TON Forms Inverse Head & Shoulders – Breakout Imminent?CRYPTOCAP:TON is forming a textbook Inverse Head & Shoulders pattern, a strong bullish reversal signal. The price is currently testing the neckline around the $3.90–$4.00 zone. A successful breakout and daily close above this level could confirm the pattern and trigger a move toward the $4.80–$5.20 resistance area.

Bullish Confirmation: Neckline breakout with volume.

Invalidation : close below 3.5

DYOR, NFA

Toncoin

Toncoin Bullish Flag Breakout in Sight?Hello guys!

ton seems like a potential coin for getting it!

The chart shows Toncoin forming a bullish flag pattern after a strong upward move. The price is testing the upper boundary of the flag, indicating a potential breakout. If the breakout confirms, the price could rally towards the $5.60 target. Traders should watch for increased volume and a clean break above resistance to validate the move. Failure to break out could result in consolidation within the channel.

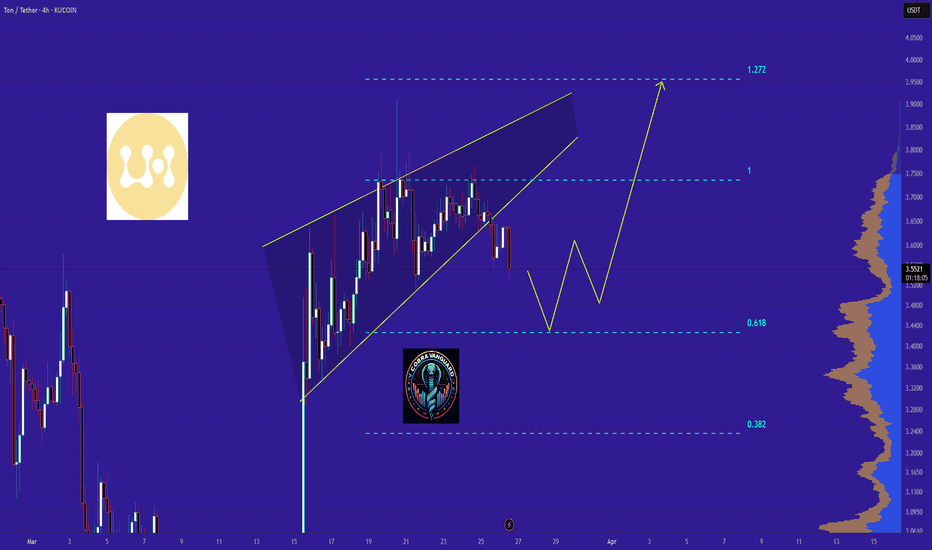

TON Ready for PUMP or what ?The price will correct to the 0.618 level and then rise to 4 dollars.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TON/USDT: Potential Pullback After Sharp RallyThe TON/USDT market experienced a 20% surge following unexpected news that Telegram founder Pavel Durov had regained his passport, enabling unrestricted travel. This bullish momentum led the price to rebound from support and approach the 4.00 resistance zone.

However, as the price neared this key resistance, momentum began to slow, and signs of a bearish divergence emerged. On the daily timeframe, candles with upper wicks suggest rejection at higher levels. Given these developments, the market may be poised for a short-term corrective move toward lower support. The next potential target is the support zone around 3.330

Toncoin TON price will surprise everyone💎If you look closely at the OKX:TONUSDT chart, you can see/think that the last six months have seen a global trend reversal pattern - Head and Shoulders.

But! This pattern will be confirmed after the price of CRYPTOCAP:TON is firmly fixed below $4.50. Then the target is $2.30-2.50.

However, this is all very obvious, trite, and not interesting)

We want this idea to become prophetic and Legendary, so we hope for the beginning of a hypercycle of #Toncoin price growth with an ultimate goal of $93

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

TON road map !!!If the price can break through this important resistance, it can easily reach the desired targets.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TON opens new horizons for users and developersThe Open Network (TON) is a decentralized blockchain originally developed by the Telegram team, designed for scalable and fast transactions. TON is utilized across various sectors, including decentralized finance (DeFi), gaming applications (GameFi), and payment systems, providing users and developers with a reliable and efficient platform for creating and using decentralized applications.

The first two months of 2025 have been pivotal for TON: the ecosystem has demonstrated significant growth and taken strategic steps that have strengthened its position in the crypto industry. During this period, 3.1 million new wallets were activated, with daily activity ranging from 170,000 to 590,000 users. Monthly trading volume reached an impressive $500–700 million, while weekly transactions grew to 20–30 million, placing TON among the top 8 blockchains by this metric.

