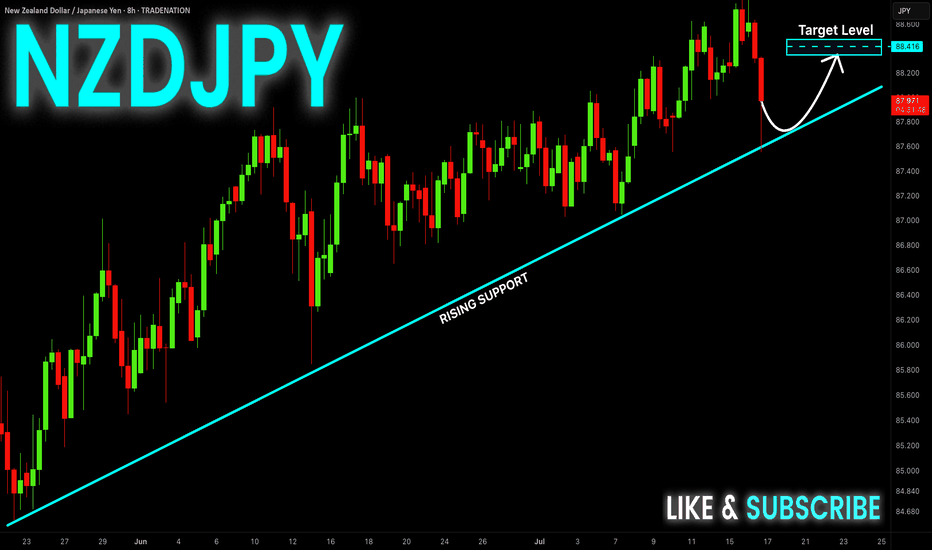

NZD-JPY Long From Rising Support! Buy!

Hello,Traders!

NZD-JPY keeps trading in

An uptrend along the rising

Support line and the pair made

A quick retest and we are seeing

A rejection so we are bullish

Biased and we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading

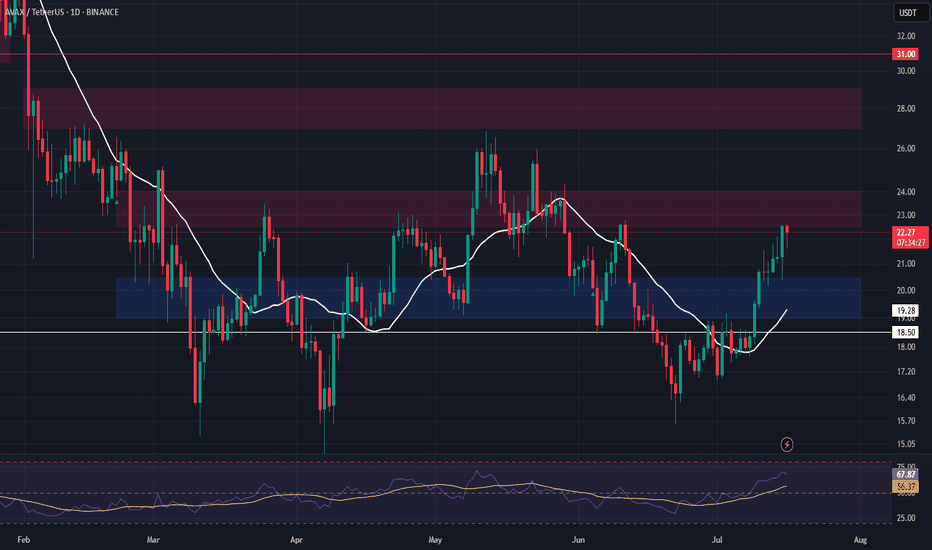

AVAX – Watching for Support Retest After Resistance TestAVAX is currently testing a major resistance level, and we’re anticipating a potential retrace into support. The $19.00–$20.45 zone offers a strong area to enter a long swing position on confirmation of the retest.

📌 Trade Setup:

• Entry Zone: $19.00 – $20.45

• Take Profit Targets:

o 🥇 $22.50 – $24.00

o 🥈 $27.00 – $30.00

• Stop Loss: Daily close below $18.50

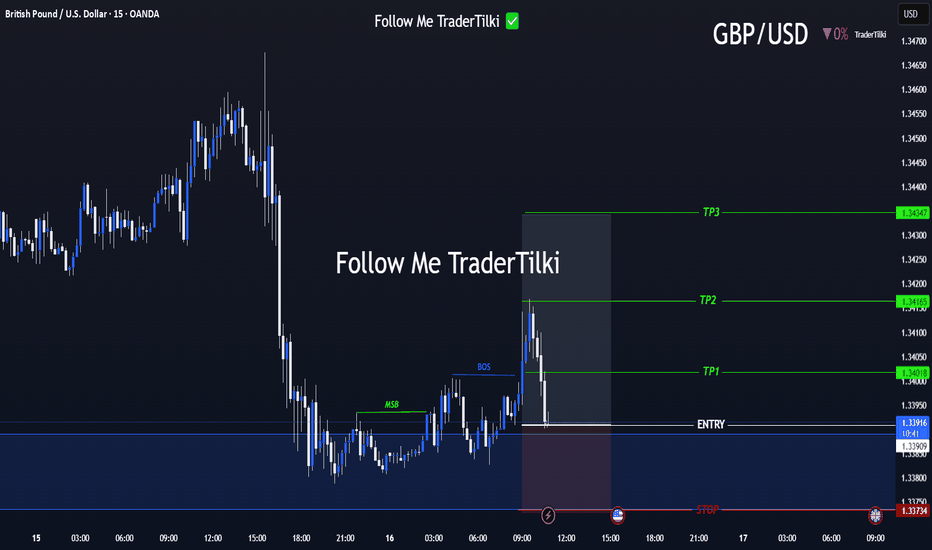

Strategic Entry, Clear Targets: The GBPUSD Game Plan Is Set📢 Hello Guys,

I've prepared a fresh GBPUSD signal for you:

