TradeCityPro | TONUSDT From Pavel’s Release to Blockchain Events👋 Welcome to TradeCityPro Channel!

Let’s dive into the analysis of TON, one of the most efficient and widely used blockchain projects that is making significant waves in the space.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you that we have moved the Bitcoin analysis to a separate section based on your requests. This allows us to discuss Bitcoin’s status in more detail and analyze its charts and dominance separately.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

🚀 Pavel Durov’s Release!

Pavel Durov, Telegram’s founder, has returned to Dubai after months of restrictions in France. He was detained in August 2024 over content monitoring allegations but announced on March 17, 2025, that he has finally returned to his main residence and Telegram’s headquarters in Dubai.

Durov thanked his team and lawyers, emphasizing that Telegram had gone beyond its legal obligations. While investigations in France continue, this return could be a turning point for Telegram’s future.

At the same time, the TON blockchain is gaining attention with its NFT ecosystem, including projects like GetGems and TON Diamonds. From Telegram usernames as NFTs to event tickets, TON is building a fast, scalable, and practical ecosystem that’s making headlines.

🔍 Deep Research

In our previous analysis, we conducted an in-depth fundamental review of TON—covering team background, blockchain developments, and ecosystem growth. Since investing requires a full understanding of a project, make sure to check out the previous analysis if you haven’t already.

📊 Weekly Time Frame

TON is one of the strongest altcoins in the market right now. While most altcoins have reached or formed new lows, TON is still holding above major supports.

After forming its all-time high of $8.288, TON entered a distribution zone. Due to overall market corrections, it lost the $4.765 support, leading to a sharp drop that reached the $2.650 support an area we previously identified for entries.

This support level is crucial, as it represents nearly 50% of the chart’s structure. Additionally, the 0.786 Fibonacci level and previous long-term resistance reinforce its importance. As seen on the chart, after touching this level, TON bounced sharply.

There is no clear spot buying trigger at this time frame yet. However, if TON forms a higher low, the chart will turn fully bullish.

For exit strategies, I am currently utilizing my TON within its ecosystem (NFT trading, etc.), so I do not plan to sell unless the price drops below $1.914.

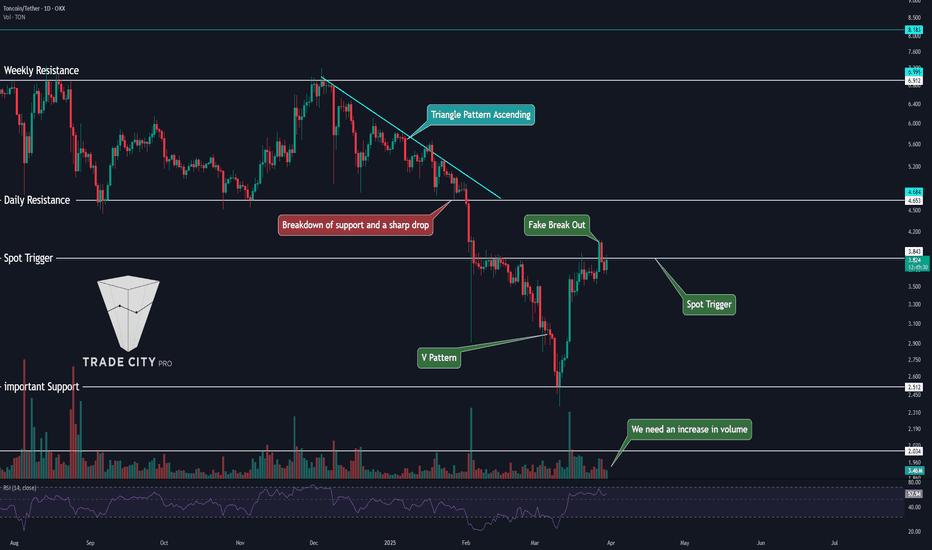

📉 Daily Time Frame

After getting rejected at $6.912, TON entered an ascending triangle pattern—which is typically a bearish continuation pattern. The chart continued forming lower highs and lower lows, indicating that selling pressure outweighed buying interest.

After breaking down from this triangle, TON experienced a sharp 50% drop from the breakout point. However, upon reaching the $2.512 support, the price suddenly pumped, partly influenced by Pavel Durov’s release and new TON blockchain developments.

Even without the fundamental catalysts, this support level was critical, and a bounce was likely. This move has now formed a V Pattern, which is bullish.

If TON breaks above $3.857, we could see further price increases, making this a potential buy opportunity. Confirmation signals include RSI entering overbought territory and increased volume.

⏳ 4H Time Frame

TON is on my watchlist for long positions due to its strong hype and ecosystem developments.

🟢 Long Position:

We are currently testing a major resistance at $4.076. If this level breaks, we can safely enter a long position. If a lower time frame trigger appears, it may be worth entering early.

🔴 Short Position:

I generally don’t recommend shorting TON, but if it breaks below $3.569, it could trigger a decent short trade. However, since TON is still ranging in the daily time frame and market volume is low at the end of the month, be cautious—unpredictable wicks are likely.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

Tonusdt

TON/USDT: Bullish Continuation Builds Above Key Breakout ZoneThe TON/USDT market is maintaining its upward momentum after breaking out of a consolidation phase, currently testing the psychological level of 4.00. Although a pullback toward the support level and upward trendline remains possible, the breakout and close above the consolidation zone suggests that this area may now act as support.

