Tradingstrategyguides

AUDUSD 30M / 4H PULLBACK LONG TRADETRADING PULLBACK RULES

1 - Find Daily uptrend with HH's & HL's.

2 - Switch to the 30m Time Frame

and Wait for a Pullback

against the Uptrend.

3 - Place Fib between last swing

high and low levels,

prior to the pullback.

4 - Buy Anywhere Between 50% and 61.8% Fib.

5 - Place Stop Loss below Swing Low.

6- Take Profit at break above the

previous Swing High.

GBPUSD 1D WOLFE WAVE STRATEGYWhen trading the best wolfe strategy you will find that after the entry is triggered your position should show you an immediate profit. This is because the reversal pattern that emerges from the wolfe wave chart pattern is very violent.

Once we’ve got the first five waves we have the general setup of the wolf wave . After the last wave has broken above the ascending wedge channel it’s the time to get ready for some action.

Step #1: Prior to the Bearish Wolfe Wave Formation look to have a clear Bullish Trend .

Firstly, before the first wave to develop we need to have a clear trend that needs to be reversed. For high probability trades, we want to see a prior bullrish trend before the bearish wolfe wave develops.

This step is quite essential if you want to correctly trade the wolfe pattern.

Now that we’ve identified a trend, it's time to apply the wolfe wave rules to the price chart. This brings us to the next step of our reversal strategy.

Step #2: Try finding a 5 wave move that can be contained in a channel. The last wave 5 must break above the wedge channel.

A valid wolfe wave is composed of 5 waves that follow some simple rules. However, the most important rules are that wave 2 and 4 must be contained within the channel created by Wave 1 and Wave 2.

Secondly, wave 5 breaks above the trendline created by wave 1 and wave 3.

Step #3: Sell after we break above and then a candle close back inside the Wedge Price Channel .

At the moment when the price enters and closes back into the price channel , we want to enter a short position. We like to wait for the close inside in order to eliminate possible fake breakouts.

Note*: If we don’t get a close back into the wedge price channel we don’t have a valid trade signal.

Another sign to look for is how quickly it goes back into the channel. We prefer to only trade the wolfe patterns that retrace very quickly back into the range.

This is a sign that a smart money reversal is at work.

Remember, in trading, you only want to trade the high probability trade setups.

Step #4: Draw a trendline that connects the wave 1 high and wave 4 low and extend it in the future. Take profit when the EPA line is hit or candle close below it..

The line that connects the wave 1 high and wave 4 low is called the wolfe wave EPA line.

The EPA line stands for Estimated Price at Arrival and it’s an effective take profit strategy. The EPA line main purpose is to show at what price the market will extend after it reversed the previous trend.

Note*: If the EPA line is too steep, often time it means that the price will never reach it. In this case, you want to take profits early.

Step #5: Hide Protective Stop Loss above Wave 5.

The protective stop loss can be located above the last wave or wave 5. This strategy gives us a very tight stop loss which is good for our risk management strategy.

Obviously that a break above wave 5 means we also break first above the channel and this will invalidate the validity of the wolfe wave chart pattern.

Note** the above was an example of a SELL trade using the best wolfe wave strategy. Use the same rules for a BUY trade.

Conclusion - Best Wolfe Wave Strategy

The wolfe wave strategy is a trading strategy built around waves the same like Elliott Wave trading. We use other trading concepts like channeling and price symmetry to find the best possible trade signals.

If the trade works in our favor then we have a really good chance to have a good trade in terms of risk to reward ratio. With trading experience, it will become much easier to spot the wolfe wave patterns.

EURUSD 1W 1D 4H TRADESThe weekly chart shows sup/res levels used to take profit levels.

The 4h chart shows entry points.

Bearish trades.

1st sell trade at breakout of triangle bottom @ 1.0663.

1st sell take profit at 1.0560.

2nd sell continuation trade breakout at sup level of 1.0560.

2nd sell take profit at 1.0450.

Bullish trades.

1st buy breakout of top of the triangle.