🟢 Entry Level: 1.33918

🔴 Stop Loss: 1.33734

🎯 TP1: 1.34018

🎯 TP2: 1.34165

🎯 TP3: 1.34347

📈 Risk/Reward Ratio: 2,40

------

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

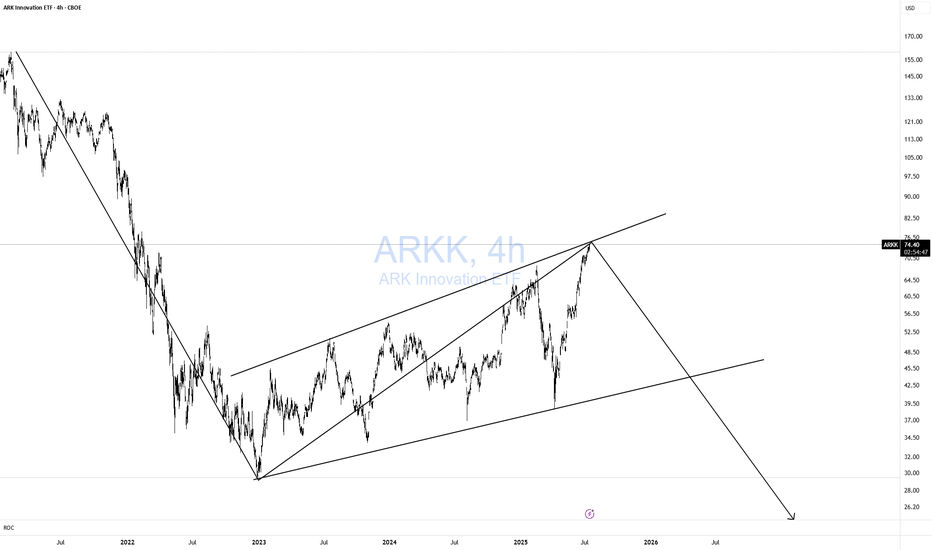

ARKK DOOMED!Classic 123 wave move down! As I like to say Short when no one else is looking! Not when everyone is looking. TOO LATE!

Simple but very effective pattern with excellent risk-reward. Remember, I am a macro trader, so don't expect to see a return on this investment tomorrow.

I won't get into the macro stuff.

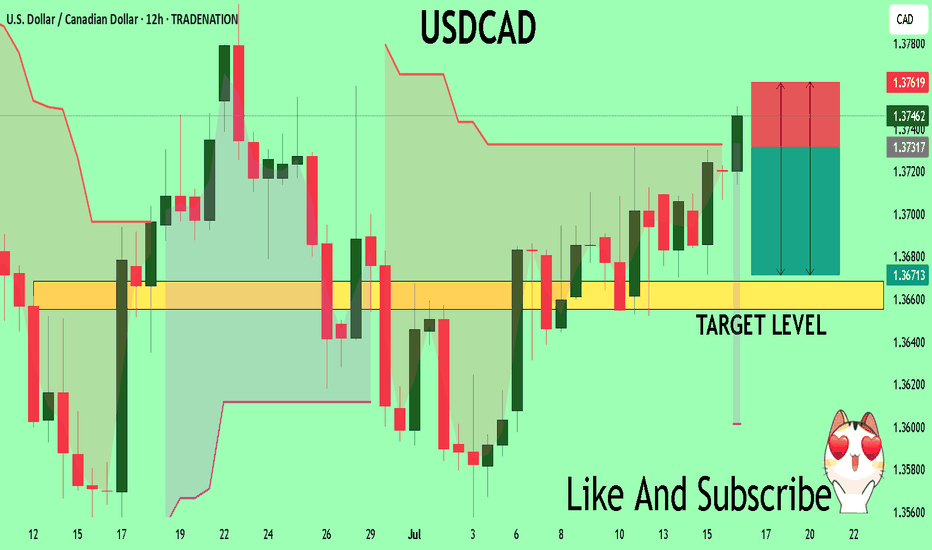

USDCAD Massive Short! SELL!

