OSK BTD off Symmetry SupportThis came to me in meditation, and this is a good thing, usually. The chart is ugly with no great trend, but this is what I'm given. I do technicals and then a "reading" with my pendulum and cards.

What I'm seeing:

- weekly timing just counting bars, and it appears to be in a weekly timing window.

- 200 EMA at $83.42, 50 week MA $82.45, weekly ATR trailing stop just above there and Symmetry support at $81.76

- I like the zig zag pattern down.

- The "reading" indicates we expect to dip below last week's low ($83.62) and reverse. I feel good about the message and the way it lines up with the technicals. I'm looking for a 5% gain this week ($86.55 from entry) and then I'm out.

- Entry ~ $82.43 near 50% retracement

- Stop is a daily close below $81.76 (sym. support)

Timing

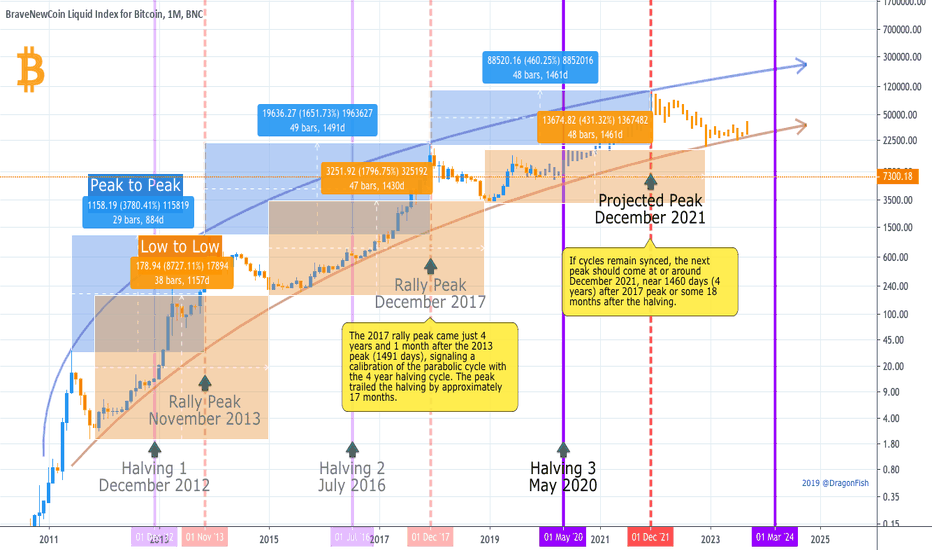

When will BTC peak in the next parabolic rally?This is another iteration of a previously published chart, but simplified to drive the point home.

Motivation

Predicting the peak of BTC's next parabolic rally is critical for the profit-taking strategies of speculators and hodlers alike. For speculators, it's about knowing when to get out. For hodlers it's about how to grow your bags. Really, knowing the timing of the peak is more important than knowing the potential price levels. BTC is a deflationary asset. As market cap continually builds, flow is being squeezed on a pre-set schedule and real value continues to grow. So, we know price will rise. Whatever levels we may reach ($50K? $150K? $250K? 1 million?), taking profits requires knowing WHEN those peaks may be attained.

Two Perspectives

There seems to be two primary camps in the timing debate. In the first camp, there are analysts who note that the time between each previous peak has grown. For these analysts, the first all-time high of around $30 in 2011 is key. The subsequent ATH in 2013 of nearly $1,200 came only 2 years 5 months later (884 days). In contrast, the next ATH took 4 years and 1 month to arrive (1491 days). This 40% expansion in time between peaks logically leads some to believe we will see a similarly expanded time frame as we wait for the next peak, with many predicting peaks delayed until 2023 or even 2024.

Such predictions, however, seem to discount or devalue the underlying architecture of BTC growth, the built-in halving cycle in which the flow of new BTC into the system drops every 4 years when the reward to miners is cut by 50%. The 2017 peak arrived 4 years and 1 month after the 2013 peak (1491 days). Was this a signal that the parabolic price cycle had become calibrated with the 4 year halving cycle? If so, the cycles seem to be offset by approximately 18 months, which would make the target for the next peak in or around December 2021, or some 18 months (1460 days) after the 3rd halving in May of 2020.

The Upshot

Obviously there are so many attenuating factors that can influence the market, and when and where we'll find peak price discovery is anyone's guess, but smart profit seekers would do well to monitor the market closely as we approach December 2021. Even if the peak is delayed, this should be a key profit-taking window for speculators. For hodlers, it will be an opportunity to strategically pull capital from overvalued BTC before the inevitable 75-85% retracement in which we can grow our bags with an eye to 2025 and beyond.