You determine the entry point.

2nd buy trade at reversal point of 1.0560.

3rd buy trade at reversal point of 1.0450.

All buy trades take profits are at 1.1030 resistance level.

You determine your stop losspoints.

LTCUSD 1W TRADE SETUPS DESCENDING BEAR TRIANGLE & BULL REVERSALChart patterns found on weekly chart.

Entries found on daily chart.

Previous support at 4.75.

1st bearish trade entry on daily candle close below triangle bottom.

1st trade take profit at 4.80.

2nd bullish trade you determine entry.

2nd take profit at 80.00.

ETHUSD 1D BEARISH FLAG PATTERN SHORT TRADEStep #1: Look for evidence of a prior bearish trend. For a valid bearish flag, you need to see a sharp decline.

Just because you can spot the bear flag pattern, doesn’t mean you have to jump straight into the market and trade it.

Remember, we need the right context and the right price structure needs to line up for a tradable bearish flag.

So, the first step is to identify the market trend prior to the flag price formation.

First, a valid bearish flag needs a sharp decline. This is strong evidence of a bearish trend and that the supply and demand is out of balance.

Note* The sharp move is also the Flagpole – the first element of the bearish flag structure.

Step #2: Identify the flag price formation. The price action needs to move in a narrow range between two parallel lines.

The flag price formation is the second element of the bear flag pattern.

Basically, all you need to do is to spot one support and one resistance level. It must contain the price action in a very narrow range.

The narrow range is key for the bear flag pattern success rate.

Step #3: Sell at the closing candle that generates the Flag Breakout.

After we identify the market trend and the characteristics of a good bearish flag pattern we need to wait for confirmation that the trend is about to resume.

There are two basic approaches to enter the market with the bear flag pattern. Aggressive traders will enter at the top of the bearish flag as this will secure a little bit of bigger profits.

If you’re a conservative trader you can wait for confirmation provided by the flag breakout.

Our team at TSG prefers to take the conservative approach and wait for a break and close below the bearish flag before executing the trade.

The bear flag chart pattern strategy only looks for trading opportunities when you get a breakout below the flag price structure to be a seller.

The next important thing we need to establish is where to place your protective stop loss.

It is important when looking at this type of strategy to keep everything in the context of the overall market. Too many traders will try to zoom on.

Step #4: Place the protective stop-loss slightly above the Flag.

The Rectangle chart pattern strategy gives you a simple way to quantify risk because you can place your protective stop-loss slightly above the flag price structure.

We’re accomplishing two things with our tight stop loss:

Small losses.

Higher risk to reward ratio.

With such a tight stop loss you’ll have the comfort of losing many trades in a row because with the amazing RR the bearish flag can potentially wipe out all your losses in a single trade and still come profitable.

The next logical thing we need to establish for the bear flag pattern strategy is where to take profits.

Step #5: Take Profit target equals the same price distance of the Flag pole measured down from the top of the bearish flag.

The textbook profit target is the height of the flag pole measured down from the top of the flag.

Our team at TSG has learned that the market likes this kind of price symmetries and we like to take advantage of it.

Note*** The above was an example of a SELL trade… Use the same rules – but in reverse – for a BUY trade, but this time we’re going to use the bullish flag, or bull flag.

USDJPY 1D/1H - HOW TO PROFIT FROM TRADING PULLBACKSTRADING PULLBACK RULES

1 - Find Daily uptrend with HH's & HL's.

2 - Switch to the 1h Time Frame

and Wait for a Pullback

against the Uptrend.

3 - Place Fib between last swing

high and low levels,

prior to the pullback.

4 - Buy Anywhere Between 50% and 61.8% Fib.

5 - Place Stop Loss below Swing Low.

6- Take Profit at break above the

previous Swing High.

BTCUSD 1D ADVANCED TRIANGLE BREAKOUT INDICATORAdvanced Triangle Breakout Indicator shows Short Trade Red Column Signal.

Advanced Triangle Breakout Indicator shows Open Short Trade Entry Signal.

