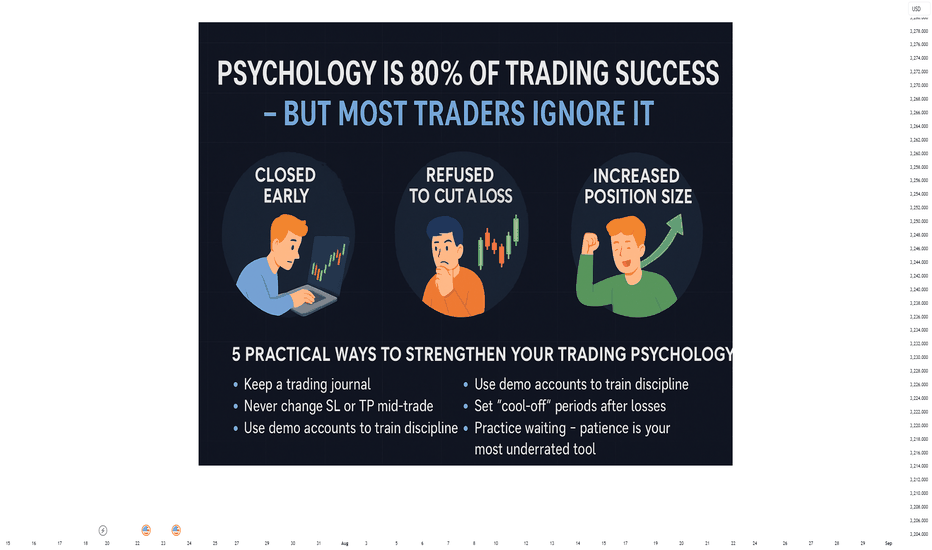

Psychology Is 80% of Trading SuccessPsychology Is 80% of Trading Success – But Most Traders Still Ignore It

Have you ever followed a perfect setup… and still lost money?

You entered at the right level.

The trend was clear.

Confirmation was solid.

But you closed the trade too early.

Or held onto a losing trade far too long.

Or took a revenge trade just to “get it back.”

This isn’t a strategy problem – it’s a psychological one.

💡 Most traders don’t fail due to poor analysis – they fail because they lose control of themselves

Let’s break down three real-world scenarios that almost every trader has experienced at some point:

🎯 1. Closing profitable trades too early – fear of giving it back

Example:

You long XAUUSD from 2360, targeting 2375.

As price hits 2366, you panic and exit early, fearing a reversal.

Later, the price hits 2375 without you.

➡️ This is classic loss aversion — where the fear of losing small gains outweighs the logic of sticking to your plan.

🎯 2. Holding onto losers – hoping the market will turn

Example:

You short EURUSD expecting a pullback, but price breaks resistance and climbs.

Instead of cutting your losses, you widen your stop and hold on.

The loss grows, and you exit in frustration.

➡️ This is denial – refusing to admit you're wrong, letting hope override discipline.

🎯 3. Increasing risk after a winning streak – “I can’t lose” mindset

Example:

After two wins, confidence spikes. You double your position size, despite a weaker setup.

One loss later – your previous gains are wiped out.

➡️ This is overconfidence bias – common after wins and extremely dangerous to consistency.

📊 Technical knowledge accounts for 20% of success – the remaining 80% lies in mindset and behaviour

You can:

Understand market structure

Use advanced indicators

Develop a robust strategy

But if you:

Ignore your stop-loss

Trade out of boredom or revenge

Break rules when under pressure

Then your edge disappears.

Your system becomes irrelevant if your psychology breaks down.

🧠 5 Practical Ways to Strengthen Your Trading Psychology

✅ Keep a trading journal – especially note your emotions

Ask yourself: “Was this trade part of my plan, or based on impulse?”

✅ Never adjust SL or TP mid-trade

Stick to your original parameters. Trust your plan, not your feelings.

✅ Use demo accounts to practise discipline, not just execution

Treat them like live accounts. Emotions will surface if you're honest.

✅ Pause trading after consecutive losses

Two losses in a row? Step away for 24 hours. Protect your decision-making clarity.

✅ Learn to wait – no trade is often the best trade

Patience is a trader’s secret weapon. Pros trade less, but with precision.

🔁 Trading isn’t about predicting the market – it’s about managing yourself within it

A 55% win-rate system can make you consistent profits

If you’re disciplined, calm, and structured.

But…

A 70% win-rate system can still blow your account

If your emotions are calling the shots.

🎯 Final Thought:

Financial markets don’t reward traders with the best strategy.

They reward those who stay rational under pressure.

