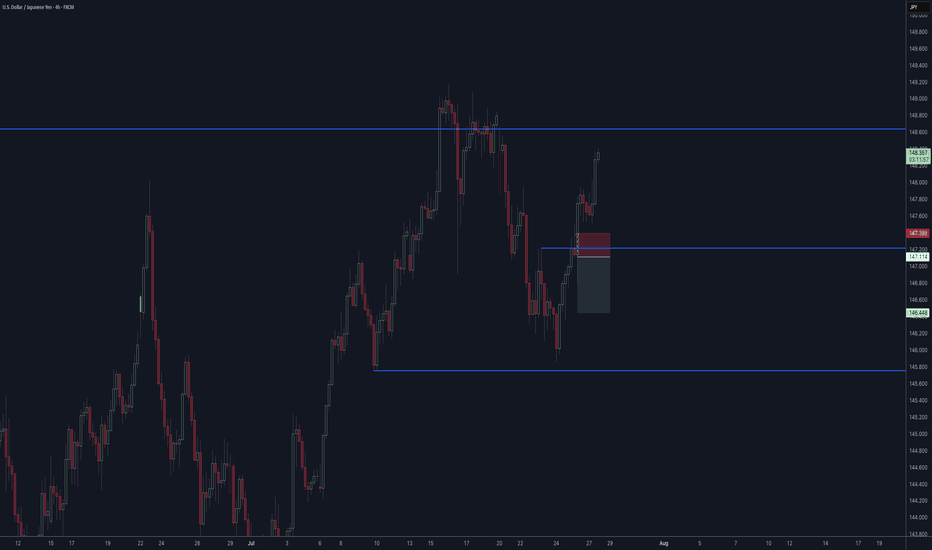

GBPUSD - GBPJPY - USDJPY Trade Recaps 28.07.25Three positions taken last week. Some vital findings within my self-review process which showed a stop loss error with GBJPY causing me to miss a solid 4% trade, and a manual close on GBPUSD to bank a little extra profit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

Tradereview

11.07.25 USDJPY Trade Recap + Re-Entry for +2.5%A long position taken on USDJPY for a breakeven, followed by a premature re-entry that I took a loss on. I also explain the true re-entry I should have taken for a 2.5% win.

Full explanation as to why I executed on these positions and also more details around the third position that I did not take.

Any questions you have just drop them below 👇

EURAUD -0.7% Short and AUDUSD MistakeA short position taken on EURAUD for a small loss after manually closing before swaps. I have also included a breakdown of a +4% AUDUSD long I was looking at taking but a small error on my behalf that caused me to stay out of the trade. Full explanation as to why I executed on this position and made the decision to manually close at the level I did.

Any questions you have just drop them below 👇

Day Trade Review – TSLAThis video is a review of TSLA intraday price action based on a request. It examines how the stock could have been traded using a technical approach. The analysis covers the entire session from the open to the close, showing execution, trade management and decision-making without hindsight bias. It also includes additional insights on time and risk management trading intraday.

If you have any requests for future reviews, let me know.

Trade Review - BYONWhen SAGE showed up in screener there was a bullish continuation pattern on the daily timeframe and a potential exhaustion on the higher timeframe.

The higher timeframe is in a downtrend, have made a measured move down (volatility projection) and is extended from the mean, thus we observe for potential reversion.

The lower timeframe provided a bullish continuation setup, which allows us to enter with a more structured approach. The target was a measured move up, as this is a projection of the current volatility.

Trade Review - SAGEWhen SAGE showed up in screener there was a bullish continuation pattern on the daily timeframe and a potential overextension on the higher timeframe downtrend.

The higher timeframe is in a downtrend, have made a measured move down (volatility projection) and is extended from the mean, thus we observe for potential reversion.

The lower timeframe provides a bullish continuation setup, which allows us to enter with a more structured approach. There was a failure test entry earlier, but since this was missed we look for a more clear range expansion as a confirmation. The target is a measured move up, as this is a projection of the current volatility.

In this chart you can observe the actual expansion / breakout, since there was a noticeable contraction 2 bars prior the move could be entered quicker. The stop is located 1-2 ATR from the entry point, which allows for a 1.5 to 2 R trade.

