See if we can hold the price above 0.05709

Hello traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

(AWEUSDT 1D chart)

The total supply of 2 billion has been unlocked.

Therefore, it seems that temporary profit taking will occur.

We will have to wait and see what kind of flow it will show in the future, but I think the key is whether there is support around 0.05709, which is the HA-Low indicator point.

Since the volume profile section formed on the current 1D chart is formed at 0.06367, we need to check whether there is support around this area.

The 0.06981-0.07188 section corresponds to the previous high point of the 1M chart.

Therefore, the start of the uptrend is expected to begin when the price breaks through the 0.06981-0.07188 section upward and is maintained.

-

In summary of the above,

- The time to buy is when support is confirmed around 0.05709.

- The resistance section is likely to be around 0.06367 and the 0.06981-0.07188 section.

Therefore, you should create a response strategy depending on whether there is support at the points or sections mentioned above, that is, 0.05709, 0.06367, 0.06981-0.07188.

If the price falls below 0.05709, you should stop all trading and wait and see.

The reason is that it is likely to lead to a step-down trend.

Even if it rises, it is expected that there will be a limit to the rise due to profit taking for the time being because all tokens have been unlocked.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Tradingstrategy

XAGUSD Analysis : Consolidation & FMFR Setup + Target🧭 Technical Overview:

Silver has had a strong bullish rally that started after the breakout of a long-term symmetrical triangle pattern. This breakout marked a Major Break of Structure (BOS) and shifted the overall market sentiment toward the bulls. Since then, price has been consolidating under a major resistance zone, forming a compression range, which is now shown as a blue elliptical zone in the chart.

This ellipse is not just a consolidation area — it represents a neutral compression zone where price can explode in either direction. The price action inside this area has been choppy and manipulative, sweeping both local highs and lows without real follow-through — a perfect environment for a Fake Move – then Reversal (FMFR) strategy.

🔍 Key Chart Components:

🔹 1. Ellipse (Dual Directional Zone)

This region shows indecision. Price is coiling inside, creating higher lows and lower highs — a volatility squeeze. A breakout from this ellipse is likely, but the first breakout move may be fake, followed by a quick reversal.

🔹 2. Major BOS (Break of Structure)

Price broke out of a long-term descending structure and pushed strongly upward, which marked a significant bullish shift. The pullback after that BOS was shallow — a sign of continued strength — but now we’re at a decision point.

🔹 3. Resistance Zone (Previous Target Area)

The price is now retesting a strong historical resistance around $37.00–$38.00, where we’ve seen rejections before. This is the liquidity zone where breakout traders enter long, but institutions may sweep them for liquidity before reversing.

🔹 4. Minor and Major CHoCH Levels

Minor CHoCH: Around $35.00–$35.50

Major CHoCH: Near $33.80–$34.00

These are reversal zones to watch if a fake move to the upside occurs and price rolls over.

📉 FMFR Setup Explained:

FMFR (First Move Fake Reversal) is a market behavior pattern where:

Price fakes a breakout in one direction (e.g., above resistance).

Attracts liquidity (traders’ orders).

Reverses rapidly in the opposite direction, trapping those who entered late.

In your chart, the blue notes say:

“In This Case, XAGUSD Have to Gave FMFR From Anyside”

“First Move Fake Then Reversal”

This highlights that no matter which direction the market initially breaks, it’s likely to reverse shortly afterward. This pattern is often seen before major moves when the market seeks to clear liquidity.

🔄 Scenarios to Watch:

🅰️ Bull Trap (Fake Breakout)

Price spikes above $37.80–$38.00.

Sweeps the highs and rejects sharply.

Reversal triggers below the ellipse, heading toward minor/major CHoCH.

🅱️ Bear Trap (Fake Breakdown)

Price dips below $35.00 (minor CHoCH).

Triggers panic sells.

Then rebounds quickly into the previous high zone or beyond.

⚙️ Trading Strategy Ideas:

Wait for Confirmation: Enter only after a confirmed breakout and retest OR a fakeout with reversal candles (e.g., engulfing, pin bar).

Use Tight Risk Management: Place stops outside sweep zones. This setup is volatile and can trap undisciplined trades.

Watch Volume & Wicks: Spikes with wicks and no close beyond the level usually confirm FMFR setups.

🔐 Key Levels to Watch:

Zone Price Level Action

Major Resistance $37.00–$38.00 Watch for fakeouts

Minor CHoCH ~$35.00–$35.50 Reversal entry zone

Major CHoCH ~$33.80 Last line of bullish defense

📝 Final Thoughts:

This is a textbook FMFR compression setup, where volatility is building inside a symmetrical price zone. The first aggressive move from this region is likely to be deceptive. Smart money traders look for trap setups, not the obvious direction. Silver is approaching a high-risk, high-reward decision zone, and staying patient will be key.

📊 Wait. Observe. React — don’t predict blindly.

BTCUSD 4hr Technical Analysis : Rejects $110K - Next TargetsOverview:

Bitcoin is currently undergoing a significant technical correction after rejecting a strong resistance level. The 4-hour chart shows a decisive bearish breakdown, suggesting that the bulls are losing control and sellers are gaining momentum. As the price continues to fall, all eyes are now on the major support levels that could trigger a potential reversal—or further acceleration to the downside.

📊 Technical Breakdown:

1. Major Resistance Zone (~$110,000 – $111,000):

This zone has acted as a strong supply area, where price has repeatedly failed to break through. Multiple rejections from this zone confirm it as a key distribution area, where large sellers are stepping in. The repeated failure to close above it shows market exhaustion at the highs.

Multiple candle wicks and strong bearish closes around this area.

Bull traps occurred after brief moves above this resistance, followed by sharp sell-offs.

2. Trendline Breakout:

Previously, BTC had been respecting a rising ascending trendline, which served as dynamic support throughout the last rally. Recently, price broke below this trendline with strong bearish momentum.

This marks a break in market structure.

The trendline retest acted as resistance—textbook confirmation of the trend shift.

3. QFL (Quantity Following Line) Breakdown:

The QFL zone, typically a bullish defense level, has failed to hold. This breakdown confirmed that bulls lost a critical level of control.

Price briefly retested the QFL from below before continuing downward.

This zone now acts as resistance, reinforcing the bearish outlook.

🔻 Downside Targets & Reversal Zones:

✅ Reversal Zone 1 (~$106,000):

This minor support level provided minimal reaction and was quickly breached.

Lack of volume or candle confirmation suggests weak buying interest here.

✅ Next Reversal Zone 2 (~$104,000):

This zone has historical importance as a short-term demand area.

Monitor closely for bullish candlestick patterns, volume spikes, or bullish divergences to assess potential bounce scenarios.

✅ Major Support Zone (~$102,000 – $100,000):

This is the most critical level in the near term.

Historically, price has reversed strongly from this zone, indicating strong buyer interest.