My dear subscribers,

This is my opinion on the USDCAD next move:

The instrument tests an important psychological level 1.3730

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.3668

My Stop Loss - 1.3761

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

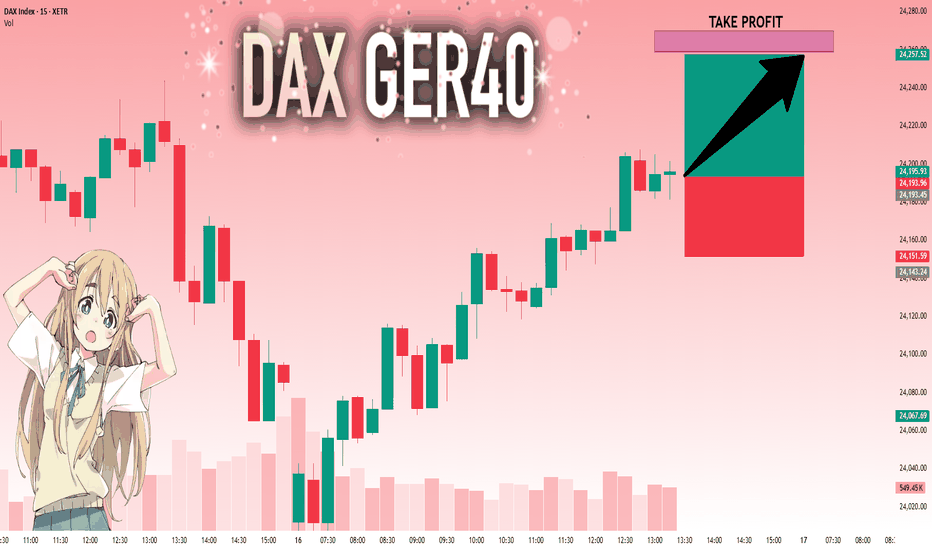

DAX: Will Go Up! Long!

My dear friends,

Today we will analyse DAX together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 24,193.45 will confirm the new direction upwards with the target being the next key level of 24,258.97 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

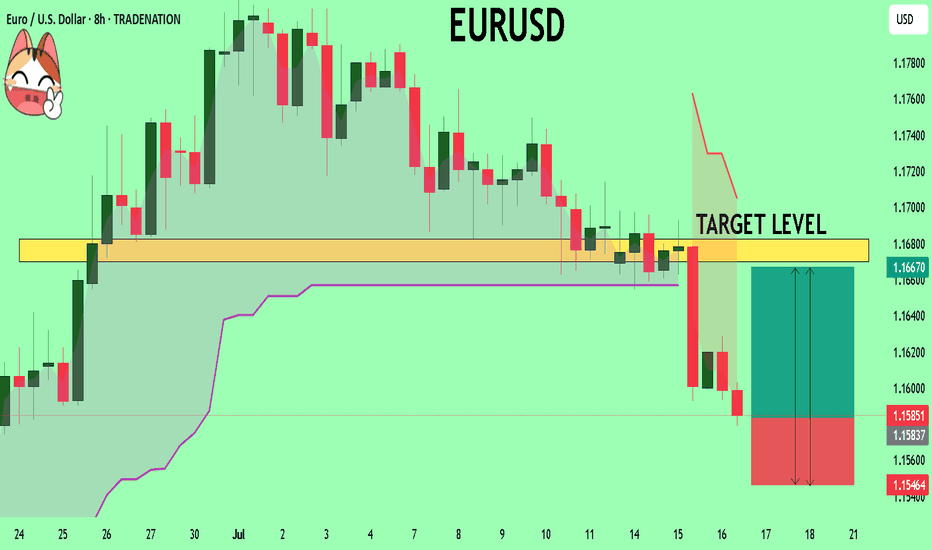

EURUSD: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 1.15850 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

EURUSD My Opinion! BUY!

My dear friends,

Please, find my technical outlook for EURUSD below:

The price is coiling around a solid key level - 1.1584

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.1670

Safe Stop Loss - 1.1546

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

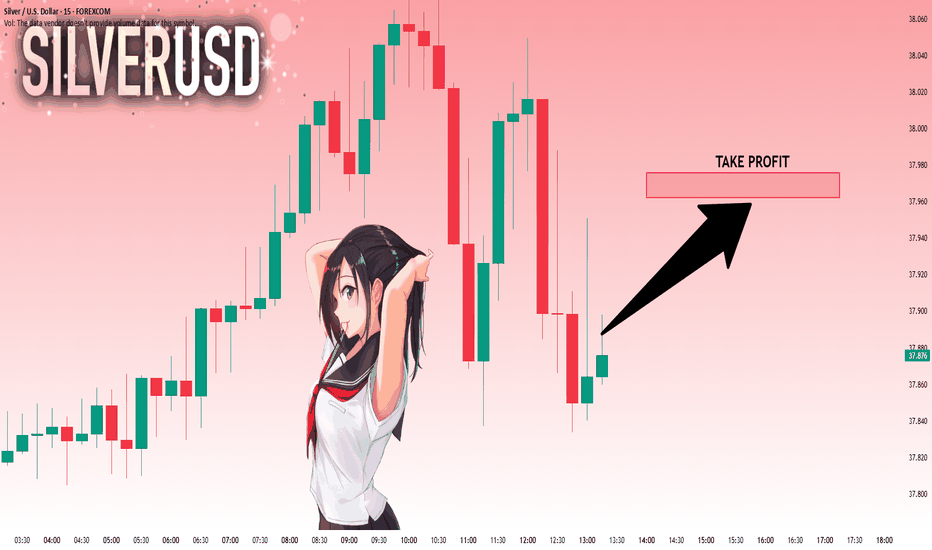

SILVER: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse SILVER together☺️

The market is at an inflection zone and price has now reached an area around 37.873 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 37.962..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

