Pipping the Aussie-Swiss Bank: Day Trading Strategy UnleashedUltimate AUD/CHF Forex Heist Plan 🚨 Swing Trade Mastery for Epic Gains! 🚀

Greetings, Wealth Warriors & Market Mavericks! 👋💸

Get ready to execute a legendary heist on the AUD/CHF "Aussie vs Swissy" Forex market with our exclusive Thief Trading Style! 🎯 This meticulously crafted strategy blends technical precision and fundamental firepower to maximize your profits. Follow the plan outlined in the chart, focusing on a long entry to conquer the high-risk Yellow MA Zone—a battleground of overbought conditions, consolidation, and potential trend reversals where bearish bandits lurk. 🐻 Stay sharp, lock in profits, and trade safely! 💪🎉

Entry 📈: The heist begins! Watch for the MA pullback in the market maker’s trap zone (0.52200 OR above) to strike. Bullish riches await! Set buy stop orders above the Moving Average or place buy limit orders within the 15 or 30-minute timeframe’s recent swing low/high.

Pro tip: Set an alert to catch the breakout entry in action! 🔔

Stop Loss 🛑: Place your Thief SL at the recent swing low/high on the 4H timeframe for swing trades basis. Adjust SL based on your risk tolerance, lot size, and multiple orders.

Target 🎯: Aim for 0.54800 or make a swift exit before the target to secure your loot!

🧲 Scalpers, listen up! 👀 Stick to long-side scalps. Big players can jump in now; others, join the swing trade heist. Use a trailing SL to protect your stash. 💰

💵 AUD/CHF "Aussie vs Swissy" Forex Heist Plan (Swing Trade) is riding a bullish wave 🐂, fueled by critical market drivers. Dive into the fundamentals—Macro Economics, COT Reports, Quantitative Analysis, Intermarket Analysis, Sentiment Outlook, and Future Trends—before launching your heist. Check the linkKs for the full scoop! 🔗👉

📌 Markets move fast, so stay vigilant and adapt your analysis to the latest developments.

⚠️ Trading Alert: News & Position Management 📰🚨

News releases can shake up prices and volatility. Protect your positions by:

Avoiding new trades during news events

Using trailing stop-loss orders to lock in gains

💖 Boost our heist plan! 💥 Hit the Boost Button to supercharge our team’s strength and make stealing profits a breeze. With the Thief Trading Style, you’ll conquer the market daily with ease! 🏆🤝🎉

Stay tuned for the next epic heist plan, Money Makers! 🤑🐱👤🚀

Trade-ideas

Market next move Original Analysis Summary:

Identifies a bullish structure breaking above a support area.

Projects a potential continuation to higher targets.

Suggests consolidation and bounce from support before climbing.

---

Disruptive Bearish Interpretation:

1. Lower High Possibility:

Recent price action might be forming a lower high rather than a continuation signal, signaling weakness in buying pressure.

2. Volume Imbalance:

Notice how the large green candle was followed by lower bullish volume, suggesting buying momentum is fading.

3. Breakout Trap:

The "Support area" may instead be a liquidity zone where breakout traders entered long positions and could now be trapped. A break below this area could cause a panic sell-off.

4. Trendline Respect (Rejection):

Price is currently retesting the underside of a descending trendline — a common reversal spot.

How to Rob the Bank (of Canada) – Legally! (USD/CAD Swing Trade)🌍 Hello Global Traders! 🌟

Money Makers, Risk Takers, and Market Shakers! 🤑💸✈️

Dive into our USD/CAD "The Loonie" Forex heist, crafted with the signature 🔥Thief Trading Style🔥, blending sharp technicals and deep fundamentals. Follow the strategy outlined in the TradingView chart, focusing on a long entry targeting the high-risk MA Zone. Expect a wild ride with overbought conditions, consolidation, and potential trend reversals where bearish players lurk. 🏆💰 Celebrate your wins, traders—you’ve earned it! 💪🎉

Entry 📈: The vault’s open! Grab bullish opportunities at any price, but for precision, set buy limit orders on a 15 or 30-minute timeframe near swing lows or highs for pullback entries.

