TOL (Toll Brothers, Inc.) TA & Trade Idea

Short-term Outlook (1–4 Weeks):

• Analysis: Oversold stochastic oscillator showing bullish crossover potential. Price approaching strong historical support near $90–$95. Candlesticks indicate seller exhaustion.

• Trade Direction: Long

• Confidence Score : 75% (Bullish reversal likely)

Medium-term Outlook (1–3 Months):

• Analysis: Significant correction from recent highs (~$150). Price action likely to consolidate near current levels. Bullish divergence forming on weekly indicators suggests recovery rally could target resistance at ~$110.

• Trade Direction: Cautiously Long (Target: $110)

• Confidence Score : 70% (Possible consolidation then bounce)

Long-term Outlook (6–12 Months):

• Analysis: Strong multi-year uptrend intact despite deep retracement. Price well above multi-year support levels (around $75–$85). Long-term fundamentals and weekly chart suggest continuation of bullish long-term trend after current correction completes.

• Trade Direction: Long (Buy-and-hold)

• Confidence Score : 80% (Bullish long-term trend intact)

Trade Summary:

• Short-term: Long from current oversold levels ($93).

• Medium-term: Hold/add positions targeting recovery to $110.

• Long-term: Maintain bullish stance targeting previous highs ($130–$150) over 6–12 months.

TOL

TOLL Brothers #TOL new high vs US single family home priceHomemakers are making money over fist.

Does this confirm that the housing bull market will continue.

It seems like it doesn't it

This ratio highlights the housing bottom in the 90's

this Ratio also topped out in 2005 before the housing bubble popped

#Roaring20's

TOL Housing collapse hasn't even started!Why is TOL rallying with other home building stocks? Great Depression 2 on the horizon, companies have begun laying off and will do so in spades soon. 30 year mortgages went from 3.2 percent to 6.5-7%, gas is $7 a gallon, credit card debt is a record $1.1 trillion! If interest rates stay UP house prices will come DOWN the American ponzi scheme of indentured slavery is based on long loans and the cost of the MONTHLY payment. Home builders are tone deaf to what's just begun....... Steer clear this sector for the foreseeable future!

TOL Bearish inclined naked calls - 19 Feb expiryFebruary's Secondary Trade

This trade is slightly riskier and is the opposite of the general market movement (bullish).

Residential Construction as a category has done generally well through the pandemic, at this point most of the companies in this sector have a very similar chart movement (Downward range) which is great as it shows a level of predictability in price movement.

Toll brothers is US's leading builder of luxury home. They have done well in the pandemic with their Q4 earnings breaking past estimates.

For Q4 the company's home sales revenue was up 9% year over year with home building deliveries growing 10%. Despite the positive results price is currently ranging with no spikes.

I'm positioning a neutral to bearish outlook as I expect the vaccination and the world getting used to the pandemic to see trading cash flow towards larger growth opportunities in COVID-19 impact sectors that are super beaten down and will see price climbing up

Sold 40 CALLs @ 0.6, Strike 49

BP block: 17k

Max gain est: $2374

Toll Brothers Short Here is an opportunity to short Toll Brothers, Toll Brothers is a luxury homebuilding company set to fall apart in our crumbling economy caused by the pandemic. This is an opportunity to short the company during these temporary choppy times. My strategy is to build my position $500 at a time. The put I will be buying has a strike price of $35 and expires 12/18.

Technicals also support the decline. You can see in the chart that the red cloud above the most recent candles is growing as this is an indicator of bears getting stronger. Theres also multiple sell signals on the Bollinger bands, while the MACD shows a history of bulls getting beat by the bears.

$LEN Bullish Descending Megaphone$LEN Bullish Descending Megaphone

$LEN has formed a beautiful descending broadening wedge or descending megaphone into its earnings report Monday after close. This pattern retested previous highs and bounced, showing support on a perfect retest of $71.30. First target is previous highs around $79.50 which I am looking for Monday into Earnings. I am looking to stay long LEN & homebuilders in general through earnings but will take some profits at first target.

$XHB on the whole looks decent

Component $DHI looks good

$TOL broke out & looks fantastic

BTO $LEN 9/18 $80c

$TOL is going to fall todayEarnings intraday trading strategy signal.

Toll Brothers occupied a big niche in the US luxury residential construction market.

The company has been beating sales and EPS estimates for 5 quarters (Q4 18, Q1 19, Q2 19, Q3 19, Q4 19). But yesterday the earnings report has a negative surprise — www.benzinga.com

I suppose many traders will close their long positions today due to bad earnings report and downside market trend.

So I hypothesize that $TOL price will be falling from the market open to market close.

