Trades

GOLD trading ideaHI.

Here's the next days Gold Map :

after the big move up we're expecting the gold to continue with a smal wave until 2042 levels then start shorting gold until 1986 where it is going to retest our broken triangle

then start big buys operations pay attention to the quick moves down to hit your Stops ! make sure you have good stop lossat least 5 dollars.

we expect the gold to respect the secondary up trend lineuntil 2176 it may accelerate and it may also goes slow it will depend on the market conditions but one thing is sure the gold is not yet to sell for the upcoming days.

trade safe and good luck to everyone!

EURUSD Possible TradesGoodday traders,

Price showed me strong Bearish momentum last week.

Im looking for price to retrace in the beginning off the week to fill more Shorts mid term.

For today if price retraces in the NY session i will be looking for a possible Long to take out BSL.

The Long POI is under a current bullish swing, so im expecting people that are long to place there SL under the structure,

and with it a chance for the market to take out the buy stops and new people trying to long on a obvious zone.

Note that it can also hold the bullish swing and continue higher from there.

The zone im playing my longs is untested 5min imbalance,

creating a probability that there would be still long orders waiting to be filled.

I will watch price for potential short entries if it will reach the short OB above.

Can be a setup for tomorrow.

No financial advice.

Dave

AUDNZD It’s been a while! Took some time away to practice. Looks like we broke out of a recent downtrend. I counted a potential impulsive wave on the breakout and am now looking for a retracement to the wave 4 low anywhere between 38-61% or more if possible. Price may be in a consolidation phase at a recent high. Could recent bullish momentum exhaust soon?

BTC/USD short selling opportunityThe BTC/USD pair has been in a downward trend for the last few weeks, as it has dropped from a high of 23041 to its current level of 22983. This downward trend has created a good opportunity for bearish traders to take advantage of short term trading opportunities.

The current bearish trend has been driven by a combination of negative news, rising volatility, and low demand. The possibility of further drops in the BTC/USD pair is high, with some analysts suggesting that the pair could fall to a low of 21000 in the near future.

In order to take full advantage of this bearish trend, traders should utilize short term trading strategies such as scalping and swing trading. These strategies involve entering and exiting trades quickly to benefit from small, short-term movements in the market. Traders should also be sure to monitor the news and any economic data releases that may affect the market, as these can have a significant impact on the price of the BTC/USD pair.

Overall, the bearish trend in the BTC/USD pair has opened up several short-term trading opportunities, with some predicting the pair could fall to 21000. Traders should take advantage of these opportunities by utilizing short-term trading strategies and closely monitoring market activity.

Bitcoin Scalp Signals for Weekend Trades🖥️ We have determined there is a 65% chance Bitcoin will Fall from our current entry point.

📉 SHORT - BTC : $20,950 📉

💵 Length of trade: we are expecting BTC to hit a $550 scalp, with a high end of $1,400, and a minimum expectation of $250.

🕰️ Duration of trade: we are expecting the minimum target to occur within 6 hours. Then we see the rest of this trade playing out Monday morning est, which is a Bank Holiday in the USA.

📊🖥️ INDICATOR SHOWN ON CHART : Scot Signal Indicator

ASX Trading (by Trades)As you can see, I have temporarily modified my bio as I am trying something new.

As currently offered by platforms, volume is a total value of all trades and does not provide specific information on the size or direction on particular trades.

This granularity is used by banks and investment funds who keep track of competitor investments.

ASX Block Trades are generally only available through the Bloomberg Terminal with an addon (extremely expensive).

I have developed this tool on TradingView which uses the Volume to project potential block trades and the direction of price change to derive the underlying direction of the potential trade(s).

However, I have made the effort to acquire direct access to the ASX data feed to get this data.

Someday, TradingView will have the functionality to integrate my external feeds into the platform, but for now - the curreent state of the Block Transaction tool is all that is available on this platform.

