Awesome 16% Profits with no leverage for now on my scriptHello Guys,

It's my first idea being published here :) I will get better in time regarding the presentation

I have been working on different strategies last year and now it's fully ready and working.

You can check out more in the video.

We've been able to get a 20x ROI in 2019 with a 2.5 leverage on bitmex, the script is not only doing great profits but i want to share my knowledge with you guys and let you know that the full automation process is offered for free, you can connect your bitmex account to the bot for free.

It's working great and I wanted to do to help small accounts grow their position over time.

Starting with a 0.1 beginning of January 2019 would give you 2 bitcoin right now. In the long run you need to find a solution that works and manage risk the right way. And that's what I am offering now here.

Cheers guys

Please like, follow me and share this great script

Tradingbot

ELASTOS (ELA:BTC) is still conforming to the ascending channel.ELASTOS (ELABTC) is still conforming to the ascending channel (Note: Log-scale).

Possibility of ca. 100% gain (similar to the ICX breakout) if it is able to pierce and hold above 0.000269 BTC? Need to continue to monitor. High risk, but potential high reward.

Continued analysis from:

Need careful risk management and protecting profits so far (I'm using my own script "Volatility {RCVI} Stop-Limit Selector") to decide suitable stop limits.

BTCUSD Trend - Expert Market Edge IndicatorCombining 2 indicators, few strategies, when we got same signal, even on smaller Time Frame on BTC is working. On Forex and traditional it's working even better, I just wanted to show how it works. You can see the win/loss ratio and all here. So, on my strategy, every time after first Profit Target is hit, I move my stop loss on my entry, so to minimize the risk, and maximize the profit, if second is hit, I move my stop loss on my first profit target and so on. Hope you like it.

Fully automated algo is in developing for Meta Trader 5 platform and will be live and available soon.

ETH/BTC Long Trade SetupHello, I hope you're enjoying your monday (if you do you're a monster..)

Here is a trade setup for BINANCE:ETHBTC

The pair has suffered a massive dump a few days ago. This could very well mean cheap prices for us!

And indeed: I just got a signal from my 8H private indicator, built upon an Heikin Ashi Strategy (on the right).

Honestly if you look at the H.A. chart, the trade is obvious, we have a nice bullish candle and it's already followed by another.

On top of that, my 4H strategy (on the left), which is built on Parabolic Stop And Reverse, also triggered a long signal!

On this one I will use a 4% trailing stop loss.

As always, we keep an eye on the leader BTC.

ETH tends to rise when BTC either climbs or goes sideways. This is not always the case, but it is what happened in the past months.

The current chart is confirming the idea.

I hope you like the setup, I will update the trade whatever happens!

Indicators Used

ETH/BTC 4H Buy & Sell

Heikin Ashi Strategy

BITCOIN - Invalidation and POTENTIAL reversalHello traders

I. Wisdom of the day

Not all traders are winners obviously. But not all losers have to be a stop-loss.

A lot of consecutive stop-loss and we're out of the "trading" game. What if there would be a way to stop... the stop-loss from getting hit?

There isn't a universal way but... using another indicator on top of a trading system is very powerful.

This allows to exit a potential big losing position with a minimal loss - or at breakeven in the best scenario.

That essentially means that .... traders have to accept that not all trades are winners... and accept to lose a few times to times.

Invalidating before a stop-loss is part of reducing one's risk and increasing one's opportunity.

Invalidations, also called hard exits, are an essential part of my personal trading method.

II. Why a 5-minutes chart?

The trading method won't give more than 3/5 trades per day even. This is not a scalping trading method, it's intraday and based on smoothed indicators for entering in a strong trend only.

Those are the most secure trades possible because:

- the engine waits for a strong confirmation and will avoid the fakeouts

- the 5 minute allows to enters early.

- entering early and getting invalidated early also. This point is crucial.

Entering early with a minimum of security is KEY

III Signals of the day

3.1 Invalidations in practice

We got invalidated twice with a small loss. Which is exactly why I love this invalidation system so much.