You don’t need to be the smartest person in the room.

You don’t need a complex system.

But you do need emotional control, patience, and trust in your process.

Knowledge helps you spot the trade. Psychology helps you survive it.

🔔 If you found value in this, follow me for more content on trading mindset, discipline, and long-term consistency – because true success begins in the mind.

Tradermindset

Subtle Trading Challenges: Under-Discussed Psychological and OpsWhile traders often focus on well-known pitfalls like fear, greed, or overtrading , there are other subtle issues that can quietly undermine trading consistency and mindset. Below are a few under-discussed problems – touching on both psychology and day-to-day operations that many traders face.

Self-Worth Tied to Trading Performance

Some traders unknowingly tie their self-esteem or sense of self-worth to their trading results. When they have a losing day, they don’t just lose money – they feel personally defeated. This can trigger intense negative self-talk and emotional reactions to losses, sometimes causing traders to abandon their strategy or second-guess decisions in the heat of the moment. Because admitting such vulnerability is often seen as a weakness in trading circles, this issue rarely gets openly discussed, even though it can greatly sabotage a trader’s confidence and long-term consistency.

Analysis Paralysis and Decision Fatigue

In the age of overflowing data, traders can fall into “analysis paralysis” – overanalyzing market information to the point where they can’t make a clear decision. With countless indicators, news feeds, and opinions, it’s easy to get bogged down comparing options until no clear choice emerges, and this inaction can lead to missed profitable opportunities. Moreover, the mental strain of constantly dissecting information can cause decision fatigue, quietly diminishing the quality of any trades that are made. Unlike impulsive errors, this problem often masquerades as diligence, so it doesn’t get much attention in public discussions – yet it can erode a trader’s decisiveness and stress levels over time.

Constant Strategy Switching (System Hopping)

Another subtle pitfall is the tendency to jump between trading strategies too frequently, known as “system hopping.” Eager for a perfect method, traders might abandon a system after just a couple of losing trades and immediately switch to a new approach, never giving any strategy enough time to prove its worth. This habit – often fueled by impatience or get-rich-quick expectations – means the trader is always restarting the learning curve and never capitalizing on a method’s long-term edge. It’s an operational inconsistency that traders seldom admit openly, but it quietly undermines confidence and prevents the development of a stable, repeatable trading process.

Each of these problems tends to fly under the radar in trading forums or education, yet they subtly impact consistency and mindset. By recognizing these lesser-discussed challenges, traders can begin to address them and strengthen their overall discipline and performance.

Master Your Emotions: The 3 Trading Psychology Hacks Most traders don’t struggle because they lack a strategy—they struggle because emotions get in the way. After coaching hundreds of traders, I’ve seen the same patterns over and over: hesitation, FOMO, revenge trading, and self-doubt.

I get it. I’ve been there too. You see the perfect setup but hesitate. Or worse, you jump in too late and watch the market turn against you. It’s frustrating, but there’s a fix.

In this video, I’m breaking down the biggest trading psychology mistake I see and the simple 3-step process that has helped my students trade with confidence, even in the most volatile markets.

If you’ve ever felt like your emotions are sabotaging your trades, this is for you. Let’s fix it.

Kris/Mindbloome Exchange

Trade Smarter Live Better

Psychology in Trading: Overcoming Fear of LossesFear of Losses"

"As traders, we often fear losses, but it’s important to understand that losses are part of the game. Instead of avoiding them, we should learn from them. Here's how I’ve learned to overcome this fear:

1️⃣ Accept losses as part of the process.

2️⃣ Focus on consistent execution, not on short-term results.

3️⃣ Develop a mindset that values learning over perfection.*

Remember: losses are temporary, but discipline leads to long-term success!

Understanding the Danger Zone of trading. They occur oftenPatience is key, but it's easier said than done. Many of us, myself included, have fallen into the trap of opening trades at the wrong time and in the wrong place, driven by impatience.

A powerful way to avoid this mistake, especially in fast-moving markets, is to use the Gann Tool on higher time frames. The secret lies in identifying when the price is in the 'killzone'. When the price is here, it's a clear signal to step back and avoid taking trades.

Stay patient, stay safe, and make sure you're trading when the conditions are in your favor.

#TradingTips

#GannAnalysis

#MarketPatience

#TradeSmart

#KillzoneAvoidance

#ForexStrategy

#RiskManagement

#TechnicalAnalysis

#TraderMindset

#PriceAction

Jesse Livermore: Trading Lessons From an Iconic Trader● Jesse Livermore, a successful stock trader, built a fortune of $100 million in 1929. He operated independently, using his own capital and strategies. Livermore preferred trending stocks and used price patterns and volume analysis to decide trades.