On the daily timeframe, a bullish engulfing candle has formed, reinforcing the presence of strong buying pressure. If the market retests and holds above the breakout zone, further upside is likely. The next key target is the resistance zone around 4.40, with potential to extend toward the 4.50–4.80 range

TON Claims $4 Pivot Amidst A Golden Cross PatternThe price of CRYPTOCAP:TON spiked 9% today reclaiming the $4 price pivot with further growth set to occur amidst a "Golden Cross" pattern.

The Open Network ( CRYPTOCAP:TON ) is a revolutionary blockchain platform designed to handle millions of transactions per second. It uses a unique multi-blockchain architecture with dynamic sharding and instant messaging between chains.

The system aims to make blockchain technology accessible to everyday users through integration with messaging apps and user-friendly services. TON has become one of the fastest-growing blockchain ecosystems, with numerous decentralized applications and services being built on its infrastructure.

As of the time of writing, CRYPTOCAP:TON is up 9% trading within overbought regions as hinted by the RSI at 78.78 with growing momentum and the appearance of a golden cross pattern, a breakout to $6 is feasible.

For TON, a breakout above the 1-month high pivot could cement a move to the $6 region. Similarly, in the case of a cool-off, given the RSI is overbought, the 38.2% Fibonacci level is acting as support for $TON.

Toncoin Price Live Data

The live Toncoin price today is $3.96 USD with a 24-hour trading volume of $285,169,930 USD. Toncoin is up 8.27% in the last 24 hours. The current CoinMarketCap ranking is #12, with a live market cap of $9,833,721,005 USD. It has a circulating supply of 2,484,304,181 TON coins and the max. supply is not available.

2024-2026 Exploration of 5-100x Web3 cryptos and Stock Targe【Old article on 2024-3-5】-republish due to private indicators before

Time flies, nearly four years have passed since we wrote a similar article, and we feel quite satisfied as 95% of the predictions have been met. Except for Boeing, which surprisingly didn't take off, Bilibili ($19), BTC ($3800), Tiger $3, and PDD ($19) achieved the expected 5-10x growth within two years. The subsequent performances of ACH,UOS, NEAR, and ALGO

provided even greater surprises with 10-80x gains.

However, I continuously reflect and hope to improve my judgment since, compared to readers who directly read the articles, those of us immersed in the sea of information sometimes have our initial judgments clouded by various external factors.

We prefer to express our views at relatively low or high points in advance, allowing time to silently validate these opinions. Real-time perspectives are highly attractive but also constantly at risk, demanding much energy and health. Many have faced health warnings, and we hope everyone remains healthy and happy in 2024. I lean towards identifying the start and end points, then trusting the driver and natural progression for everything in between.

Returning to the topic, it has been over two and a half years since a similar article, and I will discuss a few targets and core catalysts I believe are underestimated:

1.Bitcoin (BTC) BINANCE:BTCUSD

Introduction: Born in January 2009 as a hedge against inflation after the 2008 financial crisis, BTC has experienced nearly 16 years. Its underlying logic and blockchain technology have birthed foundational blockchains like Ethereum, ADA, SOL, AVAX, CFX, and Algo. BTC's development attributes have expanded potential applications, such as Stacks and RGB protocols. My ultimate expectation for BTC is simple: it could be valued highly just as a new E-GOLD for decades to come. If its ecosystem applications further explode, it could become one of this century's leading assets.

Key Catalysts: The 2024 halving, reducing block rewards to 3.125 and resulting in a yearly inflation of about 0.782%, which is lower than the inflation rates of most developed countries. The next wave of funding entering the industry could be expedited by the SEC’s approval of ETFs, the alleviation of sell pressure from Grayscale's repositioning and MGOT, and traditional financial risks causing forced rescue actions by BTC-holding companies to pass.

● Expected Valuation: $200,000 MC: 4.2 trillion USD, marking the beginning of a new world, extensively unfolding application scenarios

Reminder: It's important to emphasize that long-term expected valuations do not imply a straight path upwards from current price points. There might be an average upward trend, but short-term intense volatility is possible. Always remember not to engage in long-term commitments with high leverage. This reminder is also placed here for additional caution.

2.Telegram Ime ( POLONIEX:LIMEUSDT Lime) & TON ( BINANCE:TONUSDT TON)

Introduction

Ime Messenger is a special version of Telegram, integrating functionalities such as a multi-chain wallet, enabling direct transfers of various blockchain assets like BTC, ETH, AVAX, BNB, Polygon, Mantle, AVAX, etc., among Telegram friends. It incorporates features like Binance Pay, direct Google Translate in Twitter and TG conversations, and optimizes Telegram's overall layout and usability.

Telegram accounts and chat histories, along with other crucial data, can be directly utilized in the Ime version of Telegram without the need for a new account. Similarly, chat histories in the IME version will automatically sync with the original Telegram version, facilitating easy switching. The Ime version essentially acts as an integrator, merging the Web3 world into the TG ecosystem, with TON leaning towards the chain ecosystem.

TON is a native public blockchain ecosystem developed on top of Telegram, serving as an inherited blockchain project from TG's original project team. It introduces more development possibilities and diversity to Telegram's native ecosystem growth.

● Core Logic:

Within three years, the user base of the Ime version increased from 2 million to 10 million users, a 500% increase. The friendly relationship with Telegram's founding team enables seamless connection to Telegram's 700 million users. The latest multi-chain Token group red packet function uses Lime as the Gas fee, which will greatly benefit the project's operation and promotion if more convenient modes are optimized in the future. Ime's multi-chain integration feature can help project parties integrate into the Telegram ecosystem faster. Currently, LIME's FDV fluctuates between $5M and $10M, far below the valuation of many primary market projects.