Stop Loss 🛑:

📍 Place your Thief SL at the recent swing low on the 4H timeframe (1.38500) for scalping or day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open orders.

Target 🎯: Aim for 1.42500

💵 USD/CAD "The Loonie" is riding a bullish wave, fueled by key market drivers. ☝

Unlock the full picture—dive into Fundamentals, Macro Insights, COT Reports, Quantitative Analysis, Sentiment Outlook, Intermarket Trends, and Future Targets. Check 👉🌎🔗.

⚠️ Trading Alert: News & Position Management 📰🚨

News can shake the market hard. Protect your trades by:

Avoiding new entries during news releases.

Using trailing stops to lock in profits and shield running positions.

📌 Markets move fast—stay sharp, keep learning, and adapt your strategy as conditions evolve.

💖 Power up our heist! 🚀 Tap the Boost Button to amplify our Thief Trading Style and make stealing profits a breeze. Join our crew, grow stronger, and conquer the markets daily with ease. 🏆🤝❤️

Catch you at the next heist, traders—stay ready! 🤑🐱👤🤩

EURAUD – Trendline Holds, Bearish Setup Below 1.7626EURAUD Trend: EURAUD pair remains in a strong downtrend, marked by consistent lower highs and a descending trendline.

Resistance: 1.7626 has been retested and rejected, confirming it as a short-term ceiling.

Structure: The latest rejection from both horizontal resistance and the trendline confirms bearish intent.

🔽 Bearish Targets:

1.7254 – minor support and near-term target

1.7120 – stronger support zone

1.7060 – previous low and potential extended target

A clear break below 1.7400 could confirm continuation of the trend toward those levels.

Fundamental Overview:

🔻 EUR Weakness:

The Eurozone is slowing, particularly in Germany and France.

ECB remains cautious; recent comments show concern about tight financial conditions and sticky inflation.

Political uncertainties and mixed data prints are adding pressure.

🟢 AUD Support:

The RBA remains firm with hawkish language, holding rates while global peers lean dovish.

Commodities remain stable, and Australia benefits from demand out of Asia.

Domestic data (jobs and retail) shows surprising resilience.

Summary:

Bias: Bearish below 1.7626

Break Trigger: 1.7400

Target Range: 1.7250 – 1.7060

Fundamentals: Favor AUD on stronger economic footing and RBA policy tone

📉 EURAUD looks ready for another leg lower unless we see a breakout above 1.7630 with conviction.

$NVTS is up 125%, but they might not be done yet!NASDAQ:NVTS Could see more upside if...

We close the week above $4.66 Double Bottom Breakout. This would lead us to the following targets...

🎯$6📏$7.76

- Bullish cross on H5_L indicator

- Volume shelf launch with GAP

- NASDAQ:NVDA Partnership

- Small Cap

- High Short Float

GBP/USD Cable Heist:Join the Thief Trading Style to Raid Profit!GBP/USD Cable Heist Plan - Thief Trading Style 😎💸

Greetings, wealth chasers and market bandits! 👋💰

Welcome to the Thief Trading Style, blending sharp technicals with savvy fundamentals to raid the GBP/USD "Cable" Forex Market. 📊 Follow the strategy outlined in the chart, focusing on long entries targeting the high-stakes Red Zone. 🌋 Expect an overbought market, consolidation, or trend reversal where bears might set traps. 🐻 Nail the plan, grab your profits, and treat yourself—you’ve earned it! 🎯💵🎉

Entry 📈: The heist begins! 🚨 Wait for the MA breakout at 1.34700, then strike for bullish gains. 🐂 Set buy stop orders above the moving average or place buy limit orders within a 15/30-minute timeframe at the recent swing high/low. ⏰ Don’t miss the move—set a chart alert to catch the breakout! 🔔

Stop Loss 🛑: Listen up, crew! 🗣️ For buy stop orders, hold off on setting your stop loss until after the breakout. 🚀 Place it at the recent swing low on the 4H timeframe (1.33300) for swing/day trades. 📍 Adjust based on your risk, lot size, and number of orders. Play smart, or you’re dancing with danger! 🔥😈

