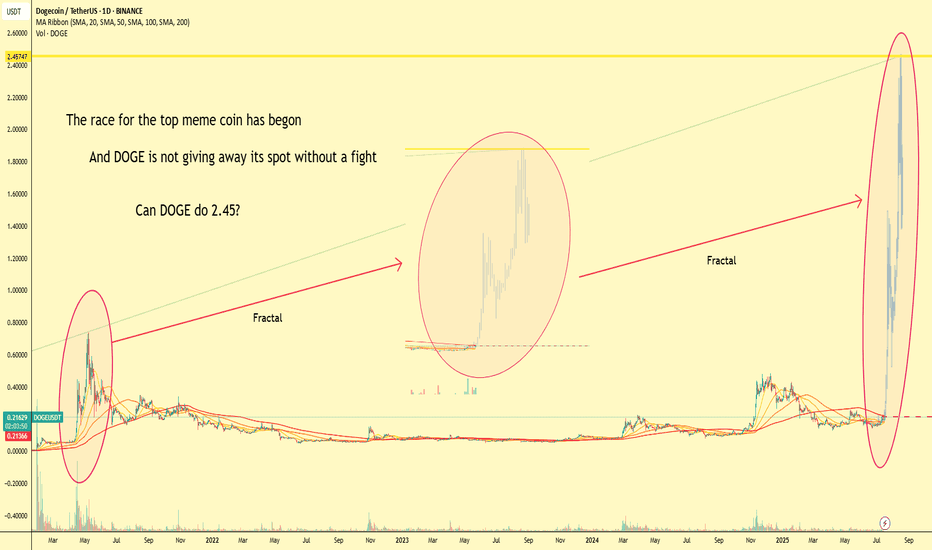

The Meme Coin Race Has Begun, DOGE fighting for top spot!📈 The Meme Coin Race Has Begun

🔥 The battle for the throne is heating up...

🐶 DOGE, the original meme coin, isn’t giving up its crown without a fight.

Fractals from the past seem to echo in today's chart – history doesn’t repeat, but it rhymes.

⚔️ With new challengers lining up in the meme arena, one question remains:

Can DOGE reach $2.45 and reclaim the top spot?

🚀 Volume is rising. Patterns are aligning.

The king is awake.

👑 The OG vs the New School. Who will win the meme war?

Comment your prediction 👇

#DOGE #MemeSeason #CryptoFractals #Altseason #DOGEUSDT #CryptoTrading #TradingView #FractalAnalysis #CryptoWar #MemeCoins

Top10

$LINK 1H ready for a pump? Let’s see if I can predict it Chain link I have held for over 1 year now it went down a lot but it’s back above purchase price!

If it goes to the $50+ area I will be ecstatic. Showing highs on 1W for $200+

Let me know some through here and remember we are all here to learn and grow so please post something helpful or for discussion! Thanks!

$ADA to $9 thoughts?I know it’s Cardano and we have lots of long holders here!

So glad for you all getting the returns after long time of down sideways action!

What do you think on this ML script? It’s pretty predictive and the MacD amongst other indicators are showing that Cardano might be one of the TOP preforming Alt coins this run.

Why? Well it’s very well established. It’s also not even far from use by governments like XRP. However Cardano is much more set in stone as for its framework. Yes it can be forked or changed if needed but Cardano is a very stable under utilised cryptocurrency.

I would love to see it at or over $5 let along $9 USD.

Please NOTE: this is not advice nor are any numbers here correct they are projections based on my own trading as that’s what crypto trading is is managing your own funds and portfolio and buying selling swapping when you want on the market not call a broker for it.

Always do your own analysis!

Leave a good comment so we can learn and grow from the info we have in front of us and make gains on the crypto market!

Render (RNDR) & NVIDIA AI Conference With the rise of Artificial Intelligence , many projects are looking to capitalise on the massive potential that AI promises.

One of those projects is RENDER , the first decentralized GPU rendering platform launched in 2017, the Render network is built to provide a platform for a wide array of computation tasks - from basic rendering to artificial intelligence - which are facilitated swiftly and efficiently in a blockchain-based peer-to-peer network, free from error or delay, while ensuring secure property rights.

Nvidia is a Tech company that focuses on production of high end graphics cards and is a world leader in Artificial Intelligence computing with a Market cap of 2.25 Trillion Dollars. Nvidia are holding an AI conference 17-21 March, one of those talks is a talk on "production rendering on GPU" on the 20th March. I would predict that Render could get a mention as the RNDR network is integrated into Nvidia Omniverse, the VP of Nvidia Omniverse is also an advisor to RNDR, so could we see any further ties between the two companies? If so I think this would propel an already well performing coin that has recently entered into price discovery.

Fib targets after the breakout are shown o the chart and these are the areas to be interested in. I am not ruling out a retest of the break above the previous ATH however with the momentum that we are seeing I think this retest could come a much later stage.

With RNDR's MCap of $3.6B there is no reason why this project shouldn't break into the top 10 at some point this cycle, currently this would mean a 4.85x to displace SHIB at 10th place double that again if you compare to SHIB ATH MCap. This project is just getting started.

All eyes on the Conference, I could see this potentially being a sell the news event as these things often are, however that would just open up a buying opportunity for DCA or long term holding.

INJECTIVE|The beginning of the BEARISH trend?Hello guys, I hope you are doing well. Have you seen Bitcoin? I hope you have used it.