TON, as TG's native underlying public blockchain, ranks at the forefront in terms of operational level and market promotion. It can be directly used in the original version of TG, reducing the teaching cost. Although it doesn't support multi-chain, the wallet is a single-chain wallet in the form of a dialogue box. TON itself also has enough potential, and its FDV has surpassed $10 billion, indicating the market's expectations for Telegram.

● Keys to Launch:

Ime Lime:

Due to the presence of many hardcore tech personnel from Russia and Ukraine, the involvement of core operational PR is needed to enhance the project's self-marketing capability.

Further optimization of the TG group members' ability to freely use the red packet function to send various TOKENs as rewards to group members.

More optimization of TG functionalities to be utilized.

Further support and policies from Russia towards blockchain applications.

TON:

A more lenient regulatory stance from the SEC towards the official Telegram TON.

Collaboration and output of SocialFi Killer-level projects on the chain.

An increase in GameFi entering through TG as a portal.

● Expected Valuation:

Lime: Current MC FDV: $5.7M, Expected FDV: 3B-5B

TON: Current MC FDV: $MUN:10B, Expected FDV: $60B

3.Conflux (CFX)

BINANCE:CFXUSDT

● Basic Introduction:

Conflux is a Layer 1 public blockchain supported by a team that includes a Turing Award winner and technical advisors from Tsinghua University's Yao Class, aimed at long-term development platforms for dApps, e-commerce, Web 3, and metaverse infrastructures. Its Tree-Graph consensus mechanism, which combines Proof of Work (PoW) and Proof of Stake (PoS) algorithms, is considered one of the most prominent purely domestic projects in my opinion.

● Core Logic:

Conflux's unique Tree-Graph consensus algorithm achieves high scalability and low latency, driven by a technology-focused team, ensuring smoothness and convenience comparable to high-valuation blockchain projects like SOL and ETH. It aligns quickly with the mainstream development pace of Web3, waiting only for further opening and an increase in active users to unlock significant potential. Trendy applications are gradually making their way onto CFX.

● Keys to Launch:

Further support and liberalization for blockchain public chain applications and the metaverse by mainland China.Further popularization of the public chain as a pilot test in China's Hong Kong, Macao, and Taiwan regions.

More official cooperation and implementation with institutions like CITIC, Xiaohongshu, leading to the complete disappearance of traditional capital suppression.

Gradual maturity of Conflux's own development and formal, successful support for BTC L2.

● Expected Valuation:

Current MC FDV of CFX: Fluctuating around $0.9B, Expected FDV: $36B-$80B

4.Opulous (OPUL)

KUCOIN:OPULUSDT

● Basic Introduction:

A music RWA+DeFi project, where RWA has already achieved application cooperation with singers. Investors can participate in purchasing a portion of album rights with OPUL to earn subsequent album revenue shares from the artist. The new feature, Opulous OLOAN, creates a unique bridge between RWA and the music industry. By staking USDC in the pool, it provides funding for musicians and earns extra income on the staked USDC.

OVAULT is a unique staking pool on the Opulous platform that allows you to stake USDC to access a diverse music library. This library, curated by Opulous music experts, features popular and high-performing songs. Participating in OVAULT not only grants access to this music library but also rewards, offering a way to engage with the music industry and profit from staking.

● Core Logic:

The company has a rich network of core music resources, with dittos being a music collaboration company of ED Sheeran, Overall, Opulous maintains a relatively leading position in market rhythm control, ranking as one of the more playful project parties on the Algorand and Arb chains. The pressure from private placements has been fully released.

● Key to Launch:

The further popularization of music applications, as well as the actual revenue generated by high-profit artists.

● Expected Valuation:

OPUL current MC FDV fluctuates around $50M-100M, with an expected FDV of $MUN:10B-$30B

5.Bilibili (BILI)

NASDAQ:BILI

● Basic Introduction:

A video creation and live streaming platform, a haven for secondary elements, and a platform concentrated with young purchasing power, which has invested in a bunch of enterprises leading to poor financial reports in recent years. Thus, the stock price has plummeted from its peak, so let's just drink to that.

● Core Logic:

Currently, the only platform in China that seems capable of competing with YouTube.

Gaming may catch up to the era of Web3 entry points.

High user stickiness, but consumer rights are currently somewhat limited to anime series.

● Key to Launch:

Encourage more original creative educational videos, as most Chinese videos now are summary-based, and original content is much less compared to YouTube. Activating this "wasteland" could be a significant source of revenue for Bili, as many are willing to pay for quality knowledge, but management needs to be stricter to prevent bad money from driving out good.

Investments from the past two years are beginning to generate exit profits.

Revise the business distribution; the current mix of live streaming and gaming services with the website is a bit odd.

● Expected Valuation:

Bili's current valuation: $3.8B MC FDV, with an expected valuation in 5 years of $50-100B.

6.Avalanche / Polygon / Near / Algorand/ Solana

CRYPTOCAP:AVAX BINANCE:NEARUSDT COINBASE:MATICUSD BINANCE:ALGOUSDT BINANCE:SOLUSDT

● Basic Introduction:

Alt-L1 is a core foundational public blockchain infrastructure. AVAX and Polygon are more akin to Ethereum's sidechains, while Sol / Near / Algo have their own underlying architectures + EVM+BTC virtual machine compatibility or stand-alone projects to enhance compatibility with Ethereum. Each public blockchain has its own unique ecosystem. In 2024, it's more suitable for each chain to be discussed separately in a comprehensive series due to their foundational architectures, which cannot be fully covered here without extending into tens of thousands of words.