● Livermore's Trading Principles

(1) Trade with the trend

A well-known saying is "The Trend Is Your Friend." Livermore preferred to trade stocks that were trending and avoided sideways market.

(2) Get confirmation before entering any trade

Hold off until the market shows clear signs before making a move. Being patient can lead to significant profits.

(3) Trade with a strict stop-loss

It is crucial to set a strict stop-loss for every trade, and it's important to know the stop-loss level before starting any trade. This approach can help a trader avoid significant losses.

(4) Trade the leading stocks from each sector

Livermore liked to trade stocks that were leaders in their industry. He thought this approach could increase his chances of winning.

(5) Avoid average down losing trades

He chose to exit the position rather than averaging it down.

(6) Avoid following too much stocks

It's quite challenging to monitor numerous stocks simultaneously. Focusing on a smaller number of stocks could lead to better trading opportunities.

How to Become a Professional Trader!The Triad of Successful Trading:

Strategies, Psychology, and Risk Management.

Introduction:

In the dynamic world of trading, achieving success is a multifaceted challenge that requires a comprehensive approach. While many enthusiasts focus primarily on trading strategies, it is crucial to recognize that a holistic approach, incorporating trading psychology and risk management, is indispensable for sustained success. This article delves into the three pillars of successful trading: trading strategies, psychology, and risk management.

Trading Strategies (25 Marks):

A robust trading strategy serves as the foundation of a trader's success. This section explores the importance of having a well-defined and tested trading strategy. Investors must understand that possessing the same strategy as others does not guarantee success; execution and adherence are key. Points will be awarded based on the clarity and effectiveness of the chosen strategy, as well as the ability to adapt to changing market conditions.

Trading Psychology (35 Marks):

Trading psychology plays a pivotal role in determining success or failure in the financial markets. This section emphasizes the significance of maintaining a disciplined and rational mindset. Factors such as emotional control, patience, and the ability to handle losses are crucial components of a trader's psychological makeup. The article will explore techniques to cultivate a resilient mindset, addressing the common pitfalls that novice traders often encounter.

Risk Management (40 Marks):

Arguably the most critical aspect of successful trading, risk management deserves the lion's share of consideration. This section delves into the methodologies and practices that traders should adopt to protect their capital. Key areas of discussion include position sizing, setting stop-loss orders, and diversification. The article will emphasize the importance of preserving capital and preventing catastrophic losses, assigning points based on the thoroughness and effectiveness of the risk management approach.

Conclusion:

In conclusion, the path to becoming a successful trader hinges on the harmonious integration of trading strategies, psychology, and risk management. While a strong trading strategy provides direction, a disciplined mindset ensures adherence to the plan, and prudent risk management safeguards against significant setbacks. Traders must recognize that neglecting any one of these pillars compromises the overall structure of their trading endeavors. By assigning marks to each component, this article underscores the balanced significance of these three elements and emphasizes their collective role in achieving success in the complex world of trading.

I'm Shaw, a seasoned forex trader with 14+ years of success. Whether you're new or experienced,

I'm here to help you achieve long-term profitability.

Trending Hashtags:

#TradingSuccess

#TraderMindset

#RiskManagement

#TradingStrategies

#FinancialMarkets

#TradingPsychology

#InvestmentStrategy

#CapitalProtection

#MarketDiscipline

#ProfessionalTrader

Trading Commandments: The Decalogue for Success 📈🔟💼

In the world of trading, there are timeless principles that serve as guiding beacons for traders, both novice and seasoned. These commandments are the keys to unlocking success, managing risk, and navigating the financial markets. In this comprehensive guide, we unveil the "10 Trading Commandments," each accompanied by real-world examples to reinforce their importance. Join us on this journey to master the art of trading, enriched with practical insights and wisdom.

The 10 Trading Commandments

1. Thou Shalt Know Thy Risk Tolerance 📊

Understanding your risk tolerance is fundamental. Your trading decisions should always align with your comfort level for potential losses.

Risk-Averse Trader

2. Thou Shalt Have a Plan and Follow It 📝

A trading plan is your roadmap to success. It should encompass your goals, strategies, and risk management rules.

