Scalping with ATM Options Using Candle + OI Confirmation!Hello Traders!

If you love quick entries and fast exits with defined logic, then ATM Option Scalping is your game. But scalping without confirmation often leads to stop-loss hits. That’s why combining candlestick structure with live Open Interest (OI) data gives you a serious edge. Let’s break down the exact setup I use to scalp with ATM options in Nifty & BankNifty .

Why ATM Options for Scalping?

Better Liquidity: ATM strikes have tight spreads and high volumes, making execution quick and efficient.

Quick Premium Movement: Even small index moves reflect fast in ATM premiums.

Less Theta Decay (Intraday): Within first half of day, theta doesn’t hurt much. Scalping avoids time decay traps.

Scalping Strategy: Candle + OI Confirmation

Step 1 – Watch 5-Min Candle Setup:

Look for strong breakout candles, bullish/bearish engulfing, or reversal candles at key zones like VWAP/PDH/PDL.

Step 2 – Confirm with OI Shift:

Check ATM strikes on option chain.

Put OI rising + Price sustaining = bullish confirmation.

Call OI rising + Price rejecting = bearish confirmation.

Step 3 – Take Trade in ATM Option:

Enter CE or PE near breakout candle close with proper SL below/above that candle.

Step 4 – Exit Fast (Scalp Mode):

Book partial profits at 30–40% or when next resistance/support is hit. Avoid overholding!

Bonus Risk Management Tips

Avoid Trading Near News or Events: OI gives false signals in high volatility zones.

1 Trade = 1 Risk Unit Only: Do not revenge trade. Scalping is about accuracy, not frequency.

Trade only when both candle + OI align: No confirmation = no entry.

Rahul’s Tip

Let the chart speak, but let the OI validate. When both agree — that’s where scalpers win big.

Conclusion

Scalping with ATM options using candle structure + OI shift is a powerful setup if executed with discipline. It’s fast, clean, and logical. Focus on 1–2 setups a day — and make them count.

Do you scalp ATM options? Share your entry rules or struggles in the comments below!

Traderrahulpal

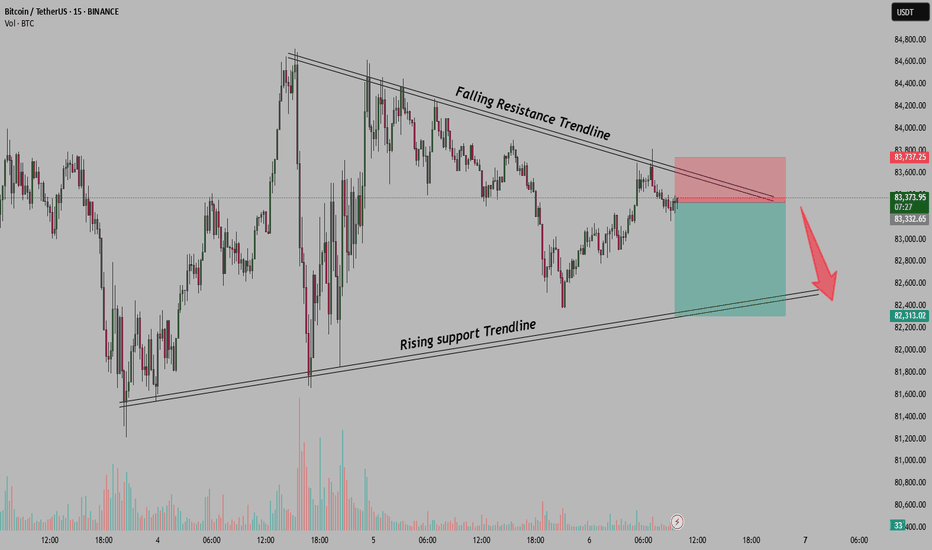

Bitcoin's Symmetrical Triangle – a short trade possible here!Bitcoin is currently forming a symmetrical triangle on the 15-minute chart, with a falling resistance trendline and a rising support trendline. This setup is a classic indication of consolidation, and the price is likely to move for downside soon as it is reversing from upper band now. If Bitcoin manages to break above 83,737, we could see a breakout of this symmetrical triangle, On the flip side, if it breaks below the rising support, 82,313 could breakdown for downside and we can see further downside then, but now we are playing inside the symmetrical triangle only and we will try to book profit once price reaches lower band of the symmetrical triangle pattern.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

If you Found this helpful? Don’t forget to like, share, and drop your thoughts in the comments below.

