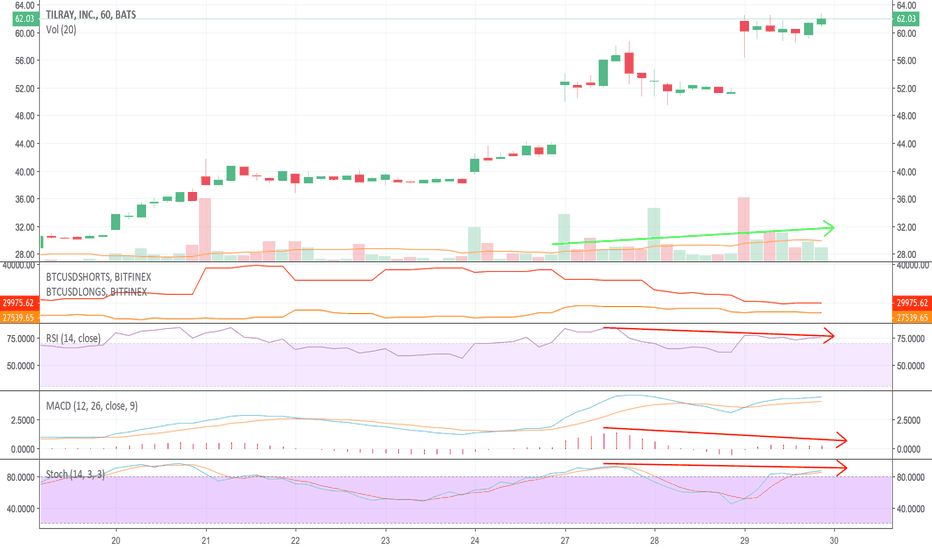

TLRY

YoungShkreli said to wait to buy and was right... what now?Hello friends,

I got way more views on my coverage of a stock than I thought I would. In my last post, I said I would be looking to short this stock. So far anyone who went short is up a lot of money.

I am expecting to fall to the line I have drawn. I will let you know when a buying opportunity comes. For now, if you are wanting to buy, you must wait. Do not short this stock from here and for the love of God, don't short without a stop loss. You will lose EVERYTHING if you short without a stop in the long run. Let this be your warning.

I am trying to make it to the top of the active daily traders page today. Check out my work, you will see I do pretty damn well. Please help me to achieve this goal, it will help all of you who want to become a successful trader.

I do not need to do these and if I am not successful, I will stop. If you value my work, you need to follow me and like my work if you want me to remain here.

Get on it, people!

-YoungShkreli

TLRY SHORTTLRY short term:

pump and dump in progress

limited stock to short with, Put options have like %300+ IV priced in with low open interest.

Should do a raise while still over $100

Long term:

-Multiple USA IPO's coming in Oct > Sector rotation into more legit plays such as TRST, APH, ACB.

-Oct 17 Sell the news

-Ontario retail only by mail. Canada Post could go on strike if no deal reached with Unions.

- withheld Float enters market

- sector valuation & P/B comes back down to reality

Canadian MJ VS. Crypto: Is Now The Time To Shift?Hello my dear MJ traders, and everyone else, who is now interested in the MJ sector! ;)

In this video, I show you the huge pump of TLRY from $20 to $300 since they got into an ETF, and we talk about the similiraties of the price action vs. Bitcoin. You will see, that right now, it might not be a good idea to shift from crypto to the MJ sector.

Obviously for the long-term it's very good news, as the legalization of marijuana is coming in the US & Europe. Have fun watching! ;)

If you had some value from my analysis, give it a thumbs-up, because the video gets shown to other people then. Make also sure to like & follow me so you don't miss it next time, I'm doing Daily Crypto Analyses! I wish you a good trading! :) No matter what you do, please set your stop loss. For short trading: Please be aware, that you can lose all your money on Bitfinex if Tether blows up one day/and or they just close, (respectively on Binance, if you're holding Tether there), as compared to Coinbase, who do not offer short trading, but who have at least an insurance up to 250k. Dollars as they state on their homepage.

