99% of people buying $NVDA don't understand this:🚨99% of people buying NASDAQ:NVDA don't understand this:

NASDAQ:GOOGL : “We’re boosting AI capex by $10B.”

Wall Street: “Cool, that’s like $1B or 0.06 per share for $NVDA.”

So from $170.50 at the time of news to $170.56 right?

No.

NASDAQ:NVDA trades at 98× earnings. So that $0.06? Turns into $6.00

Why?

Because people are expecting that to be happening every single year for 98 years and they're paying All of it Today in Full amount.

So NASDAQ:NVDA will get $1B more per year. But NASDAQ:NVDA price per share already increased by $100B in past 2 days 😂

Then it crashes 40% and everyone is wondering why.

Trader

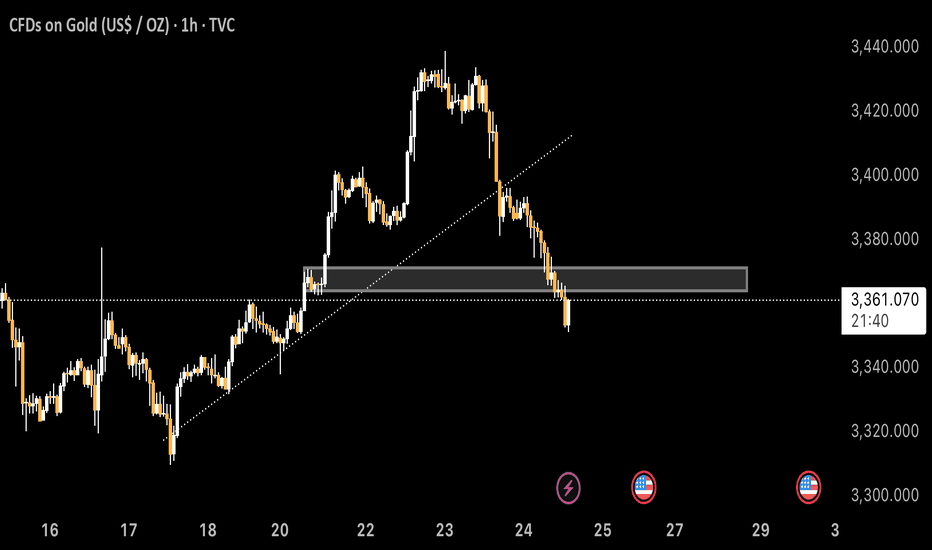

Gold Next Move Possible Hello Traders, Today I’m back with another idea.

As you know gold has changed the trend from bullish to the bearish.

The gold has fallen from the area 3438 to 3351. Now the current price is 3358.

I’m looking for the sell zone, In my view gold will drop till 3310.

I’m monitoring the sell zone 3364-3371, when the market touches the zone, I will add sell and my target will be 3310. Keep in bear my first target is 3351, second target is 3337 and the last target is 3310.

In the case if price breaks the 3377 area then we will have to wait until confirmation for another setup.

Stay Tune for every update.

Kindly share your ideas and leave positive comments. Thanks Everybody.

EURAUD sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

BSE - BUY THE FEAR, SELL THE GREED !"Buy the fear, sell on greed" is an investment strategy that means you should buy assets when most investors are scared and selling (during periods of fear), and sell those assets when most investors are excited and buying (during periods of greed).

Why does this work?

⦁ When fear dominates the market, prices often drop below their true value because people panic and sell at low prices. This creates opportunities for disciplined investors to buy quality assets at a discount.

⦁ When greed takes over, prices often rise above their real worth because people are eager to buy, hoping for quick gains. This is usually a good time to sell, as the risk of a downturn increases.

How do emotions affect markets?

⦁ Fear leads to panic selling, causing prices to fall further and often locking in losses for those who sell at the bottom.

⦁ Greed leads to speculative buying, driving prices higher and sometimes creating bubbles that eventually burst.

Why is it hard to follow?

⦁ While the idea is simple, it is emotionally difficult to buy when everyone else is pessimistic and selling, or to sell when everyone else is optimistic and buying. Most people act on emotion rather than logic, which is why few consistently succeed with this approach.