We exited losing positions at the beginning of the reversal or after a pullback

Without it, I would have lost way more pennies :)

3.2 Shorting the "future of money"

With a strong invalidation system, I get invalidated often before a "catastrophe" happens.

I never want to take them because I'm human and I have "too strong" beliefs ("BTC is the future of money") ... but that's exactly why I trade with a framework because....again I'm human with feelings/emotions (despite what my ex-GF said to me #too #personal #info)

The yesterday short was quite interesting as against the leading trend and below supports.

I often talk about a pullback in that scenario to reduce one's risk. But the pullback also allows to get invalidated with a better exit and a smaller loss.

Hopefully, you guys start connecting the dots now :)

3.3 What's next?

We're right on the Daily SMA 7 and the Weekly SMA 100 is 200 USD below.

I wouldn't re-enter before another signal (I'm dumb, I can only trade using a combo system deciding for me) - especially because a major weekly support is right under the candlesticks

All the best,

Dave

-----------------------------------------

Disclaimer:

Trading involves a high level of financial risk, and may not be appropriate because you may experience losses greater than your deposit. Leverage can be against you.

Do not trade with capital that you can not afford to lose. You must be aware and have a complete understanding of all the risks associated with the market and trading.

We can not be held responsible for any loss you incur.

Trading also involves risks of gambling addiction.

Market Analysis: Is The Altcoin Cycle Starting now ?Here's why I think an altcoin cycle might be starting just now.

Here is my analysis.

I'm first looking at BTC/USD, which is forming a pretty clear bearish wedge. Indeed, price keeps making lower highs for 2 months now. There is also a chance that the price does not breaks through the bottom, and would stay in range forming a consolidation period. In both scenarios, the altcoin market has good conditions to stay bullish. Not to mention that the price of each altcoin is close to the all time low.

BINANCE:XRPBTC

After two failed swings, this could be the good one. We already got this very bullish candle.

BINANCE:ETHBTC

Look at that chart. Beautiful. It is been so long before such a rally happened! We have been waiting for it !

BINANCE:TRXBTC

One of the most volatile altcoin. Here we put our take profit at 15%, which is usually where the rallies end.

BINANCE:ADABTC

Here we go to the moon! There was a failed attempt a few days ago, but this time looks like the good one !

Long term targets

INDICATORS USED

Thanks for reading !

> > Start using all the indicators now < <

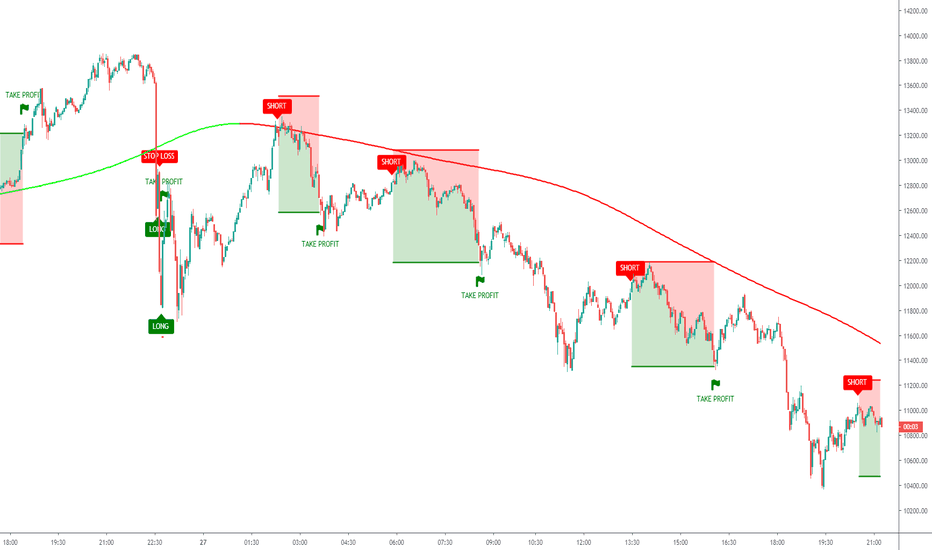

Scalping Bot In Action | 80%+ W/L | 7% Avg Trade | 15m BitMEXIf you like to use signals to trade manually or automate your trading, you will probably like this indicator!

