GBPJPY Will Grow! Buy!

Here is our detailed technical review for GBPJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 198.531.

The above observations make me that the market will inevitably achieve 202.938 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Trading

AUDCHF Will Go Higher From Support! Long!

Take a look at our analysis for AUDCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 0.522.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.533 level soon.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

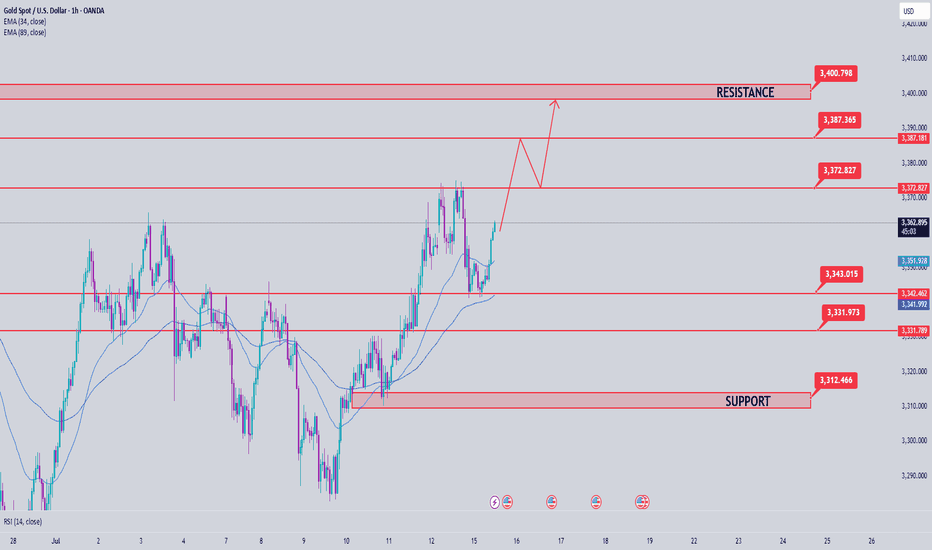

GOLD: Target Is Up! Long!

My dear friends,

Today we will analyse GOLD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 3,363.43 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

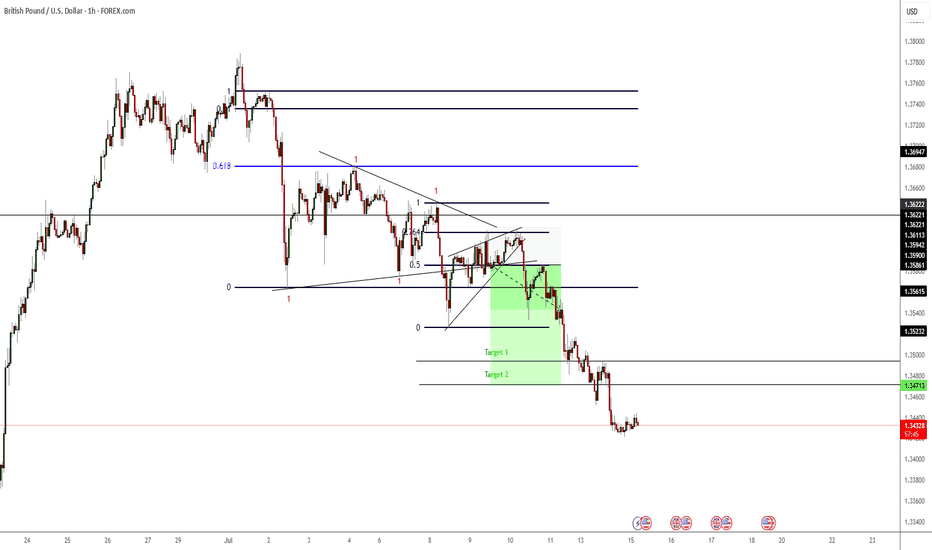

GBPUSD Will Go Lower! Sell!