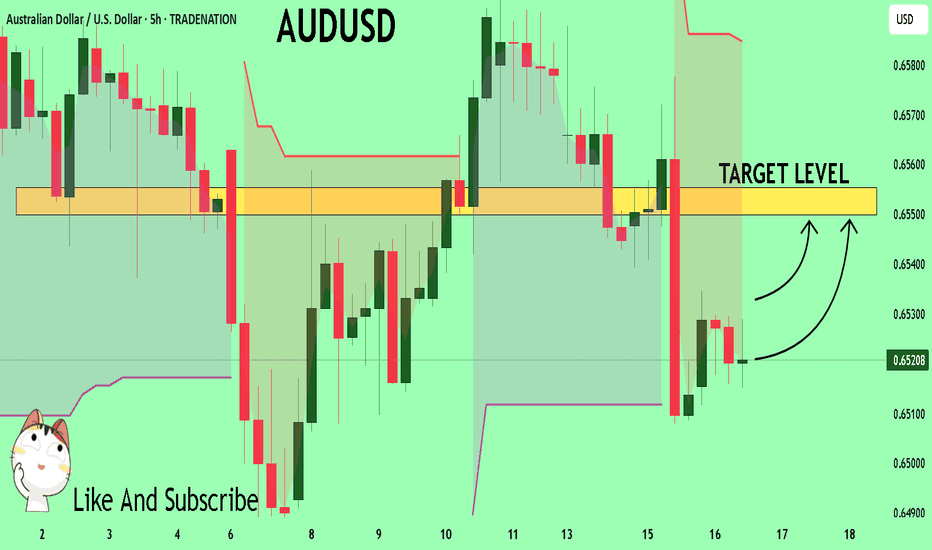

AUDUSD Set To Grow! BUY!

My dear subscribers,

AUDUSD looks like it will make a good move, and here are the details:

The market is trading on 0.6521 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.6550

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

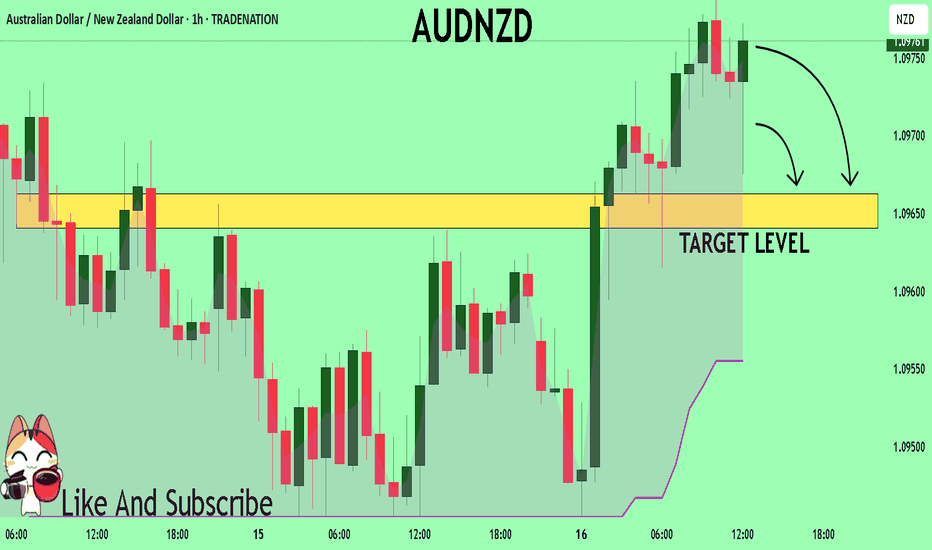

AUDNZD Under Pressure! SELL!

My dear followers,

This is my opinion on the AUDNZD next move:

The asset is approaching an important pivot point 1.0975

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.0966

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

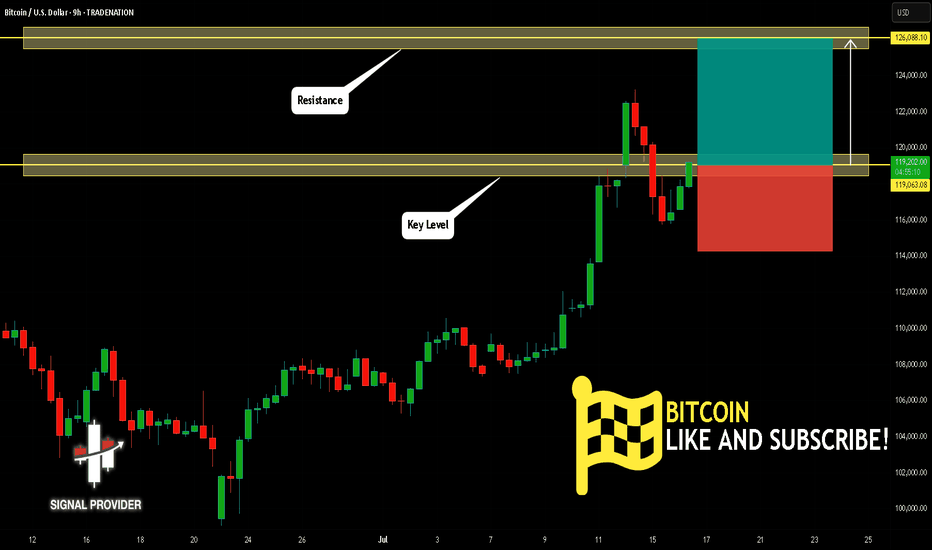

BITCOIN Will Go Higher! Long!

