5 steps for building technical analysis by time framesYou sometimes ask me how I structure my forex technical analysis.

Today I will share 5 simple steps that I go through myself to determine the direction of the price.

So.

Step 1 - start with a large TF to analyze the global price movement and mark major levels.

Step 2 - Go to Week 1 TF to find major trends and recurring items.

Step 3 - I use the daily timeframe to mark strong trend lines, find patterns and determine the approximate entry area.

Step 4 - then I use the 6h 4h and 1 hour timeframes - this helps to clarify the last price movement and pay attention to small trades.

Step 5 - minute TFs to test your hypotheses and find an entry point.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Timeframe

GOLD update Good day traders !!! On gold we are looking at a short setup because we got again into the descending channel again and it seems that we had some sort of fake breakout of the trend line. Also we just completed an "M" formation on the daylight timeframe and we retested the neckline and rejected it. We are looking for a short setup on the short term but be cautious with everything that is happening with the stock market because it has a big impact on commodities as well.

Now if you enjoyed this analysis like and share. If you have a different opinion comment below as I would love to have some more insights about this pair.

Trade safe !!1

GOLD to 1840, Buckle up !!!Good Day Traders !! On Gold as we expected the price dropped to the demand Zone and broke the trend line ! On the Monthly timeframe we have an overextended W formation and we just tested and rejected the neckline. Down on the weekly timeframe we have an "M" formation and we have confluence between the neckline of the weekly and Daily "M" formations. Also it happens that the neckline on the daily timeframe is exactly the 0.618 Fib retracement on the previous leg. With all of that being said we are looking at a potential opportunity for long in the short and mid term for gold. From an institutional perspective we have hedge funs and non commercials institutions adding a massive amount of long position on gold and this impulse to the downside could be considered as an accumulation of liquidity before the real launch.

Now if you enjoyed this analysis smash that like button and share. If you have a different opinion please leave a comment below as I would love to get more insights and ideas. I also linked my previous idea about this asset.

Trade safe !!!

USDCHF DAILY SHORT TRADE- double big up & down bar is mean the price is rejected the resistance + supply zone

- after breaks-out the head & shoulder pattern, the price is in the up trend

- short will small position to demand zone or long when price test demand zone + support level with clear price action

- if you look the volume, you will see it is increase around the head & shoulder pattern, specially the big bear bar with a large of volume. it's mean the shark started this long trade and they killed retailer investor tried long or short before. the momentum is too strong.

RULE OF THREE TIMEFRAMESHello traders,

this time I came with an educational post, because on Friday I don't take any trades due to sloppy markets.

Most of the times I see question like how many and what timeframes should you use when trading.

Rule of three timeframes says, that we should use at least two but no more than three timeframes.

Personally, I use W,D and 4h.

Here is how I use 3 TF in my trading strategy:

1) The highest TF should be used for spotting an overall and long-term trend and plotting an important key levels. So I basically do my charting on the W timeframe, identify the trend and plot the key levels.

2) Everyday I start on the D, that's where I do my analysis and what I call my main TF. I use Daily to plot daily structures, identifying the trend from short-term perspective, plot trend lines etc. When I spot a good opportunity in the market, I check W if I am going with the trend

3) After spotting an opportunity on the D, checking if I am with trend, I go to the smallest TF I use-4h. That's where I am looking for a good entry.

Hope this small summary will help you, thanks for stopping by and checking my post!

Don’t forget to let me know your opinion on this in the comment section below! 💬 Sharing is caring! 👨👩👧👦

