years (15% year-over-year increase).

- Net Income Attrib. to Ordinary Shareholders: $17.8 million (34.0% year-over-year increase).

- Assets under management: $19.8 billion (115.9% year-over-year increase).

- Funded Accounts: 1,035,000 (19.3% year-over-year increase).

- Total Accounts: 2,370,000 (10.2% year-over-year increase).

- Trading Volume: $163 billion, (103.1% year-over-year increase).

- Net Profit Margin: 17.6% (-1.3% year-over-year decrease).

All while the Asia trade has been pretty much a no go.

In January 2024 they were issued a Type 1 license (Allowing crypto on the platform) and in July 2024 they got Type 9 license (Allowing client asset management services). Two other brokerages have also been given Type 1 licenses in 2024 FUTU and HKVAX (HKVAX also got type 7 for automated trading).

FUTU is a significant competitor with 12x the market cap of TIGR, 2x the assets under management (grew 40% year-over-year), and 4x the revenue (grew 29% year-over-year), and greater brand recognition. But with 12x the market cap and lower growth numbers, TIGR seems like the better play for now, although I might add some FUTU as well.

TIGR has not released specific geographic breakdowns but they have mentioned 75% of funded accounts are outside of mainland China (Q1 2024). Singapore, New Zealand, Australia, United States all mentioned as growth stories.

They have a sizeable user base now, and growing rapidly. If you are long enough term you also just have the cultural tides in your favor as Asia, India are seeing retail investor participation increase rapidly.

I look at this and see a double up just based on the companies growth story while Asia trade has been less than ideal . If we get an actual China pump 2.5x, 3x not out of the question.

Risks

I mean China right, TIGR is incorporated in Singapore which is slightly better and analysis would lead me to believe that a majority of their assets under management are in Singapore but we all know China could yank a license, attack Taiwan, or do some other bull and send the stock tumbling. It's a foreign company, the reporting requirements are different, more opaque, and harder to analyze. Other risks include just the history of the company, offerings are not super rare occurrences and the balance sheet historically is not pretty. This was not a well oiled machine from the beginning. Still a chance management blows it, you also have real competition with FUTU.

However, you can't just luck into the numbers above so things are changing. IMHO.

TIGR UP Fintech Holding Limited Options Ahead of EarningsIf you haven`t bought TIGR before the previous earnings:

Now analyzing the options chain and the chart patterns of TIGR UP Fintech Holding Limited prior to the earnings report this week,

I would consider purchasing the 4usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.72.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TIGR | InformativeNASDAQ:TIGR

Trend and Key Levels:

Downtrend: The stock is in a long-term downtrend, indicated by the descending trendline.

Support Levels: $4.03 to $4.25

Resistance area: $4.91 to $5.01.

Candlestick and Volume Patterns:

Recent Activity: Mixed sentiment with the latest candle being bearish, suggesting potential selling pressure.

Volume: Fluctuates with spikes during significant price movements.

Current Position:

Bullish : Break above $4.91

Bearish : Drop below $4.03 could target $3.51.

TIGR UP Fintech Holding Options Ahead Of EarningsIf you haven`t bought TIGR here:

Then you should know that looking at the TIGR UP Fintech Holding options chain ahead of earnings , I would buy the $3 strike price at the money Calls with

2023-4-21 expiration date for about

$0.24 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

TIGR UP Fintech Holding Options Ahead Of EarningsTIGR is the Robinhood of Asia, i would say. HOOD has 22.8 million users as of March 2022, for a mk cap of 7.89Bil, while TIGR has 551Mil mk cap and customer accounts totaled 1.9 million. so from those metrics alone TIGR is undervalued. now if we look at financials, TIGR has positive earnings, while HOOD is still losing money with negative earnings of 3.69Bil last year. but being a Chinese company also weights in and that`s why people are afraid to invest in TIGR. overall, by the end of the year, i think it`s safe to assume that TIGR can touch $5.5 - $7 if China doesn't invade Taiwan.

Looking at the TIGR UP Fintech Holding options chain, i would buy the $5 strike price Calls with

2022-10-21 expiration date for about

$0.07 premium.

Looking forward to read your opinion about it.

BABA, a beautiful example of ANTI complete cycle !BABA is a beautiful example of ANTI complete cycle !

Many Elliott wave practitioners are not aware of different types of wave cycles ! They may consider themselves as a genius in a bull market ( As everyone else !! ) but suddenly thing change and they can not understand what is happening in a stock or market !

On the left side of the chart there is a schematic drawing showing an ascending complete cycle . In this well know wave cycle waves go up in 5 leg and go down in 3 legs. Correction will never go below the start of wave cycle in this type ( does it go in some other types? of course goes ) !!.

Many investors and traders were hoping for this cycle ( and may be were not aware of alternatives ) in BABA, opened long position at the possible end of wave 4 at related retracement levels and now have lost huge amount of money !!!

