Trade

BTC/USD – Bearish Rejection, Targeting SupportChart Analysis:

BTC/USD is trading within a descending channel, showing a bearish trend.

Price recently tested the resistance zone but faced rejection.

A strong sell signal is indicated, suggesting a move towards the support level around $79,877.

If price breaks below support, further downside is possible.

Trading Plan:

Sell below resistance with a target at support.

Watch for confirmation signals before entering a position.

If price breaks above resistance, a trend reversal could be possible.

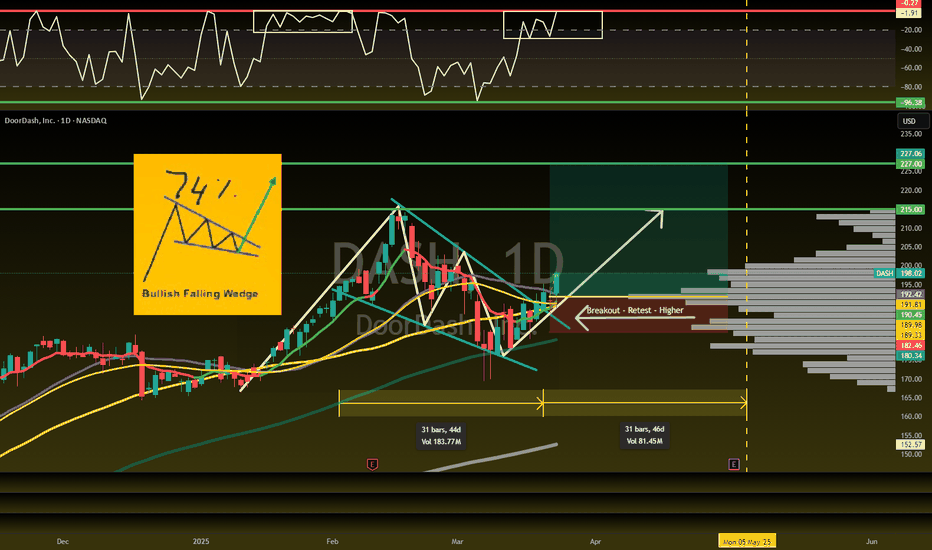

$UBER is HOTT! H5 Swing Trade with 10% Upside!NYSE:UBER is looking nice. Currently in it as a swing.

Undervalued and has been a holding up really well in this correction.

Markets get going next few weeks this name will get to $100 QUICK!

PTs: $82 / $85

WCB forming

Bullish H5_S indicator is bullish Cross

Volume Shelf Launch

Bull flag breakout!

Not financial advice.

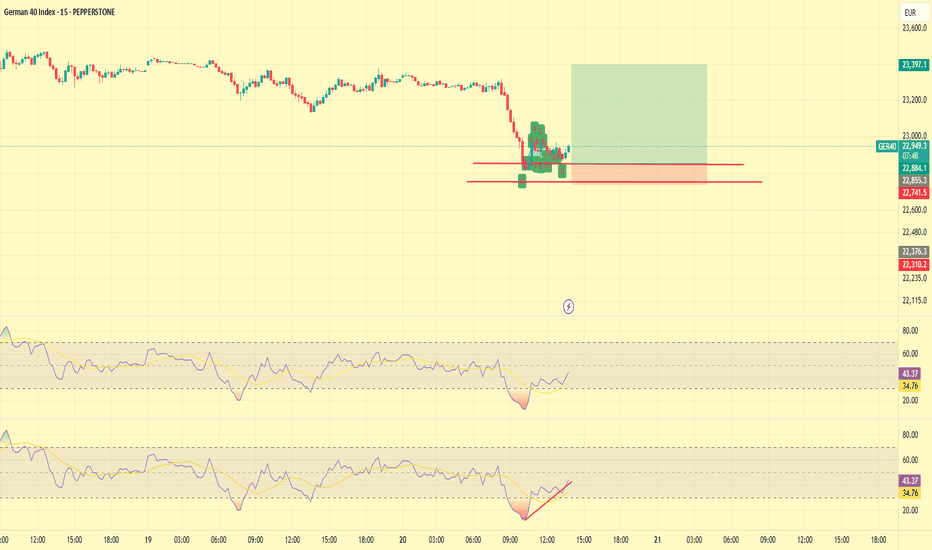

Pedramfxtrader | GBPUSD BUY We have a specific type of divergence on the 1-hour timeframe ⏳, indicating a potential drop 📉 in the higher timeframe. On the other hand, the lower 15-minute timeframe 🕒 gives us a buying perspective 📈. So, the analysis will be as shown in the image.