If price breaks and closes below this level, expect a high-probability continuation towards the $98,000 psychological level or lower.

🧠 Market Psychology:

The breakdown from the trendline and QFL indicates panic or profit-taking.

Many late long positions are likely being liquidated.

Smart money may be waiting at the $100K zone to accumulate, depending on market conditions and macro factors.

🎯 Trading Strategy Ideas:

🛑 For Bears (Shorts):

Stay short below $110K resistance.

Trail stop-loss above QFL zone or trendline breakdown.

Look to take profit at $104K and $102K zones.

Add to positions on confirmed bearish retests of broken supports.

📈 For Bulls (Longs):

Wait for clear confirmation (e.g., bullish engulfing, double bottom, RSI divergence) near $104K or $102K before entering.

Avoid catching falling knives—patience is key.

Consider scaling in with smaller position sizes and tight stops.

Watch for a reclaim of the QFL zone or a strong bounce from the $100K psychological level.

🧭 Bias: Bearish

Structure: Lower highs & lower lows.

Momentum: Selling volume increasing, bulls losing steam.

Invalidation: A strong daily close above $111K would flip bias back to neutral/bullish.

🧩 Final Thoughts:

Bitcoin is currently in a fragile state as it retraces from a failed breakout. With multiple key support zones ahead, the next few sessions will be critical in determining whether bulls can reclaim control or if we see deeper downside movement. Watch for signs of exhaustion from sellers or fresh accumulation zones to position accordingly.

Important Support and Resistance Areas: 2419.83-2706.15

Hello, traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

The key is whether ETH can find support in the 2419.83-2706.15 area and rise.

This is because this section is the section that needs to be supported in order for a full-fledged uptrend to begin.

Therefore, if you are trading ETH, you can proceed with a purchase when support is confirmed in the 2419.83-2706.15 section.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

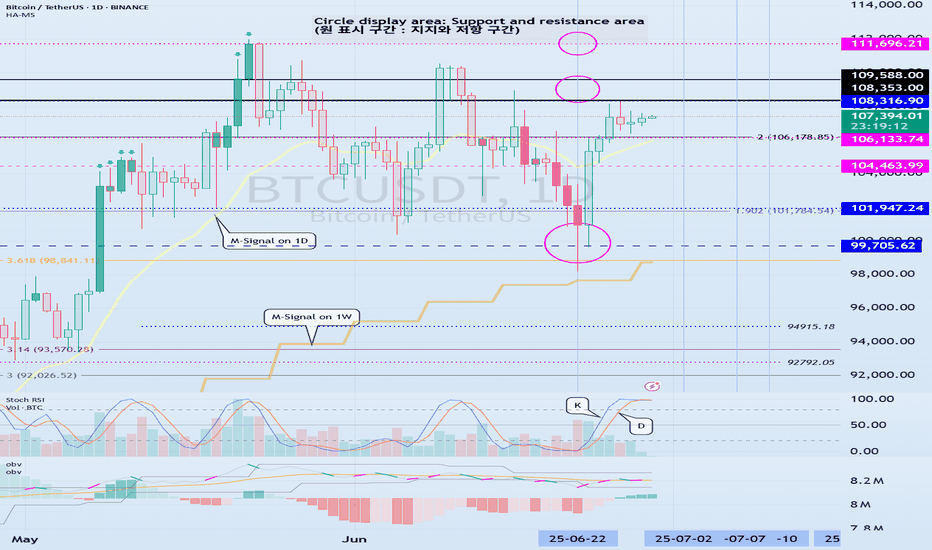

Check support at 108316.90-111696.21

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

Among the many trend lines, the one marked 1W is the important one.

Therefore, we need to look at whether it can rise above the 1W trend line or rise along the trend line.

If not, and it falls below 108316.90, it may lead to further decline, so we need to think about a countermeasure for this.

This volatility period is expected to continue until July 3, but it is expected to last until July 11, so caution is required when trading.

-

Indicators that indicate high points are DOM(60), HA-High, and StochRSI 80.

HA-High and StochRSI 80 are formed around 108316.90, and DOM(60) is formed at 111696.21.

Therefore, the 108316.90-111696.21 section is a high point boundary section, and if it is supported and rises in this section, it is highly likely that a stepwise uptrend will begin.

The conditions for a stepwise uptrend to begin are:

- The K of the StochRSI indicator must show an upward trend below 80,

- The PVT-MACD oscillator indicator must show an upward trend above the 0 point,

- The OBV of the Low Line ~ High Line channel must show an upward trend. If possible, it is better for the Low Line ~ High Line channel to form an upward channel.

When the above conditions are met, I think that if it is supported and rises in the 108316.90-111696.21 section, it is highly likely that a stepwise uptrend will continue.

If the above conditions are not met, it is likely that it will show a downward trend again while pretending to rise.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Important volume profile area: 0.2392

Hello, traders.

If you "follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(SEIUSDT.P 1M chart)

I wonder what the 1M chart means on the futures chart, but if you know the current big picture trend, I think you can trade according to your main and secondary positions.

Currently, the volume profile section is formed at 0.2392 on the 1M chart, so it is expected that the major trend will be determined based on this point.

In other words, if the price is maintained above 0.2392, I think it is highly likely to turn into an uptrend.

-

(1W chart)

Currently, on the 1W chart, we are checking for support near the 0.2750 point, which is the StochRSI 80 indicator point.

The StochRSI 80 indicator is one of the indicators that indicates the high point section.

Therefore, if it is supported near the StochRSI 80 indicator, it is highly likely to rise.

On the other hand, if it is not supported, it is important to check for support because it corresponds to the resistance point.

Once the rise begins, it is basically likely to rise until it meets the HA-High indicator.

The HA-High indicator is currently formed at 0.7406.

However, when rising, there is a possibility of receiving resistance near the area where the arrow is pointing, so you should think about a countermeasure.

-

(1D chart)

In order to rise, the price must rise above the 0.2801-0.2998 range and maintain it.

If not, there is a possibility of falling until the HA-Low indicator is met.

However, since an important volume profile range is formed at the 0.2392 range, whether there is support near this area is an important issue.

Therefore, if it falls below 0.2392, it is recommended to stop trading and check the situation if possible.

If it rises above 0.2998, it seems likely to surge to the 0.4323-0.4820 range because the resistance range is weak.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

The Power of Setting SL and TP: Secret to Mastering Your TradeThe Power of Setting SL and TP: The Secret to Mastering Your Trade

Hey there, traders! 👋 Let’s talk about something that can make a world of difference in your trading journey – Stop Loss (SL) and Take Profit (TP). These simple tools may look basic, but they are essential for every trader to stay consistent and profitable in the long run.

In today’s post, we’ll dive into the importance of setting SL and TP for each trade and how these two tools can change your trading game. Whether you’re new to trading or have been in the game for a while, understanding and applying SL and TP correctly is key to building a solid and profitable trading strategy. Let’s get started!

