EUR/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are now examining the EUR/JPY pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 168.581 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Trading

Bearish pennant pattern active. Active SELL✏️Gold price is forming a triangle accumulation pattern. That shows the hesitation of investors at the moment, they may be waiting for important economic indicators of the US this week. Just an impact that makes Price break out of the triangle border can create a strong FOMO trend. The price line is quite similar to the bearish pennant pattern and heading towards really strong support areas.

📉 Key Levels

SELL Trigger: Break bottom line 3324

Target 3285, lower is the 3250 area

BUY Trigger: Break and trading above 3333

BUY Trigger: Rejection and confirmation of candle at 3285

Leave your comments on the idea. I am happy to read your views.

BONK Setup – Watching for Retracement After 200%+ RallyBONK has surged over 200% in recent weeks. We're now eyeing a retracement to a key support zone that could offer a prime entry for the next leg higher.

📌 Trade Setup:

• Entry Zone: $0.00002240 – $0.00002500

• Take Profit Targets:

o 🥇 $0.00004050 – $0.00004800

o 🥈 $0.00005500 – $0.00006500

• Stop Loss: Just below $0.00002000

USDJPY Is Very Bearish! Sell!

Here is our detailed technical review for USDJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 150.492.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 148.583 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GOLD BEST PLACE TO SELL FROM|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,309.55

Target Level: 3,288.24

Stop Loss: 3,323.69

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 45m

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPJPY: Pullback From Resistance 🇬🇧🇯🇵

I think that GBPJPY will pull back from a wide

intraday supply area.

As a confirmation, I see a bearish imbalance candle that

is formed after its test.

Goal - 198.51

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAY UPDATE REI/USDT THE INCREASE CANDLE OF UP $0,03 - $0,05REI is an interesting coin since the update of Q4

We have seen that this coin was able to increase to $0,031 and until here $0,018 zone, a return to where we are now. There is a high chance that this coin can recover next 24H if this coin is able to confirm the confirmation $0,02 - $0,021

This coin, as before, was targeted at $ 0.02 and had low volume. We expect that if it comes back to $ 0.02, it will be confirmation of the volume, which can take the trend with a candle to up $0,03

REI CONFIRMATIONS ZONE

Higher time frame

When you look normally at this coin, then this coin is in a trend line of breakdown. This can change with the next confirmations. The question is, are we going to see again $0,02 the next 24h? If yes high chance of a break.

We also have a cycle update 2025, check it here, expecting $0,90

EUR/AUD BEARS ARE GAINING STRENGTH|SHORT

EUR/AUD SIGNAL

Trade Direction: short

Entry Level: 1.777

Target Level: 1.768

Stop Loss: 1.782

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CAD BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

We are going long on the EUR/CAD with the target of 1.607 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Nightly $SPY / $SPX Scenarios for August 1, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 1, 2025 🔮

🌍 Market-Moving News 🌍

📦 U.S. Imposes New Tariffs as Deadline Passes

Fresh tariffs rolled out on August 1 hitting major exporters: 25% on Indian goods, 20% on Taiwan, 19% on Thailand, and 15% on South Korea. Canadas tariff elevated to 35%, though Mexico got extra negotiation time. Global equity markets slipped modestly, led by declines in Asia-Pacific regions. AMEX:SPY futures also eased on mounting geopolitical and trade pressures.

🏦 Fed Uncertainty Mounts Despite Calm GDP

Despite robust Q2 GDP growth and a hold on interest rates this week, Fed Chair Jerome Powell faced growing unrest. Comments acknowledged downside labor risk amid trade uncertainty—investors are now assigning just a 39% chance of a rate cut in September.

📊 Key Data Releases & Events 📊

📅 Friday, August 1:

8:30 AM ET – Nonfarm Payrolls (July):

Payrolls rose by 106,000, less than June’s 147,000 but still positive. Wage growth slowed, easing inflation concerns slightly.

8:30 AM ET – Unemployment Rate:

Unemployment ticked up to 4.2%, from 4.1% in June—reflecting modest labor softness.

8:30 AM ET – Average Hourly Earnings (MoM):

Wages rose +0.2%, down from +0.4% in June, signaling wage pressure easing.

⚠️ Disclaimer:

This information is provided for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #jobs #Fed #tariffs #inflation #technicalanalysis

Major U.S. News Ahead—Will EURUSD Pivot?Good morning, my friends 👋

Here’s my EURUSD market analysis 📉

Currently, the pair is in a downtrend. I expect this downward move to end around 1.14899 or 1.14536, where a potential buying opportunity may emerge. I personally plan to enter a buy position once price reaches those zones 💼

Also, keep an eye on major U.S. economic reports being released today—they could trigger increased volatility 🔔

Every like you send is a huge source of motivation for me to keep sharing high-quality analysis 🙏 Thanks to everyone supporting the channel 💙

GOLD Buyers In Panic! SELL!