Here is our detailed technical review for BITCOIN.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 119,063.08.

The above observations make me that the market will inevitably achieve 126,088.10 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

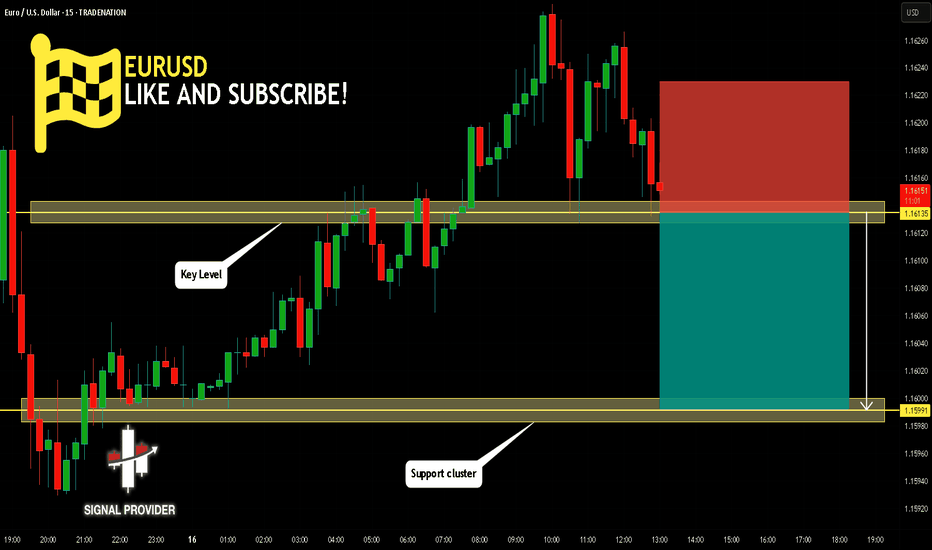

EURUSD Will Go Down! Short!

Take a look at our analysis for EURUSD.

Time Frame: 15m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.161.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.159 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

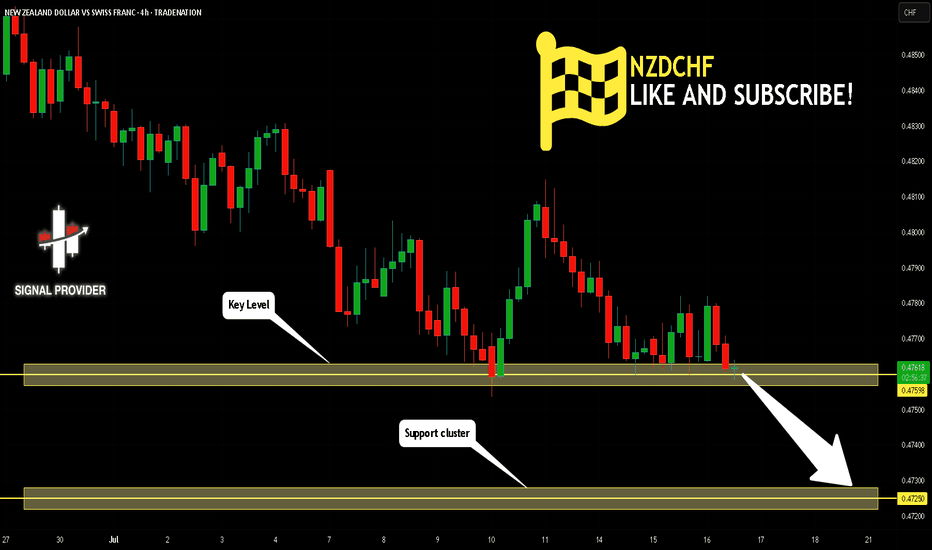

NZDCHF Will Move Lower! Sell!

Please, check our technical outlook for NZDCHF.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.475.

Considering the today's price action, probabilities will be high to see a movement to 0.472.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

