CAD_CHF BEARISH WEDGE PATTERN|SHORT|

✅CAD_CHF made a retest of

The horizontal resistance

Of 0.6213 which makes us

Locally bearish biased and

On top that we are seeing a

Fully formed bearish wedge

Pattern so IF we see a bearish

Breakout from the wedge

Pattern we will be expecting

A further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading-signals

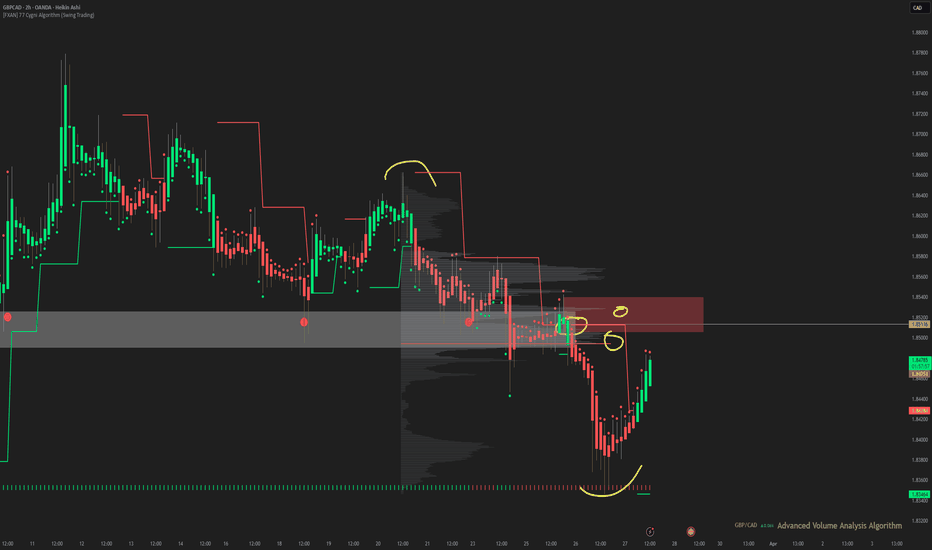

FXAN & Heikin Ashi Trade IdeaOANDA:GBPCAD

In this video, I’ll be sharing my analysis of GBPCAD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

USD-CHF Local Short Form Resistance! Sell!

Hello,Traders!

USD-CHF is trading in a

Kind of range consolidating

For a next big move but

Right now we can use the

Moment to trade the local

Range and to short the pair

From the horizontal resistance

Of 0.8855

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL SHORT FROM RESISTANCE|

✅CRUDE OIL has hit a TP

Of our last free signal and

Went further up just as we

Predicted but will soon hit

A horizontal resistance level

Of 70.57$ from where we will

Be expecting a local bearish

Correction and a move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD-CHF Free Signal! Sell!

Hello,Traders!

CAD-CHF has made some

Gains from the recent lows

Just as we expected but now

The pair is entering the

Horizontal resistance area

Around 0.6212 from where

We can enter a short trade

With the Take Profit of 0.6162

And the Stop Loss of 0.6233

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-CAD Risky Long! Buy!

Hello,Traders!

NZD-CAD made a retest

Of the horizontal support

Of 0.8170 and we are already

Seeing a bullish rebound

So we are bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-CAD Bearish Breakout! Sell!

Hello,Traders!

AUD-CAD made a bearish

Breakout of the key horizontal

Level of 0.9022 which is now

A resistance and the breakout

Is confirmed so we are bearish

Biased and we will be expecting

A further move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_CAD SHORT SIGNAL|

✅AUD_CAD is going down

And the pair made a bearish

Breakout of the key horizontal

Level of 0.9007 which is now

A resistance so we are bearish

Biased and we will be able

To enter a short trade on Monday

With the TP of 0.8970 and

The SL of 0.9030

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX WILL GO UP|LONG|

✅DAX is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the index is about to retest the rising support

Thus, a rebound and a move up is expected

With the target of retesting the level above at 23,200

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX Growth Ahead! Buy!

Hello,Traders!

DAX is going down

And will soon retest the

Rising support and after

The retest we will be

Expecting a bullish rebound

Because we are bullish biased

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-USD Bearish Breakout! Sell Limit!

Hello,Traders!

GBP-USD was trading in an

Uptrend and the pair was locally

Overbought so as we are seeing

A bearish breakout we are

Locally bearish biased

And we can set a Sell Limit

Order at 1.8649 with the

Target being 1.8465

And the Stop Loss at 1.8773

Slightly above the local high

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-AUD Will Go UP! Buy!

Hello,Traders!

EUR-AUD is trading in an

Uptrend and we are now

Seeing a nice bullish reaction

From the horizontal support

Of 1.7153 which reinforces our

Bullish bias and we will be

Expecting the pair grow more

With the target of 1.7417

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Recession Fears Extend Silver RallySilver is trading around $33.30 per ounce during Thursday's Asian session, maintaining its upward momentum for the third consecutive session. The precious metal is benefiting from increased safe-haven demand, supported by rising trade tensions and concerns over a potential US recession.

If silver breaks above $32.75, the next resistance levels are $33.15 and $33.80. On the downside, support is at $31.00, with further levels at $30.20 and $29.75 if selling pressure increases.