NOT/USDT:WHAT DO YOU THINK!Hello friends

The TON ecosystem has a lot of potential and gives good profits.

Due to the price drop, we have reached a good support area, which is also the bottom of the channel. Now we can buy in stages and with capital management and move to the specified goals.

Always buy in fear and sell in greed.

*Trade safely with us*

TON

Long Possible Zone TON/USDT⚡ Toncoin (TON/USDT) – Bullish Reversal in Play? 📈

TON just tapped into a high-confluence Long Zone between $2.80 – $2.337, which acted as a powerful demand area during the last consolidation phase in late March. After a sharp drop today, price is now sitting at a key decision level. 🟢

🔹 Long Zone: $2.80 – $2.337

🔹 Historical Support: Held in late March before a significant run

🔹 Target: $4.20

📈 If price holds this zone, we could see a strong bullish reversal toward the $4.20 region or above. The descending wedge pattern hints at a textbook accumulation-to-expansion setup—but only with proper confirmation. 🚀

🟢 High reward-to-risk setup for swing traders watching for trend shifts.

⚠️ Don’t rush in. Look for signs of strength before entering.

Are you bullish on TON/USDT? Let’s discuss! 👇

TONUSD: New bullish wave started. Next stop $9.000.Toncoin recovered its bullish 1D technical condition (RSI = 62.631, MACD = 0.117, ADX = 36.295) as this is the 4th straight week of gains following the bottom on the 3 year Channel Up. With the 1W RSI rebounding also after being oversold on March 3rd, we have a strong indication that the new bullish wave has technically started. If it only follows the weaker leg of +300% at the start of the Channel Up, it can reach $9.000 by September.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Is a TON Pump Coming?Is a TON Pump Coming? 🚀

TON, the blockchain developed by Telegram’s team, has gained significant attention due to its low transaction fees and strong connection with Telegram. Recent increases in liquidity and demand indicate growing investor interest in this cryptocurrency.

🔹 Technical Analysis:

TON is currently in a short-term uptrend, with $4 acting as a key resistance level. A confirmed breakout above this level could push the price towards $7. However, failure to break this resistance may lead to a price correction toward lower support levels.

🔹 Potential Risks:

A significant portion of TON tokens is held by whales, which could lead to high volatility. Additionally, its unlimited supply poses long-term inflation risks if not managed properly.

🔹 Growth Catalysts:

Recent positive news, such as Telegram’s potential partnership with AI (Grok) and the release of key updates, could drive further demand. If TON sustains its momentum and breaks key resistance levels, it may enter a stronger bullish phase.

📌 Conclusion:

While TON has strong fundamentals and market interest, its long-term stability depends on supply management and investor behavior. Entry at key levels with proper risk management is essential for those looking to trade or invest. 🚀

$TON Price Surge: Can Grok AI Drive the Next Breakout?Elon Musk’s confirmation of Grok AI’s integration into Telegram is a game-changer for Toncoin, enhancing the utility of projects built on the CRYPTOCAP:TON blockchain. This news coincides with TON’s recent breakout from a falling wedge, signaling potential bullish momentum as it approaches the critical $4 resistance level. A decisive break above this mark could push the price toward $5.55.

Market sentiment remains optimistic, with Toncoin’s Open Interest reaching $176.23 million. However, liquidation data reveals more long positions being wiped out than shorts, indicating volatility and potential corrections. While bullish sentiment prevails, traders should watch for sustained support above $4 to confirm TON’s continued rally.

TON Claims $4 Pivot Amidst A Golden Cross PatternThe price of CRYPTOCAP:TON spiked 9% today reclaiming the $4 price pivot with further growth set to occur amidst a "Golden Cross" pattern.

The Open Network ( CRYPTOCAP:TON ) is a revolutionary blockchain platform designed to handle millions of transactions per second. It uses a unique multi-blockchain architecture with dynamic sharding and instant messaging between chains.