The Disciplined Trader

The Power of the Decalogue

3. Thou Shalt Diversify Thy Portfolio 🌐

4. Thou Shalt Continuously Educate Thyself 📚

5. Thou Shalt Embrace Risk Management 🛡

6. Thou Shalt Keep Emotions in Check 🧘

7. Thou Shalt Adapt to Changing Markets 🔄

8. Thou Shalt Not Chase Losses 🚫

9. Thou Shalt Master Patience 🕰

10. Thou Shalt Keep Records of Thy Trades 📖

The "10 Trading Commandments" are not mere guidelines; they are the foundation upon which successful traders build their careers. These principles, when consistently followed, enable traders to navigate the markets with confidence, wisdom, and resilience. Whether you're just starting your trading journey or are a seasoned pro, embracing these commandments can lead to a more prosperous and rewarding trading experience. 📈🔟💼

What do you want to learn in the next post?

Why 90% of Traders Fail and How to Avoid Pitfalls

Introduction:

Trading in financial markets is a highly competitive and potentially lucrative venture, attracting individuals from all walks of life. However, statistics reveal a staggering truth: approximately 90% of traders end up failing. In this article, we delve into the reasons behind this disheartening trend, exploring three prominent examples that shed light on key pitfalls to avoid. Whether you are a seasoned trader or aspiring to enter the market, understanding these common mistakes can dramatically improve your chances of success.

Example 2: Emotionally Driven Decision Making

- Emotional decision making is a major hurdle often faced by traders, leading to poor judgement calls based on fear, greed, or impatience.

- Failure to stick to a well-defined trading plan and allowing emotions to dictate trades can result in severe losses.

Conclusion:

While trading offers immense potential, it is crucial to acknowledge the alarming rate at which traders fail. By avoiding common pitfalls, such as lack of proper education, emotionally driven decision making, and ineffective risk management, traders can significantly enhance their odds of success. Remember, mastering the art of trading is a journey that requires continuous learning, discipline, and perseverance.

Please, like this post and subscribe to our tradingview page!👍

Improve Your Trading ConfidenceConfidence is the backbone of any successful trading experience. You will not be able to handle this risky endeavor without a proper dose of confidence at your side. If you want to excel in trading, you will have to fiercely battle against yourself, your fear, and the market.

1. Know your methodology and plan

Having a roadmap in itself will get you started off on the right foot and instill confidence before you get into the ‘heat of battle’.

There are countless ways to analyze markets with no truly right or wrong approach. The key point here is that you have a methodology, and a relatively simple one, as too much complexity, causes paralysis by analysis, an obvious enemy of confidence.

In addition to understanding your toolbox, whether it be technical, fundamental, or a combination of the two, you should have specific trade set-ups outlined that provide you with an edge or statistical advantage over time.

2. Use both winners and losers to build trading confidence

Success is the key element that drives confidence. There are no better arguments that can make you feel really confident than a winning trade, or even better, a series of winning trades.

If you’re lucky enough to keep your mind cool and not slip into overconfidence, it’s really important to reflect on your winning trades and take some notes. However, you should remember that even a considered trading plan may fail, so never believe that every trade that meets your plan’s criteria will work the same way.

Sometimes even some perfect trade setups fail. It’s just a part of an overall picture, so just accept it and move on. Learn from your losing trades, analyze what you did wrong, and use it as an experience, which you should try to avoid next time.

3. Remember what you are good at and apply it to trading

Think about what you are good at. Was your way to success easy and smooth? Never happens. You probably had to overcome some obstacles, face doubts, and pass through hurdles and uncertainty. Despite all this, you managed to succeed.

Remember that feeling of confidence you have while doing your favorite job. Did you always feel the same? Doubt it. But the experience you've got can definitely help you in trading. Using your successful experiences as a touchstone will help you to build confidence in yourself and apply it to trading.

4. Focus on the process. learn, trade, sleep, repeat

Markets are unpredictable. Don't get obsessed with the outcome of any single trade. Instead, put your energy into consistent and disciplined trading practice, which may eventually teach you to avoid mistakes and end up with a consistently profitable account.

Practice, practice, practice!

5. Fake it till you make it

Investing with confidence sometimes requires a “fake it till you make it” approach. Particularly in trading, you should learn how to act “as if” you are confident enough, even in the face of losing trades.

At the very beginning, it may be hard to fight your inner demons and defeat your strong emotional impulses. You’ll have to stand up and walk away from your computer without getting obsessed with your wins and losses. You have to learn to accept any outcome and go ahead.

In order to proceed, you’ll have to act like a “super trader” and believe in your trading skills.

In The End

Confident and successful people in general tend to have an optimistic attitude.

If you want to achieve good results, stay positive and never give up. Follow your own trading and risk management strategy and eventually, the number of winning trades will outnumber the losing ones.

Trading with confidence is easier said than done. However, it is worth trying.

🌱 If you found value and learn something new, leave me a like to show your support. 👍🏼❤️