Take a look at our analysis for GBPUSD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.365.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.358 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD: Move Up Expected! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.16869 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 1.16975.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

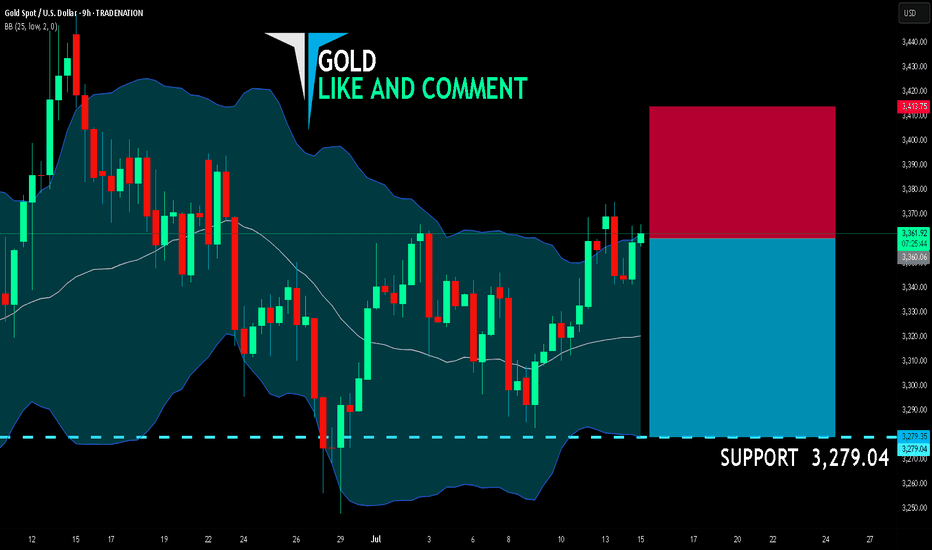

GOLD SHORT FROM RESISTANCE

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,360.06

Target Level: 3,279.04

Stop Loss: 3,413.75

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CHF BULLS WILL DOMINATE THE MARKET|LONG

GBP/CHF SIGNAL

Trade Direction: long

Entry Level: 1.070

Target Level: 1.088

Stop Loss: 1.058

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CHF SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

EUR-CHF downtrend evident from the last 1W red candle makes longs trades more risky, but the current set-up targeting 0.935 area still presents a good opportunity for us to buy the pair because the support line is nearby and the BB lower band is close which indicates the oversold state of the EUR/CHF pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

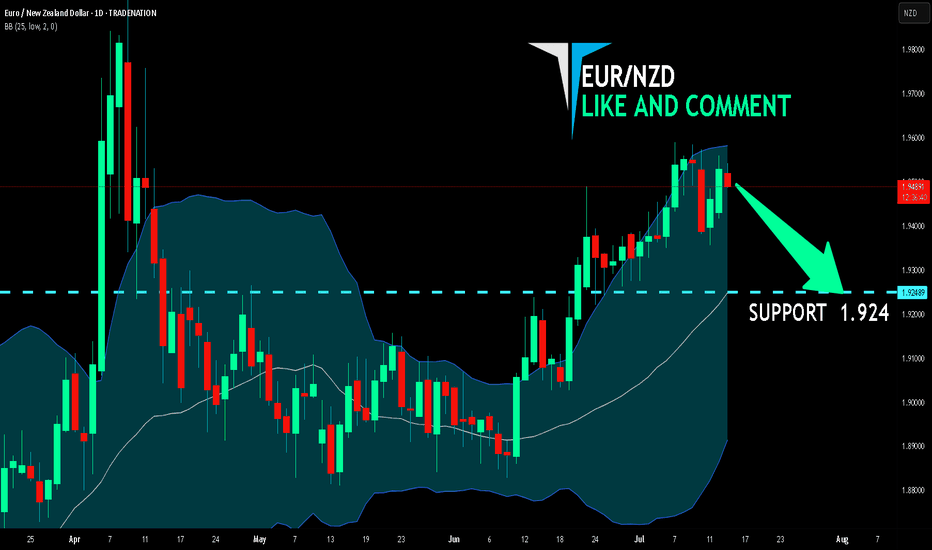

EUR/NZD BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

EUR/NZD pair is in the uptrend because previous week’s candle is green, while the price is evidently rising on the 1D timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 1.924 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CAD BEARS ARE GAINING STRENGTH|SHORT

GBP/CAD SIGNAL

Trade Direction: short

Entry Level: 1.858

Target Level: 1.849

Stop Loss: 1.863

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD: Gold Moves Sideways, Awaiting Key Economic DataXAUUSD: Gold Moves Sideways, Awaiting Key Economic Data – Correction or Continued Uptrend?