How to Trade After Major News Events – The 15-Min Trap SetupHello Traders!

We all get excited when major news hits the market — whether it’s budget day, RBI policy, US inflation data, or company results . But jumping in too early can be a trap. Smart money often creates fake moves in the first few minutes. That’s where the 15-Min Trap Setup becomes a powerful tool for intraday traders.

Let me show you how to avoid traps and catch real moves after news events.

Why the First 15 Minutes Matter

Emotions are high: Retail traders often react instantly without confirmation. This creates liquidity for big players.

Fake breakouts happen often: Price breaks key levels in the first candle — then reverses and traps traders.

Volume is misleading: The biggest volume often comes early, but the real direction is seen later.

The 15-Min Trap Setup – How It Works

Step 1: Wait for the first 15-minute candle to close after a big news event — don’t trade before that.

Step 2: Mark the high and low of this 15-minute candle.

Step 3: Wait for a fake breakout above or below that range — if price breaks out but quickly comes back inside, it’s a trap.

Step 4: Enter in the opposite direction of the breakout after confirmation — ride the real move.

When to Use This Strategy

Major economic events – like Fed decisions, budget day, inflation data, RBI policies.

Company results – high-impact earnings or news releases.

Gap up/gap down openings after big global cues.

Rahul’s Tip

Don’t react — observe. Let the market show its trap. Big players love early overconfidence. Use their game to your advantage by planning around the 15-min candle.

Conclusion

The 15-Min Trap Setup helps you avoid emotional trades and catch the real move after major news. Be patient, mark your zones, and strike when the trap is confirmed. This simple rule can completely change your intraday game.

Have you ever been trapped in the first candle after news? Let’s share experiences below and grow together!

Real Reason Most Strategies Fail–“Overfitting” Explained Simply!Hello Traders!

Have you ever seen a strategy work amazingly on historical charts, but fail badly in live markets? You’re not alone. One of the biggest reasons this happens is due to something called Overfitting . Today, let’s understand this concept in the simplest way — so you can avoid falling into this trap and build smarter strategies.

What is Overfitting in Trading?

Overfitting means your strategy is too perfect for past data:

It works great on old charts, but only because it was made to match that exact data.

It fails in real-time because the market changes:

The strategy doesn’t adapt well to new price behavior — it’s not flexible.

Example:

A strategy with 10 indicators giving perfect backtest results may be too specific and only fits that period — not future ones.

Signs Your Strategy Might Be Overfitted

Too many rules or filters:

If your strategy has too many conditions just to improve past results, that’s a red flag.

Works only on one stock or timeframe:

A good strategy should work on different stocks and market conditions.

Great backtest, bad live performance:

If your real trades don’t match the backtest, it might be too customized to the past.

How to Avoid Overfitting in Trading

Keep it simple:

Use fewer indicators and rules. Focus on clean price action and proven setups.

Test on different stocks/timeframes:

See if your setup works across Nifty, Bank Nifty, stocks, or different timeframes.

Use forward testing:

Try the strategy on live charts (paper trade) before putting real money into it.

Rahul’s Tip

A perfect backtest doesn’t mean a perfect future. Build your strategy to be reliable — not just impressive on history.

Conclusion

Overfitting is like memorizing old exam answers and failing the new paper. Don’t build strategies that only look good on past data. Make them strong, simple, and adaptable to real market conditions.

Have you faced this issue before? Let’s discuss in the comments and help each other improve!

KEI INDUSTRIES - Short Term Trade Setup with Liquidity Grab!INDUSTRIES LTD today. This one’s looking interesting, with the stock currently in a consolidation phase , stuck between a supply zone and a demand zone . The best part? We’ve had a liquidity grab near the demand zone, which means the stock is back in a sweet spot for a potential move upwards. If the price starts bouncing off that level again, we could see some nice profits.

