How to trade Cup & Handle Pattern | C&H Tuturial with ExampleCup and Handle Chart Pattern Tutorial with Example below !

Stay Tuned ! In the next educational post i will write about psychology of trading Chart Patterns and strategy of How to successfully trade few chart patterns in detail.

Cup & Handle : Cup & Handle Pattern can be seen both as a bullish continuation or bullish reversal pattern. A bullish continuation C&H pattern forms when there is a

preceding uptrend followed by consolidation period in the shape of a Cup and a Handle look pattern and then the uptrend continues after breakout. On the other hand, a trend

reversal Cup & Handle pattern forms after a preceding downtrend, then after completition of the pattern the trend reverses after a successful breakout.

Inverted Cup & Handle Pattern : Inverted Cup & Handle Pattern is the opposite of C&H pattern, Inverted C&H pattern is a bearish continuation or a bearish reversal pattern.

A bearish continuation C&H pattern forms when there is already a preceding downtrend and after a Inverted Cup & Handle pattern is formed followed by a breakout the bear trend

continues. On the other hand, a bearish reversal Inverted Cup & Handle Pattern forms after a preceding uptrend, then after completion of the pattern the trend turns to a bearish

trend from a bullish trend after a successful breakout of the pattern.

(In the Above they are Trend continuation Cup & Handle and Inverted Cup & Handle Patterns and below are the Trend Reversal C&H and Inverted C&H Patterns)

The Cup & Handle Pattern can be form in any timeframe from few minutes to hours, daily or weekly and even monthly candle charts. The price targets are measured from the verticeal

distance from the bottom to the high of the Cup looked shape then this distance projected from the breakout point. Like all the chart pattern you need to confirm the breakout with

Volume Indicator. Sometimes in a cup & handle pattern, only the cup shape forms and do not form the handle shape or we can say it rounded bottom or rounded top for Inverted C&H

pattern.

Stay Tuned; 👍

Like this tutorial & share your comment below and also

check other tutorials with example linked below;

Thank You-

Tradingidea

less effort more profits trading systemA trading system that provides you with with a 85-90% success rate with also giving you more time off the charts.

This system will equip you with the following before you even enter the trade

1. Entry - This trading strategy will show you potential entry levels

2.Exit - Before you enter the trade you will see all the potential take profit levels then you scale out and also you will see your stop out area remember you have all this information before you enter the trade.

3.Risk mangement -With the information you have accumulated so far this equips you with another skill of risk management which is very essential in trading because your risk mangement will determine whether your account grows or shrinks. So you are given the opportunity to weight the risk and decide if the trade is suitable to you, the good thing about this system is that you will always have a trade no matter which market session we are in so even if some trades are not suitable for your account you know something is just around the corner

4.BONUS - This does not need all of your time just a few hours on weekends and a few minutes everyday thats it, literally 10-minutes a day to check on your trades.

5.FOR INQUIRIES ABOUT ACCOUNT MANGEMENT NOTE MINIMUM REQUIREMENTS BEFORE INQUIRY

$250 ACCOUNT

50/50 PROFIT SHARE (THIS EXCLUDES THE INITIAL DEPOSIT MEANING YOU KEEP 100% OF YOUR INITIAL DEPOSIT)

CONTACT ME ON +27813970839

Long view of the GBPUSD, feel free to ask extra info!So in my eyes GBPUSD trying to start find the way out of the trend,at the smaller timeframe it just broke out of the trend with the fakeout candle.Go buy it now with tp 1.29943 and then sell it till 1.27715 for the buy, dont forgot to keep eyes on the long breakout cause theres gonna be good amount of pips comeing. If you have any question feel free to ask it to me at my instagram fxtradingkekkov and come join to my free demo group on telegram!

GBPAUD Trading Plan.Price got rejected again at a key level (June 2016 High). Brexit and UK political chaos further adds to bearish pressure. UK Economics are suffering from bad data coming out, so expectations are for bearish movement. On the other hand we have the trade war which is speculated every week, but in general the technical analysis shows a down movement.