About myself: Global citizen & early Bitcoin adopter from Germany. I invested in the 2nd rally from 50 to 1.000 Dollars in BTC.

Oversold Due To China News, and Being Driven By TradersLove the stats and the story.

Short term swing.

It is being driven by speculators because it's a low float China stock. Went up too much in a short period of time, hence the big sell off. Also, this China tariff news probably spooked traders.

Net income is down 2 million, but general administrative expenses increased by a factor of 10. Plus, they are exploring the blockchain sector.

Like where it is on the fib also. Volume has also decreased relative to yesterday's sell off

Only buying 1/2 because it is on the way down. Holding other 1/2 in case it goes lower so I can either bump out or get a better average.

Well, this had to happen...Looks like we finally found some new toy creating bubble cycles faster than Bitcoin.

"Hey Bob i heard about a new stock of the legal cannabis business last month, you think i should inves... ah, nevermind Bob, it is already crashing".

Hint: this could actually keep on raising more. Much more. I won't be surprised.

I won't give any advice regarding this stock. I won't say stay away from it, and i won't say buy it neither.

Marijuana the next Bitcoin?Hello friends,

I've only just discovered these parabolic pot stocks and am very interested in trading them when I see some technical setups. I wouldn't be surprised if this is crypto pt. 2 . Like with crypto, there is value here, but it's a complete bubble. Will be looking to short the hell out of these at some point - not today though.

I am expecting a correction to the green line at some point.

Keep your eyes peeled for these!

-YoungShkreli

About to Break Resistance, Same Industry Group As CBDSWeed stock are on a roll right now. CANN and CBDS have always followed each other. Big volume spike, and with TLRY and all the big names in the marijuana sector on fire, speculative fervor will transition into the smaller names. For the most part, though, I like this as a sympathy play off today's CBDS move

Full Triangle Completed. 1/2 Entry At The Close

Earnings report wasn't that bad really, just disappointing. The stock was already up 1000% at one point, and Bank Of Montreal owned 30% of the shares back in December 2017.

I initially flirted with the idea of buying on Monday, or near the 78% line near the March/April consolidation area for $8.00ish, but decided against it due to the extent of the sell off. I also considered the fact that 81% of the shares were owned by institutions, who were up significantly.

You can see buyers attempt to accumulate on Sept.11th, but they got crushed, just like I suspected

I'm buying the close today, with the intention of holding the other half in case it goes lower so I can either bump out, or get a better average. Whether i fill the other 1/2 on the way up depends on the price action and volume

This is a swing trade, not a long term hold

THE WEEK AHEAD: ORCL, KR EARNINGS: EWZ, TSLA, CRONEarnings:

ORCL: Announces Thursday after market. Rank/IV: 74/31. Sept 21st 68% Probability of Profit 20 delta 45/50.5 short strangle: .79 credit.

KR: Announces Thursday before market. Rank/IV: 54/37. Sept 21st 72% Probability of Profit 20 delta 30/35 short strangles: .60 credit.

Non-Earnings:

EWZ: Rank/IV: 97/48

TSLA: Rank/IV: 95/57

GDX: Rank/IV: 68/30

USO: Rank/IV: 62/26

FXE: Rank/IV: 53/8

Others of Note:

CRON: Background IV at 138% on volume of 24.1 million shares. Oct 19th 70% Probability of Profit 9/19 short strangle: 1.30 credit.

See also (for other cannabis-related underlyings):

TLRY: Background IV at 135% on volume of 9.02 million shares.

CGC: Background IV at 98.5% on volume of 13.1 million shares.

CRON notesWatching it on two hour chart seems like today's action was centered around where it close up at around. Trend is still up as it broke up out of an ascending triangle on the weekly chart. I still think pot stocks are in a bubble and they will continue to go higher in price. For options traders it has already breached it's expected move for the week, with the top being 11.19 for the week. Could be pulled back to that area or we are looking at a 3 sigma move

TURVI missed the green gold rush but this weed stock selling water use rights to Colorado growers is sending all the right messages. Buying in full position.