For the entry point , you want to get in around ₹3,750-3,700 , right where the stock is testing the demand zone. The stop loss should be just around at ₹3,500 , giving you some room to manage the trade. The profit target is around ₹4,560 , near the supply zone. That gives you a good risk-to-reward ratio and the potential for a solid move if the stock continues up.

Disclaimer:- This analysis is for educational purposes only. Please trade responsibly and consult a financial advisor before making any decisions.

If you found this analysis helpful, don’t forget to like, follow, and share your thoughts in the comments below! Your support keeps me motivated to share more insights. Let’s grow and learn together—happy trading!

Voltas is ready to fly in blue sky, a perfect swing trade setupHello everyone, i hope you all will be doing good in your life and your Trading as well. Today i have brought a company from a TATA Group. Stock name is Voltas and it is engaged in the business of air conditioning, refrigeration, electro - mechanical projects as an EPC contractor both in domestic and international geographies (Middle East and Singapore) and engineering product services for mining, water management and treatment, construction equipments and textile industry.

Voltas was created 6 decades ago when Tata Sons joined hands with a swiss company Volkart Brothers. Voltas is also one of the most reputed engineering solution providers specializing in project management. The company has 5,000+ Customer sites actively managed across India

Unitary Cooling Products(UCP)

Unitary Cooling products comprises Room Air

Conditioners (RAC), Air Coolers, Air Purifiers, Water Heaters, Water Dispensers, Water Coolers, Visi Coolers, Chest Freezers, Cold Rooms & Medical Refrigeration.

As of Q1FY25, company has 21.2% market share in room Acs and 36% in window ACs . It has 30,000+ touchpoints, 330+ EBOs and 5 Experience Zones. The company sold 1 mn units in 88 days.

Market Cap

₹ 46,365 Cr.

Current Price

₹ 1,401

High / Low

₹ 1,946 / 1,013

Stock P/E

65.4

Book Value

₹ 190

Dividend Yield

0.39 %

ROCE

8.51 %

ROE

4.40 %

Face Value

₹ 1.00

Industry PE

82.8

Debt

₹ 871 Cr.

EPS

₹ 21.7

Promoter holding

30.3 %

Intrinsic Value

₹ 272

Return over 5years

15.1 %

Debt to equity

0.14

Net profit

₹ 709 Cr.

Disclaimer:- This analysis is for educational purposes only. Please trade responsibly and consult a financial advisor before making any decisions.

If you found this analysis helpful, don’t forget to like, follow, and share your thoughts in the comments below! Your support keeps me motivated to share more insights. Let’s grow and learn together—happy trading!

Bank Nifty Analysis:- Sell-on-Rise Opportunity Near 49,900 ZoneHello Everyone, i hope you all will be doing good in your life and your trading as well. Today i have brought an analysis on Banknifty for short term view for few days. First of all let me tell you Banknifty chart is painting a clear picture of a sell-on-rise market . The 49,800-50,000 zone stands out as a strong resistance area, making it an ideal level for initiating short trades. This zone aligns with the broader bearish sentiment, especially after the breakdown of the key 49,000 support, which now acts as resistance. On the downside, 48,215 is the immediate support where a pullback could pause, followed by stronger levels at 47,283 and 46,696 .

Looking at the RSI, it’s nearing oversold territory , which hints at a possible short-term bounce. However, the larger trend still favors sellers. To act on this, short positions can be built near 49,800-50,000 , but make sure to confirm with bearish candlestick patterns like a bearish engulfing or shooting star . For targets, aim for 48,215, 47,283 , and potentially 46,696, while keeping your stop-loss above 50,325 to protect against sudden reversals.

The market’s message is clear that this is a sell-on-rise setup, and patience combined with discipline can lead to high-probability opportunities in this bearish trend.

Disclaimer: This analysis is for educational purposes only. Please trade responsibly and consult a financial advisor before making any decisions.

If you found this analysis helpful, don’t forget to like, follow, and share your thoughts in the comments below! Your support keeps me motivated to share more insights. Let’s grow and learn together—happy trading! 🚀 Also, check my profile for other trading-related ideas @TraderRahulPal .🚀