Have a wonderful and profitable day! ❤️

- ProfitalzTrading

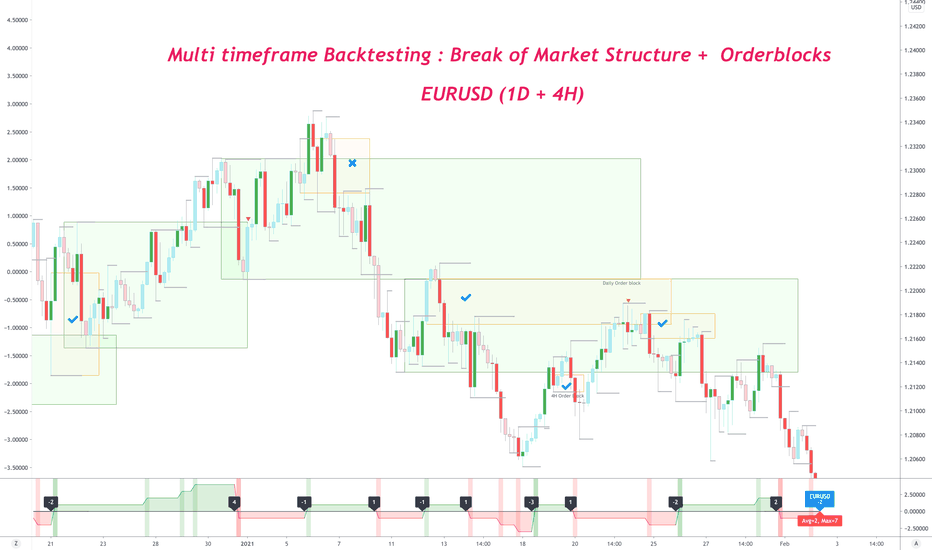

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

Timeframe selection is important to trade short squeeze!Timeframe selection is important to trade short squeeze!

What happens in a short squeeze, the short-sellers are under pressure because they are under distress trying to cover their short positions. Along with bargain hunters and active traders wanting to make a profit from the short squeeze, all that combined actions pushes the price even higher.

Time is money! Short traders try to trade carefully and fast. Short traders know that they have to act quickly otherwise the next higher price will be more expensive to cover their short position. However, short traders have to cover their short positions fast but don't want to cover the stocks too fast because that will move the price even faster and that puts short sellers at a disadvantage. Short sellers become long traders once they completely cover their short shares.

Time frame selection is crucial when making a decision to go long or short. When trading a short squeeze, the weekly chart doesn't give the active traders good information. In fact, the weekly chart is useless to active traders because it doesn't provide any information.

Active traders wanting to participate in short squeeze should consider looking at the 15-minutes chart or the 1-minute chart to make their decision to go long or to go short. With the weekly chart, it is impossible to decide the entry or exit price.

Thank you for reading!

Greenfield

This is article #3 on how to trade short squeeze. Remember to click "Like" and "Follow!" to see more articles on how to trade short squeeze.

Disclosure: Article written by Greenfield. A market idea by Greenfield Analysis LLC for educational material only.

XAUUSD H4 TIMEFRAMEMy overall analysis on XAUUSD.

Gold is respecting zones perfectly. I am waiting for price to remain bullish, range, then drop (bearish).

Did both buy and sell setups just incase of what occurs at the inauguration tomorrow.

If price breaks structure (purple line), I will look for buys. If price breaks rectangle box, and also green line(1863.61), I will WAIT for retracement, then buy Gold.

REMINDER: Always take Profit/Partial Profit for TP1. Price usually retraces then comes back to zone.

USDJPY 1HR TIMEFRAMEUSDJPY is currently in a triangle flagpole pattern on both the 4HR and the 1HR Timeframe.

Waiting for it to break the pattern. I placed both buy & sell setups if it breaks to either the upside or the downside.

USDJPY Market Structure is in a downtrend on the Daily timeframe so I'm looking for sell entries.

REMINDER: ALWAYS TAKE PROFIT/PARTIAL PROFIT AT TP1. Price majority of the time will retrace/pullback to the Supply & Demand area (Rectangle Box).

If you have any questions, ideas or concerns, feel free to message me.

MUST SEE!!!!!! How candle time ranges make a BIG differencethis is a quick chart today.

the point of this chart is to illustrate how zooming out even 30min can change your whole perspective on how the market is moving.

left side 1h chart

right side 1.5hr(90min) chart

within the circled range (the breakout) you can see in the 1HR chart 3 red candles vs. the 1.5HR chart has no red candles. NONE!

if your waiting for your candles to close before you freak out on a dip then on a 1.5hr chart you would have never seen a reason to close a long.

if red candles scare you out of trades. always zoom out on the charts instead of freaking out and being impulsive.

tip of the day...never trade based off candles smaller than 1HR.

***im not a professional ....i do this cuz i like to help other make money too!****

ETH / USDT - 1H TF. Magnet level Dear friends, a little intraday for you.

The previous idea was reviewed at an older TF.

But if we evaluate the ETHER for 1-2 hours TF, then you can see how the price very often returned to the same level. Namely to 740-745

For the given time, the price is pulled in this direction.

But we also have a rising wedge, the price of the lower border is still trading.

Going beyond this border on the volume (or an impulse closing with a candle at 2h TF, will show you the price path.

You don't need to invent anything, just confirmation.