Regards,

Grant

CRYPTO | MATICUSDT -DECRYPTERSHi people , Greetings from Team Decrypters We are Still Bearish on Over all Crypto Assets Due to Pending Downside leg of stocks Towards Pre-covid Levels & Pending liquidations of Big players

S&P500 – TRADES | KW47 | INTRADAYIn today's post I present relevant marks of the S&P500 for the next week, which could support the one or the other, in their own analysis.

= since it is a very short-term time frame, I will not comment further.

= the technical analysis approaches, are shown in individual pictures in the contribution. So that an individual interpretation of the respective - standing alone - is possible.

= the title picture shows an example, of a possible trade. This is one of many possible setups, because the current course is not able to take a clear direction.

The following methods are used and shown in the following:

- SUPPLY&DEMAND ZONES

- FIBONACCI LEVEL

- POINTS OF INTEREST

- TREND LINES

SUPPLY & DEMAND ZONES

„4 hour + 1 day – time window“

„1 hour – time window“

„1-4 hour + 1 day – time window“

FIBONACCI LEVEL

„Intraday - time window“

„Day - time window“

POINTS OF INTEREST

„4 hour - time window“

TRENDLINES

„Intraday - time window“

„Day - time window“

RAW VERSION WITHOUT DRAWINGS

„4 hour - time window“

„1 hour - time window“

> Feel free to discuss this in the comments and share our perspectives, I'd be "burning" to hear your take on this.

If this idea and explanation has added value to you, I would be very happy to receive a review of it.

Thank you and happy trading!

DXY – TRADES | MTF ANALYSE | KW48In today's post I present relevant marks of the DXY for the next week, which could support the one or the other, in their own analysis.

= the technical analysis approaches, are shown in individual images in the post. So that an individual interpretation of the respective - standing alone - is possible.

= the title picture shows an example, of a possible trade. This is one of many possible setups because the current course isn`t able to take a clear direction.

PERSONAL ASSESSMENT

If you look at the price in the higher time frames, you can quickly see that "without" another correction, we have been in free fall.

Thus, an intermediate correction in the smaller time frames is long overdue and could possibly await us next week, with a rising USD / DXY.

This just announces itself with a MACD divergence, in the small-time units. This does not mean that the price must immediately react to it, however, over the next few days after a possible small sell-off, the whole thing can run in the opposite direction.

Why this is so, I explain to you in the following.

MARKET MAKERS MOVE THE PRICE .

The DXY has been in correction for 2-months and many market participants assume a further USD value decline.

And exactly there is the existing problem,

-> "many market participants" are on the USD short side.

If you look a little bit into the TRADING of the HEDGE funds and banks, you will quickly come to the conclusion that without their participation, the market will not move.

1. from the moment the price moves permanently in one direction, it is no longer interesting for large investors.

2. their opportunities to make money are very small, which is why they have to reverse the market direction or initiate a consolidation.

This in turn is due to the following reasons:

- The position sizes of these investors are too large to be executed in a normal market environment.

- For this reason, you can e.g. only build LONG positions if enough investors sell to you = go SHORT.

- Thus, when the market falls, they can build a LONG position piece by piece, without having a "visible" influence on the market.

Then, when you decide that their position size has been successfully filled, let the price go in the opposite direction.

- During the e.g. upward movement, profits are then taken piece by piece where liquidity is highest so that the market does not break away again after these profit-takings.

So that you are prepared for both scenarios (LONG / SHORT), I have carried out the analysis combined with the different time units (monthly, weekly, daily and INTRA-Day) and in the following with chart images.

The following methods are used and shown below:

- MULTI TIME FRAME ANALYSIS

- TREND LINES + TREND CHANNELS

- SUPPLY&DEMAND ZONES

- FIBONACCI LEVEL

- MACD

MONTHLY TIME FRAME

WEEKLY WINDOW

DAY WINDOW

INNER DAY TIME WINDOW

4h + LONG

4h + SHORT

1h

4h Divergence - MACD - Intraday

> Feel free to discuss this in the comments and share our perspectives, I would be "burning" to hear your take on the whole thing.