● Core Logic:

The security of L1's underlying architecture has become increasingly refined. Although there have been debates regarding Sol's foundational security, it's undeniable that Solana has become the largest ecosystem outside of Ethereum, even leading in popularity at times. However, with the initiation of Ethereum's layering series, Ethereum's ecosystem could potentially introduce more gameplay. AVAX, SOL, and Matic are perfect examples of market rhythm mastery, with Near being average in convenience, and Algo being the least market-savvy but having the highest prestige in terms of technical strength and collaborations.

The other L1s are advancing similarly, now engaging in mutual competition. After an uninteresting two years, the public chain ecosystem is finally starting to show some vitality again.

● Key to Launch:

After global macroeconomic black swan events are thoroughly cleared, the new era's focus will shift further towards AI, blockchain, and informational fields, increasing the exploration desire for reservoirs and funds. LSD, Restaking, Rollup, and various new DeFi gameplay will further penetrate major ecosystems, sparking new value bubbles.

● Expected Valuation:

Future MC FDV:

AVAX: 150B

SOL: 300B

ALGO: 60B-150B (300B--- if the team optimizes and gets designated by US policies)

NEAR: 50B-100B

MATIC: 80B-100B (250B--- if designated by Indian policies)

7.Tiger Brokers (Tiger) NASDAQ:TIGR

● Basic Introduction:

A youthful brokerage with excellent trading experience, superb data provision, and UI design, providing ample information on financial reports and data.

● Core Logic:

Undervalued, with virtual licenses approved. The support for compliant tokens like USDC for deposit could significantly increase trading volume and financial income.

● Key to Launch:

Further relaxation and support for compliant KYC by domestic policies.

Overall recovery and accumulation in the financial markets.

● Expected Valuation:

Current FDV: 0.58B, Expected FDV: 10-20 B

8.Planetswatch (Planets)

● Basic Introduction:

An eco-friendly project monitoring air quality through air sensors, allowing for real-time air quality data transmission via different sensor nodes in exchange for token rewards.

● Core Logic:

High early valuation and low circulation rate, with prices significantly dropping due to the bear market and inflation impacts, a common issue for early-stage projects with low circulation rates.

● Key to Launch:

Further global emphasis on environmental infrastructure, with Eco projects becoming a focal point in blockchain discussions.

● Expected Valuation:

Current MC FDV: 2M, Expected FDV: 20M-200M

9.ContextLogic (Wish) $NASDAQ:WISH NASDAQ:LOGC

● Basic Introduction:

Wish is a U.S.-based e-commerce platform founded in 2010 by former Google employee Piotr Szulczewski and former Yahoo employee Danny Zhang. Its parent company, ContextLogic Inc., is headquartered in San Francisco, USA, primarily selling inexpensive household items, clothing, jewelry, electronics, toys, etc.

● Core Logic:

Overhyped by consortia like Goldman Sachs in 2020, leading to a steady fall to the verge of delisting. Prices are near low, with recent market actions and promotions starting to revive.

● Key to Launch:

Further reliance on group buying, especially the expectation of cheap group purchases by the consumption downgrade population.

Entry of new major institutions into the acquisition process.

Revival in financial reports and business.

● Expected Valuation:

Current MC FDV: 0.1B, Expected MC FDV: 2B-10B

10.Waves Enterprises (West) $KUCOIN:WESTUSDT GATEIO:WESTUSDT

● Basic Introduction:

Waves Enterprise is an enterprise-grade blockchain platform for building fault-tolerant digital infrastructures. As a hybrid solution, it combines enterprises, service providers, and decentralized applications in a trustless environment, leveraging the advantages of public permissioned blockchain across a wide range of business use cases.

Sidechains are used for building private or hybrid infrastructures, storing metadata on the mainnet. The platform is powered by Waves Enterprise System Token (

WEST

), the native utility token for all network operations.

● Core Logic:

Enterprise-grade public and private hybrid blockchain protocols may be more easily accepted by traditional enterprises.

● Key to Launch:

Further support for blockchain technology from Russia, with traditional oligarchs and consortiums responding to related policies.

Further popularization

Expected Valuation:

Current MC FDV: 2-5M fluctuation, Expected MC FDV: 2B-5B (20-50B--- if designated by Russia)

Summary:

This article analyzes the long-term potential value of several projects. Some have survived through significant trials and tribulations, and others possess superior fundamentals and philosophies but lack market operation capabilities and are in need of a discerning eye. Therefore, while they have potential, it does not guarantee they will meet expectations, and they may also suffer unexpected setbacks.

The global economy has not yet emerged from the mire; in fact, it can be likened to treading on thin ice where the superficial prosperity cannot mask the unresolved core flaws. Certain festering issues and malignancies have yet to be addressed, so even as the future for AI and blockchain seems bright, it's prudent for individuals and institutions to adhere to a set of personal principles.

For emerging public chains like SEI, TIA, and Layer 2 solutions, as well as diverse projects like Altlayer, Manta, Dymension, Edenlayer, Zeta involving Restaking, LSD, and other novel mechanisms, the extended lock-up periods of this investment round make early valuations even more challenging to gauge. This tests the responsibility and habits of the project teams since the majority of tokens are still in their hands. If the foundation dumps early, new projects could experience significant setbacks. However, there's also the possibility of projects like TIA achieving "vintage" valuations, though such outcomes are difficult to predict swiftly.