Due to strategy, the short sell can be from the market open price,

stop-loss — $1,67 per share

take-profit — market close price.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Gems in a bear market rally: The homebuildersContinuing with my search for stocks to be bullish on (before I turn decidedly bearish as the S&P approaches 2625), I arrive at the homebuilders. Much like ANF ( as highlighted in my last idea ), homebuilders did not really enjoy the fruits of a massive rally over the past 10 years.

In the chart above, we see TOL has formed an almost perfect bullish triangle and has broken out above it during Friday's price action. Fundamentally, our current rally is being fueled by a supposedly dovish Fed (although I would argue that Powell is not actually dovish) and lower interest rates means more homes being financed and bought.

Similar bullish patterns exist in PHM, BZH and LEN so I think the whole sector is buyable here.

Buy TOL here at $35.33 with a target price of $38.75 and a stop of $33.80.

An Extended Oversold Period Ends with Important FootnotesAbove the 40 (November 1, 2018) – An Extended Oversold Period Ends with Important Footnotes

November 1, 2018 by Dr. Duru

AT40 = 21.4% of stocks are trading above their respective 40-day moving averages (DMAs) – ends an 11-day oversold period that followed a 4-day oversold period

AT200 = 32.0% of stocks are trading above their respective 200DMAs

VIX = 19.3

Short-term Trading Call: bullish

Commentary

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), closed at X%. The move ended a very extended 11-day oversold period that followed a one day respite from a 4-day oversold period. Today was the kind of day I wanted for a punch out of oversold conditions; it even quickly invalidated a small bearish divergence. The rally in the S&P 500 (SPY), the NASDAQ, and the Invesco QQQ Trust (QQQ) were all strong enough to close at their intraday highs and surpass the previous day’s intraday highs. The volatility index, the VIX, even cooperated by falling below 20 and presumably starts the end of wild swings in the market.

{The S&P 500 (SPY) gained 1.1% in a move that confirmed the breakout from the lower Bollinger Band (BB) downtrend channel.}

{The NASDAQ gained 1.8% in a move that confirmed the breakout from the lower Bollinger Band (BB) downtrend channel. It closed right at downtrending 20DMA resistance.}

{The Invesco QQQ Trust (QQQ) gained 1.3% as it closed right at converged resistance from the 20 and 200DMAs.}

{The volatility index, the VIX, looks like it confirmed a double top. I earlier expected one final surge in volatility before the next implosion.}

I thought my footnote on the action would be the wildcard of Friday’s jobs report. However, a poorly received earnings report from Apple (AAPL) in the after hours has the potential for sending the market right back into oversold territory. Whatever happens Friday, attention should quickly turn to the midterm elections on Tuesday. No matter the results, I am anticipating a volatility implosion as the market settles into incrementally lower uncertainty. If volatility remains high, then I will have to re-evaluate my expectations for a relatively benign end to the year.

Perhaps an even more important footnote is the relative performance of AT40 versus AT200 (T2107), the percentage of stocks trading above their respective 200DMAs. AT40 ended the oversold period at a slightly higher level than it ended the prior oversold period. However, AT200 ended this oversold period significantly lower: 32.0% versus 39.6%. This disparity flags longer-term technical damage in the stock market; the rebound out of oversold conditions left behind a small group of stocks. These laggards will hurt breadth as the rally proceeds and could provide the seed for the next market topping action. As usual, I will take this process one step at a time.

This was another day to mainly focus discipline on holding my long positions and looking for more buying opportunities from the shopping list. I snuck into ProShares Ultra S&P500 (SSO) on the small pullback from the open. I am in accumulation mode for SSO shares. I added to my Walmart (WMT) call options. I launched another short Rio Tinto (RIO) versus long BHP Billiton (BHP) pairs trade this time with a bullish bias. I even purchased a call spread on Red Hat (RHT) to play the post IBM deal discount. However, I missed out on getting back into Baidu (BIDU); I blinked and the call options I targeted increased by almost 4x as the stock gained a whopping 6.0% by the close. President Trump’s claim that he would get a “great deal” with China helped ignite the fire.

Toll Brothers heading towards the 50'sAs we can see in the chart TOL is on the crossing of 2 trend lines which provide strong support, this could act as a catalyst for a huge trend change.

Additionally, the stock got great fundamentals too, Its revenue and earnings are growing each year, the stock pe ratio is about 6 and the stock gives dividends.

I think this is a great time to buy, personally, I entered at 30.5 points and I believe in this stock.

Buy point - 30.75 points.

Sell point - 45-50 points (half a year to a year time span).

StopLoss - 28 points.