Trade Review - ALGS

When stock showed up in screener showed a bullish continuation pattern on daily timeframe and a potential failure test / pullback on the higher timeframe downtrend, a bit near mean but was added to watchlist.

Execution chart.

Trade Overview

• Structure: Bullish Continuation (D)

• Position: Near Mean (D)

• Entry Trigger: Breakout (D)

Entry Details

• Entry Price: 11.13

• Stop Price: 9.38

• Target Price: 12.96

• Expected Risk/Reward: 1.05R

Exit Strategy

• Exit Price: 14.47 / 1.91R

Trade Review - LUNR

When found in the screener, the stock showed a decent continuation pattern on the weekly chart. It was added to the watchlist to track a potential move, still were some distance to prior swing high.

Execution Chart.

Trade Overview

• Structure: Bullish Continuation

• Position: Near Mean

• Entry Trigger: Range Expansion

Entry Details

• Entry Price: 9.38

• Stop Price: 8.30

• Target Price: 12.36

• Expected Risk/Reward: 2.65 R

Exit Strategy

• Exit Price: Closed 50% into 1R and rest at 12.18.

Trade Review - WEST

When the stock showed up on the screener there was a bullish continuation setup on the daily chart and a potential overextension on the higher timeframe downtrend. Thus added to the watchlist to monitor for a move.

Execution – Entered late on a debatable Failure Test.

Trade Overview

• Structure: Bullish Continuation (D) / Downtrend Pullback (W)

• Position: Near Mean (D) / Far from Mean (W)

• Entry Trigger: Failed Breakdown (Late)

Entry Details

• Entry Price: 6.90

• Stop Price: 6.40

• Target Price: 8.46

• Expected Risk/Reward: 3.12 R

Exit Strategy

• Exit Price: Closed 75% of position into 1R and rest hit stop at breakeven.

Trade Review - NPWR

Found this stock on the screener showing a bullish continuation setup on the daily chart. On the higher timeframe downtrend, looked like the pullback had been played out. Despite it was added it to the watchlist to monitor.

Execution – Later Entry.

Trade Overview

• Structure: Bullish Continuation (D) / Bearish Pullback (W)

• Position: Near Mean (D) / Near Mean (W)

• Entry Trigger: Breakout / Range Expansion

Entry Details

• Entry Price: 9.92

• Stop Price: 8.91

• Target Price: 12.34

• Expected Risk/Reward: 2.36 R

Exit Strategy

• Exit Price: Closed 75% at 11.34 and 25% at 12.34.

Trade Review - DNA

When this stock was added to the watchlist, it displayed a bullish continuation setup on the daily timeframe. On the higher timeframe, there was also a potential for downside overextension, suggesting a possible pullback within the larger downtrend.

On the next chart, executions are shown. In anticipation of the trade, I look for a failed breakout against the trend—a failure test—where the price moves outside the lower boundary of an established consolidation. If it then closes back within the range, I sometimes enter before market close. For these trades, I often close a partial position as the price nears the upper part of the range, in case the range holds without a breakout.

Trade Overview

• Structure: Bullish Continuation (D) / Bearish Pullback (W)

• Position: Near Mean (D) / Extended from Mean (W)

• Entry Trigger: Failed Breakout (Opposite to Trend)

Entry Details

• Entry Price: 7.77

• Stop Price: 6.73

• Target Price (Range): 8.72

• Target Price (Measured Move): 11.62

Exit Strategy

• Exit Price: Closed 50% into 9.03 > Rest hit SL at 7.95.

Trade Review - KRUS

This stock was added to the watchlist based on a bullish continuation setup on the daily timeframe (noticeable upward move followed by a pullback or consolidation near the mean price).

The higher timeframe, we observed that the stock has been moving within a range, even shown a failed breakdown / failure test to the downside. Its now inside range, without interference.

Trade was entered as a breakout.

Trade Overview

• Structure: Bullish Continuation (D) / Range (W)

• Position: Near Mean (D) / Inside Range (W)

• Entry Trigger: Breakout

Entry Details

• Entry Price: 86.45

• Stop Price: 80.50

• Target Price: 103.10

• Expected Risk/Reward: 2.8 R

Exit Strategy

• Exit: Closed 50% at 1R, rest at or near target price.