1. What Exactly Are SL and TP?

Stop Loss (SL):

A Stop Loss is the level where you decide to cut your losses if the market moves against your trade. It's your safety net, ensuring that your losses stay manageable. For example, if you’re trading XAU/USD at $1800 and don’t want to lose more than $50, you’d set your SL at $1750.

Take Profit (TP):

Take Profit is the level at which you’ll close your trade once the price reaches your desired profit. This helps you lock in profits automatically, without the temptation to stay in the market too long. For example, if you think gold will rise to $1850, you’d set your TP at that level to secure the profit.

2. Why Are SL and TP Crucial?

A. Eliminating Emotion from Your Trades

One of the hardest challenges in trading is keeping emotions out of the equation. Fear and greed can cause you to hold onto losing positions for too long or exit too soon. SL and TP automate your exits, allowing you to trade with a clear plan and reduce emotional decision-making.

B. Managing Risk Like a Pro

Risk management is the backbone of any successful trading strategy. SL limits your losses by setting a predefined level where your trade will automatically close. Without SLs, you could risk losing more than you intended, which can damage your trading account.

C. Securing Consistent Profits

TP helps you to capture profits at the right time. Without it, you might let your profits slip away as the market moves against you. A TP ensures you don’t miss out on locking in gains when the market reaches your target.

D. Building Consistency

By setting SL and TP, you create a consistent and structured approach to your trading. If you trade with a 1:2 risk-to-reward ratio, where you risk $1 to make $2, you can build long-term profitability, even if you lose some trades along the way. Consistency is the key to success in trading.

3. How to Set SL and TP Like a Pro

A. Start with Proper Analysis

Before entering any trade, always analyze the market context. Use technical analysis (like support and resistance levels, Fibonacci, and trendlines) to place your SL and TP at logical levels. For example, set your SL slightly below support for a buy trade, or slightly above resistance for a sell trade.

B. Risk-to-Reward Ratio

A good rule of thumb is to have a 1:2 risk-to-reward ratio. This means if you risk $50 on a trade, you aim to make at least $100. This allows you to lose half of your trades but still come out ahead in the long run. Always set your TP in relation to your risk tolerance.

C. Use Indicators to Help

Use indicators like EMA, RSI, Fibonacci retracements, and pivot points to determine the best levels for your SL and TP. For example, if you see a strong bullish trend and are entering a buy position, placing your TP near the next Fibonacci extension level is a great strategy.

D. Keep Volatility in Mind

Market volatility plays a big role in where you place your SL and TP. In highly volatile markets, tight SL might get hit too early. Adjust your SL to reflect the market’s movement. Similarly, your TP should be flexible enough to account for volatility.

4. Benefits of Setting SL and TP

A. Reducing Emotional Trading

Emotional trading is the quickest way to lose money. SL and TP take emotion out of the equation, making trading more objective and disciplined. You know exactly when you’re getting in, and when to get out – no guessing!

B. Avoiding Overtrading

Without clear SL and TP levels, you might overtrade, holding positions for too long or exiting too early. This lack of structure leads to emotional decisions and bad habits. Having SL and TP in place ensures that you trade only when it makes sense.

C. Gaining Confidence

By setting clear SL and TP levels, you gain confidence in your trading strategy. You know that your risk is limited and your profits are protected. This allows you to trade with a calm mindset, focusing on quality trades instead of rushing into everything.

5. Conclusion

Setting SL and TP is one of the most important skills for any trader, whether you're new to the market or experienced. They help you manage risk, capture profits, and build a disciplined approach to trading. By incorporating SL and TP into your trading plan, you can protect your capital, lock in profits, and ensure consistent growth in your trading journey.

So remember, Plan your trade and trade your plan – and always set your SL and TP before entering any trade.

Happy Trading! Stay disciplined, stay profitable! 💰🚀

Check if price can hold above M-Signal indicator on 1D chart

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

I failed to register a modified indicator of StochRSI indicator on TradingView alone, so I added it to the existing OBV by readCrypto indicator.

From the top of the indicator setting window to the bottom

1. OBV indicator of Low Line ~ High Line channel

2. PVT-MACD oscillator indicator

3. StochRSI indicator

They are registered in the order above.

Since the values used are all different, you should activate and use one indicator.

Please check the chart above.

------------------------------------------

(BTCUSDT 1D chart)

It is showing a downward trend as it failed to rise above the HA-High indicator (108316.90) on the 1D chart.

It is currently checking whether there is support near 107340.58, which is the StochRSI 50 indicator point.

If it fails to receive support and falls, it is expected to fall to around 104463.99.

The 104463.99 point is the DOM (60) indicator point of the 1W chart, which corresponds to the end of the high point on the 1W chart.

Since the StochRSI 20 indicator point is formed near the 104463.99 point, its importance can be considered high.

-

Since the M-Signal indicator of the 1D chart is passing near 106133.74, there is a possibility of volatility when touching this area.

Since the volatility period begins around July 2 (July 1-3), it is necessary to keep an eye on the current movement.

-

However, the key is to buy near the HA-Low indicator and sell near the HA-High indicator, so the current movement may be natural.

This volatility period is expected to last until around July 10 (July 9-11), so be careful when trading to avoid being fooled by fakes.

----------------------------------------

- The StochRSI indicator is showing signs of transitioning to a state where K < D.

- The PVT-MACD oscillator indicator is showing signs of decline.

- The OBV indicator of the Low Line ~ High Line channel is showing signs of decline in the High Line.

Therefore, if you look at the indicators, they are showing signs of decline overall.

However, if the OBV rises above the High Line, the price will show signs of rise.

Therefore, we need to observe the movements of the indicators while checking whether there is support at the StochRSI 50 indicator point.

Basically, the time to make a purchase is when it shows support near the DOM (-60) ~ HA-Low indicator.

If you want to make a purchase outside of that, you should not forget that a short and quick response is required.

The indicators that tell you the high point are HA-High, DOM(60) indicators.

In addition, there are StochRSI 80 and StochRSI 20 indicators that require quick response.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

Overfitting Will Break Your Strategy — Here’s Why█ Why Your Backtest Lies: A Quant’s Warning to Retail Traders

As a quant coder, I’ve seen it time and again: strategies that look flawless in backtests but fall apart in live markets.

Why? One word: overfitting.

Compare the signals in the images below. They’re from the same system, but one is overfitted, showing how misleading results can look when tuned too perfectly to the past.

⚪ Overfitting is what happens when you push a strategy to perform too well on historical data. You tweak it, optimize it, and tune every rule until it fits the past perfectly, including every random wiggle and fluke.

To retail traders, the result looks like genius. But to a quant, it’s a red flag .