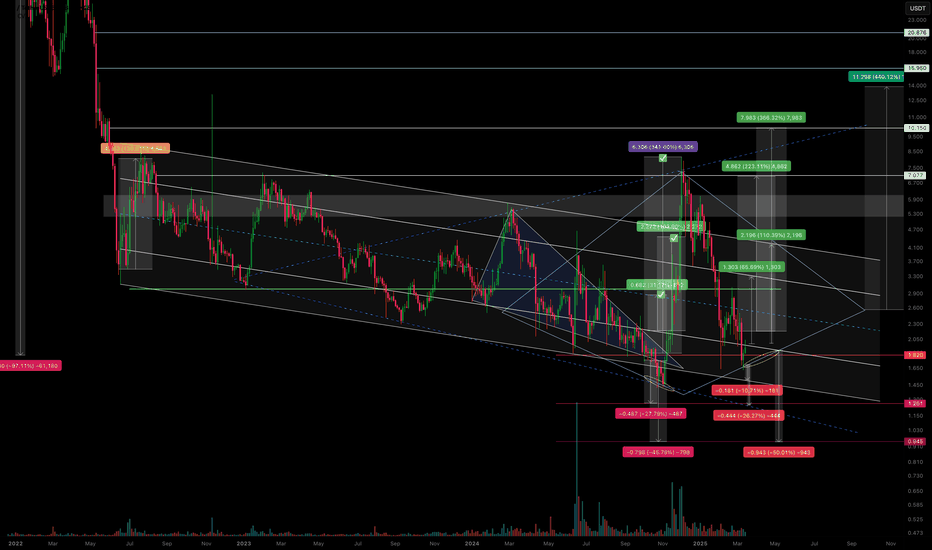

CVX/USDT – Is the scenario repeating? Continuing to work.The previous trading idea has played out with 3 out of 4 marked zones reached.

We saw a false breakout from the descending channel, followed by a pullback in line with the overall market—returning to the channel’s support zone.

I’ve noticed a potential formation of either a diamond pattern or an expanding triangle, but we’ll see how it plays out further.

Regarding declines and support zones:

-10.71% drop to the support of the descending channel.

-26.27% drop to the anticipated support of the expanding triangle.

-50% drop, likely as a squeeze under extremely negative news.

Regarding growth and resistance zones:

+65% rise to the resistance of the internal channel.

+110% rise to the resistance of the external channel (and if a diamond pattern forms, then its boundary).

+246% rise as a second attempt to break out of the descending channel.

+440% rise as a potential realization of diamond pattern pricing (if it forms).

All of this should be factored into your trading strategy, even the less likely scenarios.

I'll share the execution of the previous trading idea in my TG. I've also marked it on the chart.

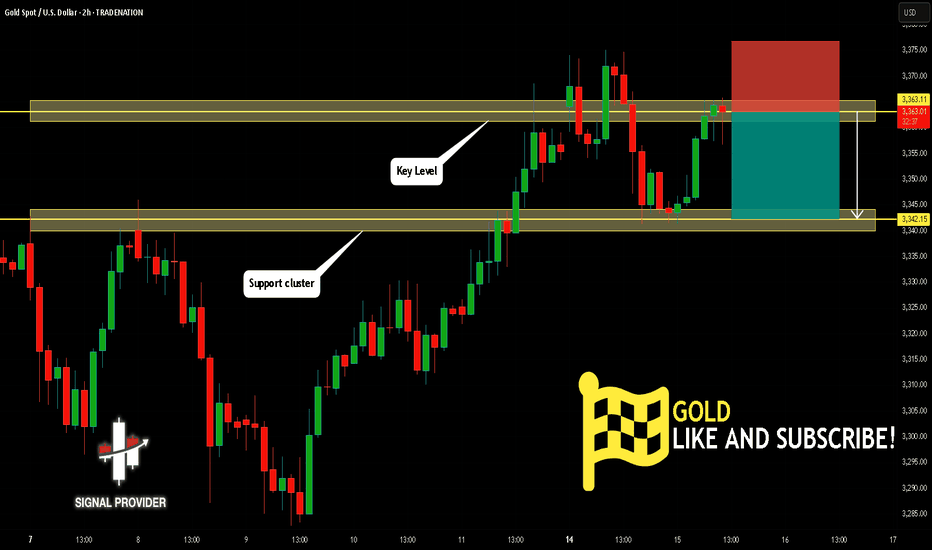

GOLD Is Going Down! Short!

Please, check our technical outlook for GOLD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 3,363.11.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 3,342.15 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUD/USD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the AUD/USD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 0.652 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

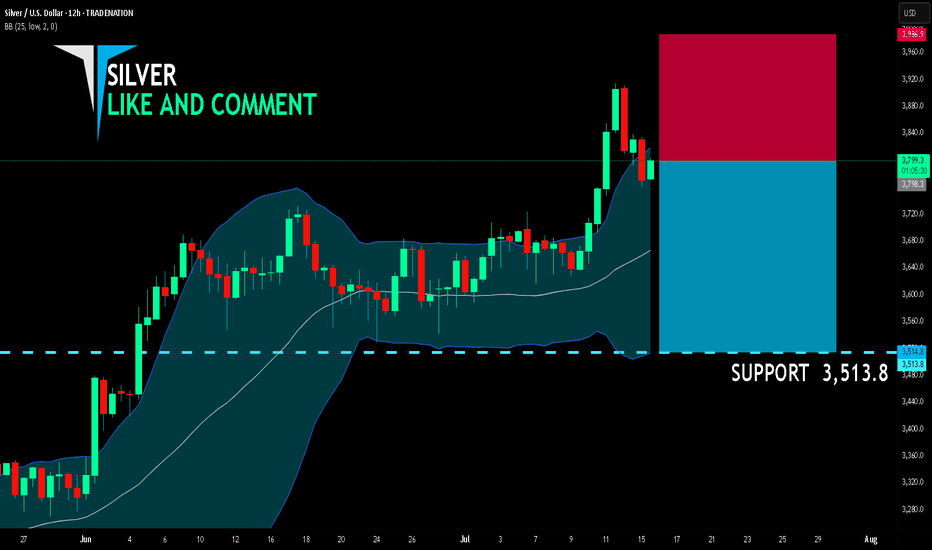

SILVER SELLERS WILL DOMINATE THE MARKET|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,798.3