Timing the Peak of the Next BTC Bull RunWhen will Bitcoin reach the peak of its next parabolic advance? Probably at roughly the same time it did in the last rally. This seems straight forward enough, but other trend analysis on this platform has variously projected the next bitcoin price peak from sometime just after the third halving in May 2020 all the way to sometime in 2023. While the earlier prediction is highly unlikely, the extended prediction is supported by the fact that, peak to peak, the third bull run of 2017 was much more extended (1491 days) than the previous bull run (884 days). Therefore, we may assume that subsequent parabolic moves will also play out over longer and longer time frames.

However, the simplest answer is probably the best in this case. If we consider that the halvings are roughly 4 years apart, it is notable that the third peak came just over 4 years after the second peak. This suggests that in fact the peaks have become calibrated to the halvings and that the next all time high will come near the 4 year mark (or day 1460) as well. Bitcoin is unique in that the stock to flow ratio can be very precisely projected, unlike any other traditional market, making this rough prediction of the timing possible.

This probably doesn’t help us predict price discovery, however. Government regulation, current events, technological disruption, etc., etc., all affect market sentiment and make it nearly impossible to guess where the price will go. That said, we do know that the halvings will become more and more priced into market valuations in the future as the market gains a greater awareness of the halving algorithm, and this process has probably already started. Futures markets (CME & Bakkt) will also act as tempering forces on BTC volatility (apparently the intention when futures trading was launched on CME in 2017). And as the value of BTC has become more tagged to store-of-value than currency utility, volatility and price discovery have naturally been tamed (relatively), a process that will also continue. This is to say that conservative predictions may fall closer to the mark. On the other hand, the mere fact that flow is dramatically cut after each halving as demand continues to grow gives BTC bulls a lot of hope.

Whatever the peak of the next parabolic rally, it is likely to be tied closely to the halving cycle and stock-to-flow models, and trend lines will probably remain inside the general channel indicated by history. In other words, we're probably not going to the moon, but we are still holding the best performing asset ever seen.

Hopefully these observations aren’t too obvious. They are just meant to help us all keep our eyes on the big picture as we hodl into the future.

DF

$XAU Daily uptrend analysis #Sequential #GoldHello everyone.

Gold remains in a bullish trend and found some exhaustion points recently:

- S13 and A21 on 08/08

- C13 on 08/13

- Nested S21 on 09/23

Despite these last exhaustion points, the daily main bullish sequential countdown has not been invalidated.

This bullish countdown is currently on a bar 5/13 and its last increased bar was on 09/04.

With the remaining countdown bars, price could then reach once again the upper limit of the bullish channel.

For now, price is forming a small consolidation pattern (blue), which looks like an ascending triangle.

If this pattern fails, the price could fall in a wider pattern (gray falling wedge) and find first some support on the middle line of the channel.

The TDST Support is @ 1400 USD and could coincide with the lower limit of the channel, so this is also a level to watch.

Best!

MATHR3E

Sequential indicators:

MATHR3E TD Multi Sequential

MATHR3E TD Setup Trend

MATHR3E TD Sequential Fibonacci Extension

MATHR3E TD Aggressive Fibonacci Extension

MATHR3E TD Combo Fibonacci Extension

Lets be honest guys. $tsla $spy it was a good run. Especially if you've been long from the lows. more than an 80% rally from the bottom. Tesla will dominate the auto industry as well as the energy sector. But just looking at the new range we find ourselves i can't help but consolidate on these gains. I have exited more than 50% of my position now and might continue to exit. overall not bullish on the stock, and the market anymore. my instinct is always to follow the trend, but nobody went broke taking profits. Thank you guys but im pretty much closing my fiscal year for stocks. Wont be looking for any positions until i see a correction in markets overall. Im comfortable now derisking from tesla and would like to see a new entry point. I have a little exposure left but anymore upside and i will continue to sell. \

Investing is my life now and im so happy to be part of a community that is so generous in offering their insight. Blessed for everyone that comments, likes and views my posts. i appreciate it so much. We are all going to make it if we continue to be constructive and thoughtful in our posts. Ill still be seeking out ideas and if you want to follow me on my youtube channel tagalong where i cover a few more markets like crypto. Thanks guys :)

www.youtube.com

$BTC Bull Flag vs Bear Trend continuation #SequentialHi everyone,

BTC is still forming a bull flag, but this could be insufficient to cancel the daily bearish countdown.

If the countdown has to complete first, this means a bearish target of at least:

- $7.993 on Coinbase

- $7.470 on Bitstamp

There is a countdown shift between the 2 platforms so it is actually quite difficult to predict a target.

I would favor the coinbase target as it coincides better with the 0.764 Fib retracement...

Targets are not a guarantee!

Countdown can be cancelled by these 2 conditions:

- A new Sell setup (After a bullish TD Price Flip, there must be nine consecutive closes, each one greater than the corresponding close four bars earlier)

- A candle low completed above TDST Resistance @10.379USD

On the 12H chart, we had 2 nice potential Buy points indicated by S13 and S21.