How did I make it profitable ?

The script never trades against the market. It uses a powerful Trend Detector that filters trades who don't take place in market convergence!

A Smart Combo of Technical Indicators to catch the most likely tops and bottoms!

A Revolutionary Integrated Trailing Stop Loss and Take Profit never seen before (or has it ? Leave a comment if you have seen one !)

A risk/reward ratio of 6/5 put aside the Trailing Take Profit which can increase gains

READ MORE

Backtest results:

cdn.discordapp.com

Plenty of backtest results and configuration on my Discord -> discord.gg

Indicator used :

Settings : SMA, 325, 7, 6, 0, 6, 0, 5, 0.5, 5, 0.5, 20, close, 2, 3, 4, 14, 14

> Get access to the Cyatophilum Indicators <

Enjoy !

Buy & Sell Strategy for ADA/BTC - CARDANOHello guys, here is a configuration for my indicator Cyatophilum Altcoins Trader

Altcoin : BINANCE:ADABTC

The settings are : 10, Tilson T3, 20, 10, 4, 0, 0, 0, 0, 0, 0 .

Buy & Sell signals using the " LONG ENTRY " and " LONG EXIT " ALERTS .

Happy Trading !

Get the indicator now !

Trading System GODMODE 2023Created for round-the-clock money management, the system provides a steady increase in the deposit every month. In the new version under the Windows / Linux / Mac operating system, the ability to monitor current positions and balance in the deposit increment chart has been added.

Our team also rewrote the Pine Script libraries into a trading bot so that you can quickly transfer your code from Tradingview into a standalone application. The transfer process will take 1 hour and the bot will be able to start working on your computer.

If you have people who want to copy your trade, our team can offer you Bitmex Mirror Trading BOT, which copies all your trades from your Bitmex account via API to any number of other accounts.

Telegram: ISMwsm

New Scalping Bot Strategy is out !If you like to use signals to trade manually or automate your trading, you will probably like this script!

Read how it works and get your trial !

> blockchainfiesta.com

Plenty of backtest results and configuration (the script can be configured on any timeframe and market) on my Discord -> discord.gg

Enjoy !

Forward Testing : BTCUSD 2H Automated StrategyHey guys I create automated strategies, and in this post I will share the trades, so make sure to leave a like if you want to see how it goes!

The script is configured for COINBASE:BTCUSD in 2h timeframe.

> > > READ HOW IT WORKS < < <

Alright let's get started, I have the alerts up running. Let's see how it goes !

Buy & Sell - ETHBTC:BINANCE 4H Trading BotHi guys, I'm a pinescripter!

With this indicator you can create Buy and Sell alerts to automate your trading.

Optimised for BINANCE:ETHBTC in a 4H timeframe.

> > > READ HOW IT WORKS < < <

The goal of trading ETH against BTC is to increase your amount of BTC. ETH is in the top 5 Coins of all time and its bull rallies are really fast and volatile so it's very important not to miss them!

Built upon my generic indicator Cyatophilum Altcoins Trader , this Strategy creates buy and sell signals to can be used for manual or automated trading.

The year 2019 started with the end of a bull run, and the script was able to catch 29% of profits. Then in Februrary, we saw another rally, but this one dropped fast and the script caught 4% of profits. Until then, two opportunities of trade triggered but ended up as a loss, as the bear market continued. In total, it made 33% of profit and 9.5% of loss . The fact that a bear market has be going on for +3 months is a good thing for what will happen next.

I think we all remember how 2018 was for ETH. It had the most insane rally of all time, another one in April-May then 6 months of bear market. Oh! by the way, did I say the script has an integrated trailing stop loss starting at 4%? Those are the green dots below the price.