🌍 Macro Overview – Waiting for CPI Data from the US

At the moment, Gold is trading in a wide sideways range between the 3x and 4x price levels, while traders are awaiting key economic data this week from USD, GBP, AUD, and EUR.

📊 Important Economic Data Today:

US CPI Report will be released during the US session today, making it one of the most important reports of the month.

CPI forecast is at 0.3%, which is considered positive for the US economy.

This report is expected to align with the recent Nonfarm data, and could lead to significant price movements upon release, potentially helping to adjust liquidity in the market.

🔍 Technical Analysis – Current Trend with Key Resistance Levels

The current trend remains bullish, but the movement on higher timeframes isn’t as pronounced.

Key resistance levels are located around 337x to 339x, where selling pressure is currently strong.

If price breaks through these levels, Gold could find support and move towards 3400.

📈 Short-Term Forecast:

A pullback to around 333x is expected, offering a good buying opportunity.

Looking further, 331x is a potential target, as the price range remains quite wide.

🎯 Trading Strategy for Today

🟢 BUY ZONE:

Entry: 3331 – 3329

SL: 3325

TP: 3335 → 3340 → 3345 → 3350 → 3360 → 3370 → ????

🔴 SELL ZONE:

Entry: 3392 – 3394

SL: 3398

TP: 3388 → 3384 → 3380 → 3376 → 3370

⚠️ Important Notes:

Watch for support and resistance levels to set up scalping trades that align with the current market trend.

Always set SL and TP to protect your account and avoid FOMO when there’s no clear confirmation for entry.

The 3350-3347 range is a key zone to look for buy opportunities.

💬 What’s your take on Gold’s movement today? Do you think it will break the resistance or will we see further correction? Share your thoughts in the comments below and join the discussion with fellow traders!

👉 If you want more daily updates and to participate in live discussions, don’t forget to follow and join our community! Let’s take advantage of these market opportunities together.

Falling Wedge Formation Ive been bullish on GBPJPY for a couple weeks now and I still believe that it has more upside potential. Here we have a Falling Wedge Formation. we have 4 touches on our pattern already and just waiting for a break and retest to enter again. I am currently in a position based of the retest price gave of the previous resistance (circled on chart). Lets see how it goes.

