Tradeidea

Gold Futures: Flight of the PhoenixCOMEX:GC1!

Gold Futures Analysis:

Gold futures are currently presenting a clearer picture compared to equity index futures. Crude oil futures, on the other hand, have already priced in much of the recent tariff news, with a reversal observed from the 2025 mid-range back towards $65. Despite heightened volatility, the WTI crude oil market remains relatively balanced, with bearish sentiment materializing, if prices drop below and stay below the $65 mark.

Gold futures, however, are offering more defined risk-reward opportunities at the moment. Our analysis shows a macro bullish trend in gold, along with price discovery and market auction trends visible on lower timeframes.

On the 4-hour chart below, we observe a rising upward channel, with key levels identified and reasoning for these levels labeled on the chart.

Key Levels:

• ATH: 3201.6

• HVN (High Volume Node) for long entry: 3115

• LVN (Low Volume Node)/LIS for short entry: 3095.1

• Key LVN Support: 3003.7-3018

Scenario 1: Bearish Continuation

If Gold futures stay below the trend line that defines both our long and short trade ideas, the bearish scenario could materialize. For a short trade to be viable, we would look for a close below the LVN/LIS level (3095.1) and enter on a pullback, targeting the major LVN support zone around 3018.0.

Example trade parameters for Scenario 1:

• Entry: 3095.1

• Stop: 3125

• Target: 3018

• Risk: 29.9 points

• Reward : 77.1 points

• Risk to Reward Ratio: RRR=77.1/29.9 ≈2.58

Scenario 2: Bullish Reversal

In the event that Gold futures push back towards all-time highs due to heightened uncertainty and a flight to safety, we expect initial profit-taking by shorter timeframe traders to provide a pullback. This could present a long opportunity towards the all-time highs.

Example trade parameters for Scenario 2:

• Entry: 3115

• Stop: 3095

• Target: 3200

• Risk : 20 points

• Reward : 85 points

• Risk-to-Reward Ratio: RRR= 85/20 = 4.25

Important Notes:

• These are example trade ideas, and traders are encouraged to do their own analysis and preparation before entering any positions.

• Stop losses are not guaranteed to trigger at specified levels, and actual losses may exceed predetermined stop levels.

AUDJPY to find sellers at market price?AUDJPY - 24h expiry

There is no indication that the selloff is coming to an end.

Further downside is expected.

Risk/Reward would be poor to call a sell from current levels.

A move through 92.50 will confirm the bearish momentum.

The measured move target is 91.75.

We look to Sell at 93.00 (stop at 93.50)

Our profit targets will be 92.00 and 91.75

Resistance: 92.75 / 93.00 / 93.25

Support: 92.25 / 92.00 / 91.75

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EURAUD rallies continue to attract sellers.EURAUD - 24h expiry

Trading has been mixed and volatile.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Risk/Reward would be poor to call a sell from current levels.

Bespoke resistance is located at 1.7265.

We look to Sell at 1.7265 (stop at 1.7325)

Our profit targets will be 1.7025 and 1.7000

Resistance: 1.7250 / 1.7310 / 1.7365

Support: 1.7100 / 1.7050 / 1.6950

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

SPX to find sellers at previous resistance?SPX500USD - 24h expiry

Daily signals are bearish.

Short term bias has turned negative.

Previous resistance located at 5700.

20 1day EMA is at 5699.8.

5705.4 has been pivotal.

We look to Sell at 5699.5 (stop at 5743.5)

Our profit targets will be 5585.5 and 5565.5

Resistance: 5630.0 / 5658.9 / 5700.0

Support: 5602.4 / 5564.3 / 5495.3

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

ASX200 to find buyers at market price?AU200AUD - 24h expiry

Risk/reward is ample to call a sell trade.

Offers ample risk/reward to sell at the market.

Daily signals are bearish.

We are trading at oversold extremes.

20 1day EMA is at 7976.

We look to Sell at 7975 (stop at 8031)

Our profit targets will be 7815 and 7765

Resistance: 7981 / 8003 / 8028

Support: 7894 / 7860 / 7807

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EURAUD forming a top?EURAUD - 24h expiry

Trading has been mixed and volatile.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Bearish divergence is expected to cap gains.

Bespoke resistance is located at 1.7360.

We look to Sell at 1.7360 (stop at 1.7420)

Our profit targets will be 1.7120 and 1.7080

Resistance: 1.7360 / 1.7420 / 1.7470

Support: 1.7275 / 1.7185 / 1.7090

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EURJPY remains mixed and volatile.EURJPY - 24h expiry

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Price action looks to be forming a top.

Preferred trade is to sell into rallies.