Practical example:

During a market crash, negative news and panic cause many to sell at low prices. A disciplined investor who buys during this fear can benefit when the market recovers. Conversely, when markets are booming and everyone is rushing to buy, selling at this point can help lock in gains before a potential correction.

Key takeaway:

This strategy is about removing emotion from investing decisions and taking a contrarian approach—buying when others are fearful and selling when others are greedy—rather than following the crowd. This approach has been used by successful investors like Warren Buffett to achieve long-term success by focusing on value and maintaining emotional discipline.

GBP/CAD (Two Trade Recaps) EUR/NZD Long and GBP/JPY LongEUR/NZD Long

Minimum entry requirements:

- If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

- If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

GBP/JPY Long

Minimum entry requirements:

- Tap into area of value.

- 1H impulse up above area of value.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

Retest of New Highs and Pullback Zone✨ By MJTrading:

Chart Overview:

AUDUSD reached a 2025 new high around 0.65600 before pulling back sharply. Price broke out of a consolidation wedge and is now retesting the prior breakout and dynamic support area.

🔹 Key Points:

Structure: Clear impulse move to new highs, followed by corrective pullback.

Support Zone: Blue box ~0.6480–0.6500 could act as a demand area if price extends lower.

EMAs: Price testing the 60 EMA (~0.6523) after losing short-term momentum.

Trade Setup:

Entry: 0.65250

SL: 0.65510

TP1: 0.65000

(Please Manage your Risk)( Ideal: 1% Per Trade)

Possible Scenarios:

Bullish reaction from current EMA support or the blue demand zone.

Deeper retracement if price fails to hold above 0.6500.

💡 Note:

This chart highlights how prior consolidation and breakout zones can offer potential retest entries in trending markets.

Thanks for your time an attention...

Follow for more setups.

#MJTrading

#AUDUSD #Forex #TechnicalAnalysis #PriceAction #BreakoutTrading #SupportResistance #TradingView #FX

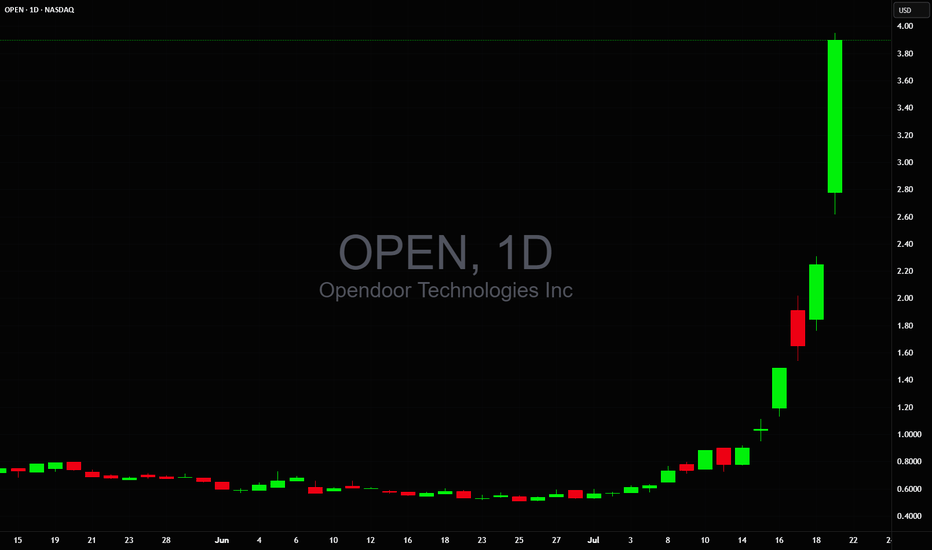

Ready for a new day, please bring another doubler like $EYENReady for a new day, please bring another doubler like NASDAQ:EYEN $5 to $10 or NYSE:SRFM yesterday which were the only 2 trades made and 2 nice wins🙏🏻

EUR/AUD Short, EUR/NZD Short, NZD/USD Long and AUD/NZD ShortEUR/AUD Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

- If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

EUR/NZD Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

- If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

NZD/USD Long

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart.

- If tight structured 1H continuation forms, 1H risk entry within it.

AUD/NZD Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart.

- If tight structured 1H continuation forms, 1H risk entry within it.