My dear friends,

Please, find my technical outlook for GOLD below:

The instrument tests an important psychological level 3309.2

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 3296.9

Recommended Stop Loss - 3316.4

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Gold price analysis July 31XAUUSD – Bearish pressure still prevails, watch for SELL in the direction of the trend

Yesterday's session witnessed a strong decline when the D1 candle closed with selling pressure up to 60 prices, forming a key candle that shapes the trend. When the market forms a main candle, the 25% and 50% candle body areas are often important price areas to continue trading in the direction of the main trend.

In the current context, the priority strategy will be to sell in the direction of the downtrend when the price rebounds to the resistance areas and there is a rejection signal.

🔹 Important resistance areas:

3301 – 3312 – 3333

🔸 Target support areas:

3285 – 3270 – 3250

🎯 Trading strategy:

Prioritize SELLing at the resistance area of 3301–3312 when there is a price reaction (rejection).

Target: 3250

BUY only considered when 3313 area is broken decisively.

Staying disciplined and sticking to the reaction price zone will be key in the context of the market moving in a clear trend.

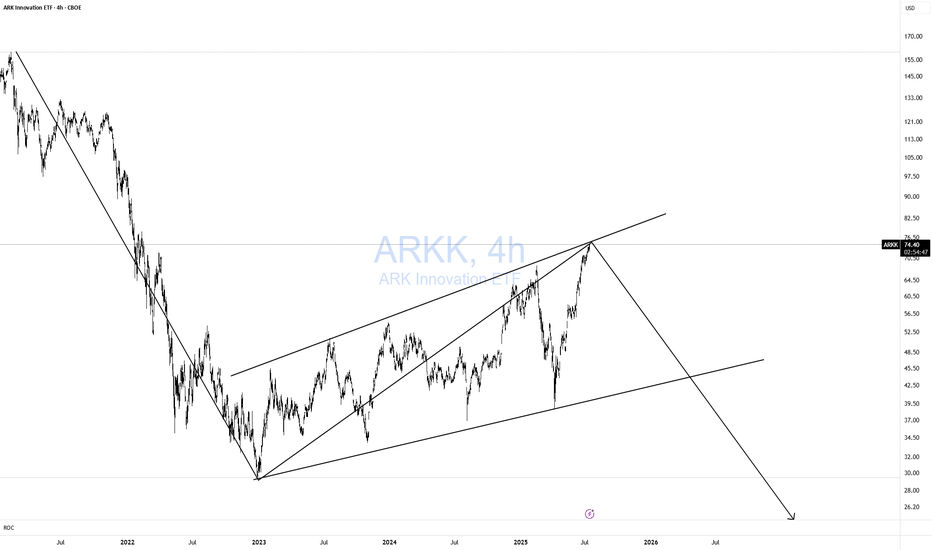

ARKK DOOMED!Classic 123 wave move down! As I like to say Short when no one else is looking! Not when everyone is looking. TOO LATE!

Simple but very effective pattern with excellent risk-reward. Remember, I am a macro trader, so don't expect to see a return on this investment tomorrow.

I won't get into the macro stuff.

CHF_JPY LOCAL SHORT|

✅CHF_JPY has been growing recently

And the pair seems locally overbought

So as the pair is approaching a

Horizontal resistance of 186.000

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_JPY RESISTANCE AHEAD|SHORT|

✅USD_JPY is going up now

But a strong resistance level is ahead at 151.232

Thus I am expecting a pullback

And a move down towards the target of 150.368

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCHF Will Go Down! Short!

Here is our detailed technical review for AUDCHF.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.524.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.522 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Follow master candle for today's SELL strategy✏️ OANDA:XAUUSD has continued a strong downtrend. Yesterday's D1 candle closed with a 60-price decrease, forming a master candle that determines the market trend. With the market having a master candle, pay attention to the 25% or 50% candle zones to trade in the direction of the trend. Today's main trading strategy will be to SELL according to the master candle. The BUY strategy will only be implemented when the 3313 zone is broken.

📉 Key Levels

Support: 3285-3270-3250

Resistance: 3301-3312-3333

SELL Trigger. Rejection 3301, 3312

Target 3250

Leave your comments on the idea. I am happy to read your views.

NZDJPY The Target Is DOWN! SELL!

My dear friends,

Please, find my technical outlook for NZDJPY below:

The price is coiling around a solid key level - 88.806

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 88.388

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUR_CHF WILL KEEP FALLING|SHORT|

✅EUR_CHF broke the key

Structure level of 0.9295

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of the

Broken level is complete

A rebound and bearish

Continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ADA Setup – Eyeing Entry After 70%+ RallyCardano (ADA) has surged over 70% in recent weeks. A healthy pullback is underway, and we’re watching the key support zone for a potential long entry targeting the next leg higher.

📌 Trade Setup:

• Entry Zone: $0.65 – $0.67

• Take Profit Targets:

o 🥇 $0.98 – $1.15

o 🥈 $1.50 – $1.60

• Stop Loss: Just below $0.62

EUR-USD Bearish Breakout! Sell!

Hello,Traders!

EUR-USD made a bearish

Breakout of the key horizontal

Level of 1.1460 then made

A retest and a pullback so

We are bearish biased and

We will be expecting a

Further bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.