The development of the blockchain industry is expected to be relatively bright in the coming years. However, it's important to reiterate the caution stated at the beginning of this article: long-term valuations do not mean a continuous upward trend from current price points. The market could experience intense volatility, similar to a scenario where BTC suddenly drops to

1K

and then rebounds to $40k, although such an event is highly unlikely. If one can maintain a healthy position in such scenarios, there should be no cause for concern.

Remember not to engage in long-term commitments with high leverage. Try to avoid or minimize engagement with contracts unless for entertainment and if you possess sufficient self-discipline. Do Your Own Research (DYOR) remains the primary way to maintain a healthy investment strategy.

Disclaimer: This article is not intended as investment or financial advice but merely reflects the author's opinions and insights, hoping for mutual learning and progress.

Toncoin Bullish Flag Breakout in Sight?Hello guys!

ton seems like a potential coin for getting it!

The chart shows Toncoin forming a bullish flag pattern after a strong upward move. The price is testing the upper boundary of the flag, indicating a potential breakout. If the breakout confirms, the price could rally towards the $5.60 target. Traders should watch for increased volume and a clean break above resistance to validate the move. Failure to break out could result in consolidation within the channel.

Valuation iMe Messenger: Reach 5-20% of Telegram's $30B ?Valuation Potential of iMe Messenger: Why It Has the Prospect to Reach 5-20% of Telegram's $30 Billion Valuation?

Authors: SanTi Li, Naxida, Feng Yu, Li Feiyu

Abstract:

In the Web3 era, the functionality of messaging applications is no longer limited to information transmission. Many failures of Web3 social applications (SocialFi) stem from a lack of sustained user engagement and long-term foundation, or their core functionality merely copying existing platforms (such as borrowing from Twitter). Additionally, the integration of tokens into these platforms often lacks depth and practical utility. Social applications, once adopted by users, establish strong defensive moats, and further integrating Web3 elements such as multi-domain payments, multi-chain interaction, financial services, and decentralized applications can significantly enhance their intrinsic value.

iMe Messenger (LIME), as an extension of Telegram's ecosystem, enhances and optimizes its functionality while maintaining a unique market position. This has attracted growing attention from users, investors, and institutional clients.

By analyzing market trends, user demands, and the synergies between Telegram, its public blockchain TON, and iMe Messenger, this paper explores why iMe Messenger has the potential to reach 5-20% of Telegram's valuation and how it fits within the triad of TON, Telegram, and iMe to mutually enhance value.

1. Market Positioning and User Value of iMe Messenger

1.1 Compatibility with Telegram: Lowering User Migration and Learning Costs

iMe Messenger ( GATEIO:LIMEUSDT LIME) is not only a standalone social application but also a Pro-version developed on top of Telegram, allowing seamless synchronization of chat history, contacts, and channels. This drastically reduces migration costs, enabling iMe to inherit Telegram's ecosystem rather than building an entirely new application from scratch.

Essentially, every Telegram user can also be an iMe user, and all iMe users are inherently Telegram users.

1.2 Enhanced Features for Greater User Engagement and Experience

Building upon Telegram's core, iMe offers additional features such as:

●Integrated Wallets: Supporting multi-chain payments and fund transfers among Telegram friends, including BSC, Solana BINANCE:SOLUSDT , ETH, and TON.

●Translation & Content Organization: Enabling translation for personal and group chats without requiring Telegram's Star VIP subscription.

●Payment and Exchange Integration: Supports Binance Pay and Uniswap's DEX functionalities.

●Improved Group Features: Introduces Crypto Box, similar to WeChat's red packet and gifting features.

●AI Assistant & Antivirus Protection: Enhances user experience with AI-driven features.

●Latest AI Integrations: Users can directly utilize AI models like Gemini and GPT for multi-format content creation and image generation.

●Enhanced Privacy: Strengthened encryption and privacy protection.

●Customizable UI: More personalized interface options than Telegram, appealing to specific user demographics.

These enhancements make iMe a superior choice for certain use cases compared to Telegram's native experience.

Feature Telegram iMe Messenger

Core Messaging ✅ ✅ + Premium Antivirus

Cross-Platform Sync ✅ ✅

AI Translation & Speech-to-Text ✅ (VIP only) ✅ (Free via Lime token)

Multi-Chain Transfers ❌ ✅ (Supports Sol, BSC,

ETH, etc.)

AI BOT Integration ✅ ✅ (Advanced AI models)

Functional Optimization ❌ ✅ (More user-friendly UI)

Payment System ❌ ✅ (Binance Pay, CryptoBox)

Staking Services ❌ (Requires third-party access) ✅ (Directly accessible

in Wallet module)

Telegram API Requirement ✅ (Native API) ❌ (Requires external

API access)

Independent App Download ✅ (App Store) ✅ (App Store)

2. Valuation Comparison: iMe vs. Telegram

2.1 Telegram's Valuation Logic

Telegram is currently valued at approximately $30 billion, primarily due to:

1.A massive user base of 900 million to 1 billion with rapid growth.

2.A deep ecosystem including groups, channels, Bot economy, ad revenue, and potential Web3 applications.

3.TON blockchain integration, enhancing payment and application functionalities.

4.An expected IPO and its role in the broader blockchain and AI landscape.

Telegram's valuation is based on user scale × monetization potential × technology moat × IPO expectations, with some influence from its blockchain interactions with TON.