A lower correction is expected.

Bespoke resistance is located at 162.35.

We look to Sell at 162.35 (stop at 162.75)

Our profit targets will be 160.75 and 160.50

Resistance: 162.00 / 162.70 / 163.20

Support: 160.75 / 160.20 / 159.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

S&P to find buyers at current market price?US500 - Intraday

Closed the day little net changed.

An overnight negative theme in Equities has led to a lower open this morning.

Immediate signals are hard to interpret.

Bespoke resistance is located at 5853.

Bespoke support is located at 5536.

Dips continue to attract buyers.

We look to Buy at 5609 (stop at 5572)

Our profit targets will be 5719 and 5853

Resistance: 5719 / 5737 / 5853

Support: 5616 / 5607 / 5536

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Japan225 to find buyers at market price?NIK225 - 24h expiry

Price action looks to be forming a bottom.

A Doji style candle has been posted from the base.

Short term bias is mildly bullish. Preferred trade is to buy on dips.

Weekly pivot is at 37485.

We look to Buy at 37485 (stop at 37131)

Our profit targets will be 38496 and 40675

Resistance: 38275 / 40675 / 42155

Support: 36790 / 35590 / 34390

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

$PEP $150 retest Hi, liking NASDAQ:PEP here for a retest of mental price $150. NASDAQ:PEP is at 4 year lows, was at four year lows and bounced twice off $141 zone. Short term $150c could be a play here for April expiration but also could be patient and see if it retests the supply zone of $140. This is on watch. Just acquired Poppi brand as well. Overall it could be forming a rising wedge, not definitive on that thesis just yet, though.

NFA

WSL

Nikkei price action forming a top?JP225USD -24h expiry

Price action looks to be forming a top.

The primary trend remains bearish.

Preferred trade is to sell into rallies.

The hourly chart technicals suggests further upside before the downtrend returns.

We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

We look to Sell at 38270 (stop at 38679)

Our profit targets will be 37247 and 36790

Resistance: 38275 / 40675 / 42155

Support: 36790 / 35590 / 34390

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

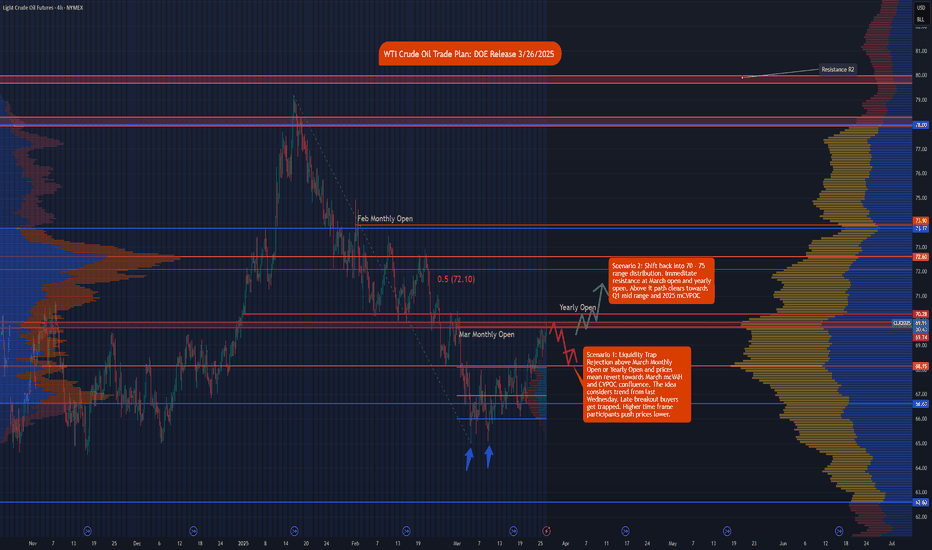

WTI Crude Oil Trade Plan: DOE Release NYMEX:CL1!

In this tradingview blog, we go over our technical setup and trade idea for Crude oil.

It is important to note we also have DOE inventory numbers coming at 10:30 ET.

Once the release has settled in, the trade idea can be framed using either of our two scenarios.

Scenario 1: Liquidity Trap

Rejection above March Monthly Open or Yearly Open and prices mean revert towards March mcVAH and CVPOC confluence. The idea considers the trend from last Wednesday. Late breakout buyers get trapped. Higher time frame participants push prices lower.

An example swing trade idea would be taking a long position once the release has settled and waiting for a pull back around 69.50.

• Entry: 69.50

• Stop: 70.30

• Target: 68.15

• Risk: 80 ticks

• Reward: 135 ticks

• Risk/Reward ratio: 1.69

This is an example swing trade idea that may play out by the end of the week.