Here also the main bearish sequential countdown has not been canceled so we could reach the next S34 exhaustion point.

Best!

MATHR3E

Sequential indicators:

MATHR3E TD Setup Trend

MATHR3E TD Sequential Fibonacci Extension

MATHR3E TD Aggressive Fibonacci Extension

MATHR3E TD Combo Fibonacci Extension

Bitcoin Price Action Update (day 352)Disclaimer: If you are primarily interested in copying other people’s trades then this is not for you. However, if you are willing to put in the work that it takes to learn how to trade for yourself then you have found the right place! Nevertheless please be advised that you can give 10 people a profitable trading strategy and only 1-2 of them will be able to succeed long term. If you fall into the majority that tries and fails then I assume no responsibility for your losses. What you do with your $ is your business, what I do with my $ is my business.

Sawcruhteez Strategies: Comprehensive Trading Strategy - Consensio | Comprehensive Trading Process | How to BUY THE DIP | Advanced Dollar Cost Averaging Methods

Consensio: Long term is bullish. Short and medium term starting to turn bearish. If 50 and 200 EMA’s get death cross on 4h then medium term trend will be bearish for me.

Patterns: Pulling up and into death cross on 4h? If so would that be considered a pattern?

Horizontals: R: $10,800 | S: $10,500

Parabolic SAR: If looking for SAR based on Welles Wilder’s original calculations then use “Lucid SAR” on Trading View. Weekly bullish SAR recently brokedown which indicates medium term bear trend.

Futures Curve: Contango, but spread is narrowing on this selloff which is bullish

Funding Rates: Shorts pay long 0.01%. Nothing out of balance here.

BTCUSDSHORTS: Shorts are at new all time low

TD’ Sequential: 4h hit a green 9 on this last move

Ichimoku Cloud: Weekly and daily are bullish. Look at how the daily cloud (traditional settings) acted as support. 4h is bearish.

Relative Strength Index: Appears to be resisting 50 on daily.

Average Directional Index: Daily has fallen below 20 which is similar to the RSI resisting 50. Weekly is just showing the first signs of reversing.

Price Action: 24h: +8.51% | 2w: -3.76% | 1m: +16.67%

Summary: My last update was on July 7th and that is when I predicted “four figure Bitcoin within 48 hours”. Furthermore my price target for the expected selloff was $8,975 by July 10th.

Both of those predictions were wrong. I roughly got the price targets right, but the time targets were about 1 week premature. Profitable trading revolves around projecting the price and the time. If you get one of those wrong then you are wrong, simple as that.

This has been a great example. I shorted above $11,000 with a $9,000 price target and I lost money eventhough the price went to $9,000 within weeks of entering my position. I had a stop set at $11,876 and that was triggered before the selloff that followed.

This is a great example of why trading revolves around price and time. Get one wrong and you will lose money.

About 5 days after my call the price of bitcoin reached my target of $9,000. I had a pretty good idea of where the price was going in the future but I still lost money because I thought it would happen a little sooner than it did.

With all of that being said I am prepared to take my second stab at the same call. As it stands I strongly expect four figure Bitcoin within the next 48 hours. From my perspective the market is very overbought while testing a major resistance level. This tells me that resistance will hold and that another leg down is to be expected.

Therefore I am viewing this as a good opportunity to sell. Whether that be short or a profit take.

It looks to me like $10,800 resistance is holding. If that is the case then we should get a death cross with the 50 and 200 EMAs on the 4h chart. If we do get a death cross then it would lead to a $7,500 target, at a minimum.

As a result I am viewing this as a selling opportunity. Selling $10,500 - $10,700 with a stop at $10,900 makes a lot of sense to me. If we are able to breakthough $10,800 and spend some time above that price (> 1 day) then I will very much be changing my tune while looking to buy back what I sold around $11,000.

Daily VZ forecast timing analysis by Supply-Demand strength21-Jun

Investing strategies by pretiming

Investing position about Supply-Demand(S&D) strength: In Falling section of high risk & low profit

Supply-Demand(S&D) strength Trend Analysis: About to begin a rebounding trend as a downward trend gradually gives way to slowdown in falling and rises fluctuations

Today's S&D strength Flow: Supply-Demand strength has changed from a strong selling flow to a suddenly strengthening buying flow.

View a Forecast Candlestick Shape Analysis of 10 days in the future: www.pretiming.com

(You can easily create a trading plan.)