Target 🎯: Aim for 1.37000 or bail early if the market shifts. 🏃♂️ Scalpers, stick to long-side trades. 👀 Got deep pockets? Jump in now. 💪 Otherwise, join the swing traders and execute the plan with a trailing stop loss to secure your loot. 🔒💰

Market Outlook: GBP/USD is riding a bullish wave, fueled by key fundamentals. 🐃 Dive into the COT Report, macro data, sentiment, intermarket analysis, and future trend targets via the linkss below for the full scoop. 🔗👉

Why This Trade?: The bullish setup on GBP/USD is backed by strong technical signals, with the MA breakout confirming upward momentum. 📈 Fundamentals, including favorable COT positioning and positive macro data, suggest sustained strength in the pound. 💪 Intermarket correlations and sentiment analysis further align with a bullish outlook, making this an ideal moment to strike the Cable for potential high rewards. 🌟 The Red Zone target at 1.37000 offers a prime risk-to-reward ratio for disciplined traders. 🤑

⚠️ Trading Alert: News & Position Management 📰:

News releases can shake up prices and volatility. 🌪️ To stay safe:

Skip new trades during news events. 🚫

Use trailing stops to lock in profits and protect open positions. 🔐

Boost the Heist! 🚀: Support our plan by hitting the Boost Button to supercharge our market raids. 💥 With the Thief Trading Style, we’re stacking profits daily. 📈 Join the crew, execute the plan, and let’s make money moves! 💪🤝😺

Stay sharp for the next heist plan. Until then, keep robbing the markets! 🤑🐱👤

AUD/NZD Forex Ambush: Thief Trading’s Profit-Grabbing Plan!🌟 AUD/NZD Forex Heist: Snag Profits with the Thief Trading Plan! 🚀💰

Hey there, wealth hunters and market bandits! 🤑💸

Welcome to the Thief Trading blueprint for cracking the AUD/NZD "Aussie vs Kiwi" Forex vault! 🏦🔥 This plan fuses sharp technicals 📊 with gritty fundamentals 📈 to score big loot. Follow the charted strategy, leaning into long entries, and aim to cash out near the high-risk Yellow Moving Average Zone 🎯—a hotspot for overbought vibes, consolidation, or trend flips where bearish bandits prowl 🐻. Grab your profits and treat yourself—you’ve earned it! 💪🎉

Entry Signals 🔑:

Bullish Ambush 🚀: Jump in on a pullback to the Blue MA at 1.08600 or Green MA at 1.07600. 📈

Bearish Blitz ⚡: Go short on a break below the Blue MA at 1.08200, riding the downward wave. 📉

Set a chart alert 🔔 to catch the breakout entry in real-time!

Stop Loss Tactics 🛑:

For buy stop orders, wait for the breakout to confirm before setting your stop. 📍 Place it at 1.07800 for Blue MA bullish entries or 1.06800 for Green MA entries on swing trades. Adjust based on your risk, lot size, and number of orders—play smart, not wild! 😎🔥

Profit Targets 🎯:

Bullish Raiders 🏴☠️: Shoot for 1.09700 or bail early if the market shifts.

Bearish Thieves 🕵️: Target 1.07600.

Scalpers 👀: Stick to long-side scalps. Big players can dive in; smaller traders, join the swing crew and execute the heist with a trailing stop loss to guard your gains! 💰🛡️

The AUD/NZD Forex Bank Heist (Day/Swing Trade) is riding a bullish surge 🐂, driven by key fundamentals. 📜 Dig into the COT Report, macroeconomics, sentiment analysis, intermarket trends, and future price targets for the full scoop—check those links! 🔗👉

Trading Alert: News & Position Management 🚨

News drops can shake the market! 📰 To protect your stash:

Avoid new trades during news events. 🚫

Use trailing stops to lock in profits on open positions. 🔒

Support the heist! Hit that Boost Button 🚀 to power up our robbery squad. With the Thief Trading Style, stacking profits daily is a breeze! 🌟 Stay sharp for the next heist—catch you in the markets! 🤑🐱👤🤝.