2.2 iMe's Growth Potential

Currently, iMe's Fully Diluted Valuation (FDV) is around $20 million, with 18 million users. While this is significantly lower than Telegram's 900+ million users, its interoperability with Telegram provides substantial user growth potential.

Considering Web3 applications with over 10 million real registered users are rare, iMe's niche appeal could further bolster its valuation. With a 600% growth over 3.5 years, iMe has promising expansion potential.

Factors contributing to iMe’s ability to achieve 5-20% of Telegram’s valuation:

1.User Growth: If iMe captures 5-10% of Telegram's user base (45M-90M users), its market valuation would rise accordingly.

2.Monetization Potential: Ad revenue, VIP subscriptions, Binance Pay integration, and staking services expand its financial ecosystem.

3.Token Utility & Burning Mechanism: Increased usage of Lime token for payments and transactions enhances its long-term value.

4.Multi-Chain Support: Since Telegram prioritizes TON, other blockchain tokens need a third-party solution—iMe fills this gap.

5.TON Ecosystem Integration: iMe strengthens its value by serving as a gateway for blockchain applications within Telegram’s ecosystem.

2.3 Other Reasons for the Valuation Growth Potential of iMe Messenger

There are many projects in the market with overestimated and inflated values, but it is indeed difficult to find undervalued Web3 projects. The core reasons for this mostly relate to the operational strategies of project teams over a period of time, project management styles, and the experiences and habits of personnel. There are even intricate connections with partner institutions, investors, and other stakeholders.

Apart from the valuation growth potential points compared in sections 2.1 and 2.2, the hidden value and potential of the iMe project are also related to the following factors:

1.iMe’s operational model primarily exists within its internal ecosystem and lacks sufficient collaboration with media, rating agencies, and third-party content platforms. This has resulted in valuable updates and the five advantages we mentioned earlier being largely unknown to many investors and enthusiasts.

2.Limited collaboration with KOLs (Key Opinion Leaders) in value-driven or hype-driven streams. In fact, this project was discovered as early as the end of 2021, but we waited to see if others would also identify its value and write about it. However, we found that very few people had actually created content on it. Later, after communicating with the project team, we discovered that they indeed lacked deep collaboration with content institutions and KOLs. Unlike 2018, when PR agencies were of relatively high quality—such as Block72 and Winkrypto, which had at least dozens of team members providing comprehensive support—by 2025, many so-called PR agencies consisted of just one or two individuals. This has significantly increased the difficulty for project teams in making the right choices and the probability of encountering pitfalls. This situation is as challenging as distinguishing between Dogecoin in 2020 and the tens of thousands of meme tokens emerging daily today.

3.Since 2024, Lime has only gradually been listed on new exchanges. Previously, it was primarily listed on Gate, which is known for its extensive range of trading pairs but lacks significant independent AMA (Ask Me Anything) sessions or media promotion through research reports. From 2023 onwards, many major exchanges adopted a strategy of listing only entirely new projects. This strategy undoubtedly impacted a group of high-quality projects that were listed around 2021 and had successfully endured the bear market. With the recent wave of meme token promotion and the market adjustments of 2024-2025, exchange operators and traders have begun to recognize the underlying issues in purely new projects and meme-based projects.

4.The team has a strong technical mindset, focusing on R&D while lacking market operation experience. This issue is not unique to iMe’s team. Even a project as robust as Algorand, which had an MIT-backed “king bomb” team, later faced operational chaos due to blind hiring of Web2 product managers who lacked experience and made misguided decisions.

5.Insufficient utilization of traffic and promotional platforms. During due diligence, we found that the iMe team produces high-quality animations and content. However, these materials are often only published within their own community and Twitter. Many high-quality users are not necessarily effective disseminators—just as in real life, many exceptionally talented individuals are not good at expressing themselves or spreading information. Therefore, leveraging high-quality third-party platforms and engaging in interactive campaigns (such as writing contests) is also key to furthering brand building.

In summary, the fundamental prerequisite for a project to have sufficient growth potential is that its core technology is strong and its sector and market trends are favorable. However, a lack of brand promotion and groundwork is one of the primary reasons why high-quality content goes undiscovered. This issue can be mitigated with the support of large institutions, major exchanges, or influential figures. This is also one of the main reasons why undervalued projects have room for valuation growth.

3. The Impact of the BINANCE:TONUSDT TON Ecosystem on IME’s Valuation

3.1 Growth Potential of the TON Ecosystem

TONUSDT

TON, as the decentralized blockchain platform officially supported by Telegram, encompasses multiple application scenarios, including DeFi and GameFi. Telegram is actively promoting the TON ecosystem.

1.TON’s growth potential: TON currently has a market valuation exceeding $10 billion, and with its integration into the Telegram ecosystem, its value could potentially double in the future.

2.Potential of TON payments: IME has a built-in TON wallet, gradually making it one of the most important payment and transaction gateways within the TON ecosystem. This undeniably enhances IME’s long-term product value. Although the Lime token has not yet been launched on the TON chain, this development is likely imminent.

3.Binding effect between TON and Telegram: TON is poised to become the Web3 core of Telegram’s economic system. As a Telegram-compatible all-in-one development application, IME is naturally positioned to benefit from this ecosystem’s growth.

3.2 Direct Impact of TON on IME’s Valuation

The expansion of the TON ecosystem means that IME is no longer just a messaging app—it is becoming a Web3 gateway. If TON’s overall valuation grows to $20 billion or beyond, then iMe, as an important Web3 entry point, will also see an increase in its valuation. TON’s decentralized payment services and smart contract capabilities, combined with iMe’s built-in multi-chain wallet, provide strong support for Telegram-based iMe users. This transforms iMe from a mere communication tool into a cross-chain financial and social platform.