D+1 Candlestick Color forecast: RED Candlestick

%D+1 Range forecast: 0.1% (HIGH) ~ -1.2% (LOW), -0.8% (CLOSE)

%AVG in case of rising: 0.9% (HIGH) ~ -0.5% (LOW), 0.5% (CLOSE)

%AVG in case of falling: 0.3% (HIGH) ~ -1.6% (LOW), -1.3% (CLOSE)

Price Forecast Timing Criteria: Price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

Daily ETH/USD forecast timing analysis by Supply-Demand strength22-Jun

Investing strategies

Investing position about Supply-Demand(S&D) strength: In Rising section of high profit & low risk

Supply-Demand(S&D) strength Trend Analysis: In the midst of an upward trend of strong upward momentum price flow marked by the temporary falls and strong rises.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

View a Forecast Candlestick Shape Analysis of 10 days in the future: www.pretiming.com

(You can easily create a trading plan.)

D+1 Candlestick Color forecast: RED Candlestick

%D+1 Range forecast: 0.1% (HIGH) ~ -2.8% (LOW), -1.6% (CLOSE)

%AVG in case of rising: 5.3% (HIGH) ~ -1.6% (LOW), 4.1% (CLOSE)

%AVG in case of falling: 2.5% (HIGH) ~ -4.1% (LOW), -1.5% (CLOSE)

Price Forecast Timing Criteria: Price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

HYG stock price forecast timing analysis. 13-JunStock investing strategies by pretiming

Investing position about Supply-Demand(S&D) strength: Rising section of high profit & low risk

Supply-Demand(S&D) strength linkage Trend Analysis: In the midst of an adjustment trend of downward direction box pattern stock price flow marked by limited rises and downward fluctuations.

Today's Supply-Demand(S&D) strength Flow: Supply-Demand strength has changed to a strengthening buying flow when stock market opening.

Possibility of change in forecast timing: Forecast timing has become high variability conditions. because the flow of supply - demand has changed, and the supply - demand linkage is unstable.

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 0.1% (HIGH) ~ 0.0% (LOW), 0.1% (CLOSE)

%AVG in case of rising: 0.3% (HIGH) ~ -0.1%(LOW), 0.3% (CLOSE)

%AVG in case of falling: 0.1% (HIGH) ~ -0.2%(LOW), -0.1%(CLOSE)

Stock Price Forecast Timing Criteria: Stock price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

Read more a detailed Forecast Analysis Reports that candlestick shape and %change, S&D strength flow in the future 7 days.

www.pretiming.com

Time analysis: Could the bitcoin bear market end October 2020?To me, it looks like the market is moving slower after each cycle. Our last bull run was longer than the previous one. The 2014 bear market was also longer than the 2011 bear market.

To my findings, the bear market of 2014 moved 2.5x slower than the 2011 one. If we use that same factor this time according to my calculations the bear market now should end around October 2020.

I know that sounds very depressing but as a long term trader I'm trying to find every possible outcome and this is one of them.

Timing the BTC bottom with Murad, Vinzen & Tone V.MustStopMurad had this analysis where he suggested that the next BTC bottom would be around the 300 MA.

Tone Vays has for a long time compared MA crosses from 2014 with todays MA crosses for estimating how far into the bear market we currently are.

Yesterday when watching Tone Vays video with Vinzent and Willy Woo (first of the recent Thailand videos) Vinzen suggested with the Fib Time Zone (I believe) that the bottom would be between 2020-22. Combining the above two analysis’ which I attempted in the chart actually suggests the same a bottom around 2021 which I found interesting. Estimations of moving averages is drawn by hand so not sure how accurate this will be (and obviously these estimations are also just a predictions so could be completely inaccurate). Would still be very interesting to hear peoples thoughts on this anyways.

Best regards.

$DNA entry/exitDNA displaying a popular window of opportunity in the December period.

R: @0.098

S: @0.089 (conservative, last 4 hours of trade prior 31/12 close)

Volume still attractive.

RSI above 35 (however, capping at 70 showing overbought signals).

Conservative Strategy:

Proposed re-entry: @0.080

Proposed exit: @0.090

SL: 0.076

Aggressive Strategy:

Proposed re-entry: @0.085

Proposed exit: @0.095

SL: 0.082

Resistance and volume drop expectedALOT is showing a resistance in supply/demand in buyers with more selling on 4h chart.

Fibretracement 0.786 would drop to $20.75-20.80 or more likely $19.20-19.35 resistance zone areas as better

buy.

Watch the black change to blue on 4h or 1d chart for entrance, which is currently black. @MarxBabu for longbuylongsell chart adding MACD, volume, volume average and running average and here RSI Stoichastics. Optionally replace RSI Stoich with CCI for entry timing once blue, or RSI, or fast RSI.

View 1w, 1d and 4h for blue entry signal.

USD/JPY Yen volatility leading up to USA stock market open VideoI've noticed a clear trend leading up to 6:30am pacific time USA stock market open time, I think people are hedging currencies in order to trade in different markets. You can ride it down then up more days than not check profile for more examples