Target Level: 3,513.8

Stop Loss: 3,986.9

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

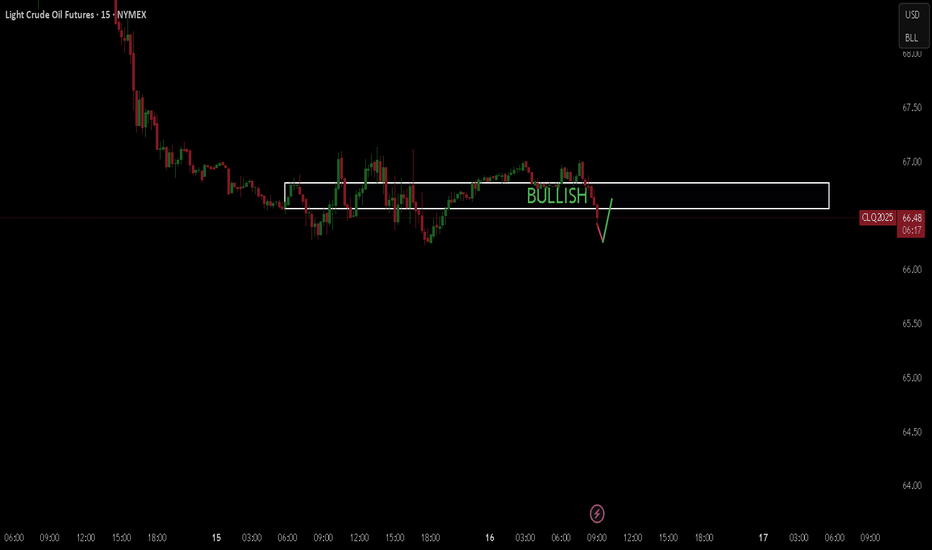

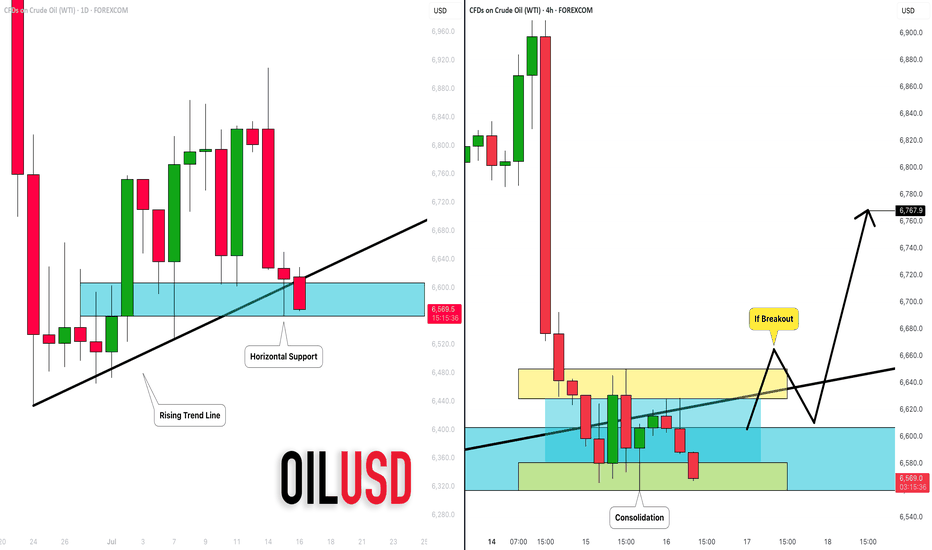

CRUDE OIL (WTI): Your Trading Plan Explained

Do not forget that today we expect Crude Oil Inventories data

release - it will be 10:30 am NY time.

Ahead of this news, the market is testing a significant daily support cluster

that is based on a rising trend line and a horizontal structure.

You signal to buy will be a bullish breakout of a minor intraday

horizontal resistance on a 4H.

4H candle close above 66,5 will be your confirmation.

A bullish continuation will be expected to 67.6 then.

I suggest waiting for the news release first and then check how

the market prices in the news. If our technicals align with fundamentals,

it will provide an accurate setup.

Alternatively, a bearish violation of a blue support will push the prices lower.