(This also applies to native iMe users—i.e., institutional users who directly use the iMe software without relying on the Telegram client—bringing new users to Telegram’s ecosystem and creating potential TON adopters.)

Risks and Challenges

Of course, the development of iMe Messenger is not without risks. As a platform based on decentralization and blockchain technology, it faces multiple challenges similar to those of Telegram, including technical security, user privacy protection, and regulatory policies. There is also the systemic risk of Telegram suddenly ceasing API development (although such a move would be self-sabotaging for Telegram itself). Additionally, the Web3 market is highly competitive, with new products continuously emerging, exerting competitive pressure on iMe. How to ensure user privacy and security while continuously optimizing product features and enhancing user experience will be key to iMe Messenger’s future development.

4. Comprehensive Summary: Factors Affecting iMe’s Valuation

Based on the above analysis, iMe’s development trajectory and speed suggest that it has the potential to reach 5-10% of Telegram’s user base. The expansion and growth of iMe also contribute to the overall expansion and development of Telegram. At the same time, by leveraging the mutual benefits of the Telegram and TON ecosystems, iMe can create additional value. This enables iMe to benefit from Telegram’s strong user retention moat while positioning itself as a potential Web3 or secondary version of Telegram.

From the perspectives of user base, business model, TON enablement, integrated wallet, and Lime token functionalities, IME has the potential to achieve a valuation of 5%-20% of Telegram’s estimated value, equating to a valuation of over $1.5 billion. As the Telegram ecosystem matures and the TON network further develops, iMe’s market value may continue to grow, with potential for further valuation increases.

Overall, iMe

LIMEUSDT

Lime is not merely a secondary development software utilizing Telegram’s API. Instead, it is a Web3 social communication and payment tool with significantly stronger utility. Its valuation model is closer to a combination of Wallet + Telegram + TON + AI, making it more akin to a Web3 version of WeChat. It holds the potential to become a fully realized Web3 social application. Hopefully, it will ultimately succeed alongside Telegram.

Next, we will explore the long-term value of several public blockchain networks. May the force be with you~

Friendly Reminder: This article is created for research and educational purposes only and does not constitute investment advice. The Web3 space is simultaneously full of opportunities and risks. We encourage readers to conduct their own research (DYOR) on every project or topic.

TON/USDT: Potential Pullback After Sharp RallyThe TON/USDT market experienced a 20% surge following unexpected news that Telegram founder Pavel Durov had regained his passport, enabling unrestricted travel. This bullish momentum led the price to rebound from support and approach the 4.00 resistance zone.

However, as the price neared this key resistance, momentum began to slow, and signs of a bearish divergence emerged. On the daily timeframe, candles with upper wicks suggest rejection at higher levels. Given these developments, the market may be poised for a short-term corrective move toward lower support. The next potential target is the support zone around 3.330

#TON #TONUSDT #TONCOIN #LONG #Scalp #Scalping #Eddy#TON #TONUSDT #TONCOIN #LONG #Scalp #Scalping #Eddy

TONUSDT.P Scaliping Long Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Be successful and profitable.

Toncoin TON price will surprise everyone💎If you look closely at the OKX:TONUSDT chart, you can see/think that the last six months have seen a global trend reversal pattern - Head and Shoulders.

But! This pattern will be confirmed after the price of CRYPTOCAP:TON is firmly fixed below $4.50. Then the target is $2.30-2.50.

However, this is all very obvious, trite, and not interesting)

We want this idea to become prophetic and Legendary, so we hope for the beginning of a hypercycle of #Toncoin price growth with an ultimate goal of $93

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

TON road map !!!If the price can break through this important resistance, it can easily reach the desired targets.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TON Main trend 16 03 2025Logo of rhymes. Gann fan for understanding the logic of trend development and dynamic levels of support and resistance.

Time frame 1 week, for full orientation in the trend and potential targets. Key price reversal zones on which the trend development depends are shown with arrows. Conservative and adequate targets in the medium and long term. Everything above, as for me, should not worry you much, but this is purely my opinion, nothing more.

🟡 Pay attention how clearly the percentages of large triangles and time reversal zones are worked out according to the algorithm. Someone who is far from trading says that TA does not work on cryptocurrency.

TA is a banal logic, an exchange algorithm (you need to be tied to something), real supply/demand (market participants) and manipulative supply/demand, that is, large market participants (exchanges, funds, creators).

In the development of the trend, there is a fractal behavior of the price in the trend at the moment. Perhaps this logic will continue. The secondary, downward trend formed a wedge-shaped formation, as before.

1 day time frame

🟣 Currently locally an aggressive buyback is taking place (probably, as an excuse for the price movement, some positive news was released) from the dynamic support of the fan (on the 5-minute time frame, after the impulse-buyback, a bullish triangle was formed in consolidation, and now its goals are being realized). If after a rollback on the senior time frame (1 day, 1 week) this zone is preserved - a reversal of the secondary trend. At the moment, the price is moving within the wedge canvas, locally there is a complete absorption of the bearish candle on the weekly time frame.

🔴 Also, if there is a test of this reversal zone (less likely) , then the price can consolidate according to the logic of the descending wedge. Price consolidation, especially not overcoming the dynamic former fan support on a repeated retest — a decline to begin with to the median (red dotted line) of the range. On the chart you will see an "illogical" head and shoulders. This is an extremely unlikely scenario, but I will describe it just in case, so that you take this into account in your money management (not risk management).

