BTCUSD 15MINTS CHART TECHNICAL ANALYSIS NEXT MOVE POSSIBLE..This chart shows a potential bullish move for Bitcoin (BTC/USD).

The price is currently in a support zone (blue area) around 81,800-82,000.

A breakout from this level is expected, leading to a rise toward 83,224 (resistance level).

If momentum continues, BTC could reach 84,457.

The blue arrows indicate the expected bullish movement.

Trade

Missed trade opportunity on MNQ due to Tight SLOnce again, we shifted sl too soon and got stopped out of a good trade. It was nice to see the outcome, it ended up tapping inside of that Volume imbalance once again before falling over quickly for the remaining sellside liqudity.

If my SL was kept at the highs we would've captured the whole move. This week I have been feeling a little tired and my birthday is this thursday guys!! lol I would hate to have a bad trading week on my BDAY 😢. I don't know if that's why I am being so cautious, I wanna enjoy my week. haha

Anyways, I will post any new trades if I get into another one. But I might call it here depending on where price is at after I post this video.

If you guys enjoyed this give it a like and share with your friends(:

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

Good Trade SetupIt has taken a Support from

a Very Strong Level around 90 - 94.

Immediate Resistance is around 110 - 113

Day / Swing Traders may enjoy 5 - 7 rupees profit.

Good Support level is around 102.50 - 104.50

The Stock has the potential to reach upto 120 - 130

& if this level is Crossed with Good Volumes,

Next Target can be around 150+

96 is an Important level that should not break now.

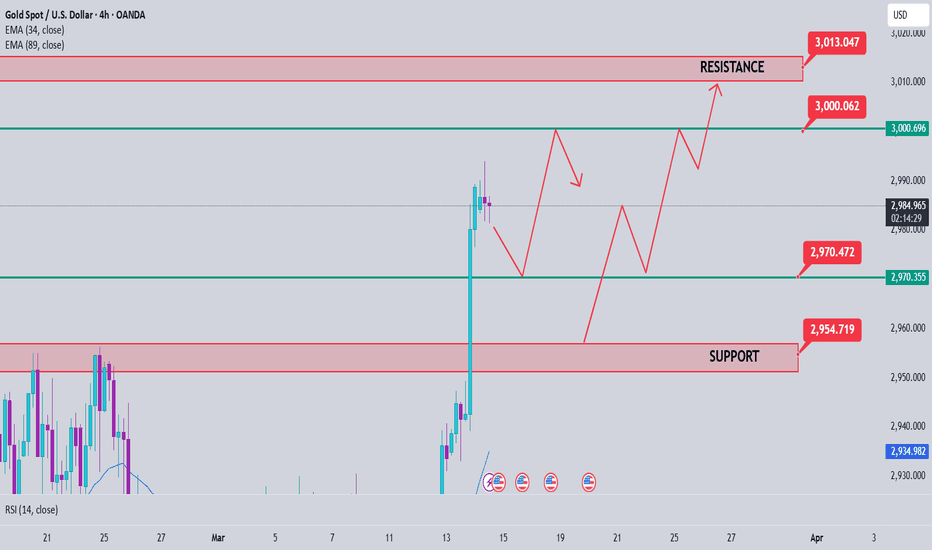

XAUUSD - Pullback Before Breaking $3,000 ResistanceGold spot prices have established a strong uptrend against the US dollar, currently trading near 2,986 after recently testing the psychological 3,000 level. The price action indicates a potential pullback to the blue support zone around 2,955-2,965 before resuming its bullish trajectory. Technical analysis suggests that the ascending trendline, which has supported price action since late February, remains intact and continues to provide a solid foundation for further upside. After the anticipated correction, gold appears poised to make another attempt at breaking above the 3,000 barrier, with potential targets extending toward 3,010 and beyond as indicated by the upward-pointing arrow. Traders should watch for buying opportunities during any retracement to the highlighted support zone, as the overall trend remains bullish with higher lows forming along the ascending trendline.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY - Higher Probability Favors Upside ContinuationThe GBP/JPY pair is displaying strong bullish momentum as it trades near 192.25, having recently tested but failed to break through the key resistance level at 193.05. After forming a higher low structure within an ascending trendline since late February, the pair shows notable strength with buyers stepping in at each pullback. Technical analysis suggests that the higher probability move is a continuation to the upside, with price likely to break above the horizontal resistance at 193.05 after a possible minor retracement. If this bullish scenario plays out, we could see the pair extend toward the 194.50 level before potentially reaching higher targets as indicated by the upward-pointing arrow on the chart. The ascending trendline and the support zone marked by the blue box near 191.00 should provide solid foundations for this anticipated upward move, keeping the overall bullish bias intact as long as price remains above these key structural levels.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY - Bullish pattern towards descending trendlineThe USD/JPY pair appears to be forming a potential reversal pattern after reaching a low around 146.50 in early March. Having bounced from this support level, the price is now hovering near 148.60 with indications of a larger corrective move ahead. Technical analysis suggests we are expecting a bigger correction in this area, with the price likely to test higher levels before encountering significant resistance. The initial price target will be the upper boundary of the blue box area (approximately 150.50-151.00), with potential to go toward the descending trendline that has been capping price action since January.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold Price Analysis March 14⭐️Fundamental analysis