An ascending ANTI complete cycle is shown on the right side of the chart. In this cycle waves go up in 3 legs and go down in 5 legs and correction will never go below the start of the wave cycle. Does BABA play like this wave cycle? So far yes.

Is there any other alternative ? Of course yes ! please note we have many other types of wave cycle and we just showed two of them here !. For example, we have neutral or descending antic cycles ( for example of descending anti cycle see my related idea about BROS stock ).

It is worth to note many Chinese stocks like TIGR and XPEV showed anti cycles and this is not a surprise as BABA is leading Chinese stocks in the market.

Things sound complicated? Yes they are ! but we can extract many useful tips among all these complications :

1. Overconfidence is dangerous ! always set stop loss . Things may change suddenly in a way that we did not predict.

2. Be mindful there are many types of wave cycles . Things are not as simple as they may seem at first look.

3. Do not jump blindly into a long position after apparent up going 1 2 3 form of wave !

4. Retracement more than 50 % in what we consider a wave 4 is a dangerous warning.

We can add many other implications to the list by thinking deeply about different types of wave cycles. Hope this publication to be helpful.

Good luck every one !

TIGR - Is the Selloff Finally Over?NASDAQ:TIGR Breakout imminent along with a double bottom bullish pattern on a strong support level.

Current candle has broken out of downtrend but the next candle that follows is key to get confirmation of this breakout.

Longs can choose to enter once next candle respects the new resistance-turned-support.

Conservative longs can choose to enter once price pulls back and retests new support for a better RR ratio.

Regardless, longs are in for a highly attractive RR if we get confirmation and breakout holds as we move to higher levels.

Nearest resistance level is that of the previous double top levels (~$7.54).

Would advise to exit or take profit on trade before earnings.

New "Rocket" trend expectations!Support and Ressistance:

TIGR have made test of strong support line at $12-13.

However didn't break it and going up to the ressistance line at $18-19.

It seems new upcoming trend appeared and new potential are oppening for $29-30 until the end of November begging of December.

MACD:

Indicators below zero line during July - August.

It showing undersell status and potential of turn up trend.

Summary:

If no any fundumental news will be appeared I'm expecting 3 steps target $18-19, $24-25, $29-30!

TIGR: Will the support hold? Requested by veeteeeTiger brokerage is a up & coming brokerage firm. They seem to be pretty aggressive in their acquisition recently.

The run at the beginning of this year has definitely fueled lots of buying interest. However, price is now back at a strong support of $14-15.50 range.

The question is will it hold? The recent clamped down by the Chinese government mounts unnecessary pressure of potential growth companies. So we will have to thread very carefully with all Chinese companies. Nonetheless, I'm leaning towards the bullish side on most Chinese stocks. (I had reviewed FXI - China Large-Cap ETFs suggesting that bullishness is expected in the upcoming weeks.)

I'd like to see a reversal candle pattern on the Daily chart before buying. For now, I'll stay aside.

Disclaimer: I'm not giving any trading and investing advice. I'm just sharing my chart observations.

If you have any symbols that you'd like me to analyze, feel free to drop me a comment.

🟢 $TIGR Target 28.12 for 35% (Risk Level - MED)🟢 $TIGR Target 28.12 for 35% (Risk Level - MED)

Or double position at 15.41

-----

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

Numbers with an A are places that are a good idea to add if you can.

Numbers with a D are places where you should double your position.

I start every position with .5 - 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

TIGR more uptrend to come?Since 13 May 2021, Tiger price enjoyed a nice swing up to reach $29.95 on 15 June before a deep retracement. It has since moving in a range between $22 and $30.

Last Friday (25 June) in hourly chart, there seems to be some rejection around $28.80. However, as long as the price is able to sustain above $26, the up trend is still intact. If able to break above $30, next target is likely $34 area then re-challenge all time high at $38.50.

The nearest support would be $22 or $20.

NEW POSITION $TIGR Target 29.99 for 32.11% $TIGR Target 30.01 for 32.11%

Or double position at 15.43

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

TIGR BUY/LONG BIG POTENTIAL INCOMING 7.60 to 41.30TICKER CODE: TIGR

Company Name: UP Fintech Holding Limited

Industry: Financial | Capital Markets | China

Position Proposed: BUY

Technical Analysis

1. Large Falling Wedge (Forming)

2. Large Head & Shoulders

3. Fibonacci Retracement (Potentially) to reach 0.786 ( Silver Zone)

4. Fibonacci Expansion Safe Take Profit Level 1 (Grey Zone) at the length of Flagpole Price Range

and also Trendline Resistance Level

5. 2nd Take Profit Level maybe a Head & Shoulders (NO FULL DATA ON 1st Shoulder)

Buy Entry: NOT READY (7.60-9.50)

1st Partial Take Profit: 41.30 (November-End 2021) - Note that I would consider Full Take Profit Here

2nd Partial Take Profit: 62.00 (Mid 2022) - Note that we might not reach this Take Profit

Stop Loss: 5.00