The system aims to make blockchain technology accessible to everyday users through integration with messaging apps and user-friendly services. TON has become one of the fastest-growing blockchain ecosystems, with numerous decentralized applications and services being built on its infrastructure.

As of the time of writing, CRYPTOCAP:TON is up 9% trading within overbought regions as hinted by the RSI at 78.78 with growing momentum and the appearance of a golden cross pattern, a breakout to $6 is feasible.

For TON, a breakout above the 1-month high pivot could cement a move to the $6 region. Similarly, in the case of a cool-off, given the RSI is overbought, the 38.2% Fibonacci level is acting as support for $TON.

Toncoin Price Live Data

The live Toncoin price today is $3.96 USD with a 24-hour trading volume of $285,169,930 USD. Toncoin is up 8.27% in the last 24 hours. The current CoinMarketCap ranking is #12, with a live market cap of $9,833,721,005 USD. It has a circulating supply of 2,484,304,181 TON coins and the max. supply is not available.

Toncoin Bullish Flag Breakout in Sight?Hello guys!

ton seems like a potential coin for getting it!

The chart shows Toncoin forming a bullish flag pattern after a strong upward move. The price is testing the upper boundary of the flag, indicating a potential breakout. If the breakout confirms, the price could rally towards the $5.60 target. Traders should watch for increased volume and a clean break above resistance to validate the move. Failure to break out could result in consolidation within the channel.

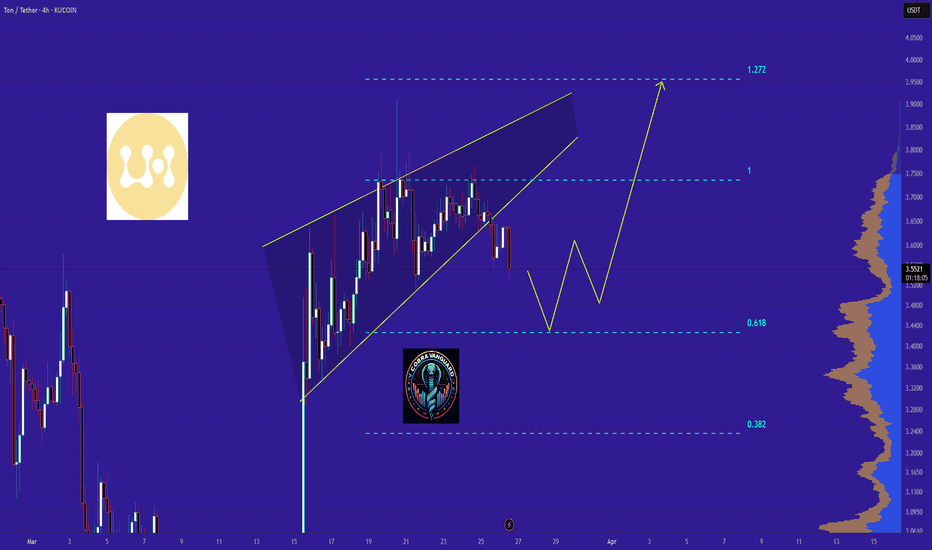

TON Ready for PUMP or what ?The price will correct to the 0.618 level and then rise to 4 dollars.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

#TON #TONUSDT #TONCOIN #LONG #Scalp #Scalping #Eddy#TON #TONUSDT #TONCOIN #LONG #Scalp #Scalping #Eddy

TONUSDT.P Scaliping Long Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Be successful and profitable.

Toncoin TON price will surprise everyone💎If you look closely at the OKX:TONUSDT chart, you can see/think that the last six months have seen a global trend reversal pattern - Head and Shoulders.

But! This pattern will be confirmed after the price of CRYPTOCAP:TON is firmly fixed below $4.50. Then the target is $2.30-2.50.