Optimistic comments from the White House and Canada, along with news that enough Democrats have voted to avoid a US government shutdown, have boosted investor sentiment. However, gold's gains were capped by a stronger US dollar, which was bought for the third consecutive session.

However, expectations that the Fed will cut interest rates multiple times this year could limit the strong recovery of the US dollar. In addition, concerns about former President Trump's tough trade policies and their impact on the global economy continue to support gold prices. This suggests that any correction in gold could be a buying opportunity, helping the precious metal maintain its upward trend for the second consecutive week.

⭐️Technical analysis

any pullback today is considered a reasonable buy 2970 is the area where the European session Gold can find deeper and 2953 are the two BUY zones today. The sell zone is still noticeable around the 3000 round resistance and the 3015 border is considered resistance today. When gold has ATH, the FOMO is very high, so this is a difficult time to trade. Pay attention to volume and good capital management.

Gold Price Analysis March 13⭐️Fundamental Analysis

Gold prices maintained a positive trend in early European trading on Thursday and remained near the all-time high reached on February 24. The chaotic implementation of US President Donald Trump's trade tariffs and their impact on the global economy continued to drive safe-haven flows into bullion for the third consecutive day.

Meanwhile, fears of a US recession, coupled with signs of a cooling labour market and falling inflation, will allow the Federal Reserve (Fed) to resume its rate-cutting cycle sooner than expected. This, in turn, kept the US dollar (USD) near its lowest level since October 16 touched on Friday and turned out to be another factor supporting non-yielding gold prices.

⭐️Technical Analysis

Gold is correcting to the immediate support zone of 2930 if the support zone is broken 2922 is the next support point before gold price moves to 2910. The resistance zone of 2950 is considered as a barrier before reaching ATH and the daily sell plan is noticed around 2970

ES futures trade setup 13/03/'25Hello,

In today's trade analysis, I will review potential setups for this trading day. Since the overall trend is bearish, I favor short positions over long positions.

I have identified two important zones on the 4H timeframe that align well with the 1H timeframe.

4H supply zone: 5,643 - 5,630

4H demand zone: 5,577 - 5,558

We've seen both false breakouts and breakdowns in recent days, indicating choppy market conditions.

My plan is to either go short in the upper 4H supply zone or short a breakdown of the 4H demand zone. For the latter, I'll wait for the candle to close below the zone and set my entry on a retest.

EUROUSD 4H LONG (ALL Targets DONE)This position worked perfectly.

Now it is important to wait for the correction structure, as it was indicated in the previous update post:

Considering the current formations on the 1D TF, the probability of price growth to the current maximum increases multiple times. Locally, I expect to see a price correction (a rollback next week) and preferably with a depiction of a bullish imbalance. After which, you can work long for a whole month until 1.12758

EURUSD - Rally overextended? The EUR/USD pair appears to be approaching a significant correction phase after its recent rally to the 1.09 level. As shown on the chart, we're expecting a pullback from current levels, with two key support zones (marked in blue) serving as potential targets for this retracement. The upper blue zone around 1.0650-1.0680 represents the first support area where buyers might step in, while the lower blue zone near 1.0550-1.0580 provides a secondary support level should the correction deepen. These zones represent previous price action areas of significance where demand could emerge. The downward arrows illustrate the expected path of this correction, suggesting a measured move lower before potentially finding stability.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold Price Analysis March 12⭐️Fundamental analysis

Gold prices are fluctuating in a narrow range due to cautious sentiment before the US inflation data is released. The USD has recovered thanks to investors selling positions after the recent decline.

If inflation is weaker than expected, the Fed may cut interest rates, weakening the USD and pushing gold prices up. Conversely, if inflation is higher than expected, the Fed may keep interest rates high, putting downward pressure on gold prices.

In addition, US-Canada trade tensions and US-Russia peace talks on Ukraine also affect the market, so the impact of inflation data on gold prices may not last long.