Bullish breakout on the horizon?Price appears to have started a new bullish rotation with some follow-through after the large outside bar on 1st Nov.

Price consolidated and broke to the downside on Friday, which was swiftly and powerfully rejected.

Expecting a continuation of the move higher, I am looking for a swing long (as seen on charts), with targets at:

TP_1: $64.50

TP_2: $68.00

Both targets have confluence with the dominant structure fib levels.

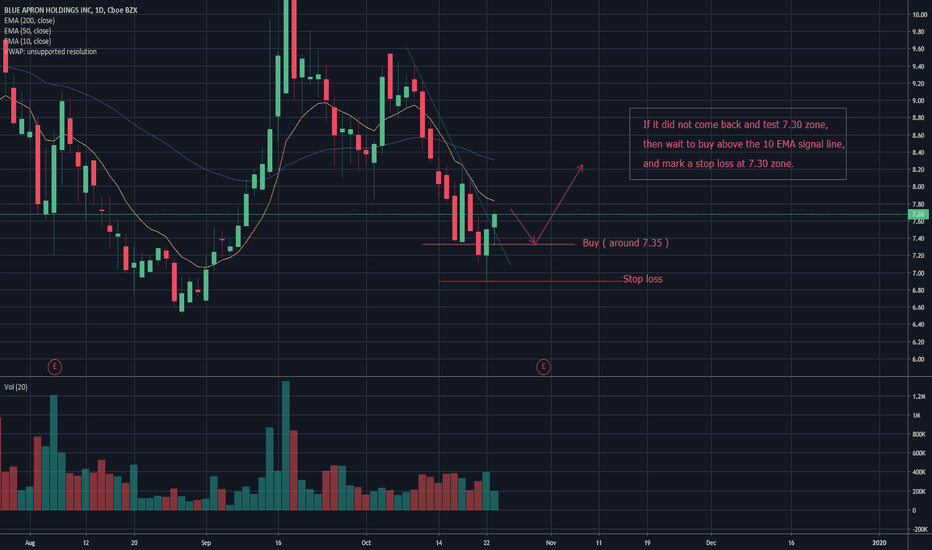

APRN buy signalAPRN

The buyer is stepping in, and seller is getting weak.

Target price is around $10

CND/BTC - Best place to buy! Cindicator (CND) Overview:

Cindicator (CND) aims to provide the social and technological infrastructure needed to make effective decisions under the conditions of the high uncertainty of the new economy. It offers a synthesis of financial analysts and machine-learning models to create a Hybrid Intelligence infrastructure to facilitate the efficient management of investors' capital in traditional and crypto-markets.

CND/BTC - Chart Analysis

* We have a nice break out of falling wedge and a retest of the break out!

* CND/BTC now trading above MA21.

* Bullish divergence with the MACD.

* Bullish RSI ( it's close to break above the 55)

This pair can generate up to 88% profit with a nice Risk/Ratio Reward of 4,7 !

All targets and details are shared on the chart.

Feel free to leave a comment and share your love for this work!

Happy trading!

BTC is losing strength! Aiming to 9200$ area?!I still believe that BTC will go down before it will make another move up and here is why:

REASON NR.1

I know it looks like a strong support and I agree, but bears are dominating so far and it's just a matter of time until they take control.

REASON NR.2

As you can see the price is below all important MA, which indicates that BTC is losing strenght!

REASON NR.3

RSI is below 50 and has break out on the down side of triangle!

If you liked this idea don't forget to give it a like! Until next time!

GBPUSD a small recovery before the breakGBP is breaking because of brexit

the pound is low very low... I'll it push up again? Potencially yes, the pound is still powerfull, as England is. Even with the Exit from EU, the british pound will stay on track. Every market can break and that happen already, but it dosen't mean it can't recover..