Advanced Triangle Breakout Indicator shows Stop Loss Signal.

Advanced Triangle Breakout Indicator shows Adjusted Stop Loss Signal.

Advanced Triangle Breakout Indicator shows 1 x 2 risk/reward Take Profit Short Trade Exit Signal.

PM me if you have any questions I can help you with about this indicator.

USDCHF 1D HOW TO TRADE BREAKOUTS - HOW TO SURVIVE HEAD FAKESBreakouts are found using Trendlines - Horizontal Sup/Res Ranges - Channels.

Finding the opportunity to see the 2nd or 3rd breakout increases breakout success.

Use a tighter stop loss on a 15m chart helps reduce risk.

If caught in a head fake - with a lighter stop loss - watch for another breakout setup.

Hold for a longer intraday or daily trend move.

S&P 500 Emini Futures Breakout StrategyEmini Breakout and Momentum Strategies

Profiting from breakouts and momentum trading is a favorite trading approach among Emini day traders. Emini momentum strategies often rely on capitalizing on a spike in momentum (order flow) activity. That’s the reason why Emini momentum strategies work best during times of increased volatility.

Similar to momentum trading strategies, Emini breakout strategies can offer many opportunities to maximize your profits. Emini breakout traders can capture trades with a good risk to reward ratio. A trend always starts from a breakout so this approach can also lead to possibly capture a trend.

The anatomy of trading breakouts can be summarized by Emini price breaking a key support or resistance level.

Emini breakouts usually follow after periods of tight congestions and as stated previously, they can lead to trend development.

As you can see the Emini futures market is very tempting as there are numerous trading opportunities. However, trading the Emini market without losing your hard-earned capital is a little bit harder. That’s why in order to increase your chances of successfully day trading Emini, we’re going to share the best Emini trading strategy.

With this approach, you can build another stream of income.

The only way you make money in the market is if you’re able to catch a trend. It doesn’t matter if you’re a day trader or a swing trader. In order to make a profit day trading the 5-minute time frame, you need an intraday trend to secure a profit.

The best Emini trading strategy requires to hold your trades to the close. Don’t try to get in and out scalping ES futures because when you have a loss most likely it will eat all the previous profits. Instead, try to catch a trend move and hold it to the close.

With this approach, you’ll make a lot more money because during the trend days the Emini contract tends to close near the high for bullish candles. The same is true for all large bearish range day, which closes near the low of the candle.

Go study your Emini chart and you’ll see this repeating pattern over and over again. Some research suggests that when the Emini futures close in the top 10% of its range, it has an 80% chance of follow-through the next day

Trade your trading plan to find entry, Stop Loss & Take Profit.

XRPUSD 4H BUMP & RUN SHORT STRATEGYBump and Run Trading Strategy – Sell Rules

The Bump and Run trading strategy is one of the best reversal trading strategies that you’ll probably ever need to learn. The psychological reason why the Bump and Run reversal is such a powerful pattern is because it takes advantage of the result of excessive speculation. This propels the price too swiftly to the extreme which leads to a reversal.

Moving forward, we present the sell-side rules of the Bump and Run trading strategy:

Step #1: Wait until you can identify an uptrend (lead-in) and then an acceleration of that uptrend (Bump)

We’re breaking down the Bump and Run chart pattern into several steps. The first step is to identify an uptrend and then an acceleration of that uptrend. These two components of a trend constitute the first part of the Bump and Run Reversal.

*Note: A valid Bump and Run chart pattern has the first section of the trend drifting upwards very slowly and in the second part of the trend we need to see momentum picking up and the uptrend moving to the extreme.

Step #2: Draw the lead-in trendline that connects the lows during the first stage of the trend and draws a second trendline connecting the lows during the uptrend acceleration stage

The way you draw the trendline can be a subjective matter because there are several ways to do it and neither of them is better than the other. Ultimately, it all comes down to your experience and understanding of the price action.