█ Trading strategy developers have long known that “curve-fitting” a strategy to historical data (overfitting) creates an illusion of success that rarely holds up in live markets. Over-optimizing parameters to perfectly fit past price patterns may produce stellar backtest results, but it typically does not translate into real profits going forward.

In fact, extensive research and industry experience show that strategies tuned to past noise almost inevitably disappoint out-of-sample.

The bottom line: No one succeeds in markets by relying on a strategy that merely memorized the past — such “perfect” backtests are fool’s gold, not a future edge.

█ The Illusion of a Perfect Backtest

Overfitted strategies produce high Sharpe ratios, beautiful equity curves, and stellar win rates — in backtests. But they almost never hold up in the real world.

Because what you’ve really done is this:

You built a system that memorized the past, instead of learning anything meaningful about how markets work.

Live market data is messy, evolving, and unpredictable. An overfit system, tuned to every quirk of history, simply can’t adapt.

█ A Warning About Optimization Tools

There are many tools out there today — no-code platforms, signal builders, optimization dashboards — designed to help retail traders fine-tune and "optimize" their strategies.

⚪ But here’s the truth:

I can't stress this enough — do not rely on these tools to build or validate your strategy.

They make it easy to overfit.

They encourage curve-fitting.

They give false hope and lead to false expectations about how markets actually work.

⚪ The evidence is overwhelming:

Decades of academic research and real-world results confirm that over-optimized strategies fail in live trading. What looks good in backtests is often just noise, not edge.

This isn’t something I’ve made up or a personal theory.

It’s a well-documented, widely accepted fact in quantitative finance, supported by decades of peer-reviewed research and real-world results. The evidence is overwhelming. It’s not a controversial claim — it’s one of the most agreed-upon truths in the field.

█ Why Overfitting Fails

Let me explain it like I do to newer coders:

Random patterns don’t repeat: The patterns your strategy "learned" were noise. They won't show up again.

Overfitting kills the signal: Markets have a low signal-to-noise ratio. Fitting the noise means you've buried the signal.

Markets change: That strategy optimized for low-volatility or bull markets? It breaks in new regimes.

You tested too many ideas: Try enough combinations, and something will look good by accident. That doesn’t make it predictive.

█ The Research Backs It Up

Quantopian’s 888-strategy study:

Sharpe ratios from backtests had almost zero predictive power for live returns.

The more a quant optimized a strategy, the worse it performed live.

Bailey & López de Prado’s work:

After testing enough variations, you’re guaranteed to find something that performs well by chance, even if it has no edge.

█ My Advice to Retail Traders

If your strategy only looks great after a dozen tweaks… It’s probably overfit.

If you don’t validate on out-of-sample data… you’re fooling yourself.

If your equity curve is “too good” to be true… it probably is.

Real strategies don’t look perfect — they look robust. They perform decently across timeframes, markets, and conditions. They don’t rely on lucky parameter combos or obscure filters.

█ What to Do Instead

Use out-of-sample and walk-forward testing

Stick to simpler logic with fewer parameters

Ground your system in market rationale, not just stats

Risk management over performance maximization

Expect drawdowns and variability

Treat backtest performance as a rough guide, not a promise

Overfitting is one of the biggest traps in strategy development.

If you want your trading strategy to survive live markets, stop optimizing for the past. Start building for uncertainty. Because the market doesn’t care how well your model memorized history. It cares how well it adapts to reality.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Analyzing the new month, new week, new day

Hello, traders.

If you "follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1M chart)

A new month begins in one day.

The key is whether it can hold the price by rising above 109588.0.

If not, there is a possibility that it will fall below the 94172.00 StochRSI 50 indicator point that the arrow is pointing to.

We need to see if it can rise with support near the Fibonacci ratio of 1.618 (89050.0).

Since the current low-point trend line is not complete, it is not surprising that it can show a downward trend at any time.

However, if it rises above 109588.0 and maintains the price, it is expected that there will be an attempt to rise near the Fibonacci ratio of 2.618 (133889.92).

I think it is likely to be the last target of the target bull market in 2025.

-

(1W chart)

It is a period of volatility around the week including June 23.

That is, from June 16 to July 6 is the volatility period.

The key is whether it can rise to the right Fibonacci ratio 2.24 (116940.43) during this volatility period.

Even if it fails to rise, if the price maintains above 104463.99, it is expected to show an upward trend around the next volatility period.

The next volatility period on the 1W chart is expected to be around the week of August 18.

-

When it falls below 104463.99, we need to check whether the HA-High indicator is newly generated.

If not, it is important to check whether there is support around the current HA-High indicator point of 99705.62.

Since the M-Signal indicator on the 1W chart is passing around 99705.62, its importance can be said to be high.

If it falls below the M-Signal indicator of the 1W chart, it is expected to determine the trend again when it meets the M-Signal indicator of the 1M chart.

-

(1D chart)

The key is whether it can maintain the price by rising above the HA-High indicator point of 108316.90 on the 1D chart.

If it fails to rise,

1st: 104463.99

2nd: 99705.62

You should check for support near the 1st and 2nd above.

If it falls below the M-Signal indicator of the 1W chart,

1st: 89294.25

2nd: M-Signal of the 1M chart

There is a possibility that it will fall near the 1st and 2nd above.

-----------------------------------------

(1W chart)

The chart above is a trend line chart drawn on the 1W chart.

It looks complicated, but what's important to look at is the correlation between the high-point trend line and the low-point trend line.

That is, even if the price rises above 109.588.0, if it doesn't rise above the high-point trend line, it is likely to fall near the low-point trend line.

Fortunately, since it is forming an upward channel, it is expected that the price will eventually rise even if it falls.

-

(1D chart)

Unlike the trend line on the 1W chart, the high-point trend line on the 1D chart forms a downward trend line.

Accordingly, the period around July 7, when the low-point trend line and the high-point trend line intersect, can be considered an important period of volatility.

However, the volatility period starts around July 2nd and is expected to end around July 10th.

----------------------------------------------

As shown above, many lines were drawn to analyze the chart.

I have roughly explained which of the lines drawn in this way should be prioritized.

Since chart analysis is for creating a trading strategy, the support and resistance points drawn on the 1M, 1W, and 1D charts are ultimately the most important.

Therefore, it is most important to check how the support and resistance points were created and find the reason for them.

Other analyses are only additional elements.

As I always say, chart analysis that does not show support and resistance points is only an analysis chart that can be used for trading.

You cannot trade with such analysis charts.

Also, if support and resistance points are shown, you should check the basis for setting the support and resistance points.

In order to serve as a support and resistance point, there must be a basis.

When you cannot confirm the basis for the support and resistance point, it is important to ask questions and find out the basis.

Fibonacci ratios are not suitable for actual trading.

However, when the ATH or ATL is updated, it is valuable enough for analysis.