GBP/AUD Heist: Bullish Breakout Plan to Steal Profits!🌟 Pound vs. Aussie Heist: GBP/AUD Trading Plan 🚀💸

Hey Money Makers & Thieves! 🤑💰 Ready to pull off a master heist on the GBP/AUD Forex market? Based on 🔥 Thief Trading Style 🔥 blending technicals and fundamentals, here’s the plan to conquer the "Pound vs. Aussie" with a long entry strategy targeting the high-risk Red Zone. Let’s dive in! 📈🎯

Entry 📈:

The heist is live! Wait for the MA breakout at 2.10000 to strike—bullish profits are calling! 🔔

Set buy stop orders above the Moving Average for breakout entries.

Or, place buy limit orders on a 15 or 30-minute timeframe at the most recent swing low/high for pullback entries.

📌Pro tip: Set an alert on your chart to catch the breakout moment! 🚨

Stop Loss 🛑:

Protect your loot with a Thief SL at the recent swing low/high on the 4H timeframe (2.07400).

Adjust SL based on your risk, lot size, and number of orders. Stay sharp! 🔍

Target 🎯:

Aim for 2.14400 or exit early to secure profits before the target. Don’t get greedy! 💪

Scalpers, Listen Up 👀:

Stick to the long side for quick scalps.

Big players can jump in now; smaller traders, join the swing trade robbery with a trailing SL to lock in gains. 💰

Market Outlook 💵:

GBP/AUD is riding a bullish wave, fueled by fundamentals, macro trends, COT reports, quantitative analysis, sentiment, and intermarket dynamics. Stay updated as these can shift fast! 🌎📊

⚠️ Trading Alert: News & Position Management 📰:

Avoid new trades during news releases to dodge volatility traps.

Use trailing stop-loss orders to protect running positions and secure profits. 🚫

Latest Market Data (UTC+1, May 20, 2025, 12:02 PM BST):

Forex (GBP/AUD): Current price ~2.09850 (source: financialjuice.com).

COT Report (Latest Friday, May 16, 2025):

Non-commercial long positions increased, signaling bullish sentiment among large speculators.

Net long positions rose by 5,200 contracts (source: CFTC.gov).

Commodities & Metals: Gold and oil prices stable, supporting AUD strength but GBP bolstered by UK economic data.

Indices & Crypto: No direct impact, but risk-on sentiment in global indices supports bullish GBP/AUD bias.

💖 Boost the Heist! 💥:

Hit the Boost Button to power up our robbery team! 🤝 With the Thief Trading Style, we’re stealing profits daily. Stay tuned for the next heist plan! 🐱👤🚀

Happy trading, and let’s make that money! 💸🎉

Disclaimer: Trading involves risk. Always manage your risk and stay informed.

EUR/JPY "Yuppy" Heist: Sniping Swiss Profits with Thief Trading!🌍 Hello Global Traders! 🌟

Money Makers, Risk Takers, and Market Shakers! 🤑💸✈️

Dive into our EUR/JPY "Yuppy" Forex heist, crafted with the signature 🔥Thief Trading Style🔥, blending sharp technicals and deep fundamentals. Follow the strategy outlined in the TradingView chart, focusing on a long entry targeting the high-risk MA Zone. Expect a wild ride with overbought conditions, consolidation, and potential trend reversals where bearish players lurk. 🏆💰 Celebrate your wins, traders—you’ve earned it! 💪🎉

Entry 📈: The vault’s open! Grab bullish opportunities at any price, but for precision, set buy limit orders on a 15 or 30-minute timeframe near swing lows or highs for pullback entries.

Stop Loss 🛑:

📍 Place your Thief SL at the recent swing low on the 4H timeframe (163.00) for scalping or day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open orders.

Target 🎯: Aim for 167.00

💵 EUR/JPY "Yuppy" is riding a bullish wave, fueled by key market drivers. ☝

Unlock the full picture—dive into Fundamentals, Macro Insights, COT Reports, Quantitative Analysis, Sentiment Outlook, Intermarket Trends, and Future Targets. Check 👉🌎🔗.