EUR/AUD ShortEUR/AUD Short

Minimum entry requirements:

- 1H impulse down below area of interest.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

USOIL || Geopolitical Spike Hits Major Resistance - Watch $77.77🛢️

📅 June 13, 2025

👤 By: MJTRADING

🔍 🧭 Fundamental Context – Risk Premium on the Rise:

Crude oil surged sharply today following reports of Israeli airstrikes on Iranian territory — a move that reawakens fears of broader Middle East escalation. Iran plays a crucial role in OPEC and controls the strategic Strait of Hormuz , through which ~20% of global oil passes.

While Iran has not officially responded yet, markets are pricing in the potential for:

* Military retaliation

* Disruption of oil exports or maritime routes

* Heightened volatility across global risk assets

=======================================================

📉 📊 Technical Structure – Tag of Key Resistance at $77.7:

Price exploded upward, piercing the descending channel that's been intact since mid-2022.

Today's daily wick tagged the $77.70 level, a major horizontal resistance and channel top.

This zone has repeatedly acted as a pivot in both bullish and bearish phases.

Volume confirmed the move – highest daily volume in months, suggesting institutional reaction.

💡 Trading Outlook:

🔼 Scenario A – Breakout & Close Above $77.7 = Bull Continuation

If tomorrow closes firmly above $77.70:

Target 1: $88.88 supply zone

Target 2: $90.00 psychological resistance

Setup: Conservative entries on retest of $75–77 area with tight invalidation

🔽 Scenario B – Failed Breakout → Fade Back Inside Channel

If this was a headline-driven spike with no follow-through, bears may re-enter strongly

A close below $75 could confirm bull trap

Support zone to watch: $66.66 (mid-channel, EMA confluence)

⚠️ Risk Factors to Monitor:

Iran’s response (military, diplomatic, strategic)

US/NATO reaction to potential escalation

Strait of Hormuz disruption

OPEC commentary or Saudi-led output adjustment

Market sentiment unwind (profit-taking from overbought spike)

💬 Markets love emotion, but traders survive with structure. This is not the time to be reckless — size down, be responsive, and respect both breakouts and fakeouts.

📎 #CrudeOil #Geopolitics #OilSpike #WTI #MiddleEastTensions #Iran #IranIsrael #TechnicalAnalysis #MJTRADING

EUR/USD Short and GBP/USD ShortEUR/USD Short

Minimum entry requirements:

- If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

- If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

GBP/USD Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart.

- If tight structured 1H continuation forms, 1H risk entry within it.

USD/CHF ShortUSD/CHF Short

Minimum entry requirements:

- Corrective tap into area of value.

- 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

- Tap into area of value.

- 1H impulse down below area of value.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

AUD/JPY Short, EUR/JPY Short, GBP/JPY Short and USD/CHF ShortAUD/JPY Short

Minimum entry requirements:

- 1H impulse down below area of value.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

EUR/JPY Short

Minimum entry requirements:

- If structured 1H continuation forms, 1H risk entry within it.

GBP/JPY Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart.

- If tight structured 1H continuation forms, 1H risk entry within it.

USD/CHF Short

Minimum entry requirements:

- Corrective tap into area of value.

- 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

- Tap into area of value.

- 1H impulse down below area of value.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

Biggest gainer of Fresh Cash Friday $KNWTOTAL gain of the week: +78.8% realized 💪

Monday: +31.7% ✅

Tuesday: +12.5% ✅

Wednesday: +5.3% ✅

Thursday: +9.4% ✅

Friday: +19.9% ✅

All trades posted were posted in real-time.

Not letting emotions take over, keep following the strategy, trading like a robot and letting the stats work in your advantage!

Let’s do it again this week!

USD/JPY Short, AUD/NZD Short, AUD/JPY Neutral and EUR/USD ShortUSD/JPY Short

Minimum entry requirements:

- If tight non-structured 5 min continuation forms, reduced risk entry on the break of it.

- If tight structured 5 min continuation forms, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

AUD/NZD Short

Minimum entry requirements:

- If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

AUD/JPY Neutral

Minimum entry requirements:

- If structured 1H continuation forms, 1H risk entry within it.

Minimum entry requirements:

- 1H impulse down below area of value.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

EUR/USD Short

Minimum entry requirements:

- Tap into area of value.

- 1H impulse down below area of value.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.