#GBPUSD #ForexTrading #PriceAction #ForexSignals #TradingAnalysis 💹

USDJPY Analysis week 14Fundamental Analysis

The US dollar continues to attract cash flows as the US Federal Reserve (Fed) is unlikely to cut interest rates in the near future. Fed Chairman Jerome Powell stressed that the Fed is in no hurry to adjust policy amid growing economic uncertainty under President Donald Trump, while warning of the negative impact of tariff policies on growth and inflation.

In the Asia-Pacific region, weak Japanese CPI data in February put pressure on the Yen (JPY), although the growth rate still reached 3%. However, expectations of tightening policy by the Bank of Japan (BoJ) remained after the Rengo union announced a 5.4% wage increase this year.

Technical Analysis

The short-term range is limited to 150,100-148,200. This border area is also very easy to break because there is a lot of buying and selling in this area and just enough factors will break the border area. Krado is aiming for the resistance area of 150,900 which will be the weekly resistance area. Important support when the price breaks out of the trendline is extended to 147,300 for buying force to jump into the market.

MUBARAKUSDT Hourly Technical AnalysisMUBARAKUSDT Hourly Technical Analysis

In the 1-hour technical analysis of the newly listed Mubarak Meme Coin, it is moving at the same level as the 21-day price average. Indicators are positive, and the price is consolidating in a sideways range, fluctuating between 0.130 - 0.150.

This meme coin is supported by CZ and is currently undergoing a voting process on Binance. CZ has shown his support for this meme coin by wearing the traditional Arab outfit featured in the coin's symbol in his social media posts. In short, since MUBARAK coin has a potential chance of getting listed on Binance in the future, the probability of positive price movements is high.

THIS IS NOT INVESTMENT ADVICE.

The information, comments, and recommendations provided here do not constitute investment advice. Investment advisory services are offered within the framework of an investment advisory agreement signed between the investor and brokerage firms, portfolio management companies, or non-deposit banks. The content on this page reflects only personal opinions and may not be suitable for your financial situation, risk tolerance, or return expectations. Therefore, no investment decisions should be made based on the information and statements provided here.

To stay updated on our analyses with both positive and risky technical indicators, please follow and like our page. Your support is greatly appreciated!

PIUSDT Hourly Technical AnalysisPIUSDT Hourly Technical Analysis

In the 1-hour technical analysis of Pi Network Coin, the selling pressure continues as it failed to break the 1.21 resistance. The price has dropped to the 1.0770 support level. If this support is also broken downward, the next support levels are 1.031 - 1.010. Our current expectation is negative. Next week, we may shift to daily technical analysis since daily technical data is also becoming clearer. However, for now, the daily outlook also appears negative. If there are sharp declines, buying at lower prices could create a potential for significant long-term returns.

THIS IS NOT INVESTMENT ADVICE.

The information, comments, and recommendations provided here do not constitute investment advice. Investment advisory services are provided within the framework of an investment advisory agreement signed between the investor and brokerage firms, portfolio management companies, or non-deposit banks. The content on this page reflects only personal opinions and may not be suitable for your financial situation, risk tolerance, or return expectations. Therefore, no investment decisions should be made based on the information and statements provided here.

To stay updated on our analyses with both positive and risky technical indicators, please follow and like our page. Your support is greatly appreciated!