Let's check the ING currency, the four-hour time is inside a trending range, it has tried several times to stabilize higher ceilings, but was unsuccessful, now it has fallen again when it reaches the four-hour supply area and has entered the form of a descending channel.

It is registering lower highs and lower lows, on the other hand, Bitcoin has fallen, which is not without effect.

Currently, the four-hour demand area has stopped ING from falling, if this area is broken down, the selling pressure will increase and it can easily fall to the $29 and $19 targets.

Pay attention to the demand area (32.20-33.80), by breaking this area, look for selling positions.

Uniswap (UNI) Forming Road to $40+My favorite Unicorn. Uniswap has been having a beautiful run up this year to say the least. Just recently Uniswap has solidified a top 10 cryptocurrency status as of last week making this one of the most valuable cryptocurrency projects and exchanges in the world. Given the innovation and technology behind Uniswap I'm not surpised. It is now the most used decentralized exchange (DEX) in the entire world. Cheers to all the Uniswap holders! History is constantly in the making.

We have a nice strong uptrend on Uniswap we've been holding since January 21st 2021. If we continue to hold this trendline we will see Uniswap's next destination going to $40.00 plus and beyond. Especially when V3 is announced, finalized, and implemented there likely be a nice run up. Keep an eye out for Uniswap's V3 upgrade. As decentralized finance (DeFi) grows Uniswap grows.

Much peace, love, health and wealth.

Chainlink on the LINKUSD view 2020Before im charting a chainlink against BTC,

this time compare with USD.

if u see the the price, there u see since

it born, the price is around peny. 0.03 USD.

during the hard time for crypto world, the only i see a great

climbing is chainlink.

Although its born from a token of etherium, but

it oracle base will connect between the real world and digital world.

Damnnn!!!! give me a like u like my chart.

Current Price

$15.02 USD (2.38%)

0.00080513 BTC (0.22%)

0.02550463 ETH (-6.27%)

SPY - Top 10 Holdings - Compared with Overall MarketHere we have the top 10 holdings within the SPY ETF,

~ MSFT

~ AAPL

~ AMZN

~ FB

~ BRK.B

~ GOOGL

~ GOOG

~ JNJ

~ JPM

~ V

These represent 25.23% of total assets within the ETF, by combining them we are able to get a gauge of what the market movers are doing compared with the entire index.

The first thing you will notice is the difference in retracement levels, between the top 10 and the broader market, this is not surprising, but it is interesting.

For the top 10, we are sitting just shy of the 78.6% retracement, whereas the broader SPX is just shy of the 61.8%.

The second thing you will notice, is when the chart scale is measuring percentage gain, the top 10 are actually doing VERY well relative to the broader market.

This difference is even clearer when a baseline chart is used.

I have also done the same thing with the FAANG stocks (FB, AMZN, AAPL, NFLX, GOOGL).

Look at that!

If you ignore that pesky "real economy" we are back at all time highs!

The difference between the curated FAANG stocks, the top 10 and the broader SPX is quite startling

A better lesson in why "diversification" is just a tool to part fools from their cash, i have yet to see.

The other observation i can see, is that both the FAANGs, the top 10 and the broader SPX are all looking a tad extended, the FAANGs have gap filled and have put in a rather ordinary looking closing candle.

The top 10 is just shy of gap filling and appears to be struggling a little at the 78.6% and the SPX looks like it might be able to get to the 61.8, but will likely struggle from there.

Overall, i am expecting to see some more potential strength, but only marginally, before either the markets enter a more choppy condition, or they roll over and look to retest their prior lows (SPX that is).

In any case, all three markets from the "cool kid" FAANGs to the "above average" top 10 to the "bastard stepchild" SPX are looking like their relief rallies are a little long in the tooth, that being said, with the Fed printing and propping up these markets, a melt-up is not off the table and is a scenario i will be watching carefully.

-TradingEdge

Sources:

finance.yahoo.com

The Top 10 - Cryptocurrency Market Cap - 11th November 2018I give my view about what I'm seeing on the chart's and certain things I'm looking for in order to take trades.

There doesn't seem to be anything too spactacular (lol realised I can't speak english after rewatching this)

If yoi're interested in learning the methods I use to scan, take trades and the strategies I use, visit www.tradercobb.com

Peace :)

The Top 10 - Cryptocurrency Market Cap - 10th November 2018I take you through what I'm seeing in the top 10 for today and specifically what I'm seeing on ripple.

It seems we are now in a period of waiting to see which way the market wants to go. Will we see it continue to the upside with a flurry of buying, or will we see the bears regain control?

I hope you enjoy my video, Peace.

My view on the top 10 Crypto Market - 8 November 2018I take you through where I think are critical levels and pivotal points within this market.

Although we have seen green within the last few days, it's still very early days here in this market.

If you enjoyed my video and are curious of where I learned how to trade, head over to www.tradercobb.com

Peace.

$ATTBF Bio and Marijuana All In One 4/20 and MJ Rush PlayWell 4/20 is almost here and our favorite MJ stocks are slowly starting to create uptrends. One of my favorite ones has always been $ATTBF It saw a massive move today and seeks to attain its old fond highs of $1.00+ from the first rush back in 2014. A lot of people went disenfranchised because they thought the trend was dead due to the AG. However he is feeling a lot of resistance and Canada is to legalize MJ recreationally in the next few weeks. This being mainly located in Canada will have a massive boost from it.