Scenario 2: Shift back into 70 - 75 range distribution.

Immediate resistance is at March monthly open and yearly open. Above it the path clears towards Q1 mid-range and 2025 mCVPOC.

An example of a trade idea for this scenario is to wait for a breakout and close of candle on the 30 minutes time frame above yearly open. Wait for a pullback towards 70.28

• Entry: 70.35

• Stop: 69.50

• Target 71.45

• Risk: 85 ticks

• Reward: 110 ticks

• Risk/Reward ratio: 1.29

Please note that these are example trade ideas. Trades are advised to do their own preparation. Stops are not guaranteed to trigger, and losses may be greater than predetermined stops.

GOLD, XAUUSDTHIS ANALYSIS FOR "XAUUSD , GOLD" ON MULTIPLE TIME FRAME.

- What i can see on Gold right now price wanna make a big retreacement on daily time frame as we can see DXY already make clear breakout resistance on time frame 4 hour, possible now its time for DXY make a retracement.

- If trendline 1 hour and 1 hour S.S.R zone breakout just wait price comeback into this zone then we can SELL

- Or we can find opportunity on SELL ZONE 1

- If price make Sell desicon point on sell zone 2 please hold the position a bit far

- But if price break Sell zone 2 and minor resistance we just focus Buy

#TradeWhatYouSeeNotWhatYouThink

All the best !!!

If you want more update on "XAUUSD , GOLD". Kindly follow and like.

Feel free to comment my outlook and share with your friends. Thanks!

NZDUSD to find buyers at market price?NZDUSD - 24h expiry

Price action has stalled at good support levels and currently trades just above here (0.5725).

We expect a reversal in this move.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5775 will confirm the bullish momentum.

The measured move target is 0.5800.

We look to Buy at 0.5725 (stop at 0.5690)

Our profit targets will be 0.5795 and 0.5800

Resistance: 0.5775 / 0.5795 / 0.5800

Support: 0.5725 / 0.5700 / 0.5690

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

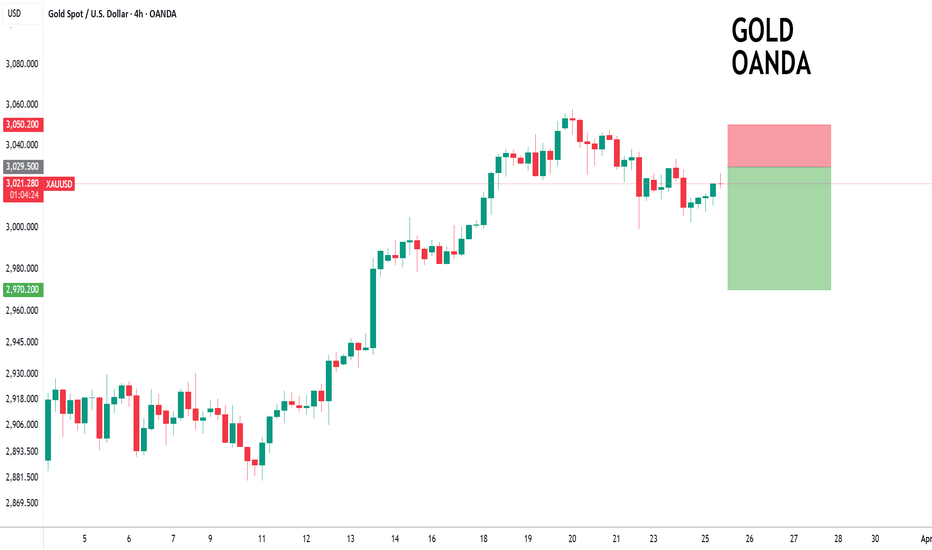

GOLD to turnaround?XAUUSD - 24h expiry

Previous support at 3030 now becomes resistance.

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Posted a Bearish Inverted Hammer Bottom on the Daily chart.

A higher correction is expected.

The RSI is trending lower.

We look to Sell at 3029.5 (stop at 3050.2)

Our profit targets will be 2970.2 and 2960.2

Resistance: 3020.8 / 3033.3 / 3047.4

Support: 3014.5 / 2999.3 / 2978.4

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDJPY rallies to continue attract sellers?NZDJPY - 24h expiry

The primary trend remains bearish.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

The RSI is trending higher.

Bespoke resistance is located at 86.55.

We look to Sell at 86.55 (stop at 86.95)

Our profit targets will be 84.95 and 84.70

Resistance: 86.70 / 87.15 / 87.65

Support: 85.20 / 84.75 / 84.40

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.