Step #3: Sell Entry 1 at the break and close below the first Trendline , Sell Entry 2 at the break and close below Lead-in Trendline .

In order to maximize our potential profits we like to implement a two entries technique as follows:

Sell Entry 1 once the first trendline is broken. For confirmation of a valid breakout, we like to wait for the candle close below the trendline .

Sell Entry 2 once the Lead-in trendline is broken. Wait for confirmation of a valid breakout we like to wait for the candle close below the trendline .

During this stage, the market is in the process of reversal and the “Run” component of the Bump and Run chart pattern is formed.

The Run phase is identified when the price falls and breaks below the Lead-in trendline which also confirms that we’re in the process of reversing the previous trend.

The next logical thing we need to establish for the Bump and Run trading strategy is where to take profits.

Step #4: Take profit at the Lead-in trendline starting point

The ideal profit target for the Bump and Run trading strategy is at the Lead-in trendline starting point. In other words, take profits at the exact same level you use to draw your Lead-in trendline .

We encourage you to experiment different take profit strategies because the Bump and Run chart pattern can also lead to a severe reversal that can be the starting point of a big bearish trend .

Step #5: Place initial SL above the swing high created by the uptrend acceleration. Second SL placed above the Lead-in trendline breakout candle

Since we’re splitting our trade into two trades, we’re going to have two protective stop losses. The initial stop loss is placed just above the swing high created by the uptrend acceleration phase.

The second protective stop loss is placed above the candle that breaks the Lead-in trendline .

We’re adopting a very conservative approach here because if we truly have a reversal we consider that the market should not look back. In this regard, we keep our SL very tight.

We also recommend that once your second entry gets triggered to move your initial stop loss in the exact location as the SL2. This will guarantee you that even if you get stopped out on your second entry you’ll still be left with some profits.

*Note: The above was an example of a SELL trade… Use the same rules – but in reverse – for a BUY trade, but this time we’re going to use the inverse Bump and Run reversal.

BIG BEN BREAKOUT INDICATOR SHOWS TIMING OF TRADEBig Ben Indicator shows the Asian Session Range

Big Ben Indicator shows 1H pre-London area

Big Ben Indicator shows 1h London Open area

Big Ben Indicator shows pre-London Stop Hunt Breakout

Big Ben Indicator shows Sell Signal as London Opens

Big Ben Indicator shows the Entry Price level

Big Ben Indicator shows adjusting Trailing Stop

Big Ben Indicator shows Take Profit level

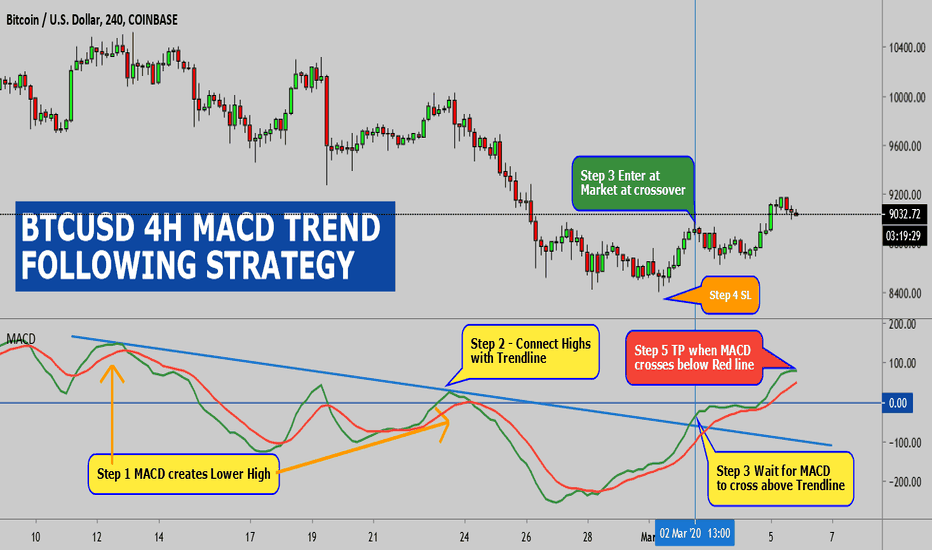

BTCUSD 4H MACD TREND FOLLOWING STRATEGY(Rules for A Buy Trade)

Step #1: Wait for the MACD lines to develop a higher high followed by a lower high swing point.