Other than that, there must be support and resistance points drawn on the 1M, 1W, and 1D charts.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Example of how to draw a trend line using the StochRSI indicator

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

We use the StochRSI indicator to draw a trend line.

We draw a trend line by connecting the peaks of the StochRSI indicator, i.e. the K line, when they are created in the overbought area or when they are created in the overbought area.

That is, when the K line of the StochRSI indicator forms a peak in the overbought area, the trend line is drawn by connecting the Open values of the falling candles.

If the candle corresponding to the peak of the StochRSI indicator is a rising candle, move to the right and use the Open value of the first falling candle.

When drawing the first trend line, draw it from the latest candle.

Since the third trend line indicates a new trend, do not draw anything after the third trend line.

The currently drawn trend line corresponds to the high-point trend line.

-

Therefore, you should also draw the low-point trend line.

The low-point trend line is drawn by connecting the K line of the StochRSI indicator when the top is formed in the oversold zone.

The low-point trend line uses the low value of the candle when the K line of the StochRSI indicator forms the top in the oversold zone.

That is, it doesn't matter whether the candle is a bearish candle or a bullish candle.

The drawing method is the same as when drawing the high-point trend line, drawing from the latest candle.

The top of the best K line of the StochRSI indicator was not formed within the oversold zone.

(The top is indicated by the section marked with a circle.)

Since the trend line was not formed, the principle is not to draw it.

If you want to draw it and see it, it is better to display it differently from the existing trend line so that it is intuitively different from the existing trend line.

-

The chart below is a chart that displays the trend line drawn separately above as a whole.

It is also good to distinguish which trend line it is by changing the color of the high-point trend line and the low-point trend line.

The chart below is a chart that distinguishes the high-point trend line in blue (#5b9cf6) and the low-point trend line in light green (#00ff00).

The low-point trend line is a line drawn when the trend has changed, so it does not have much meaning, but it still provides good information for calculating the volatility period.

-

To calculate the volatility period, support and resistance points drawn on the 1M, 1W, and 1D charts are required.

However, since I am currently explaining how to draw a trend line, it is only drawn on the 1M chart.

-

I use the indicators used in my chart to indicate support and resistance points.

That is, I use the DOM(60), DOM(-60), HA-Low, HA-High, and OBV indicators to indicate support and resistance points.

Since the DOM(-60) and HA-Low indicators are not displayed on the 1M chart, I have shown the 1W chart as an example.

The indicators displayed up to the current candle correspond to the main support and resistance points.

Although it is not displayed up to the current candle, the point where the horizontal line is long is drawn as the sub-support and resistance point.

It is recommended to mark them separately to distinguish the main support and resistance point and the sub-support and resistance point.

The trend line drawn in this way and the support and resistance points are correlated on the 1D chart and the volatility period is calculated.

(For example, it was drawn on the 1M chart.)

The sections marked as circles are the points that serve as the basis for calculating the volatility period.

That is,

- The point where multiple trend lines intersect

- The point where the trend line and the support and resistance points intersect

Select the point that satisfies the above cases at the same time to display the volatility period.

When the point of calculating the volatility period is ambiguous, move to the left and select the first candle.

This is because it is meaningless to display it after the volatility period has passed.

If possible, the more points that are satisfied at the same time, the stronger the volatility period.

If the K-line peak of the StochRSI indicator is formed outside the overbought or oversold zone, it is better to exclude it when calculating the volatility period.

-

The chart below is a chart drawn on a 1D chart by summarizing the above contents.

The reason why there are so many lines is because of this reason.

For those who are not familiar with my charts, I have been simplifying the charts as much as possible these days.

However, when explaining, I have shown all the indicators to help you understand the explanation.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Skeptic | RSI Masterclass: Unlock Pro-Level Trading Secrets!Hey traders, it’s Skeptic ! 😎 Ready to transform your trading? 95% of you are using the Relative Strength Index wrong , and I’m here to fix that with a game-changing strategy I’ve backtested across 200+ trades. This isn’t a generic RSI tutorial—it’s packed with real-world setups, myth-busting insights, and precise rules to trade with confidence. Join me to master the art of RSI and trade with clarity, discipline, and reason. Big shoutout to TradingView for this epic free tool! 🙌 Let’s dive in! 🚖

What Is RSI? The Core Breakdown

The Relative Strength Index (RSI) , crafted by Welles Wilder, is a momentum oscillator that measures a market’s strength by comparing average gains to average losses over a set period. Here’s the formula:

G = average gains over n periods, L = average losses.

Relative Strength (RS) = | G / L |.

RSI = 100 - (100 / (1 + RS)).

Wilder used a 14-period lookback , and I stick with it—it’s smooth, filters noise, and gives a crystal-clear read on buyer or seller momentum. Let’s get to the good stuff—how I use RSI to stack profits! 📊

My RSI Strategy: Flipping the Script

Forget what you’ve read in books like The Handbook of Technical Analysis by Mark Andrew Lim— overbought (70) and oversold (30) aren’t just for shorting or buying. I go long when RSI hits overbought, and it’s been a goldmine. I’ve backtested over 200 trades with this approach, and it’s my go-to confirmation for daily setups. Why does it work? When RSI hits overbought on my 15-minute entry chart, it signals explosive buyer momentum. Here’s what you get:

Lightning-Fast R/R: I hit risk/reward targets in 30 minutes to 2 hours on 15-minute entries (longer for 1-hour entries, depending on your timeframe).

Massive R/R Potential: An overbought RSI on 15-minute can push 1-hour and 4-hour RSI into overbought, driving bigger moves. I hold for R/Rs of 5 or even 10, not bailing early. 🚀

Rock-Solid Confirmation: RSI confirms my entry trigger. Take BTC/USD:

BTC bounces off a key support at 76,000, sparking an uptrend.

It forms a 4-hour box range, but price tests the ceiling more than the floor, hinting at a breakout.

Trigger: Break above the box ceiling at 85,853.57.

On 15-minute, a powerful candle breaks the ceiling, and RSI hits overbought—that’s my green light. I open a long.

Soon, 1-hour and 4-hour RSI go overbought, signaling stronger momentum. I hold, and BTC pumps hard, hitting high R/R in a short window.

This keeps trades fast and efficient—quick wins or quick stops mean better capital management and less stress. Slow trades? They’re a mental grind, pushing you to close early for tiny R/Rs. 😴

Pro Rules for RSI Success

Here’s how to wield RSI like a trading weapon:

Stick to the Trend : Use RSI in the direction of the main trend (e.g., uptrend = focus on longs).

Confirmation Only: Never use RSI solo for buy/sell signals. Pair it with breakouts or support/resistance triggers.

Fresh Momentum: RSI is strongest when it just hits overbought/oversold. If the move’s already rolling, skip it—no FOMO, walk away!

Customize Zones: Overbought (70) and oversold (30) can shift—it might show reactions at 65 or 75. Adjust to your market’s behavior.