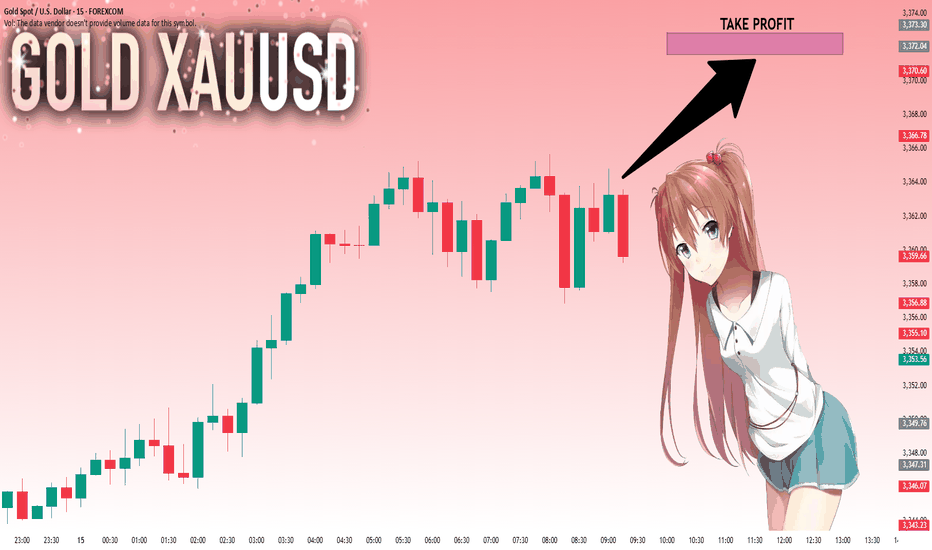

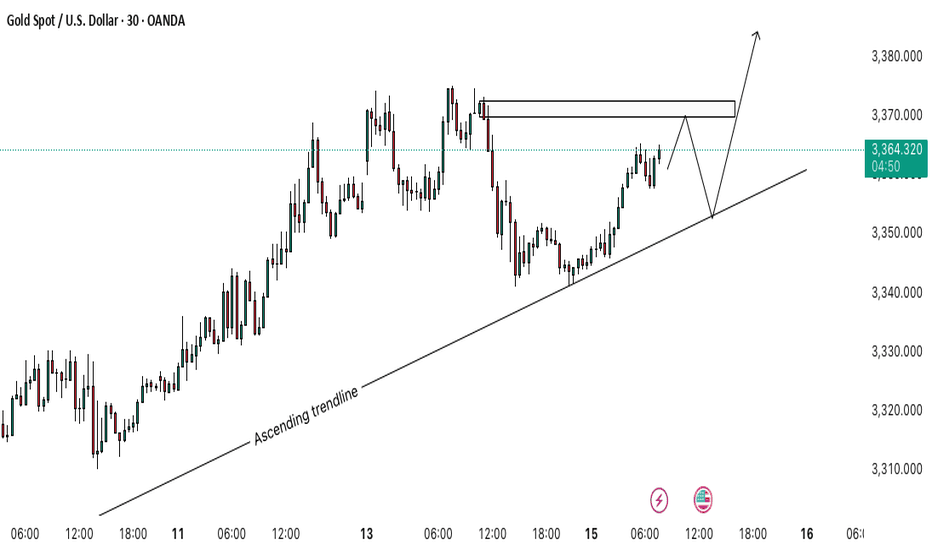

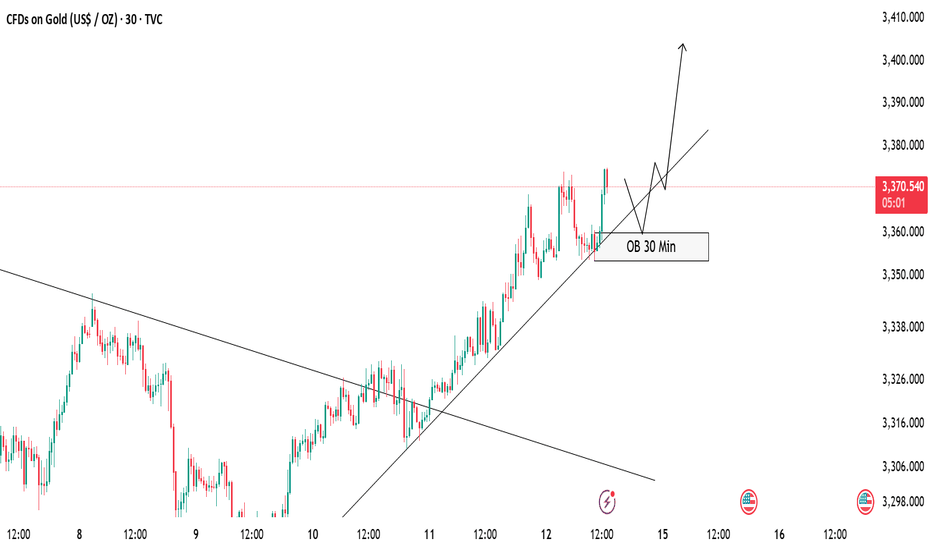

Gold (XAU/USD) – Bullish Continuation SetupGold is moving within an ascending trendline, showing strong bullish momentum. Price is approaching a Bearish Order Block near 3,370, which may trigger a short-term pullback 📉.