If this idea and explanation has added value to you, I would be very happy to receive a review of it.

Thank you and happy trading!

Bitcoin Day Trade Setups, Scalping Entries🖥️ We have determined there is a 65% chance Bitcoin will RISE from our current entry point.

📉 LONG - BTC : $17,810 📉

💵 Length of trade: we are expecting BTC to hit a $400 scalp, with a high end of $550 - minimum expectation $250.

🕰️ Duration of trade: we are expecting this to occur within a couple hours of market open Thursday. But we can see a fast spike up to 18k at anytime prior.

📊🖥️ INDICATOR SHOWN ON CHART : Scot Signal Indicator

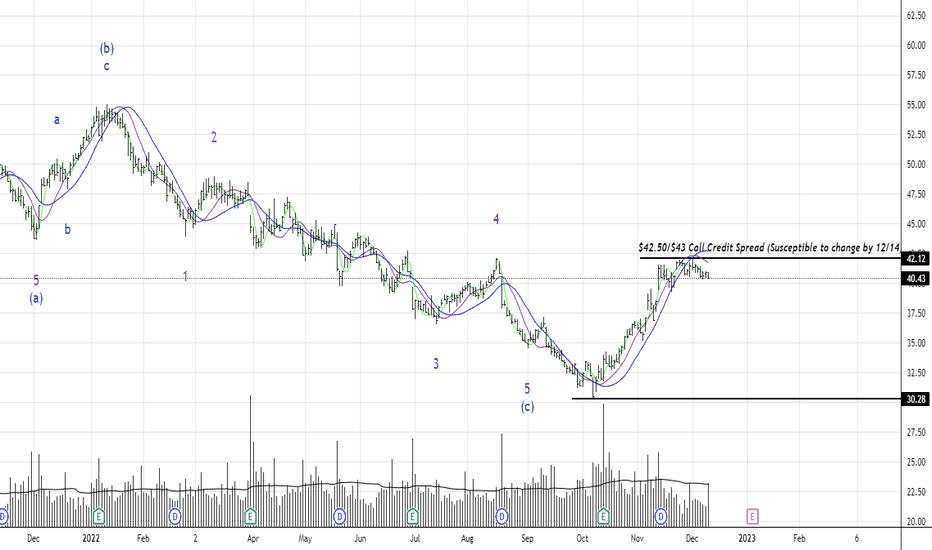

KHC (Range Trade)Price closed Friday under $40.50 after almost reaching that same price this week but stalling out near $40.44. This stock tends to move slower than others. $41.50 to me is a safe price range with zeroing out at $42 worst case before we lose money. Daily bar Friday closed under the most recent candle before that as well to note. Wave 3 may lowkey be a wave 5 but not sure. Might wait til the fed decision and cpi reports pass next week to get a second look.

PFE (Range Trade)Since the recent news relative to the authorization this past week, price has been making higher highs and lower lows. Only 6 times this year price played around in the $54 -$56 area. I'm banking on price exhaustion from the recent "good" news this past week. Daily is overbought as well. Maybe we can get a bar close or two this week lower than previous to give us some time. If price reaches this resistance area, we will reassess Might wait til the fed decision and cpi reports pass next week to get a second look.

WBA (Range Trade)The last two times price touched $42 was in August ($42.10) and December ($42.03). Price hovered near $42 highs in November but didn't hold. Could also be a start of new impulsive wave to the downside. Might wait til the fed decision and cpi reports pass next week to get a second look.

GM (Range Trade)$41.48 to $42.36 were two recent noteable highs since September. Price rejected the $41.50 area twice in November. Daily is oversold so we still need to be a bit careful here for the type of range trade we are looking for. Might wait til the fed decision and cpi reports pass next week to get a second look.