I used TradingView's Strategy Tester with historical data starting from 2017-08. Results are calculted using 100% equity from a 10 000$ capital and a 0.05% commission fee on each trade.

See the results below.

> > > READ HOW TO USE < < <

> Get access to the Cyatophilum Indicators <

My Bitcoin 15m Long strategy Hi guys, this strategy uses a 2% trailing take profit and a 5% trailing stop. Backtest is calculated with 100% equity and 0.05% fees on BINANCE:BTCUSDT

Breakouts

Trend Detector

Trailing Take Profit

Trailing Stop Loss

Try this strategy !

Leave a like if you would like to see a forward testing of this strategy !

Thanks for your feedback and support !

Bitcoin Trading Bot - Forward TestingHi guys,

Last time I tested a strategy for over a month, and I must say I got lucky. You can check it here:

This time I will try to simply beat Buy & Hold with a 3H automated strategy for BINANCE:BTCUSDT

I will be using this script :

My starting capital for this strategy is 501.89822985 USDT

Let's get started !

LTC/USD Automated Strategy - Bitfinex - 15mHello, here is a config for my indicator Cyatophilum Bands Pro Trader V4

About the backtest below:

Short + Long Strategy

0.05% Commission

10% of 10 000% equity per trade. Net Profit can be increased with a bigger % of equity.

Strategy data from 2019/01/01 to 2019/05/01

Bitcoin 4h Automated StrategyHello !

I build automated strategies for trading cryptocurrencies in every timeframe.

Here I share my best strategy for trading BTC/USDT in 4h with Longs and Shorts

The backtest below is make with 10% of equity from an initial capital of 10 000$ and with a 0.05% comission.

Learn more about this indicator here .

I hope you like it !

BAT TOKEN LONG STRATEGYHi guys,

Today I share an automated strategy for BAT/USDT on BINANCE in 15m Timeframe.

This is a long only strat.

Backtest below is made with 0.05 commissions and an order size of 10% from an equity of 10 000$.

I used my latest indicator Cyatophilum Bands Pro Trader V3

You can get it here today.

Ethereum Long Strategy - Bands Pro Trader V3Hello,

If you trade Ethereum ( ETH/BTC ) on Binance and want to make more BTC even when the bears take over ETH, then this strategy is for you !

The goal as we do not use shorts or leverage, is to beat the Buy & Hold line ! ( see backtest below )

For this you can use my script Bands Pro Trader :

The configuration is simple.

Set the Bands Lookback to 58 and keep the smoothing to 10 (default value).

Activate a 2% Stop Loss with a Trailing Speed of 1.

Activate a 6% Take Profit.

Note: Profitability ( % profitable) can be increased to 55% by reducing Take Profit to 1%

Get access to the Cyatophilum Indicators today !

Join my Discord channel for more configurations !

Leave a comment and a like if you want a free trial, thanks !

Bitcoin - Automated Strategy Weekly ResultsHello,

We are the 22 of April, a few days after the release of my latest Strategy.

The idea in these kind of post is to check every week how the strategy went out.

So let's start with this week, from 15th to 22th April 2019.

1st Trade (15 April) : Long

Positive

2nd Trade (15 April) : Long

Negative

3rd Trade (15 April) : Short

Positive

4th Trade (16 April) : Long

Positive

5th Trade (16 April) : Short

Positive

6th Trade (16-17 April) : Long

Positive

7th Trade (18 April) : Short

Positive

8th Trade (19 April) : Long

Positive

9th Trade (21 April) : Short

Negative

10th Trade (21 April) : Long

Negative

11th Trade (21 April) : Short

Positive

You can find the configuration on my website

New Automated Strategy - Multitimeframe Indicator - FREE TRIALAn Original Automated Strategy that can be used for Manual or Bot Trading, on any timeframe and market.