⚠️ Trading Alert: News & Position Management 📰🚨

News can shake the market hard. Protect your trades by:

Avoiding new entries during news releases.

Using trailing stops to lock in profits and shield running positions.

📌 Markets move fast—stay sharp, keep learning, and adapt your strategy as conditions evolve.

💖 Power up our heist! 🚀 Tap the Boost Button to amplify our Thief Trading Style and make stealing profits a breeze. Join our crew, grow stronger, and conquer the markets daily with ease. 🏆🤝❤️

Catch you at the next heist, traders—stay ready! 🤑🐱👤🤩

Market next move 1. Over-Reliance on Support Zone

The analysis heavily leans on the assumption that the support zone (marked with the purple "Support" label) will hold.

However, this support has already been tested multiple times, which weakens its strength.

A break below this zone could trigger significant stop-loss hunting, leading to a bearish breakdown instead of a bullish reversal.

2. Volume Analysis Suggests Weak Momentum

The recent bounce lacks strong volume. This suggests that buying interest is not convincing at this level.

Without volume confirmation, any bullish move is less likely to sustain.

3. Lower Highs Pattern

Despite small rallies, the chart is forming lower highs, which is typically a bearish signal.

This hints at seller dominance, and the yellow bullish projection might be overly optimistic.

4. Resistance Overhead

The price is approaching a short-term resistance zone (red box), which has rejected the price previously.

Without a clear breakout above that, the bullish case is speculative.

5. Fundamental Factors Unaccounted

The chart doesn’t account for macro factors like U.S. dollar strength, interest rates, or geopolitical influences that often affect gold.

If the dollar strengthens, gold may drop, breaking the support.

Market next move Bearish Disruption Analysis:

1. Range Weakness and Exhaustion Risk:

The price has been ranging within a tight zone, and repeated tests of the support line near 3,215–3,218 show weakening buyer pressure.

If bulls were strong, we might have already seen a breakout with momentum. Instead, there's sideways choppiness, suggesting indecision or exhaustion.

2. Lower Highs Forming:

Despite a flat support zone, price is forming lower highs, a bearish signal. Sellers are stepping in earlier on each bounce, tightening the range from the top.

3. Volume Depletion:

Volume is gradually dropping during this consolidation. If a breakout happens without a volume surge, it risks becoming a false breakout.

4. Liquidity Sweep Possibility:

Market makers might push price below the support zone (~3,215) to trigger stop-losses and accumulate orders before a potential real breakout. This would trap late buyers who enter early.

5. Bearish Scenario Path:

If price breaks below 3,215 and closes under that on decent volume, expect a move to the next demand zone near 3,200 or lower.

Downside target could be around 3,180–3,190, where the previous demand base formed on May 15.

EUR/GBP Caper: Bearish Breakout Blueprint!🌍 Greetings, global money heisters! 🌟 Welcome to the EUR/GBP "Chunnel" Forex Market caper! 🤑💸

Dear traders and fortune chasers, get ready to execute our cunning plan based on the 🔥 Thief Trading Style 🔥, blending sharp technicals with savvy fundamentals. Our mission? A slick short entry targeting the high-risk Support Zone. The market’s oversold, consolidation’s brewing, and a trend reversal’s lurking—perfect for our ambush! 🏆🎯 Here’s the blueprint to steal those pips! 🚀

Entry 📈: The heist kicks off at the Major Support breakout. Lock in your sell at 0.84000 for bearish gains! 💰 For precision, set sell stop orders above the Moving Average or sell limit orders post-breakout within a 15/30-minute window near the swing low/high for pullback entries. 📌 Pro tip: Set a chart alert 🚨 to catch the breakout moment!