Since there is a possibility of growth, before the upgrade of the peaks, as well as up to 800-850 dollars for 1 ETH

We cannot ignore the moment that we have an upward trend.

Therefore, I am writing to you all the plans, if someone decided to take a position.

I still adhere to the fact that the price will fall, but the 745 level will show itself.

ETHEREUM BULLISH! BREAKOUT over 800??Hey there,

Thanks for liking the post and following me on TV!

Comment below!

We got a nice ascending triangle on Ethereum USD.

The measured move target is alining aproximately with the prior swing high

on big timeframes.

Seems like there is heavy resistance at ~830 USD.

At around 760 USD we have the 50% retracement of the fibonacci,

yet I think that will be crushed easily, let's see!

Since Bitcoin will struggle to hold above 30k, I think we won't see higher

prices than 35k. Most likely ETH will retrace at a similiar time.

Bigger timeframes is largely extended and screams for a correction.

Therefore this is only a quick swing trade over a few days, maybe a week!

Cheers,

Konrad

EURUSD is resting to do a big jumpEURUSD has broken its resistance of 1.2000 after a consolidation of 130days.

it also has broken major resistance of 1.21000 strongly.

to continue , this pair needed a rest, last week eurusd was in a bullish flag and one time tried to break that.

the zone of 1.21 is a key level i think. in this zone we have major SR zone , and as you see in 4H the EMA50 is waiting for price just close to 1.21

I personally will open a long position in this zone just in case i see a 4H signal .target can be 1.25000 but of curse we will face barriers near zone of 1.22.

just note, if price close lower than 1.2100 it can come to start from 1.2000....so wait for signals....

position will be long anyway but just keep an eye on zone of 1.21.

DXY(Dollar INDEX) Support is not yet reached! Analysis!

Hello, Traders!

DXY, The Dollar Index keeps falling

It takes looking at the 1D timeframe to see the next support level 89-88

Till then, we might see some pullbacks, but the first real support is there

So looking at the chart, it seems like the dollar will keep falling

Before it reaches this support, and only then will reverse and go UP

Buy from support 89-88!

Like, comment and subscribe to boost your trading!

See other ideas below too!

Continued long forecast (History and psych level based)So far a my sentiment for this pair has been fairly accurate and I have been basing off my preferred trading strategy incorporating News, fundamentals, and technicals.

The levels of support and resistance I have mapped out above the 1.19990 level become psychological levels that have strong support and resistance rejections/breaches that can be strongly correlated to the pairs history in this zone.

The continued forecast I have mapped out is based off the end of 2017 beginning of 2018 trend that reached a target of 1.25000 which will be my ultimate target. To add to this sentiment, the trend we are seeing at the end of 2020 is accelerated comparatively.

The next retest point is 1.23000 and we will see a pullback with continuation to 1.24000 followed by consolidation and a final push to retest 1.25000. Given the acceleration of this trend based off time period we may see a push through 1.25000 to reach previous highs.

If you have the time back track to 2017 and 2018 to observe the pattern and correlated to my sentiment. I have attached two previous EURUSD one of which was spot on price action.

Thank you for taking the time to check this out please comment with thoughts and ideas.

How to trade a Range / Real case on EUR/AUDGood morning traders! Today we detected a trade opportunity in the EUR / AUD pair and we want to share with you in detail how we perform a multi-timeframe analysis to develop a setup.

🔸The first step is to start on a high timeframe chart in order to see the long-term behavior, whether it is in an uptrend, downtrend, or range.

🔸What we see on the daily chart of this pair is that it has been moving within a range for several months without a clear main trend. Of course, inside this range, there are internal trends of less temporality, which is what we will use later to be able to develop the setup.

🔸Talking about the price situation at this time, we see that it is coming out of a support zone that was tested multiple times, and that each time it faced that zone it generated an upward movement. Because of this, we are now expecting the same behavior.

🔸Decreasing the timeframe to 4H, we are preparing to analyze the short-term behavior.

🔸Following the bounce in the support zone, the price broke to the upside the Descending Trendline, this was a strong bullish sign. The problem with this break is that there was a Resistance zone very close, so we needed this zone to be penetrated to the upside before looking for an opportunity.

🔸This is what happened a few days ago. The price generates a bullish breakout, and not only that, but also begins a corrective process in a throwback to the support zone (previous resistance).

🔸Due to all this confluence of factors, we consider this pair to be a good opportunity.

🔸Using the cloning of the first impulse as a movement objective, it offers us an excellent risk-benefit ratio.