Another major announcement was that TON has become the exclusive blockchain infrastructure for Mini Apps on Telegram. This means that all mini-apps on Telegram will now utilize TON for tokenization, payments, and integrations, ensuring users a more convenient, secure, and faster experience with decentralized services.

A key growth factor was the partnership with LayerZero, enabling seamless USDT transfers between Ethereum, TRON, and Arbitrum , with plans to expand to over 100 different blockchains in the future. This move significantly boosts network liquidity and enhances its attractiveness for developers and users.

Toncoin – The native currency of TON. It is used for network operations, transactions, gaming, and NFTs. Key growth factors for the TONUSD crypto pair in 2025:

Deep integration with Telegram – TON’s role as the primary blockchain infrastructure for Mini Apps in Telegram grants access to a vast user base and attracts developers.

Expansion into the U.S. market – The new president of TON Foundation is actively developing strategic partnerships in the U.S., strengthening the blockchain’s global influence.

Investments in DeFi and PayFi – The TVM Ventures fund is allocating $100 million to ecosystem development, fostering growth and innovation.

Technological enhancements and integrations – Integration with LayerZero and the launch of the Omnichain Fungible Token (OFT) standard will improve TON’s compatibility with other blockchains, expanding its functionality.

With such strategic initiatives and continuous infrastructure development, 2025 is set to be a breakthrough year for TON, solidifying its position as one of the leading blockchain projects worldwide.

And at FreshForex, we proudly offer you:

1. The ability to open a trading account in TON (Toncoin).

2. The option to trade the TONUSD (Toncoin vs. US Dollar) pair and profit from price fluctuations 24/7.

TonCoin- Eliminate the useless, keep the essential.

- imo Toncoin looks bottomed, but remember, crypto moves fast, if BTC dips, altcoins usually follow harder.

- That said, for now, I don’t see altcoins dropping further; they sound to be not far from a rock bottom.

------------------------------------------------------------------

Simple Trade Strategy :

------------------------------------------------------------------

- Buy now around 3$

- Keep some juice to DCA more around 2.30$

------------------------------------------------------------------

TP : 5.50$

SL : 1.95$

------------------------------------------------------------------

Play Wisely !

Happy Tr4Ding !

Toncoin Gets Ready For $17 & $22 (Elliott Wave Theory)There is a classic ABC (Zig-zag) correction on the chart based on Elliot Wave Theory. The correction is perfect in size and proportions and comes out of a perfect 12345 bullish impulse. The end of the correction signals the start of a new bullish phase.

The dynamics here are the exact same we just looked at with AAVEUSDT. After the correction reaches its end, there is some sideways (consolidation), this sideways then produces slow and steady growth and finally a strong price advance.

In 2023, there were almost three months of sideways action after the low was in before the first advance got started. Then another period of sideways preceding the major bullish climax. This is standard price dynamics and we should experience something similar in the coming months.

Patience is key. But the market looks good now for accumulation in anticipation of a major bullish wave that will end in a bull-run. Targets can easily hit $11, $17, $22 and beyond.

Namaste.

Be careful with Toncoin !!!Now that the price is at the bottom of the wedge, it can raise the price to the top of the wedge.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TON - Time to buy again!The price has formed a Triangle on the 4h time frame, and if it breaks out, it can drive the price up to around $4.3.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TON is following a bearish scenario 12H TFTON has entered a bearish structure after losing the flip zone. If a pullback to the flip zone occurs, it could present a good opportunity for sell/short positions.

A daily candle closing above the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

The bearish scenario for TON has been activatedThis analysis is an update of the analysis you see in the "Related publications" section

We were counting on the flip zone for the continuation of the uptrend, but this zone was strongly broken.

We are not biased toward any analysis; we simply share what the chart shows us and always strive to reduce our errors and find the correct market direction.

If a pullback toward the flip zone occurs, we can look for sell/short positions.

The best zone for buying and investing is the green area. There is a liquidity pool at the bottom of the chart, which is expected to be swept in the coming weeks.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

TON (telegram coin): is ready for an upward hello guys!

let's analyze TON!

Ton formed a head and shoulders pattern and broke the neckline!

The target of this pattern has already been achieved!

and the last candle touched the flip area too!

so there is no debt to a lower level for this coin! it is ready for an upward movement!

TONUSD Be ready for $12.00 this Summer.It has been almost 5 months (September 12, see chart below) since the last time we analyzed Toncoin (TONUSD) and made our bearish call:

As you can see, it successfully hit our 3.50 Target and the 0.618 Fibonacci level. With that being a direct contact with the bottom (Higher Lows trend-line) of the 1-year Channel Up, while the 1D RSI got oversold (<30.00), we expect the new Bullish Leg to start.