However, this is all very obvious, trite, and not interesting)

We want this idea to become prophetic and Legendary, so we hope for the beginning of a hypercycle of #Toncoin price growth with an ultimate goal of $93

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

TON road map !!!If the price can break through this important resistance, it can easily reach the desired targets.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TON Main trend 16 03 2025Logo of rhymes. Gann fan for understanding the logic of trend development and dynamic levels of support and resistance.

Time frame 1 week, for full orientation in the trend and potential targets. Key price reversal zones on which the trend development depends are shown with arrows. Conservative and adequate targets in the medium and long term. Everything above, as for me, should not worry you much, but this is purely my opinion, nothing more.

🟡 Pay attention how clearly the percentages of large triangles and time reversal zones are worked out according to the algorithm. Someone who is far from trading says that TA does not work on cryptocurrency.

TA is a banal logic, an exchange algorithm (you need to be tied to something), real supply/demand (market participants) and manipulative supply/demand, that is, large market participants (exchanges, funds, creators).

In the development of the trend, there is a fractal behavior of the price in the trend at the moment. Perhaps this logic will continue. The secondary, downward trend formed a wedge-shaped formation, as before.

1 day time frame

🟣 Currently locally an aggressive buyback is taking place (probably, as an excuse for the price movement, some positive news was released) from the dynamic support of the fan (on the 5-minute time frame, after the impulse-buyback, a bullish triangle was formed in consolidation, and now its goals are being realized). If after a rollback on the senior time frame (1 day, 1 week) this zone is preserved - a reversal of the secondary trend. At the moment, the price is moving within the wedge canvas, locally there is a complete absorption of the bearish candle on the weekly time frame.

🔴 Also, if there is a test of this reversal zone (less likely) , then the price can consolidate according to the logic of the descending wedge. Price consolidation, especially not overcoming the dynamic former fan support on a repeated retest — a decline to begin with to the median (red dotted line) of the range. On the chart you will see an "illogical" head and shoulders. This is an extremely unlikely scenario, but I will describe it just in case, so that you take this into account in your money management (not risk management).

TON Go to $4.5?Durov was finally released, he returned to Dubai, and #TON perked up by +16% in a day.

That's it, now people will love the CRYPTOCAP:TON Ecosystem again, a bunch of new tapals will come out.

The key resistance level will be at $4.5

We can also go to $2.7

The break of the global triangle upwards may be in Seb-Oct

Correction time The TON Ecosystem was used wisely, they identified weak points, protected their market from Competitors with protectionism, mini apps in Telegram should only use TON, now Liquidity will accumulate more inside Telegram, and not go to Solana.

The game starts again)) and we are ready for it.

TonCoin- Eliminate the useless, keep the essential.

- imo Toncoin looks bottomed, but remember, crypto moves fast, if BTC dips, altcoins usually follow harder.

- That said, for now, I don’t see altcoins dropping further; they sound to be not far from a rock bottom.

------------------------------------------------------------------

Simple Trade Strategy :

------------------------------------------------------------------

- Buy now around 3$

- Keep some juice to DCA more around 2.30$

------------------------------------------------------------------

TP : 5.50$

SL : 1.95$

------------------------------------------------------------------

Play Wisely !

Happy Tr4Ding !

Toncoin Gets Ready For $17 & $22 (Elliott Wave Theory)There is a classic ABC (Zig-zag) correction on the chart based on Elliot Wave Theory. The correction is perfect in size and proportions and comes out of a perfect 12345 bullish impulse. The end of the correction signals the start of a new bullish phase.

The dynamics here are the exact same we just looked at with AAVEUSDT. After the correction reaches its end, there is some sideways (consolidation), this sideways then produces slow and steady growth and finally a strong price advance.

In 2023, there were almost three months of sideways action after the low was in before the first advance got started. Then another period of sideways preceding the major bullish climax. This is standard price dynamics and we should experience something similar in the coming months.

Patience is key. But the market looks good now for accumulation in anticipation of a major bullish wave that will end in a bull-run. Targets can easily hit $11, $17, $22 and beyond.

Namaste.