If price rejects from this zone and retests the trendline (around 3,355), it could offer a high-probability long setup for a continuation move toward 3,380+ 📈🚀.

🔍 Key Levels:

Resistance: 3,368–3,370 (Bearish Order Block)

Support: 3,355 (Trendline area)

💡 Trading Idea:

Look for price action confirmation near the trendline for potential buys. Break above the order block could fuel further upside.

MarketBreakdown | GBPAUD, WTI CRUDE OIL, US30, US100

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #GBPAUD daily time frame 🇬🇧🇦🇺

The market is trading within a wide horizontal parallel channel.

The price is stuck on its support.

Probabilities will be high that the market will start growing from that.

Alternatively, its bearish breakout will provide a strong bearish signal.

2️⃣ #WTI CRUDE OIL daily time frame 🛢️

The price is now testing a significant rising trend line.

It is a critical decision moment for the market.

A bearish breakout of that may trigger a strong bearish continuation.

Monitor intraday price action today. If you see a strong bullish pattern,

it will provide a reliable confirmation to buy,

3️⃣ DOW JONES INDEX #US30 daily time frame

The market started a correction movement in

a bullish flag pattern.

Your next signal to buy will be a breakout of its resistance

and a daily candle close above that.

4️⃣ NASDAQ INDEX #US100 daily time frame

The market is now breaking a resistance of a horizontal parallel channel.

IF a today's daily candle closes above that, it will confirm a start of

another bullish wave.

The market will continue growing then.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Targets Hit So as you can see previously I stated that I was waiting for a breakout of the rising wedge before I entered this trade. Now it didn't go quite as planned as price made a bigger rising wedge from what I originally mapped out but nonetheless I was able to recognise, it re-adjust and enter the trade. Price hit both targets.

Gold Price Analysis July 15Continued uptrend after touching the 3345 buy zone

As analyzed at the beginning of the week, gold price has touched the buy zone around 3345 and continues to maintain the bullish wave structure, heading towards the 3400 resistance zone.

Currently, if gold breaks the 3373 mark, the uptrend is likely to be further strengthened. At that time, it is not advisable to trade against the trend, especially when the buyers completely control the market.

However, in case gold falls below the 3343 support zone (the resistance level in yesterday's US session), the current uptrend may be temporarily interrupted. At that time, the market will need to form a new momentum to establish the next trend.

🔑 Important price zones:

Support: 3343 – 3330 – 3313

Resistance: 3373 – 3387 – 3400

📌 Trading strategy:

Hold BUY order at 3345, expected target 3400

Activate SELL order if there is a clear price rejection signal at 3373 or 3387 (with confirmation of selling pressure)

SELL at 3400 if the strong resistance zone reacts clearly

GBPUSD downtrend continuesOANDA:GBPUSD is trading in a bearish channel heading towards the important support zone of 1.340. This is the bottom support zone of last month so there is a lot of buying pressure in this zone. Any recovery of GBPUSD is considered a good opportunity to enter a SELL signal to the target. When the price breaks 1.361, the downtrend will really break.

Support: 1.340

Resistance: 1.355-1.361

SELL Trigger: rejection 1.355 with bearish confirmation

SELL zone 1.361 (Strong Resistance zone)

Target: 1.340

Leave your comments on the idea. I am happy to read your views.

GBP_CHF SWING LONG|

✅GBP_CHF is set to retest a

Strong support level below at 1.0650

After trading in a strong downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 1.0750

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

End-of-Session Market ReviewToday was a solid trading day with some interesting moves across the markets:

S&P 500: The market trended upwards from the open, gradually moving into and above the prior day’s value area, closing near the high of that range.

NASDAQ 100: After some initial back-and-forth, it climbed above the prior day’s high and value area, showing strength into the close.

Russell 2000: This market was quite choppy and balanced for a good part of the session, but eventually pushed up to close near the prior value area high.

Gold: It stayed range-bound, moving between the CVA high and the prior day’s value area without breaking out.