The first rule of thumb to recognize a swing high on the MACD indicator is to look at the price chart if the respective currency pair is doing a swing high the same as the MACD indicator does. A higher high is the highest swing price point on a chart and must be higher than all previous swing high points. While a lower high happens when the swing point is lower than the previous swing high point.

Step #2: Connect the MACD line swing points that you have identified in Step #1 with a trendline.

At this point, we really ignored the MACD histogram because much of the information contained by the histogram is already showing up by the moving averages. Look at the price action now and compare it to our MACD trendline we drew early. We can clearly notice that the MACD contains the price action much better and reflects the trend much clear.

But, at this point, we’re still not done with the MACD indicator, which brings us to the critical part of our MACD Trend Following Strategy.

Step #3: Wait for the MACD line to break above the trendline. (Entry at the market price as soon as the MACD line breaks above).

When the MACD line (the blue line) crosses the signal line (the orange line) it’s an early signal that a bullish trend might start. However, if trading would be that easy we would all be millionaires, right? And that’s the reason why our MACD Trend Following Strategy is so unique. We’re not only waiting for the MACD moving averages to cross over but we also have our other criteria for the price action to break aka the trend line we drew early.

This is a clever way to filter out the false MACD signals, but you have to be equipped with the right mindset and have patience until all the piece of the puzzle come together. If you were to trade just based on the MACD crossover over time you’ll lose money because that’s not a reliable strategy. But if you use the MACD indicator along with other criteria such what this strategy tells you to do, you will find great trade entries on a consistent basis.

Step #4: Use Protective Stop Loss Order. (Place the SL below the most recent swing low).

Now, that you already know how to enter a trade at this point you have to learn how to manage risk and where to place the SL. After all, a trader is basically a risk manager.

You want to place your stop loss below the most recent low, like in the figure below. But make sure you add a buffer of 5-10 pips away from the low, to protect yourself from possible false breakouts.

Basically, a good entry price means a smaller stop loss and ultimately it means you’ll lose a lot less comparing it with the profit potential, so a positive risk to reward ratio.

Step #5: Take Profit when the MACD crossover happens in the opposite direction of our entry.

Knowing when to take profit is as important as knowing when to enter a trade. However, we want to make sure we don’t use the same trading technique as for our entry order. When the MACD line (the blue line) produces signal line crossovers (the orange line) we want to close the position and take full profits.

Before taking profits, it’s important to wait for the candle close – either the 4h or the daily candle – depending on the time frame you trade so you make sure the MACD crossover actually happens.

Note** The above was an example of a buy trade using the MACD Trend Following Strategy. Use the exact same rules – but in reverse – for a sell trade.

Big Ben Breakout Indicator Keeps On Tickin'Big Ben Indicator shows the Asian Session Range

Big Ben Indicator shows 1H pre-London area

Big Ben Indicator shows 1h London Open area

Big Ben Indicator shows pre-London Stop Hunt Breakout

Big Ben Indicator shows Sell Signal as London Opens

Big Ben Indicator shows the Entry Price level

Big Ben Indicator shows adjusting Trailing Stop

Big Ben Indicator shows Take Profit level

EURCHF 1D MA-X CROSSOVER STRATEGYTim's MA-X Strategy.

This is a Moving Average Crossover or MA-X Trading Strategy setup.

MA-X strategy consists of the 100 period simple moving average (SMA) in red,

and the 20 period exponential moving average in blue.

If the 20 ema is above the 100 sma then we only take buys or longs.

If the 20 ema is below the 100 sma the we only take selss or shorts.

*In this case price is above the 100 sma so we will only take buys or longs.