TON Go to $4.5?Durov was finally released, he returned to Dubai, and #TON perked up by +16% in a day.

That's it, now people will love the CRYPTOCAP:TON Ecosystem again, a bunch of new tapals will come out.

The key resistance level will be at $4.5

We can also go to $2.7

The break of the global triangle upwards may be in Seb-Oct

Correction time The TON Ecosystem was used wisely, they identified weak points, protected their market from Competitors with protectionism, mini apps in Telegram should only use TON, now Liquidity will accumulate more inside Telegram, and not go to Solana.

The game starts again)) and we are ready for it.

Crypto Markets See $3.8 Billion Outflow, What Does It Mean?Ethereum, Solana, and Toncoin were hit with multi-million outflows; but Bitcoin took the biggest hit with $2.59 billion in funding.

For the third week in a row, digital asset investment products have seen investors siphon off funds. This past week alone marked a historic $2.9 billion outflow, raising the cumulative figure to $3.8 billion in three weeks.

According to the latest edition of the Digital Asset Fund Flows Weekly Report, Bitcoin was hit the hardest by negative sentiment, suffering $2.59 billion in outflows last week, while short coin products attracted $2.3 million in inflows. Ethereum also faced heavy losses and received a record $300 million in outflows.

Toncoin was not immune, with investors siphoning off $22.6 million. Meanwhile, multi-asset products experienced $7.9 million in outflows, while Solana and Cardano saw outflows of $7.4 million and $1.2 million, respectively. Even blockchain stocks fell, losing $25.3 million.

Sui, on the other hand, saw inflows of $15.5 million, followed by XRP, which received $5 million, while Litecoin added $1 million in inflows.

Over the past week, outflows were broad, with the United States leading with $2.87 billion, followed by Switzerland with $73 million and Canada with $16.9 million. Sweden also recorded $14.5 million in outflows, while Brazil and Hong Kong saw $2.6 million and $2.5 million, respectively.

In contrast, Germany trended with $55.3 million in inflows as investors bought into the trend. Australia also recorded a modest inflow of $1 million. BITSTAMP:BTCUSD COINBASE:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT CRYPTO:ETHUSD

Toncoin Gets Ready For $17 & $22 (Elliott Wave Theory)There is a classic ABC (Zig-zag) correction on the chart based on Elliot Wave Theory. The correction is perfect in size and proportions and comes out of a perfect 12345 bullish impulse. The end of the correction signals the start of a new bullish phase.

The dynamics here are the exact same we just looked at with AAVEUSDT. After the correction reaches its end, there is some sideways (consolidation), this sideways then produces slow and steady growth and finally a strong price advance.

In 2023, there were almost three months of sideways action after the low was in before the first advance got started. Then another period of sideways preceding the major bullish climax. This is standard price dynamics and we should experience something similar in the coming months.

Patience is key. But the market looks good now for accumulation in anticipation of a major bullish wave that will end in a bull-run. Targets can easily hit $11, $17, $22 and beyond.

Namaste.

TON/USDT : A Strong Bullish Rally Ahead?🚀 Trade Setup Details:

🕯 #TON/USDT 🔼 Buy | Long 🔼

⌛️ TimeFrame: 1D

--------------------

🛡 Risk Management:

🛡 If Your Account Balance: $1000

🛡 If Your Loss-Limit: 1%

🛡 Then Your Signal Margin: $18.25

--------------------

☄️ En1: 5.177 (Amount: $2.74)

☄️ En2: 4.443 (Amount: $6.39)

☄️ En3: 3.92 (Amount: $8.21)

☄️ En4: 3.398 (Amount: $1.83)

--------------------

☄️ If All Entries Are Activated, Then:

☄️ Average.En: 4.432 ($18.25)

--------------------

☑️ TP1: 8.288 (+87%) (RR:1.59)

☑️ TP2: 9.62 (+117.06%) (RR:2.14)

☑️ TP3: 11.312 (+155.23%) (RR:2.83)

☑️ TP4: 13.465 (+203.81%) (RR:3.72)

☑️ TP5: 15.842 (+257.45%) (RR:4.7)

☑️ TP6: Open 🔝

--------------------

❌ SL: 1.990 (-49%) (-$10)

--------------------

💯 Maximum.Lev: 1X

⌛️ Trading Type: Swing Trading

‼️ Signal Risk: Low-Risk!

🔎 Technical Analysis Breakdown:

This technical analysis is based on price action, SMC (Smart Money Concepts), and ICT (Inner Circle Trader) concepts. All entry points, Target Points, and Stop Loss are calculated based on professional mathematics formulas as a result you can have an optimal trade setup based on great risk management.

📊 Sentiment & Market Context:

The TON/USDT pair is showing promising bullish signals as the market sentiment strengthens in favor of TON Coin. With a robust foundation built on its decentralized ecosystem, TON Coin continues to capture attention for its scalability and fast transaction speeds. Technically, we are witnessing a series of higher lows, suggesting continued upward momentum. As we move through key support levels, the potential for a breakout toward the next resistance is high. Investors should keep an eye on market conditions, as this could be the start of a sustained rally for TON against USDT.

⚠️ Disclaimer:

Trading involves significant risk, and past performance does not guarantee future results. This analysis is for informational purposes only and should not be considered financial advice. Always conduct your research and trade responsibly.

💡 Stay Updated:

Like this technical analysis? Follow me for more in-depth insights, technical setups, and market updates. Let's trade smarter together!