Crude Oil: We saw a significant drop right from the start, with prices falling about 1.5 points and ending the day lower, though still within the prior day’s range.

Euro Dollar: It tested the CVA low, dipped below the prior day’s low, and then bounced back to close around that level.

Yen Dollar: It started near the prior value area low, accepted below it by midday, and remained balanced in that lower range.

Aussie Dollar: Initially, it held above the CVA area and tested a higher level before sharply dropping below the prior day’s low and then balancing in that lower area.

In total, I took eight trades today. Two of them were in the Yen, both valid setups that didn’t work out and ended in stop-outs. I also took some long trades in the Aussie Dollar that I probably could have avoided since the market was choppy.

On the positive side, I managed risk well and ended up with two winning trades that put me in the green by about $1,200. Overall, I’d rate today as an A- day. Moving forward, I’ll focus on staying out of choppy markets, paying attention to the developing value area, and possibly using Heikin Ashi bars for better clarity.

GBP-CAD Support Ahead! Buy!

Hello,Traders!

GBP-CAD keeps falling down

But a strong horizontal support

Level of 1.8322 is ahead so after

The retest we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Buy Setup – OB Zone in FocusCurrently, gold is respecting the ascending trendline and maintaining a bullish structure 🟢. Price hasn’t tapped into the 30 Min Order Block (OB) yet, but we are expecting a potential pullback into this OB zone 📍.

✅ Our Plan:

We will wait patiently for price to mitigate the OB.

After the tap, we will look for bullish confirmation (rejection wick, bullish engulfing, or break of minor structure) before entering a buy position 🚀.

As long as the trendline holds, we remain bullish on gold.

📝 Invalidation:

If price breaks and closes below the trendline and OB zone, we will stay out or re-evaluate the setup ❌.

Stay disciplined and follow the plan! 💪

Nightly $SPY / $SPX Scenarios for July 15, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 15, 2025 🔮

🌍 Market-Moving News 🌍

📦 Dow Futures Dip on New Tariff Announcements

President Trump announced new 30% tariffs on EU and Mexico, with additional duties on Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, and Myanmar starting August 1. Dow, S&P, and Nasdaq futures each slipped ~0.3% as markets assess inflation risk ahead of key CPI data this week

📈 Tech & AI Stocks Lead Despite Tariffs

Stocks like Circle (+9.3%), CoreWeave (+5.2%), Palantir (+5%), Roblox (+5.8%), and Shopify (+4.1%) surged, showcasing sector resilience amid broader tariff fears

⚠️ Deutsche Bank Warns of Summer Volatility

With thin market liquidity and rising geopolitical tension (tariff deadline Aug 1), Deutsche Bank flags summer as a period prone to sudden corrections

📊 Key Data Releases & Events 📊

📅 Tuesday, July 15:

8:30 AM ET – CPI (June)

Core CPI is projected at +0.3% MoM (2.7% YoY) and headline CPI +0.3% MoM—signs tariff effects may be feeding into prices

8:30 AM ET – Core CPI (June)

Expected to come in around 3.0% YoY.

8:30 AM ET – Empire State Manufacturing Survey (July)

Forecast: –7.8 (less negative than June’s –16.0) — a modest sign of stabilizing factory conditions

Fed Speakers Throughout the Day

Watch for commentary from Fed officials (Michael Barr, Barkin, Collins, Logan) for fresh insights on inflation and monetary policy

⚠️ Market Interpretation:

Inflation Watch: A hotter-than-expected CPI could delay anticipated rate cuts and lift yields. A pick-up in core CPI above 3% would be a red flag.

Growth Signals: A less-negative Empire State reading may suggest improving industrial momentum but still signals contraction.

Political Risk: Tariff escalation could shift investor appetite, even if markets right now are focusing on broader macro narratives.

Volatility Setup: The combination of thin liquidity, tariff uncertainty, and critical data makes for a potentially choppy week.

📌 #trading #stockmarket #economy #inflation #tariffs #Fed #CPI #manufacturing #technicalanalysis