*This Pair has been in a nice uptrend foe some time.

*It's now pulled back below the 20 ema and consolidating below the 20.

*We are going to look for a close above the 20 ema to go long.

*This trade plan we buy a daily candle close above the 20 ema.

On the breaking candle to enter a full-sized position we want to the volume bar reach up to the volume average.

If it doesn't reach the average but does reach 75% of the average open a ½ size position to reduce risk.

You can calculate the percentage by dividing the first volume average by the second volume average.

You should at least get 75%, if you don't then stand aside on the trade.

The stop loss will be 1.5 x ATR.

The first target will be 1 x ATR.

So the way that works is you get your candle close above the 20 ema that's your entry point.

At that time you look at the ATR of that candle.

You multiply that by 1.5 to get your SL.

You measure that distance behind the entry and that will be your SL.

Then you measure 1 ATR above the entry and that will be your first target.

If after entering the trade the candle closes back below the 20 ema, tke the loss right then.

Do not wait for price to hit the SL.

Our intention is that a breakout above the 20 ema should be explosive and hit our target fairly quickly.

If the momentum goes away we want to shut the trade down without taking a full stop if possible.

When price hits our first target, close half the position for profit and set the SL to break even on the remainder.

Follow stops as price moves in our direction until the market takes us out.

These two rules are the very definition of cuttoing your losses and letting your winners run.

Typically does this by using two positions.

The first position has a stop loss and a take profit.

That position will close automatically when the first target is hit.

The second position will only have a stop loss and not take profit.

This is the position that will be allowed to run.

When the first target is hit we have to manually move our stop up to break even on the second position.

Risk only two percent of your trading account of each trade.

Each position will then only be 1%.

EURCHF 15M BIG BEN BREAKOUT INDICATOR DID IT AGAINBig Ben Indicator shows the Asian Session Range

Big Ben Indicator shows 1H pre-London area

Big Ben Indicator shows 1h London Open area

Big Ben Indicator shows pre-London Stop Hunt Breakout

Big Ben Indicator shows Sell Signal as London Opens

Big Ben Indicator shows the Entry Price level

Big Ben Indicator shows adjusting Trailing Stop

Big Ben Indicator shows Take Profit level

GBPCAD 15M BIG BEN BREAKOUT INDICATORBig Ben Indicator shows the Asian Session Range

Big Ben Indicator shows 1H pre-London area

Big Ben Indicator shows 1h London Open area

Big Ben Indicator shows pre-London Stop Hunt Breakout

Big Ben Indicator shows Sell Signal as London Opens

Big Ben Indicator shows the Entry Price level

Big Ben Indicator shows adjusting Trailing Stop

Big Ben Indicator shows Take Profit level

CADCHF 1W RANGE TRADESRanges are repeatable trading chart patterns.

Ranges are consolidation chart patterns that can breakout either direction.

Each chart pattern will have defining trendlines of the support/resistance levels creating the pattern.

What ever time frame you are trading this chart pattern, wait for a candle close outside of the trendline in the direction of the breakout candle. (Our time frame preference is the Daily chart).

Add volume indicator - Volume is the amount of $ that went into a particular candle or in Forex the # of trades that took place.

Add ATR indicator - Volatility is the amount of price movement that occurred. Use the ATR to measure the price movement.

When you see descending Volume bars and descending ATR line (which indicates volatility) this shows

a dis-interest in traders to invest in this pair creating consolidation which creates the chart pattern.

Trade Management after there is a breakout candle close.

1 - Position size (compare volume bar to volume ma line).

a - Breakout candle must be 100% of average volume for a full position size.

b - If 75% of average volume then ½ position size. (To find 75% of Volume

look at the charts volume settings – divide smaller # into larger # = 75%+)

2 - Enter two trades.

3 - SL for both trades will be 1.5 x ATR.

4 - 1st trade TP will be 1 x ATR.

5 - No TP on 2nd trade – letting profit run and adjusting SL to follow price.