Stop Loss 🛑: Stay sharp, crew! For sell stop orders, hold off on placing your stop loss until the breakout confirms. 📍 Place it at the nearest swing high/low on the 4H timeframe (0.84400) for swing/day trades. Adjust based on your risk, lot size, and multiple orders. Play smart—your capital, your rules! ⚠️🔥

Target 🎯: Aim for 0.83500 or slip out early if the market whispers an escape. 🏃♂️💨

💵 Why’s the Chunnel ripe for the taking? The EUR/GBP’s in a bearish groove, driven by key market signals. Curious? Dive into the fundamentals, COT reports, sentiment, and intermarket analysis for the full scoop! 🌎🔗 Check linkk macro trends and future targets & overall score. 📊

⚠️ Trading Alert: News can shake the market like a getaway car! 📰🚗 Avoid new trades during high-impact releases and use trailing stops to lock in profits and shield your positions. Safety first, heisters! 🚫🔐

💖 Boost our heist! Hit that Boost Button 🚀 to fuel our Thief Trading crew. With daily market raids, we’re stacking pips and living the trader’s dream! 🤑🤝 Stay tuned for the next caper—more profits await! 🐱👤🎉

Happy heisting, and let’s make those charts bleed green! 💪🌟

USD/JPY Multi-Timeframe Trading Plan – Week AheadUSD/JPY is trending higher short-term but remains below key resistance on the daily chart. The daily timeframe shows an inverted head-and-shoulders forming, with a neckline at 152. Until that breaks, rallies into 148–150 are likely to fade. The 1-hour chart shows a rising wedge from 142 to 148.5 with support around 145.0. Momentum is slowing, warning of potential exhaustion near 148.

On the 15-minute chart, recent price action shows a bull flag and a double bottom, offering buy zones at 146.10–146.30. The plan for early week is to long dips to this zone, targeting 146.80–147.20 with stops below 145.90. Watch for fades around 147.50–148.00 mid-week. A break above 148.00 opens room to 150.00; below 145.00, momentum shifts bearish.

Strategy: Buy pullbacks early in the week; fade rallies near 148 mid-week. Flip long above 148.00 or short below 145.00. Use tight stops and manage risk per trade.

NZD/USD "Kiwi" Forex Vault Heist Plan!🌟 Yo, what's good? Salaam! Ciao! Konnichiwa! 🌟

Dear Cash Snatchers & Market Bandits, 🤑💰💸😎

Get ready to raid the NZD/USD "Kiwi" Forex Vault with the slickest 🔥Thief Trading Style🔥 Our tech-fueled, fundamental-backed heist plan is locked and loaded for a long-entry score. Stick to the chart’s sneaky blueprint and aim to slip out near the Red Zone—a high-stakes trap where overbought vibes, consolidation, and bearish bandits lurk. 🏆💸 Grab your loot and treat yourself, you sly foxes! 💪🎉

- 📈 Entry Point: The heist’s ON! 🕵️♂️ Lay low for the MA pullback at Institutional Buy Zone 1 (0.57700) or Buy Zone 2 (0.56000), then pounce for juicy bullish profits! 🚀

- 🛑 Stop Loss: Yo, ears up! 🗣️ If you’re setting a buy stop order, don’t touch that stop loss ‘til the breakout pops off. 📍 Stash it at the closest swing low on the 4H: Buy Zone 1 SL at 0.56500, Buy Zone 2 SL at 0.54500. Size it to your risk, lot, and multi-order game plan. Mess around, and you’re toast! 🔥

- 🎯 Target: Shoot for 0.62500 or ghost out early with the goods. 💰

- 👀 Scalper Crew: Long-side scalping only! Got deep pockets? Dive in. Tight budget? Roll with swing traders and slap on a trailing SL to shield your stash. 🧲

- 📊 Why It’s Lit: The Kiwi’s bullish run is powered by fundamentals, macro trends, COT reports, quant analysis, market vibes, and intermarket signals. Scope the full scoop from legit sources! 🌍🔗

⚠️ Heads-Up: News drops can flip the game! 📰 Stay sharp:

- Dodge new trades when news hits.

- Slap trailing stop-losses on to lock profits and cover your back.