❤️Please, support my work with like, thank you!❤️

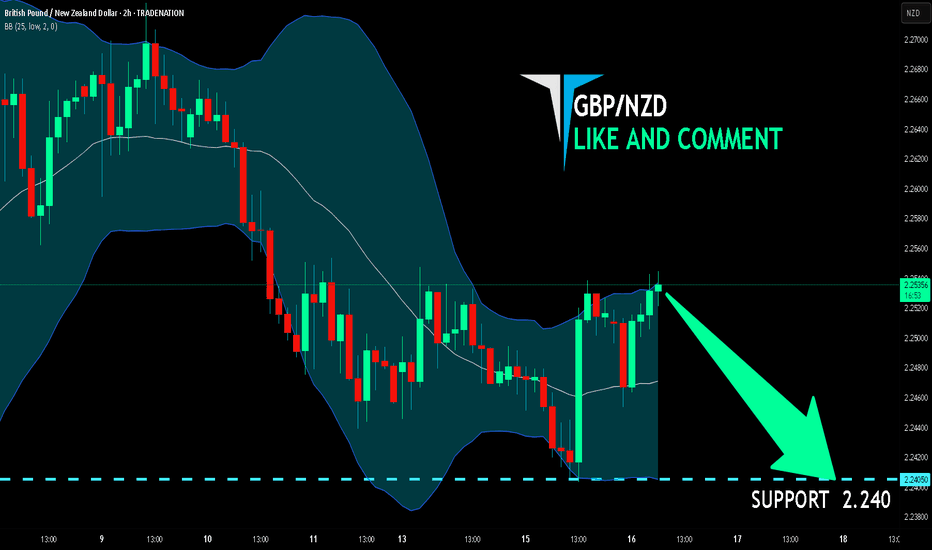

GBP/NZD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

It makes sense for us to go short on GBP/NZD right now from the resistance line above with the target of 2.240 because of the confluence of the two strong factors which are the general downtrend on the previous 1W candle and the overbought situation on the lower TF determined by it’s proximity to the upper BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

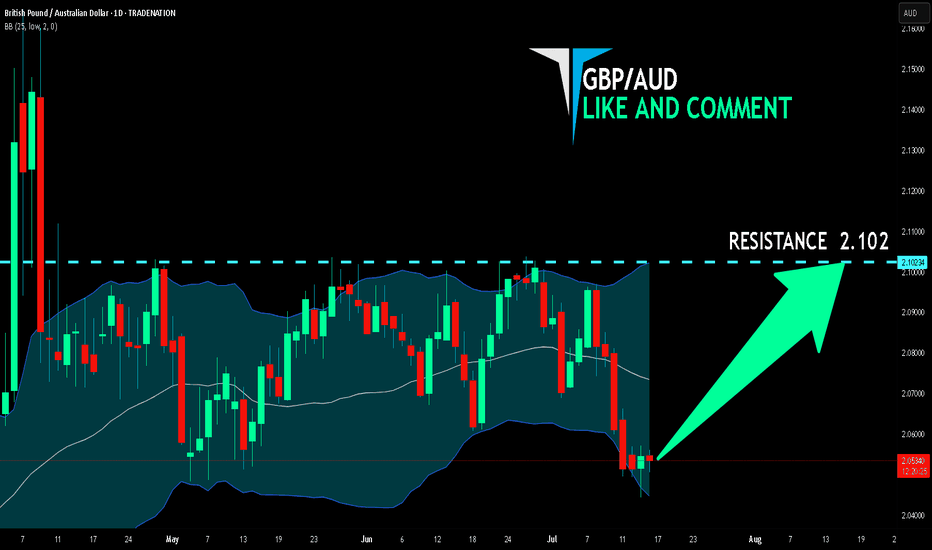

GBP/AUD BULLS ARE STRONG HERE|LONG

Hello, Friends!

Previous week’s red candle means that for us the GBP/AUD pair is in the downtrend. And the current movement leg was also down but the support line will be hit soon and lower BB band proximity will signal an oversold condition so we will go for a counter-trend long trade with the target being at 2.102.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

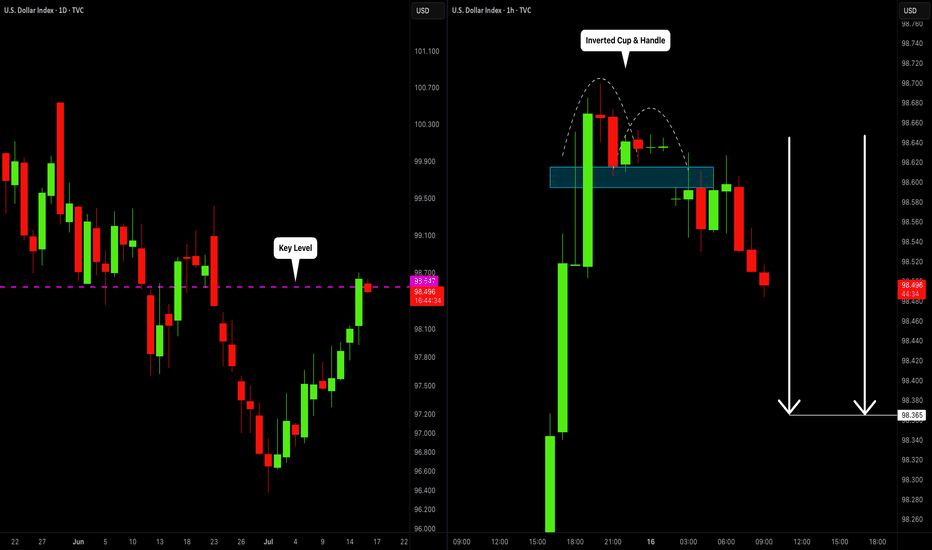

DOLLAR INDEX (DXY): Bearish Move From Key Level

I think that Dollar Index may drop from a key daily horizontal resistance level.

As a confirmation, I spotted an inverted cup & handle pattern on an hourly time frame

and a bearish violation of its neckline.

The market will most likely continue falling at least to 98.36

❤️Please, support my work with like, thank you!❤️