Backtesting RSI: Your Path to Mastery

To make RSI yours, backtest it across at least 30 trades in every market cycle— uptrend, downtrend, and range. Test in volatile markets for extra edge. 😏 Key takeaways:

Range Markets Kill RSI: Momentum oscillators like RSI (or SMA) are useless in ranges—no momentum, no signal. Switch to ROC (Rate of Change) for ranges—I use it, and it’s a beast. Want an ROC guide? Hit the comments!

Overextended RSI Zones: On your entry timeframe (e.g., 15-minute), check higher timeframes (e.g., 4-hour) for past RSI highs/lows. These are overextended zones—price often rejects or triggers a range. Use them to take profits.

Final Vibe Check

This RSI masterclass is your key to trading like a pro—fast R/Rs, big wins, and unshakable confidence . At Skeptic Lab, we live by No FOMO, no hype, just reason. Guard your capital— max 1% risk per trade, no excuses. Want an ROC masterclass or more tools? Drop a comment! If this fired you up, smash that boost—it means everything! 😊 Got a setup or question? Hit me in the comments. Stay sharp, fam! ✌️

Anatomy of a Breakout: How to Spot It Before It Fakes You OutFew things in trading are as appealing as a breakout. The chart tightens, volume starts to stir, headlines align, your alerts start going off , and suddenly — boom! Price explodes above resistance. Your adrenaline spikes and you pop open that long.

But just as often, that breakout turns out to be nothing more than an expensive head fake. Price stalls. Sellers swoop in. Your stop gets clipped. And now you’re sitting there, blinking at your screen, “Welp… that was quick.”

Welcome to the bittersweet world of breakouts — where opportunity and deception dance like partners at a high-stakes poker table.

📢 What Is a Breakout, Really?

Let’s get the basics out of the way: A breakout happens when price pushes beyond a key support or resistance level that’s been holding for a while.

That level could be a previous high, a consolidation range, a trendline, or a psychological number that traders obsess over because humans love round numbers (did someone say Bitcoin BITSTAMP:BTCUSD at $120,000 ?).

The logic is simple: Once price clears a well-watched level, trapped shorts have to cover, new longs pile in, and momentum feeds on itself. That’s the dream scenario.

But markets aren’t always that generous. For every clean breakout, there are a few fakeouts lurking — luring in overeager traders with the promise of easy money before slamming the door shut.

⚠️ Why Breakouts May Fail

If breakouts were easy, we’d all be rich. The problem is that breakouts attract a special kind of crowd: late-to-the-party momentum chasers, breakout algorithm bots, and retail traders who read one blog post about technical analysis.

The moment price nudges above resistance, FOMO kicks in. Volume surges. But if the move isn’t backed by genuine institutional buying (you need lots of billions to move the needle nowadays), it quickly becomes what seasoned traders call a “liquidity vacuum” — thin air where the only participants are you, a few equally optimistic Reddit threads, and market makers more than happy to take the other side.

Sometimes breakouts fail because:

The move lacked volume confirmation.

Macro headlines shifted mid-breakout.

A key level was front-run, and the real buyers have already taken profit.

It was a deliberate trap set by larger players to hunt stops before reversing.

Or — more often — the market just needed an excuse to shake out weak hands before resuming the actual move later.

🍸 Volume: The Truth Serum

Let’s be very clear: Breakouts without volume are like dating profiles without photos — you should be suspicious.

When real breakouts occur, you’ll usually see strong accompanying volume. That’s your proof that big players — funds, institutions, serious money — are committing to the move. No volume? Maybe the summer vibes are already here .

Smart traders wait for confirmation:

Is volume above average relative to recent sessions?

Is price holding above the breakout level after the initial pop?

Are follow-through candles printing convincingly?

Are we seeing continuation across related sectors or instruments?

Without these signs, that breakout candle may just be a cruel joke.

🤯 Breakout Psychology

Breakouts prey on two of the most dangerous emotions in trading: greed and urgency. The market whispers, “If you don’t get in now, you’ll miss it.”

This is where breakout psychology becomes more dangerous than the chart itself. Once a breakout happens, most traders are no longer analyzing — they’re reacting. They buy late, set tight stops below the breakout level, and become easy prey for stop-hunting algorithms.

✨ Types of Breakouts

Not all breakouts are created equal. Here’s the lineup you should be watching for:

Clean Breakouts:

The rarest and most beautiful. Strong move, high volume, sustained momentum. You’ll know it when you see it — or after you’ve hesitated and missed it.

Fakeouts (a.k.a. False Breakouts):

Price nudges just past resistance, triggers breakout orders, then swiftly reverses. Designed to shake out breakout traders before resuming the original trend.

Break-and-Retest Setups:

Often the highest-probability trades. Price breaks out, then pulls back to retest the former resistance (now support). If buyers defend this retest, you’ve got confirmation.

News-Driven Breakouts:

Triggered by earnings, economic data, or political events. Volatile, fast, and often unsustainable unless backed by real fundamental shifts.

📈 The “Pre-Breakout Tell”: Reading the Tape

Good breakout traders aren’t just watching levels — they’re watching how price behaves near those levels in advance.

Tight consolidation? Lower volatility into resistance? Declining volume as price grinds higher? That often signals an impending breakout as supply dries up.

Conversely, choppy action with large wicks and erratic volume often signals indecision — ripe conditions for failed breakouts and fakeouts.

Tape-reading matters. The cleaner the structure before the breakout, the better your odds.

💰 Breakout Traders Need Thick Skin

Even with perfect analysis, breakout trading requires accepting that many will fail. That’s the game. Your job isn’t to nail every breakout — it’s to size your positions properly , keep losses small when faked out, and let the clean breakouts run when you catch one.

Stop-loss discipline is everything. Breakouts are binary events: you’re either right quickly, or you’re cutting the trade quickly. There’s no room for “maybe it’ll come back.”

The most painful breakouts are the ones that fake out, stop you, then continue in your original direction. Every breakout trader has lived that nightmare. Accept it. Build it into your risk plan.

👉 Takeaway: Prepare the Setup, Anticipate the Fakeout

Breakouts will always be part of every trader’s playbook. But they require discipline, experience, and an iron stomach. The market loves to tempt you with early signals — your job is to separate signal from noise.

Pro tip: Start your day by checking the Economic calendar and browsing the latest news — staying informed (and witty) helps you build better context for smarter decisions.

So before you chase that next breakout candle, ask yourself:

Is volume there?

Is the broader market supportive?

Have I managed my risk before clicking buy?

Because in trading, the only thing worse than missing a breakout… is getting faked out and blowing up your account chasing it.

Now over to you : Are you a breakout trader or a fakeout victim? Share your best (or worst) breakout stories — we’ve all been there.

Next Volatility Period: Around July 2nd

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

The key is whether it can rise above 108316.90 and find support.