This script comes with a Backtest Version

.. and an Alert Setup Version

>> Presentation <<

How it works

No, these are NOT Bollinger Bands..

The Cyatophilum Bands are an original formula that I created. You will probably never find it anywhere else.

Their behavior is the following:

When they are horizontal it means the trend is going sideways and they represent supports (lower band) and resistances (upper band).

When they are climbing or falling it means the trend is either bullish or bearish and they represent Trend Lines.

The strategy enters Long on a Bull Breakout and enters Short on a Bear Breakout.

The exits are triggered either on a Trend Reversal, a Stop Loss or a Take Profit.

FEATURES

Take Profit System

Stop Loss System

Show Net profit Line

More features here

Finding a profitable configuration is GUARANTEED

0. Choose your symbol and timeframe. Then add the Backtest version to your chart. If at any time you decide to change your timeframe, go back to step 1.

1. Open the strategy tester and look at the buy & hold line.

If it is mostly climbing (last value greater than 0) then it means we are in a bull market. You should then opt or a long only strategy.

If it is mostly dropping (last value lower than 0) then it means we are in a bear market. You should then opt or a short only strategy.

Note : This first step is really important. Trading against the market has very little chances to succeed.

2. Go into the Strategy Input Parameters:

check "Enable Long Results" and uncheck "Enable Short Results" if you are in a long only strategy.

check "Enable Short Results" and uncheck "Enable Long Results" if you are in a short only strategy.

3. Open the Strategy Tester and open the Strategy Properties.

We are going to find the base parameters for the Bands.

The "Bands Lookback" is the main parameter to configure for any strategy. It corresponds to how strong of a support and resistance the bands will behave. The lower the timeframe, the higher lookback you will need. It can move from 10 to 60. For example 60 is a good value for a 3 minute timeframe. Try different values, and look at the "net profit" value in the Overview tab of the Strategy Tester. Keep the Lookback value that shows the best net profit value.

Then play with the "Bands Smoothing" from 2 to 20 and keep the best net profit value.

The "Band Smoothing" is used to reduce noise.

Usually, the default value (10) is what gives the best results.

From this point you should already be able to have a profitable strategy (net profit>0), but we can improve it using the Stop Loss and the Take Profit feature.

4. To activate the Stop Loss feature, click on the "SECURITY" checkbox

You should see horizontal red lines appear.

A Long/short exit alert will be triggered if the price were to cross this line. (A red Xcross will appear)

Choose the Stop Loss percentage.

On top of that, you can enable the feature "Trailing Stop". It will make the red line follow the price, at a speed that you can configure with the "Trailing Speed" parameter.

Now, sometimes a stop is triggered and it was just a fakeout. You can enable "Re-entries after a stop" to avoid missing additional opportunities.

5. To activate the Take Profit feature, click on the "TAKE PROFIT" checkbox

You should see horizontal green lines appear.

A Long/short exit alert will be triggered if the price were to cross this line. (A flag will appear)

Choose the Take Profit percentage.

A low takeprofit will provide a safer strategy but can reduce potential profits.

A higher takeprofit will increase risk but can provide higher potential profits.

6. Money Management

You can configure the backtest according to your own money management.

Let's say you have 10 000 $ as initial capital and want to trade only 5%, set the Order Size to 5% of Equity.

You can increase net profit by increasing the order size but this is at your own risk.

How to create alerts explained here

Sample Uses Cases

Use it literally anywhere

This indicator can be used on any timeframe and market (not only cryptocurrencies).

About the Backtest below

The Net Profit (Gross profit - Gross loss) is calculated with a commission of 0.05% on each order.

No leverage used. This is a long strategy.

Each trade is made with 10 % of equity from an inital capital of 10 000$. The net profit can be bigger by increasing the % of equity but this a trader's rule to minimise the risk.

I am selling access to all my indicators on my website : blockchainfiesta.com

To get a 2 days free trial, just leave a comment , thanks !

Join my Discord for help, configurations, requests, etc. discord.gg