💖 Fuel the heist! 💥 Smash that Boost Button to power up our Thief Trading Style squad. Swipe profits daily like a pro and roll with the slickest crew! 🏆🤝🚀 Catch you on the next big score, bandits! 🤑🐱👤😎

CAD/CHF Loonie Heist: Sniping Swiss Profits with Thief Trading!🌍 Hello Global Traders! 🌟

Money Makers, Risk Takers, and Market Shakers! 🤑💸✈️

Dive into our CAD/CHF "Loonie vs Swiss" Forex heist, crafted with the signature 🔥Thief Trading Style🔥, blending sharp technicals and deep fundamentals. Follow the strategy outlined in the TradingView chart, focusing on a long entry targeting the high-risk MA Zone. Expect a wild ride with overbought conditions, consolidation, and potential trend reversals where bearish players lurk. 🏆💰 Celebrate your wins, traders—you’ve earned it! 💪🎉

Entry 📈: The vault’s open! Grab bullish opportunities at any price, but for precision, set buy limit orders on a 15 or 30-minute timeframe near swing lows or highs for pullback entries.

Stop Loss 🛑:

📍 Place your Thief SL at the recent swing low on the 1H timeframe (0.59400) for scalping or day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open orders.

Target 🎯: Aim for 0.61400.

💵 CAD/CHF is riding a bullish wave, fueled by key market drivers. ☝

Unlock the full picture—dive into Fundamentals, Macro Insights, COT Reports, Quantitative Analysis, Sentiment Outlook, Intermarket Trends, and Future Targets. Check 👉🌎🔗.

⚠️ Trading Alert: News & Position Management 📰🚨

News can shake the market hard. Protect your trades by:

Avoiding new entries during news releases.

Using trailing stops to lock in profits and shield running positions.

📌 Markets move fast—stay sharp, keep learning, and adapt your strategy as conditions evolve.

💖 Power up our heist! 🚀 Tap the Boost Button to amplify our Thief Trading Style and make stealing profits a breeze. Join our crew, grow stronger, and conquer the markets daily with ease. 🏆🤝❤️

Catch you at the next heist, traders—stay ready! 🤑🐱👤🤩

EURUSD Bearish Structure Forming Amid Dollar UncertaintyEURUSD appears to be carving out a series of lower highs, showing potential signs of distribution. With price compressing inside a symmetrical triangle following multiple failed breakout attempts, the stage could be set for a bearish breakdown. This comes as U.S. inflation and Fed policy hold the spotlight and the euro faces political and structural crosswinds.

📉 Technical Breakdown (4H Chart)

Triple Top / Head & Shoulders Variant Forming:

Price action has traced a rounded top sequence, forming a triple top or complex head and shoulders structure.

Each rally attempt has been followed by steeper declines and faster recoveries—typical of a topping process.

Triangle Contraction Zone:

Current price is consolidating into a symmetrical triangle, which is often a continuation pattern.

Bearish breakout is expected if support around 1.1330–1.1320 fails.

Key Bearish Targets:

TP1: 1.1090 – former resistance turned support.

TP2: 1.0890 – April breakout base and key structure low.

Trade Setup (as per chart):

Sell Entry Zone: Break and retest of 1.1320–1.1300.

Stop Loss: Above 1.1527 (supply zone high).

Targets:

TP1: 1.1090

TP2: 1.0890

🌐 Macro Context

USD Side:

Fed is holding rates steady amid rising inflation fears triggered by tariffs

Tariff shocks are already pushing prices up, while growth slows—a tough environment for the Fed.

Dollar could strengthen if market sentiment shifts risk-off.

Euro Side:

Former EU Commissioner Gentiloni calls for unified borrowing to boost the euro’s global role, as U.S. stability is questioned

Political uncertainty around German leadership transitions may also weigh on the euro short term.

✅ Conclusion

EURUSD is trading at the apex of a tightening triangle pattern following a distribution structure. With a clean break of 1.1320 support, expect increased volatility and bearish momentum toward 1.1090 and 1.0890.

GBP/JPY testing critical zoneThe GBP/JPY is testing a critical resistance area between 189.20 to 190.00. For as long as this area holds as resistance, the path of least resistance remains to the downside.

Should the selling resume from here, we could see the Guppy trade down to test the key support range between 185.00 to 186.00 again.

However, if the GBP/JPY breaks decisively above the 189.20 to 190.00 range, then that could potentially pave the way for a short-squeeze rally towards the next major resistance in the 193.00 to 194.20 range, where we also have the 200 day MA converging.