Trade on Chart

USDCHF is running a downward rally very wellWhy I am going short on USDCHF? Well first of all it breaks below its upward trend line, the trend line was in place since Oct 2018 and now after almost 9 months price breaks below that level, it already had a pull back and now ready to go lower. The second reason is from price action point of view market is clearly making lower highs and lower lows which is the simplest way of indicating a down trend. 3rd signal comes from Moving Averages . They are in an order of low to high. You can see the shortest EMA (20) is below EMA50 and 50 is below 100. This is another definition for down trend, market is bouncing and touching its EMA20 every time, just before it drops further. Finally fundamentally we will see a rate cut in USD soon , most probably in July, which makes USD weaker and facilitates the USDCHF down trend even further.

If price comes up to 1.0035 this analysis will be voided. Otherwise every up movement is a good chance to go short. Specially if it goes up to touch its EMA20 again around 0.9850 it will be a good chance then to go short.

USDJPY breaking below its 3 years trend lineAs you probably know for the last 3 years USDJPY was under pressure inside a symmetric triangle. During this time it bounced couple of times between upper side and lower side of the triangle and everytime moved couple of hundreds pips. Recently it seems breaking below the lower side for the first time in the last 3 years. It can be a significant sign for a massive downward movement as chart is finally coming out of the compression zone.

Fundamentally trade war between US and China and recently adding tariff to Mexican imports caused a lot of pressure on the dollar shoulder. On the other side weakness of Euro and GBP creates a good opportunity for Yen to become the top gainer in the past few weeks.

Today Fed's Powel will speak and just in a few days we will hear about ISM release and NFP. All of these important news can throw down USDJPY a few hundred pips.

The other scenario is if this break out will become a fake breakout then market will get energy to start another bullish rally however I don't put more weight on this scenario.

Why I am going short on EURAUDEURAUD has reached to one of its strongest resistance zone. In the past few years price fell down sharply after reaching this point in several occasions. Now again market is in this area.

If you look at the oscillators like RSI, MACD, Stochastic on the chart to measure the energy of the market, you see divergences and RSI overbought which all means market doesn't have enough energy to break this resistance zone.

Based on price action and the Japaneese Candle Stick patterns we can easily see a few small candles has been shaped on that area which is showing buyers are not very strong to push the price higher. The last candle for yesterday is a kind of high test bar which has a long leg on its top and then a long red body indicated the pressure from sellers. As you see this candle went below the low's of its previous candle which is another selling signal.

Based on Elliot Waves we had an ABC correction when priced came down from this zone last time ( From Jan 2019 to mid Apr). After than a new set of 5 waves completed. If you test the idea with Fibonacci it confirms the 5 impulse waves are counted correctly.

From the fundamental analysis point of view, Mario Draghi said ECB could cut interest rates again or provide further asset purchases if inflation doesn't reach its target. He admits the only option to increase the rate is when inflation goes much higher than the target. So this sounds like a sell signal or at least not supporting a bullish rally for EUR anymore.

These are just a couple of signals we have to go short on EURAUD. The other possible scenario is EUR breaking this area upward which means our forecast failed, we change the position direction and get ready for a long position then, but we don't want to put much emphasis on this scenario as it is not really high probability.

Is Gold ready for a new bearish trend?Technical Analysis:

1) Gold reached to an area of 1355 to 1365 dollar which has been its resistance area for the past few years. 2) Oscillators are showing the energy of the market dropped and we see some over bought signals as well. 3) From Elliot wave perspective market completed a 5 waves and now ready for correction. 4) If you draw Fibonacci expansion you can see market reached to 261% of it's original movement which can be potentially a good ending point. 5) Price Action: the last candles have only long shadows on their top which means sellers are taking heavy positions on that area. Usually these high test bars are a good signal for starting a bearish trend

Fundamental Analysis:

Today we will have Federal Funds Rate announcement and FOMC statement. Market expects Federal Reserve to cut the interest rate by 0.25 but not still sure whether it happens tonight or will remain for July meeting. As you probably know the major central banks around the world are trying to support their economies by cutting rates or other supportive tools and it's expected to see the same movement from Federal reserve. It can increase the risk appetite of the market and smart money will flow from safe investments like Gold towards more riskier ones like indices.

Based on above, we expect a bearish trend in the mid term movement of the Gold. In short term it might still fluctuate around this area. We need to carefully follow what FOMC is releasing tonight.