When OBV rises above the High Line, we need to check if the PVT-MACD oscillator switches to above the 0 point.

However, since the StochRSI indicator is currently showing signs of entering the overbought zone, I think there is a high possibility of resistance.

We need to check for support in the 108316.90-111696.21 zone, which is the high point boundary zone.

- If OBV fails to rise above the High Line,

- If the PVT-MACD oscillator fails to remain above the 0 point,

- If the StochRSI indicator falls from the overbought zone and switches to a state where K<D,

It is highly likely that it will eventually encounter resistance in the high point boundary zone and fall.

Therefore, what we need to do is to check for support near 108361.90-108353.0.

If it rises after that, we need to check for support near 111696.21.

Entering a new purchase in the high point boundary section is a very risky transaction.

Therefore, a short and quick response is required when making a purchase.

The basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

Do not forget this.

However, since the HA-Low or HA-High indicators are intermediate values, they may move in the opposite direction.

In other words, there is a possibility that the HA-Low indicator will receive resistance and fall, showing a stepwise downtrend, and the HA-High indicator will receive support and rise, showing a stepwise uptrend.

Therefore, you must check whether there is support in the low point boundary section of the DOM(-60) ~ HA-Low section or the high point boundary section of the HA-High ~ DOM(60) section.

To do this, you must trade in a split transaction method.

-

The next volatility period is expected to start around July 2 (July 1-3).

The reason why we calculate the volatility period is because it can be a turning point of the trend.

Therefore, making a new trade during the volatility period means that there is a high possibility of being caught in a fake.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

The key is whether it can rise above 61800

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(Samsung Electronics 1D chart)

HA-Low indicator and HA-High indicator have begun to converge.

Accordingly, a trend is expected to occur soon.

Since the price is currently located below the M-Signal indicator on the 1M chart, it is possible that the rise is limited.

In addition, the PVT-MACD oscillator is showing signs of falling below the 0 point, so it is showing signs of switching to a selling trend.

Since the Low Line ~ High Line channel is showing signs of switching to a rising channel, if it rises above the High Line this time and is maintained, it is possible that it will switch to a buying trend again.

That is, when it shows support around 54100-58500, it is the first purchase period.

When it rises above the M-Signal indicator on the 1M chart and maintains the price, it is the second purchase period.

Accordingly, when it shows support around 61800 from the current price position, it is the second purchase period.

The expected target range is 77500-79400, which is near the current HA-High point.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

Check 350.47 support (HA-MS indicator interpretation method)

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(HD 1D chart)

Can the HA-MS indicator be applied to stock charts?!!!

The conclusion is that it can be applied to all charts.

However, since the stock market is traded one week at a time, you cannot collect stocks corresponding to the profit of the coin market.

Since the coin market can be traded in decimals, you can create a medium- to long-term trading strategy by selling the purchase amount when realizing profit and collecting the number of coins (tokens) corresponding to profit.

The basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, when conducting short-term trading, you need to be careful to check whether the price is above or below the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, you need to respond quickly and quickly in the form of day trading.

Therefore, it is important to find stocks that maintain their price above the M-Signal indicator on the 1M chart if possible.

If you are familiar with day trading, you can conduct trading according to the basic trading strategy regardless of the location of the M-Signal indicator on the 1M chart.

However, since the HA-Low or HA-High indicators are intermediate values, they may proceed in the opposite direction to the basic trading strategy depending on whether there is support.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downtrend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise uptrend.

To confirm this, you need to check the movement of the auxiliary indicator PVT-MACD oscillator indicator and the OBV indicator consisting of the Low Line ~ High Line channel.

One thing to keep in mind here is that there are differences depending on the situation, whether it is a decline or an increase.

In other words, if the HA-Low indicator declines, there is a possibility of a stepwise decline, but the end is an increase.

This means that if the HA-Low indicator shows a stepwise decline, you should focus on finding the right time to buy.

On the other hand, if the HA-High indicator rises, there is a possibility of a stepwise rise, but the end is a decline.

Therefore, if the HA-HIgh indicator shows a stepwise rise, you should focus on finding the right time to sell.

----------------------------------------------

Looking at the current price position based on the above, the price is located near the HA-Low indicator.

However, since the price is located below the M-Signal indicator on the 1M chart, it is recommended to approach the transaction in a short and fast short-term trading (day trading) manner.

The PVT-MACD oscillator indicator is showing a downward trend below the 0 point.

In other words, it should be interpreted that the selling force is dominant.

The OBV indicator is showing signs of breaking through the Low Line upward.

However, since the Low LIne ~ High Line channel is not showing an upward trend, caution is required when trading even if the price is rising until it turns into an upward trend.

Therefore, the key is whether there is support near 350.47, which is the HA-Low indicator point.

If it receives support and rises above the M-Signal indicator of the 1M chart and maintains the price, it is highly likely to turn into an upward trend.

At this time, since the HA-High indicator of the 1M chart is formed at the 363.37 point, there is a high possibility that it will act as resistance near this point.

Therefore, if you are going to make a mid- to long-term investment in this stock, it is recommended to check for support near 363.37 or near the M-Signal indicator on the 1M chart.

Otherwise, if you are thinking of buying in installments, you can buy whenever it shows support on the HA-Low indicator regardless of the M-Signal indicator on the 1M chart.

This is because the end of the stepwise downtrend on the HA-Low indicator is ultimately an uptrend.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

Checking the trend change after the volatility period

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

This volatility period is expected to last from June 21st to 23rd.

Therefore, it is necessary to check the trend formed after the volatility period.

The 99705.62 point is the HA-High indicator point of the 1W chart, so it is important to see if there is support near this point.

If it falls without support, it may fall to around 89294.25.

The 89294.25 point is the HA-Low indicator point of the 1D chart.

Since the M-Signal indicator of the 1W chart is rising to around 99705.62, the area around 99705.62 is likely to play an important role as support and resistance.

Even if it turns upward, it must rise above the HA-High indicator point of 108316.90 of the 1D chart to maintain the price.

If not, it is likely to fall again.

-

The fact that the HA-High indicator was created means that it fell from the high point range.

In other words, if it falls below the HA-HIgh indicator point, it is likely to start a downtrend.

However, since the HA-High indicator is an intermediate value, if it is supported near the HA-High indicator, it is possible to show a stepwise upward trend.

The end point of the high point is the DOM (60) indicator.

Therefore, it should be interpreted that it has risen above the high point section only if it rises above the 111696.21 point.

Therefore, depending on how the 108316.90-111696.21 section is broken upward, an upward trend can be predicted.

----------------------------------------------------------------------

There are auxiliary indicators OBV indicators made of Low Line ~ High Line channels and PVT-MACD oscillator indicators.

The OBV indicator made of Low Line ~ High Line channels is an indicator that can see how the channel is structured, and whether OBV falls below the Low Line of the channel or rises above the High Line.