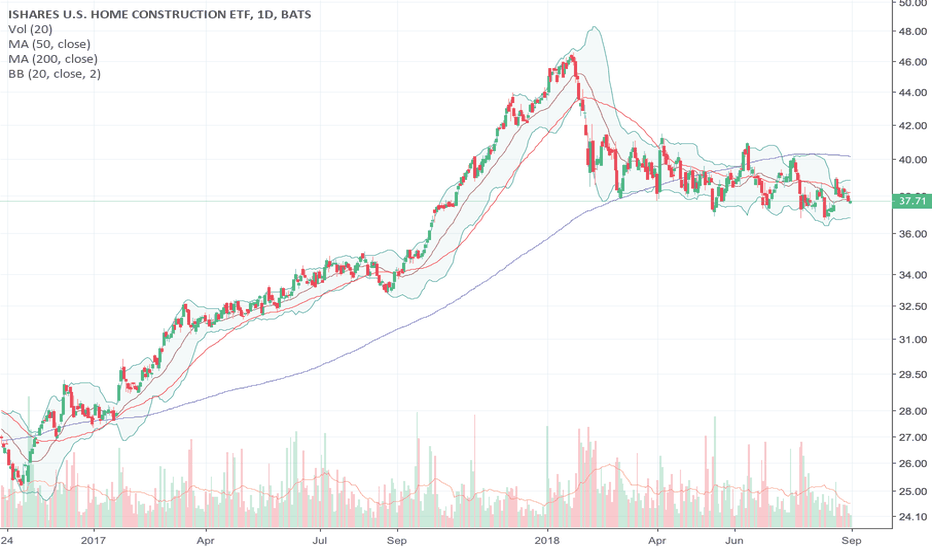

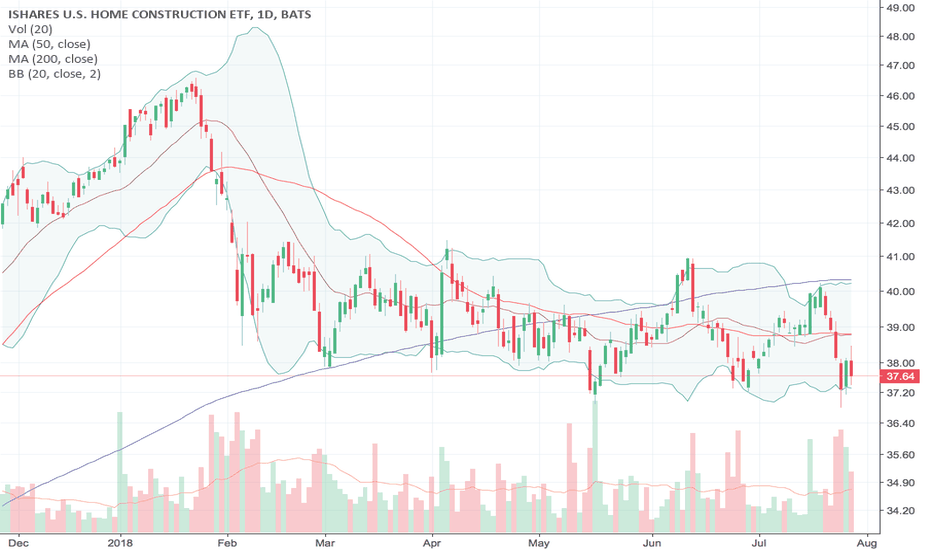

Housing Market Review – A Wobbly Edifice As Builders Break Down Alongside bearish trading action in builder stocks, July’s housing market data may have delivered confirmation of persistent investor fears.

"Housing Market Review – A Wobbly Edifice As Builders Break Down And Data Weaken" drduru.com $ITB $DHI $MTH $KBH $PHM $TOL $TPH #housingmarket #housingwatch #homebuilders #stockmarket #economy #gdp

Toll Brothers: ABCD completion with downside target at $38Interest rates are up and new home sales are slowing. Weekly ABCD completion for TOL and declining volumes. Downside potential to test congestion zone at $38 which coincides with a 50% retracement of the CD leg. Do note this is a weekly chart and the tactical price action appears to be basing, so there could be a better price to be had for initiating any short.

Overbought Threshold Rejects A Stock Market With Crossed SignalsThe headlines are headwinds, then tailwinds, then headwinds all over again. The stock market ominously pulled back from overbought again.

"An Overbought Threshold Rejects A Stock Market With Crossed Signals" drduru.com $SPY $QQQ $IWM #AT40 #T2108 #VIX $BA $TOL $BBY $AZO $MNRO $ULTA $AUDJPY #forex

$TOL to rocket after earnings?Looking at this tending chart its easy to see that TOL has has a nice run as of lately. With a lack of liquidity for new home buyers in current markets, home builders have been seeing substantial upside in their businesses.

TOL is expected to beat earnings, may be a good run to the upside.

Please invest at your own risk, I'm not a professional nor do I claim to be.

Ref:

www.nahb.org

www.usatoday.com

www.nasdaq.com