6 - When 1st TP hit – move 2nd trade SL to breakeven.

7 - Adjust the 2nd trade SL to follow price.

*8 – After Breakout candle – if price closes back into chart pattern close trade

*9 - When breakout candle is more than 1 ATR from breakout candle open.

a - Enter 1st trade at candle close with ½ position size.

b - Enter 2nd trade with a pending limit order that is 1 ATR of breakout candle open.

c – Price should pullback to that pending limit order for 2nd trade.

d – If Price returns back into chart pattern close trade before SL is hit.

USDJPY 15M BIG BEN BREAKOUT STRATEGY SHORTRule #1 Define the Asian (London) Trading Range

We’re going to use the range definition that takes into consideration only the body of the candles, excluding the wicks.

Note* this trading rule can be adapted as you get more experienced at reading the price action.

Who knows, maybe you’ll be able to discover some price action tendencies around the London open that no-ones was able to see.

The London open breakout strategy works because the Asia trading range tends to attract buy and sell stops above and below the trading range.

The bulk of buying and selling stops becomes an easy target for smart money.

Remember that traders need liquidity to execute their orders.

And, the smart money is always in search of liquidity to fill their large orders. That’s the reason why smart money needs to trigger those stops.

Rule #2: The One-Hour before the London Open Needs to Generate the Breakout

Our backtesting results revealed that momentum really starts to pick up 1-hour earlier than the actual London opening session.

There are some smart ways to trade this burst of momentum.

Let’s see some technical ways to trade the pre-London open.

We don’t need to guess in which way the market will break, we let the market tip his hand and show us the way.

This is where things get interesting.

Let me explain…

During the London session, we’re going to see the most traded volume thus the foreign exchange market should really take off in one direction or another.

From our example, we can note the USD/JPY is a one-sided move.

We didn’t have any interruptions in the momentum activity, and that’s the KEY for this whole trading setup to work.

Let’s now outline the second technical element you want to see with the London setup.

Rule #3 Fade the London Open Breakout (follow the smart money)

Immediately after the London session opens, we want to see the price fading the pre-open move.

If the price move starts fading, we know it was a false breakout

The smart money has used the pre-open move to trigger the stops below the range and now they reverse the tie and start buying.

We want to see price pulling back into the range at the same speed as it went up.

Let me explain…

In simple words, the bullish momentum used to produce the false breakout needs to be equal to the bearish momentum used to fade the pre-open move.

We enter our trade after the first 5-minutes have confirmed that the price is reversing.

Once this trade setup is completed, you should see a price formation that takes the V-shaped form (or inverse V-shape).

Let’s now explore what methods you can use to cash in the profits.

Rule #4 Take Profit or Ride the Trend

We can measure the size of the Asia trading range and project that, from the top or bottom of our range to get our profit target.

But, oftentimes this type of setup can lead to a trading day that can extend in the days to come.

In this example, the better take profit strategy would be to use a trailing stop.

You need to be ready to explore other trading methods to manage your trades.

Now…

Protecting the downside is as important as making money.

Below, we’re going to reveal how to use time as your stop loss.

Sounds interesting?

So, let’s get straight into the matter.

Rule #5 Use a Time Stop Instead of a Price Stop (or you use your TP trading method)

In order to fade the London breakout, you need to use unconventional trading methods.

In this regard, for our stop loss trading strategy we’re going to use a time stop instead of a price stop.

The first time I’ve ever heard about the time stop concept was while reading the Market Wizards book.

Billionaire Hedge Fund manager Paul Tudor Jones one of the greatest traders of our times said:

“When I trade, I don’t just use a price stop, I also use a time stop.”

If you want to get a glimpse into the mindset of the most successful traders and hedge fund managers, please read: Top Trading Quotes of All Time - Learn to Trade.

So, do you want to know how to apply the time stop to the London strategy?

It’s very simple…

If in the first hour after the London open the price didn’t COMPLETELY reverse the pre-opening breakout, we exit the trade.

It’s simple as that, no further explanation is needed.