Therefore, you can predict the future trend based on the channel pattern.

-

The PVT-MACD oscillator indicator is an indicator created by adding the Close value dash PVT value to the MACD formula.

Therefore, it shows a similar appearance to the MACD oscillator indicator.

The reason for looking at the PVT-MACD oscillator indicator is to find out how the trading volume flows.

There are many trading volume indicators, but I think this PVT-MACD oscillator indicator reflects the trading volume flow well.

-

However, you should look at the support and resistance points where the changes in the movement of the PVT-MACD oscillator indicator, the OBV indicator created by the Low Line ~ High Line channel, and the StochRSI indicator occur.

If the changes in these indicators occur near the DOM(-60), HA-Low, HA-High, and DOM(60) indicator points, it can be of great help in creating a trading strategy.

The DOM(-60) indicator indicates the end point of the low point.

That is, falling below the DOM(-60) indicator means that it has entered the low point range, and there is a high possibility that it will show a full-scale downtrend.

The fact that the HA-Low indicator was created means that it has left the low point range.

That is, if it rises above the HA-Low indicator, it means that there is a high possibility that an uptrend will begin.

However, since the HA-Low indicator is an intermediate value, if it encounters resistance and falls, it is possible that it will show a stepwise downtrend.

Therefore, whether there is support in the DOM(-60) ~ HA-Low range is important.

-

Currently, the OBV indicator created as the Low Line ~ High Line channel has fallen below the Low Line.

Therefore, we need to look at whether the Low Line ~ High Line channel will change to a downtrend channel in the future.

We need to look at whether an 'M'-shaped pattern indicating a trend change occurs.

Since the PVT-MACD oscillator indicator is still below the 0 point, it can be seen that the selling force is dominant.

However, since the oscillator is maintaining an upward trend, you can see that the overall selling pressure is decreasing.

Even so, since it is located near the HA-High indicator, the resistance in the HA-High ~ DOM(60) section is expected to be considerable.

-

Support and resistance points should be drawn on the 1M, 1W, and 1D charts.

This will increase accuracy.

However, since the standard time frame chart for all indicators is a 1D chart, it is most important to check the flow of the 1D chart.

-

You may think it is difficult because you have to look at multiple indicators at once.

The most important thing is to look at the movement when approaching the HA-Low or HA-High indicator.

The reason is that the basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Here is a description of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

The Importance of the 104463.99 Point

Hello, traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

This volatility period is around June 22nd (June 21-23rd).

Therefore, waves can be generated at any time during the volatility period.

The 104463.99 point is the DOM (60) indicator point of the 1W chart, which corresponds to the end of the high point of the 1W chart.

Therefore, it seems that the price defense is being done well.

I think that defending the price at the high point is significant because it raises expectations for further increase.

-

If it falls after a period of volatility, there is a possibility that it will meet the M-Signal indicator of the 1W chart, and I think the important point at that time is the 99705.62 point.

Therefore, when it falls, you need to check whether the M-Signal indicator of the 1W chart rises to around 99705.62 and whether it is supported.

-

Even if it rises after receiving support near 104463.99, the key is whether it can maintain the price by rising above 108316.90.

The 108316.90 point is the HA-High indicator point of the 1D chart, which corresponds to the middle value of the high point range.

Therefore, in order to continue the uptrend, it must be supported and rise in the 108316.90-111696.21 range.

Currently, both the Low Line and High Line of the auxiliary indicator OBV are showing a downward trend.

Therefore, in order for the uptrend to begin, OBV must rise above the High Line and be maintained.

If not, it is highly likely that it will fall due to selling pressure.

One hopeful(?) thing is that the PVT oscillator is showing an overall upward trend.

(Changed from OBV oscillator to PVT oscillator.)

Therefore, we can see how important the area around 104463.99 is playing a role of support and resistance.

-

In my chart, the basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

Therefore, it is virtually impossible to create a trading strategy at the current price level.

In such cases, you should conduct trading through day trading or quick response.

If not, you may experience a lot of psychological fear and anxiety.

The basic time frame chart of all indicators is the 1D chart.

Therefore, if you cannot read the flow of the 1D chart, you are likely to end up getting faked and suffer losses.

Therefore, you should read the flow of the 1D chart and create a big picture of how to create a trading strategy, and respond in detail on the time frame chart below the 1D chart.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Apple Near Key Support — Long Setup DevelopingIntroduction:

Apple NASDAQ:AAPL is approaching a critical support zone that has consistently held over the past two months. As price retraces toward this level, it presents a potential long opportunity for traders looking to position ahead of the next bullish leg.

Technical Setup:

Support Zone: $193 – $196

This area has acted as a strong demand zone, providing multiple bounce points since April.

Price is now pulling back into this region, offering a potential entry for a long trade.

Trade Idea:

Entry: $193 – $196 (on confirmation of support holding)

Take Profit Targets:

First Target: $210 – $215

Second Target: $225 – $233

Stop Loss: Just below $184 (to protect against a breakdown from support)

#AAPL #Apple #Stocks #TechnicalAnalysis #SupportZone #LongSetup #TradingStrategy #NASDAQ #TechStocks #RiskReward

Breakout point: 2706.15

Hello, traders.

If you "follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

The key is whether the price can rise above the important support and resistance area of 2419.83-2706.15 and maintain it.

Therefore, when the 2706.15 point is broken upward, it can be said that a breakout trade is possible.

The conditions for a breakout trade are:

- OBV must rise above the High Line and be maintained,

- OBV oscillator must show an upward trend,

- StochRSI indicator must show an upward trend.

However, it is better if StochRSI indicator has not entered the overbought zone.

When the rise begins, the resistance zone is expected to be around 3265.0-3321.30.

-

Although funds are continuously flowing into the coin market, it may feel like the trading volume has decreased.

The reason for this is thought to be that BTC dominance is generally showing an upward trend.

The meaning of BTC dominance rising means that funds in the coin market are concentrated toward BTC.

Therefore, I think that the overall trading volume has decreased because more funds are needed for the price to rise.

When the altcoin bull market begins, more transactions will occur, which will make you think that liquidity has increased in the coin market.

Therefore, for the altcoin bull market to begin, the BTC dominance must fall below 55.01 and remain there or continue to fall.

If the USDT dominance remains below 4.97 or continues to fall, the coin market is likely to rise.

At this time, depending on the BTC dominance mentioned earlier, you can distinguish whether the rise is focused on BTC or whether the altcoin is also rising.

If the BTC dominance continues to rise, most altcoins are likely to gradually move sideways or fall.

Therefore, if you are trading altcoins in this situation, I think it would be useful to increase the number of coins (tokens) corresponding to profit while responding quickly and briefly.

In other words, it means selling the purchase amount (+including transaction fees) when the price rises by purchase price, leaving the number of coins (tokens) corresponding to profit.