By Fawad Razaqzada, market analyst with FOREX.com

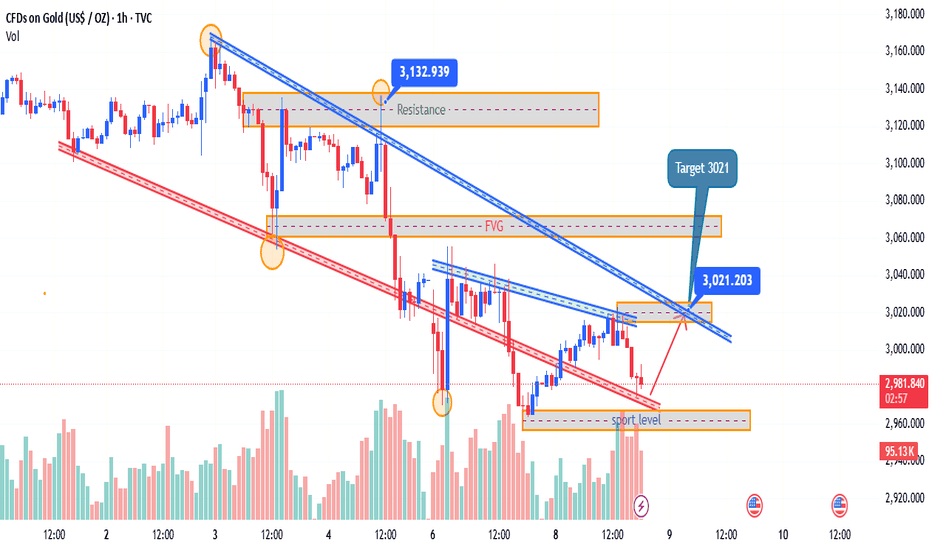

Gold ChatGPT: Chart Analysis for Gold (XAU/USD) – April 08, 2025 – 1-Hour Timeframe

Key Observations:

1. Trend and Price Action:

- The price of Gold is currently in a downtrend, as indicated by the red trendline showing lower highs and lower lows. The price has recently broken below the previous support level, signaling a continuation of the bearish movement.

- The resistance zone near 3,141.64 remains a significant barrier for any upward movement, while the support level at 2,960.00 is holding the price from falling further.

2. Order Block and FVG (Fair Value Gap):

- The order block located at 3,138.95 to 3,141.64 has been a key area where price rejection occurred. The price approached this area but failed to break above, indicating strong selling pressure. This …

ChatGPT: - The target for the current bearish setup is 3,021, which aligns with the support level near 2,987.47. If the price continues to decline, this target could be reached soon, with further downside movement expected.

- If the price holds at the support level and forms a bullish reversal pattern, it may head back towards the resistance zone. However, until the support level holds, the price is likely to continue the downward trajectory.

4. Volume and Market Sentiment:

- The volume shows a consistent decline, confirming the selling pressure. The recent spikes in volume near the support level suggest that the market is reacting to the critical support area.

- Market sentiment remains bearish, with the price currently below its recent highs and the resistan…

ChatGPT: - Bullish Reversal Scenario: If Gold finds support at 2,960 and forms a bullish pattern (such as a reversal candle or engulfing candle), the price might move towards 3,141.64 again.

Conclusion:

The price of Gold is currently in a downtrend, facing resistance around 3,141.64 and support near 2,960. Traders should watch for price action near these levels to assess the next move. The target of 3,021 is the key level to focus on, and a breakout below this could lead to further downside. If the support level holds, there could be a potential for a bullish rebound towards resistance.

BTCUSD 15MINTS CHART TECHNICAL ANALYSIS NEXT MOVE POSSIBLE..This chart shows a potential bullish move for Bitcoin (BTC/USD).

The price is currently in a support zone (blue area) around 81,800-82,000.

A breakout from this level is expected, leading to a rise toward 83,224 (resistance level).

If momentum continues, BTC could reach 84,457.

The blue arrows indicate the expected bullish movement.