BTCUSD - Consolidation Likely to Resolve with Bullish BreakoutThe Bitcoin/USD 4-hour chart displays a consolidation pattern after recovering from the March lows near $77,000, with current price action hovering around $83,928. Following a recent test of resistance at $86,500, a minor pullback appears to be underway, but the higher probability move remains to the upside as indicated by the directional arrows on the chart. The price has been forming a series of higher lows since the March 11 bottom, suggesting accumulation and underlying bullish momentum. Key to this outlook is the strong support established by the blue reaction zone near $76,000-$78,000, which has successfully contained selling pressure. Traders should monitor for a potential shallow retracement before the anticipated push toward the orange resistance level at $87,650, which represents the next significant hurdle. A decisive break above this resistance would likely trigger an acceleration in buying momentum and confirm the bullish scenario, potentially opening the path toward retesting the $90,000-$92,000 region in the coming sessions.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAGUSD - Hunting for Bullish Entries on Smaller TFThe Silver/USD 4-hour chart displays a significant retracement from recent highs around $3,420, with price currently rebounding near the $3,300 level. This correction has brought price to test both the ascending trendline and the horizontal support at $3,275 (marked by the red line), creating a potential buying opportunity. Given the overall uptrend structure and the recent bounce from this dual support zone, we need to prepare for finding buy setups on smaller timeframes. Traders should shift to lower timeframe charts (15-minute, 30-minute, or 1-hour) to identify precise entry signals. The price action suggests a potential retest of the upper blue reaction zone after completing the current zigzag correction, as indicated by the directional arrow on the chart. Monitoring these smaller timeframes will help capture optimal entry points with tighter stop-losses while maintaining the broader bullish bias shown on this 4-hour chart.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI - Positioning for Upside After Anticipated CorrectionThe US Light Crude 4-hour chart shows price action currently oscillating near the $68,60 level after recovering from early March lows. The recent price structure suggests we may see a short-term pullback before a stronger upward move develops. The chart indicates a potential bullish scenario with price expected to eventually rally toward the blue reaction zone (around $69,00-$69,50) after a possible retracement. This anticipated upside move is supported by the higher lows forming since mid-March and the overall recovery pattern from the $65,67 support level (marked by the red line). A prudent approach would be monitoring for reversal signs at lower levels before positioning for the higher probability move toward the blue reaction zone, with the orange resistance at $70,77 serving as the ultimate target if bullish momentum accelerates.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCAD - Higher Probability Upside Within Broader CorrectionThe USD/CAD 4-hour chart displays a complex price structure with recent upward momentum after finding support in the blue reaction zone (approximately 1.4250-1.4280). Currently trading around 1.4350, the pair appears poised for continued upside movement, with the higher probability scenario being a break above the orange resistance line at 1.4402. This view is supported by the recent series of higher lows and the bullish reversal from the support zone. However, traders should approach this opportunity cautiously, as we remain within a larger corrective structure in the broader market context. This suggests that while the immediate bias favors upside movement, price may still experience downward swings before a definitive breakout. A prudent approach would be to take this trade piece by piece, using smaller position sizes and tighter risk management to navigate potential volatility until the orange resistance is decisively broken.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD - Anticipated Pullback to Key Reaction ZoneThe EUR/USD 4-hour chart shows a recent downward movement after reaching peaks around 1.0950. Price action indicates a bearish momentum developing, with the pair currently trading at approximately 1.0815. We are expecting a pullback to occur first to the reaction zone marked on the chart (approximately 1.0730-1.0750 area, highlighted in blue), which represents a significant fair value gap. Traders should wait for the price to reach this zone and then look for signs of a bullish reversal, such as candlestick patterns (like hammers or engulfing patterns), divergences on oscillator indicators, or increased buying volume. This reaction zone could provide an attractive entry opportunity for long positions if bullish confirmation signals appear, potentially initiating a new upward movement from this established support area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD Trading Opportunity! BUY!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.0815

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.0880

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

———————————

WISH YOU ALL LUCK

EURNZD BUYThis symbol has a good buying opportunity based on price action conditions, but we don’t have a precise confirmation from the MACD indicator. However, overall, we can expect the scenario shown in the image.

#Forex #Trading #PriceAction #NZDUSD #ForexTrading #ForexSignals #ForexAnalysis #TechnicalAnalysis #MACD #Trader #ForexMarket #TradingView #CurrencyTrading #FXTrader #ChartAnalysis

KAVABINANCE:KAVAUSDT

KAVA / USDT

1D time frame ( wait for the price to come to buying zone)

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

Bitcoin (BTC/USD) – Bullish Breakout in Progress📈 Chart Pattern:

Bitcoin has been trading inside a descending channel for several weeks. Recently, BTC has broken out of the channel’s upper boundary, indicating a potential shift in momentum.

🔹 Key Levels:

Support: $80,043.75 (Critical stop-loss level)

Resistance: $87,500 (Short-term)

Target: $92,944.17 (Upside projection)

📊 Trading Plan:

BTC might retest the breakout zone before continuing the upward move.

A confirmed higher low formation could signal strong bullish momentum.

If BTC remains above $85,500, further upside toward $92,944.17 is possible.

⚠️ Risk Management:

If BTC drops below $80,043.75, the bullish setup could become invalid.

Traders should wait for confirmation before entering long positions.

💡 Conclusion:

This breakout could lead to a strong uptrend, but traders should watch for a successful retest before making a move. 🚀🔍