Trade Review - AIRS

Daily chat showed a bullish continuation structure and weekly chart within a larger range (price inside of structure).

Above chart shows execution, showed up on active scan instantly but decided to enter with some reservation.

Trade Overview

• Structure: Bullish Continuation (D) / Range (W)

• Position: Near Mean (D) / Inside Range (W)

• Entry Trigger: Range Expansion / Breakout

Entry Details

• Entry Price: 6.42

• Stop Price: 5.54

• Target Price: 7.56

• Expected Risk/Reward: 1.3 R

Exit Strategy

• Exit Price: Closed all into 7.56 (Measured Move)

Performance Summary

• Result: 1.3R from a 17.75% move

Trade Review - UPST

Added UPST to the watchlist on October 27 due to a bullish continuation pattern on the daily chart. A quick look at the higher timeframe showed that the price was near the upper extreme of its range, with an earnings report date approaching as a precaution.

I closed the position within the measured move range (based on the assumption that the stock would maintain a similar range and volatility). However, expect that events or shifts in market behavior can move prices short of / outside this projection.

Trade Overview

• Structure: Bullish Continuation (D) / Range (W)

• Position: Near Mean (D) / Inside Range (W)

• Entry Trigger: Failed Breakdown (BIR) at EOD

Entry Details

• Entry Price: 50.26

• Stop Price: 45.41 (1.7 ATR)

• Target Price: 72.24

• Expected Risk/Reward: 4.55 R

Exit Strategy

• Exit Price: Closed 80% at 1R and rest into 72.24. Precaution into ER.

Trade Review - IBTA

Trade Overview

• Structure: Bullish Continuation (Daily) / Bearish Pullback (Weekly)

• Position: Near Mean (D) / Extended from Mean (W)

• Entry Trigger: Range Expansion / Breakout

Entry Details

• Entry Price: 65.38

• Stop Price: 59.55

• Target Price: 76.33

• Expected Risk/Reward: 1.88 R

Exit Strategy

• Exit Price: 76.24

Performance Summary

• Result: Total 16.5% move with a 1.88 R

Trade Review - SYMI plan to be more active and share my trades and insights regularly.

Information

I swing trade with focus on stock with short term momentum. My trades are identified through a two-step screening process. I use a passive screener outside of market hours to manually select stocks based on structure and position, to allow preparation and prevent too many options. At market open, I run an active screener to track for movement within the watchlist, as timing and momentum in selected stocks can be unpredictable. This allows me to be time efficient, I require no more than 20-30 minutes per open session.

Identified through my passive screener outside of market hours, this stock showed an initial momentum move to the upside on the daily timeframe, followed by consolidation near the mean price - a setup conducive to continuation. I occasionally check a higher timeframe (weekly) for context; in this case, it made a overextension to the downside which could follow with a pullback toward the mean (or not). The aim here isn’t to predict but to take a bet / capitalize on potential imbalances when they appear. Thus it was added to the watchlist.

At market open, this stock appeared on my active scanner, and when it reached 24.60, I entered as a clear range expansion was forming. I typically scale out at 1R and hold the remaining position for a measured move (projected from the prior momentum move). While the approach is straightforward, I occasionally adjust based on real-time conditions, as seen in this example. Execution details are shown below.

Trade Overview

• Structure: Bullish Continuation (Daily) and Bearish Pullback (Weekly)

• Position: Near mean price (Daily) and extended from mean price (Weekly).

• Entry Trigger: Range Expansion

Entry Details

• Entry Price: 24.60

• Stop Price: 22.07

• Target Price: 34.32

• Expected Risk/Reward: 3.84 R

Exit Strategy

• Exit Price: Closed 50% at 29.84 and 25% at 29.45.

Performance Summary

• Result: Price have moved 20.53% with a profit of 2R, trailing 25% with a near SL.

I wrote a bit more than usual for this review since it's my first review post, but the real approach itself is quite simple. Future posts will be more concise.