⭐️ Technical analysis

Gold is sideways in the Asian session with a small range from 2912-2920. Waiting for signs of breaking out of this range. When the price breaks 2912 to 2908, the US session's Buyer zone is very noticeable. By the end of the US session, the price was still trading above 2908, proving that the price wanted to increase and break 2920 to reach 2929 and 2943. Note that the support zone of 2880 will still be the boundary that gold will find difficult to break today.

BTC/USDT SELL/SHORTbitcoin can move down

In this analysis, we are observing the potential repetition of market history by comparing the current Bitcoin price action to the previous bearish cycle. By utilizing Fibonacci retracement levels, historical patterns, , we can formulate a hypothesis that the market might follow a similar trajectory if bearish sentiment prevails.

Gold price analysis March 11⭐️Fundamental Analysis

Gold prices are struggling to capitalize on a modest intraday rebound from a one-week low and remain below $2,900 in Asian trading on Tuesday. Uncertainty surrounding US President Donald Trump’s trade policies and their impact on the global economy continues to weigh on investor sentiment. This, in turn, has supported the safe-haven bullion, attracting some intraday dip buyers near the $2,880 region.

Furthermore, the prevailing US Dollar (USD) selling bias, fueled by speculations that a tariff-driven slowdown in US growth could force the Federal Reserve (Fed) to cut interest rates multiple times this year, further underpins the non-yielding gold price.

⭐️Technical Analysis

Gold price is approaching the resistance level of session 2909 when breaking this zone waiting for the SELL zone in the European session at 2915-2918, the SELL margin is relatively wide. Support 2880 is still an important support level that gold needs more momentum to break this zone.

Heikin Ashi Trade IdeaCOINBASE:BTCUSD

In this video, I’ll be sharing my analysis of BTCUSD, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

WTI - High Probability of Continued Downtrend US Light Crude's 4-hour chart suggests a high probability that price will continue with the dominant downtrend and eventually break below recent lows. Currently trading around $67.17, crude oil has been in a persistent decline since late February, forming a series of lower highs and lower lows. The chart's projected path indicates a potential corrective bounce within the blue box area (approximately $68.50-$69.50), characterized by zigzag movements that would likely form a complex correction before resuming the bearish trend. This anticipated bearish continuation targets the horizontal red support line at around $65.77, with potential for moves below this level as indicated by the downward arrow. Recent failed attempts to sustain rallies and the steep decline from the $74.00 area reinforce the bearish outlook, suggesting that any upward movements should be viewed as selling opportunities within the larger downtrend.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAG/USD: Dual Paths to Bullish ResolutionSilver's 4-hour chart presents two potential scenarios for price action in the near term. In the first scenario, price could break above the current consolidation around $3,254 and move directly toward the red resistance line at approximately $3,278, as indicated. Alternatively, the second scenario suggests we may first see a deeper retracement toward the lower blue box support zone (around $3,160-$3,180) before finding buyers and resuming the upward movement, as illustrated by the zigzag pattern and second arrow. Both scenarios ultimately project bullish outcomes, with price expected to challenge the upper resistance after completing either path. The recent recovery from the late February lows around $3,080 provides the foundation for this bullish bias, though traders should monitor which scenario unfolds to adjust their entry strategies accordingly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCAD - Bullish ProspectsUSD/CAD's 4-hour chart suggests that if we see a nice correction in the current area around 1.434, we may experience a continuation to the upside as indicated by the arrow on the chart. The pair has been showing volatility since early March, reaching a peak of approximately 1.4540 before pulling back. The projected path illustrated with the zigzag line indicates a potential corrective move down followed by renewed bullish momentum. This potential upside continuation would likely target levels beyond the recent high, with the current consolidation possibly serving as a base for the next leg up. The highlighted blue box area represents a support zone that could contain the correction before the anticipated upward move materializes. Traders should watch for price action confirmation within this region to validate the bullish scenario.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY - Bigger correction on the daily timeframeUSD/JPY's daily chart indicates we're expecting a larger correction in the near term, followed by a likely continuation of the downtrend toward the blue box target area (143.50-146.00). After reaching peaks near 162.00 in July 2024 and 158.00 in December 2024/January 2025, the pair has established a series of lower highs, creating a clear downtrend pattern. Currently trading around 148.05, the price sits at a critical juncture, with the projected path suggesting a temporary bounce (as illustrated by the zigzag line) before bearish momentum likely resumes. This outlook is supported by the consistent lower highs since mid-2024, the price's position near a historical support/resistance level, February's failed attempt to sustain prices above 150, and the overall downward momentum that has dominated since December 2024.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.