All previous oversold RSI hits (with the exception of Aug 05 2024) have been bottoms and with +300% being a standard rise within this pattern, we expect to see $12.000 as the next High.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

TON/USDT: How to Act in the Market When Panic Takes Over?Crypto Panic or Manipulation? A Deep Market Breakdown

🔥 Hello everyone, this is Ronin!

The last two trading days have been a real test for investors and traders in the cryptocurrency market. 📉 We witnessed a massive wave of liquidations, which literally crashed altcoins. Looking at the numbers:

Most assets dropped by 10–30%.

Some coins lost 50% of their value.

The total crypto market capitalization shrank by more than 10% in just a few days.

We haven’t seen a crash like this in a long time. 📉💥

What Are Analysts Saying?

According to most experts, the main reason for this decline was the new trade sanctions imposed by Donald Trump against Canada and Mexico. These sanctions allegedly led to an overall deterioration of the economic climate, causing capital to flow out of risk assets, including cryptocurrencies.

But is that really the case?

My Perspective: What Really Happened?

I can’t say with 100% certainty, but my decade of experience tells me otherwise. What we saw over the weekend was nothing more than crypto panic and large-scale market manipulation.

🔹 Why do I believe this?

The sanctions have no direct or indirect impact on the crypto market.

The key factor was the psychological state of market participants.

Friday was extremely positive: the Fear and Greed Index was in the "greed" zone, and ETF funds recorded record capital inflows.

The Fed left interest rates unchanged, which the market viewed more positively than negatively.

However, by the weekend, we saw massive sell-offs. The logic is simple: big players took advantage of the news cycle to wipe out market liquidity. 💸

The Hardest Hit: TON

💎 TON (The Open Network) is one of the most promising blockchain projects, closely tied to the Telegram ecosystem.

And here’s the question: Is there any real reason for TON to be this undervalued?

❌ The answer is a definite NO!

For comparison:

Even when Telegram’s founder, Pavel Durov, was arrested in France, the risks for the project were much higher, yet the price never dropped below $4.

However, on Sunday night, the price plummeted to $3 – with no real fundamental reason behind it.

📌 If that’s not manipulation, then what is?

What Do the Stats Say?

📊 More than $2 billion in liquidations occurred in a single trading day.

💥 This was one of the largest liquidation events in the history of the crypto market.

If you check CoinGlass, you’ll see a massive imbalance in liquidations between buyers and sellers. Big players literally wiped out everyone who was leveraged long.

What’s Next? Where Is the Market Headed?

As the saying goes: "Buy when everyone is selling, and sell when everyone is buying."

Right now:

✅ Everyone is selling.

✅ The market is in panic mode.

✅ Big players have wiped out overleveraged long positions.

What should you do in this situation? 🤔

Personally, my average entry on TON is $5. I bought 40,000 tokens, and yes – the drawdown is significant.

I had the temptation to close my position, wait for the bottom, and re-enter, but then I remembered one of the golden rules of the market:

💡 If everyone is selling, it’s time to buy!

So not only did I NOT close my position, but I increased it.

Conclusion: What to Expect Next?

📌 This was an artificial correction – a manipulation aimed at liquidating overloaded positions.

📌 The coming days will show a recovery, especially if volumes begin to rise.

📌 Market psychology is a key factor. When the market is in panic mode, big players are accumulating assets at low prices.

I will continue to publish updates on my TON position and other cryptocurrencies. If you’re interested in my strategy for recovering from this deep drawdown, follow my profile on TradingView.

🚀 In upcoming articles, we’ll analyze other coins and provide a microeconomic breakdown of projects in similar situations.

This has been Ronin – stay tuned for updates! There's a lot more to come. 🎯

Skyrexio | Toncoin TON Will Dump Before Huge Pump!Hello, Skyrexians!

Today we will take a look at the most hyped crypto of 2023. Now it looks like everybody forgot about BINANCE:TONUSDT because asset is in boring flat for 9 months. In our opinion price is about to start moving and we will see nice entry point soon for the potential insane growth.

Let's take a look at the weekly time frame. Here we can see the clear 5 waves cycle and now the wave 4 is in terminal phase. Target for the wave 4 is 0.38 Fibonacci level. If in this area Bullish/Bearish Reversal Bar Indicator will flash the green dot it's going to be strong sign to enter the trade for the wave 5. Wave 5 can easily break $10. We will update this idea when wave 4 is going to be finished.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!